REPORT OUTLOOK

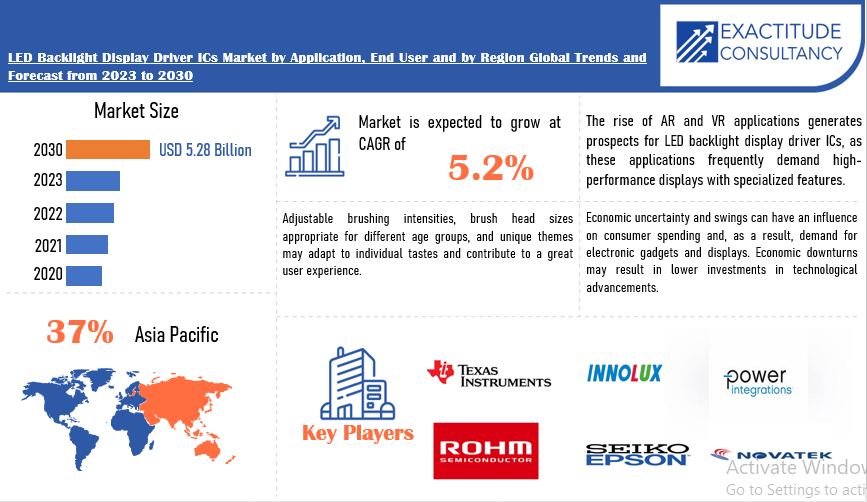

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 5.28 billion by 2030 | 5.2% | Asia Pacific |

| by Application | by End User |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

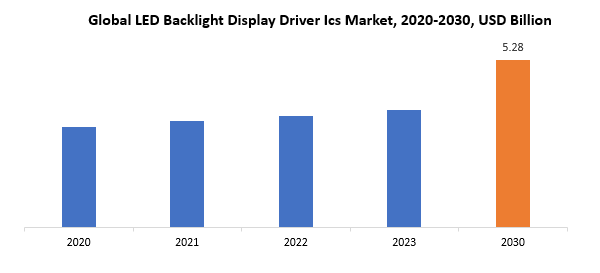

The global LED Backlight Display Driver ICs market size is projected to grow from USD 3.70 billion in 2023 to USD 5.28 billion by 2030, exhibiting a CAGR of 5.2% during the forecast period.

LED Backlight Display Driver ICs are specialized semiconductor devices designed to control and regulate the illumination of LED (Light Emitting Diode) backlights in displays, such as those used in LCD (Liquid Crystal Display) panels. These driver integrated circuits are critical for enhancing the performance and efficiency of LED backlighting systems. LED Backlight Display Driver ICs’ major job is to manage the power provided to the LEDs, guaranteeing consistent brightness across the display while conserving energy. These integrated circuits frequently include complex control algorithms and features such as dimming and color temperature change, allowing for dynamic alterations to adapt changing content or ambient lighting conditions.

Furthermore, LED Backlight Display Driver ICs help to the display’s overall dependability and lifetime by protecting the LEDs from overcurrent, overheating, and other possible concerns. These ICs improve the visual quality of the display, reduce energy consumption, and provide a more customizable and user-friendly experience for a wide range of electronic devices, from TVs and monitors to smartphones and automotive displays, by efficiently managing the power distribution to the LED backlight array. Because of its importance in improving the performance, efficiency, and visual quality of various display devices, the LED Backlight Display Driver ICs market is critical in the electronics industry. Demand for specialist ICs that drive and regulate LED backlights has increased as LED technology continues to dominate the display industry due to its energy economy and excellent colour reproduction. One of the most important aspects is the optimization of energy use. LED Backlight Display Driver ICs offer effective power management, which contributes to decreased energy usage in electronic devices such as TVs, monitors, laptops, and smartphones. This is in line with the increased emphasis on energy efficiency and environmentally friendly solutions. Furthermore, these ICs contribute to the overall user experience by providing uniform brightness and high-quality pictures across the display. The ability of LED Backlight Display Driver ICs to provide features such as dynamic dimming and colour temperature change improves user comfort, especially under changing lighting circumstances. This versatility is critical for applications ranging from consumer electronics to vehicle displays, where visibility and readability are critical.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Application, End Use and Region |

|

By Application |

|

| By End User |

|

|

By Region

|

|

LED Backlight Display Driver ICs market Segmentation Analysis

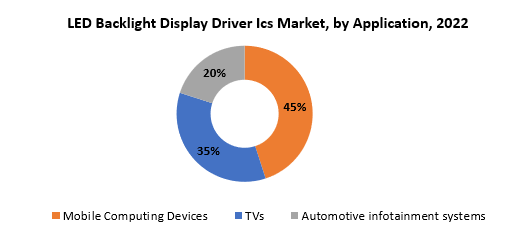

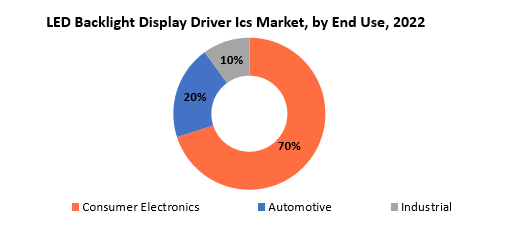

The global LED Backlight Display Driver ICs market is bifurcated three segments, by application, end user and region. By application, the market is bifurcated into mobile computing devices, tvs, automotive infotainment systems. By end user, the market is bifurcated consumer electronics, automotive, industrial and region.

The LED Backlight Display Driver ICs market is segmented significantly by application, responding to the specialized demands of mobile computing devices, TVs, and vehicle infotainment systems. These ICs are critical in enabling a visually engaging and power-efficient display experience in mobile computing devices such as smartphones, tablets, and laptops. The demand for slim, lightweight devices with vibrant and high-resolution screens has driven the demand for LED Backlight Display Driver ICs that provide precise control over backlight intensity, color temperature, and dynamic adjustments, ensuring optimal visibility and energy conservation for portable electronics. LED Backlight Display Driver ICs play an important role in the growth of high-definition and smart television technology. These integrated circuits offer consistent brightness distribution, dynamic contrast ratios, and sophisticated dimming functions, all of which improve the viewing experience. As the trend toward larger and more sophisticated television screens continues, the need for innovative LED Backlight Display Driver ICs rises to match customers’ expectations for greater picture quality and energy efficiency. Automotive infotainment systems are another major application area for LED Backlight Display Driver ICs. These integrated circuits are critical components in modern automobiles for displays incorporated into dashboards, navigation systems, and entertainment consoles. They enable excellent visibility in changing lighting circumstances, contribute to the streamlined design of in-car displays, and support technologies such as touchscreens and dynamic content modifications. The automotive industry’s growing emphasis on smart and connected cars drives up demand for high-performance LED Backlight Display Driver ICs that can match the severe standards of the automotive environment.

The LED Backlight Display Driver ICs market is divided into consumer electronics, automotive, and industrial applications. These integrated circuits (ICs) serve a critical part in consumer electronics devices such as smartphones, tablets, laptops, and displays. The emphasis in consumer electronics on small designs, energy economy, and high-quality displays has increased demand for LED Backlight Display Driver ICs. These ICs enable fine control over illumination, providing brilliant images, dynamic modifications for varied content, and effective power management, all of which contribute to an improved user experience. Another important end-use area for LED Backlight Display Driver ICs is the automobile industry. These ICs are critical for the operation of in-car displays, instrument clusters, and entertainment systems in modern automobiles. They provide maximum visibility, responsiveness, and dependability in demanding vehicle conditions. The incorporation of advanced driver assistance systems (ADAS) and smart infotainment features in cars increases demand for high-performance LED Backlight Display Driver ICs that satisfy automotive industry requirements and contribute to overall road safety and user experience. LED Backlight Display Driver ICs are utilized in different equipment, control panels, and displays used in manufacturing, automation, and other industrial operations. In the end, the segmentation by end use illustrates the adaptability of LED Backlight Display Driver ICs across many industries. From enhancing the visual experience in consumer electronics to contributing to safety and information displays in automotive applications and supporting industrial processes with reliable interfaces, these ICs are integral components in a wide range of end-use applications, driving advancements in technology and user experiences across various industries.

LED Backlight Display Driver ICs market Dynamics

Driver

Rising desire for energy-efficient displays has been a key driver in the widespread usage of LED backlight display driver integrated circuits (ICs).

These integrated circuits (ICs) serve an important part in current displays, which include televisions, monitors, and mobile devices. The incentive for this transition toward energy-efficient solutions is principally anchored in the benefits afforded by Light Emitting Diode (LED) backlight technology over previous options. LEDs, the basic components lighted by LED backlight display driver ICs, are well-known for their efficiency in converting electrical energy into visible light. LEDs utilize far less electricity to attain comparable or even greater brightness levels than older backlight technologies such as Cold Cathode Fluorescent Lamps (CCFLs). This natural energy efficiency correlates with worldwide initiatives to cut power usage, lower carbon footprints, and improve overall sustainability. LED backlighting, enabled by specialized driver ICs, has become a regular feature in television screens due to its ability to offer brilliant colors and crisp contrasts while preserving energy economy. This trend extends to displays and mobile devices, as manufacturers attempt to match the expectations of environmentally concerned consumers by balancing performance with energy efficiency. Lowering power usage not only helps end users save money on their electricity bills, but it also conforms to severe energy efficiency criteria enforced by regulatory bodies and governments. Demand for LED backlight display driver ICs is increasing as energy saving becomes a fundamental aspect of corporate social responsibility and environmental activities.

Restraint

The price sensitivity of LED backlight display driver integrated circuits (ICs) poses a significant challenge.

LED technology, while providing various benefits in terms of energy economy, lifespan, and improved display performance, frequently has a greater production cost as compared to traditional options. This pricing gap might be a disincentive in price-sensitive markets where affordability is a key element affecting purchase decisions. Manufacturers in the LED backlight display driver ICs market must strike a difficult balance between combining sophisticated LED technology and fulfilling customer-pricing expectations. The difficulty is to create a product that not only satisfies the exacting technical criteria of current screens, but also remains competitive in terms of cost. LED backlight display driver ICs are more expensive due to variables such as manufacturing complexity, the usage of sophisticated materials, and the inclusion of cutting-edge technology to assure maximum performance. These expenses are subsequently passed on to end users, which might hinder the broad adoption of LED backlighting systems in regions where price is a deciding issue. Furthermore, price sensitivity is amplified in areas with small profit margins, such as entry-level consumer electronics or low-cost screens. Manufacturers in such areas confront the combined challenge of providing cost-effective solutions while maintaining the quality and performance associated with LED technology.

Opportunities_Remain

The burgeoning emphasis on health and wellness in contemporary society is creating a promising opportunity for the kids’ electric toothbrush market.

As parents prioritize their children’s health from an early age, there is a rising need for advanced oral care products that go beyond standard manual toothbrushes. This shift in mentality reflects parents’ realization that appropriate dental hygiene is a critical component of overall well-being. Parents are actively seeking innovative items that not only offer excellent dental care but also contribute to their children’s long-term health. Kids’ electric toothbrushes, with their improved features and technical advancements, coincide with this trend by providing a more complete and engaging dental care experience. The realization that excellent oral health habits in childhood can have long-term consequences on general health is a major motivator for the growing use of electric toothbrushes for children. These technologically sophisticated gadgets outperform traditional brushes in terms of cleaning efficacy, answering the concerns of health-conscious parents who wish to reduce their children’s risk of dental disorders. Manufacturers in the kids’ electric toothbrush market have the chance to capitalize on this health-conscious trend by producing products that not only satisfy the fundamental needs of successful oral care but also incorporate extra features that encourage a holistic approach to health. Smart toothbrushes, for example, with interactive apps and educational components may not only make brushing pleasant for children, but also help to their general health education.

LED Backlight Display Driver ICs market Trends

- There was a constant emphasis on improving the energy efficiency of LED Backlight Display Driver ICs. Manufacturers were working on producing ICs that not only give outstanding display quality but also contribute to energy reduction, coinciding with the larger industry trend toward sustainability.

- LED Backlight Display Driver ICs were gradually adopting advanced functions such as dynamic dimming, local dimming, and color temperature control. These capabilities provide more control over the display’s brightness and color, responding to user preferences and improving the overall viewing experience.

- With the increasing integration of displays in automobile interiors, there was a growing need for LED Backlight Display Driver ICs designed specifically for automotive applications. These ICs have to fulfill automotive-grade specifications to ensure dependability, longevity, and performance in harsh automotive settings.

- The market was seeing miniaturization and component integration developments. Manufacturers were focused on developing small and integrated solutions to fulfill the expectations of ultra-books, tablets, and smartphones, which are thin and light consumer electronics products.

- While LED Backlight Display Driver ICs are generally connected with LCD panels, the industry also saw developments relating to OLED (Organic Light Emitting Diode) displays. As OLED technology matured, the function of LED Backlight Display Driver ICs in certain applications, including luxury smartphones and TVs, evolved to support OLED displays.

Competitive Landscape

The competitive landscape of the LED Backlight Display Driver ICs market was dynamic, with several prominent companies competing to provide innovative and advanced Cloud Kitchen Foodservice solutions.

- Texas Instruments Inc.

- ON Semiconductor Corporation

- Maxim Integrated Products, Inc.

- Macroblock, Inc

- Silicon Works Co., Ltd

- Novatek Microelectronics Corp

- Intersil

- Dialog Semiconductor

- Samsung Electro-Mechanics Co., Ltd

- NXP Semiconductors N.V

- Toshiba Electronic Devices & Storage Corporation

- ROHM Semiconductor

- Power Integrations, Inc.

- Monolithic Power Systems

- Winbond Electronics Corporation

- Linear Technology Corporation

- Realtek Semiconductor Corp

- Seiko Epson Corporation

- Innolux Corporation

- Parade Technologies, Ltd

Recent Developments:

December 14, 2023 – As demand for battery-powered applications continues to grow rapidly, low-IQ technologies can help extend battery life without compromising system performance.

Regional Analysis

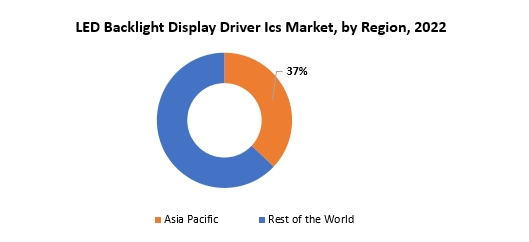

Asia-Pacific is the most important region in the LED Backlight Display Driver ICs market. This area has evolved as a worldwide center for electronics manufacturing, with nations such as China, Japan, South Korea, and Taiwan playing significant roles in the manufacture of consumer electronics, displays, and semiconductor components. The Asia-Pacific region’s dominance in the LED Backlight Display Driver ICs market may be ascribed to a variety of factors. The region’s concentration of major original equipment manufacturers (OEMs) and semiconductor foundries, in particular, fosters a healthy ecosystem for the manufacturing and integration of display technologies. Additionally, the availability of experienced workforce, technological competence, and advantageous manufacturing infrastructure has supported the expansion of the LED Backlight Display Driver ICs market in Asia-Pacific.

The region’s response to increasing consumer expectations for innovative and energy-efficient displays, together with its role as a key participant in the automotive and industrial sectors, places it at the forefront of the LED Backlight Display Driver ICs market. As worldwide demand for electronic products rises, Asia-Pacific remains a dominant force, pushing innovation, manufacturing, and technical improvements in the LED Backlight Display Driver ICs business. Asia Pacific presently controls the roost, the market is fluid, and the tides may change in the future. Continued expansion in other places, along with technical improvements and shifting customer tastes, might change the picture. Nonetheless, Asia Pacific’s strong foundation and favorable climate position it as a contender for the foreseeable future.

Target Audience for LED Backlight Display Driver ICs market

- Electronics Manufacturers

- Automotive Industry

- Industrial Equipment Manufacturers

- Semiconductor Companies

- System Integrators

- Research and Development (R&D) Teams

- Technology Enthusiasts and Innovators

- Regulatory Bodies and Standards Organizations

Segments Covered in the LED Backlight Display Driver ICs market Report

LED Backlight Display Driver ICs market by Application

- Mobile Computing Devices

- TVs

- Automotive infotainment systems

LED Backlight Display Driver ICs market by End User

- Consumer Electronics

- Automotive

- Industrial

LED Backlight Display Driver ICs market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the LED Backlight Display Driver ICs market over the next 7 years?

- Who are the key market participants in Cloud Kitchen Foodservice, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the LED Backlight Display Driver ICs market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the LED Backlight Display Driver ICs market?

- What is the current and forecasted size and growth rate of the global LED Backlight Display Driver ICs market?

- What are the key drivers of growth in the LED Backlight Display Driver ICs market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the LED Backlight Display Driver ICs market?

- What are the technological advancements and innovations in the LED Backlight Display Driver ICs market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the LED Backlight Display Driver ICs market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the LED Backlight Display Driver ICs market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- LED BACKLIGHT DISPLAY DRIVER ICS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON LED BACKLIGHT DISPLAY DRIVER ICS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- LED BACKLIGHT DISPLAY DRIVER ICS MARKET OUTLOOK

- GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- MOBILE COMPUTING DEVICES

- TVS

- AUTOMOTIVE INFOTAINMENT SYSTEMS

- GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- CONSUMER ELECTRONICS

- AUTOMOTIVE

- INDUSTRIAL

- GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- TEXAS INSTRUMENTS INC.

- ON SEMICONDUCTOR CORPORATION

- MAXIM INTEGRATED PRODUCTS, INC.

- MACROBLOCK, INC

- SILICON WORKS CO., LTD

- NOVATEK MICROELECTRONICS CORP

- INTERSIL

- DIALOG SEMICONDUCTOR

- SAMSUNG ELECTRO-MECHANICS CO., LTD

- NXP SEMICONDUCTORS N.V

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- ROHM SEMICONDUCTOR

- POWER INTEGRATIONS, INC.

- MONOLITHIC POWER SYSTEMS

- WINBOND ELECTRONICS CORPORATION

- LINEAR TECHNOLOGY CORPORATION

- REALTEK SEMICONDUCTOR CORP

- SEIKO EPSON CORPORATION

- INNOLUX CORPORATION

- PARADE TECHNOLOGIES, LTD *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 2 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 13 US LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 14 US LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 15 US LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 16 US LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 18 CANADA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 20 CANADA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 MEXICO LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 24 MEXICO LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 32 BRAZIL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 34 BRAZIL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 36 ARGENTINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 38 ARGENTINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 40 COLOMBIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 42 COLOMBIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 INDIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 56 INDIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 58 CHINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 60 CHINA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 62 JAPAN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 64 JAPAN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 84 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 86 EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 88 GERMANY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 90 GERMANY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 91 UK LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 UK LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 93 UK LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 94 UK LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 96 FRANCE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 98 FRANCE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 100 ITALY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 102 ITALY LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 SPAIN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 106 SPAIN LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 108 RUSSIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 110 RUSSIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 121 UAE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 122 UAE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 123 UAE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 124 UAE LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION USD BILLION, 2020-2030

FIGURE 9 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER, USD BILLION, 2020-2030

FIGURE 10 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY APPLICATION, USD BILLION 2022

FIGURE 13 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY END USER, USD BILLION 2022

FIGURE 14 GLOBAL LED BACKLIGHT DISPLAY DRIVER ICS MARKET BY REGION, USD BILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 TEXAS INSTRUMENTS INC.: COMPANY SNAPSHOT

FIGURE 17 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 18 MAXIM INTEGRATED PRODUCTS, INC.: COMPANY SNAPSHOT

FIGURE 19 MACROBLOCK, INC: COMPANY SNAPSHOT

FIGURE 20 SILICON WORKS CO., LTD: COMPANY SNAPSHOT

FIGURE 21 NOVATEK MICROELECTRONICS CORP: COMPANY SNAPSHOT

FIGURE 22 INTERSIL: COMPANY SNAPSHOT

FIGURE 23 DIALOG SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 24 SAMSUNG ELECTRO-MECHANICS CO., LTD: COMPANY SNAPSHOT

FIGURE 25 NXP SEMICONDUCTORS N.V: COMPANY SNAPSHOT

FIGURE 26 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ROHM SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 28 POWER INTEGRATIONS, INC.: COMPANY SNAPSHOT

FIGURE 29 MONOLITHIC POWER SYSTEMS: COMPANY SNAPSHOT

FIGURE 30 WINBOND ELECTRONICS CORPORATION: COMPANY SNAPSHOT

FIGURE 31 LINEAR TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

FIGURE 32 REALTEK SEMICONDUCTOR CORP: COMPANY SNAPSHOT

FIGURE 33 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

FIGURE 34 INNOLUX CORPORATION: COMPANY SNAPSHOT

FIGURE 35 PARADE TECHNOLOGIES, LTD: COMPANY SNAPSHOT

FAQ

The global LED Backlight Display Driver ICs market size is projected to grow from USD 3.70 billion in 2023 to USD 5.28 billion by 2030, exhibiting a CAGR of 5.2% during the forecast period.

North America accounted for the largest market in the LED Backlight Display Driver ICs market.

Philips, Saky, Oral-B, Colgate, Braun, Panasonic, Nuvita, Foreo, Vekkia, Fairywill, Boots, Quip, SmileDirectClub, Violife, Jordan AS, Firefly Toothbrush, Brush Buddies, Crest, Dr. Brown’s, Tooth Tunes.

An increasing emphasis on safety features in the automobile industry led to the introduction of LED Backlight Display Driver ICs in applications related to heads-up displays (HUDs), digital instrument clusters, and other safety-critical systems.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.