REPORT OUTLOOK

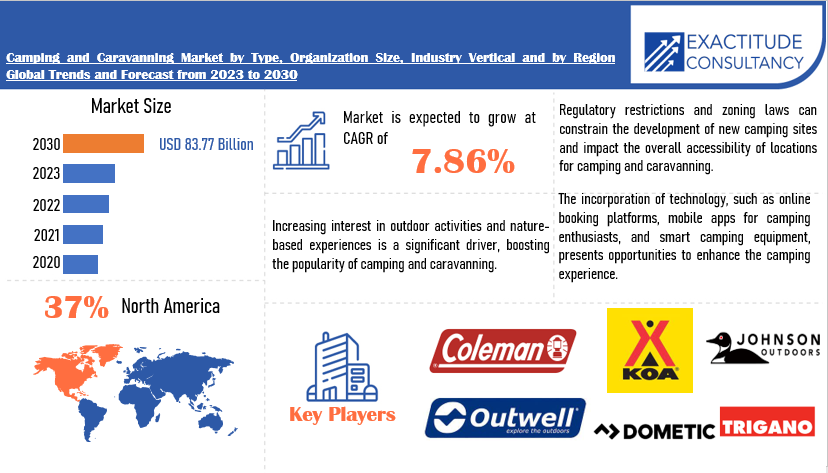

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 49.33 Billion by 2030 | 7.86 % | North America |

| by Type of Camper | Market by Age | by Destination Type |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Camping and Caravanning Market Overview

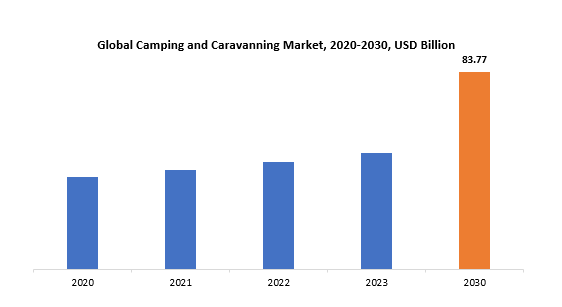

The global camping and caravanning market are anticipated to grow from USD 83.77 Billion in 2023 to USD 49.33 Billion by 2030, at a CAGR of 7.86 % during the forecast period.

Camping and caravanning are popular leisure activities that entail immersing oneself in outdoor life and going on excursions in temporary accommodations such as tents or caravans, allowing people to connect with nature and appreciate the beauty of the great outdoors. Camping, which ranges from basic tent setups in natural settings such as woods or mountains to more lavish “glamping” experiences, provides a broad range of experiences to suit a variety of interests. Caravanning, on the other hand, is traveling and camping with a caravan or camper trailer towed by a vehicle.

Caravans offer a movable living area complete with sleeping quarters, a kitchen, and occasionally toilet facilities, allowing campers to explore new places while keeping the ease of a home on wheels. Both activities provide an opportunity to disengage from city life, cultivating an appreciation for environment and offering a platform for outdoor activities such as hiking, fishing, or simply relaxing around a campfire beneath the stars. Camping and caravanning foster a feeling of adventure, self-sufficiency, and a stronger connection to the natural world in addition to individual activities. These activities frequently foster a sense of community, with participants congregating in campgrounds to exchange tales and form lasting friendships. The popularity of camping and caravanning has spurred the development of an array of accessories, equipment, and specialized vehicles, enhancing the overall outdoor experience for enthusiasts worldwide.

In addition, people seek opportunities to engage with the natural world, there is a rising cultural trend toward nature-based and experience travel. Many people try camping and caravanning as avenues for leisure and adventure because they want to get away from city life. Furthermore, increased awareness of the importance of mental health and a healthy lifestyle has increased demand for outdoor activities, with camping and caravanning providing an immersive approach to achieve both. The growth of a mobile and technologically connected lifestyle is another crucial aspect. The current campers and caravanners may work remotely, allowing them to extend their outdoor vacations while remaining connected to business and social networks.

Furthermore, the development of varied camping experiences caters to a vast variety of tastes. Whether you like classic tent camping or more comfortable and opulent glamping, the market caters to a wide range of comfort levels and tastes, making outdoor activities more accessible to a wider audience. Environmental awareness is also a big driving force in the Camping and Caravanning business. Camping and caravanning, which promote low-impact tourism, connect with these principles as a growing number of individuals seek sustainable and eco-friendly vacation choices. The option to enjoy nature responsibly resonates with ecologically aware customers, moving the sector forward even more.

Furthermore, the sense of community and shared experiences fostered at campsites and caravan parks contribute considerably to the market’s growth. Enthusiasts frequently develop close-knit groups, forming a supportive network that encourages others to adopt the camping and caravanning lifestyle. This community feature adds to the attractiveness of these outdoor activities by promoting a sense of connection and shared enjoyment among participants.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) |

| Segmentation | By Type of Camper, Age, Destination Type and Region |

|

By Type of Camper |

|

|

By Age |

|

|

By Destination Type |

|

|

By Region

|

|

Camping and Caravanning Market Segmentation Analysis

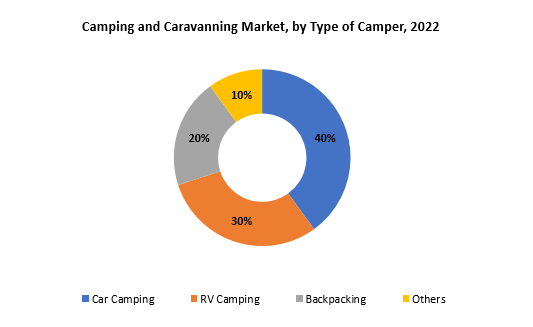

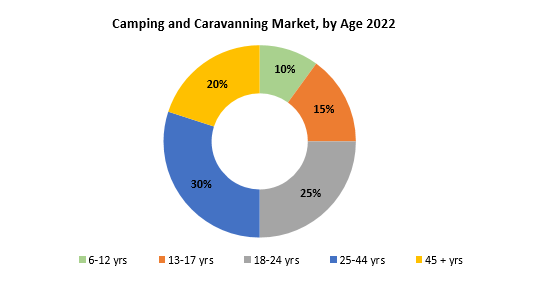

The global Camping and Caravanning market is divided into three segments, type of camper, age, destination type and region. By type of camper the market is divided into car camping, RV camping, backpacking, others. By destination type the market is classified into Public or Privately Owned Land Other Than a Campground, Backcountry, National Forest or Wilderness Areas, Parking Lots, State or National Park Campgrounds, Privately Owned Campgrounds, Others. By Age the market is classified into 6-12 yrs, 13-17 yrs, 18-24 yrs, 25-44 yrs, 45 + yrs.

Based on type of camper, car camping segment dominating in the camping and caravanning market. Car camping, which involves people or families sleeping in or near their automobiles, has grown in popularity owing to its simplicity and accessibility. Because it reduces the need for specialized gear or considerable planning associated with more primitive camping practices, this category appeals to a broad population, including both seasoned campers and beginners. The prevalence of car camping can be ascribed to the ease of travel and the opportunity to carry larger, more comfortable equipment. This sector of campers often has the option of hauling large tents, cooking equipment, and other amenities directly in their cars, making the whole camping experience more easy and pleasurable. This method caters to folks who enjoy the outdoors but are not interested in the more rough parts of camping.

Car camping is consistent with the rising trend of combining technological and comfort-oriented facilities into outdoor activities. Car camping allows people to experience nature without compromising comfort, thanks to modern camping gear built for convenience, such as inflatable beds, portable stoves, and solar-powered electronics. The ability to stay connected via electronic devices, as well as the ease of having facilities similar to those found at home, contribute to the segment’s dominance, particularly among the digitally connected age.

RV camping is an important and increasing component of the Camping and Caravanning Market. These vehicles provide a movable living area with facilities such as kitchens, restrooms, and sleeping spaces, making camping comfortable and easy. This category caters to people or families seeking a home-like setting while traveling to diverse areas, with RV campsites providing flexibility and a feeling of community. Backpacking is a more minimalist and adventurous camping style that emphasizes mobility and self-sufficiency. Backpackers carry lightweight stuff on their backs, allowing them to explore distant and inaccessible locations. This section draws outdoor enthusiasts looking for a closer connection to nature, which typically involves hiking to remote campgrounds. Backpacking aligns with the desire for a more immersive and challenging outdoor experience, emphasizing simplicity and resourcefulness.

Based on age, 25-44 yrs. segment dominating in the camping and caravanning market. The 25-44 age group dominates the Camping and Caravanning sector, indicating a high fondness for outdoor leisure within this generation. Individuals in this age group frequently find themselves at a life stage where they are attempting to strike a balance between career, family, and personal pleasure. Camping and caravanning provide a great respite for this demographic, allowing them to withdraw from the stresses of modern life and reconnect with nature.

Individuals and families in this age group are commonly developing professions and raising families, making outdoor activities like camping desirable for creating lasting experiences and strengthening family relationships. Camping caters to the 25-44 age group’s desire for experiences over material belongings by providing an opportunity to unwind, discover new areas, and engage in outdoor adventures. Furthermore, the 25-44 age group is distinguished by a greater degree of discretionary money and a more adventurous attitude. These people are frequently open to attempting new camping types, such as classic tent camping, RV vacations, or even glamping.

The age range of 6-12 years reflects a developing interest in outdoor experiences, introducing youngsters to the delights of camping and laying the groundwork for a lifetime love for nature. Teenagers between the ages of 13 and 17 have a more adventurous attitude, and they frequently seek out unusual and engaging camping experiences. The 18-24 age group represents a period of discovery and independence, and young adults are drawn to camping for its cost, social appeal, and desire for experiencing travel. The 45+ age group represents a more mature demographic, with a preference for leisurely and pleasant camping experiences, frequently in RVs or trailers, expressing a desire for relaxation and a connection to nature.

Camping and Caravanning Market Dynamics

Driver

Growing interest in outdoor activities and nature-based experiences is a key driver for the camping and caravanning market.

There has been an interesting shift in consumer tastes in recent decades, showing a rising desire among people and families to immerse themselves in natural settings and participate in outdoor experiences. This movement is rooted in a larger social trend toward adopting healthier and more active lives, as people recognize the holistic advantages of spending quality time outside for both physical and emotional well-being.

Camping and caravanning, two traditional outdoor leisure activities, are well aligned with this growing interest. These experiences offer a unique way to escape the demands of city living, acting as a respite from the stresses of daily existence. The attractiveness of these activities is in the potential to develop a closer connection with nature, whether via energetic excursions in scenic landscapes, the enjoyment of campfires underneath the heavenly sky, or the waking to the sounds of the forest. Furthermore, the appeal of nature-based activities extends beyond the physical health benefits to a desire for real and unforgettable encounters. Camping allows people to disconnect from technology distractions, developing a true relationship with nature and generating lasting memories.

Restraint

Unfavorable weather condition is projected to hinder the camping and caravanning market during the forecast period.

Unfavorable weather conditions provide challenges for the camping and caravanning industry, providing a substantial impediment to growth over the projection period. Because these activities are fundamentally outside, inclement weather, such as severe heat, heavy rains, and storms, can interrupt or impair the entire camping experience, deterring potential participants. Individuals may be discouraged from camping and caravanning due to safety concerns and discomfort caused by adverse weather.

Seasonal fluctuations, such as severe winter weather or blazing summer heat, limit the attraction of camping at some periods, affecting the market’s steady development trend. Furthermore, the unpredictability of weather patterns caused by climate change adds an added element of uncertainty to preparation for both campers and business partners. During inclement weather, campsites and outdoor facilities may have operational issues, resulting in closures or limited services. The discomfort associated with camping in inclement weather might prevent people from camping and caravanning, particularly those who are inexperienced in outdoor activities.

Opportunities

Technological innovation is projected to boost the demand for camping and caravanning market.

Technological advancements are expected to play an important role in boosting demand for the camping and caravanning markets, ushering in revolutionary changes to the outdoor recreation scene. Recent technological improvements have responded to the changing demands of modern campers by creating a variety of smart camping gear and accessories. From solar-powered devices and small, high-efficiency stoves to cutting-edge navigation and communication equipment, these technologically advanced solutions considerably improve the whole camping experience by providing ease, efficiency, and enhanced connectivity.

Furthermore, the seamless integration of digital platforms and mobile applications has simplified many parts of camping, including trip planning, campsite bookings, and real-time weather reports. This digital integration offers campers extensive information for exploring camping areas, discovering new destinations, and interacting with fellow enthusiasts via online communities. This not only improves the whole camping experience, but it also appeals to the tech-savvy population, therefore broadening the market’s reach.

Additionally, technical development impacting the camping and caravanning business is the growing popularity of electric and hybrid cars. The introduction of electric-powered camping vehicles offers environmentally favorable choices, lowering the environmental effect of outdoor experiences. The usage of electric and hybrid cars for camping is likely to grow as charging infrastructure expands, matching with the larger sustainability trend in outdoor leisure. Furthermore, continual improvements in materials and manufacturing processes lead to the creation of lightweight, long-lasting, and environmentally friendly camping gear.

Camping and Caravanning Market Trends

- Smart RVs with Wi-Fi, app-controlled features, and augmented reality experiences are creating a hyper-connected camping experience.

- Glamping, a luxurious and comfortable form of camping, gained popularity among consumers seeking outdoor experiences with added amenities.

- Increasing integration of technology into camping experiences, including the use of smart camping gear, mobile apps for trip planning, and online platforms for campground reservations.

- Growing emphasis on sustainability and eco-friendly camping practices. Campers are increasingly opting for green camping options, utilizing eco-friendly products, reducing waste, and adhering to Leave No Trace principles.

- The rise of remote work has influenced a trend known as “workation” or combining work with vacation. Campers, equipped with mobile work setups, are exploring camping and caravanning as a way to work remotely while enjoying the outdoors.

- A growing recognition of the mental and physical health benefits of spending time in nature has led to a trend focusing on wellness in camping.

- Eco-friendly camping practices, like composting toilets and solar-powered gear, are gaining traction among environmentally conscious travelers.

Competitive Landscape

The competitive landscape of the Camping and Caravanning market was dynamic, with several prominent companies competing to provide innovative and advanced Camping and Caravanning solutions.

- The Coleman Company, Inc.

- Kampgrounds of America, Inc. (KOA)

- Johnson Outdoors Inc.

- Outwell

- Dometic Group AB

- Columbia Sportswear Company

- Groupe Trigano

- Thule Group

- ASG Sports

- Hilleberg the Tentmaker

- Gelert

- Big Agnes, Inc.

- Snow Peak Inc.

- REI Co-op

- MSR (Mountain Safety Research)

- Montbell Co., Ltd.

- Blacks Outdoor Retail Ltd.

- Kampa

- Zempire Camping Equipment

- Robens

Recent Developments:

September 25, 2023: Kampgrounds of America, Inc., a leader in the outdoor hospitality industry, announced its recent designation as a VetFran member, reinforcing its commitment to supporting veterans as they transition into the world of entrepreneurship. This partnership underscores KOA’s mission to connect people to the outdoors and each other and its core value of entrepreneurship while recognizing the unique skills and dedication of military veterans.

August 28, 2023: Two beloved Montana brands are coming together to crack open a cold one in the great outdoors. Billings-based Kampgrounds of America, Inc. and Sidney-based Meadowlark Brewing announce the launch of their handcrafted collaborative microbrew, the Happy Camper IPA, available for purchase now at select retail stores and KOA campgrounds.

Regional Analysis

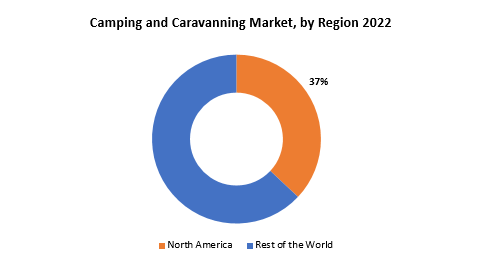

North America accounted for the largest market in the camping and caravanning market. North America accounted for 37 % market share of the global market value. North America has always held the greatest market share in the camping and caravanning business. This dominance may be linked to a number of elements that contribute to the region’s thriving camping culture. North America’s large and diverse landscapes, including national parks, woods, and gorgeous coastlines, provide a wide range of camping options, drawing campers from all over the world.

Camping and outdoor leisure have a long history in the United States and Canada, in particular. A well-developed network of campsites, state parks, and private camping facilities caters to a wide range of camping interests, including classic tent camping, RV camping, and glamping. Camping’s cultural relevance as a leisure activity, which is typically embedded in North American lifestyles, adds to its continued appeal. Furthermore, the North American camping and caravanning sector has seen developments and trends aligned with changing customer tastes, such as the emergence of glamping, an emphasis on environmentally responsible practices, and the use of technology for better camping experiences.

Europe has a long camping history that is strongly ingrained in its culture. The continent is a popular camping destination due to its various landscapes, historic landmarks, and well-maintained camping facilities. European campers frequently enjoy a variety of camping techniques, ranging from classic tent camping to RV experiences and glamping. The popularity of camping festivals and events contributes to the market’s liveliness. In recent years, there has been a significant emphasis on sustainable and eco-friendly camping methods, which is consistent with the region’s dedication to environmental protection.

The Asia-Pacific camping and caravanning industry has been seeing considerable expansion due to a number of factors. Camping fans will find plenty of chances in the different environments, which include mountains, beaches, and woods. Camping is strongly established in the outdoor lifestyle in nations such as Australia and New Zealand, with a strong camping culture dominating among residents and drawing foreign tourists. The increase of adventure tourism and the allure of personal encounters with nature all contribute to the market’s expansion. Furthermore, as disposable incomes grow in many Asia-Pacific nations, more people and families are investigating camping and caravanning as cost-effective and fun vacation choices.

Target Audience for Camping and Caravanning Market

- Camping Gear Manufacturers

- Recreational Vehicle (RV) Manufacturers

- Adventure Tourism Companies

- Camping Equipment Retailers

- Travel Agencies

- Nature and Wildlife Conservation Organizations

- Local and National Tourism Boards

- E-commerce Platforms specializing in Outdoor and Camping Products

- Campground Owners and Operators

- Outdoor Event Organizers

- Camping Site Developers

- Eco-friendly and Sustainable Product Manufacturers

- Government Agencies involved in Tourism and Recreation

- Leisure Vehicle Rental Companies

- Outdoor Activity Instructors and Guides

- Camping and Outdoor Magazines and Publications

- Adventure Travel Enthusiasts.

Segments Covered in the Camping and Caravanning Market Report

Camping and Caravanning Market by Type of Camper

- Car Camping

- RV Camping

- Backpacking

- Others

Camping and Caravanning Market by Age

- 6-12 yrs

- 13-17 yrs

- 18-24 yrs

- 25-44 yrs

- 45 + yrs

Camping and Caravanning Market by Destination Type

- Public or Privately Owned Land Other Than a Campground

- Backcountry, National Forest or Wilderness Areas

- Parking Lots

- State or National Park Campgrounds

- Privately Owned Campgrounds

- Others

Camping and Caravanning Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Camping and Caravanning market over the next 7 years?

- Who are the major players in the Camping and Caravanning market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Camping and Caravanning market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Camping and Caravanning market?

- What is the current and forecasted size and growth rate of the global Camping and Caravanning market?

- What are the key drivers of growth in the Camping and Caravanning market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Camping and Caravanning market?

- What are the technological advancements and innovations in the Camping and Caravanning market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the camping and caravanning market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Camping and Caravanning market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CAMPING AND CARAVANNING MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CAMPING AND CARAVANNING MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CAMPING AND CARAVANNING MARKET OUTLOOK

- GLOBAL CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER, 2020-2030, (USD BILLION)

- CAR CAMPING

- RV CAMPING

- BACKPACKING

- OTHERS

- GLOBAL CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE, 2020-2030, (USD BILLION)

- PUBLIC OR PRIVATELY OWNED LAND OTHER THAN A CAMPGROUND

- BACKCOUNTRY, NATIONAL FOREST OR WILDERNESS AREAS

- PARKING LOTS

- OTHERS

- STATE OR NATIONAL PARK CAMPGROUNDS

- PRIVATELY OWNED CAMPGROUNDS

- GLOBAL CAMPING AND CARAVANNING MARKET BY AGE, 2020-2030, (USD BILLION)

- 6-12 YRS

- 13-17 YRS

- 18-24 YRS

- 25-44 YRS

- 45 + YRS

- GLOBAL CAMPING AND CARAVANNING MARKET BY REGION, 2020-2030, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- THE COLEMAN COMPANY, INC.

- KAMPGROUNDS OF AMERICA, INC. (KOA)

- JOHNSON OUTDOORS INC.

- OUTWELL

- DOMETIC GROUP AB

- COLUMBIA SPORTSWEAR COMPANY

- GROUPE TRIGANO

- THULE GROUP

- ASG SPORTS

- HILLEBERG THE TENTMAKER

- GELERT

- BIG AGNES, INC.

- SNOW PEAK INC.

- REI CO-OP

- MSR (MOUNTAIN SAFETY RESEARCH)

- MONTBELL CO., LTD.

- BLACKS OUTDOOR RETAIL LTD.

- KAMPA

- ZEMPIRE CAMPING EQUIPMENT

- ROBENS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 2 GLOBAL CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 3 GLOBAL CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 4 GLOBAL CAMPING AND CARAVANNING MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA CAMPING AND CARAVANNING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 9 US CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 10 US CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 11 US CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 12 CANADA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 13 CANADA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 14 CANADA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 15 MEXICO CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 16 MEXICO CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 17 MEXICO CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 22 BRAZIL CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 23 BRAZIL CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 24 BRAZIL CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 25 ARGENTINA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 26 ARGENTINA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 28 COLOMBIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 29 COLOMBIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC CAMPING AND CARAVANNING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 38 INDIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 39 INDIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 40 INDIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 41 CHINA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 42 CHINA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 43 CHINA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 44 JAPAN CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 45 JAPAN CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 46 JAPAN CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 59 EUROPE CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 60 EUROPE CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 62 EUROPE CAMPING AND CARAVANNING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 63 GERMANY CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 64 GERMANY CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 65 GERMANY CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 66 UK CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 67 UK CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 68 UK CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 69 FRANCE CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 70 FRANCE CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 71 FRANCE CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 72 ITALY CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 73 ITALY CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 74 ITALY CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 75 SPAIN CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 76 SPAIN CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 77 SPAIN CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 78 RUSSIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 79 RUSSIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 80 RUSSIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 88 UAE CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 89 UAE CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 90 UAE CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2020-2030

FIGURE 9 GLOBAL CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2020-2030

FIGURE 10 GLOBAL CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2020-2030

FIGURE 11 GLOBAL CAMPING AND CARAVANNING MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CAMPING AND CARAVANNING MARKET BY TYPE OF CAMPER (USD BILLION) 2022

FIGURE 14 GLOBAL CAMPING AND CARAVANNING MARKET BY DESTINATION TYPE (USD BILLION) 2022

FIGURE 15 GLOBAL CAMPING AND CARAVANNING MARKET BY AGE (USD BILLION) 2022

FIGURE 16 GLOBAL CAMPING AND CARAVANNING MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 THE COLEMAN COMPANY, INC.: COMPANY SNAPSHOT

FIGURE 19 KAMPGROUNDS OF AMERICA, INC. (KOA): COMPANY SNAPSHOT

FIGURE 20 JOHNSON OUTDOORS INC.: COMPANY SNAPSHOT

FIGURE 21 OUTWELL: COMPANY SNAPSHOT

FIGURE 22 DOMETIC GROUP AB: COMPANY SNAPSHOT

FIGURE 23 COLUMBIA SPORTSWEAR COMPANY: COMPANY SNAPSHOT

FIGURE 24 GROUPE TRIGANO: COMPANY SNAPSHOT

FIGURE 25 THULE GROUP: COMPANY SNAPSHOT

FIGURE 26 ASG SPORTS: COMPANY SNAPSHOT

FIGURE 27 HILLEBERG THE TENTMAKER: COMPANY SNAPSHOT

FIGURE 28 GELERT: COMPANY SNAPSHOT

FIGURE 29 BIG AGNES, INC.: COMPANY SNAPSHOT

FIGURE 30 SNOW PEAK INC.: COMPANY SNAPSHOT

FIGURE 31 REI CO-OP: COMPANY SNAPSHOT

FIGURE 32 MSR (MOUNTAIN SAFETY RESEARCH): COMPANY SNAPSHOT

FIGURE 33 MONTBELL CO., LTD.: COMPANY SNAPSHOT

FIGURE 34 BLACKS OUTDOOR RETAIL LTD.: COMPANY SNAPSHOT

FIGURE 35 KAMPA: COMPANY SNAPSHOT

FIGURE 36 ZEMPIRE CAMPING EQUIPMENT: COMPANY SNAPSHOT

FIGURE 37 ROBENS: COMPANY SNAPSHOT

FAQ

The global camping and caravanning market is anticipated to grow from USD 83.77 Billion in 2023 to USD 49.33 Billion by 2030, at a CAGR of 7.86 % during the forecast period.

North America accounted for the largest market in the camping and caravanning market. North America accounted for 37 % market share of the global market value.

The Coleman Company, Inc., Kampgrounds of America, Inc. (KOA), Johnson Outdoors Inc., Outwell, Dometic Group AB, Columbia Sportswear Company, Groupe Trigano, Thule Group, ASG Sports, Hilleberg the Tentmaker, Gelert, Big Agnes, Inc., Snow Peak Inc., REI Co-op, MSR (Mountain Safety Research), Montbell Co., Ltd., Blacks Outdoor Retail Ltd., Kampa, Zempire Camping Equipment, Robens

Key trends in the camping and caravanning market include a growing interest in adventure tourism, where travelers seek unique and immersive outdoor experiences. Additionally, the digitalization of camping services is on the rise, enhancing booking processes, campsite management, and overall customer experience. However, the seasonal nature of demand remains a challenge, affecting market growth during off-peak periods.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.