REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 738.04 million by 2030 | 3.3% | North America |

| by Type | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Market Overview

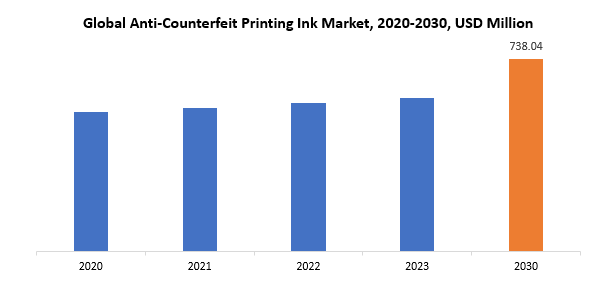

The global anti-counterfeit printing ink market size is projected to grow from USD 588 million in 2023 to USD 738.04 million by 2030, exhibiting a CAGR of 3.3% during the forecast period.

Anti-counterfeit printing ink refers to a specialized ink utilized in printing processes, aimed at thwarting the replication or forging of valuable documents, currency, labels, packaging, and other items of significance. This ink is formulated with distinctive properties that render it challenging to accurately duplicate, thereby serving as a deterrent to counterfeiters. Characterized by both overt and covert security features, anti-counterfeit inks may incorporate elements such as fluorescent dyes, taggants, color-shifting pigments, micro text, and intricate patterns or designs. These features are often imperceptible to the unaided eye or necessitate specialized equipment for detection, posing significant obstacles to counterfeit production. Moreover, certain anti-counterfeit inks are engineered to resist various forms of tampering, including alteration, erasure, or chemical removal, thereby bolstering the security of the printed material. In essence, anti-counterfeit printing ink assumes a pivotal role in upholding the authenticity and integrity of printed materials, serving as a crucial tool for businesses, governments, and consumers in their efforts to combat counterfeiting and fraud.

The scope of anti-counterfeit printing ink is wide-ranging, spanning diverse industries and applications where maintaining authenticity and deterring counterfeiting are paramount concerns. This specialized ink is utilized in printing a broad spectrum of documents, currency, packaging, labels, pharmaceuticals, consumer goods, and more. Its use is prevalent across sectors including finance, government, healthcare, consumer products, and luxury goods. Within the finance sector, anti-counterfeit printing ink serves a crucial function in producing banknotes, checks, and other financial documents, ensuring protection against fraudulent replication and safeguarding the integrity of monetary systems. Government agencies rely on these inks for creating secure documents like passports, identification cards, and tax stamps, thereby ensuring the authenticity of essential credentials and preventing identity theft or document fraud. In the pharmaceutical industry, anti-counterfeit printing ink is employed to mark packaging and labels, enabling consumers to verify the authenticity of medicines and safeguarding public health by preventing the circulation of counterfeit drugs. Similarly, within the consumer goods sector, brands leverage these inks to authenticate products and combat the spread of counterfeit merchandise, thereby preserving their reputation and fostering consumer trust.

Moreover, anti-counterfeit printing ink plays a crucial role in bolstering supply chain security by facilitating product traceability and authentication throughout the distribution process. This is particularly relevant in industries such as food and beverage, where verifying product legitimacy is essential for consumer safety and regulatory compliance. In summary, the scope of anti-counterfeit printing ink is extensive and diverse, serving as a vital asset across industries to combat counterfeiting, protect intellectual property, ensure consumer safety, and uphold the integrity of goods and documents. Its application continues to evolve alongside technological advancements, driving innovation in anti-counterfeiting strategies and enhancing security measures on a global scale.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) (Thousand Units) |

| Segmentation | By Type, Application and Region |

|

By Type |

|

|

By Application |

|

|

By Region |

|

Anti-Counterfeit Printing Ink Market Segmentation Analysis

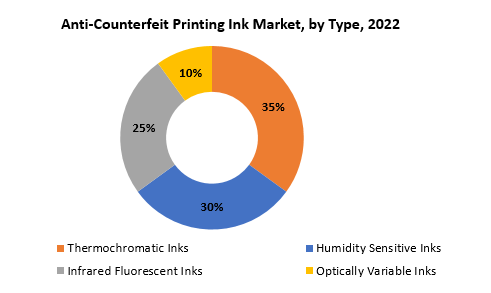

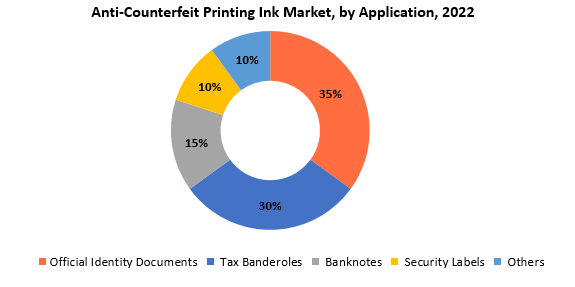

The global anti-counterfeit printing ink market is bifurcated three segments, by type, application and region. By type, the market is bifurcated into thermochromatic inks, humidity sensitive inks, infrared fluorescent inks, and optically variable inks. By application, the market is bifurcated official identity documents, tax banderoles, banknotes, security labels, and others and region.

Anti-counterfeit printing inks are available in various types, each offering distinct features and functionalities to effectively combat counterfeiting. Thermochromatic inks react to temperature variations, changing color or transparency in response to heat manipulation, making them suitable for applications requiring temperature-sensitive security measures. Humidity-sensitive inks alter their appearance based on moisture levels, serving as visible indicators of tampering or exposure to environmental conditions. Infrared fluorescent inks are detectable under infrared light, enabling covert authentication using specialized equipment. Optically variable inks exhibit color-shifting characteristics, appearing differently depending on the viewing angle or lighting conditions, rendering them challenging to replicate accurately. Additional types of anti-counterfeit inks incorporate taggants or unique identifiers detectable through chemical analysis or specialized equipment, providing supplementary layers of security. In essence, the diverse array of anti-counterfeit printing inks, encompassing thermochromatic, humidity-sensitive, infrared fluorescent, optically variable, and other specialized formulations, equips businesses, governments, and consumers with a comprehensive toolkit to combat counterfeiting effectively and uphold the integrity of valuable documents, currency, products, and packaging.

The anti-counterfeit printing ink market is categorized by application into distinct sectors, which encompass media & entertainment, automotive, online education, and other fields. Within the media & entertainment industry, Anti-Counterfeit Printing Ink plays a pivotal role in crafting films, television series, and video games, captivating audiences with its visually stunning narratives and immersive experiences. In the automotive sector, Anti-Counterfeit Printing Ink is employed for tasks like designing and simulating vehicle prototypes, as well as creating interactive interfaces for in-car entertainment systems and promotional materials. Within online education platforms, Anti-Counterfeit Printing Ink is integrated to enrich learning experiences, rendering intricate concepts more engaging and comprehensible through interactive visuals and simulations. Moreover, Anti-Counterfeit Printing Ink finds utility across a spectrum of other industries, including advertising, healthcare, architecture, and manufacturing, where it serves purposes such as product visualization, training simulations, and promotional content creation. In essence, Anti-Counterfeit Printing Ink stands as a versatile tool that drives innovation, creativity, and engagement across a myriad of applications.

Anti-Counterfeit Printing Ink Market Dynamics

Driver

The rise in counterfeit products across various industries such as pharmaceuticals, cosmetics, and electronics is a significant driver for the demand for anti-counterfeit printing inks.

The surge in counterfeit products spanning various sectors like pharmaceuticals, cosmetics, and electronics has emerged as a critical issue for businesses globally. With the expansion of global trade and advancements in technology, counterfeiters have honed their skills in replicating authentic products, posing significant risks to brands and consumers alike. As this illicit activity escalates, companies find themselves under increasing pressure to safeguard their reputations and customers by implementing robust anti-counterfeit measures. Central to these efforts is the adoption of specialized anti-counterfeit printing inks. These advanced inks integrate sophisticated security features that are challenging counterfeiters to replicate, thereby enhancing product authentication and dissuading illicit replication. Through the application of state-of-the-art printing technologies like micro printing, taggants, and invisible inks, companies can embed unique markers and covert identifiers into their packaging, facilitating the distinction between genuine products and counterfeit imitations. In light of the escalating threat posed by counterfeiting, there is a burgeoning demand for anti-counterfeit printing inks offering heightened security and authentication capabilities. Across diverse industries, manufacturers are increasingly turning to these specialized inks to fortify their packaging and preserve brand integrity. Moreover, stringent regulatory mandates and consumer awareness initiatives further propel the adoption of anti-counterfeit technologies, prompting businesses to invest in advanced printing solutions to mitigate the risks associated with counterfeit goods. In summary, the upsurge in counterfeit activities acts as a driving force behind the widespread adoption of anti-counterfeit printing inks. As companies strive to combat the pervasive menace of counterfeit goods and uphold their brand reputation and consumer trust, the need for sophisticated anti-counterfeit technologies continues to surge. By embracing innovative printing solutions and incorporating advanced security features into their packaging, companies can bolster their defenses against counterfeiters and reaffirm their commitment to product authenticity and consumer confidence.

Restraint

High implementation costs can act as a barrier to adoption, especially for companies operating on tight budgets.

The substantial upfront costs involved in implementing anti-counterfeit printing inks can pose a significant financial challenge, particularly for small and medium-sized enterprises (SMEs). These initial investments encompass not only the purchase of specialized inks but also infrastructure upgrades and equipment modifications necessary for seamless integration into existing production processes. For SMEs operating within constrained budgets, these expenses can represent a considerable portion of their financial resources, serving as a deterrent to adoption. Several factors contribute to the high implementation costs associated with anti-counterfeit printing inks. Firstly, the specialized nature of these inks often commands a premium price compared to conventional printing inks. Additionally, deploying anti-counterfeit measures may require adjustments to printing equipment or the adoption of new technologies, further contributing to overall implementation expenses. Moreover, SMEs may lack the economies of scale enjoyed by larger enterprises, making it challenging to negotiate favorable pricing terms or absorb the upfront costs. Consequently, the significant investment required for anti-counterfeit printing inks can hinder widespread adoption, especially among smaller businesses. Despite recognizing the importance of safeguarding their products and brands against counterfeiting, SMEs may find it difficult to justify the initial expenditure, particularly when faced with competing financial priorities and constraints. To overcome this barrier, stakeholders in the anti-counterfeit printing ink industry must explore avenues to make these solutions more accessible and cost-effective for SMEs. This could involve offering flexible pricing structures, providing financing options, or developing scalable solutions tailored to the specific needs and budget constraints of smaller enterprises. By lowering entry barriers and facilitating easier access to anti-counterfeit technologies, the industry can extend its reach and empower SMEs to protect their products against the threats of counterfeiting.

Opportunities

Rapid economic growth in emerging markets presents significant opportunities for the anti-counterfeit printing ink market.

The swift economic expansion witnessed in emerging markets signifies a substantial opportunity for the anti-counterfeit printing ink market. With the growth of these economies, there is a simultaneous surge in the consumption of branded goods across various sectors. However, this upswing also brings with it an escalated risk of counterfeit activities, as counterfeiters seek to exploit the surging demand for popular products. In response to these challenges, there is an increasing awareness among consumers and regulatory bodies in emerging markets regarding the perils associated with counterfeit products. Consumers are becoming more vigilant about ensuring the authenticity of the items they purchase, propelling the demand for robust anti-counterfeit solutions. This heightened awareness, coupled with regulatory initiatives aimed at curbing counterfeiting, establishes a favorable climate for the adoption of anti-counterfeit printing inks. Furthermore, the expanding middle class in emerging markets is fueling the desire for branded products, encompassing pharmaceuticals, cosmetics, electronics, and luxury items. As consumers become more discerning about the quality and legitimacy of products, there emerges a pressing need for manufacturers to implement effective anti-counterfeit measures to safeguard their brands and uphold consumer trust. Additionally, rapid technological advancements are democratizing access to anti-counterfeit solutions, rendering them more accessible and cost-effective. Manufacturers in emerging markets to combat counterfeiting are increasingly embracing innovative printing technologies like micro printing, holograms, and invisible inks. In essence, the amalgamation of rapid economic growth, heightened consumer awareness, regulatory initiatives, and technological progress offers substantial growth prospects for the anti-counterfeit printing ink market in emerging markets. As companies endeavor to shield their brands and consumers from the hazards of counterfeiting, the demand for sophisticated anti-counterfeit solutions is poised to persistently ascend, propelling market expansion in these vibrant and rapidly evolving economies.

Anti-Counterfeit Printing Ink Market Trends

-

Ongoing progress in ink formulation technologies is propelling the creation of more intricate anti-counterfeit features. This involves the incorporation of nanotechnology, micro- and nano-structures, and advanced materials to develop ink solutions with heightened security attributes.

-

The merging of printing technologies with digital solutions is becoming more prevalent. This entails utilizing digital printing techniques to produce personalized and highly secure features, as well as integrating digital authentication methods like QR codes, NFC tags, and block chain technology into printed products.

-

With the surge in online commerce and the expansion of global supply chains, brands are placing greater emphasis on safeguarding their products from counterfeiting. This has led to a rising demand for anti-counterfeit printing inks with customizable security features tailored to specific brand needs.

-

Stringent regulatory standards for product authentication and traceability are driving the adoption of anti-counterfeit printing inks across diverse industries. Adhering to regulations such as the EU Falsified Medicines Directive (FMD) and the FDA’s Drug Supply Chain Security Act (DSCSA) is prompting companies to invest in robust anti-counterfeit solutions.

-

There is an increasing focus on sustainability and environmental responsibility within the printing industry. This has prompted the development of eco-friendly and biodegradable anti-counterfeit printing inks, as manufacturers seek to minimize their products’ environmental footprint while maintaining high security levels.

-

The globalization of trade has facilitated the proliferation of counterfeit products across borders, posing significant challenges for brand owners and regulatory bodies. This has spurred the adoption of more sophisticated anti-counterfeit measures, including advanced printing inks with multi-layered security features.

Competitive Landscape

The competitive landscape of the anti-counterfeit printing ink market was dynamic, with several prominent companies competing to provide innovative and advanced anti-counterfeit printing ink.

- Agfa-Gevaert Group

- AlpVision

- ALTANA AG

- ArjoWiggins Security

- Authentix, Inc.

- Cabot Corporation

- Colorcon, Inc.

- CTI

- Dover Corporation

- Flint Group

- Giesecke+Devrient GmbH

- Gleitsmann Security Inks

- ITW Security Division

- Kao Collins

- Luminescence International Ltd.

- Microtrace, LLC

- Saueressig GmbH + Co. KG

- Sicpa

- SICPA Holding SA

- Sun Chemical Corporation

Recent Developments:

January 17, 2024 – Dover announces acquisition of transchem group, a leading provider of car wash chemicals and water reclaim systems. Dover announced that it has completed the acquisition of Transchem Group (“Transchem”), one of the largest suppliers of car wash chemistry and associated solutions in North America. Transchem is now part of OPW’s Vehicle Wash Solutions business (“OPW VWS”) within Dover’s Clean Energy & Fueling segment.

February 29, 2024 — Global print consumables supplier Flint Group has launched Novasens® P670 PRIME, a high-performance low odour, low migration (LOLM) process ink series formulated to meet the needs of Sheetfed Offset packaging printers worldwide.

Regional Analysis

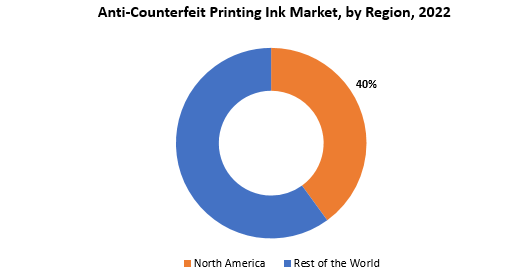

The dominance in the anti-counterfeit printing ink market shifts based on factors such as economic strength, regulatory frameworks, technological prowess, and demand from key industries. However, certain regions consistently stand out due to their significant contributions to manufacturing, innovation, and consumption of anti-counterfeit printing inks. One such influential region is North America, particularly the United States, which benefits from a robust economy advanced printing technology infrastructure, and stringent regulations governing product authentication and brand protection. North America’s leadership is further solidified by the presence of key market players and high awareness among businesses and consumers regarding counterfeit risks. Moreover, the region’s prominence in industries like pharmaceuticals, consumer goods, and finance fuels substantial demand for anti-counterfeit printing inks to safeguard products, currency, and documents. Europe also holds a dominant position in the anti-counterfeit printing ink market, notably in countries such as Germany, Switzerland, and the United Kingdom, renowned for their expertise in security printing and advanced manufacturing capabilities. The European Union’s stringent regulations on product authentication and intellectual property protection contribute to the region’s leadership. Additionally, Europe’s diverse industrial base across sectors like pharmaceuticals, automotive, luxury goods, and government generates significant demand for anti-counterfeit printing inks across diverse applications.

Asia Pacific emerges as another key area, propelled by fast industrialization, expanding consumer markets, and rising awareness of counterfeit hazards. Countries such as China, India, Japan, and South Korea are experiencing rapid expansion in the anti-counterfeit printing ink market, driven by rising investments in security printing technology and severe counterfeiting regulations. The region’s expanding industrial sectors, notably those in electronics, pharmaceuticals, and consumer products, provide attractive prospects for anti-counterfeit printing ink makers to fulfill growing demand.

Target Audience for Anti-Counterfeit Printing Ink Market

- Government and Regulatory Bodies

- Investors and Financial Institutions

- Research and Consulting Firms

- Corporate Training Departments

- Government agencies

- Printing companies

- Pharmaceutical companies

- Consumer goods manufacturers

- Trade associations

- Technology providers

Segments Covered in the Anti-Counterfeit Printing Ink Market Report

Anti-Counterfeit Printing Ink Market by Type

- Thermochromatic Inks

- Humidity Sensitive Inks

- Infrared Fluorescent Inks

- Optically Variable Inks

Anti-Counterfeit Printing Ink Market by Application

- Official Identity Documents

- Tax Banderoles

- Banknotes

- Security Labels

- Others

Anti-Counterfeit Printing Ink Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Anti-Counterfeit Printing Ink Market over the next 7 years?

- Who are the key market participants Anti-Counterfeit Printing Ink, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Anti-Counterfeit Printing Ink Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Anti-Counterfeit Printing Ink Market?

- What is the current and forecasted size and growth rate of the global Anti-Counterfeit Printing Ink Market?

- What are the key drivers of growth in the Anti-Counterfeit Printing Ink Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Anti-Counterfeit Printing Ink Market?

- What are the technological advancements and innovations in the Anti-Counterfeit Printing Ink Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Anti-Counterfeit Printing Ink Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Anti-Counterfeit Printing Ink Market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- ANTI-COUNTERFEIT PRINTING INK MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON ANTI-COUNTERFEIT PRINTING INK MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- ANTI-COUNTERFEIT PRINTING INK MARKET OUTLOOK

- GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- THERMOCHROMATIC INKS

- HUMIDITY SENSITIVE INKS

- INFRARED FLUORESCENT INKS

- OPTICALLY VARIABLE INKS

- GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- OFFICIAL IDENTITY DOCUMENTS

- TAX BANDEROLES

- BANKNOTES

- SECURITY LABELS

- OTHERS

- GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY REGION, 2020-2030, (USD MILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AGFA-GEVAERT GROUP

- ALPVISION

- ALTANA AG

- ARJOWIGGINS SECURITY

- AUTHENTIX, INC.

- CABOT CORPORATION

- COLORCON, INC.

- CTI

- DOVER CORPORATION

- DUPONT

- FLINT GROUP

- GIESECKE+DEVRIENT GMBH

- GLEITSMANN SECURITY INKS

- ITW SECURITY DIVISION

- KAO COLLINS

- LUMINESCENCE INTERNATIONAL LTD.

- MICROTRACE, LLC

- SAUERESSIG GMBH + CO. KG

- SICPA HOLDING SA

- SUN CHEMICAL CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 2 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 4 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 13 US ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 14 US ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 16 US ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 18 CANADA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 20 CANADA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 22 MEXICO ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 24 MEXICO ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 28 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 30 SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 32 BRAZIL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 34 BRAZIL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 36 ARGENTINA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 38 ARGENTINA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 40 COLOMBIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 42 COLOMBIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 50 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 52 ASIA-PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 54 INDIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 56 INDIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 58 CHINA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 60 CHINA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 62 JAPAN ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 64 JAPAN ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 66 SOUTH KOREA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 68 SOUTH KOREA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 70 AUSTRALIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 72 AUSTRALIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 82 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 84 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 86 EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 88 GERMANY ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 90 GERMANY ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 UK ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 92 UK ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 94 UK ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 96 FRANCE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 98 FRANCE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 100 ITALY ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 102 ITALY ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 104 SPAIN ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 106 SPAIN ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 108 RUSSIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 110 RUSSIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 112 REST OF EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 114 REST OF EUROPE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 121 UAE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 122 UAE ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 124 UAE ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 126 SAUDI ARABIA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 128 SAUDI ARABIA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 130 SOUTH AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 132 SOUTH AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (USD MILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE USD MILLION, 2020-2030

FIGURE 9 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION, USD MILLION, 2020-2030

FIGURE 10 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY TYPE, USD MILLION 2022

FIGURE 13 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY APPLICATION, USD MILLION 2022

FIGURE 14 GLOBAL ANTI-COUNTERFEIT PRINTING INK MARKET BY REGION, USD MILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

FIGURE 17 ALPVISION: COMPANY SNAPSHOT

FIGURE 18 ALTANA AG: COMPANY SNAPSHOT

FIGURE 19 ARJOWIGGINS SECURITY: COMPANY SNAPSHOT

FIGURE 20 AUTHENTIX, INC.: COMPANY SNAPSHOT

FIGURE 21 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 22 COLORCON, INC.: COMPANY SNAPSHOT

FIGURE 23 CTI: COMPANY SNAPSHOT

FIGURE 24 DOVER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 DUPONT: COMPANY SNAPSHOT

FIGURE 26 FLINT GROUP: COMPANY SNAPSHOT

FIGURE 27 GIESECKE+DEVRIENT GMBH: COMPANY SNAPSHOT

FIGURE 28 GLEITSMANN SECURITY INKS: COMPANY SNAPSHOT

FIGURE 29 ITW SECURITY DIVISION: COMPANY SNAPSHOT

FIGURE 30 KAO COLLINS: COMPANY SNAPSHOT

FIGURE 31 LUMINESCENCE INTERNATIONAL LTD.: COMPANY SNAPSHOT

FIGURE 32 MICROTRACE, LLC: COMPANY SNAPSHOT

FIGURE 33 SAUERESSIG GMBH + CO. KG: COMPANY SNAPSHOT

FIGURE 34 SICPA HOLDING SA: COMPANY SNAPSHOT

FIGURE 35 SUN CHEMICAL CORPORATION: COMPANY SNAPSHOT

FAQ

The global anti-counterfeit printing ink market size is projected to grow from USD 588 million in 2023 to USD 738.04 million by 2030, exhibiting a CAGR of 3.3% during the forecast period.

North America accounted for the largest market in the anti-counterfeit printing ink market.

Agfa-Gevaert Group, AlpVision, ALTANA AG, ArjoWiggins Security ,Authentix, Inc., Cabot Corporation, Colorcon, CTI, Dover Corporation, Flint Group, Giesecke+Devrient GmbH and Others.

Rapid industrialization and economic development in emerging markets are driving heightened demand for anti-counterfeit printing inks. Countries with substantial manufacturing sectors, such as China, India, and Brazil, are experiencing growing concerns about counterfeit goods and are investing in robust anti-counterfeit solutions.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.