REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 29.30 Billion by 2030 | 20.74 % | North America |

| by Type | by Technology | by Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Agriculture Drones and Robots Market Overview

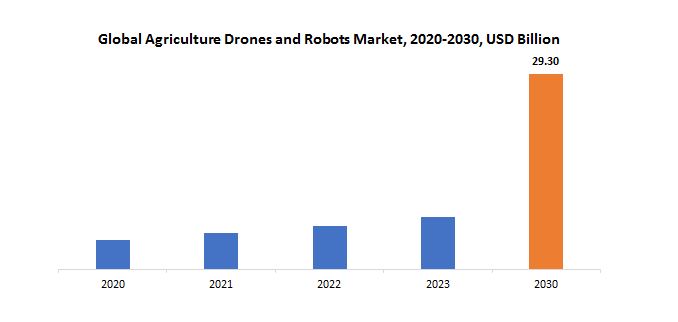

The global agriculture drones and robots market is anticipated to grow from USD 7.83 Billion in 2023 to USD 29.30 Billion by 2030, at a CAGR of 20.74 % during the forecast period.

Agriculture drones and robots represent a transformative convergence of technology and agriculture, revolutionizing traditional farming practices. Drones, also known as Unmanned Aerial Vehicles (UAVs), are equipped with advanced sensors and imaging systems, allowing farmers to monitor vast agricultural fields with unprecedented precision. These devices provide real-time data on crop health, soil conditions, and other essential parameters, enabling data-driven decision-making for optimized resource utilization.

Agricultural robots encompass a diverse range of autonomous or semi-autonomous machines designed for various tasks, such as planting, harvesting, and crop maintenance. These robots leverage technologies like Artificial Intelligence (AI), GPS, and automation to execute tasks with efficiency and accuracy. The integration of AI facilitates data analysis, predictive modeling, and intelligent automation in both drones and robots, enhancing their capabilities. The primary goals of agriculture drones and robots include improving yield, reducing operational costs, addressing labor shortages, and promoting sustainable farming practices. These technologies are central to the concept of precision agriculture, empowering farmers to manage their crops at a granular level, leading to increased productivity and environmental stewardship.

The increasing global population and subsequent rising demand for food necessitate more efficient and productive farming practices. Agriculture drones and robots offer precision and automation, addressing these demands by optimizing resource utilization and enhancing overall yield. advancements in technology, including sensors, artificial intelligence, and GPS systems, have significantly improved the capabilities of these devices, enabling real-time data collection and analytics for informed decision-making. Thirdly, the ongoing trend toward sustainable and precision agriculture is a key driver.

Drones and robots enable farmers to precisely manage crops, minimizing waste, reducing environmental impact, and promoting responsible use of resources. Additionally, labor shortages in the agriculture sector, particularly in regions with aging farming populations, are prompting the adoption of automation technologies to perform tasks such as planting, monitoring, and harvesting. Furthermore, government support and initiatives, including subsidies and incentives, are encouraging farmers to invest in advanced agricultural technologies. Finally, the increasing awareness of the benefits of these technologies, coupled with a growing number of successful use cases, is fostering a positive perception and driving widespread acceptance of agriculture drones and robots across the industry.

These technologies are instrumental in optimizing farming practices through precision agriculture, offering real-time monitoring and data-driven decision-making. The importance of agriculture drones and robots lies in their ability to revolutionize traditional farming methods, mitigating issues such as labor shortages, increasing global food demand, and environmental concerns. These technologies enhance productivity by automating labor-intensive tasks, including planting, monitoring, and harvesting, thereby improving overall yield. Moreover, the precise application of resources, such as water, fertilizers, and pesticides, minimizes waste and contributes to sustainable farming practices. The Agriculture Drones and Robots market is crucial in promoting resilience in the face of climate change, helping farmers adapt to evolving environmental conditions and ensuring food security for a growing global population.

Additionally, by offering advanced capabilities like data analytics, AI-driven insights, and autonomous operations, these technologies empower farmers to make informed decisions, ultimately fostering a more efficient, environmentally conscious, and technologically advanced agricultural sector. In essence, the Agriculture Drones and Robots market is pivotal in shaping the future of farming, addressing pressing challenges, and contributing to the global effort for sustainable and resilient food production.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Technology, Application and Region |

| By Type |

|

| By Application |

|

Agriculture Drones and Robots Market Segmentation Analysis

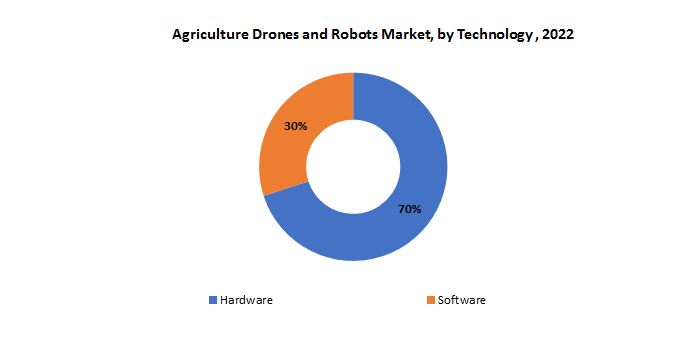

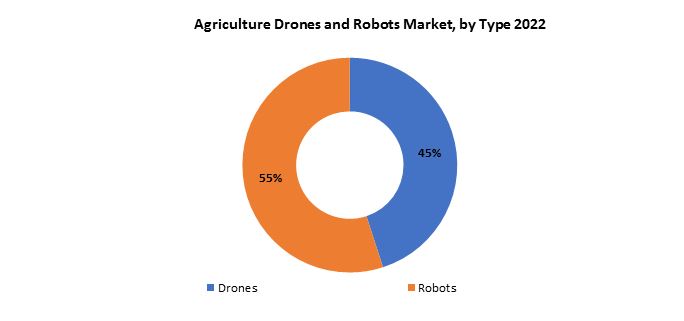

The global Agriculture Drones and Robots market is divided into three segments, type, Application, Technology and region. By type the market is divided drones, robots. By Application the market is classified into precision agriculture, livestock management, smart greenhouse management, irrigation management, inventory management, precision fish farming, others. By Technology, the market is classified into hardware, software.

Based on technology, Hardware segment dominating in the agriculture drones and robots market. The Hardware segment stands as the dominant force in the Agriculture Drones and Robots market, playing a central role in shaping the technological landscape of precision agriculture. This dominance is primarily attributed to the critical components that constitute the hardware of agriculture drones and robots, including sensors, cameras, GPS systems, and automation mechanisms.

Sensors and cameras are instrumental in collecting real-time data on crop health, soil conditions, and environmental parameters, providing farmers with actionable insights. GPS systems enable precise navigation and mapping, facilitating accurate and efficient task execution. The automation mechanisms embedded in hardware, such as robotic arms and grippers in agricultural robots, contribute to the seamless execution of tasks like planting and harvesting. The robust and reliable performance of these hardware components is paramount for the success of agriculture drones and robots, making them indispensable for modern farming practices.

Agricultural software encompasses a spectrum of applications and functionalities tailored to enhance the capabilities of drones and robots. Data analytics software plays a pivotal role by processing the vast amount of data collected by sensors and cameras on drones, providing farmers with actionable insights into crop health, pest infestations, and soil conditions. Furthermore, Artificial Intelligence (AI) algorithms integrated into the software enable advanced functionalities, such as predictive analytics, allowing farmers to anticipate crop yields and optimize resource allocation. Farm management software is another essential aspect, facilitating the planning and coordination of tasks, monitoring equipment performance, and streamlining overall agricultural operations.

Based on type, robots segment dominating in the agriculture drones and robots market. Agricultural robots, equipped with advanced technologies such as Artificial Intelligence (AI) and automation, play a pivotal role in automating labor-intensive tasks throughout the agricultural value chain. These robots are specifically designed for various functions, including planting, harvesting, weeding, and crop monitoring. The dominance of the Robots segment can be attributed to the increasing demand for autonomous machines that can efficiently handle complex tasks with precision and speed, addressing challenges associated with labor shortages in the agriculture sector.

These robots offer a high level of customization, adapting to diverse agricultural environments and crop types. Their ability to operate autonomously or semi-autonomously, guided by sophisticated sensors and GPS systems, enhances overall operational efficiency. The Robots segment not only streamlines traditional farming practices but also contributes to sustainability efforts by optimizing resource use and reducing the environmental impact of agricultural activities.

Unmanned Aerial Vehicles (UAVs), commonly known as drones, equipped with advanced technologies, have become indispensable for precision agriculture. Drones offer a bird’s-eye view of agricultural fields, collecting real-time data through high-resolution cameras, multispectral sensors, and other sophisticated imaging systems. This data includes crucial insights into crop health, soil conditions, and pest infestations. The ability to cover vast expanses of farmland quickly and efficiently sets drones apart, enabling farmers to monitor and assess large areas in a fraction of the time it would take with traditional methods. Additionally, drones equipped with GPS systems facilitate precise mapping and navigation, optimizing the application of resources such as fertilizers and pesticides.

Agriculture Drones and Robots Market Dynamics

Driver

The rising global population puts pressure on food production, making agricultural drones and robots a potential solution to increase efficiency and yield.

Agricultural drones equipped with advanced sensors and imaging technologies enable farmers to monitor crop health, detect diseases, and assess the overall condition of fields with unprecedented precision. This real-time data allows for targeted interventions, such as optimized pesticide and fertilizer application, minimizing waste and environmental impact. Drones also facilitate rapid and large-scale surveying, enabling farmers to cover vast expanses of land efficiently, which would be impractical or time-consuming with traditional methods.

Robots in agriculture further contribute to increased efficiency by automating labor-intensive tasks, such as planting, weeding, and harvesting. These machines can operate tirelessly, reducing the dependence on manual labor and addressing the challenges associated with labor shortages in many agricultural regions. Additionally, agricultural robots are designed to work in diverse environments, from traditional farmlands to vertical farms, offering flexibility and adaptability to varying agricultural needs.

The integration of artificial intelligence (AI) and machine learning algorithms enhances the capabilities of agricultural drones and robots. These technologies enable the systems to analyze vast amounts of data, identify patterns, and make data-driven decisions. Farmers can benefit from predictive analytics, which helps in anticipating crop diseases, optimizing irrigation schedules, and maximizing crop yields.

Restraint

Technical complexity and operational challenges can hinder the agriculture drones and robots market during the forecast period.

The intricate nature of integrating advanced technologies into agricultural practices. The deployment of drones and robots often requires a sophisticated understanding of various technical aspects, including sensor technology, artificial intelligence, and communication systems. Farmers may encounter difficulties in adapting to and effectively utilizing these technologies, particularly if they lack the necessary technical expertise or access to specialized training programs.

Moreover, the diversity of agricultural environments adds to the complexity. Agricultural operations vary widely in terms of crops, topography, and climate, making it challenging to develop universal solutions that cater to the specific needs of different farming scenarios. Customizing drones and robots to effectively operate in various conditions requires substantial research and development efforts, further contributing to the technical complexity.

Operational challenges pose another significant hurdle. Agricultural drones and robots need to seamlessly integrate into existing farming practices without disrupting workflows. This requires careful planning, implementation, and monitoring to ensure a smooth transition. Farmers may face issues related to compatibility with existing machinery, data management, and connectivity in remote or rural areas. Additionally, the maintenance and repair of sophisticated technology can be demanding, potentially leading to downtime and increased operational costs.

Regulatory constraints also contribute to operational challenges. Drones, in particular, are subject to strict regulations governing their airspace usage, data privacy, and safety measures. Navigating these regulations and ensuring compliance can be cumbersome for farmers, adding an additional layer of complexity to the adoption of these technologies.

Opportunities

Improvements in areas like artificial intelligence, robotics, and drone technology are making these solutions more efficient, affordable, and user-friendly.

In the realm of AI, machine learning algorithms have become more sophisticated, enabling systems to analyze vast datasets, recognize patterns, and make intelligent decisions with remarkable accuracy. This has translated into more effective applications in agriculture, healthcare, manufacturing, and beyond. The evolution of robotics has seen the development of more agile and versatile machines, capable of performing complex tasks with precision. Collaborative robots, or cobots, are gaining popularity for their ability to work alongside human operators, contributing to increased productivity and workplace safety.

Drone technology has witnessed remarkable progress, with improvements in design, functionality, and affordability. Smaller, more agile drones equipped with advanced sensors and imaging capabilities are increasingly being used for tasks such as aerial surveying, crop monitoring, and disaster response. These advancements make drones more accessible to a broader range of industries and applications, reducing costs and expanding the potential use cases.

The synergy of these technologies is particularly evident in sectors like agriculture, where AI-driven analytics, robotics, and drones converge to revolutionize traditional farming practices. Precision agriculture, for instance, leverages AI algorithms to analyze data collected by drones and robotic machinery, enabling farmers to make informed decisions about crop management, resource allocation, and pest control. These technologies not only enhance productivity but also contribute to sustainable farming practices by minimizing resource use.

In healthcare, AI is transforming diagnostics and treatment planning, while robotics are playing a crucial role in surgeries and rehabilitation. Drones equipped with medical supplies can provide swift and efficient emergency response in remote or disaster-stricken areas. These advancements collectively contribute to more effective and accessible healthcare solutions.

Agriculture Drones and Robots Market Trends

-

Increasing incorporation of Artificial Intelligence (AI) and machine learning in agriculture drones and robots for data analysis, predictive analytics, and intelligent decision-making in real-time.

-

Growing use of swarm robotics for collaborative tasks in agriculture, where multiple drones or robots work together to accomplish complex operations such as planting, monitoring, or harvesting

-

Continued emphasis on precision agriculture, leveraging drones and robots equipped with advanced sensors and imaging technologies for precise monitoring, crop management, and resource optimization.

-

Rising adoption of autonomous vehicles in agriculture, including autonomous tractors and robotic equipment for tasks like planting, plowing, and spraying, leading to increased efficiency.

-

Development and integration of smart farming platforms that connect drones and robots to centralized systems, enabling farmers to monitor and manage agricultural operations remotely.

-

Rising interest in environmental monitoring using drones and robots to assess soil health, water quality, and overall environmental conditions, aiding in sustainable farming practices.

-

Integration of 5G connectivity for improved communication and data transfer, enhancing the capabilities of agriculture drones and robots, especially in remote or large-scale farming operations.

Competitive Landscape

The competitive landscape of the agriculture drones and robots market was dynamic, with several prominent companies competing to provide innovative and advanced agriculture drones and robots solutions.

- DJI

- Deere & Company

- Trimble Inc.

- AgEagle Aerial Systems Inc.

- Parrot Drones SAS

- Yamaha Motor Co., Ltd.

- AeroVironment, Inc.

- DroneDeploy

- PrecisionHawk

- Agribotix LLC

- Topcon Positioning Systems

- Delair

- Lely

- CNH Industrial

- Autonomous Solutions Inc.

- Kubota Corporation

- CLAAS KGaA mbH

- senseFly SA

- Naio Technologies

- Agrobotix LLC

Recent Developments:

-

28, 2024: John Deere (NYSE: DE) introduced the new S7 Series of combines, a family of harvesters designed for efficiency, harvest quality and operator friendliness. Harvest time is no time to let up in the chase for efficiency. The new S7 Series of combines helps farmers and custom operators perform at the maximum to make the most of the season’s efforts.

-

12, 2024: Trimble (NASDAQ: TRMB) announced the integration of the Trimble Applanix POSPac CloudⓇ post-processed kinematic (PPK) GNSS positioning service, featuring CenterPointⓇ RTX, with the drone mapping and data collection capabilities of DroneDeploy’s reality capture platform. With the Trimble cloud positioning service, DroneDeploy customers can expect centimeter-level accuracy and an automated, streamlined workflow when performing reality capture with drones.

Regional Analysis

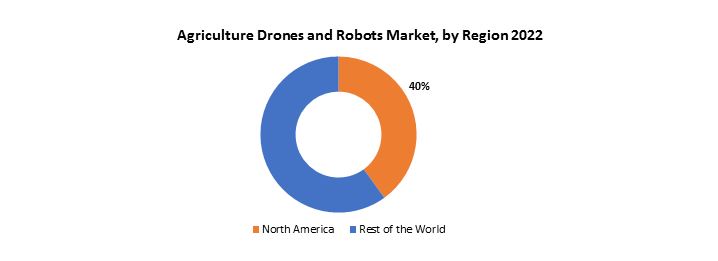

North America accounted for the largest market in the agriculture drones and robots market. North America accounted for 40 % market share of the global market value. North America stands as the dominant force in the Agriculture Drones and Robots Market, primarily owing to a combination of technological prowess, extensive adoption of precision agriculture, and a mature agricultural landscape. The region’s farmers and agricultural enterprises have been early adopters of advanced technologies, recognizing the transformative potential of drones and robots in enhancing productivity and sustainability.

The presence of major industry players, coupled with robust research and development initiatives, has accelerated the integration of cutting-edge technologies into agricultural practices. Supportive government policies and substantial investments in agricultural technology further fuel market growth. The vast scale of North American farms aligns seamlessly with the capabilities offered by drones and robots, addressing challenges related to labor shortages and improving overall efficiency. Additionally, the region’s commitment to sustainable and precision farming practices solidifies its position as a leader in the global Agriculture Drones and Robots Market, setting trends and influencing the trajectory of technological advancements in the sector.

In Europe, the market is shaped by the region’s emphasis on sustainable agriculture, stringent environmental regulations, and the presence of diverse farming practices. European farmers are increasingly integrating drones and robots for precision agriculture, leveraging technologies to optimize resource use and reduce environmental impact. The European Union’s support for smart farming initiatives and investments in agricultural innovation contribute to the growth of the market.

The Asia-Pacific region, encompassing countries like China, India, and Australia, experiences a surge in demand driven by the need to address food security challenges posed by a growing population. Precision farming practices are gaining traction in response to the region’s diverse climatic conditions and varied agricultural practices. The Asia-Pacific market is characterized by a rapid adoption of agricultural technology, with a focus on affordability and scalability. Government initiatives and collaborations with technology providers further propel the integration of drones and robots in the agricultural landscape.

Target Audience for Agriculture Drones and Robots Market

- Agricultural Cooperatives

- Agricultural Technology Companies

- Investors and Venture Capitalists

- Drone and Robot Manufacturers

- Regulatory Authorities

- Precision Agriculture Service Providers

- Research and Educational Institutions

- Crop Consultants

- Supply Chain and Logistics Providers

Import & Export Data for Agriculture Drones and Robots Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the agriculture drones and robots market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global agriculture drones and robots This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the agriculture drones and robots From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on agriculture drones and robots Product Types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Agriculture Drones and Robots Market Report

Agriculture Drones and Robots Market by Type

- Drones

- Robots

Agriculture Drones and Robots Market by Technology

- Hardware

- Software

Agriculture Drones and Robots Market by Application

- Precision Agriculture

- Livestock Management

- Smart Greenhouse management

- Irrigation management

- Inventory management

- Precision Fish Farming

- Others

Agriculture Drones and Robots Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the agriculture drones and robots market over the next 7 years?

- Who are the major players in the agriculture drones and robots market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the agriculture drones and robots market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the agriculture drones and robots market?

- What is the current and forecasted size and growth rate of the global agriculture drones and robots market?

- What are the key drivers of growth in the agriculture drones and robots market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the agriculture drones and robots market?

- What are the technological advancements and innovations in the agriculture drones and robots market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the agriculture drones and robots market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the agriculture drones and robots market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- AGRICULTURE DRONES AND ROBOTS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON AGRICULTURE DRONES AND ROBOTS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- AGRICULTURE DRONES AND ROBOTS MARKET OUTLOOK

- GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- DRONES

- ROBOTS

- GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- PRECISION AGRICULTURE

- LIVESTOCK MANAGEMENT

- SMART GREENHOUSE MANAGEMENT

- IRRIGATION MANAGEMENT

- INVENTORY MANAGEMENT

- PRECISION FISH FARMING

- OTHERS

- GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TECHNOLOGY, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- HARDWARE

- SOFTWARE

- GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- DJI

- DEERE & COMPANY

- TRIMBLE INC.

- AGEAGLE AERIAL SYSTEMS INC.

- PARROT DRONES SAS

- YAMAHA MOTOR CO., LTD.

- AEROVIRONMENT, INC.

- DRONEDEPLOY

- PRECISIONHAWK

- AGRIBOTIX LLC

- TOPCON POSITIONING SYSTEMS

- DELAIR

- LELY

- CNH INDUSTRIAL

- AUTONOMOUS SOLUTIONS INC.

- KUBOTA CORPORATION

- CLAAS KGAA MBH

- SENSEFLY SA

- NAIO TECHNOLOGIES

- AGROBOTIX LLC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 4 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 6 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 17 US AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 US AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 US AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 20 US AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 21 US AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 22 US AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 24 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 26 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 28 CANADA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 30 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 32 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 34 MEXICO AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 46 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 48 BRAZIL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 52 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 54 ARGENTINA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 56 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 58 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 60 COLOMBIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 78 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 80 INDIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 84 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 86 CHINA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 90 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 92 JAPAN AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 120 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 122 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 124 EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 128 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 130 GERMANY AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 131 UK AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 132 UK AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 133 UK AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 134 UK AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 135 UK AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 136 UK AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 138 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 140 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 142 FRANCE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 144 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 146 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 148 ITALY AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 150 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 152 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 154 SPAIN AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 156 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 158 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 160 RUSSIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 175 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 176 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 177 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 178 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 179 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 180 UAE AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2020-2030

FIGURE 10 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2020-2030

FIGURE 11 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY FARMING ENVIRONMENT (USD BILLION) 2022

FIGURE 15 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY END-USE APPLICATION (USD BILLION) 2022

FIGURE 16 GLOBAL AGRICULTURE DRONES AND ROBOTS MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 DJI: COMPANY SNAPSHOT

FIGURE 19 DEERE & COMPANY: COMPANY SNAPSHOT

FIGURE 20 TRIMBLE INC.: COMPANY SNAPSHOT

FIGURE 21 AGEAGLE AERIAL SYSTEMS INC.: COMPANY SNAPSHOT

FIGURE 22 PARROT DRONES SAS: COMPANY SNAPSHOT

FIGURE 23 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

FIGURE 24 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

FIGURE 25 DRONEDEPLOY: COMPANY SNAPSHOT

FIGURE 26 PRECISIONHAWK: COMPANY SNAPSHOT

FIGURE 27 AGRIBOTIX LLC: COMPANY SNAPSHOT

FIGURE 28 TOPCON POSITIONING SYSTEMS: COMPANY SNAPSHOT

FIGURE 29 DELAIR: COMPANY SNAPSHOT

FIGURE 30 LELY: COMPANY SNAPSHOT

FIGURE 31 CNH INDUSTRIAL: COMPANY SNAPSHOT

FIGURE 32 AUTONOMOUS SOLUTIONS INC.: COMPANY SNAPSHOT

FIGURE 33 KUBOTA CORPORATION: COMPANY SNAPSHOT

FIGURE 34 CLAAS KGAA MBH: COMPANY SNAPSHOT

FIGURE 35 SENSEFLY SA: COMPANY SNAPSHOT

FIGURE 36 NAIO TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 37 AGROBOTIX LLC: COMPANY SNAPSHOT

FAQ

The global agriculture drones and robots market is anticipated to grow from USD 7.83 Billion in 2023 to USD 29.30 Billion by 2030, at a CAGR of 20.74 % during the forecast period.

North America accounted for the largest market in the agriculture drones and robots market. North America accounted for 40 % market share of the global market value.

DJI, Deere & Company, Trimble Inc., AgEagle Aerial Systems Inc., Parrot Drones SAS, Yamaha Motor Co., Ltd., AeroVironment, Inc., DroneDeploy, PrecisionHawk, Agribotix LLC, Topcon Positioning Systems, Delair, Lely, CNH Industrial, Autonomous Solutions Inc., Kubota Corporation, CLAAS KGaA mbH, senseFly SA, Naio Technologies, Agrobotix LLC.

Key trends in the agriculture drones and robots market include the integration of Artificial Intelligence (AI) for advanced decision-making and automation, the rise of swarm robotics to enhance collaborative tasks on farms, and the increasing use of robotic arms and grippers for delicate and precise agricultural operations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.