SCOPE OF THE REPORT

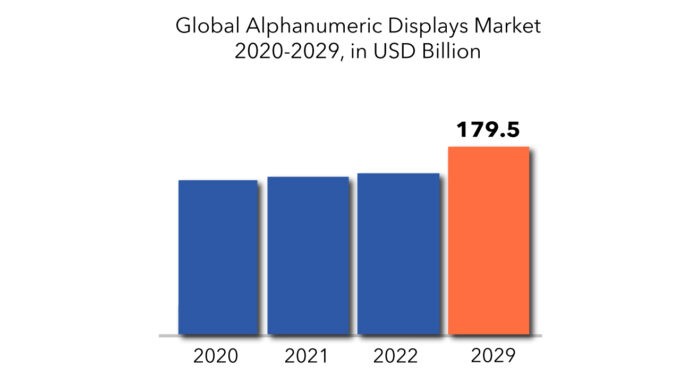

The global alphanumeric displays market is expected to grow at a 2.22% CAGR from 2023 to 2029. It is expected to reach above USD 179.5 million by 2029 from USD 147.3 million in 2022.

Alphanumeric Displays Market Overview

Screens that project information such as photos, movies, and words are examples of the alphanumeric display. Light-emitting diode (LED), liquid crystal display (LCD), organic light-emitting diode (OLED), and other technologies are used in these alphanumeric display panels. It is also widely utilized in consumer electronic products such as televisions, computers, tablets, laptops, smartwatches, and so forth. The introduction of modern technology allows for improved visualizations in a variety of industry verticals, including consumer electronics, retail, sports and entertainment, transportation, and others. 3D alphanumeric displays are popular in the consumer electronics and entertainment industries. Furthermore, alphanumeric display technologies like an organic light-emitting diode (OLED) have grown in popularity in items like televisions, smart wearables, smartphones, and other gadgets. Furthermore, smartphone makers intend to add flexible OLED Displays in order to attract customers. Furthermore, the market is now creating energy-saving gadgets, especially in the form of wearable devices.

High demand for flexible display technology in consumer electronics devices, increased adoption of electronic components in the automotive sector, rise in trend of touch-based devices, high cost of transparent and quantum dot display technologies, stagnant growth of desktop PCs, notebooks, and tablets, the surge in adoption of AR/VR devices, and commercialization of autonomous vehicles are the major influencing factors in the global display industry. During the forecast period, each of these variables is expected to have a significant influence on the display market.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | USD Millions |

| Segmentation | By Technology, Type |

By Technology

|

|

By Type

|

|

By Region

|

The worldwide display market is growing due to developments in the flexible display, an increase in demand for OLED display devices, and an increase in the popularity of touch-based devices. However, the high cost of the most recent display technologies, including transparent displays and quantum dot displays, as well as the stagnating growth of desktop PCs, notebook computers, and tablets, are impeding market development. Furthermore, the global display industry is likely to benefit from new applications in flexible display technologies.

Over conventional displays, which are significantly heavier, flexible display technology has several advantages such as lightweight, flexible nature, luminous, uses minimal power, and is shatter-proof. These displays may be found in a variety of consumer electronics devices. The rise in demand for consumer electronics, particularly smartphones, TVs, smart wearable devices, PCs, and other display devices, is propelling the display industry further.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global alphanumeric displays market is crowded with established players. These players have a commanding say in the market. The technology used in the alphanumeric displays market is proprietary and needs long-term research and development planning implemented efficiently.

Alphanumeric Displays Market Segment Analysis

Based on technology the alphanumeric displays market is segmented into LCD, OLED, Micro-LED, and Direct-view LED. LCD technology has been widely used in display goods. LCD-based devices are being used in various industries, including retail, corporate offices, and banking. In 2020, the LCD sector had the biggest market share and was a very mature segment. LED technology, also, is predicted to expand at a rapid pace throughout the projection period. LED technology advancements and its energy-efficient nature are pushing the demand for this technology. High competition from newer technologies, disruption in the supply-demand ratio, and a reduction in LCD display panel ASPs are likely to push the LCD display market into negative growth throughout the projection period. Furthermore, Panasonic intends to end LCD manufacture by 2021. Due to the drop in demand for LCD panels, major TV makers such as LG Electronics and Sony are suffering enormous losses.

On the basis of type, the alphanumeric displays market is divided into smartphones, television sets, PC monitors & laptops, digital signage/large format displays, automotive displays, tablets, and smart wearables. Smartphones are likely to account for a sizable portion of the industry. This expansion will be driven mostly by smartphone manufacturers, and increased use of OLED and flexible screens. Shipments of high-priced flexible OLED displays are rapidly expanding, and this trend is projected to continue during the projection period. The smart wearables sector has emerged as the worldwide market’s new development route. The market for these devices is fast expanding, and with the widespread use of AR/VR technologies, the demand for smart wearables is predicted to skyrocket throughout the forecast period.

Alphanumeric Displays Market Players

From large companies to small ones, many companies are actively working in the alphanumeric displays market. These key players include Xiamen Eshine D, Samsung Electronics, LG Display, BOE Technology, AU Optronics, INNOLUX, Xiamen Eshine Display Co.Ltd, Bigbook (DG) Electronic Technology Co.Ltd., Shenzhen Better Group Limited, RONBO ELECTRONICS LIMITED, RAYSTAR OPTRONICS INC., WINSTAR Display Co.Ltd, Newhaven Display International Inc., Bigbook (DG) Electronic Technology Co.Ltd., ShenZhen Better Group Limited, RONBO ELECTRONICS LIMITED, RAYSTAR OPTRONICS INC., WINSTAR Display Co. Ltd, Newhaven Display International Inc., and others.

Companies are mainly in alphanumeric displays they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In April 2020, to create high-resolution flexible micro-LED display technology, AU Optronics collaborated with PlayNitride Inc., a Micro LED technology provider. AUO and PlayNitride combined their display and LED experience to create a leading 9.4-inch high-resolution flexible micro-LED display with the greatest 228 PPI pixel density.

- In February 2020, The first Onyx screen in Australia was launched by Samsung at the HOYTS Entertainment Quarter in Moore Park, Sydney. The latest installment includes Samsung’s 14-meter Onyx Cinema LED screen.

- In January 2020, LG Display exhibited its newest displays and technologies at CES 2020, which took place from January 7 to 10 in Las Vegas. A 65-inch Ultra HD (UHD) Bendable OLED panel and a 55-inch Full HD (FHD) Transparent OLED display will be introduced by the firm.

Who Should Buy? Or Key stakeholders

- Alphanumeric Displays suppliers

- Investors

- End user companies

- Research institutes

Alphanumeric Displays Market Regional Analysis

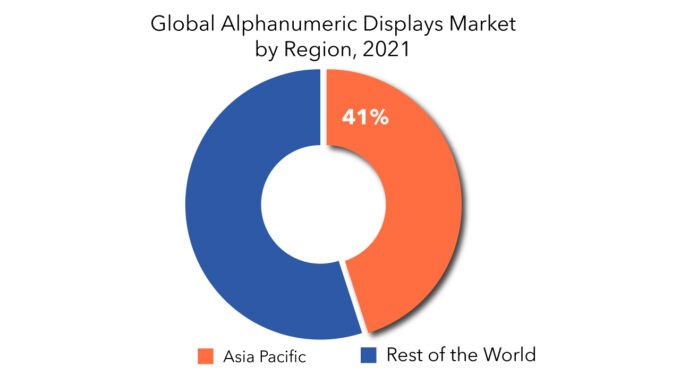

The alphanumeric displays market by region includes Asia-Pacific (APAC), North America, Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by Asia Pacific, Europe, Middle East & Africa (MEA), and North America. The Asia Pacific shares 41% of the total market. The factors contributing to the region’s market growth include the increasing number of display panel production plants and the rapid usage of OLED displays. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: Alphanumeric Displays Market

Alphanumeric Displays Market by Technology, 2020-2029, (USD Millions)

- LCD

- OLED

- Micro-LED

- Direct-View LED

Alphanumeric Displays Market by Type, 2020-2029, (USD Millions)

- Smartphones

- Television Sets

- Pc Monitors & Laptops

- Digital Signage/Large Format Displays

- Automotive Displays

- Tablets

- Smart Wearables

Alphanumeric Displays Market by Region, 2020-2029, (USD Millions)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the worth of global alphanumeric displays market?

- What are the new trends and advancements in the alphanumeric displays market?

- Which product categories are expected to have the highest growth rate in the alphanumeric displays market?

- Which are the key factors driving the alphanumeric displays market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Alphanumeric Displays Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Alphanumeric Displays Market

- Global Alphanumeric Displays Market Outlook

- Global Alphanumeric Displays Market by Technology, (USD Million)

- LCD

- OLED

- Micro-LED

- Direct-view LED

- Global Alphanumeric Displays Market by Type, (USD Million)

- Smartphones

- Television Sets

- PC Monitors & Laptops

- Digital Signage/Large Format Displays

- Automotive Displays

- Tablets

- Smart Wearables

- Global Alphanumeric Displays Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

- Xiamen Eshine D

- Samsung Electronics

- LG Display

- BOE Technology

- AU Optronics

- INNOLUX

- Xiamen Eshine Display Co.Ltd.

- Bigbook (DG) Electronic Technology Co.Ltd.

- Shenzhen Better Group Limited

- RONBO ELECTRONICS LIMITED

- RAYSTAR OPTRONICS INC.

- WINSTAR Display Co.Ltd

- Newhaven Display International Inc.

- Bigbook (DG) Electronic Technology Co.Ltd.

- ShenZhen Better Group Limited

- RONBO ELECTRONICS LIMITED

- RAYSTAR OPTRONICS INC.

- WINSTAR Display Co. Ltd

- Newhaven Display International Inc. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 6 US ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 7 US ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 9 CANADA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 10 CANADA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 12 MEXICO ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 13 MEXICO ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 27 INDIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 28 INDIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 30 CHINA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 31 CHINA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 33 JAPAN ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 34 JAPAN ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 48 GERMANY ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 49 GERMANY ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 51 UK ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 52 UK ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 FRANCE ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 55 FRANCE ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 57 ITALY ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 58 ITALY ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 60 SPAIN ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 61 SPAIN ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 69 UAE ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 70 UAE ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA ALPHANUMERIC DISPLAYS MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA ALPHANUMERIC DISPLAYS MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA ALPHANUMERIC DISPLAYS MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ALPHANUMERIC DISPLAYS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 ALPHANUMERIC DISPLAYS MARKET BY REGION 2020

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 XIAMEN ESHINE D: COMPANY SNAPSHOT

FIGURE 15 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 16 LG DISPLAY: COMPANY SNAPSHOT

FIGURE 17 BOE TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 18 AU OPTRONICS: COMPANY SNAPSHOT

FIGURE 19 INNOLUX: COMPANY SNAPSHOT

FIGURE 20 XIAMEN ESHINE DISPLAY CO.LTD.: COMPANY SNAPSHOT

FIGURE 21 BIGBOOK (DG) ELECTRONIC TECHNOLOGY CO.LTD.: COMPANY SNAPSHOT

FIGURE 22 SHENZHEN BETTER GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 23 RONBO ELECTRONICS LIMITED: COMPANY SNAPSHOT

FIGURE 24 RAYSTAR OPTRONICS INC.: COMPANY SNAPSHOT

FIGURE 25 WINSTAR DISPLAY CO.LTD: COMPANY SNAPSHOT

FIGURE 26 NEWHAVEN DISPLAY INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 27 BIGBOOK (DG) ELECTRONIC TECHNOLOGY CO.LTD.: COMPANY SNAPSHOT

FIGURE 28 SHENZHEN BETTER GROUP LIMITED: COMPANY SNAPSHOT

FIGURE 29 RONBO ELECTRONICS LIMITED: COMPANY SNAPSHOT

FIGURE 30 RAYSTAR OPTRONICS INC.: COMPANY SNAPSHOT

FIGURE 31 WINSTAR DISPLAY CO. LTD: COMPANY SNAPSHOT

FIGURE 32 NEWHAVEN DISPLAY INTERNATIONAL INC.: COMPANY SNAPSHOT

FAQ

Surging adoption of OLED displays in various applications and increasing use of LED displays will drive significant growth in the market.

The global alphanumeric displays market registered a CAGR of 2.22% from 2022 to 2029.

Asia Pacific holds the largest regional market for the Alphanumeric Displays market.

Decline in retail display demand as a result of a significant move toward online advertising and shopping will restrain the market growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.