REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 22.15 Billion by 2029 | 5.40% | Asia Pacific |

| By Type | By Formulation | By Crop Type | By Form |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Insecticides Market Overview

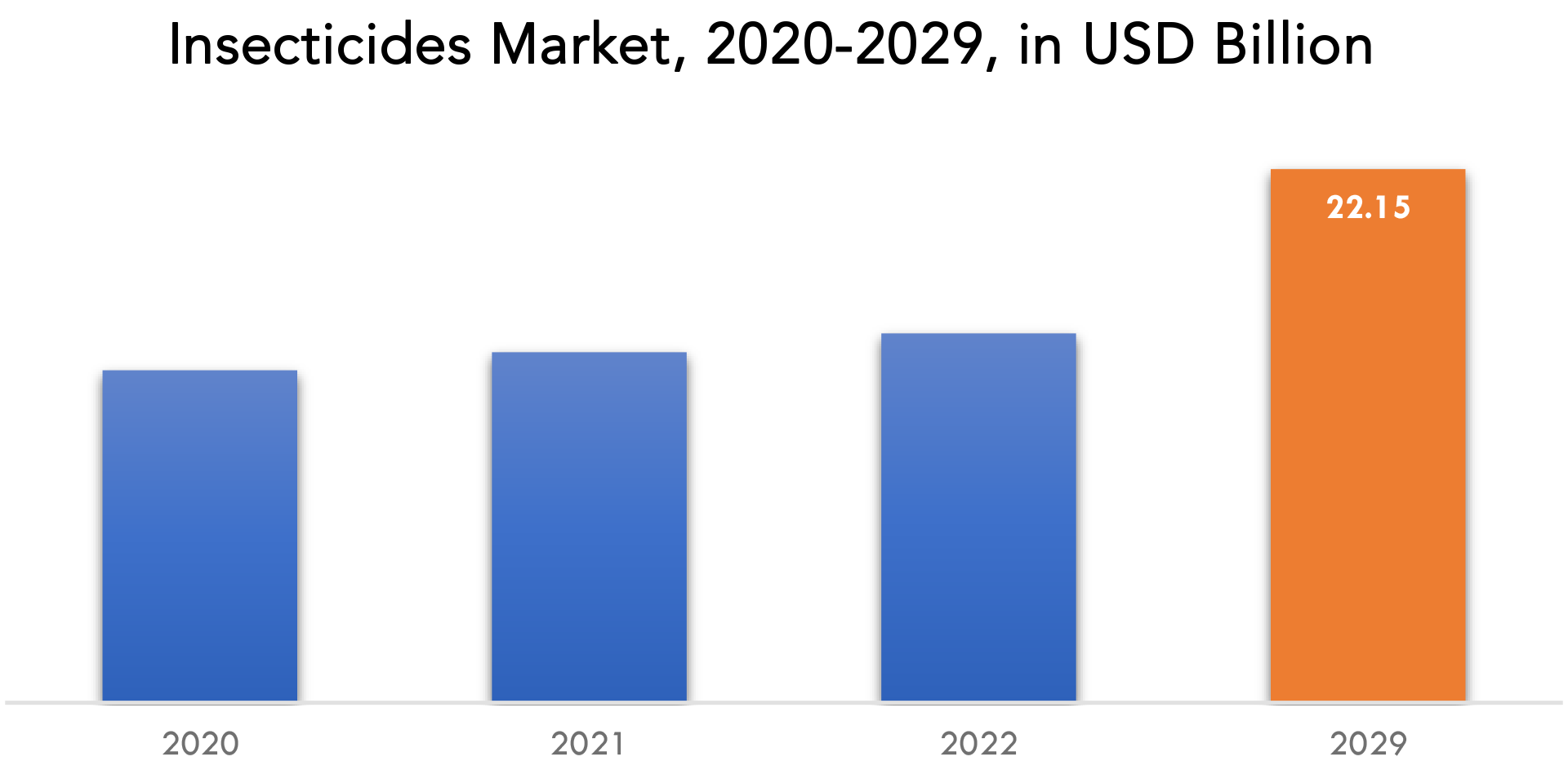

The Insecticides Market is expected to grow at 5.40% CAGR from 2022 to 2029. It is expected to reach above USD 22.15 Billion by 2029 from USD 13.80 Billion in 2020.

Insecticides are chemical substances or compounds designed to kill, repel, or control insects that are considered pests, either by directly poisoning them or by disrupting their biological processes. These chemicals are often used in agriculture, public health, and home pest control to protect crops, livestock, and humans from the negative effects of insect infestations. Insecticides can be applied in various forms, such as sprays, baits, dusts, or fumigants, and can target specific insects or have a broad-spectrum effect on a range of pests. However, their use can also have negative impacts on non-target organisms, the environment, and human health if not properly regulated and managed.

Increasing awareness of crop protection is an important driver of the insecticides market. With the growing population and increasing demand for food, farmers are under pressure to maximize their crop yields and protect their crops from pests and diseases. This has led to a greater focus on crop protection and increased awareness of the importance of controlling pests in order to achieve higher yields. In recent years, there has been a growing awareness of the negative impact that pests can have on crop yields, quality, and safety. This has led to increased demand for insecticides that are effective at controlling pests and reducing crop losses. Farmers are now more aware of the different types of pests that can affect their crops, and are actively seeking out products that can protect their crops from these pests. In addition, there has been a growing interest in sustainable agriculture practices, which includes the use of safer and more environmentally friendly insecticides. This has led to the development of new, innovative insecticide products that are designed to be more targeted, less harmful to non-target species, and more sustainable in the long term.

Environmental regulations can be a restraining factor for the insecticides market as many insecticides contain chemicals that can have harmful effects on the environment, such as water and air pollution, soil contamination, and harm to non-target species. These effects can lead to concerns about human health, as well as the health of wildlife and ecosystems. As a result, governments around the world have implemented various regulations to control the use of insecticides and minimize their impact on the environment. Some countries have banned certain types of insecticides that are known to be particularly harmful. Others require insecticide manufacturers to conduct rigorous safety testing and provide detailed information about the chemicals in their products. These regulations can increase the cost and complexity of developing and marketing insecticides, as companies must comply with the various requirements and standards set by regulatory bodies. In addition, they can limit the availability of certain types of insecticides, which can reduce the options available to farmers and other users.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Type, By Formulation, By Crop Type, By Region |

| By Type |

|

| By Formulation |

|

| By Crop Type |

|

| By Region |

|

Investment in research and development is an important opportunity for the insecticides market. There is a need for continued innovation in this industry to create new and improved insecticide products that are more effective and safer for the environment and non-target species. Research and development efforts can lead to the creation of new insecticide products, as well as improvements in existing products. One area of research and development that is particularly important is the development of sustainable insecticides. This includes products that are less toxic to non-target species, have lower environmental impact, and are more targeted in their approach to pest control. Sustainable insecticides are becoming increasingly important as consumers become more concerned about the impact of agricultural practices on the environment and the health of the food they consume.

The impact of COVID-19 on the insecticides market has been mixed, with some segments experiencing negative effects and others seeing increased demand. On one hand, the pandemic has caused disruptions in the supply chain for insecticides, leading to shortages and increased prices for some products. In addition, restrictions on movement and social distancing measures have affected the ability of farmers and pest control professionals to access and use insecticides, leading to a decline in demand in some regions. On the other hand, the pandemic has also increased demand for insecticides in some segments, as people spend more time at home and are more concerned about pests such as mosquitoes and cockroaches. In addition, the pandemic has led to an increase in agriculture production in some areas as people stock up on food, leading to increased demand for insecticides in agricultural settings.

Insecticides Market Segment Analysis

Organophosphates are the most often used insecticides as they are less expensive than alternatives. Organophosphates are still used in agriculture, houses, gardens, and veterinary professions; however, numerous organophosphates have been phased out of usage in the last decade. Although the market for organophosphates as pesticides is expanding, there are significant risks involved with their manufacture. Stringent government regulations on the use of chemical insecticides, together with the introduction of bioinsecticides as a viable option, are the primary reasons limiting the growth of the organophosphate insecticides industry.

An emulsifiable concentration formulation typically includes an oil-soluble liquid active component, one or more petroleum-based solvents, and a mixing agent. Emulsifiable concentrates are a popular formulation for insecticides across the world, owing to their flexibility in agricultural and non-agricultural uses. They are applicable to any form of sprayer, from portable sprayers to hydraulic spraying equipment. They are comparatively simpler to handle for spraying broad areas, which is why emulsifiable concentrates dominate the pesticides market.

The cereals and grains category dominated the pesticides market. As grains are cultivated in practically every country, there is a high need for pesticides worldwide, and this trend is expected to continue over the projected period. Global grain output is increasing, making it more important than ever for producers to focus on crop productivity and quality by using effective insecticides. Cereals and grains are gaining market share due to their high vitamin and mineral content and widespread usage in animal feed.

Segmentation by form includes liquid, granules, sprays, and powders, each catering to specific applications and user preferences. Liquid insecticides are the most dominant segment due to their versatility and ease of use. They are commonly applied as sprays and are effective for both residential and agricultural applications, providing quick results and easy coverage of large areas. Granular insecticides are favored for soil application, particularly in gardens and agricultural fields, where they provide long-lasting protection against soil-dwelling pests without the risk of drift. Sprays are popular in residential settings for their convenience in targeting pests on plants and indoor areas, while powder forms are often used in specific agricultural applications or for targeting pests in confined spaces.

Insecticides Market Players

The insecticides market key players include BASF, Bayer Cropscience, ChemChina, FMC Corporation, Corteva Agriscience, Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions, Syngenta.

Recent Developments:

April 23, 2024 – Bayer announced today that it has signed an agreement with UK-based company AlphaBio Control to secure an exclusive license for a new biological insecticide. The new product will be the first available for arable crops, including oilseed rape and cereals. Targeted for initial launch in 2028 pending further development and registration, this new insecticide was discovered by AlphaBio, with whom Bayer distributes FLiPPER® an award-winning bioinsecticide-acaricide.

December 8, 2023 – Corteva Agriscience, a global leader in agriculture announced the launch of SpadinTM 11.7 per cent SC (Isoclast™ active), a new insecticide with a unique mode of action for aphid control. Its broad-spectrum activity and excellent residual control make it an ideal addition to control aphids protect crops and preserve yield potential.

April 2022- Farmers in India would be able to protect their crops and boost productivity with the launch of Exponus insecticide today by BASF. The pioneering solution is powered by BASF’s new active ingredient, Broflanilide in a specialized formulation.

September 2022- Syngenta Crop Protection collaborated with an artificial intelligence (AI) company, Insilico Medicine, to increase the invention and development of new, more effective crop protection solutions that protect crops from diseases and pests.

Who Should Buy? Or Key stakeholders

- Suppliers and Distributor

- FMCG Companies

- Insecticides Companies

- Fertilizer Manufacturer

- Government Organization

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Insecticides Market Regional Analysis

The Insecticides Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

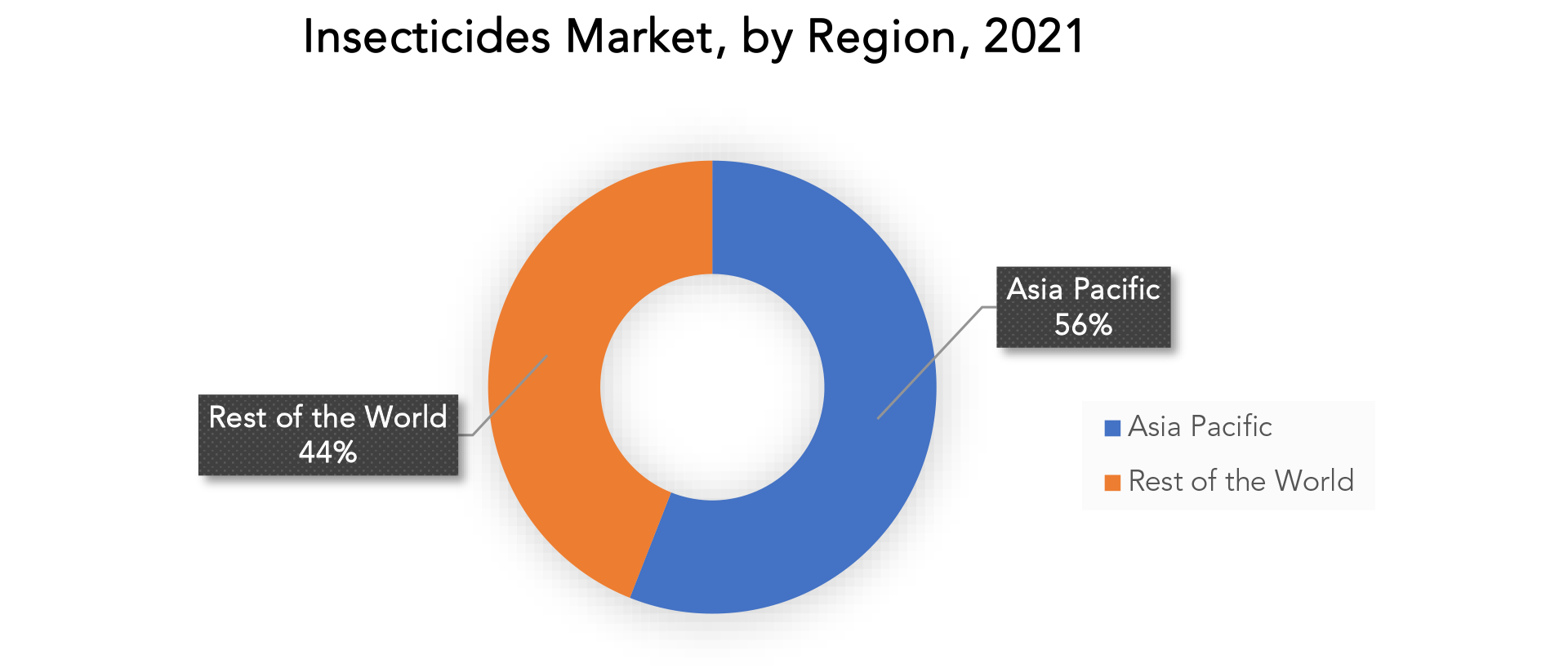

The Asia Pacific region is projected to witness a high growth rate in the insecticides market The Asia Pacific area has a diverse climate that allows for the development of a wide range of crops. The growth in the number of resistant pests, rising food consumption, and the requirement for higher agricultural output are the primary drivers driving the Asia-Pacific pesticide market. China dominates the Asia-Pacific pesticides market. However, the use of traditional pesticides on agricultural crops in the country has decreased in recent years, since the rising use of chemical insecticides, which causes environmental degradation, is generating serious soil pollution. The region is also distinguished by highly advanced technology breakthroughs, which, in conjunction with increased expenditures in R&D of biological pest control products, would fulfill the growing local demand for high-quality food. The aforementioned elements might be linked to the region’s market growth.

The North America insecticides market is a significant and highly competitive market, driven by the need to control insect pests in various industries such as agriculture, public health, and industrial settings. The market is expected to grow at a steady pace in the coming years, driven by increasing demand from key end-use segments. The agriculture sector is the largest end-user of insecticides in North America, with crops such as corn, soybeans, and cotton being the major users of insecticides. In addition, the public health sector, including government agencies and private companies, also uses insecticides to control pests such as mosquitoes, ticks, and bed bugs.

Key Market Segments: Insecticides Market

Insecticides Market By Type, 2020-2029, (USD Billion), (Kilotons).

- Pyrethroids

- Organophosphorus

- Carbamates

- Organochlorine

- Botanicals

Insecticides Market By Formulation, 2020-2029, (USD Billion), (Kilotons).

- Wettable Powder

- Emulsifiable Concentrate

- Suspension Concentrate

- Oil Emulsion In Water

- Microencapsulated Suspension

- Granules

Insecticides Market By Crop Type, 2020-2029, (USD Billion), (Kilotons).

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

Insecticides Market By Form, 2020-2029, (USD Billion), (Kilotons).

- Liquid

- Granules

- Sprays

- Powders

Insecticides Market By Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the insecticides market over the next 7 years?

- Who are the major players in the insecticides market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-pacific, middle east, and Africa?

- How is the economic environment affecting the insecticides market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the insecticides market?

- What is the current and forecasted size and growth rate of the global insecticides market?

- What are the key drivers of growth in the insecticides market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the insecticides market?

- What are the technological advancements and innovations in the insecticides market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the insecticides market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the insecticides market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL INSECTICIDES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON INSECTICIDES MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL INSECTICIDES MARKET OUTLOOK

- GLOBAL INSECTICIDES MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- PYRETHROIDS

- ORGANOPHOSPHORUS

- CARBAMATES

- ORGANOCHLORINE

- BOTANICALS

- GLOBAL INSECTICIDES MARKET BY FORMULATION, 2020-2029, (USD BILLION), (KILOTONS)

- WETTABLE POWDER

- EMULSIFIABLE CONCENTRATE

- SUSPENSION CONCENTRATE

- OIL EMULSION IN WATER

- MICROENCAPSULATED SUSPENSION

- GRANULES

- GLOBAL INSECTICIDES MARKET BY CROP TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- CEREALS & GRAINS

- PULSES & OILSEEDS

- FRUITS & VEGETABLES

- GLOBAL INSECTICIDES MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF

- BAYER CROPSCIENCE

- CHEMCHINA

- FMC CORPORATION

- CORTEVA AGRISCIENCE

- NUFARM LIMITED

- UPL LIMITED

- SUMITOMO CHEMICAL CO. LTD.

- ADAMA AGRICULTURAL SOLUTIONS

- SYNGENTA *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 6 GLOBAL INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 7 GLOBAL INSECTICIDES MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL INSECTICIDES MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA INSECTICIDES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA INSECTICIDES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 17 US INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 18 US INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 19 US INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 20 US INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 21 US INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 22 US INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 23 CANADA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 26 CANADA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 27 CANADA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 28 CANADA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 29 MEXICO INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 32 MEXICO INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 33 MEXICO INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 34 MEXICO INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA INSECTICIDES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA INSECTICIDES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 43 BRAZIL INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 48 BRAZIL INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 49 ARGENTINA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 54 ARGENTINA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 55 COLOMBIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 60 COLOMBIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC INSECTICIDES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC INSECTICIDES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 75 INDIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 78 INDIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 79 INDIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 80 INDIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 81 CHINA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 84 CHINA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 85 CHINA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 86 CHINA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 87 JAPAN INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 90 JAPAN INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 91 JAPAN INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 92 JAPAN INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 117 EUROPE INSECTICIDES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE INSECTICIDES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 122 EUROPE INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 123 EUROPE INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 124 EUROPE INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 125 GERMANY INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 128 GERMANY INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 129 GERMANY INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 130 GERMANY INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 131 UK INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 132 UK INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 133 UK INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 134 UK INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 135 UK INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 136 UK INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 137 FRANCE INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 140 FRANCE INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 141 FRANCE INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 142 FRANCE INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 143 ITALY INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 146 ITALY INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 147 ITALY INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 148 ITALY INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 149 SPAIN INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 152 SPAIN INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 153 SPAIN INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 154 SPAIN INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 155 RUSSIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 160 RUSSIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 175 UAE INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 176 UAE INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 177 UAE INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 178 UAE INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 179 UAE INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 180 UAE INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY FORMULATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY FORMULATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY CROP TYPE (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA INSECTICIDES MARKET BY CROP TYPE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL INSECTICIDES MARKET BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL INSECTICIDES MARKET BY FORMULATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL INSECTICIDES MARKET BY CROP TYPE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL INSECTICIDES MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL INSECTICIDES MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL INSECTICIDES MARKET BY FORMULATION, USD BILLION, 2021

FIGURE 15 GLOBAL INSECTICIDES MARKET BY CROP TYPE, USD BILLION, 2021

FIGURE 16 GLOBAL INSECTICIDES MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA INSECTICIDES MARKET SNAPSHOT

FIGURE 18 EUROPE INSECTICIDES MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA INSECTICIDES MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC INSECTICIDES MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA INSECTICIDES MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 BASF: COMPANY SNAPSHOT

FIGURE 24 BAYER CROPSCIENCE: COMPANY SNAPSHOT

FIGURE 25 CHEMCHINA: COMPANY SNAPSHOT

FIGURE 26 FMC CORPORATION: COMPANY SNAPSHOT

FIGURE 27 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

FIGURE 28 NUFARM LIMITED: COMPANY SNAPSHOT

FIGURE 29 UPL LIMITED: COMPANY SNAPSHOT

FIGURE 30 SUMITOMO CHEMICAL CO. LTD.: COMPANY SNAPSHOT

FIGURE 31 ADAMA AGRICULTURAL SOLUTIONS: COMPANY SNAPSHOT

FIGURE 32 SYNGENTA: COMPANY SNAPSHOT

FAQ

The insecticides market is expected to grow at 12.20% CAGR from 2022 to 2029. It is expected to reach above USD 4.51 Billion by 2029 from USD 1.60 Billion in 2020.

Asia Pacific held more than 56% of the insecticides market revenue share in 2021 and will witness expansion in the forecast period.

Increasing awareness of crop protection is an important driver of the insecticides market. With the growing population and increasing demand for food, farmers are under pressure to maximize their crop yields and protect their crops from pests and diseases.

Insecticides has leading application in agriculture industry.

Asia Pacific region dominated the market with highest revenue share.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.