REPORT OUTLOOK

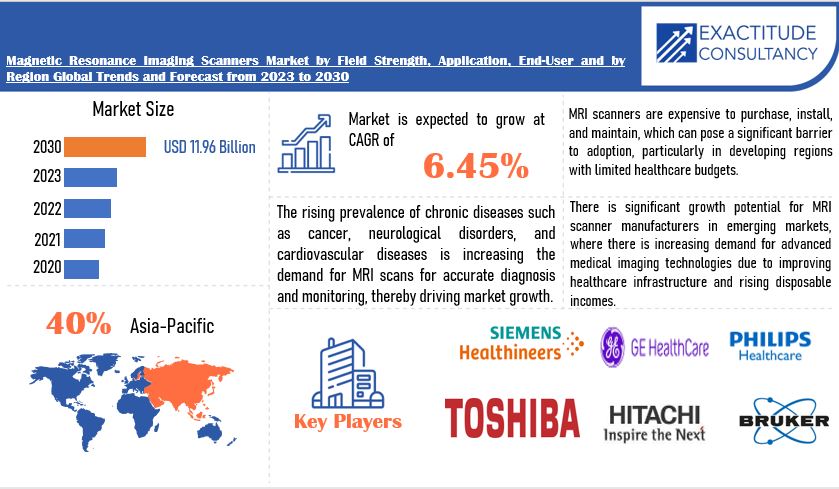

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 11.96 Billion by 2030 | 6.45 % | Asia Pacific |

| by Field Strength | by Application | by End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Market Overview

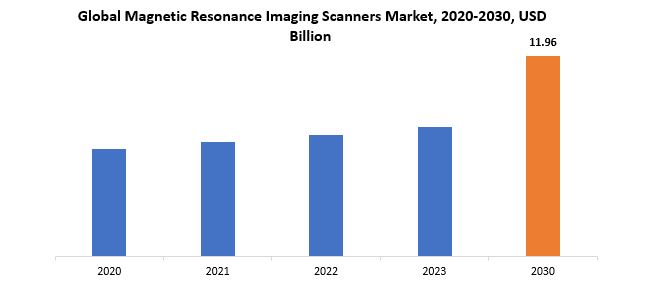

The global magnetic resonance imaging scanners market is anticipated to grow from USD 7.72 Billion in 2023 to USD 11.96 Billion by 2030, at a CAGR of 6.45 % during the forecast period.

Magnetic Resonance Imaging (MRI) scanners are sophisticated medical devices that utilize the principles of nuclear magnetic resonance to produce detailed and high-resolution images of the internal structures of the human body. When a patient is placed inside the MRI machine, which consists of a strong magnetic field and radiofrequency coils, the hydrogen atoms align with the magnetic field. Subsequently, a radiofrequency pulse is applied, temporarily disrupting this alignment. As the hydrogen atoms return to their original alignment, they emit signals that are detected by the MRI machine. By analyzing the emitted signals, a computer generates cross-sectional images of the body’s internal structures, such as organs, tissues, and bones.

The strength of the magnetic field, measured in Tesla, plays a crucial role in the resolution and quality of the images. Higher magnetic field strengths generally result in clearer and more detailed images. MRI scanners can produce images in various planes, allowing for comprehensive visualization of anatomical structures. Additionally, advanced techniques such as contrast enhancement, functional MRI, and diffusion-weighted imaging provide further insights into tissue characteristics and functions.

The non-invasive nature of MRI, without the use of ionizing radiation, makes it a preferred imaging modality for diagnosing a wide range of medical conditions, including neurological disorders, musculoskeletal issues, and soft tissue abnormalities. The versatility of MRI scanners in capturing detailed internal structures with minimal patient discomfort has made them an indispensable tool in modern medicine for both diagnostic and research purposes.

Technological developments are crucial; they improve the functionality, efficiency, and image quality of MRI scanners. MRI is becoming a more effective and diverse diagnostic tool due to ongoing research and development efforts that have produced better imaging sequences, higher field strengths, and sophisticated software algorithms. The global aging population and the rising incidence of chronic illnesses have also raised the need for precise, non-invasive diagnostic techniques, which has expanded demand for MRI scanners.

In addition, MRI’s growing range of uses, from neurology and orthopedics to cardiology and oncology, has expanded its usefulness in a number of medical disciplines. These uses include functional and molecular imaging. The growing need for these scanners in healthcare facilities is a result of the emphasis on early and accurate diagnosis as well as growing knowledge of the advantages of MRI. In addition, government programs to improve healthcare infrastructure and favorable reimbursement rules have made it easier for MRI technology to be adopted in both developed and developing nations.

Precision diagnosis and treatment planning for a variety of medical diseases are made possible by the comprehensive and non-invasive internal structural imaging that MRI scanners provide. Where they differ from other imaging modalities like computed tomography (CT) or X-rays is that they can provide higher-resolution images of soft tissues, organs, and the central nervous system. As a result, MRI is especially important for the identification and diagnosis of a number of diseases, such as oncological abnormalities, musculoskeletal problems, neurological disorders, and cardiovascular diseases.

MRI is a safer alternative for recurrent imaging, particularly for susceptible groups like children and pregnant women, because it is non-ionizing and does not expose patients to hazardous radiation. Early detection, prompt therapies, and improved patient outcomes are all made possible by the diagnostic precision offered by MRI scanners. Furthermore, these scanners are kept at the forefront of medical imaging capabilities by the ongoing advancement of MRI technology, which is fueled by research and development initiatives.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Field Strength, End-user, Application and Region |

|

By Field Strength |

|

|

By Application |

|

|

By End User |

|

|

By Region

|

|

Magnetic Resonance Imaging Scanners Market Segmentation Analysis

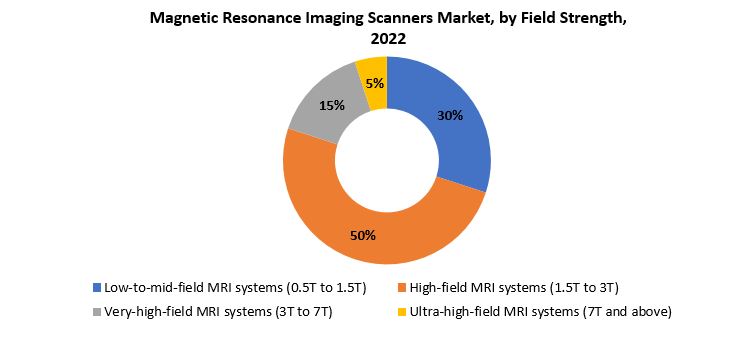

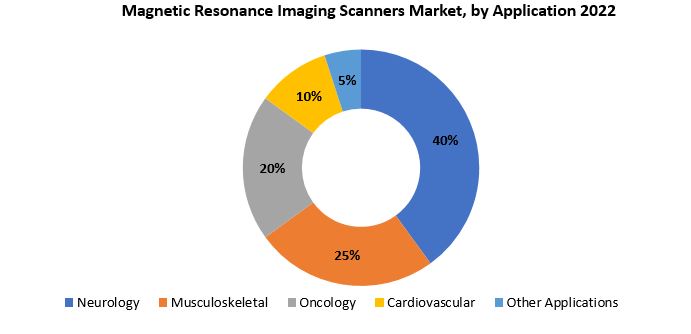

The global Magnetic Resonance Imaging Scanners market is divided into three segments, field strength, application, end-user and region. By field strength the market is divided Low-to-mid-field MRI systems (0.5T to 1.5T), High-field MRI systems (1.5T to 3T), Very-high-field MRI systems (3T to 7T), Ultra-high-field MRI systems (7T and above). By application the market is classified into Neurology, Musculoskeletal, Oncology, Cardiovascular, Other Applications. By end-user the market is classified into Hospitals, Diagnostic Imaging Centers, Other End Users.

Based on field strength, high-field MRI systems (1.5T to 3T) segment dominating in the magnetic resonance imaging scanners market. High-field MRI systems offer superior image resolution and quality compared to lower field strengths, enabling clinicians to obtain detailed and clearer images of anatomical structures and pathological conditions. The 1.5T to 3T range strikes a balance between image quality and practical considerations such as cost and patient comfort, making these systems widely adopted in clinical settings.

The higher magnetic field strength enhances signal-to-noise ratios, which is crucial for improving image clarity and reducing the need for contrast agents in certain examinations. This is particularly advantageous in imaging soft tissues, neurological structures, and musculoskeletal components, where precise visualization is critical for accurate diagnosis and treatment planning. High-field MRI systems also facilitate advanced imaging techniques such as functional MRI (fMRI) and magnetic resonance angiography (MRA), expanding their applications across various medical specialties.

Furthermore, technological advancements in superconducting magnets and radiofrequency coils have contributed to the increased efficiency and performance of high-field MRI systems. The ability to acquire images faster and with better signal strength enhances the overall workflow in healthcare facilities, improving patient throughput and diagnostic accuracy. Despite their higher upfront costs, the long-term benefits of improved diagnostic capabilities and versatility make high-field MRI systems a preferred choice for many healthcare providers.

Based on application, neurology segment dominating in the magnetic resonance imaging scanners market. Neurological disorders, including brain and spinal cord conditions, demand precise and detailed imaging for accurate diagnosis and treatment planning, making MRI an indispensable tool in neurology. The high-resolution capabilities of MRI scanners allow for the visualization of intricate structures within the brain, enabling healthcare professionals to identify abnormalities such as tumors, vascular malformations, and degenerative diseases with exceptional clarity.

Neurological applications of MRI extend beyond structural imaging, encompassing functional MRI (fMRI) for mapping brain activity, diffusion-weighted imaging for assessing tissue microstructure, and magnetic resonance spectroscopy (MRS) for studying chemical composition. These advanced techniques contribute to a comprehensive understanding of neurological conditions, aiding in early detection and providing critical information for surgical planning or therapeutic interventions.

The non-invasive nature of MRI is particularly advantageous in neurology, as it eliminates the need for invasive procedures and minimizes patient discomfort. Additionally, the versatility of MRI allows for multi-parametric imaging, enabling clinicians to evaluate different aspects of neurological health in a single examination. The neurology segment’s dominance is further fueled by the rising incidence of neurological disorders globally, driven by factors such as aging populations, increased awareness, and evolving lifestyles.

Magnetic Resonance Imaging Scanners Market Dynamics

Driver

Rising prevalence of chronic diseases boosts demand for magnetic resonance imaging scanners market.

Chronic diseases, which include afflictions like cancer, neurological disorders, musculoskeletal ailments, and cardiovascular diseases, are on the rise worldwide as a result of factors including sedentary lifestyles, aging populations, and eating habits. Since many chronic illnesses require constant observation, prompt and correct diagnosis is essential to efficient treatment planning and administration. In this context, magnetic resonance imaging (MRI) scanners are essential tools because they provide high-resolution imaging capabilities that let medical practitioners see and evaluate soft tissues, organs, and structures in unprecedented detail.

MRI is a vital diagnostic and monitoring technique for chronic illnesses because it offers non-invasive, comprehensive insights into the anatomical and functional elements of the body. Furthermore, MRI’s adaptability makes multi-parametric imaging possible, which promotes a comprehensive comprehension of the course of a disease. The demand for cutting-edge diagnostic instruments like MRI scanners is anticipated to increase due to the growing burden that chronic diseases are placing on healthcare systems around the globe. These tools are critical in addressing the healthcare issues brought on by the rising prevalence of chronic illnesses.

Restraint

Competition from alternative imaging modalities can hinder the magnetic resonance imaging scanners market during the forecast period.

The Magnetic Resonance Imaging (MRI) scanners market will face significant competition from alternative imaging modalities during the forecast period. While MRI scanners have unrivaled advantages in terms of non-invasiveness, excellent soft tissue contrast, and the absence of ionizing radiation, alternative modalities such as X-rays and computed tomography (CT) scans remain viable options, especially in certain clinical scenarios. X-rays and CT scans are frequently regarded as more cost-effective and time-saving for routine checkups and emergency scenarios. Given the speed with which these modalities acquire and process images, they are preferable in urgent situations requiring speedy decision-making.

Furthermore, technological developments have increased the spatial resolution of CT scans, allowing for comprehensive imaging of anatomical features. Furthermore, emerging imaging technologies such as molecular imaging, positron emission tomography (PET), and hybrid imaging modalities are challenging MRI’s supremacy in certain applications including oncology and cardiac imaging. The competitive landscape forces MRI makers to develop constantly, addressing issues about cost, accessibility, and speed in order to remain competitive in the face of alternative imaging modality. Despite MRI’s distinct benefits, market operators must handle these hurdles strategically, stressing the technology’s capabilities while adapting to changing healthcare demands in order to preserve and extend their market share.

Opportunities

Integration of artificial intelligence (AI) is projected to boost the demand for magnetic resonance imaging scanners market.

The integration of artificial intelligence (AI) is expected to be a game changer in increasing demand for Magnetic Resonance Imaging (MRI) scanners in the healthcare market. AI applications in MRI scanners include a wide variety of operations, including image capture, reconstruction, and interpretation, resulting in increased efficiency, accuracy, and diagnostic capabilities. Machine learning algorithms can improve image processing by shortening acquisition times and refining scan parameters based on individual patient traits. Furthermore, AI-driven image reconstruction approaches help to improve image quality, reduce artifacts, and increase the diagnostic utility of MRI images.

AI’s ability to automate and streamline the interpretation process is one of its major contributions to the MRI scanner market. AI systems can speed up the diagnostic process and increase overall accuracy by helping radiologists identify anomalies, segment anatomical structures, and even forecast disease outcomes. This may help with issues relating to the growing amount of data from medical imaging tests and the requirement for accurate and rapid diagnosis.

AI also makes it easier to build sophisticated imaging methods like quantitative imaging and functional MRI (fMRI), which allow for a more thorough evaluation of physiological processes and tissue properties. MRI scanners may now be used for more precise diagnosis thanks to artificial intelligence (AI), which also makes these machines essential for treatment planning and tailored therapy.

Magnetic Resonance Imaging Scanners Market Trends

-

The integration of artificial intelligence (AI) and machine learning in MRI scanners has been a prominent trend. AI is being used for image processing, interpretation, and even predicting patient outcomes, thereby enhancing diagnostic accuracy and efficiency.

-

The market has seen a preference for high-field MRI systems (1.5T to 3T), driven by their superior image quality. Continued advancements in high-field technology have contributed to clearer and more detailed images.

-

There has been a growing focus on functional MRI, especially in neuroscience and neurology applications. fMRI allows for the mapping of brain activity, providing valuable insights into cognitive functions and neurological disorders.

-

Advancements in portable and point-of-care MRI technologies have gained attention. These innovations aim to increase accessibility to MRI in various settings, including remote areas and emergency situations.

-

The expanding applications of MRI in oncology, including tumor detection, characterization, and treatment response assessment, have been a notable trend. MRI’s ability to provide detailed soft tissue imaging is particularly beneficial in oncological diagnostics.

-

The integration of MRI with other imaging modalities, such as positron emission tomography (PET-MRI) and single-photon emission computed tomography (SPECT-MRI), has been an emerging trend.

Competitive Landscape

The competitive landscape of the magnetic resonance imaging scanners market was dynamic, with several prominent companies competing to provide innovative and advanced magnetic resonance imaging scanners solutions.

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Toshiba Medical Systems Corporation

- Hitachi Medical Corporation

- Bruker Corporation

- Esaote SpA

- Fonar Corporation

- Mindray Medical International Limited

- Neusoft Medical Systems Co., Ltd.

- Samsung Medison Co., Ltd.

- Shenzhen Anke High-tech Co., Ltd.

- Time Medical Systems Co., Ltd.

- AllTech Medical Systems America, Inc.

- Aspect Imaging Ltd.

- Aurigin Technology Inc.

- CMR Naviscan Corporation

- Cubresa Inc.

- Mediso Ltd.

- MR Solutions Ltd.

Recent Developments:

-

January 17, 2024: Siemens Healthineers and City Cancer Challenge (C/Can) are expanding the geographical and technological scope of their partnership for the long term, building on their existing collaboration to enable more timely cancer diagnosis and treatment, and increase survivorship for patients in low- and middle-income countries.

-

February 8, 2024 – GE HealthCare (Nasdaq: GEHC), a leading global medical technology, pharmaceutical diagnostics, and digital solutions innovator, and MedQuest Associates (MedQuest), a leading owner, operator, and manager of outpatient diagnostic imaging facilities, announced a three-year collaboration to deliver excellence in patient care by providing access to innovative technologies from GE HealthCare and the infrastructure and resources from MedQuest that are needed to optimize multi-site outpatient imaging networks for success.

Regional Analysis

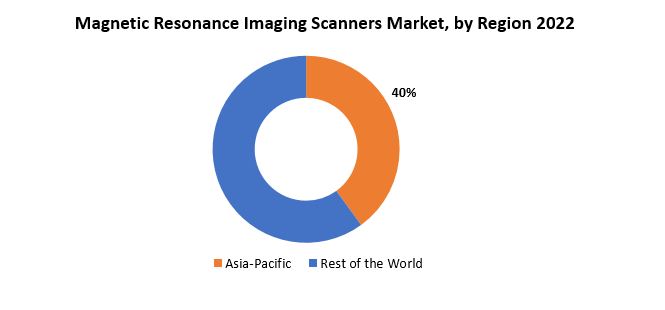

Asia-Pacific accounted for the largest market in the magnetic resonance imaging scanners market. Asia-Pacific accounted for 40 % market share of the global market value. the region’s robust economic growth has led to increased healthcare expenditure, resulting in greater investments in advanced medical technologies, including MRI scanners. Moreover, the rising prevalence of chronic diseases and a growing aging population in countries such as China, Japan, and India have driven the demand for diagnostic imaging procedures, fostering the adoption of MRI scanners.

Furthermore, technological advancements and a focus on research and development in the healthcare sector have propelled the Asia-Pacific MRI scanners market forward. The region has witnessed collaborations between international medical equipment manufacturers and local healthcare institutions, facilitating the introduction of state-of-the-art MRI technologies. The increased awareness and understanding of the benefits of early disease detection and accurate diagnosis have also played a crucial role in boosting the demand for MRI scanners in the region.

Government initiatives to enhance healthcare infrastructure and provide accessible and affordable healthcare services have been pivotal in the growth of the MRI scanners market in Asia-Pacific. Additionally, a surge in private investments in healthcare facilities, coupled with favorable reimbursement policies, has created a conducive environment for the expansion of the MRI scanners market in the region.

In Europe, countries like Germany, the United Kingdom, and France have witnessed significant growth in the MRI scanners market, driven by increasing incidences of chronic diseases, a rapidly aging population, and a strong emphasis on early and accurate diagnosis. The European market benefits from a collaborative approach between healthcare providers and medical device manufacturers, fostering innovation and the adoption of cutting-edge MRI technologies.

In North America, particularly in the United States and Canada, the MRI scanners market is well-established and highly competitive. The region boasts advanced healthcare facilities, a robust regulatory framework, and a high level of awareness among both healthcare professionals and the general population regarding the benefits of MRI diagnostics. The constant evolution of healthcare policies and reimbursement systems has further stimulated the demand for MRI scanners in these markets. The presence of key players and continuous investments in research and development contribute to the ongoing growth and sophistication of the MRI scanners market in North America.

Target Audience for Magnetic Resonance Imaging Scanners Market

- Magnetic Resonance Imaging Scanners Enthusiasts

- High-End Interior Designers

- Luxury Homeowners

- Upscale Restaurants and Hotels

- Collectors of Fine Tableware

- Event Planners for Exclusive Events

- Luxury Gift Buyers

- Affluent Consumers with Discerning Taste

- Luxury Retailers and Boutiques

- Interior Decorators for Luxury Properties

Segments Covered in the Magnetic Resonance Imaging Scanners Market Report

Magnetic Resonance Imaging Scanners Market by Field Strength

- Low-to-mid-field MRI systems (0.5T to 1.5T)

- High-field MRI systems (1.5T to 3T)

- Very-high-field MRI systems (3T to 7T)

- Ultra-high-field MRI systems (7T and above)

Magnetic Resonance Imaging Scanners Market by Application

- Neurology

- Musculoskeletal

- Oncology

- Cardiovascular

- Other Applications

Magnetic Resonance Imaging Scanners Market by End-User

- Hospitals

- Diagnostic Imaging Centers

- Other End Users

Magnetic Resonance Imaging Scanners Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Magnetic Resonance Imaging Scanners market over the next 7 years?

- Who are the major players in the Magnetic Resonance Imaging Scanners market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Magnetic Resonance Imaging Scanners market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Magnetic Resonance Imaging Scanners market?

- What is the current and forecasted size and growth rate of the global Magnetic Resonance Imaging Scanners market?

- What are the key drivers of growth in the Magnetic Resonance Imaging Scanners market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Magnetic Resonance Imaging Scanners market?

- What are the technological advancements and innovations in the Magnetic Resonance Imaging Scanners market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the magnetic resonance imaging scanners market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Magnetic Resonance Imaging Scanners market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- MAGNETIC RESONANCE IMAGING SCANNERS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MAGNETIC RESONANCE IMAGING SCANNERS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- MAGNETIC RESONANCE IMAGING SCANNERS MARKET OUTLOOK

- GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- LOW-TO-MID-FIELD MRI SYSTEMS (0.5T TO 1.5T)

- HIGH-FIELD MRI SYSTEMS (1.5T TO 3T)

- VERY-HIGH-FIELD MRI SYSTEMS (3T TO 7T)

- ULTRA-HIGH-FIELD MRI SYSTEMS (7T AND ABOVE)

- GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NEUROLOGY

- MUSCULOSKELETAL

- ONCOLOGY

- CARDIOVASCULAR

- OTHER APPLICATIONS

- GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- HOSPITALS

- DIAGNOSTIC IMAGING CENTERS

- OTHER END USERS

- GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- SIEMENS HEALTHINEERS

- GE HEALTHCARE

- PHILIPS HEALTHCARE

- TOSHIBA MEDICAL SYSTEMS CORPORATION

- HITACHI MEDICAL CORPORATION

- BRUKER CORPORATION

- ESAOTE SPA

- FONAR CORPORATION

- MINDRAY MEDICAL INTERNATIONAL LIMITED

- NEUSOFT MEDICAL SYSTEMS CO., LTD.

- SAMSUNG MEDISON CO., LTD.

- SHENZHEN ANKE HIGH-TECH CO., LTD.

- TIME MEDICAL SYSTEMS CO., LTD.

- ALLTECH MEDICAL SYSTEMS AMERICA, INC.

- ASPECT IMAGING LTD.

- AURIGIN TECHNOLOGY INC.

- CMR NAVISCAN CORPORATION

- CUBRESA INC.

- MEDISO LTD.

- MR SOLUTIONS LTD.

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 2 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 4 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 6 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 7 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 8 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 13 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 14 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 15 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 16 NORTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 17 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 18 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 19 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 20 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 21 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 22 US MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 23 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 24 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 25 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 26 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 27 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 28 CANADA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 29 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 30 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 31 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 32 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 33 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 34 MEXICO MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 35 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 36 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 37 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 38 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 39 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 40 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 41 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 42 SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 43 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 44 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 45 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 46 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 47 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 48 BRAZIL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 49 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 50 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 51 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 52 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 53 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 54 ARGENTINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 55 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 56 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 57 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 58 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 59 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 60 COLOMBIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 61 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 62 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 63 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 64 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 65 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 66 REST OF SOUTH AMERICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 67 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 68 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 69 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 70 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 71 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 72 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 73 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 74 ASIA-PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 75 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 76 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 77 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 78 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 79 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 80 INDIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 81 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 82 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 83 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 84 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 85 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 86 CHINA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 87 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 88 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 89 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 90 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 91 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 92 JAPAN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 93 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 94 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 95 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 96 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 97 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 98 SOUTH KOREA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 99 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 100 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 101 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 102 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 103 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 104 AUSTRALIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 105 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 106 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 107 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 108 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 109 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 110 SOUTH-EAST ASIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 112 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 114 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 115 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 116 REST OF ASIA PACIFIC MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 117 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 118 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 119 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 120 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 121 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 122 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 123 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 124 EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 125 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 126 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 127 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 128 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 129 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 130 GERMANY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 131 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 132 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 133 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 134 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 135 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 136 UK MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 137 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 138 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 139 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 140 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 141 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 142 FRANCE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 143 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 144 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 145 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 146 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 147 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 148 ITALY MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 149 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 150 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 151 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 152 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 153 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 154 SPAIN MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 155 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 156 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 157 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 158 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 159 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 160 RUSSIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 161 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 162 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 163 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 164 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 165 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 166 REST OF EUROPE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 167 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 168 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 169 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 170 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 171 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 172 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 173 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 174 MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 175 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 176 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 177 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 178 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 179 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 180 UAE MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 181 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 182 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 183 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 184 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 185 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 186 SAUDI ARABIA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 187 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 188 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 189 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 190 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 191 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 192 SOUTH AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

TABLE 193 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

TABLE 194 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (THOUSAND UNITS) 2020-2030

TABLE 195 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

TABLE 196 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (THOUSAND UNITS) 2020-2030

TABLE 197 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

TABLE 198 REST OF MIDDLE EAST AND AFRICA MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2020-2030

FIGURE 9 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2020-2030

FIGURE 10 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2020-2030

FIGURE 11 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY FIELD STRENGTH (USD BILLION) 2022

FIGURE 14 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY APPLICATION (USD BILLION) 2022

FIGURE 15 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY END USER (USD BILLION) 2022

FIGURE 16 GLOBAL MAGNETIC RESONANCE IMAGING SCANNERS MARKET BY REGION (USD BILLION) 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

FIGURE 19 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 20 PHILIPS HEALTHCARE: COMPANY SNAPSHOT

FIGURE 21 TOSHIBA MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT

FIGURE 22 HITACHI MEDICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 23 BRUKER CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ESAOTE SPA: COMPANY SNAPSHOT

FIGURE 25 FONAR CORPORATION: COMPANY SNAPSHOT

FIGURE 26 MINDRAY MEDICAL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

FIGURE 27 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY SNAPSHOT

FIGURE 28 SAMSUNG MEDISON CO., LTD.: COMPANY SNAPSHOT

FIGURE 29 SHENZHEN ANKE HIGH-TECH CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 TIME MEDICAL SYSTEMS CO., LTD.: COMPANY SNAPSHOT

FIGURE 31 ALLTECH MEDICAL SYSTEMS AMERICA, INC.: COMPANY SNAPSHOT

FIGURE 32 ASPECT IMAGING LTD.: COMPANY SNAPSHOT

FIGURE 33 AURIGIN TECHNOLOGY INC.: COMPANY SNAPSHOT

FIGURE 34 CMR NAVISCAN CORPORATION: COMPANY SNAPSHOT

FIGURE 35 CUBRESA INC.: COMPANY SNAPSHOT

FIGURE 36 MEDISO LTD.: COMPANY SNAPSHOT

FIGURE 37 MR SOLUTIONS LTD.: COMPANY SNAPSHOT

FAQ

The global magnetic resonance imaging scanners market is anticipated to grow from USD 7.72 Billion in 2023 to USD 11.96 Billion by 2030, at a CAGR of 6.45 % during the forecast period.

Asia-Pacific accounted for the largest market in the magnetic resonance imaging scanners market. Asia-Pacific accounted for 40 % market share of the global market value.

Siemens Healthineers, GE Healthcare, Philips Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Bruker Corporation, Esaote SpA, Fonar Corporation, Mindray Medical International Limited, Neusoft Medical Systems Co., Ltd., Samsung Medison Co., Ltd., Shenzhen Anke High-tech Co., Ltd., Time Medical Systems Co., Ltd., AllTech Medical Systems America, Inc., Aspect Imaging Ltd., Aurigin Technology Inc., CMR Naviscan Corporation, Cubresa Inc., Mediso Ltd., MR Solutions Ltd.

Key trends in the magnetic resonance imaging (MRI) scanners market include the growing adoption of artificial intelligence (AI) for enhanced imaging interpretation, the development of more compact and portable MRI scanners for increased accessibility, and a focus on advanced applications such as functional MRI (fMRI) for neurological studies and precision medicine. Additionally, there is a continuous emphasis on improving patient comfort and experience during MRI examinations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.