REPORT OUTLOOK

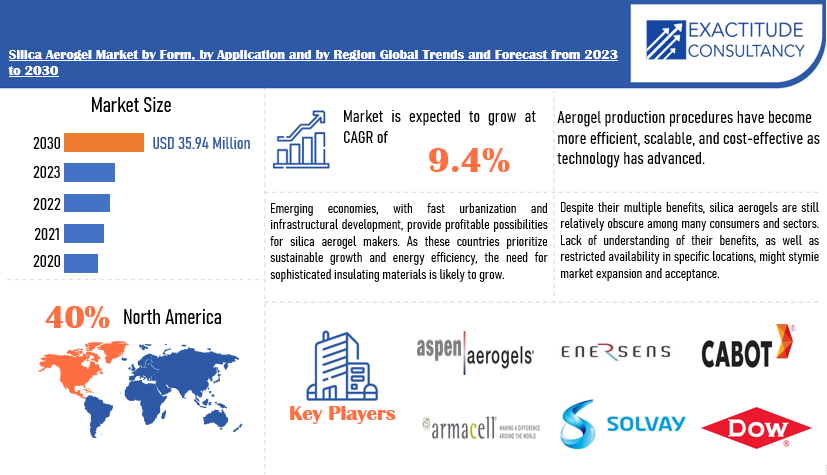

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 35.94 million by 2030 | 9.4% | North America |

| by Form | by Application |

|---|---|

|

|

SCOPE OF THE REPORT

Silica Aerogel Market Overview

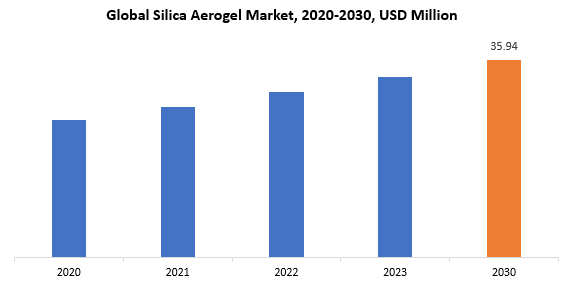

The global silica aerogel market size is projected to grow from USD 32.85 million in 2023 to USD 35.94 million by 2030, exhibiting a CAGR of 9.4% during the forecast period.

Silica aerogel is an exceptional substance recognized for its particularly low density and great porosity, giving it the distinction of “lightest solid material” according to Guinness World Records. It is principally made out of silica (silicon dioxide), the same substance found in quartz, but in a more porous and lightweight form. The aerogel is made via a method known as sol-gel, in which a silica gel is super critically dried, removing moisture from the gel while preserving its precise nanostructure. This procedure results in a solid network of linked Nano pores, which gives silica aerogel its low density and large surface area. Aerogel’s outstanding thermal insulation capabilities make it useful in a variety of industries, including aircraft, building, insulation, and as a catalyst substrate. Silica aerogel is a fascinating material with a wide range of practical applications due to its low weight and ability to tolerate high temperatures and compression.

Silica aerogel is highly valued for its outstanding qualities and flexible uses in a variety of sectors. Its exceptionally low density, high porosity, and good thermal insulating qualities make it an ideal material for applications needing lightweight insulation in harsh environments, such as aircraft and space exploration. Furthermore, its transparency to visible light and infrared radiation makes it suitable for optical components and window insulation. Silica aerogel’s capacity to tolerate high temperatures, resist compression, and efficiently trap air molecules inside its Nano porous structure increases its usefulness in domains such as energy conservation, building insulation, and as a substrate for catalysts in chemical processes. Overall, the unique combination of properties possessed by silica aerogel contributes to its importance as a versatile material with promising applications in numerous industries, ranging from construction and energy to electronics and environmental remediation. Silica aerogel’s remarkable characteristics and adaptability make it useful in a wide range of industries and applications. Silica aerogel, one of the lightest solid materials with amazing thermal insulation qualities, is widely used in construction, aerospace, automotive, oil and gas, electronics, healthcare, and other industries. In the construction business, silica aerogel is used to provide energy-efficient building insulation, lowering heating and cooling expenses while increasing interior comfort. In aerospace and military, it offers lightweight thermal shielding for airplanes and spacecraft. Automotive manufacturers use silica aerogel for heat management and light weighting, resulting in increased fuel efficiency and passenger comfort. It provides insulation solutions for pipelines, tanks, and equipment in the oil and gas industry, allowing for the preservation of ideal operating temperatures while lowering energy usage. Furthermore, silica aerogel has uses in electronics, where it serves as an insulator for electrical equipment, and healthcare, where it is used in wound dressings and medication delivery systems. With continued R&D activities driving innovation, the scope of silica aerogel continues to broaden, providing prospects for breakthroughs in existing applications as well as the discovery of new frontiers across diverse sectors.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Million) (Kilotons) |

| Segmentation | By Form, Application and Region |

| By Form |

|

| By Connectivity |

|

|

By Region

|

|

Silica Aerogel market Segmentation Analysis

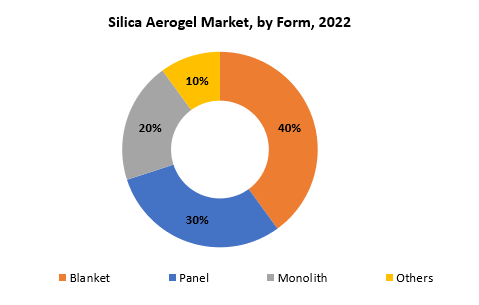

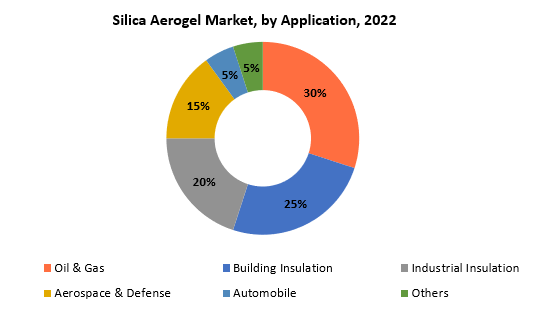

The global silica aerogel market is bifurcated three segments, by form, application and region. By form, the market is bifurcated into blanket, panel, monolith, others. By application, the market is bifurcated oil & gas, building insulation, industrial insulation, aerospace & defense, automobile and others and region.

The silica aerogel market is divided into four major divisions based on its form: blanket, panel, monolith, and others. Blankets are flexible, lightweight sheets of silica aerogel that may be draped or wrapped over objects or surfaces to provide insulation in a wide range of applications, including pipelines, refrigeration systems, and clothing. Panels, on the other hand, are stiff or semi-rigid structures used in building, transportation, and electronics to provide thermal insulation and soundproofing. Monoliths are three-dimensional aerogel structures that, due to their large surface area and porosity, are frequently used in catalysis, filtration, and as support materials for numerous chemical processes. The “others” category includes different types of silica aerogel materials, such as granules, powders, or bespoke shapes for specialized uses. These shapes might be useful in industries like as cosmetics, pharmaceuticals, and aerospace, where specific requirements necessitate the usage of specialist aerogel materials. In conclusion, the market segmentation by form illustrates silica aerogel’s broad uses and adaptability, catering to a wide range of sectors and demands through personalized solutions in blanket, panel, monolith, and other forms.

The silica aerogel market is divided into many primary sectors based on application, with each representing a specific area where aerogel’s distinctive qualities are useful. In the oil and gas business, silica aerogel is used as thermal insulation in pipelines, tanks, and equipment to reduce heat loss and maintain ideal operating temperatures. This helps to increase efficiency, reduce energy consumption, and avoid the production of hydrates and wax deposits. Building insulation is another important application in which silica aerogel’s exceptional thermal insulation characteristics are used to improve energy efficiency and interior comfort. Aerogel insulation is used in walls, roofs, and windows to manage internal temperatures, lower heating and cooling expenses, and increase overall sustainability. Industrial insulation has a wide range of uses in industrial facilities, refineries, power plants, and chemical processing plants. Silica aerogel is used to insulate equipment, pipelines, and vessels, resulting in thermal stability, reduced heat loss, and increased safety in high-temperature situations. The lightweight nature of silica aerogel, thermal insulation properties, and durability to harsh circumstances make it ideal for aerospace and defence applications. It is used in aircraft insulation, spacecraft thermal protection systems, and military equipment, where weight reductions, thermal control, and durability are important. Silica aerogel is rapidly being used in automobiles for heat management, noise reduction, and light weighting. It may be found in engine compartments, exhaust systems, and interior insulation to increase fuel economy, lower emissions, and improve passenger comfort. The “others” category includes further specialist applications such as electronics, healthcare, fashion, and sports goods, in which silica aerogel’s distinctive features are used for specific objectives ranging from electrical device insulation to lightweight protective gear.

Silica Aerogel Market Dynamics

Driver

Silica aerogels have excellent thermal insulation capabilities, making them ideal for use in the building, transportation, and oil and gas sectors.

The increasing emphasis on energy efficiency across various industries, including construction, transportation, and oil & gas, has sparked a growing demand for advanced materials capable of providing superior thermal insulation. Among these materials, silica aerogels have emerged as a standout solution, prized for their exceptional thermal insulation properties. In the construction sector, where energy consumption accounts for a significant portion of operational costs, there is a growing preference for materials that can reduce heating and cooling expenses while maintaining comfortable indoor environments. Silica aerogels excel in this regard, offering remarkable thermal insulation capabilities that outperform conventional materials like fiberglass and foam insulation. By incorporating silica aerogels into building envelopes, walls, roofs, and windows, construction projects can significantly enhance energy efficiency and reduce carbon footprint. Similarly, in the transportation industry, where fuel efficiency and weight reduction are critical, silica aerogels provide a lightweight yet very efficient thermal insulation option.

Silica aerogels, whether used in airplanes, vehicles, or marine vessels, help to reduce heat transmission, lowering the energy required for heating or cooling systems. This not only saves gasoline, but also improves passenger comfort and safety. Furthermore, in the oil and gas industry, where activities frequently include high temperatures and harsh environmental conditions, silica aerogels are used to insulate pipelines, storage tanks, and equipment. Silica aerogels assist improve energy utilization and preserve operational efficiency in oil refineries, petrochemical facilities, and offshore platforms by reducing heat loss or gain. Overall, the growing emphasis on energy conservation across sectors is pushing up demand for silica aerogels, which have unsurpassed thermal insulation qualities. As organizations and governments across the world prioritize sustainability and aim to minimize greenhouse gas emissions, the usage of silica aerogels as a crucial component of energy-efficient solutions is likely to rise further, driving industry innovation and growth.

Restraint

Despite advancements in manufacturing technologies, the production of silica aerogels remains relatively expensive compared to traditional insulation materials.

Despite major developments in manufacturing methods, the manufacture of silica aerogels remains challenging due to their comparatively high prices when compared to standard insulating materials. These higher production costs might limit market penetration, particularly in applications and locations where price sensitivity is a major concern. Silica aerogels’ high production costs are due in part to the intricacy of their manufacturing process. Aerogels are often created in a multi-step process that includes sol-gel chemistry, supercritical drying, and, in some cases, additional post-processing processes. These processes need sophisticated equipment, careful control over factors like as temperature and pressure, and the utilization of costly raw materials and chemicals. Furthermore, the high quality control requirements required to assure constant product performance increase production costs. Furthermore, aerogels’ low bulk density raises transportation costs since higher quantities are necessary to attain the same insulating thickness as denser materials. This can be especially challenging in areas with poor transportation infrastructure or high logistical expenses.

In price-sensitive applications and countries where cost concerns play a key role in material selection, the higher initial investment required for silica aerogels may put off potential customers. This is especially true in industries like construction, where margins are tight and cost-effectiveness is a top priority for builders and developers. While advances in manufacturing technology have resulted in incremental gains in production efficiency and cost reduction, considerable impediments remain to cost parity with conventional insulating materials. However, current research and development initiatives focused at improving production processes, acquiring more cost-effective raw materials, and increasing manufacturing capacity show promise for tackling these difficulties in the future.

Opportunities

Exploring new applications and markets presents significant growth opportunities for manufacturers.

Silica aerogels, which are well known for their extraordinary characteristics, have applications far beyond insulation. Their distinct properties make them extremely adaptable materials with several potential uses in a variety of sectors. In aircraft, where weight reduction is crucial for fuel efficiency and performance, silica aerogels provide a lightweight yet strong alternative. Because of their high strength-to-weight ratio and thermal stability, they are suitable for use in spaceship insulation, thermal protection systems for re-entry vehicles, and structural components. Furthermore, aerogels’ remarkable thermal insulation qualities make them ideal for insulating cryogenic tanks and preserving temperature-sensitive payloads. Silica aerogels are used in heat management solutions in electronics. Silica aerogels show potential in a variety of biological applications. Their biocompatibility, large surface area, and porous structure make them ideal for drug delivery systems, wound dressings, tissue engineering scaffolds, and diagnostic devices. Silica aerogels may be designed to encapsulate and release therapeutic substances, stimulate tissue regeneration, and allow controlled release of bioactive molecules, all of which help to develop personalized medicine and healthcare delivery.

Furthermore, silica aerogels contribute significantly to environmental clean-up efforts. Their large surface area and porous structure make them good adsorbents for pollutants, heavy metals, and volatile organic compounds in air and water. Aerogel-based filtration systems may clean polluted water, remove contaminants from industrial emissions, and reduce environmental risks.

Silica Aerogel Market Trends

-

With increased concerns about energy saving and sustainability, there is an increasing need for materials with exceptional thermal insulation qualities, such as silica aerogel.

-

The aerospace and defence industries are continuing to investigate the use of silica aerogel for lightweight insulation, thermal protection, and acoustic dampening in aircraft, spacecraft, and military equipment.

-

Continuous R&D efforts are propelling technological improvements and product developments in the field of silica aerogels. Aerogel composites, hybrid materials, and bespoke formulations have been developed to fulfil specific application needs and performance parameters.

-

The automobile sector is increasingly using silica aerogel materials for thermal management, acoustic insulation, and light weighting. Because of its lightweight nature and good thermal and acoustic insulation capabilities, silica aerogel is an appealing alternative for carmakers looking to increase fuel economy, decrease vehicle weight, and improve passenger comfort.

-

With sustainability becoming a major emphasis in many businesses, there is a rising interest in ecologically friendly materials such as silica aerogel. Silica aerogel, a highly porous and lightweight material with minimal environmental impact, meets the rising need for sustainable solutions in a variety of applications such as building insulation, transportation, and consumer items.

Competitive Landscape

The competitive landscape of the silica aerogel market was dynamic, with several prominent companies competing to provide innovative and advanced silica aerogel.

- BASF SE

- Acoustiblok

- Active Aerogels

- Aerogel Technologies

- Armacell

- Aspen Aerogels Inc.

- Cabot Corporation

- Dow Chemical Company

- Enersens

- Technologies

- Green Earth Aerogel Technologies

- Guangdong Alison Hi-Tech

- Guizhou Aerospace

- Insulgel High-Tech

- Jios Aerogel Corporation

- Maero Tech Sdn Bhd

- Nano High-Tech

- Ocellus Inc

- Solvay

- Svenska Aerogel Holding AB

Recent Developments:

November 6, 2023 — JIOS Aerogel (JIOS), a global leader in silica aerogel technology, has celebrated the opening of its advanced manufacturing plant in Pioneer, Singapore, in a ceremony attended by investors, suppliers and partners. The establishment of this facility represents a pivotal component of JIOS’ ongoing investment strategy, which is geared towards supporting automakers in their adoption of aerogel-based technology to enhance the safety and performance of electric vehicle (EV) batteries.

19 June 2023 – Armacell, a global leader in flexible foam for the equipment insulation market and a leading provider of engineered foams, together with AIS, a global leader in the engineering, manufacture and application of insulation and passive fire protection systems, has established a joint venture for the manufacturing of insulation jackets in the USA. Armacell AIS, LLC will be operating from Armacell’s existing facility in Yukon.

Regional Analysis

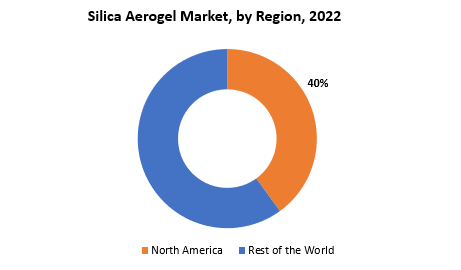

North America has a robust aerospace and defense sector, which is a significant consumer of silica aerogel for applications such as thermal insulation in aircraft and spacecraft. Additionally, the region has a well-established construction industry that values energy-efficient materials like silica aerogel for building insulation purposes. Furthermore, stringent environmental regulations and a growing emphasis on sustainability have fueled the demand for eco-friendly insulation solutions, further driving the adoption of silica aerogel in North America.

In addition, the region’s dominance in the silica aerogel market is supported by the presence of important industry companies and research institutes focusing in aerogel technologies. However, it is vital to note that the silica aerogel market is expanding in other areas, such as Europe and Asia-Pacific, owing to increased industrialization, infrastructural development, and rising awareness of the benefits of silica aerogel in a variety of applications. The North American Silica Aerogel market will lead this market throughout the forecast period, owing to the Aerogel industry’s tremendous growth potential in the areas of application development, efficacy, and product innovation. At the same time, its high insulating and low conductivity properties are fuelling demand, which will accelerate market expansion in North America.

Target Audience for Silica Aerogel market

- Construction industry

- Aerospace and defense sector

- Automotive manufacturers

- Oil and gas industry

- Industrial sector

- Electronics industry

- Healthcare sector

- Apparel manufacturers

- Sporting goods manufacturers

- Research and development organizations

Segments Covered in the Silica Aerogel Market Report

Silica Aerogel Market by Form

- Blanket

- Panel

- Monolith

- Others

Silica Aerogel Market by Application

- Oil & Gas

- Building Insulation

- Industrial Insulation

- Aerospace & Defense

- Automobile

- Others

Silica Aerogel Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Silica Aerogel market over the next 7 years?

- Who are the key market participants Silica Aerogel, and what are their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the Middle East, and Africa?

- How is the economic environment affecting the Silica Aerogel market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Silica Aerogel market?

- What is the current and forecasted size and growth rate of the global Silica Aerogel market?

- What are the key drivers of growth in the Silica Aerogel market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Silica Aerogel market?

- What are the technological advancements and innovations in the Silica Aerogel market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Silica Aerogel market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Silica Aerogel market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- SILICA AEROGEL MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SILICA AEROGEL MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- SILICA AEROGEL MARKET OUTLOOK

- GLOBAL SILICA AEROGEL MARKET BY FORM, 2020-2030, (USD MILLION) (KILOTONS)

- BLANKET

- PANEL

- MONOLITH

- OTHERS

- GLOBAL SILICA AEROGEL MARKET BY APPLICATION, 2020-2030, (USD MILLION) (KILOTONS)

- OIL & GAS

- BUILDING INSULATION

- INDUSTRIAL INSULATION

- AEROSPACE & DEFENSE

- AUTOMOBILE

- OTHERS

- GLOBAL SILICA AEROGEL MARKET BY REGION, 2020-2030, (USD MILLION) (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- BASF SE

- ACOUSTIBLOK

- ACTIVE AEROGELS

- AEROGEL TECHNOLOGIES

- ARMACELL

- ASPEN AEROGELS INC.

- CABOT CORPORATION

- DOW CHEMICAL COMPANY

- ENERSENS

- TECHNOLOGIES

- GREEN EARTH AEROGEL TECHNOLOGIES

- GUANGDONG ALISON HI-TECH

- GUIZHOU AEROSPACE

- INSULGEL HIGH-TECH

- JIOS AEROGEL CORPORATION

- MAERO TECH SDN BHD

- NANO HIGH-TECH

- OCELLUS INC

- SOLVAY

- SVENSKA AEROGEL HOLDING AB *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 2 GLOBAL SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 3 GLOBAL SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 4 GLOBAL SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 5 GLOBAL SILICA AEROGEL MARKET BY REGION (USD MILLION) 2020-2030

TABLE 6 GLOBAL SILICA AEROGEL MARKET BY REGION (KILOTONS) 2020-2030

TABLE 7 NORTH AMERICA SILICA AEROGEL MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 8 NORTH AMERICA SILICA AEROGEL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 9 NORTH AMERICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 10 NORTH AMERICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 11 NORTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 12 NORTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 13 US SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 14 US SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 15 US SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 16 US SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 17 CANADA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 18 CANADA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 19 CANADA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 20 CANADA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 21 MEXICO SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 22 MEXICO SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 23 MEXICO SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 24 MEXICO SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 25 SOUTH AMERICA SILICA AEROGEL MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 26 SOUTH AMERICA SILICA AEROGEL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 27 SOUTH AMERICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 28 SOUTH AMERICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 29 SOUTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 30 SOUTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 31 BRAZIL SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 32 BRAZIL SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 33 BRAZIL SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 34 BRAZIL SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 35 ARGENTINA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 36 ARGENTINA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 37 ARGENTINA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 38 ARGENTINA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 39 COLOMBIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 40 COLOMBIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 41 COLOMBIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 42 COLOMBIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 47 ASIA-PACIFIC SILICA AEROGEL MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 48 ASIA-PACIFIC SILICA AEROGEL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 49 ASIA-PACIFIC SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 50 ASIA-PACIFIC SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 51 ASIA-PACIFIC SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 52 ASIA-PACIFIC SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 53 INDIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 54 INDIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 55 INDIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 56 INDIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 57 CHINA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 58 CHINA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 59 CHINA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 60 CHINA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 61 JAPAN SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 62 JAPAN SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 63 JAPAN SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 64 JAPAN SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 65 SOUTH KOREA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 66 SOUTH KOREA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 67 SOUTH KOREA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 68 SOUTH KOREA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 69 AUSTRALIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 70 AUSTRALIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 71 AUSTRALIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 72 AUSTRALIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 73 SOUTH-EAST ASIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 75 SOUTH-EAST ASIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 81 EUROPE SILICA AEROGEL MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 82 EUROPE SILICA AEROGEL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 83 EUROPE SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 84 EUROPE SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 85 EUROPE SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 86 EUROPE SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 87 GERMANY SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 88 GERMANY SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 89 GERMANY SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 90 GERMANY SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 91 UK SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 92 UK SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 93 UK SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 94 UK SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 95 FRANCE SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 96 FRANCE SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 97 FRANCE SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 98 FRANCE SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 99 ITALY SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 100 ITALY SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 101 ITALY SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 102 ITALY SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 103 SPAIN SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 104 SPAIN SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 105 SPAIN SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 106 SPAIN SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 107 RUSSIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 108 RUSSIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 109 RUSSIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 110 RUSSIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 111 REST OF EUROPE SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 112 REST OF EUROPE SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 113 REST OF EUROPE SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 114 REST OF EUROPE SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY COUNTRY (USD MILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY COUNTRY (KILOTONS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 121 UAE SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 122 UAE SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 123 UAE SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 124 UAE SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 125 SAUDI ARABIA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 126 SAUDI ARABIA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 127 SAUDI ARABIA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 128 SAUDI ARABIA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 129 SOUTH AFRICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 130 SOUTH AFRICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 131 SOUTH AFRICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 132 SOUTH AFRICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY FORM (USD MILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY FORM (KILOTONS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY APPLICATION (USD MILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA SILICA AEROGEL MARKET BY APPLICATION (KILOTONS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SILICA AEROGEL MARKET BY FORM USD MILLION, 2020-2030

FIGURE 9 GLOBAL SILICA AEROGEL MARKET BY APPLICATION, USD MILLION, 2020-2030

FIGURE 10 GLOBAL SILICA AEROGEL MARKET BY REGION, USD MILLION, 2020-2030

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL SILICA AEROGEL MARKET BY FORM, USD MILLION 2022

FIGURE 13 GLOBAL SILICA AEROGEL MARKET BY APPLICATION, USD MILLION 2022

FIGURE 14 GLOBAL SILICA AEROGEL MARKET BY REGION, USD MILLION 2022

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 BASF SE : COMPANY SNAPSHOT

FIGURE 17 ACOUSTIBLOK: COMPANY SNAPSHOT

FIGURE 18 ACTIVE AEROGELS: COMPANY SNAPSHOT

FIGURE 19 AEROGEL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 20 ARMACELL : COMPANY SNAPSHOT

FIGURE 21 ASPEN AEROGELS INC. : COMPANY SNAPSHOT

FIGURE 22 CABOT CORPORATION : COMPANY SNAPSHOT

FIGURE 23 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 24 ENERSENS: COMPANY SNAPSHOT

FIGURE 25 F. TECHNOLOGIES : COMPANY SNAPSHOT

FIGURE 26 GREEN EARTH AEROGEL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 27 GUANGDONG ALISON HI-TECH: COMPANY SNAPSHOT

FIGURE 28 GUIZHOU AEROSPACE: COMPANY SNAPSHOT

FIGURE 29 INSULGEL HIGH-TECH: COMPANY SNAPSHOT

FIGURE 30 JIOS AEROGEL CORPORATION: COMPANY SNAPSHOT

FIGURE 31 MAERO TECH SDN BHD: COMPANY SNAPSHOT

FIGURE 32 NANO HIGH-TECH: COMPANY SNAPSHOT

FIGURE 33 OCELLUS INC: COMPANY SNAPSHOT

FIGURE 34 SOLVAY: COMPANY SNAPSHOT

FIGURE 35 SVENSKA AEROGEL HOLDING AB

FAQ

The global silica aerogel market size is projected to grow from USD 32.85 million in 2023 to USD 35.94 million by 2030, exhibiting a CAGR of 9.4% during the forecast period.

North America accounted for the largest market in the silica aerogel market.

BASF SE ,Active Aerogels, Aerogel Technologies, Aspen Aerogels Inc. ,BASF SE, Cabot Corporation ,Dow Chemical Company, Enersens, F. Technologies ,Green Earth Aerogel Technologies, Guangdong Alison Hi-Tech and Others.

As the benefits of silica aerogel become more widely known and technological limitations are overcome, the market for silica aerogel is growing outside its typical regions.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.