REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 13.61 billion by 2029 | 2.93% | Asia Pacific |

| By Brake Type | By Application Type | By Material Type | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Automotive OEM Brake Friction Material Market Overview

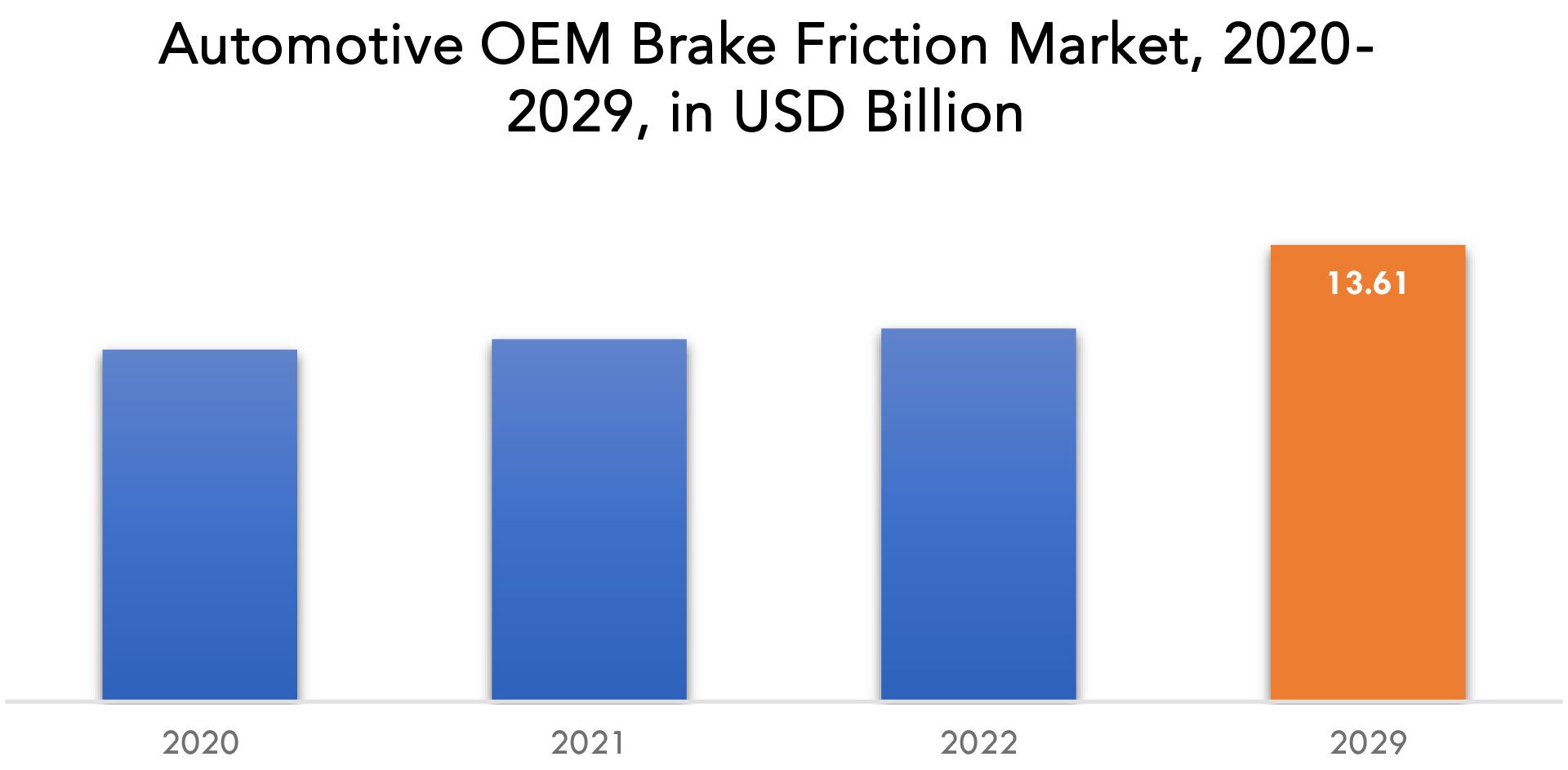

The Automotive OEM Brake Friction Material market is expected to grow at 2.93% CAGR from 2023 to 2029. It is expected to reach above USD 13.61 billion by 2029 from USD 10.49 billion in 2022.

The brake pad market is primarily driven by increasing demand for environmentally friendly brake pads with superior heat resistance and improved mechanical efficiency. Moreover, the introduction of electric vehicles with regenerative braking systems is expected to increase the demand for lightweight automotive brake pads. The expected growth of the brake pads market will be supported during the evaluation period. In addition, powder, metallurgy, and renewable brake friction materials are the pattern in the automotive frequency friction products industry. Carbon based brake pads market is expected to increase due to its positive properties such as improved wear resistance and eco-friendly properties.

The brake pad market is expected to grow as vehicle production is expected to increase during the evaluation period. This drives the demand for advanced technology braking systems and will continue to lead to the introduction of advanced automotive frequency friction products in the near future. Additionally, stringent state regulations and the enforcement of federal motor vehicle safety laws are forcing manufacturers to focus on making their vehicles safer. The demand for brake pads will continue to increase and the automotive brake pads market will increase during the forecast period.

Automotive brake traction products are forcing OEMs to cut costs and jeopardize profits. This may adversely affect expected growth of the automotive friction products market during the evaluation period. Growth of the automotive friction products market is limited by poor durability and high replacement costs.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION), (KILLOTONS) |

| Segmentation | by product type, by application, by Material Type by region |

| By Product Type

|

|

| By Application Type

|

|

| By Material Type

|

|

| By Region

|

|

One of the major factors driving the growth of the automotive brake pad market is the ready availability of low-cost friction pads. Brake pads form an integral part of automobile disc and drum braking systems. They act as friction materials and are fitted as standard in vehicle braking systems. Brake pads are a common component, readily available and affordable. Asbestos brake pads are cheap to manufacture and therefore form an integral part of the automotive braking system. For reference, the average aftermarket price for brake pads ranges from USD 25 to USD 75, depending on the vehicle and car make. Additionally, the presence of numerous regional and global brake pad manufacturers makes the market more competitive, leading to price competition. The brake products of domestic and foreign players are easily available through both offline and online sales channels. Easy product availability and low cost play a key role in promoting the penetration of brake products into automobiles, thereby driving the global automotive brake pads market.

The development of automotive brake pad manufacturing is the main trend affecting the growth of the automotive brake pad market. The global automotive brake pad market is directly related to brake pads in terms of penetration of the automotive industry. Vendors operating in the global automotive brake pad market focus on innovative materials and advanced design and testing techniques to improve the overall performance and efficiency of automotive braking systems. increase. Research and development of efficient materials for brake pad applications is increasing year by year.

However, due to the COVID-19 pandemic, the production of vehicles and related parts was temporarily halted or reduced in the first half of 2020 to prevent the spread of the disease in the community through social contact. In addition, the supply-demand balance collapsed due to the reduced production of auto parts. However, after this crisis, demand for cars, especially passenger cars, is expected to increase as people’s concerns weigh on social distancing and decisions on whether to buy a new car or participate in car sharing. intensifying competition between Manufacturer. This will inspire us to offer highly differentiated products, including automotive friction materials, and drive the growth of the local market. Therefore, all the factors mentioned above are expected to boost the demand for automotive brake pads, boosting the growth of the regional market during the forecast period.

Automotive OEM Brake Friction Material Market Segment Analysis

The Automotive OEM Brake Friction Material market is segmented based on Brake Type, Application Type, Material Type and Region, Global trends and forecast. By Brake Type, the Automotive OEM Brake Friction Material market is divided into disc brake and drum brake. Based on Application Type, the market is bifurcated into brake lining and brake pad. Based on Material Type industry, the market is fragmented into organic and semi metallic ceramic. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Brakes are further divided into disc brakes and drum brakes. Disc brakes hold the largest market share in the world’s braking systems due to their high durability, light weight and high effectiveness. Most OEMs install disc brakes on the front wheels of the vehicle and drum brakes on the rear wheels. In contrast to drum brakes in sports cars, disc brakes consist of brake pads. Brake linings and pads cause friction, which in my business causes the vehicle to stop or slow down. Disc brakes are now widely used by automotive OEMs, impacting the brake pad market.

By type of brake pad material, the market is further segmented into organic, semi-metallic and ceramic brakes. The ceramic brake segment is expected to hold a large market share in the brake pad materials segment. Ceramic brakes wear less and last longer than other types of brakes. Semi-metallic brakes are expected to occupy his second largest position on the market. These brakes are mainly used on heavy vehicles.

Automotive OEM Brake Friction Material Market Key Players

The major key players of market include Aisin Corp, Akebono Brake Industry Co. Ltd., Brembo Spa, Continental AG, General Motors Co., Knorr Bremse AG, Nisshinbo Holdings Inc., Robert Bosch GmbH, Showa Denko Materials Co. Ltd., and ZF Friedrichshafen AG.

30th November 2022: Bosch and Mercedes-Benz have achieved an important milestone on the road to automated driving. The Federal Motor Transport Authority (KBA) has approved a highly automated parking system for use in his APCOA P6 parking lot at Stuttgart Airport. This makes it the world’s first highly automated driverless parking feature that is SAE Level 4¹ compliant and officially approved for commercial use.

4th January 2023: Make your car, e-bike, smartphone, fitness tracker, and headphones aware of your surroundings. Bosch develops and manufactures intelligent sensors that make life safer and more comfortable. And these sensors will become increasingly efficient and help protect the planet. Bosch is the pioneer and market leader in micro-electro-mechanical (MEMS) sensors. MEMS sensors are currently one of the most important and widespread sensor types.

Who Should Buy? Or Key Stakeholders

- Buyers and Suppliers

- Government Agencies

- Local Communities

- Providers of automotive related fields

- Research Organizations

- Investors

- Others

Automotive OEM Brake Friction Material Market Regional Analysis

The Automotive OEM Brake Friction Material market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

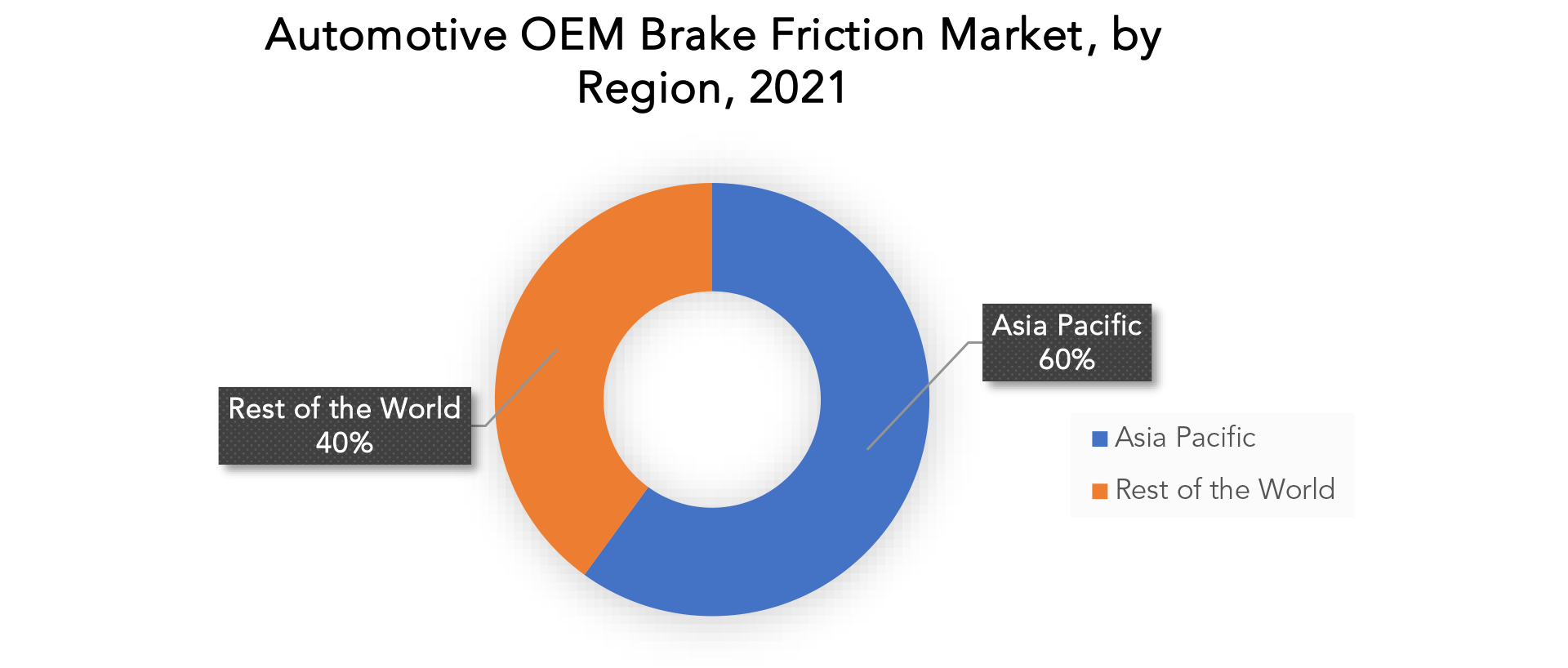

60% of the market growth is due to APAC during the forecast period. China, Japan, India and South Korea (Republic of Korea) are the major markets for automotive brake pads in APAC. The market growth in this region will be faster than the market growth in other regions. High acceptance of commercial vehicles in countries such as China, India and South Korea will drive the growth of the APAC automotive brake pads market during the forecast period. This market research report provides detailed information on competitor information, marketing gaps, and regional opportunities to help vendors create efficient business plans.

Key Market Segments: Automotive OEM Brake Friction Material market

Automotive OEM Brake Friction Material Market By Brake Type, 2023-2029, (USD Billion), (Kilotons)

- Disc Brake

- Drum Brake

Automotive OEM Brake Friction Material Market By Application Type, 2023-2029, (USD Billion), (Kilotons)

- Brake Lining

- Brake Pad

Automotive OEM Brake Friction Material Market By Material Type, 2023-2029, (USD Billion), (Kilotons)

- Organic

- Semi Metallic

- Ceramic

Automotive OEM Brake Friction Material Market By Region, 2023-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the Automotive OEM Brake Friction Material market?

- What are the key factors influencing the growth of Automotive OEM Brake Friction Material market?

- Who are the major key players in the Automotive OEM Brake Friction Material market?

- Which region will provide more business opportunities Automotive OEM Brake Friction Material market in future?

- Which segment holds the maximum share of the Automotive OEM Brake Friction Material market?

FAQ

The Automotive OEM Brake Friction Material market is expected to grow at 2.93% CAGR from 2023 to 2029. It is expected to reach above USD 13.61 billion by 2029 from USD 10.49 billion in 2022.

Asia Pacific held more than 60% of the Automotive OEM Brake Friction Material market revenue share in 2022 and will witness expansion in the forecast period.

One of the major factors driving the growth of the automotive brake pad market is the ready availability of low-cost friction pads. Brake pads form an integral part of automobile disc and drum braking systems. They act as friction materials and are fitted as standard in vehicle braking systems. Brake pads are a common component, readily available and affordable. Asbestos brake pads are cheap to manufacture and therefore form an integral part of the automotive braking system.

Asia Pacific, the largest market in 2022 accounted for more revenue generation of worldwide sales and is likely to dominate the market over the estimated period. The growth of the region is attributed to the increasing demand.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.