REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

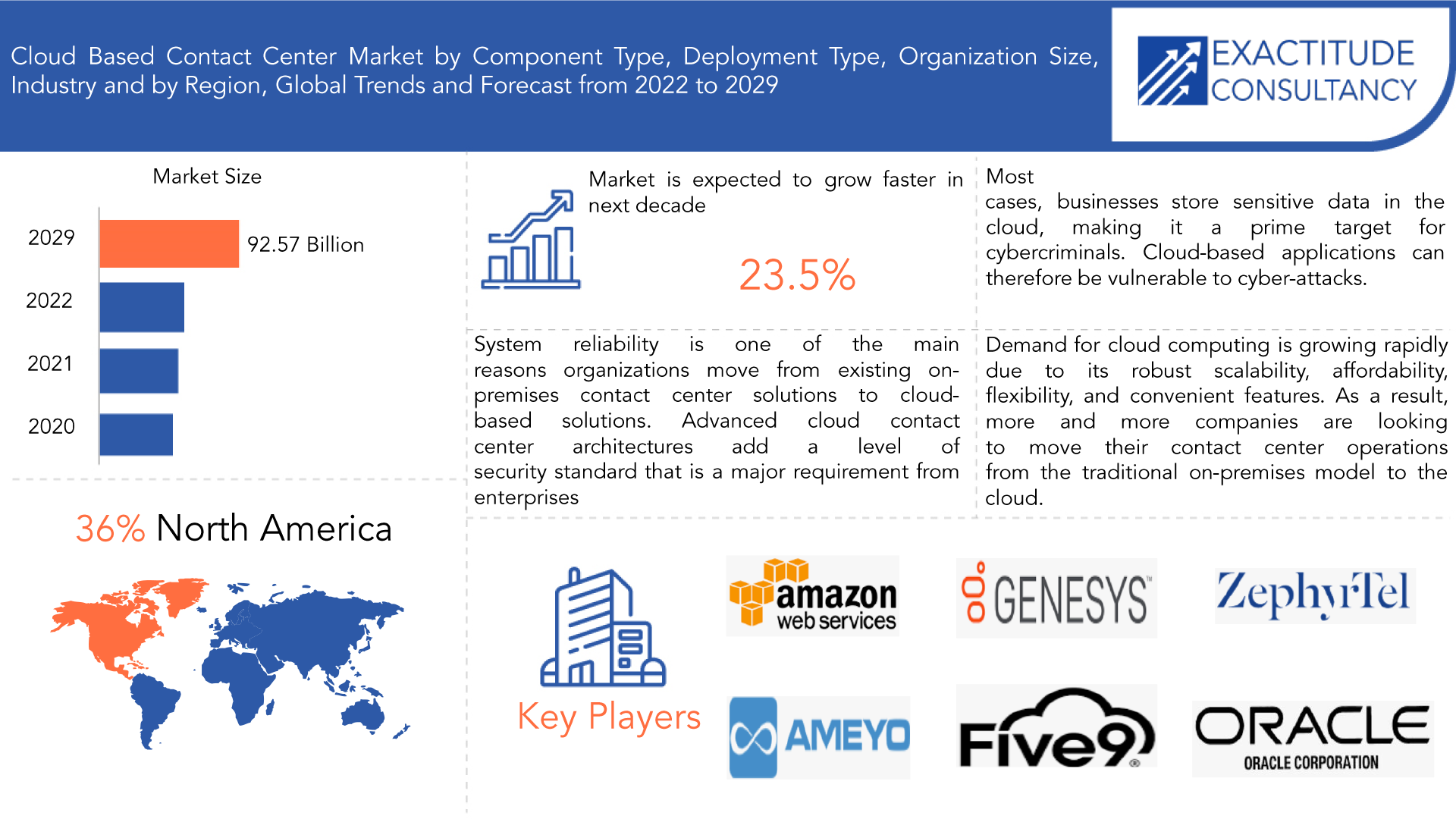

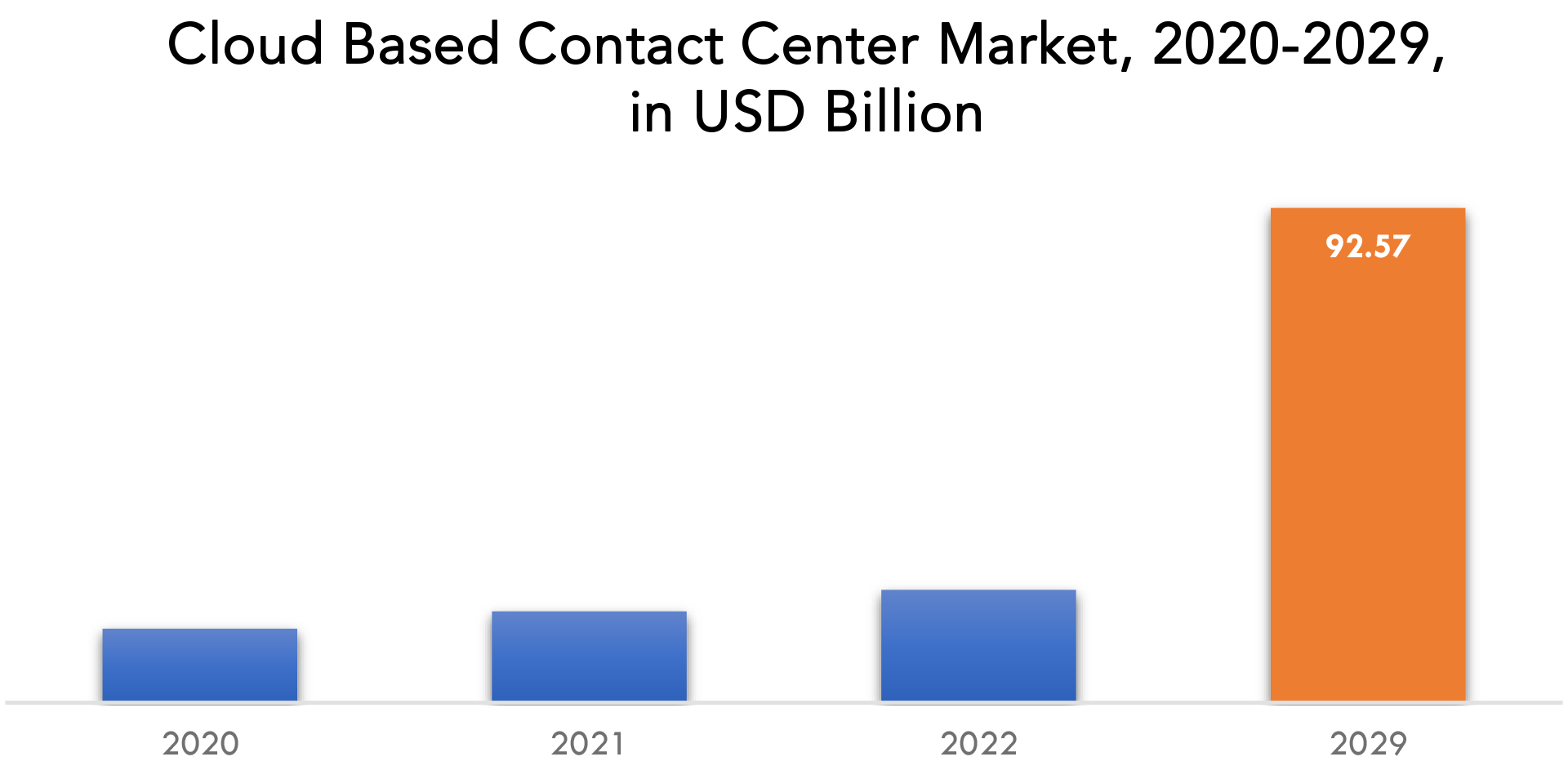

| USD 92.57 billion by 2029 | 23.5% | North America |

| By Component Type | By Deployment | By Organization Size | By Application |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Cloud Based Contract Center Market Overview

The Cloud Based Contract Center market is expected to grow at 23.5% CAGR from 2022 to 2029. It is expected to reach above USD 92.57 billion by 2029 from USD 13.85 billion in 2020.

A cloud-based contact center solution combines several communication channels into a single system for allowing agents to connect with customers over a phone call, email, or instant message while maintaining a consistent record. It offers workforce management tools so that agents and supervisors can manage their time effectively. As a result, it finds extensive applications in banking, financial services and insurance (BFSI), consumer goods, retail, government, public, healthcare, manufacturing, telecommunication, and information technology (IT) sectors across the globe.

At present, there is a rise in the demand for cloud computing due to its robust scalability, affordability, flexibility, and features. As a result, organizations worldwide are migrating their contact center operations from a traditional on-premises model to the cloud, which represents one of the key factors driving the market. Moreover, cloud-based contact centers allow agents to work remotely for improving their productivity and overall operational efficiency. This is driving the growth of the market along with various advantages provided by cloud-based contact centers such as superior security, reliability, and affordable convenience. Additionally, rapid digitization in the banking, financial services and insurance (BFSI) industry is boosting the growth of the market by improving services, reducing human error, and saving time. Additionally, the increasing use of Contact Center as a Service (CCaaS) technologies to minimize operational costs, reduce downtime, and ensure business continuity is positively impacting the market. I’m here. Additionally, key market players are funding research and development (R&D) activities to provide natural interactive voice response (IVR) and enable conversational chatbots for customers. This is expected to drive market growth in the coming years.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION) |

| Segmentation | by component, by deployment, by organization size, by industry, by region |

| By Component Type |

|

| By Deployment |

|

| By Organization Size |

|

| By Industry |

|

| By Region |

|

System reliability is one of the main reasons organizations move from existing on-premises contact center solutions to cloud-based solutions. Advanced cloud contact center architectures add a level of security standard that is a major requirement from enterprises. Flexibility, control over functionality, and improved performance are key factors in adopting cloud-based solutions. Cloud deployments allow organizations to host their contact centers in third-party data centers, eliminating the need for hardware infrastructure. This significantly reduces overall infrastructure costs. In addition, cloud-based contact centers enable HR teams to scale instantly to quickly respond to customer demand. As a result, more and more small businesses are moving from on-premises contact centers to cloud-based models.

Demand for cloud computing is growing rapidly due to its robust scalability, affordability, flexibility, and convenient features. As a result, more and more companies are looking to move their contact center operations from the traditional on-premises model to the cloud. For example, in November 2019, Five9, Inc. acquired Whendu, his iPaaS platform for Spider Monkey, to help move the company’s contact center to the cloud. Cloud-based contact centers are not tied to physical locations, allowing contact center agents to work remotely. This remote working approach helps contact centers improve agent productivity and overall operational efficiency. Cloud infrastructure offers superior security, reliability, and convenience at an affordable price. These are key factors in the adoption of these contact centers.

The sudden outbreak of COVID-19 has made contact centers a reliable, unique and convenient option for businesses to keep their business running. Adoption of these contact centers increased during this period as the pandemic increased the demand for remote work. Beneficial factors such as flexibility and affordability. The scalability and ease of integration provided by cloud-based systems further facilitate the migration of contact centers to the cloud. While some organizations had business continuity plans in place before the pandemic, most others have not considered a scenario where all employees are forced to work from home (WFH). bottom. Organizations that have already moved their contact center operations to the cloud have easily weathered business continuity during the pandemic.

Cloud Based Contract Center Market Segment Analysis

The Cloud Based Contract Center market is segmented based on Component, Deployment, Organization Size, Industry and Region, Global trends and forecast. By component, the Cloud Based Contract Center market is divided into solution, services. Based on deployment, the market is bifurcated into public, private, hybrid. Based on organization size, the market is fragmented into large, medium, small. Based on deployment, the market is bifurcated into public, private, hybrid. Based on industry, the market is fragmented into BFSI, telecommunications, retail, consumer goods. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Based on component, the market is segmented into solutions and services. While the solutions segment holds a large market share, the services segment is expected to grow significantly during the forecast period. The services segment is further divided into professional services and managed services, with professional services such as integration, deployment, and optimization expected to account for the largest share.

Based on the types of managed services

deployments that are expected to grow more rapidly, the market is segmented into public, private, and hybrid deployments. It is estimated that public deployments will make up a significant portion, followed by hybrid cloud deployments. Providers deploy cloud-based contact centers primarily in a public delivery model due to the low operating costs. We provide maintenance services as part of our services. This is another important factor in adopting public deployment.

The market is segmented into large enterprises and small and medium enterprises (SMEs) based on the size of the organization. Large companies are likely to capture the largest share of the market, as most of them are early adopters of Advent technology. Reduced capital expenditures and operating expenses, and a large customer base are also important factors supporting the growth of this segment. In addition, the increasing trend of remote work or remote workers is projected to boost adoption.

By industry, the market is segmented into BFSI, Telecom, Consumer Goods and Retail. The BFSI segment is likely to hold the largest market share. Increasingly, these agencies are moving to cloud communications platforms to automate, engage, and empower their customers.

The market for Cloud Based Contact Center is steadily expanding as observed by the growing relevance of Cloud Based Contact Center solutions in diverse spheres of business. One of the main uses is in the area of CRM where through cloud based contact centers, customer relations and data is improved making customer relations more efficient and better for business. Closely related to the concept of customer journey mapping is Customer Experience Management, which means that all the client’s interactions and all his experiences should be only positive. This has turned out as among the most crucial use as businesses continue to focus on customers’ satisfaction and loyalty. Real-time Monitoring is also another important area in the application of the technology it can help in monitoring and analyzing customer interaction in real-time so as to offer a quick solution to their needs.

Another application that has been long associated with IVR is customer self-service through the use of IVR Systems to attend to customers and reduce queue time and operational expenses. In the field of Logistics Management cloud based contact center help in overseeing the supply chain events and thereby helps in delivering supplies better and faster. Workforce Optimization is another important one, since the main goal of these platforms is to control the performance, schedules and general effectiveness of the agents which ensures high services quality.

Cloud Based Contract Center Market Key Players

The major key players of market include 3CLogic, 8×8 Inc., Avaya Inc., Cisco Systems Inc., Content Guru Limited, Five9 Inc., Genesys, NICE Ltd., RingCentral Inc., Talkdesk, Twilio Inc., Vocalcom and Vonage.

Recent News

- 12th January 2023: AWS announced the preview release of AWS Clean Rooms, a new analytics service that helps customers collaborate with their partners to more easily and securely analyze their collective datasets—without sharing or revealing underlying raw data. Instead of spending weeks or months developing clean room solutions, customers can use AWS Clean Rooms to create their own clean rooms in minutes

- 11th January 2023: AWS announced the retirement of IAM actions for AWS Billing, Cost Management, and Account consoles under aws portal service prefix is replacing them with fine-grained service specific actions. This launch gave AWS customers more control over access to Billing, Cost Management, and Account services. These new permissions will also provide a single set of IAM actions that govern console and programmatic access to these services

Who Should Buy? Or Key stakeholders

- Leading Companies

- Government Agencies

- Local Communities

- Industries

- Research Organizations

- Investors

- Others

Cloud Based Contract Center Market Regional Analysis

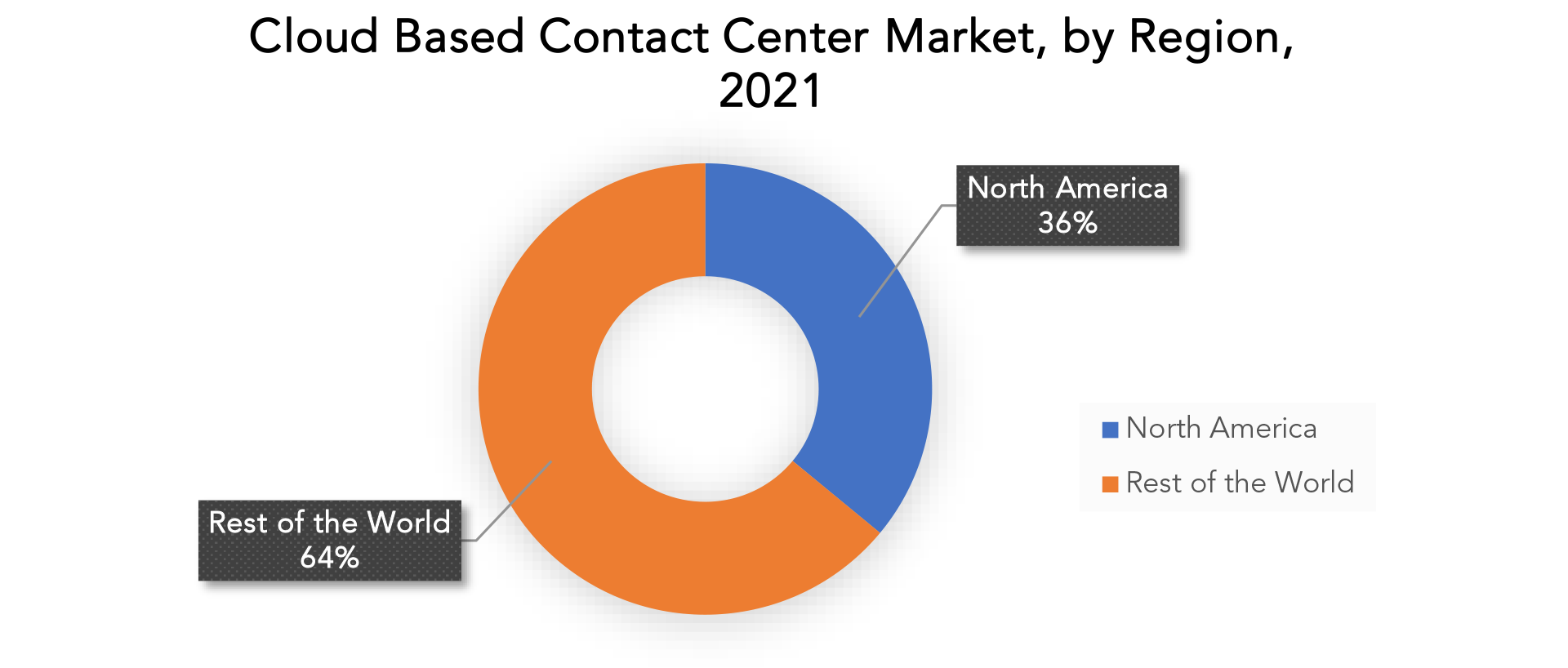

The Cloud Based Contract Center market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America dominated the global market in 2020 with a revenue of USD 13.85 billion. The dominant growth of this market has been attributed to the presence of innovative and influential vendors across the region such as Oracle Corporation, Microsoft Corporation and Cisco Systems. Increased investment by these major players in research and development activities is accelerating the growth of the global market. Organizations are increasingly moving their business operations to the cloud. This is another key factor underpinning its leadership in the North American market. Additionally, the increasing trend of remote work is further driving the adoption of cloud-based contact centers.

Key Market Segments: Cloud Based Contract Center market

Cloud Based Contract Center Market by Component, 2020-2029, (USD Billion)

- Solution

- Services

Cloud Based Contract Center Market by Application, 2020-2029, (USD Billion)

- Customer Relationship Management (CRM)

- Customer Experience Management

- Real-time Monitoring

- Interactive Voice Response (IVR) Systems

- Logistics Management

- Workforce Optimization

- Others

Cloud Based Contract Center Market by Deployment, 2020-2029, (USD Billion)

- Public

- Private

- Hybrid

Cloud Based Contract Center Market by Organization Size, 2020-2029, (USD Billion)

- Large

- Medium

- Small

Cloud Based Contract Center Market by Industry, 2020-2029, (USD Billion)

- Bfsi

- Telecommunications

- Retail

- Consumer Goods

Cloud Based Contract Center Market by Region, 2020-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the infectious disease diagnostics market over the next 7 years?

- Who are the major players in the infectious disease diagnostics market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the infectious disease diagnostics market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the infectious disease diagnostics market?

- What is the current and forecasted size and growth rate of the global Infectious disease diagnostics market?

- What are the key drivers of growth in the infectious disease diagnostics market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the infectious disease diagnostics market?

- What are the technological advancements and innovations in the infectious disease diagnostics market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the infectious disease diagnostics market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the infectious disease diagnostics market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of infectious disease diagnostics market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL CLOUD BASED CONTACT CENTER OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON CLOUD BASED CONTACT CENTER MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL CLOUD BASED CONTACT CENTER OUTLOOK

- GLOBAL CLOUD BASED CONTACT CENTER MARKET BY COMPONENT TYPE

- SOLUTION

- SERVICES

- GLOBAL CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT TYPE

- PUBLIC

- PRIVATE

- HYBRID

- GLOBAL CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE

- LARGE

- MEDIUM

- SMALL

- GLOBAL CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY

- BFSI

- TELECOMMUNICATIONS

- RETAIL

- CONSUMER GOODS

- GLOBAL CLOUD BASED CONTACT CENTER MARKET BY REGION

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3CLOGIC

- 8X8 INC

- AVAYA INC

- CISCO SYSTEMS INC

- CONTENT GURU LIMITED

- FIVE9 INC

- GENESYS

- NICE LTD

- RINGCENTRAL INC

- TALKDESK

- TWILIO INC *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 2 GLOBAL CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 3 GLOBAL CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 4 GLOBAL CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 5 GLOBAL CLOUD BASED CONTACT CENTER MARKET BY REGION (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 9 NORTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 11 US CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 12 US CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 13 US CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 14 US CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 15 CANADA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 16 CANADA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 17 CANADA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 18 CANADA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 19 MEXICO CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 20 MEXICO CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 21 MEXICO CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 22 MEXICO CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 23 SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 24 SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 25 SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 26 SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 27 SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 28 BRAZIL CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 29 BRAZIL CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 30 BRAZIL CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 31 BRAZIL CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 32 ARGENTINA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 33 ARGENTINA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 34 ARGENTINA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 35 ARGENTINA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 36 COLOMBIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 37 COLOMBIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 38 COLOMBIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 39 COLOMBIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 41 REST OF SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 42 REST OF SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 43 REST OF SOUTH AMERICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 44 ASIA-PACIFIC CLOUD BASED CONTACT CENTER MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 45 ASIA-PACIFIC CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 46 ASIA-PACIFIC CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 47 ASIA-PACIFIC CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 48 ASIA-PACIFIC CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 49 INDIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 50 INDIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 51 INDIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 52 INDIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 53 CHINA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 54 CHINA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 55 CHINA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 56 CHINA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 57 JAPAN CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 58 JAPAN CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 59 JAPAN CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 60 JAPAN CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 61 SOUTH KOREA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 62 SOUTH KOREA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 63 SOUTH KOREA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 64 SOUTH KOREA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 65 AUSTRALIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 66 AUSTRALIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 67 AUSTRALIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 68 AUSTRALIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 69 SOUTH-EAST ASIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 70 SOUTH-EAST ASIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 71 SOUTH-EAST ASIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 72 SOUTH-EAST ASIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 73 REST OF ASIA PACIFIC CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 74 REST OF ASIA PACIFIC CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 75 REST OF ASIA PACIFIC CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 76 REST OF ASIA PACIFIC CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 77 EUROPE CLOUD BASED CONTACT CENTER MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 78 GERMANY CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 79 GERMANY CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 80 GERMANY CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 81 GERMANY CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 82 UK CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 83 UK CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 84 UK CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 85 UK CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 86 FRANCE CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 87 FRANCE CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 88 FRANCE CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 89 FRANCE CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 90 ITALY CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 91 ITALY CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 92 ITALY CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 93 ITALY CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 94 SPAIN CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 95 SPAIN CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 96 SPAIN CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 97 SPAIN CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 98 RUSSIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 99 RUSSIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 100 RUSSIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 101 RUSSIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 102 REST OF EUROPE CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 103 REST OF EUROPE CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 104 REST OF EUROPE CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 105 REST OF EUROPE CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 106 MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 107 MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 108 MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 109 MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 111 UAE CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 112 UAE CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 113 UAE CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 114 UAE CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 115 SAUDI ARABIA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 116 SAUDI ARABIA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 117 SAUDI ARABIA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 118 SAUDI ARABIA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 119 SOUTH AFRICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 120 SOUTH AFRICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 121 SOUTH AFRICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 122 SOUTH AFRICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

TABLE 123 REST OF MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY COMPONENT (USD BILLION) 2020-2029

TABLE 124 REST OF MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY DEPLOYMENT (USD BILLION) 2020-2029

TABLE 125 REST OF MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY ORGANIZATION SIZE (USD BILLION) 2020-2029

TABLE 126 REST OF MIDDLE EAST AND AFRICA CLOUD BASED CONTACT CENTER MARKET BY INDUSTRY (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CLOUD BASED CONTACT CENTER BY FIBER TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CLOUD BASED CONTACT CENTER BY RESIN TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CLOUD BASED CONTACT CENTER BY DEPLOYMENT, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CLOUD BASED CONTACT CENTER BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL CLOUD BASED CONTACT CENTER BY FIBER TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL CLOUD BASED CONTACT CENTER BY RESIN TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL CLOUD BASED CONTACT CENTER BY DEPLOYMENT, USD BILLION, 2021

FIGURE 16 GLOBAL CLOUD BASED CONTACT CENTER BY REGION, USD BILLION, 2021

FIGURE 17 CLOUD BASED CONTACT CENTER BY REGION 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 3CLOGIC: COMPANY SNAPSHOT

FIGURE 20 8X8 INC: COMPANY SNAPSHOT

FIGURE 21 AVAYA INC: COMPANY SNAPSHOT

FIGURE 22 CISCO SYSTEMS INC: COMPANY SNAPSHOT

FIGURE 23 CONTENT GURU LIMITED: COMPANY SNAPSHOT

FIGURE 24 FIVE9 INC.: COMPANY SNAPSHOT

FIGURE 25 GENESYS: COMPANY SNAPSHOT

FIGURE 26 NICE LTD: COMPANY SNAPSHOT

FIGURE 27 RINGCENTRAL INC: COMPANY SNAPSHOT

FIGURE 28 TALKDESK: COMPANY SNAPSHOT

FIGURE 29 TWILIO INC: COMPANY SNAPSHOT

FAQ

The Cloud Based Contract Center market is expected to grow at 23.5% CAGR from 2022 to 2029. It is expected to reach above USD 92.57 billion by 2029 from USD 13.85 billion in 2020.

North America held more than 36% of the Cloud Based Contract Center market revenue share in 2021 and will witness expansion in the forecast period.

System reliability is one of the main reasons organizations move from existing on-premises contact center solutions to cloud-based solutions. Advanced cloud contact center architectures add a level of security standard that is a major requirement from enterprises. Flexibility, control over functionality, and improved performance are key factors in adopting cloud-based solutions. Cloud deployments allow organizations to host their contact centers in third-party data centers, eliminating the need for hardware infrastructure. This significantly reduces overall infrastructure costs. In addition, cloud-based contact centers enable HR teams to scale instantly to quickly respond to customer demand. As a result, more and more small businesses are moving from on-premises contact centers to cloud-based models.

North America, the largest market in 2021 accounted for more revenue generation of worldwide sales and is likely to dominate the market over the estimated period. The growth of the region is attributed to the increasing demand.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.