REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 7.48 billion by 2029 | 7.66% | Asia Pacific |

| By Source | By Livestock Type | By Form | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Probiotics In Animal Feed Market Overview

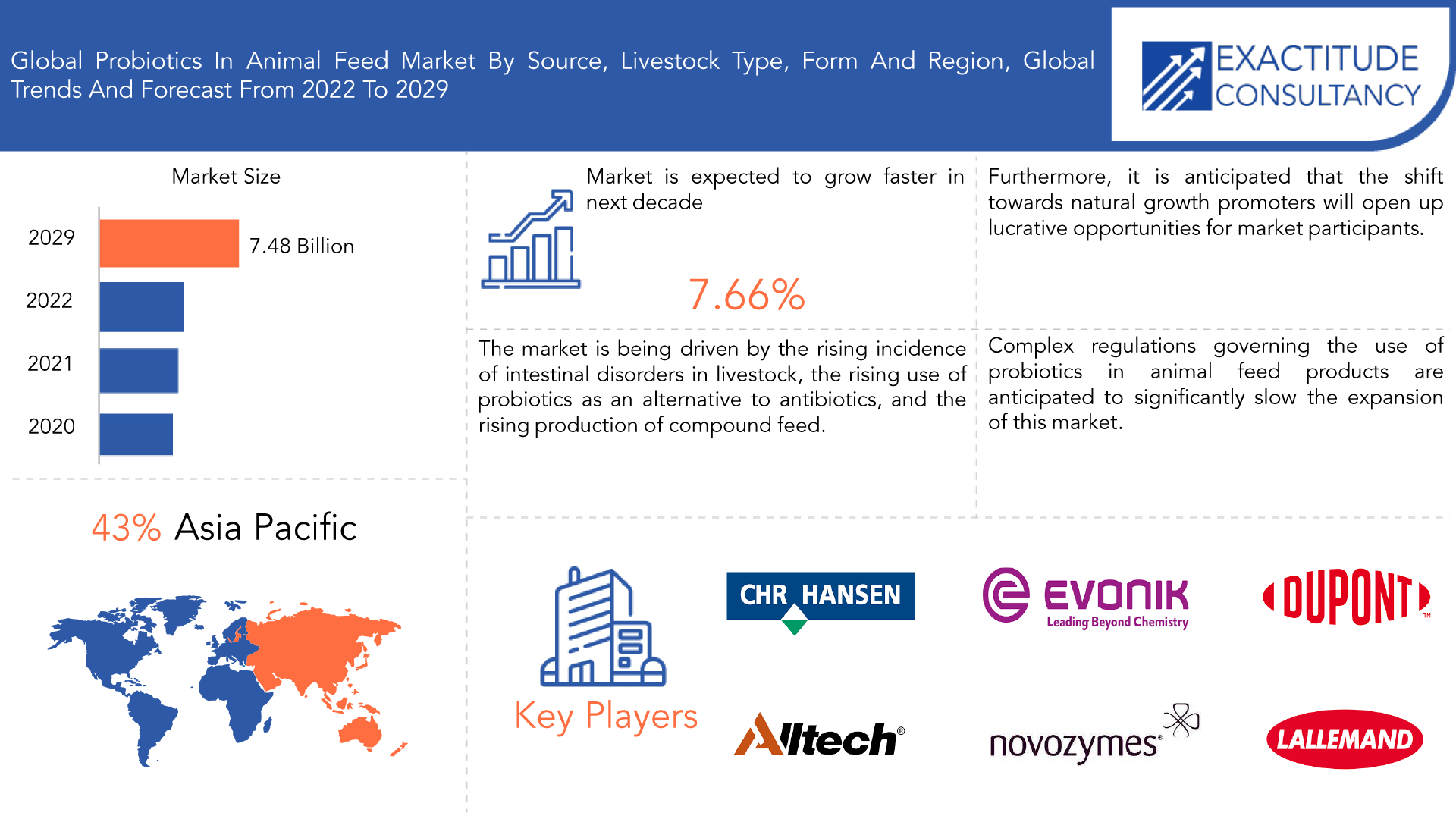

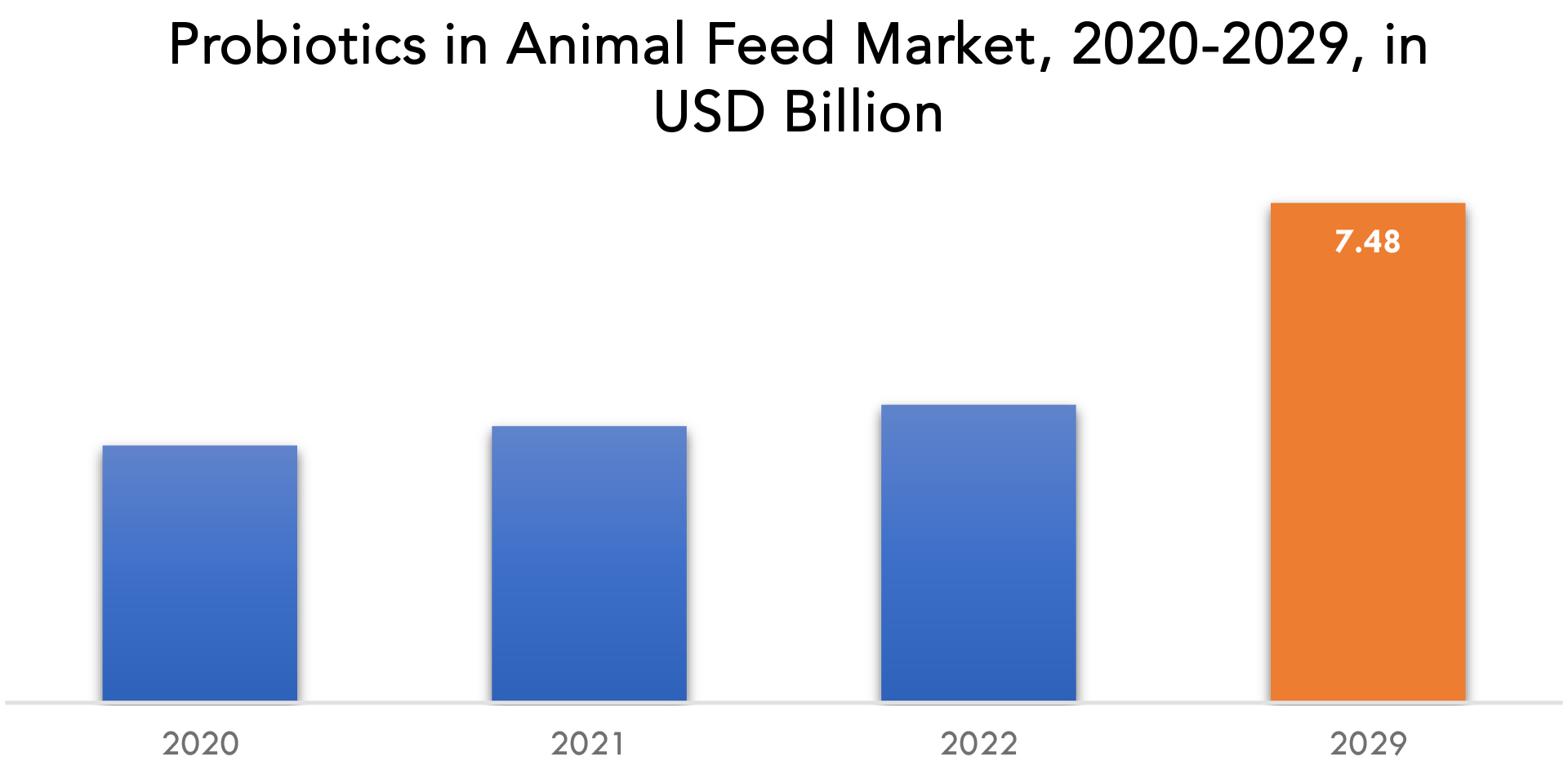

The global probiotics in c market size is expected to grow at more than 7.66% CAGR from 2021 to 2029. It is expected to reach above USD 7.48 billion by 2029 from a little above USD 3.85 billion in 2020.

Probiotics are beneficial microorganisms (bacteria, yeast, and fungus) that offer users several health advantages. The immune system is strengthened against many diseases and the vital immune systems work better thanks to probiotics. Biological digestive processes are accelerated by probiotics, which also support the digestive system and enhance intestinal health. As of this, probiotics are frequently used as crucial components in animal feed items. In many probiotics found in livestock feed, such as Lactobacillus and Bifidobacterium, bacterial genera are a common ingredient. Antibiotics can develop more effectively and efficiently when they are produced by bacteria, according to research.

While Saccharomyces cerevisiae supports sufficient protein synthesis in animals and exhibits immune function in farm animals without enhancing digestive physiology, the use of yeast and other fungi has gained popularity. Probiotics businesses have a wonderful opportunity thanks to the increasing awareness of the advantages of probiotics in animal health among pet owners, cattle ranchers, and hobbyists. Cats and dogs frequently consume foods high in carbohydrates. On the demand side, developments in transportation, such as long-term cold free shipping and greater consumption of livestock products, have made it easier to move goods and food. By 2050, the Food and Agriculture Organization (FAO) projects that demand for food supplies will rise by 60% while demand for animal proteins will rise by 1.7% yearly. The World Health Organization reports that there is more pressure on the livestock industry to satisfy the rising demand for animal protein. Urbanization, income development, and population growth are the main causes of the livestock industry’s unprecedented expansion. Food items like milk, eggs, and poultry are now consumed at higher rates. Access to cold chain technology, which enables the selling of perishable products, has improved due to the increase in urban migration.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Source, By Livestock Type, By Form, By Region |

| By Source

|

|

| By Livestock Type

|

|

| By Form

|

|

| By Region

|

|

One of the few factors driving the demand for livestock products is the growing consumer knowledge of the health advantages of using animal protein, including enhanced immunity, decreased protein deficiency, and improved bone health. Significant drivers of market expansion include rising levels of per capita revenue and improvements in animal health. The development of animal husbandry initiatives, the prevention of the use or use of antibiotics, the expansion of large corporations’ research and development programs, particularly in developing nations, changes in lifestyle, western trade, the use of or avoidance of antibiotics, and the ever-increasing global population all act as growth-promoting factors. To increase development towards natural animal health promoters, expand the distribution network, raise customer knowledge of the advantages of using meat and dairy products, and increase demand for animal-based products in emerging economies will all increase market value.

A significant obstacle to market expansion will be the stringent regulations governing the use of probiotics in animal feed products in order to meet international quality standards. Additionally, limiting the market’s expansion will be fluctuations in raw material prices and supply disruptions brought on by the pandemic. The high costs involved with R&D efforts will limit the market’s ability to expand.

Due to the difficulties brought on by the COVID-19 pandemic, the export of beef, chicken, and pork all experienced a substantial drop globally. In addition, the American government implemented curfews, which led many farms to panic-buy animal feed in an effort to avoid possible shortages. Additionally, the transportation and logistics industry suffered significantly as a result of staff members contracting COVID-19, which slowed deliveries and forced farms to stockpile animal feed. As governments put stringent controls in place to stop the spread of COVID-19, other problems like reduced air freight capacity, port congestion, roadblocks, and logistical problems in Southeast Asia grew worse. In Southeast Asian economies during the second quarter of 2020, there was a drop in the consumption of seafood, poultry, pork, and beef. As a result, there was a decrease in demand for livestock feed probiotics due to decreased consumption of seafood, poultry, pork, and beef. The market for animal feed probiotics was thus adversely impacted in terms of volume sales in 2020 and 2021 by the negative effects on the transportation and logistics sector and the decreased output as a result of lockdowns around the world.

Probiotics In Animal Feed Market Segment Analysis

Based on source, market is segmented into bacteria and yeast. Over the forecast period, it is anticipated that the yeast sector will expand at a faster CAGR. The strict laws governing the use of antibiotics in livestock feed in a number of European and North American nations are to blame for this market’s expansion. The addition of yeast strain probiotics to animal feed also enhances the performance of the animals and the digestion of the fiber, which leads to a rise in milk and egg output.

Based on livestock type, market is segmented into poultry, swine, ruminants, aquaculture, pets. It is predicted that the market for livestock feed probiotics will be dominated by the poultry industry. This segment’s significant market share can be ascribed to rising poultry meat intake as well as rising demand for poultry products free of antibiotics. In addition, the high demand for and output of poultry meat in developing nations raises the need for probiotics to increase yield and safety, which increases the demand for probiotics in the poultry industry.

Based on the form, market is segmented into dry and liquid. During the forecast period, it is anticipated that the dry sector will expand at a faster CAGR. As it is simpler to store and transport, has lower storage costs, and has a longer shelf life, the dry form of probiotics is typically favored in animal feed applications. Dry probiotics are therefore in high demand due to the advantages they provide.

Probiotics In Animal Feed Market Players

Key competitors from both domestic and international markets compete fiercely in the worldwide global probiotics in animal feed industry are Chr. Hansen, Koninklijke DSM, Lallemand, Dupont, Novozymes, Calpis, Schouw, Alltech, Mitsui & Co. Ltd., Evonik Industries AG.

Recent News:

30th August 2021: Chr. Hansen introduced a new portfolio of stable live probiotics for use in pet foods and supplements, empowering every pet’s life stage with good bacteria.

28th February 2023: Alltech, a global leader in agriculture and animal nutrition, and Finnish aquaculture innovator Finnforel joined forces to acquire the Raisioaqua fish feed production facility from Raisio, a Finnish company.

Who Should Buy? Or Key Stakeholders

- Global Probiotics in Animal Feed Suppliers

- Investors

- Regulatory Authorities

- Probiotics In Animal Feed Vendors

- Consultants

- Research and Development Organizations

- Others

Probiotics In Animal Feed Market Regional Analysis

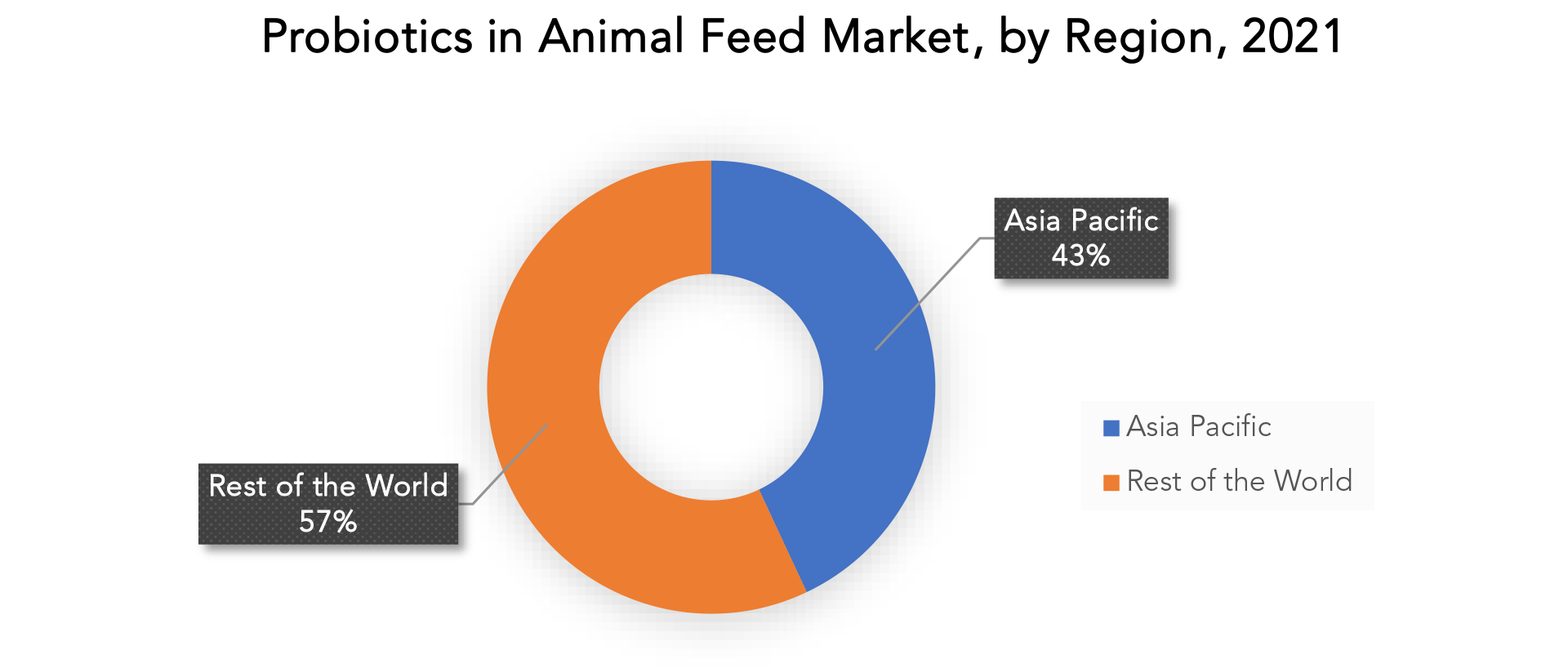

The global probiotics in animal feed market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

Due to the high prevalence of various diseases and the rising consumer knowledge of the need for supplemental consumption, developing nations, especially those in the Asia Pacific region, present opportunities for the market for probiotics in animal feed to experience rapid development. It is anticipated that related businesses will participate in forward or backward integration to take advantage of market opportunities. According to projections, China and India will produce the most beef and chicken meat products, which is fueling demand for probiotics in animal feed in this area.

Key Market Segments: Probiotics In Animal Feed Market

Global Probiotics In Animal Feed Market By Source, 2020-2029, (Usd Billion), (Kilotons)

- Bacteria

- Yeast

Global Probiotics In Animal Feed Market By Livestock Type, 2020-2029, (Usd Billion), (Kilotons)

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

Global Probiotics In Animal Feed Market By Form, 2020-2029, (Usd Billion), (Kilotons)

- Dry

- Liquid

Global Probiotics In Animal Feed Market By Region, 2020-2029, (Usd Billion), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the probiotics in animal feed market over the next 7 years?

- Who are the major players in the probiotics in animal feed market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the probiotics in animal feed market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the probiotics in animal feed market?

- What is the current and forecasted size and growth rate of the global probiotics in animal feed market?

- What are the key drivers of growth in the probiotics in animal feed market?

- What are the distribution channels and supply chain dynamics in the probiotics in animal feed market?

- What are the technological advancements and innovations in the probiotics in animal feed market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the probiotics in animal feed market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the probiotics in animal feed market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of probiotics in animal feed’s in the market and what is the impact of raw material prices on the price trend?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Probiotics In Animal Feed Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Probiotics In Animal Feed Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Probiotics In Animal Feed Market Outlook

- Global Probiotics In Animal Feed Market by Source, 2020-2029, (USD BILLION), (KILOTONS)

- Bacteria

- Yeast

- Global Probiotics In Animal Feed Market by Livestock Type, 2020-2029, (USD BILLION), (KILOTONS)

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

- Global Probiotics In Animal Feed Market by Form, 2020-2029, (USD BILLION), (KILOTONS)

- Dry

- Liquid

- Global Probiotics in Animal Feed Market by Region, 2020-2029, (USD BILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Hansen

- Koninklijke DSM

- Lallemand

- Dupont

- Novozymes

- Calpis

- Schouw

- Alltech

- Mitsui & Co. Ltd.

- Evonik Industries AG

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 2 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 3 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 4 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 5 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 6 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 7 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 17 US PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 18 US PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 19 US PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 20 US PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 21 US PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 22 US PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 23 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 24 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 25 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 26 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 27 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 28 CANADA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 29 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 30 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 31 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 32 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 33 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 34 MEXICO PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 43 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 44 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 45 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 46 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 47 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 48 BRAZIL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 49 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 52 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 53 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 54 ARGENTINA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 55 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 58 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 59 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 60 COLOMBIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 75 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 76 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 77 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 78 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 79 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 80 INDIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 81 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 82 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 83 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 84 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 85 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 86 CHINA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 87 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 88 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 89 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 90 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 91 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 92 JAPAN PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 117 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 120 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 121 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 122 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 123 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 124 EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 125 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 126 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 127 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 128 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 129 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 130 GERMANY PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 131 UK PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 132 UK PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 133 UK PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 134 UK PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 135 UK PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 136 UK PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 137 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 138 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 139 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 140 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 141 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 142 FRANCE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 143 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 144 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 145 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 146 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 147 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 148 ITALY PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 149 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 150 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 151 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 152 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 153 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 154 SPAIN PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 155 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 156 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 157 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 158 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 159 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 160 RUSSIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 175 UAE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 176 UAE PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 177 UAE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 178 UAE PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 179 UAE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 180 UAE PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY FORM (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY FORM, USD BILLION, 2020-2029

FIGURE 11 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY SOURCE, USD BILLION, 2021

FIGURE 14 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY LIVESTOCK TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY FORM, USD BILLION, 2021

FIGURE 16 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET BY REGION, USD BILLION, 2021

FIGURE 17 NORTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT

FIGURE 18 EUROPE PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT

FIGURE 19 SOUTH AMERICA PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT

FIGURE 21 MIDDLE EAST ASIA AND AFRICA PROBIOTICS IN ANIMAL FEED MARKET SNAPSHOT

FIGURE 22 MARKET SHARE ANALYSIS

FIGURE 23 CHR. HANSEN: COMPANY SNAPSHOT

FIGURE 24 KONINKLIJKE DSM: COMPANY SNAPSHOT

FIGURE 25 LALLEMAND: COMPANY SNAPSHOT

FIGURE 26 DUPONT: COMPANY SNAPSHOT

FIGURE 27 NOVOZYMES: COMPANY SNAPSHOT

FIGURE 28 CALPIS: COMPANY SNAPSHOT

FIGURE 29 SCHOUW: COMPANY SNAPSHOT

FIGURE 30 ALLTECH: COMPANY SNAPSHOT

FIGURE 31 MITSUI & CO. LTD.: COMPANY SNAPSHOT

FIGURE 32 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FAQ

Some key players operating in the global probiotics in animal feed market include Chr. Hansen, Koninklijke DSM, Lallemand, Dupont, Novozymes, Calpis, Schouw, Alltech, Mitsui & Co. Ltd., Evonik Industries AG.

The market is being driven by the rising incidence of intestinal disorders in livestock, the rising use of probiotics as an alternative to antibiotics, and the rising production of compound feed.

The global probiotics in animal feed market size was estimated at USD 4.14 billion in 2021 and is expected to reach USD 7.48 billion in 2029.

The global probiotics in animal feed market is expected to grow at a compound annual growth rate of 7.66% from 2022 to 2029 to reach USD 7.48 billion by 2029.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.