Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 10.04 Billion | 11.3% | North America |

| By Offering | By End Use | By Technology |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

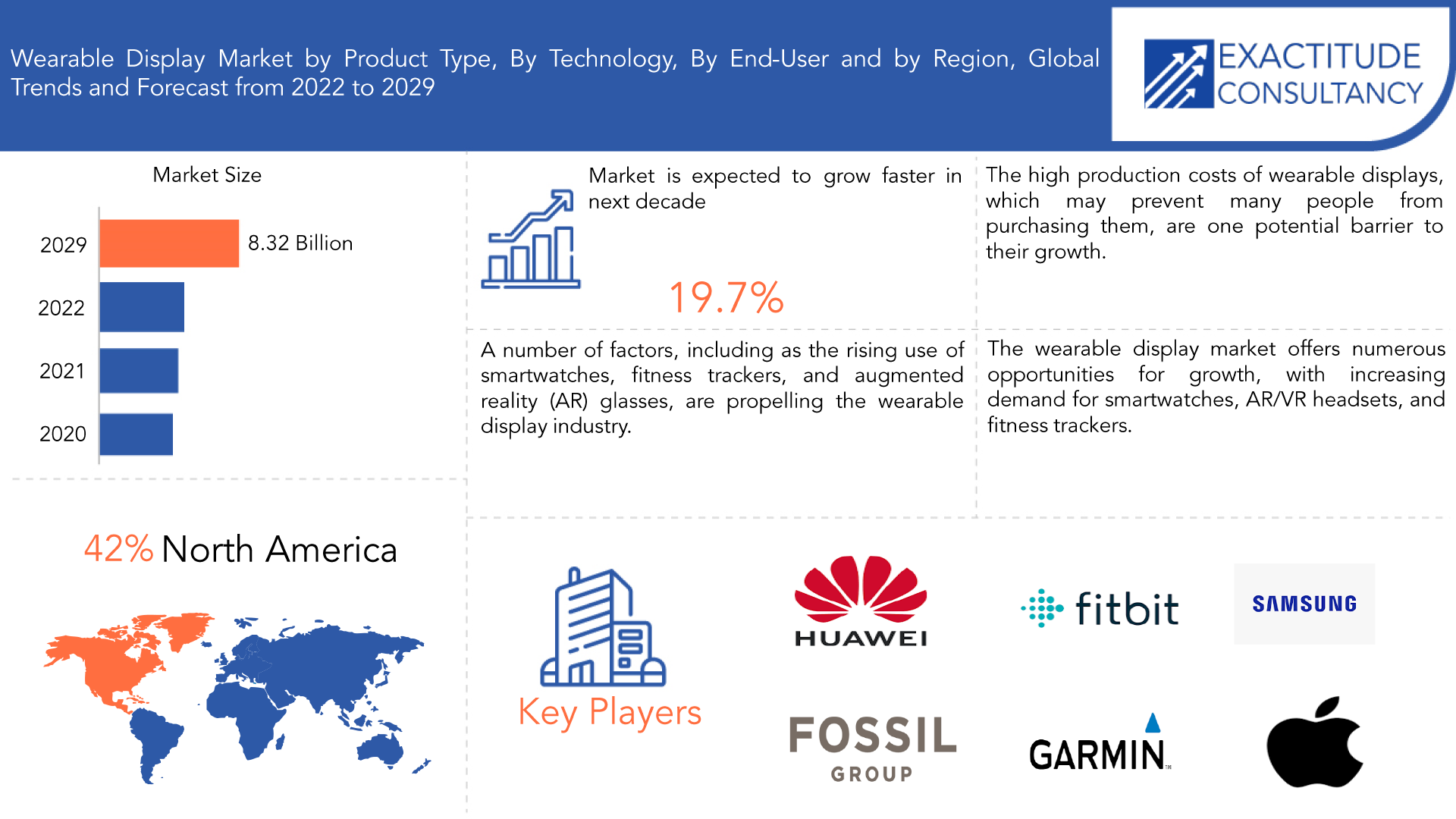

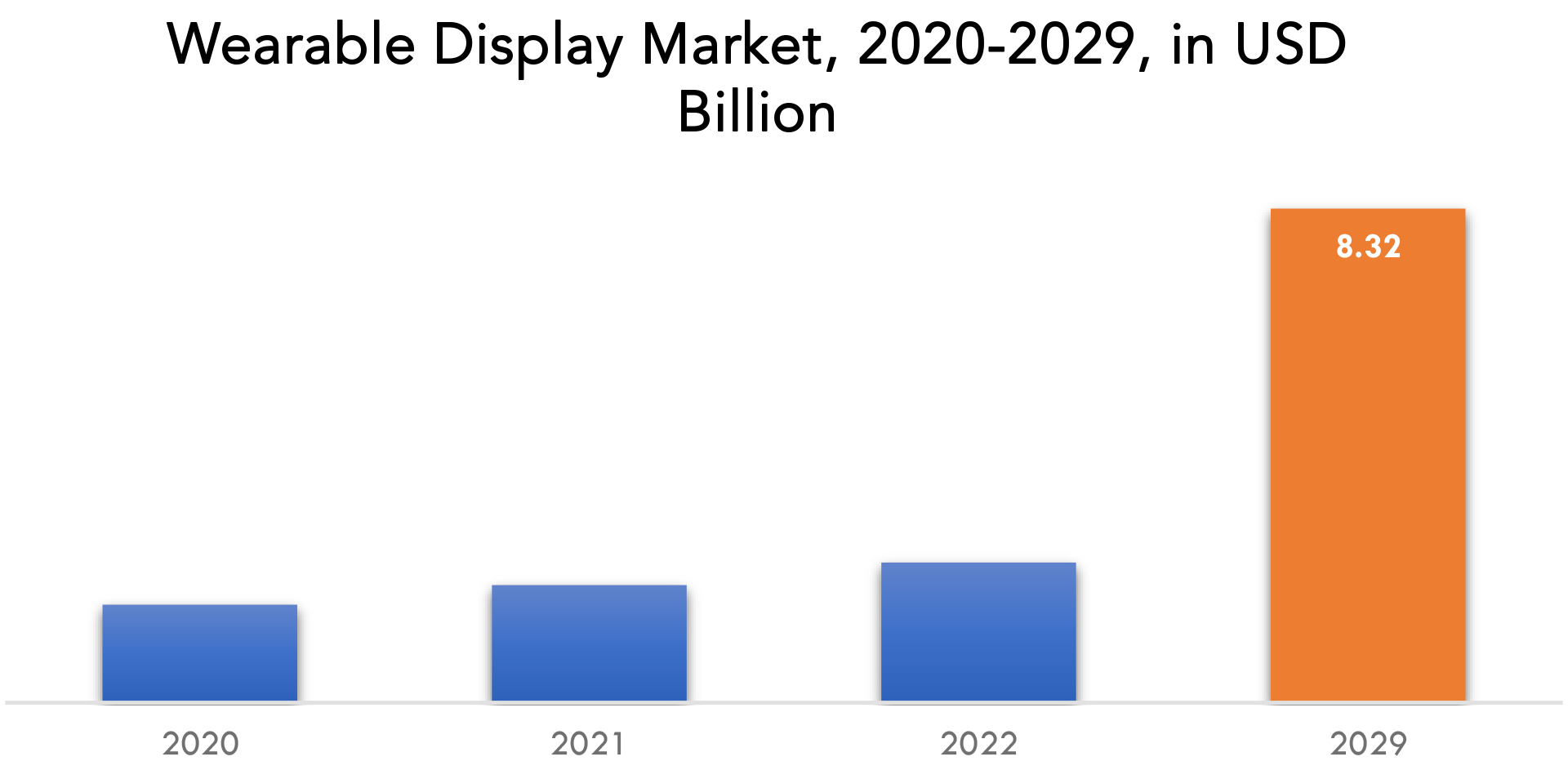

Wireless Display Market Overview

The global wireless display market size was valued at USD 3.83 billion in 2020, and projected to reach USD 10.04 billion by 2029, with a CAGR of 11.3% from 2022 to 2029.

Wireless Display Technology is a wireless display sharing technology that offers wireless display capabilities to smart device and business users in a wireless setting. The chip known as a wireless display adaptor for smart devices has wireless display technology built in. The users of this display adapter may mirror the screen and see whatever is on the laptop or phone screen. Screens for tablets and smartphones employ wireless display technology. On the user’s television, which can handle a maximum resolution of 1080p, it was wirelessly shown.

The wireless display standard allows Wi-Fi networking technology from a user’s smartphone or portable tablet device to be wirelessly shown on the TV in a living room without the use of any cords. Users may browse or surf the internet, view HD films, and watch slideshows wirelessly on the TV from their smartphone device by using wireless display technology. This eliminates the requirement for wired communication. By employing wired HDMI or audio video cable communication, the user needed wire to show on a TV.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Offering, By End Use, By Technology, By Region. |

| By Offering |

|

| By End Use |

|

| By Technology |

|

| By Region |

|

When sharing or displaying material, wireless display systems give users more freedom and convenience by doing away with the need for cords. The expanding trend of remote and hybrid work, the necessity for digital collaboration tools in the education and business sectors, and the rising demand for smart homes and smart gadgets are the market’s main drivers. With the implementation of 5G technology, the creation of fresh and cutting-edge wireless display technologies, and the rising demand for wireless display solutions across several industries, the market is anticipated to expand in the next years. The market does, however, confront difficulties including compatibility problems, latency problems, security issues, and a constrained range.

It is anticipated that technological development and rising acceptance in a range of applications, including tablets, smartphones, laptops, and smart TVs, will propel market revenue growth. The wireless display market is being driven by the rising availability of over-the-top (OTT) based content for consumer applications. Cost savings, which may be attained through easy setup and a reduction in the amount of time spent setting up meeting rooms, is another important factor boosting the market for corporate applications of wireless displays.

The expansion of the worldwide wireless display market is significantly constrained by the availability of less expensive substitutes and high production costs. One of the key reasons impeding the growth of the global wireless display market is the low cost of wired connection technologies like USB and HDMI. Rising manufacturing costs and a lack of technological protocol compatibility are other factors that are anticipated to limit market expansion over the projected period.

Several governments are formulating plans and taking action in emerging countries to boost the uptake of digital multimedia devices. In the next years, it is anticipated that businesses in the banking, retail, government, and DOOH sectors would use digital signage more often.

The wireless display industry confronts a number of difficulties, such as restricted range, latency problems, security issues, and device compatibility problems. Different wireless protocols used by various devices might cause compatibility problems, communication problems, and the need for extra gear or adapters. The user experience can be impacted by latency problems, which might delay the streaming of material. Sensitive data sent wirelessly raises security issues since it can be intercepted and hacked. Wireless display solution vendors must keep creating cutting-edge technologies with seamless connectivity, minimal latency, strong security, and a long range in order to meet these difficulties.

Wireless Display Market Segment Analysis

The market has been divided into hardware and software and services as a result of offerings. Companies are concentrating on improving display device features since hardware is the main element of a wireless display setup. Over 57.0% of the market’s entire revenue in 2021 came from the hardware sector. The affordability of a variety of devices, including adapters, dongles, and other streaming devices, has helped the market expand.

The worldwide wireless display market is divided into residential and commercial segments based on the kind of application. Due to rising demand for wireless displays for broadcasting and advertising in industries including the public sector, healthcare, and educational institutions, the commercial segment had the greatest revenue share in 2021. Businesses looking to boost consumer interaction have found wireless digital signage to be more successful.

Over the projected period, the Google Cast sector is anticipated to have the greatest CAGR, at around 12.0%. Customers choose inexpensive, readily accessible gadgets since they may be used for a variety of purposes, including gaming, business, and personal. Better interoperability between low-cost consumer electronics and different resolution systems, such as low, HD, and Ultra-HD systems, is made possible by Google Cast. In the upcoming years, these advantages should help the industry flourish.

Wireless Display Market Players

The global market is fragmented in nature with the presence of various key players such as Sony Corporation, LG Electronics, Samsung Electronics Co., Ltd., NVIDIA Corporation, Rockchip Electronics Co., Ltd., Marvell Technology Inc., Panasonic Holding Corporation, Squirrels LLC, Microsoft Corporation, Netgear Inc., Cavium Inc., Belkin International Inc. along with medium and small-scale regional players operating in different parts of the world. Major companies in the market compete in terms of application development capability, product launches, and development of new technologies for product formulation.

Industrial Development:

April 18, 2023 – The inauguration of Dubai’s newest ultra-luxury experience resort, Atlantis the Royal, was scheduled for 2023. By offering guests experiences that are unparalleled and enhanced by cutting-edge display technology from Samsung Electronics, Atlantis the Royal upped the bar for all other resorts.

January 4, 2023 – The world’s first consumer TV using Zero Connect1 technology, a wireless system capable of real-time video and audio transmission at up to 4K 120Hz, was unveiled by LG Electronics as a 97-inch LG SIGNATURE OLED M (model M3).

Who Should Buy? Or Key stakeholders

- Retailers

- E-commerce platforms

- Wireless display product developers

- Original device manufacturers (ODM)

- End-users

- Research institutes

- Government bodies

- Market researchers

- Enterprise data center professionals

Wireless Display Market Regional Analysis

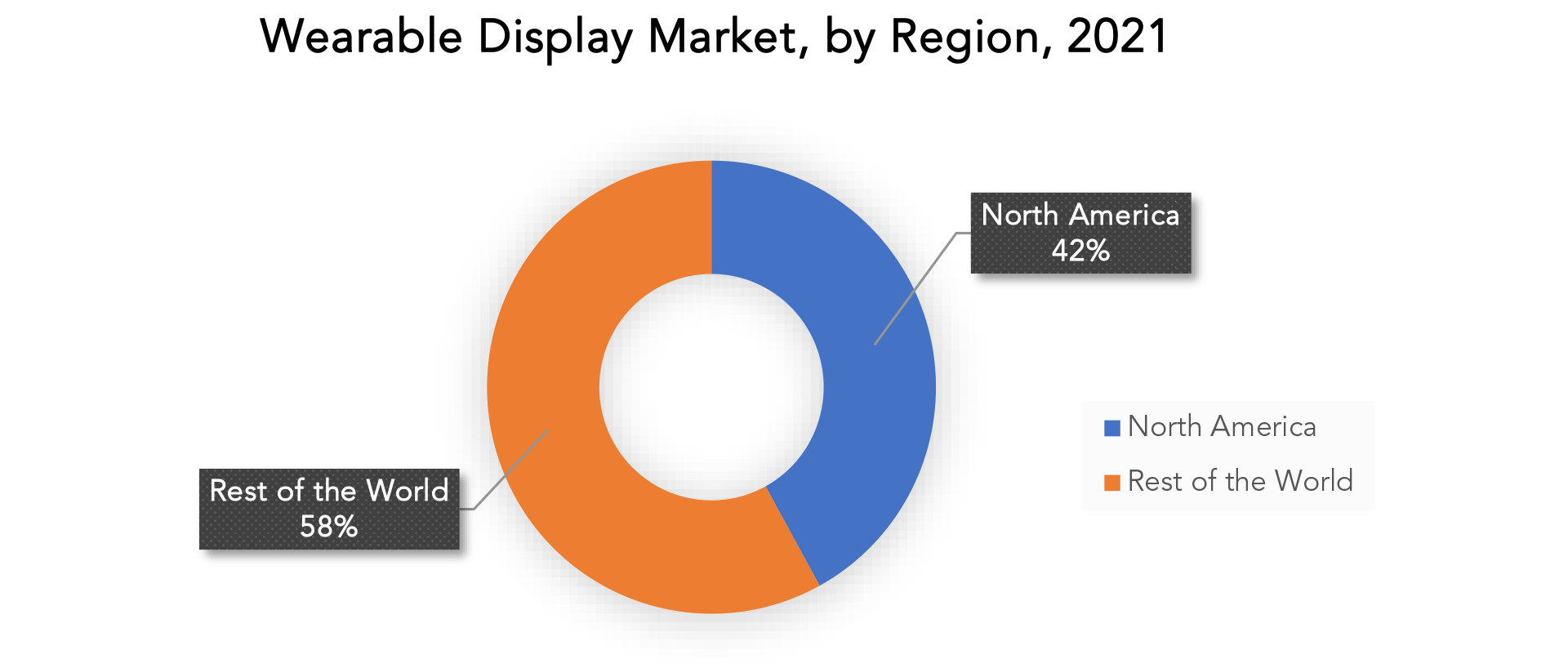

Geographically, the wireless display market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

In 2021, North America’s wireless display market held the greatest revenue share of 40%, primarily as a result of the adoption of cutting-edge production techniques and technical breakthroughs in the wireless display industry. Additionally, the region’s tech-savvy population is driving uptake of smartphones, smart TVs, tablets, and PCs as well as driving up demand for visual advertising and promotional tactics in retail settings, which is fueling market expansion in this area.

Due to the low total cost of building and installing wireless display systems in the area, Asia Pacific accounted for the second-largest revenue share in 2021. Chinese businesses have also boosted their spending in the creation of wireless display technologies.

Key Market Segments: Wireless Display Market

Wireless Display Market by Offering, 2020-2029, (USD Billion)

- Hardware

- Software

- Services

Wireless Display Market by End Use, 2020-2029, (USD Billion)

- Residential

- Commercial

Wireless Display Market by Technology, 2020-2029, (USD Billion)

- Airplay

- Miracast

- Google Cast

- Others

Wireless Display Market by Region, 2020-2029, (USD Billion)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the wireless display market over the next 7 years?

- Who are the major players in the wireless display market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the wireless display market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on wireless display market?

- What is the current and forecasted size and growth rate of the global wireless display market?

- What are the key drivers of growth in the wireless display market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the wireless display market?

- What are the technological advancements and innovations in the wireless display market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the wireless display market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the wireless display market?

- What are the service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- WIRELESS DISPLAY MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON WIRELESS DISPLAY MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- WIRELESS DISPLAY MARKET OUTLOOK

- GLOBAL WIRELESS DISPLAY MARKET BY OFFERING, 2020-2029, (USD BILLION)

- HARDWARE

- SOFTWARE

- SERVICES

- GLOBAL WIRELESS DISPLAY MARKET BY END USE, 2020-2029, (USD BILLION)

- RESIDENTIAL

- COMMERCIAL

- GLOBAL WIRELESS DISPLAY MARKET BY TECHNOLOGY, 2020-2029, (USD BILLION)

- AIRPLAY

- MIRACAST

- GOOGLE CAST

- OTHERS

- GLOBAL WIRELESS DISPLAY MARKET BY REGION, 2020-2029, (USD BILLION)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

9.1 SONY CORPORATION

9.2 LG ELECTRONICS

9.3 SAMSUNG ELECTRONICS CO., LTD.

9.4 NVIDIA CORPORATION

9.5 ROCKCHIP ELECTRONICS CO., LTD.

9.6 MARVELL TECHNOLOGY, INC.

9.7 PANASONIC HOLDING CORPORATION

9.8 SQUIRRELS LLC

9.9 MICROSOFT CORPORATION

9.10 NETGEAR INC.

9.11 CAVIUM INC.

9.12 BELKIN INTERNATIONAL INC. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 2 GLOBAL WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 3 GLOBAL WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 4 GLOBAL WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 5 NORTH AMERICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 6 NORTH AMERICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 7 NORTH AMERICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 8 NORTH AMERICA WIRELESS DISPLAY MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 9 US WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 10 US WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 11 US WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 12 US WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 13 CANADA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 14 CANADA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 15 CANADA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 16 CANADA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 17 MEXICO WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 18 MEXICO WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 19 MEXICO WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 20 MEXICO WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 21 SOUTH AMERICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 22 SOUTH AMERICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 23 SOUTH AMERICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 24 SOUTH AMERICA WIRELESS DISPLAY MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 25 BRAZIL WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 26 BRAZIL WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 27 BRAZIL WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 28 BRAZIL WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 29 ARGENTINA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 30 ARGENTINA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 31 ARGENTINA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 32 ARGENTINA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 33 COLOMBIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 34 COLOMBIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 35 COLOMBIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 36 COLOMBIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 37 REST OF SOUTH AMERICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 38 REST OF SOUTH AMERICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 39 REST OF SOUTH AMERICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 40 REST OF SOUTH AMERICA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 41 ASIA-PACIFIC WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 42 ASIA-PACIFIC WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 43 ASIA-PACIFIC WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 44 ASIA-PACIFIC WIRELESS DISPLAY MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 45 INDIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 46 INDIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 47 INDIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 48 INDIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 49 CHINA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 50 CHINA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 51 CHINA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 52 CHINA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 53 JAPAN WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 54 JAPAN WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 55 JAPAN WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 56 JAPAN WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 57 SOUTH KOREA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 58 SOUTH KOREA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 59 SOUTH KOREA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 60 SOUTH KOREA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 61 AUSTRALIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 62 AUSTRALIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 63 AUSTRALIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 64 AUSTRALIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 65 SOUTH-EAST ASIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 66 SOUTH-EAST ASIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 67 SOUTH-EAST ASIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 68 SOUTH-EAST ASIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 69 REST OF ASIA PACIFIC WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 70 REST OF ASIA PACIFIC WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 71 REST OF ASIA PACIFIC WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 72 REST OF ASIA PACIFIC WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 73 EUROPE WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 74 EUROPE WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 75 EUROPE WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 76 EUROPE WIRELESS DISPLAY MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 77 GERMANY WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 78 GERMANY WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 79 GERMANY WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 80 GERMANY WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 81 UK WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 82 UK WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 83 UK WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 84 UK WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 85 FRANCE WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 86 FRANCE WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 87 FRANCE WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 88 FRANCE WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 89 ITALY WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 90 ITALY WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 91 ITALY WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 92 ITALY WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 93 SPAIN WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 94 SPAIN WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 95 SPAIN WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 96 SPAIN WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 97 RUSSIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 98 RUSSIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 99 RUSSIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 100 RUSSIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 101 REST OF EUROPE WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 102 REST OF EUROPE WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 103 REST OF EUROPE WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 104 REST OF EUROPE WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 105 MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 106 MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 107 MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 108 MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 109 UAE WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 110 UAE WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 111 UAE WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 112 UAE WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 113 SAUDI ARABIA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 114 SAUDI ARABIA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 115 SAUDI ARABIA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 116 SAUDI ARABIA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 117 SOUTH AFRICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 118 SOUTH AFRICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 119 SOUTH AFRICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 120 SOUTH AFRICA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

TABLE 121 REST OF MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

TABLE 122 REST OF MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

TABLE 123 REST OF MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

TABLE 124 REST OF MIDDLE EAST AND AFRICA WIRELESS DISPLAY MARKET BY REGIONS (USD BILLION) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2020-2029

FIGURE 9 GLOBAL WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2020-2029

FIGURE 10 GLOBAL WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2020-2029

FIGURE 12 GLOBAL WIRELESS DISPLAY MARKET BY REGION (USD BILLION) 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL WIRELESS DISPLAY MARKET BY OFFERING (USD BILLION) 2021

FIGURE 15 GLOBAL WIRELESS DISPLAY MARKET BY END USE (USD BILLION) 2021

FIGURE 16 GLOBAL WIRELESS DISPLAY MARKET BY TECHNOLOGY (USD BILLION) 2021

FIGURE 18 GLOBAL WIRELESS DISPLAY MARKET BY REGION (USD BILLION) 2021

FIGURE 19 NORTH AMERICA WIRELESS DISPLAY MARKET SNAPSHOT

FIGURE 20 EUROPE WIRELESS DISPLAY MARKET SNAPSHOT

FIGURE 21 SOUTH AMERICA WIRELESS DISPLAY MARKET SNAPSHOT

FIGURE 22 ASIA PACIFIC WIRELESS DISPLAY MARKET SNAPSHOT

FIGURE 23 MIDDLE EAST ASIA AND AFRICA WIRELESS DISPLAY MARKET SNAPSHOT

FIGURE 24 MARKET SHARE ANALYSIS

FIGURE 25 SONY CORPORATION: COMPANY SNAPSHOT

FIGURE 26 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 27 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 28 NVIDIA CORPORATION: COMPANY SNAPSHOT

FIGURE 29 ROCKCHIP ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

FIGURE 30 MARVELL TECHNOLOGY, INC.: COMPANY SNAPSHOT

FIGURE 31 PANASONIC HOLDING CORPORATION: COMPANY SNAPSHOT

FIGURE 32 SQUIRRELS LLC: COMPANY SNAPSHOT

FIGURE 33 MICROSOFT CORPORATION: COMPANY SNAPSHOT

FIGURE 34 NETGEAR INC.: COMPANY SNAPSHOT

FIGURE 35 CAVIUM INC.: COMPANY SNAPSHOT

FIGURE 36 BELKIN INTERNATIONAL INC.: COMPANY SNAPSHOT

FAQ

The wireless display market is expected to reach USD 5.28 billion by the end of 2023.

The adoption of 5G technology is the ongoing trend observed.

The global wireless display market size was valued at USD 3.83 billion in 2020, and projected to reach USD 10.04 billion by 2029, with a CAGR of 11.3% from 2022 to 2029.

The North America dominated the global industry in 2021 and accounted for the maximum share of more than 40% of the overall revenue.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.