REPORT OUTLOOK

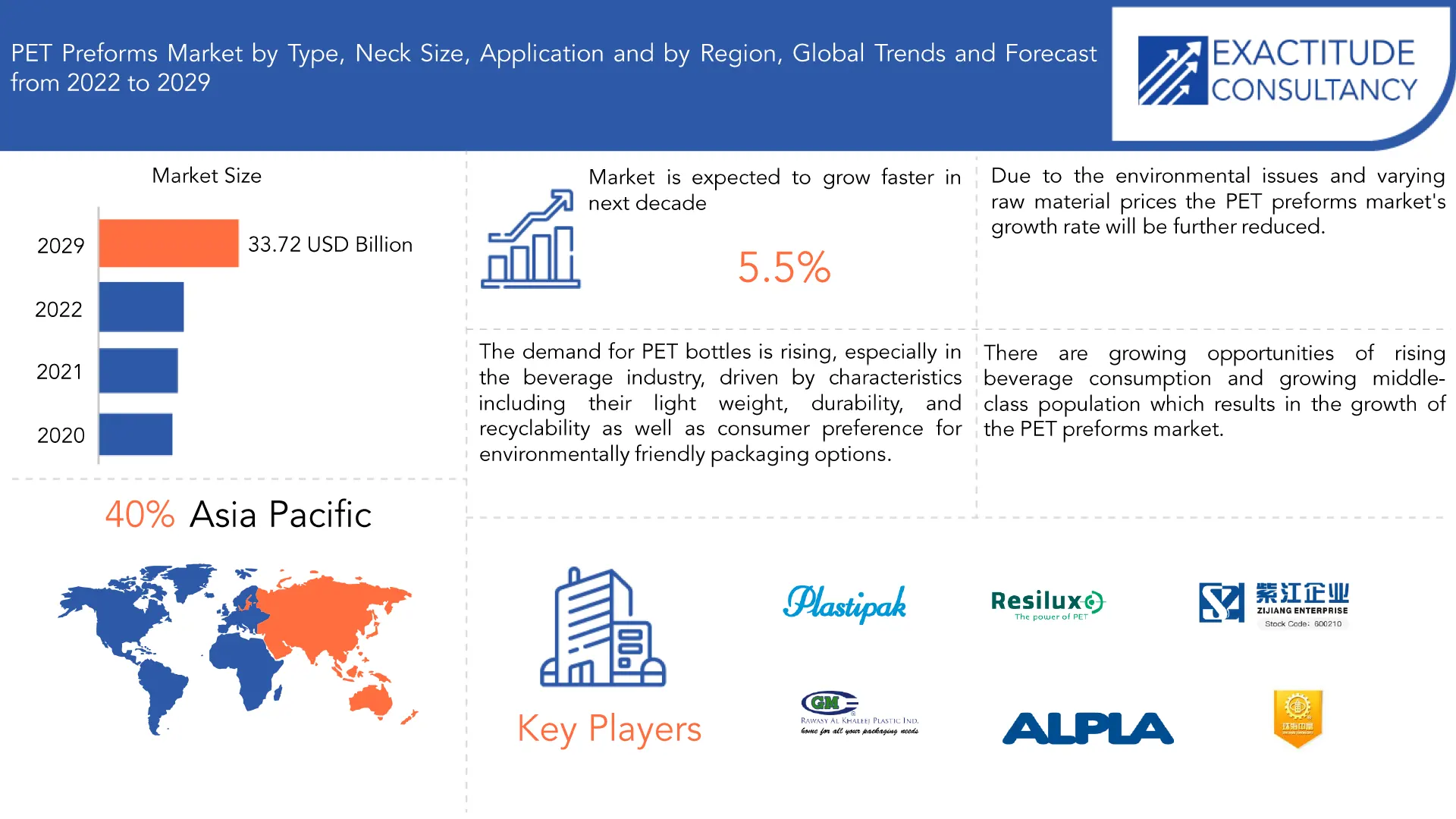

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 33.72 billion by 2029 | 5.5% | Asia Pacific |

| By Type | By Neck Size | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

PET Preforms Market Overview

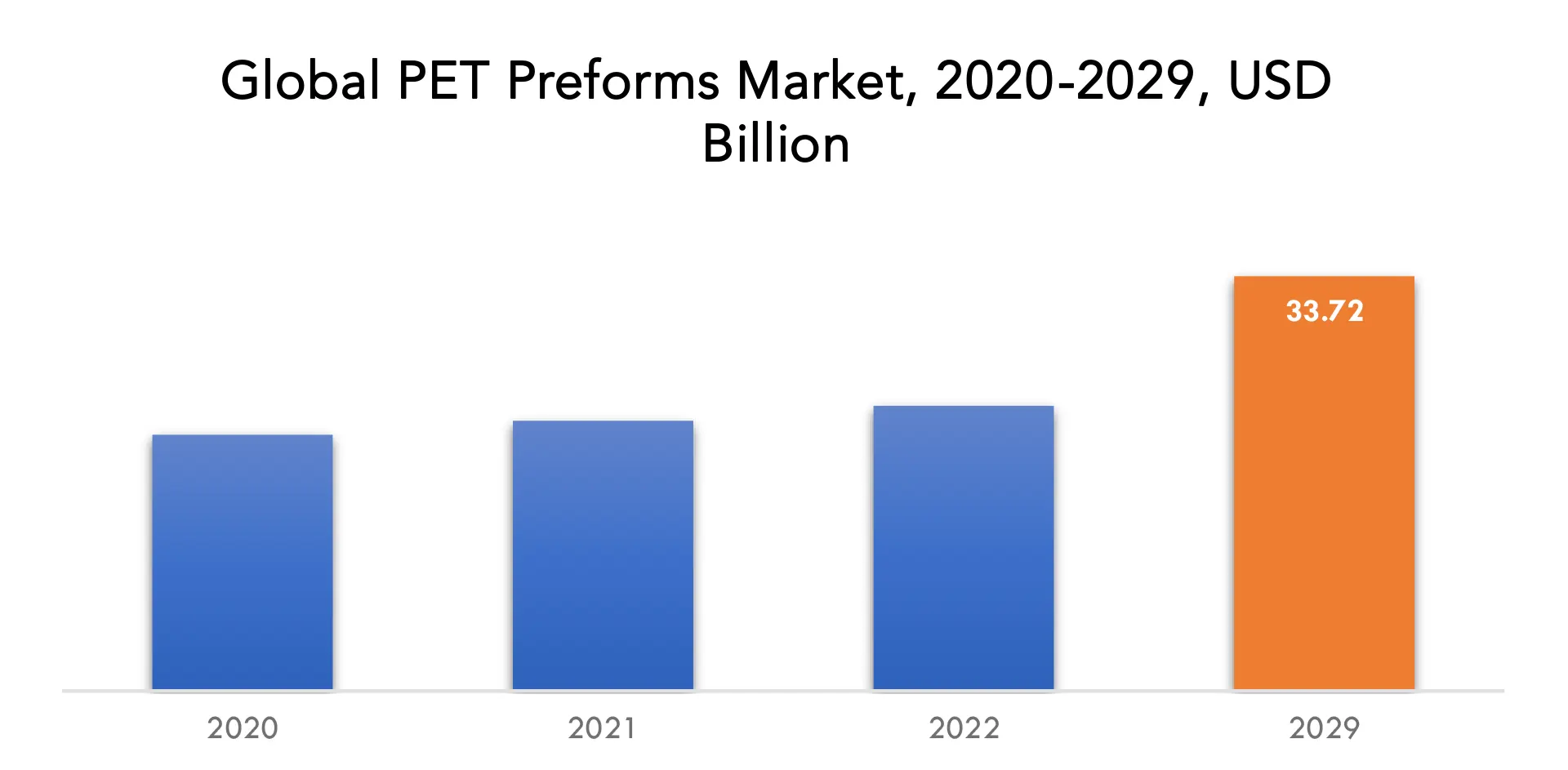

PET preforms market is expected to grow at 5.5% CAGR from 2022 to 2029. It was valued 20.83 billion at 2020. It is expected to reach above USD 33.72 billion by 2029.

The demand for PET bottles is rising, especially in the beverage industry, driven by characteristics including their light weight, durability, and recyclability as well as consumer preference for environmentally friendly packaging options.

Preformed semi-finished items composed of polyethylene terephthalate (PET) resin are known as PET preforms. They have a tubular shape and are used as the foundation for making PET bottles and containers. PET preforms are frequently used in the packaging business to create a variety of bottle sizes and shapes, especially in the beverage industry. Injection molding is a technique used to create PET preforms. Molten PET resin is injected into a mold cavity to create the desired shape. After cooling and solidifying, the preforms are transformed into a stiff, hollow structure with a threaded neck and a closed bottom. The final PET bottles are created by heating and stretching these preforms during the blow molding process.

PET preforms have a number of benefits for the packaging sector. Since they are lightweight, they need less energy and less money to transport them. Additionally strong and offering outstanding barrier qualities, PET ensures the preservation of the product’s quality and increases its shelf life. In comparison to other packaging materials, PET is an environmentally favourable choice as it is extensively recyclable. PET preforms, which are tiny, hollow tubes made of PET, are used in the production of PET bottles and containers.

As a cost-effective alternative for bottled water, carbonated soft drinks, edible oil, and other consumer items, these PET preforms are an essential part of the packaging business. The cost of PET preforms varies according on their dimensions, weight, and manufacturing technology. The increased popularity of ready-to-drink coffee, tea, soft drinks, and juices has contributed to a major rise in the demand for PET preforms during the past ten years. The hot filling method is expanding the market for PET preform bottles in industrialized nations as it involves less upfront investment and doesn’t employ preservers.

The market for PET preforms is impacted by a number of dynamic factors that determine demand and growth. First off, the expansion and innovation of the beverage sector fuel demand for PET preforms. Since PET preforms are the main raw material used to make PET bottles, the demand for bottled beverages such as water, carbonated drinks, juices, and alcoholic beverages is on the rise. The market for PET preforms is fueled by the increasing focus on environmentally friendly packaging options. PET is a recyclable material, and when compared to alternative packaging materials, PET bottles have a lower carbon footprint. The use of PET preforms in packaging applications is a result of government rules promoting sustainable practices and rising consumer awareness of environmental issues.

The dynamics of the market are also influenced by technological developments in the PET preform production processes. PET preforms may now be produced quickly and affordably thanks to advancements in injection molding processes including multi-cavity molds and hot runner systems. Demand for PET preforms is further increased by improvements in stretch-blow molding techniques and PET resin compositions, which improve the functionality and appearance of PET bottles.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion, Thousand Units) |

| Segmentation | By Type, By Neck Size, By Application |

| By Type |

|

| By Neck Size |

|

| By Application |

|

| By Region |

|

PET Preforms Market Segment Analysis

By type the market is segmented into ROPP, standard PCO, Alaska, CTC preforms, others. With a revenue share of 8.3% in 2021, the Standard PCO category held the greatest revenue share and is anticipated to increase. Carbonated soft drinks, such as cola, lemon-lime soda, and other carbonated beverages, are frequently packaged using the Standard PCO section. For the purpose of preserving carbonation and preventing gas egress, the PCO neck finish offers a reliable closure and sealing system. The demand for the Standard PCO preforms segment is highly correlated with both the expansion of the beverage industry and the consumption of carbonated beverages.

By neck size the market is segmented into 25 mm, 28 mm, 29 mm, 30 mm, others. Sizes in the 25 mm, 28 mm, 29 mm, and 30 mm range are typical. These common neck finishes, which may support different closures, are frequently utilised in the beverage sector. Other neck finish sizes are designed to meet specialized packaging needs and applications.

By application the market is segmented into carbonated soft drinks, water, food, non-carbonated drinks, cosmetics and chemical, others. The food industry for packaging edible oils, sauces, and condiments is the second largest consumer of PET preforms after the carbonated soft drink and water sectors. The industry is also driven by non-carbonated beverages including juices and energy drinks. PET preforms are also used in the chemical and cosmetics sectors to package industrial, domestic, and personal care items. The market’s scope and potential are increased by other industries like medicines, transportation, and specialized packaging.

PET Preforms Market Key Players

PET preforms market key players include RETAL, Plastipak, Hon Chuan, Resilux NV, PET-Verpackungen GmbH Deutschland, Zijiang Enterprise, SGT, Rawasy Al Khaleej Plastic, Alpla, Zhuhai Zhongfu Enterprise.

Recent developments:

May 18, 2023: LanzaTech & Plastipak Partnered to Produce World’s First PET Resin Made from Waste Carbon.

April 06, 2023: Sustainable Pumps: Alpla And Hana Innovation Launched Joint Venture.

Who Should Buy? Or Key stakeholders

- Beverage manufacturers

- Packaging manufacturers

- Raw material suppliers

- Equipment manufacturers

- Brand owners

- Retailers

- Regulatory authorities

- Recycling industry

- Investors

- Government agencies

- Others

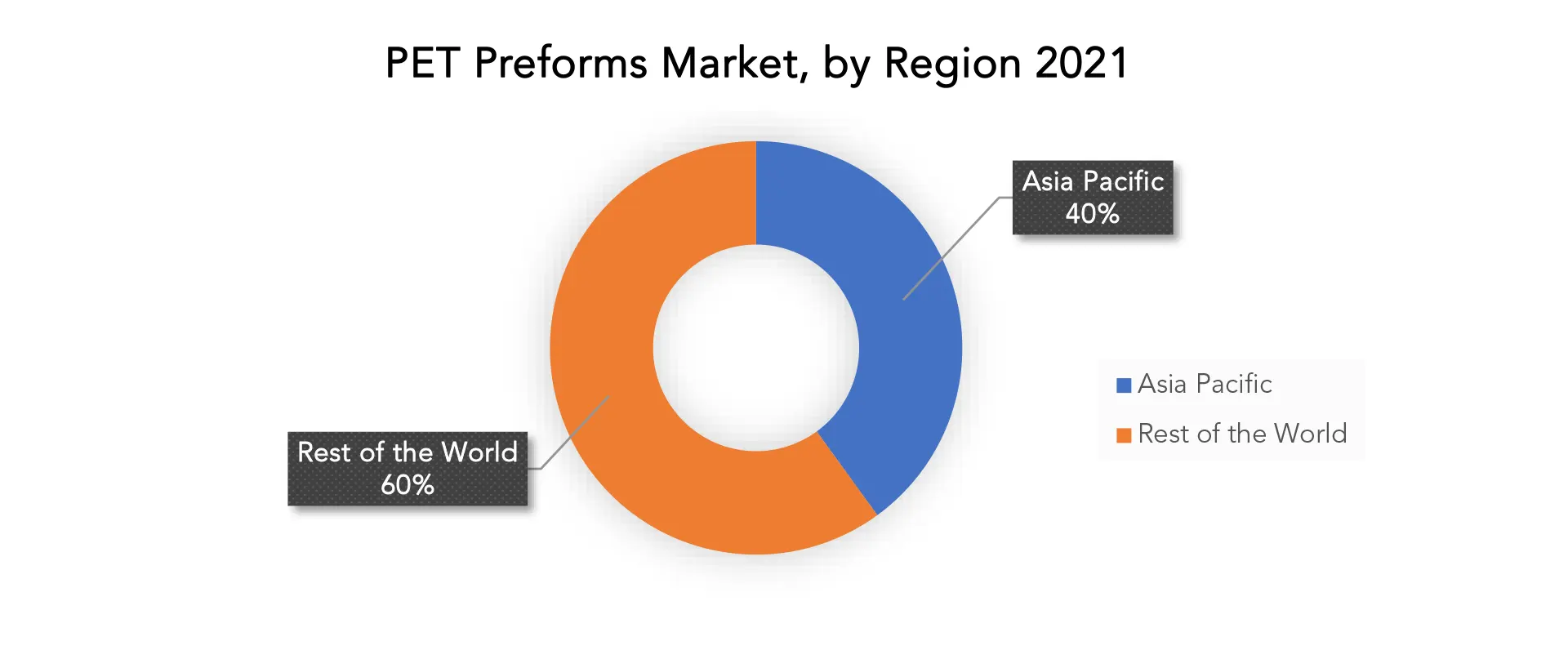

PET Preforms Market Regional Analysis

PET preforms market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The market for PET preforms in Asia and the Pacific has grown significantly in recent years. The need for PET preforms has expanded as a result of the region’s growing population, increasing disposable incomes, and changing consumer lifestyles. The market growth has also been accelerated by the quick industrialization, urbanisation, and expansion of the food and beverage industries in nations like China and India. The manufacture and distribution of PET preforms are being supported by growing investments in infrastructure and packaging technology in the Asia Pacific area. Overall, these factors support the PET preforms market’s robust growth in the Asia Pacific region.

Due to the increased consumption of beverages in the North American area, such as carbonated soft drinks, bottled water, juices, sports drinks, and ready-to-drink teas and coffees, the PET Preforms market is anticipated to expand over the forecast period. In North America, recycling and sustainability are highly valued. PET preforms and PET bottles can be recycled to a high degree, and there are established recycling activities and infrastructure in the area. The demand for PET preforms as a preferred option for eco-friendly packaging is further fueled by the emphasis on sustainability and recycling. Additionally, the North American PET preforms business benefits from technological developments in production methods and equipment. Modern injection molding techniques make it possible to produce PET preforms quickly and efficiently, satisfying the volume, quality, and customization requirements of beverage producers.

Key Market Segments: PET Preforms Market

PET Preforms Market By Type, 2020-2029, (USD Billion, Thousand Units)

- ROPP

- Standard PCO

- Alaska

- CTC Preforms

- Others

PET Preforms Market By Neck Size, 2020-2029, (USD Billion, Thousand Units)

- 25 Mm

- 28 Mm

- 29 Mm

- 30 Mm

- Others

PET Preforms Market By Application, 2020-2029, (USD Billion, Thousand Units)

- Carbonated Soft Drinks

- Water

- Food

- Non-Carbonated Drinks

- Cosmetics And Chemical

- Others

PET Preforms Market By Region, 2020-2029, (USD Billion, Thousand Units)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the PET preforms market over the next 7 years?

- Who are the major players in the PET preforms market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as asia-pacific, middle east, and africa?

- How is the economic environment affecting the PET preforms market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the PET preforms market?

- What is the current and forecasted size and growth rate of the global PET preforms market?

- What are the key drivers of growth in the PET preforms market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the PET preforms market?

- What are the technological advancements and innovations in the PET preforms market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the PET preforms market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the PET preforms market?

- What are the product voltage ratings and specifications of leading players in the market?

- What is the pricing trend of PET preforms market in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA NECK SIZENG

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA NECK SIZENG

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PET PERFORMS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON PET PREFORMS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL PET PERFORMS MARKET OUTLOOK

- GLOBAL PET PREFORMS MARKET BY TYPE (USD BILLION, THOUSAND UNITS), 2020-2029

- ROPP

- STANDARD PCO

- ALASKA

- CTC PREFORMS

- OTHERS

- GLOBAL PET PREFORMS MARKET BY NECK SIZE (USD BILLION, THOUSAND UNITS), 2020-2029

- 25 MM

- 28 MM

- 29 MM

- 30 MM

- OTHERS

- GLOBAL PET PREFORMS MARKET BY APPLICATION (USD BILLION, THOUSAND UNITS), 2020-2029

- CARBONATED SOFT DRINKS

- WATER

- FOOD

- NON-CARBONATED DRINKS

- COSMETICS AND CHEMICAL

- OTHERS

- GLOBAL PET PREFORMS MARKET BY REGION (USD BILLION, THOUSAND UNITS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TYPES OFFERED, RECENT DEVELOPMENTS)

- RETAL

- PLASTIPAK

- HON CHUAN

- RESILUX NV

- PET-VERPACKUNGEN GMBH DEUTSCHLAND

- ZIJIANG ENTERPRISE

- SGT

- RAWASY AL KHALEEJ PLASTIC

- ALPLA

- ZHUHAI ZHONGFU ENTERPRISE. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 4 GLOBAL PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 6 GLOBAL PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL PET PREFORMS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL PET PREFORMS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA PET PREFORMS BY COUNTRY (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA PET PREFORMS BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA PET PREFORMS MARKET BY APPLICATION INDUSTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 US PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 US PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 20 US PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 21 US PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 US PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 24 CANADA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 26 CANADA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 CANADA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 30 MEXICO PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 32 MEXICO PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 MEXICO PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA PET PREFORMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA PET PREFORMS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 BRAZIL PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 46 BRAZIL PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 48 BRAZIL PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 50 ARGENTINA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 52 ARGENTINA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 54 ARGENTINA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 56 COLOMBIA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 57 COLOMBIA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 58 COLOMBIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 59 COLOMBIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 60 COLOMBIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 61 COLOMBIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 62 REST OF SOUTH AMERICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 63 REST OF SOUTH AMERICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 64 REST OF SOUTH AMERICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 65 REST OF SOUTH AMERICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 66 REST OF SOUTH AMERICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 67 REST OF SOUTH AMERICA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 68 ASIA-PACIFIC PET PREFORMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 69 ASIA-PACIFIC PET PREFORMS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 70 ASIA-PACIFIC PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 71 ASIA-PACIFIC PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 72 ASIA-PACIFIC PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 73 ASIA-PACIFIC PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 74 ASIA-PACIFIC PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 75 ASIA-PACIFIC PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 76 INDIA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 77 INDIA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 78 INDIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 79 INDIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 80 INDIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 81 INDIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 82 CHINA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 83 CHINA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 84 CHINA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 85 CHINA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 86 CHINA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 87 CHINA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 88 JAPAN PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 89 JAPAN PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 90 JAPAN PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 91 JAPAN PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 92 JAPAN PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 93 JAPAN PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 94 SOUTH KOREA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 95 SOUTH KOREA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 96 SOUTH KOREA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 97 SOUTH KOREA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 98 SOUTH KOREA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 99 SOUTH KOREA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 100 AUSTRALIA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 101 AUSTRALIA PET PREFORMS BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 102 AUSTRALIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 103 AUSTRALIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 104 AUSTRALIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 105 AUSTRALIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 106 SOUTH EAST ASIA PET PREFORMS MARKET BY TYPE (USD MI LLION), 2020-2029

TABLE 107 SOUTH EAST ASIA PET PREFORMS BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 108 SOUTH EAST ASIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 109 SOUTH EAST ASIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 110 SOUTH EAST ASIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 111 SOUTH EAST ASIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 112 REST OF ASIA PACIFIC PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 113 REST OF ASIA PACIFIC PET PREFORMS BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 114 REST OF ASIA PACIFIC PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 115 REST OF ASIA PACIFIC PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 116 REST OF ASIA PACIFIC PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 117 REST OF ASIA PACIFIC PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 118 EUROPE PET PREFORMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 EUROPE PET PREFORMS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 120 EUROPE PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 121 EUROPE PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 122 EUROPE PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 123 EUROPE PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 124 EUROPE PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 125 EUROPE PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 126 GERMANY PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 127 GERMANY PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 128 GERMANY PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 129 GERMANY PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 130 GERMANY PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 131 GERMANY PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 132 UK PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 133 UK PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 134 UK PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 135 UK PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 136 UK PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 137 UK PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 138 FRANCE PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 139 FRANCE PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 140 FRANCE PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 141 FRANCE PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 142 FRANCE PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 143 FRANCE PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 144 ITALY PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 145 ITALY PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 146 ITALY PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 147 ITALY PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 148 ITALY PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 149 ITALY PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 150 SPAIN PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 151 SPAIN PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 152 SPAIN PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 153 SPAIN PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 154 SPAIN PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 155 SPAIN PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 156 RUSSIA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 157 RUSSIA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 158 RUSSIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 159 RUSSIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 160 RUSSIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 161 RUSSIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 162 REST OF EUROPE PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 163 REST OF EUROPE PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 164 REST OF EUROPE PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 165 REST OF EUROPE PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 166 REST OF EUROPE PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 167 REST OF EUROPE PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 175 MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 176 UAE PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 177 UAE PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 178 UAE PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 179 UAE PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 180 UAE PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 181 UAE PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 182 SAUDI ARABIA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 183 SAUDI ARABIA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 184 SAUDI ARABIA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 185 SAUDI ARABIA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 186 SAUDI ARABIA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 187 SAUDI ARABIA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 188 SOUTH AFRICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 189 SOUTH AFRICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 190 SOUTH AFRICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 191 SOUTH AFRICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 192 SOUTH AFRICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 193 SOUTH AFRICA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY NECK SIZE (USD BILLION), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY NECK SIZE (THOUSAND UNITS), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 199 REST OF MIDDLE EAST AND AFRICA PET PREFORMS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONTYPEERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PET PREFORMS BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL PET PREFORMS BY NECK SIZE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL PET PREFORMS BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL PET PREFORMS BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL PET PREFORMS MARKET BY TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL PET PREFORMS MARKET BY NECK SIZE, USD BILLION, 2021

FIGURE 15 GLOBAL PET PREFORMS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 16 GLOBAL PET PREFORMS MARKET BY REGION, USD BILLION, 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 RETAL: COMPANY SNAPSHOT

FIGURE 19 PLASTIPAK: COMPANY SNAPSHOT

FIGURE 20 HON CHUAN: COMPANY SNAPSHOT

FIGURE 21 RESILUX NV: COMPANY SNAPSHOT

FIGURE 22 PET-VERPACKUNGEN GMBH DEUTSCHLAND: COMPANY SNAPSHOT

FIGURE 23 ZIJIANG ENTERPRISE: COMPANY SNAPSHOT

FIGURE 24 SGT: COMPANY SNAPSHOT

FIGURE 25 RAWASY AL KHALEEJ PLASTIC: COMPANY SNAPSHOT

FIGURE 26 ALPLA: COMPANY SNAPSHOT

FIGURE 27 ZHUHAI ZHONGFU ENTERPRISE: COMPANY SNAPSHOT

FAQ

PET preforms market is expected to grow at 5.5% CAGR from 2022 to 2029. it is expected to reach above USD 33.72 billion by 2029

Asia Pacific held more than 40% of PET preforms market revenue share in 2021 and will witness expansion in the forecast period.

The demand for PET bottles is rising, especially in the beverage industry, driven by characteristics including their light weight, durability, and recyclability as well as consumer preference for environmentally friendly packaging options.

By application the market is segmented into carbonated soft drinks, water, food, non-carbonated drinks, cosmetics and chemical, others. The food industry for packaging edible oils, sauces, and condiments is the second largest consumer of PET preforms after the carbonated soft drink and water sectors. The industry is also driven by non-carbonated beverages including juices and energy drinks. PET preforms are also used in the chemical and cosmetics sectors to package industrial, domestic, and personal care items.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.