REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 51.17 Billion by 2029 | 5.3% | North America |

| by Technology | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Epoxy Coatings Market Overview

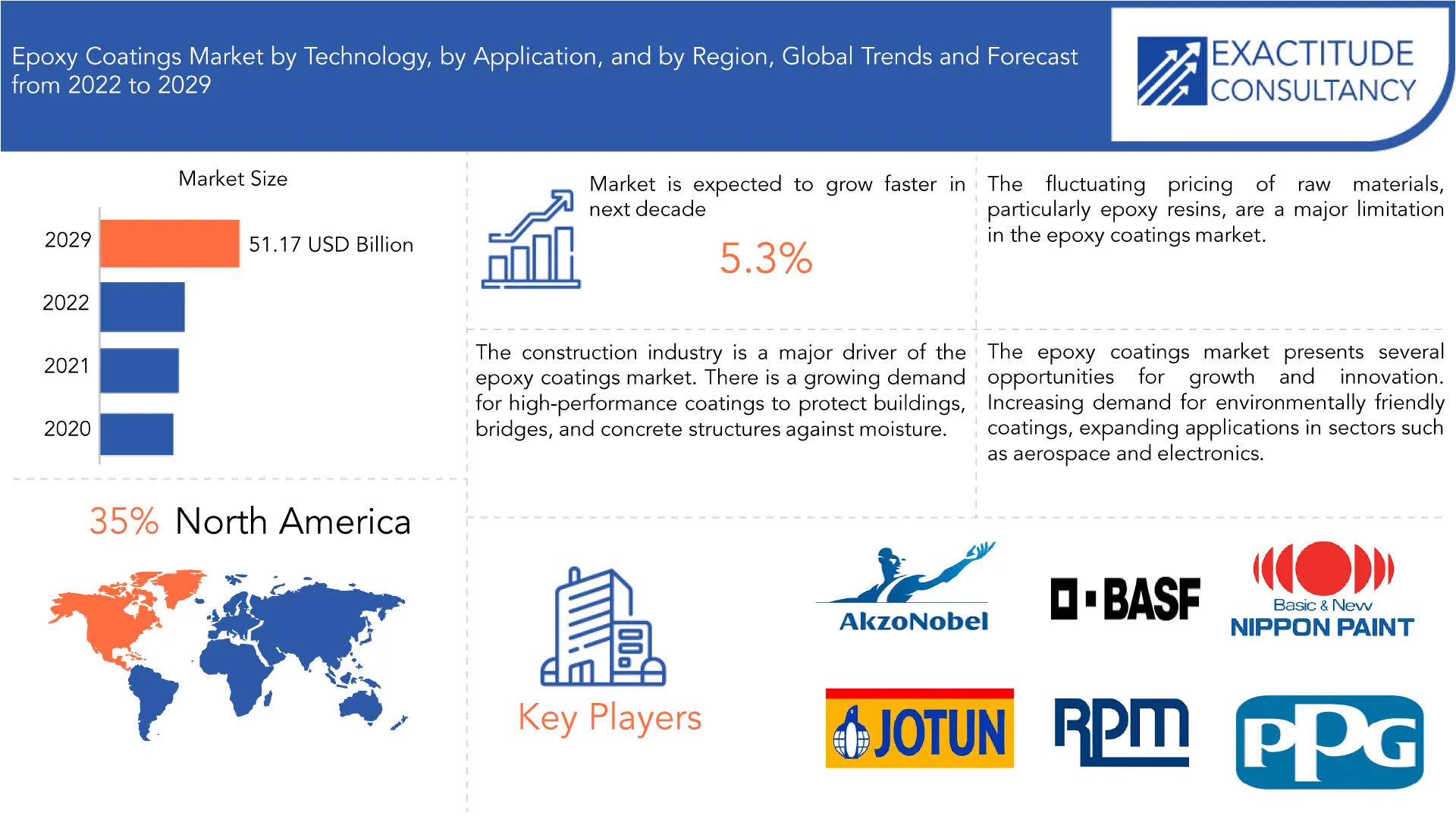

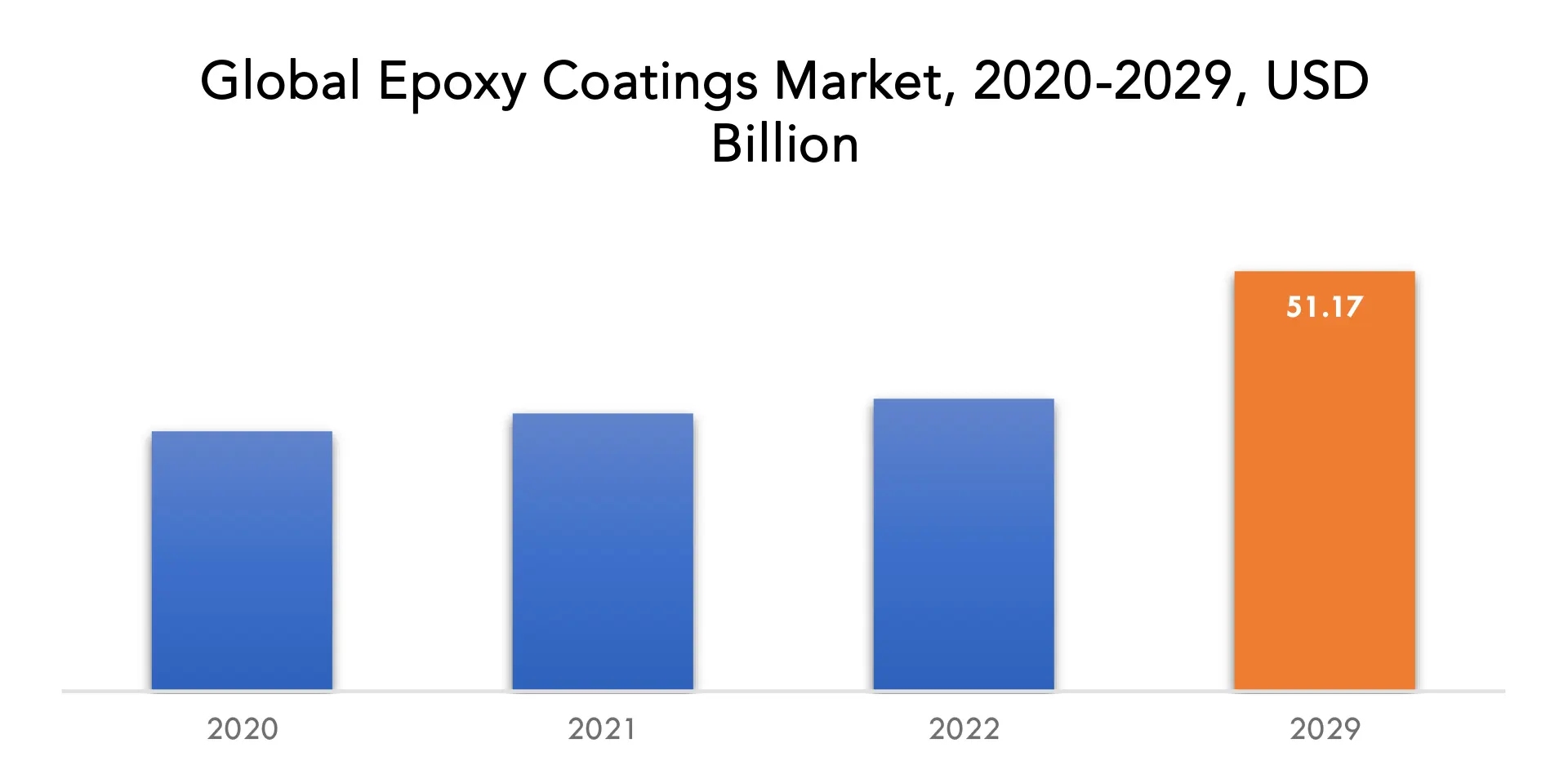

The epoxy coatings market is expected to grow at 5.3% CAGR from 2022 to 2029. It is expected to reach above USD 51.17 Billion by 2029 from USD 31.67 Billion in 2020.

Epoxy coatings are ornamental and protective coatings made from epoxy resins. They are applied to a variety of surfaces, including metals, concrete, and wood, to produce a long-lasting, chemical-resistant finish. Epoxy coatings stick effectively to substrates and have high abrasion, impact, corrosion, and chemical resistance. They’re widely utilised in industries including construction, automotive, aerospace, and electronics for everything from floor coatings to corrosion prevention on metal structures.

Epoxy coatings are decorative and protective coatings that are manufactured from epoxy resins. They are used to create a long-lasting, chemical-resistant finish on a variety of surfaces, including metals, concrete, and wood. Epoxy coatings adhere to substrates well and offer excellent abrasion, impact, corrosion, and chemical resistance. They are widely used in construction, automotive, aerospace, and electronics industries for anything from floor coatings to corrosion prevention on metal structures.

The growing need for protective coatings in various industries drives the epoxy coatings industry. Epoxy coatings have excellent adhesion and corrosion resistance, making them ideal for use in infrastructure, oil and gas, and maritime applications. The growing awareness of the necessity for long-lasting protective coatings to extend asset life and decrease maintenance costs is driving market expansion. Furthermore, severe environmental rules encouraging the usage of low VOC (volatile organic compound) epoxy coatings are fueling market growth.

The construction industry is a major driver of the epoxy coatings market. There is a growing demand for high-performance coatings to protect buildings, bridges, and concrete structures against moisture, chemicals, and abrasion as the world’s population grows and infrastructure development projects expand. Epoxy coatings are popular for architectural and ornamental applications because they provide outstanding surface protection and aesthetics.

The epoxy coatings market presents several opportunities for growth and innovation. Increasing demand for environmentally friendly coatings, expanding applications in sectors such as aerospace and electronics, and the rising need for protective and decorative coatings in the construction and automotive industries provide avenues for market expansion. Additionally, advancements in epoxy formulations and technologies, along with emerging markets and infrastructure development, offer further opportunities for industry players to capitalize on.

The fluctuating pricing of raw materials, particularly epoxy resins, are a major limitation in the epoxy coatings market. Epoxy resins are made from petrochemicals, and their pricing are affected by factors such as crude oil prices and supply-demand dynamics. This volatility in raw material costs can have an effect on the overall cost of epoxy coatings, making them less appealing to customers and potentially stifling industry growth.

The pandemic of COVID-19 had a mixed effect on the epoxy coatings market. There was a major disturbance at first as a result of supply chain disruptions, project delays, and reduced construction operations. However, as economies began to improve, the industry began to revive due to increased demand for protective coatings in healthcare facilities, industrial settings, and infrastructure projects. The emphasis on hygiene and sanitation fueled demand for epoxy coatings in a variety of industries, minimizing the pandemic’s detrimental impact.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Technology, By Application, By Region |

|

By Technology

|

Solvent Borne

Water Borne Powder Based |

|

By Application

|

Construction

Transportation General industrial Decorative Coatings |

|

By Region

|

North America

Asia Pacific Europe South America Middle East Asia & Africa |

Epoxy Coatings Market Segment Analysis

The Epoxy Coatings market is segmented based on Technology, application and region.

Based on technology, the epoxy coatings market is divided into three technology segments: solvent-based, water-based, and powder-based coatings. Historically, solvent-based coatings were popular as of their great performance, but there is an increasing trend towards water-based and powder-based coatings due to their environmental friendliness and regulatory compliance. These segments provide distinct benefits and are selected based on unique application needs and industry preferences.

By the application, epoxy coatings are used in various applications such as construction, automotive, aerospace, electronics, and others. In the construction industry, they are utilized for floorings, walls, and waterproofing. In the automotive sector, epoxy coatings find application in vehicle exteriors and interiors. They are also used for corrosion protection in the aerospace industry and electronic component encapsulation.

Epoxy Coatings Market Key Players

The Epoxy Coatings market key players PPG Industries, AkzoBobel, RPM International Inc, BASF SE, Jotun Group, Nippon Paint Holdings Co.ltd, Kansai paint Co.Ltd, Asian Paints Limited, Berger Paints India Limited,.

Recent News:

23-05-2023: – PPG (NYSE:PPG) announced that it would deliver paint and clear film solutions for automotive and industrial customers through PPG Advanced Surface Technologies, a new joint venture that was formed with entrotech, Inc., a provider of technology-driven film solutions.

01-03-2023: Nippon Paint China and Corning Incorporated donated 5 million RMB worth of Nippon Paint Antivirus Kids Paint (specially produced for frontline hospital use, not available in the market) to four Hubei coronavirus-designated hospitals with a total area of 120,000 square meters.

Epoxy Coatings Market Regional Analysis

The Epoxy Coatings market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

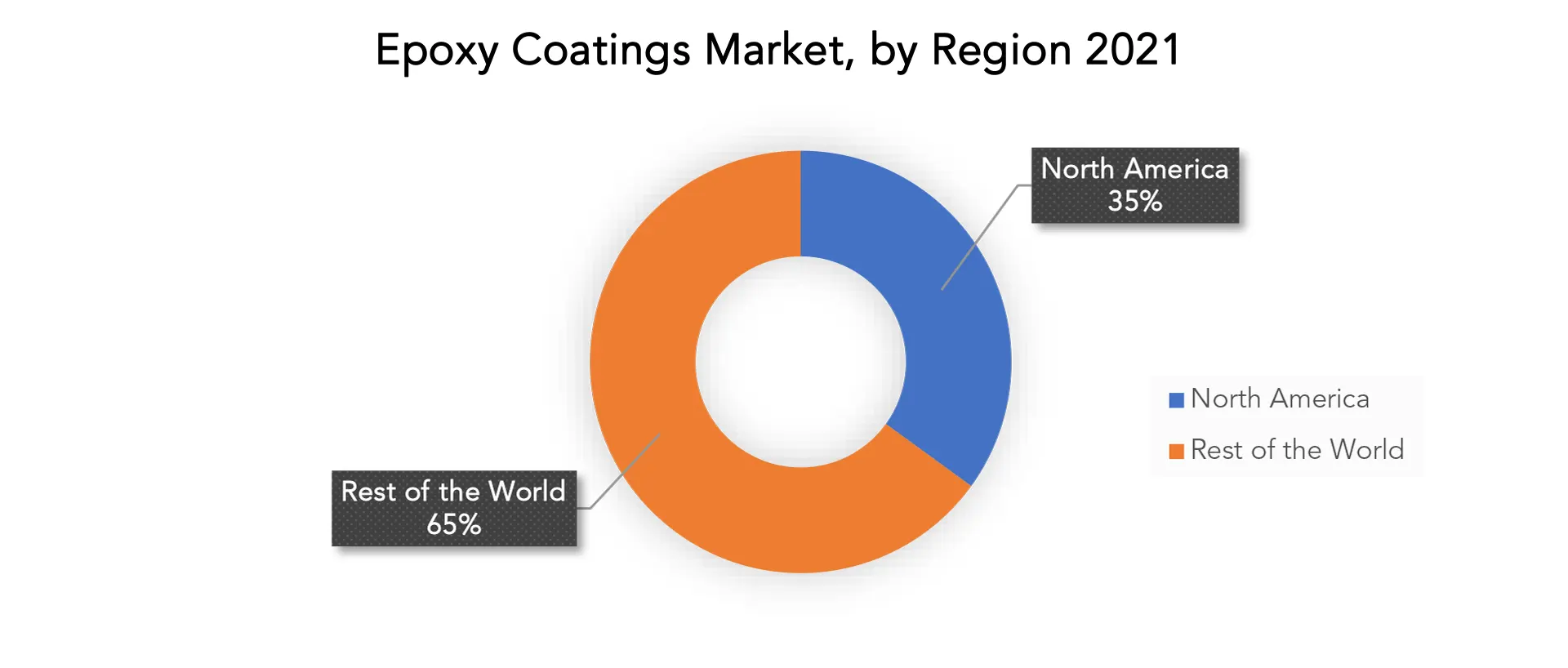

The market for epoxy coatings in North America is sizable and expanding holds 35% of total market size. The epoxy coatings market in North America is significant and growing. Factors such as infrastructure development, industrial expansion, and increasing demand for protective coatings drive the market’s expansion. The construction, automotive, and aerospace industries are major consumers of epoxy coatings in the region. Additionally, the adoption of eco-friendly and water-based epoxy coatings is gaining momentum. Overall, North America’s epoxy coatings market is witnessing steady growth and offers substantial opportunities for manufacturers and suppliers in the region.

The epoxy coatings market in the Asia Pacific region is experiencing significant growth driven by increasing infrastructure development, industrialization, and the automotive sector. Rising construction activities, the demand for corrosion-resistant coatings, and the expansion of the electronics industry are contributing to the market’s expansion.

Key Market Segments: Epoxy Coatings Market

Epoxy Coatings Market by Technology, 2020-2029, (USD Billion), (Kilotons).

- Solvent Borne

- Water Borne

- Powder Based

Epoxy Coatings Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Construction

- Transportation

- General Industrial

- Decorative Coatings

Epoxy Coatings Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Who Should Buy? Or Key stakeholders

- Construction Companies

- Industrial Manufacturers

- Architectural Firms

- Building Owners

- Government Agencies

- Maintenance and Repair Professionals

- Investors

Key Question Answered

- What is the expected growth rate of the epoxy coatings market over the next 7 years?

- Who are the major players in the epoxy coatings market and what is their market share?

- What are the application industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, And Africa?

- How is the economic environment affecting the epoxy coatings market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the epoxy coatings market?

- What is the current and forecasted size and growth rate of the global epoxy coatings market?

- What are the key drivers of growth in the epoxy coatings market?

- What are the distribution channels and supply chain dynamics in the epoxy coatings market?

- What are the technological advancements and innovations in the epoxy coatings market and their impact on technology development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the epoxy coatings market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the epoxy coatings market?

- What are the technology offerings and specifications of leading players in the market?

- What is the pricing trend of epoxy coatings in the market and what is the impact of raw material prices on the price trend?

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new Technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL EPOXY COATINGS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON EPOXY COATINGS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL EPOXY COATINGS MARKET OUTLOOK

- GLOBAL EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION, KILOTONS)

- SOLVENT BORNE

- WATER BORNE

- POWDER BASED

- GLOBAL EPOXY COATINGS MARKET BY APPLICATION (USD BILLION, KILOTONS)

- CONSTRUCTION

- TRANSPORTATION

- GENERAL INDUSTRIAL

- DECORATIVE COATINGS

- GLOBAL EPOXY COATINGS MARKET BY REGION (USD BILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PPG INDUSTRIES

- AKZONOBEL

- RPM INTERNATIONAL INC

- BASF SE

- JOTUN GROUP

- NIPPON PAINT HOLDINGS CO.LTD

- ANSAI PAINT CO.LTD

- ASIAN PAINTS LIMITED

- BERGER PAINTS INDIA LIMITED

- THE VALSPAR CORPORATION *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 2 GLOBAL EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 3 GLOBAL EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL EPOXY COATINGS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL EPOXY COATINGS MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA EPOXY COATINGS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA EPOXY COATINGS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 14 US EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 15 US EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 18 CANADA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 19 CANADA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 22 MEXICO EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 23 MEXICO EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA EPOXY COATINGS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA EPOXY COATINGS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 31 BRAZIL EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 32 BRAZIL EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 33 BRAZIL EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 36 ARGENTINA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 37 ARGENTINA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 40 COLOMBIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 41 COLOMBIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC EPOXY COATINGS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC EPOXY COATINGS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 54 INDIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 55 INDIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 58 CHINA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 59 CHINA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 62 JAPAN EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 63 JAPAN EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 82 EUROPE EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 83 EUROPE EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE EPOXY COATINGS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE EPOXY COATINGS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 88 GERMANY EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 89 GERMANY EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 92 UK EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 93 UK EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 96 FRANCE EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 97 FRANCE EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 100 ITALY EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 101 ITALY EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 104 SPAIN EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 105 SPAIN EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 108 RUSSIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 109 RUSSIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 122 UAE EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 123 UAE EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY TECHNOLOGY (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA EPOXY COATINGS MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL EPOXY COATINGS MARKET BY TECHNOLOGY, USD BILLION, 2020-2029

FIGURE 9 GLOBAL EPOXY COATINGS MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL EPOXY COATINGS MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL EPOXY COATINGS MARKET BY TECHNOLOGY, USD BILLION, 2021

FIGURE 13 GLOBAL EPOXY COATINGS MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL EPOXY COATINGS MARKET BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 PPG INDUSTRIES: COMPANY SNAPSHOT

FIGURE 17 ALZONOBEL: COMPANY SNAPSHOT

FIGURE 18 RPM INTERNATIONAL INC: COMPANY SNAPSHOT

FIGURE 19 BASF SE: COMPANY SNAPSHOT

FIGURE 20 JOTUN GROUP: COMPANY SNAPSHOT

FIGURE 21 NIPPON PAINT HOLDINGS CO.LTD: COMPANY SNAPSHOT

FIGURE 22 KANSAI PAINT CO.LTD: COMPANY SNAPSHOT

FIGURE 23 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

FIGURE 24 BERGER PAINTS INDIA LIITED: COMPANY SNAPSHOT

FIGURE 25 THE VALSPAR CORPORATION: COMPANY SNAPSHOT

FAQ

The epoxy coatings market is expected to grow at 5.3% CAGR from 2022 to 2029. It is expected to reach above USD 51.17 Billion by 2029 from USD 31.67 Billion in 2020.

North America held more than 35% of the epoxy coatings market revenue share in 2021 and will witness expansion in the forecast period.

The growing need for protective coatings in various industries drives the epoxy coatings industry. Epoxy coatings have excellent adhesion and corrosion resistance, making them ideal for use in infrastructure, oil and gas, and maritime applications. The growing awareness of the necessity for long-lasting protective coatings to extend asset life and decrease maintenance costs is driving market expansion. Furthermore, severe environmental rules encouraging the usage of low VOC (volatile organic compound) epoxy coatings are fueling market growth.

The construction industry is a major driver of the epoxy coatings market. There is a growing demand for high-performance coatings to protect buildings, bridges, and concrete structures against moisture, chemicals, and abrasion as the world’s population grows and infrastructure development projects expand. Epoxy coatings are popular for architectural and ornamental applications because they provide outstanding surface protection and aesthetics.

Based on technology, the epoxy coatings market is divided into three technology segments: solvent-based, water-based, and powder-based coatings. Historically, solvent-based coatings were popular as of their great performance, but there is an increasing trend towards water-based and powder-based coatings due to their environmental friendliness and regulatory compliance. These segments provide distinct benefits and are selected based on unique application needs and industry preferences.

The market for epoxy coatings in North America is sizable and expanding holds 35% of total market size. The epoxy coatings market in North America is significant and growing. Factors such as infrastructure development, industrial expansion, and increasing demand for protective coatings drive the market’s expansion. The construction, automotive, and aerospace industries are major consumers of epoxy coatings in the region. Additionally, the adoption of eco-friendly and water-based epoxy coatings is gaining momentum. Overall, North America’s epoxy coatings market is witnessing steady growth and offers substantial opportunities for manufacturers and suppliers in the region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.