REPORT OUTLOOK

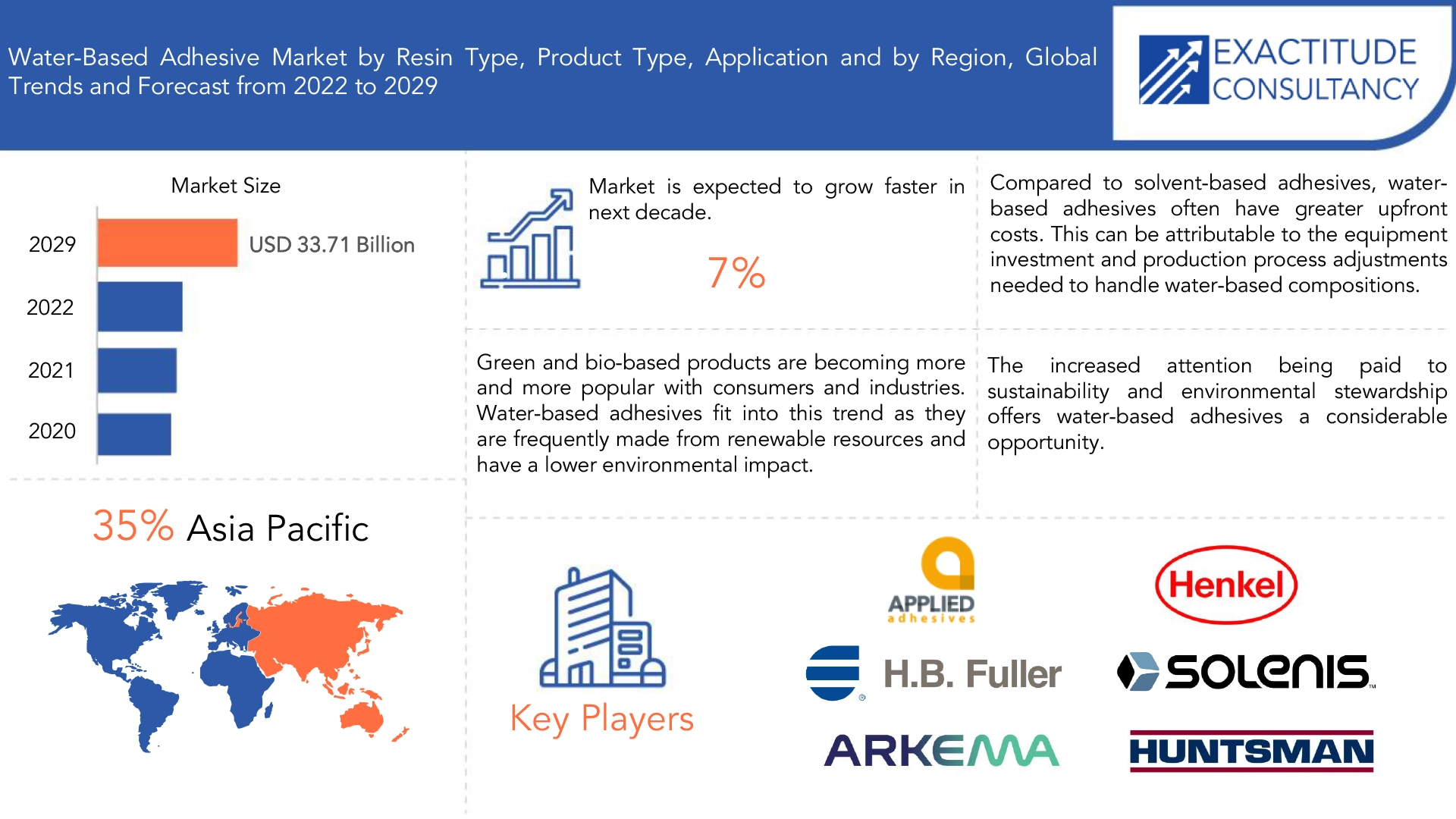

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 33.71 Billion by 2029 | 7% | Asia-Pacific |

| By Product Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Water-Based Adhesive Market Overview

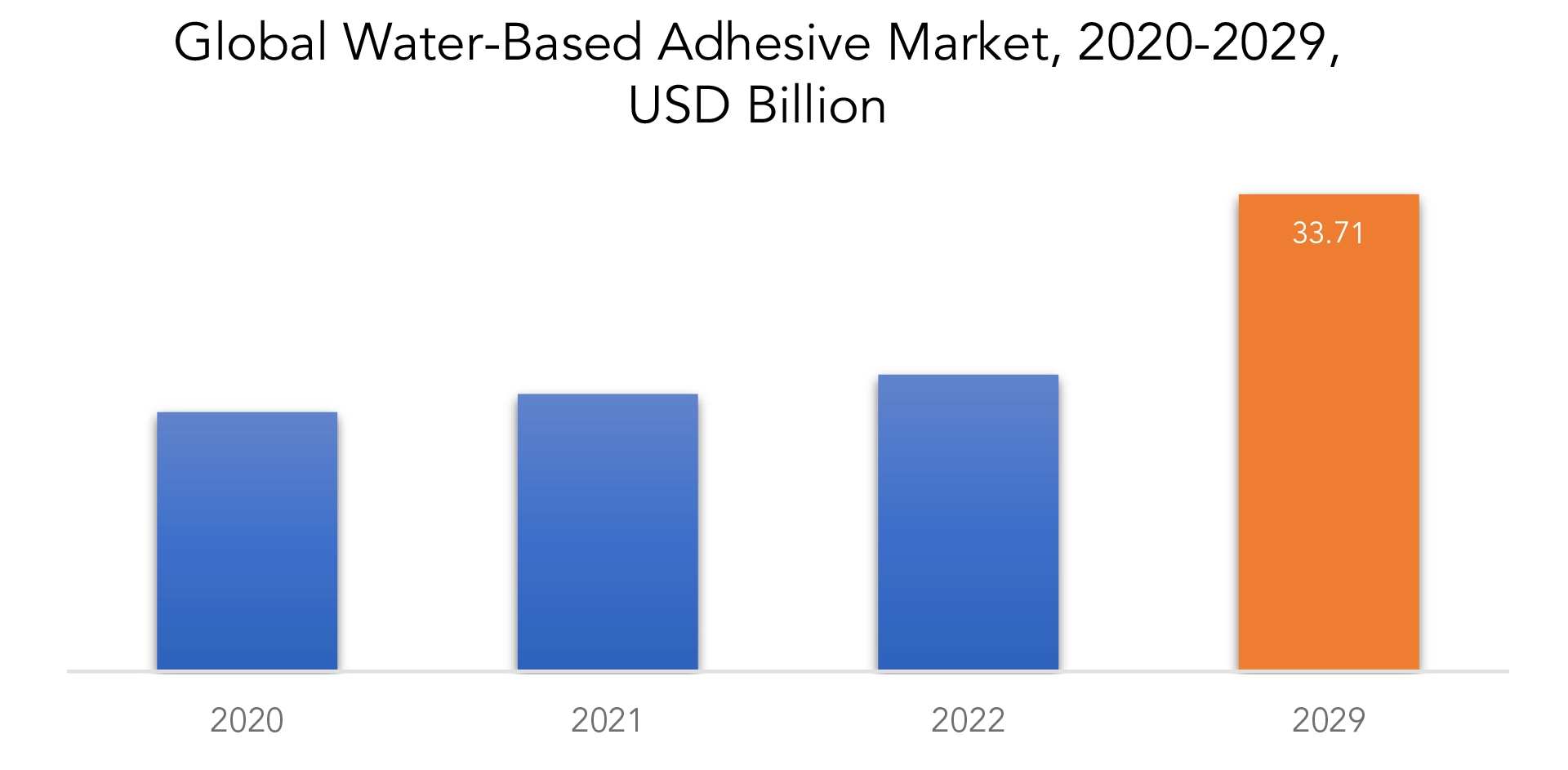

The water-based adhesive market is expected to grow at 7% CAGR from 2021 to 2029. It is expected to reach above USD 33.71 Billion by 2029 from USD 18.32 Billion in 2020.

Chemical composites known as “water-based adhesives” are comprised of a combination of water, polymers, and other additives. These adhesives are available as powder solutions or liquids. Both porous and non-porous substrates can use them. These adhesives are activated either when the substrate absorbs water from the liquid solution or when the water they contain evaporates from the liquid solution. The soluble polymers used to make the water-based glue can be either artificial or natural. Water often serves as the primary carrier fluid to regulate the fluidity of practical adhesive composites for a variety of substrates with a wide range of thicknesses. The glue is designed to stick to PET bottles or thermoformed containers rapidly and securely until they are recycled, at which point they will simply separate.

The rising demand from the packaging sector is one of the major reasons propelling the global market for water-based adhesives. Improved attributes like toughness, adaptability, and cost effectiveness encourage market expansion. The rise in demand for small, low-emission automobiles must be a major factor in the market’s expansion. It is believed that a shorter shelf life and the difficulty to store the product for an extended amount of time will slow market expansion. Costs for vulnerable commodities are also expected to restrain sector growth. Business growth is influenced by consumers’ increasing preference for cutting-edge and ecologically friendly goods across a range of end markets, such as water-based adhesives, which have advantages over traditional solvent-based adhesives in terms of VOC emissions. Additionally, these adhesives outperform comparable products in terms of flexibility and economy. This is one of the significant trends in the global market for water-based adhesives that has been discovered. The market for products made with water is supported by government restrictions that restrict VOC emissions. In contrast to solvent-based adhesives, the formulation of water-based adhesives is extremely complicated. Therefore, it is anticipated that in the future, it will impede the growth of the global market for water-based adhesives. The main issues with water-based adhesives are slower drying and freezing at low temperatures. The drying process requires a lot of time and can cause delays in the working process since water is volatile. As a result, the development of water-based adhesives is constrained by their slower drying time.

The market for water-based adhesives has been negatively impacted by the COVID-19 pandemic. The management of the supply chain and the transportation of goods and services were disrupted, which hurt the market’s expansion. Lockdowns and curfews imposed by governments around the world disrupted numerous production and manufacturing facilities, resulting in the loss and waste of numerous water-based adhesive products. Additionally, the pandemic had a big impact on consumer demand and behaviour. The pandemic caused consumers to hold off on non-essential purchases, which affected the sales of products with water-based adhesives. The pandemic had a substantial influence on the market and created an unforeseen and uncertain scenario, which slowed market expansion. Due to lockdowns and travel restrictions in practically every country, the demand for water-based adhesives sharply decreased, which had a negative impact on the market’s expansion. But since the pandemic, things have gotten better. The market has bounced back and is anticipated to expand quickly.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Resin Type, By Product Type, By Application, By Region |

| By Resin Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

Water-Based Adhesive Market Segment Analysis

The water-based adhesive market is segmented based on resin type, product type, application and region.

Based on resin type, the market is segmented into acrylic polymer emulsion (PAE), polyvinyl acetate (PVA) emulsion, vinyl acetate ethylene (VAE) emulsion, styrene butadiene (SB) latex, polyurethane dispersion (PUD), vinyl acetate acrylates (VAA). The market for water-based adhesive in 2021 was led by the polyvinyl acetate emulsions (PVA emulsion) segment in terms of revenue. Since many years ago, PVA-based adhesives have been widely utilised in consumer and domestic goods due to their adaptable and practical performance in a variety of applications. The PAE industry also grew at a high rate over the predicted period. Many packaging applications, including bookbinding, paper bags, cartons, labels, foils, films, paperboard decals, wood assembly, vehicle upholstery, and leather binding, favour PAE over other materials. An eco-friendly glue that offers a good compromise between the bond’s shear, tack, and peel strength is acrylic polymer emulsion. Numerous packaging applications, including bookbinding, paper bags, cartons, labels, foils, films, paperboard decals, wood assembly, automotive upholstery, and leather binding, favour it heavily. In order to bond backing material and lessen vibrations in car body panels, the automotive sector also uses acrylic polymer emulsion.

Based on application, the market is segmented into tapes & labels, paper & packaging, building & construction, automotive & transportation, consumer & DIY, leather & footwear, sports & leisure, assembly. Due to its use in medium- and heavy-duty carton sealing, gift wrapping and decoration, general purpose repair, bundling and strapping, and stationery, water-based adhesives are in great demand in the tapes and labels application. Tapes and labels are mostly used in the packaging of consumer and industrial goods, medical and hygiene products, medicine delivery systems, building materials in transit, electronic and electrical device packaging, packaging for automotive and transportation, and packaging for hygiene and medical products. As a result, the need for waste-based adhesives is increasing as the market for packaging adhesive tapes expands. The expansion of the water-based adhesive market was notably strong in the building and construction industry. More water-based adhesives will be used in a variety of applications, including flooring, glazing, walls, ceilings, and windows, as the building and construction industry expands. Due to its use in medium and heavy-duty carton sealing, gift wrapping and decoration, general-purpose repair, bundling and strapping, and stationery, water-based adhesives are in great demand in the tapes and labels business.

Water-Based Adhesive Market Players

The water-based adhesive Market Key players include 3M Company, Henkel Corporation, H.B. Fuller Company, The Dow Chemical Co., Sika AG, Applied Adhesives, Palmetto Adhesives Company, Solenis, BASF SE, Arkema Group (Bostik SA), Illinois Tool Works, Avery Dennison, Huntsman International, Ashland, Akzo Nobel.

Recent News:

11 February, 2021: Henkel introduced Technomelt Supra ECO, a new range of hot melt adhesives, that offer greater sustainability.

06 April, 2021: H.B. Fuller announced two new compostable adhesive solutions under its worldwide renowned FlextraTM Evolution brand that offers differentiated advantages in terms of sustainability goals and manufacturer benefits.

Who Should Buy? Or Key stakeholders

- Adhesive Manufacturers

- Raw Material Supplier

- Retailers, Wholesalers and Distributors

- Packaging Sector

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

Water-Based Adhesive Market Regional Analysis

The water-based adhesive Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

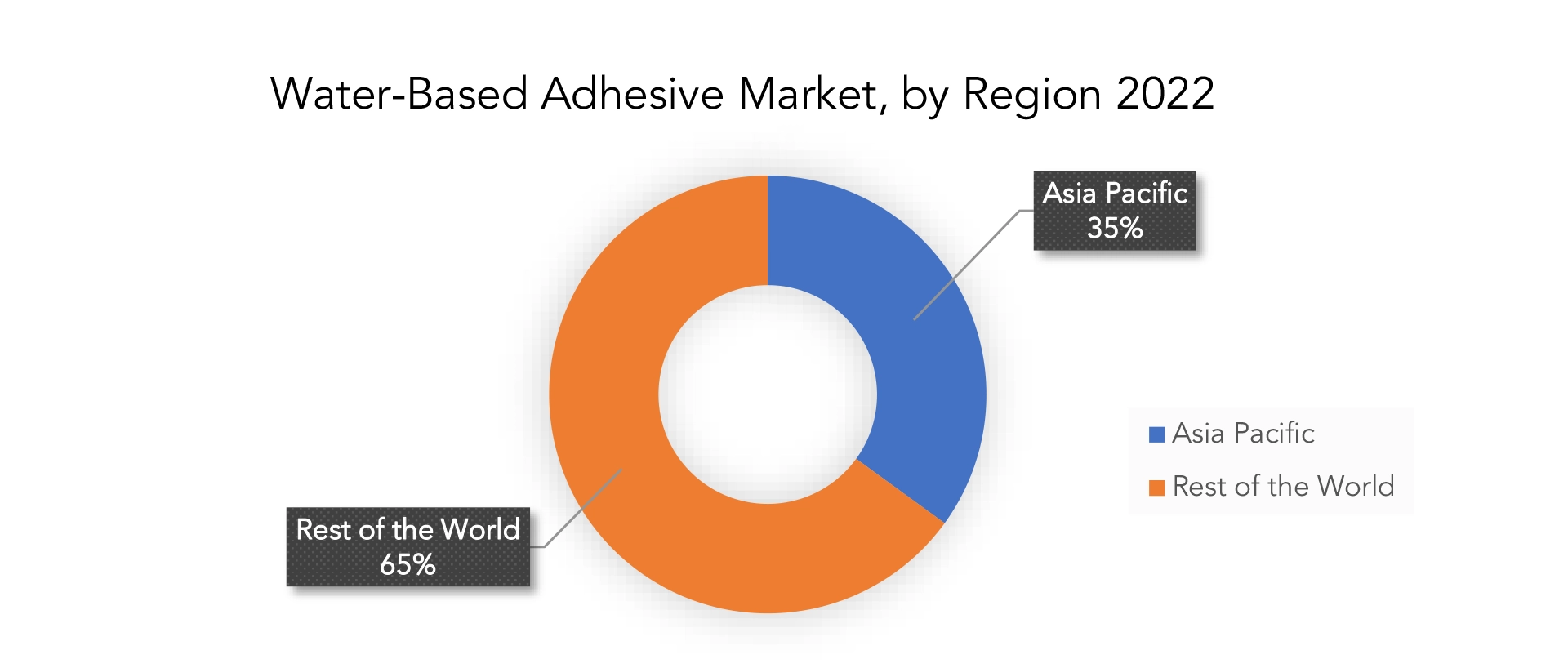

In 2021, the water-based adhesive market’s largest market share was in the Asia-Pacific region. The enormous potential for the packaging, automotive, coating, and paints sectors in growing countries like China and India predicts significant growth for the regional industry. The Asia-Pacific region may have significant growth potential as these countries strengthen the market by constructing multiple production facilities for various end-user industries. Vendors of water-based glue in the Asia-Pacific region might have particularly high expectations for building and packaging. The consumer shift towards flexible packaging may also have a significant positive impact on the expanding Asia-Pacific water-based adhesive industry.

The market for water-based adhesive is anticipated to increase significantly with the help of the North American market. The market size for water-based adhesives in North America, led by Canada, and the US, may see an increase trend as a result of government-established regulations for green products and possibilities for more construction. Water-based glue manufacturers might look into new business potential as internet shopping increases in North America. Due to the demand for non-residential development and consumer expenditure on home furnishings, the requirement for water-based adhesives used in building and construction applications has increased.

Key Market Segments: Water-Based Adhesive Market

Water-Based Adhesive Market By Resin Type, 2020-2029, (USD Billion, Kilotons)

- Acrylic Polymer Emulsion (PAE)

- Polyvinyl Acetate (PVA) Emulsion

- Vinyl Acetate Ethylene (VAE) Emulsion

- Styrene Butadiene (SB) Latex

- Polyurethane Dispersions (PUD)

- Vinyl Acetate Acrylates (VAA)

Water-Based Adhesive Market By Product Type, 2020-2029, (USD Billion, Kilotons)

- Vinyl Acetate Adhesives

- Starch/Dextrin Adhesives

- Rubber Latex Adhesives

- Protein/ Casein Adhesives

Water-Based Adhesive Market By Application, 2020-2029, (USD Billion, Kilotons)

- Tapes & Labels

- Paper & Packaging

- Building & Construction

- Automotive & Transportation

- Consumer & DIY

- Leather & Footwear

- Sports & Leisure

- Assembly

Water-Based Adhesive Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new product type

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the water-based adhesive market over the next 7 years?

- Who are the major players in the water-based adhesive market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the water-based adhesive market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the water-based adhesive market?

- What is the current and forecasted size and growth rate of the global water-based adhesive market?

- What are the key drivers of growth in the water-based adhesive market?

- Who are the major players in the market and what is their market share?

- What are the applications and supply chain dynamics in the water-based adhesive market?

- What are the technological advancements and innovations in the water-based adhesive market and their impact on product type development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the water-based adhesive market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the water-based adhesive market?

- What are the product offering and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL WATER-BASED ADHESIVE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON WATER-BASED ADHESIVE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL WATER-BASED ADHESIVE MARKET OUTLOOK

- GLOBAL WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION, KILOTONS), 2020-2029

- ACRYLIC POLYMER EMULSION (PAE)

- POLYVINYL ACETATE (PVA) EMULSION

- VINYL ACETATE ETHYLENE (VAE) EMULSION

- STYRENE BUTADIENE (SB) LATEX

- POLYURETHANE DISPERSIONS (PUD)

- VINYL ACETATE ACRYLATES (VAA)

- GLOBAL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION, KILOTONS), 2020-2029

- VINYL ACETATE ADHESIVES

- STARCH/DEXTRIN ADHESIVES

- RUBBER LATEX ADHESIVES

- PROTEIN/ CASEIN ADHESIVES

- GLOBAL WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION, KILOTONS), 2020-2029

- TAPES & LABELS

- PAPER & PACKAGING

- BUILDING & CONSTRUCTION

- AUTOMOTIVE & TRANSPORTATION

- CONSUMER & DIY

- LEATHER & FOOTWEAR

- SPORTS & LEISURE

- ASSEMBLY

- GLOBAL WATER-BASED ADHESIVE MARKET BY REGION (USD BILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- 3M COMPANY

- HENKEL CORPORATION

- B. FULLER COMPANY

- THE DOW CHEMICAL CO.

- SIKA AG

- APPLIED ADHESIVES

- PALMETTO ADHESIVES COMPANY

- SOLENIS

- BASF SE

- ARKEMA GROUP (BOSTIK SA)

- ILLINOIS TOOL WORKS

- AVERY DENNISON

- HUNTSMAN INTERNATIONAL

- ASHLAND

- AKZO NOBEL*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 4 GLOBAL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 5 GLOBAL WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 6 GLOBAL WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 7 GLOBAL WATER-BASED ADHESIVE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL WATER-BASED ADHESIVE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 US WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 18 US WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 19 US WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 20 US WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 21 US WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 22 US WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 CANADA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 26 CANADA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 27 CANADA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 28 CANADA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 29 MEXICO WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 32 MEXICO WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 33 MEXICO WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 MEXICO WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 BRAZIL WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 46 BRAZIL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 47 BRAZIL WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 48 BRAZIL WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 ARGENTINA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 52 ARGENTINA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 53 ARGENTINA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 54 ARGENTINA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 COLOMBIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 58 COLOMBIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 59 COLOMBIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 COLOMBIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 INDIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 78 INDIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 79 INDIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 80 INDIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 81 CHINA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 84 CHINA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 85 CHINA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 86 CHINA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 JAPAN WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 90 JAPAN WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 91 JAPAN WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 92 JAPAN WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 117 EUROPE WATER-BASED ADHESIVE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE WATER-BASED ADHESIVE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 122 EUROPE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 123 EUROPE WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 124 EUROPE WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 125 GERMANY WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 128 GERMANY WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 129 GERMANY WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 130 GERMANY WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 131 UK WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 132 UK WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 133 UK WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 134 UK WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 135 UK WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 136 UK WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 FRANCE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 140 FRANCE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 141 FRANCE WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 142 FRANCE WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 ITALY WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 146 ITALY WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 147 ITALY WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 ITALY WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 SPAIN WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 152 SPAIN WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 153 SPAIN WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 154 SPAIN WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 RUSSIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 158 RUSSIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 159 RUSSIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 RUSSIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 175 UAE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 176 UAE WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 177 UAE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 178 UAE WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 179 UAE WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 180 UAE WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA WATER-BASED ADHESIVE MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL WATER-BASED ADHESIVE MARKET BY RESIN TYPE, USD BILLION, 2020-2029

FIGURE 6 GLOBAL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 7 GLOBAL WATER-BASED ADHESIVE MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 8 GLOBAL WATER-BASED ADHESIVE MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 9 PORTER’S FIVE FORCES MODEL

FIGURE 10 GLOBAL WATER-BASED ADHESIVE MARKET BY RESIN TYPE, USD BILLION, 2021

FIGURE 11 GLOBAL WATER-BASED ADHESIVE MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 12 GLOBAL WATER-BASED ADHESIVE MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 13 GLOBAL WATER-BASED ADHESIVE MARKET BY REGION, USD BILLION, 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 3M COMPANY: COMPANY SNAPSHOT

FIGURE 16 HENKEL CORPORATION: COMPANY SNAPSHOT

FIGURE 17 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 18 THE DOW CHEMICAL CO.: COMPANY SNAPSHOT

FIGURE 19 SIKA AG: COMPANY SNAPSHOT

FIGURE 20 APPLIED ADHESIVES: COMPANY SNAPSHOT

FIGURE 21 PALMETTO ADHESIVES COMPANY: COMPANY SNAPSHOT

FIGURE 22 SOLENIS: COMPANY SNAPSHOT

FIGURE 23 BASF SE: COMPANY SNAPSHOT

FIGURE 24 ARKEMA GROUP (BOSTIK SA): COMPANY SNAPSHOT

FIGURE 25 ILLINOIS TOOL WORKS: COMPANY SNAPSHOT

FIGURE 26 AVERY DENNISON: COMPANY SNAPSHOT

FIGURE 27 HUNTSMAN INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 28 ASHLAND: COMPANY SNAPSHOT

FIGURE 29 AKZO NOBEL: COMPANY SNAPSHOT

FAQ

The water-based adhesive market size had crossed USD 18.32 Billion in 2020 and will observe a CAGR of more than 7% up to 2029.

Rising focus on development of sustainable & eco-friendly products, increasing adoption of water based adhesives in packaging and footwear industries, and increasing usage of acrylic dispersion adhesives in the construction industry are factors driving market growth.

The region’s largest share is in Asia Pacific. Products manufactured in nations like India and China that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.