REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 8.10 Billion by 2030 | 20 % | North America |

| by Type | by Product |

|---|---|

|

|

SCOPE OF THE REPORT

Smart Door Lock Market Overview

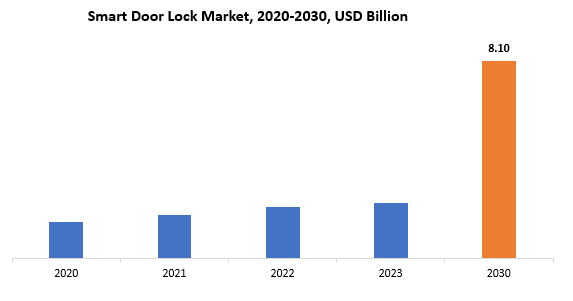

The global Smart Door Lock market is anticipated to grow from USD 2.26 Billion in 2023 to USD 8.10 Billion by 2030, at a CAGR of 20 % during the forecast period.

The industry that develops and offers cutting-edge locking systems for residential, commercial, and industrial doors is known as the “smart door lock market.” Smart door locks, in contrast to conventional mechanical locks, incorporate electronic parts and networking capabilities, allowing users to manage access remotely via smartphones, tablets, or other linked gadgets. These cutting-edge locks provide increased flexibility, convenience, and security because they can be controlled and observed from any location with an internet connection. The ability of smart door locks to allow or prohibit access via a variety of authentication techniques, including PIN codes, biometrics (like fingerprints or facial recognition), and virtual keys sent via smartphone apps, is one of their primary features. This improves security and gives businesses and homeowners comprehensive access logs so they can monitor who comes and goes from a property and when.

Because of the convenience that remote access control offers, the growing acceptance of smart home technologies, and growing awareness of security concerns, the market for smart door locks has experienced significant growth. Smart door locks are frequently incorporated into bigger smart home or building automation systems as the Internet of Things (IoT) ecosystem grows, resulting in a seamless and networked living or working environment. Additionally, a wide range of consumer preferences and needs are met by the smart door lock market, which offers a selection of designs, styles, and functionalities to fit various applications. The market for smart door locks is anticipated to develop further as technology breakthroughs fuel innovation in the security sector, bringing new features and capabilities to suit the changing needs of consumers and businesses alike.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2030 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2030 |

| Historical period | 2019-2021 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, Product and Region |

| By Type |

|

| By Product |

|

|

By Region

|

|

Smart Door Lock Market Segmentation Analysis

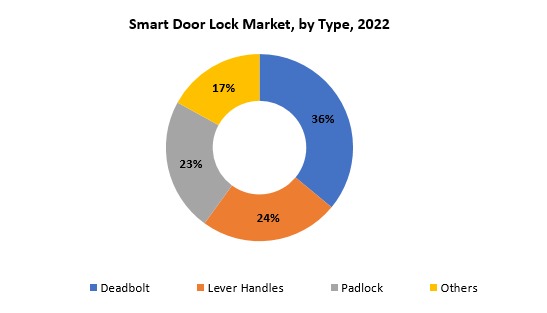

The global Smart Door Lock market is divided into three type, product and region. By type it is divided as Deadbolt, Lever Handles, Padlock, and Others. Deadbolt holds largest market share. The market for smart door locks is divided into different segments according to their designs and uses. With the biggest market share among these varieties, deadbolts are clearly the most popular category. Because of their strong and dependable locking mechanisms, deadbolts are a popular option for both residential and commercial applications. Unlike conventional spring-bolt locks, these locks usually extend a solid metal bolt into the door frame, adding an extra degree of security.

The reason deadbolts are so popular in the market is because they have a long history of providing robust protection against forced entry and unauthorized access. By enabling users to control and monitor access remotely via smart devices, smart deadbolts further improve these security features. The widespread use of smart deadbolts in contemporary security systems is partly due to their integration with electronic keypads, biometric sensors, and connectivity options. Even though deadbolts account for the lion’s share of the market, other varieties of smart door locks, like lever handles, padlocks, and other options, also add to the industry’s diversity. Lever handles offer a practical and easily accessible choice, particularly in business environments, whereas padlocks can be used to secure gates, sheds, or other external buildings.

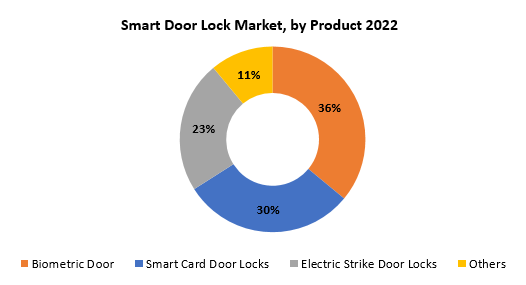

By product it is divided into Biometric Door, Smart Card Door Locks, Electric Strike Door Locks, and Others. In this Biometric Door Lock holds the largest market share. The smart door lock industry is divided into product categories, each of which serves a particular set of security requirements and user preferences. The main classifications consist of Electric Strike Door Locks, Biometric Door Locks, Smart Card Door Locks, and a Miscellaneous category with other creative designs. These products use cutting-edge technologies to offer convenient and safe access control solutions. Biometric door locks authenticate and authorize access using distinct physiological or behavioural traits like fingerprints, facial recognition, or iris scans. Because biometrics are hard to duplicate, they provide an additional layer of security that increases the smart door lock system’s dependability.

Conversely, smart card door locks rely on users presenting electronic cards or key fobs to the lock for verification. These cards offer a practical and contactless way to access the lock by utilizing NFC (Near Field Communication) or RFID (Radio-Frequency Identification) technology. The conventional strike plate on the door frame is replaced by an electronically controlled metal plate in electric strike door locks. The electric strike opens doors by disengaging the bolt or latch when it is triggered. These locks are well-liked for their longevity and compatibility with a range of door types, and they are frequently utilized in conjunction with other access control systems. The “Others” category in the product segmentation may include emerging or unique smart door lock designs that don’t fit into the specific Biometric, Smart Card, or Electric Strike classifications. This category represents the ongoing innovation and diversity within the smart door lock market as manufacturers explore new technologies and features.

Smart Door Lock Market Dynamics

Driver

Smart door locks provide features such as remote monitoring, real-time alerts, and integration with other security systems, enhancing overall security.

Through a web portal or mobile app, users can keep an eye on the condition of their door locks from a distance. They are able to ascertain the security status of their property in real time by doing this and seeing if the door is locked or not. Those who wish to monitor their home’s security while on vacation will find this feature to be extremely helpful. Users’ smartphones or other linked devices can receive real-time alerts and notifications from smart door locks. When the door is unlocked, users receive alerts that tell them who entered the property and when. By alerting users to any unauthorized access attempts, this instant notification system improves security. A lot of smart door locks are compatible with more comprehensive home security systems.

Smart door locks frequently keep thorough access logs that document the day, time, and mode of entry (e.g., physical key, PIN code, smartphone app) for every lock/unlock event. Users can review and track who has accessed the property over time with the help of access history logs. Certain sophisticated smart door locks provide fingerprint recognition and other biometric authentication techniques. Because biometrics are unique to each person and increase the difficulty of unauthorized individuals gaining access, they provide an additional layer of security. Tamper detection features on smart door locks can sound alarms in the event that someone tries to force open or tamper with the lock. This can involve physically manipulating the lock mechanism or receiving alerts for repeated unsuccessful attempts at entry.

Restraint

While smart locks are designed to enhance security, there may be concerns about the vulnerability of connected devices to hacking or unauthorized access.

Like any other connected device, smart locks can have cybersecurity vulnerabilities. Inadequate security measures may leave them open to hacker attacks and open the door for unauthorized people to enter a person’s house. Data such as user access logs and authentication details are frequently gathered and stored by smart locks. Users become concerned about privacy when they fear that if the smart lock system is compromised, their personal information may be misused or compromised. Firmware and software are essential to the functioning of smart locks. If any of these parts are vulnerable, hackers might be able to use them to control the lock, get around security measures, or change access rights. Networks are used to facilitate communication between smart locks and the related mobile applications or home automation platforms.

Users run the risk of unauthorized access if they use weak passwords or don’t use the right authentication procedures. Similarly, it could be exploited by attackers if manufacturers don’t implement strong authentication protocols. Another issue with the smart lock is its physical security. Any tampering with the physical device could jeopardize the lock’s overall security. Over time, security flaws could be found, and in order to fix these problems, manufacturers must promptly release firmware and software updates. A smart lock may be more open to hacking if it doesn’t have a way to receive updates on a regular basis or if users forget to apply them.

Opportunities

Consumer awareness regarding the importance of home security and the convenience offered by smart door locks continues to drive demand.

A growing number of consumers are investigating cutting-edge solutions like smart door locks as a result of growing concerns about home security brought on by things like rising crime rates and a desire for greater safety. A proactive approach to residential space security has been motivated by the awareness of potential threats. Convenience is becoming more and more important to consumers in their daily lives. The capacity to remotely operate and keep an eye on door locks, allow guests access, and get real-time notifications is in line with the contemporary way of life, where people appreciate quick and easy fixes. Publications such as news articles, reviews, and essays all contribute to educating consumers about the advantages of smart door locks. Sharing information via social media, internet platforms, and word-of-mouth referrals raises awareness and understanding.

A greater understanding of the potential provided by networked devices has resulted from the wider adoption of smart home technologies. It makes sense to incorporate smart door locks into a whole smart home ecosystem as consumers embrace smart lighting, thermostats, and security cameras. Through marketing and advertising campaigns, manufacturers and retailers have been instrumental in increasing awareness. Key tactics have included highlighting the features of smart door locks, stressing the security advantages, and presenting actual situations where these gadgets are convenient.

Smart Door Lock Market Trends

-

Manufacturers of smart door locks were concentrating on creating a smooth interface with well-known smart home systems like Apple HomeKit, Google Assistant, and Amazon Alexa. As part of a larger connected home system, users can now monitor and control their smart door locks thanks to this integration.

-

Integration of biometric authentication techniques—like facial and fingerprint recognition—was becoming more and more common. Biometric features improve security and give users individualized, convenient access control.

-

There was a demand for smart door locks with monitoring and remote access features. Users value being able to use mobile apps to remotely monitor access, lock and unlock doors, and receive real-time notifications.

-

Through marketing and advertising campaigns, manufacturers and retailers have been instrumental in increasing awareness. Key tactics have included highlighting the features of smart door locks, stressing the security advantages, and presenting actual situations where these gadgets are convenient.

-

Industry associations, manufacturers, and proponents of technology have undertaken educational campaigns to enlighten consumers about the features and benefits of smart door locks. Consumers can make educated decisions with the aid of webinars, tutorials, and product demonstrations.

Competitive Landscape

The competitive landscape of the Smart Door Lock market was dynamic, with several prominent companies competing to provide innovative and advanced Smart Door Lock solutions.

- Assa Abloy

- Allegion

- Dormakaba

- Samsung SDS

- Honeywell

- Schlage

- August Home

- Kwikset

- Ultraloq

- Gate Labs

- Nuki

- Igloohome

- Lockitron

- Danalock

- Salto Systems

- Aventsecurity

- Xeeder

- Haven

- Panasonic

- Yale

Recent Developments:

December 19, 2023: Panasonic Life Solutions India (PLSIND) and Panasonic Corporation (PC) in collaboration with a leading seed stage venture capital (VC) – 100X.VC announced the shortlist of 12 start-ups from over 140 entries received for the ‘Panasonic Ignition’ Corporate Innovation accelerator program. Panasonic aims to mentor, guide, and fund early to mid-stage startups that are creating innovative solutions in the field of Energy Management for commercial spaces.

December 8, 2023: Honeywell To Strengthen Building Automation Business With Acquisition Of Carrier’s Global Access Solutions. Purchase price of $4.95 billion represents ~13x 2023E EBITDA, inclusive of tax benefits and run-rate cost synergies. Acquisition will strengthen Honeywell’s strategic alignment to the megatrend of automation, underpinned by digitalization.

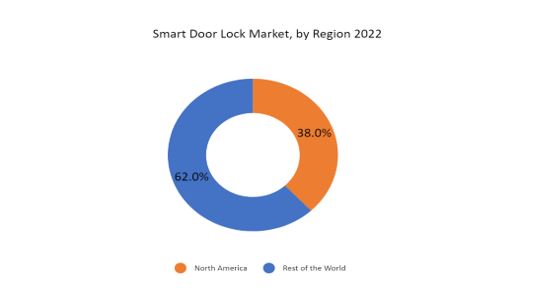

Regional Analysis

North America accounted for the largest market in the Smart Door Lock market. North America accounted for 38% of the worldwide market value. The increasing focus on home security is a major driver of market expansion. The adoption of smart door locks has been accelerated by consumers’ search for cutting-edge security solutions in response to growing concerns about break-ins and illegal access. By providing features like remote monitoring, biometric authentication, and integration with other smart home systems, these devices improve overall security. The competitive environment and wide range of new products being introduced by various players define the North American market. In order to provide cutting-edge features and functionality, both established businesses and startups are investing in research and development, which is fostering a dynamic market environment. A wider range of consumers can now afford smart door locks thanks to price competition and increased product offerings brought about by this competition.

Furthermore, a major trend now is the integration of smart door locks with platforms and ecosystems for smart homes. A growing number of customers want their security systems to work seamlessly with other smart devices, like voice assistants, smart lighting, and cameras. By improving the whole home automation experience, this integration encourages smart door locks to become a standard feature of the connected home. The market has been further stimulated by legislative support and programs that encourage energy efficiency and home automation. In North America, smart home technology is being actively endorsed by governments and industry associations to build safer and more energy-efficient dwellings. This backing has made smart door locks more widely accepted and established them as necessary elements of contemporary, intelligent homes.

Target Audience for Smart Door Lock Market

- Homeowners

- Property Managers

- Real Estate Developers

- Security System Integrators

- Technology Enthusiasts

- Smart Home Device Retailers

Import & Export Data for Smart Door Lock Market

Exactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Smart Door Lock market. This knowledge equips businesses with strategic advantages, such as:

- Identifying emerging markets with untapped potential.

- Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.

- Navigating competition by assessing major players’ trade dynamics.

Key insights

-

Trade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Smart Door Lock market. This data-driven exploration empowers readers with a deep understanding of the market’s trajectory.

-

Market players: gain insights into the leading players driving the Smart Door Lock trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.

-

Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry’s global footprint.

-

Product breakdown: by segmenting data based on Smart Door Lock types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.

Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids government in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential component for comprehensive and informed analyses.

Segments Covered in the Smart Door Lock Market Report

Home Fitness Equipment Market by Type, 2020-2030, (USD Billion) (Thousand Units)

- Deadbolt

- Lever Handles

- Padlock

- Others

Home Fitness Equipment Market by Product, 2020-2030, (USD Billion) (Thousand Units)

- Biometric Door

- Smart Card Door Locks

- Electric Strike Door Locks

- Others

Home Fitness Equipment Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Key Question Answered

- What is the expected growth rate of the Smart Door Lock market over the next 7 years?

- Who are the major players in the Smart Door Lock market and what is their market share?

- What are the end-user industries driving market demand and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, the middle east, and Africa?

- How is the economic environment affecting the Smart Door Lock market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Smart Door Lock market?

- What is the current and forecasted size and growth rate of the global Smart Door Lock market?

- What are the key drivers of growth in the Smart Door Lock market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Smart Door Lock market?

- What are the technological advancements and innovations in the Smart Door Lock market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Smart Door Lock market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Smart Door Lock market?

- What are the product offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL GREETING CARDS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GREETING CARDS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL GREETING CARDS MARKET OUTLOOK

- GLOBAL GREETING CARDS MARKET BY TYPE, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ECARD

- TRADITIONAL CARD

- GLOBAL GREETING CARDS MARKET BY PRODUCT, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- ONLINE

- OFFLINE

- GLOBAL GREETING CARDS MARKET BY REGION, 2020-2030, (USD BILLION) (THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCT OFFERED, RECENT DEVELOPMENTS)

- HALLMARK CARDS, INC.

- AMERICAN GREETINGS CORPORATION

- PAPYRUS

- CARLTON CARDS

- ARCHIES LIMITED

- PAPERCHASE

- MOONPIG

- AVANTI PRESS

- CLINTONS

- NOBLEWORKS CARDS

- CARD FACTORY

- CURRENT CATALOG

- UNICEF

- ETSY

- MINTED

- DAYSPRING CARDS

- DESIGNER GREETINGS

- GRAPHIQUE DE FRANCE

- CARDTHARTIC

- RECYCLED PAPER GREETINGS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 3 GLOBAL GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 4 GLOBAL GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 5 GLOBAL GREETING CARDS MARKET BY REGION (USD BILLION) 2020-2030

TABLE 6 GLOBAL GREETING CARDS MARKET BY REGION (THOUSAND UNITS) 2020-2030

TABLE 7 NORTH AMERICA GREETING CARDS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA GREETING CARDS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 9 NORTH AMERICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 NORTH AMERICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 11 NORTH AMERICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 12 NORTH AMERICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 13 US GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 14 US GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 15 US GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 16 US GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 17 CANADA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 18 CANADA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 19 CANADA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 20 CANADA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 21 MEXICO GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 22 MEXICO GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 23 MEXICO GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 24 MEXICO GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 25 SOUTH AMERICA GREETING CARDS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 26 SOUTH AMERICA GREETING CARDS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 27 SOUTH AMERICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 28 SOUTH AMERICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 29 SOUTH AMERICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 30 SOUTH AMERICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 31 BRAZIL GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 BRAZIL GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 33 BRAZIL GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 34 BRAZIL GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 35 ARGENTINA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ARGENTINA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 37 ARGENTINA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 38 ARGENTINA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 39 COLOMBIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 40 COLOMBIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 41 COLOMBIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 42 COLOMBIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 43 REST OF SOUTH AMERICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 44 REST OF SOUTH AMERICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 45 REST OF SOUTH AMERICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 46 REST OF SOUTH AMERICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 47 ASIA-PACIFIC GREETING CARDS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 48 ASIA-PACIFIC GREETING CARDS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 49 ASIA-PACIFIC GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 50 ASIA-PACIFIC GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 51 ASIA-PACIFIC GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 52 ASIA-PACIFIC GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 53 INDIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 INDIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 55 INDIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 56 INDIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 57 CHINA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 58 CHINA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 59 CHINA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 60 CHINA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 61 JAPAN GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 62 JAPAN GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 63 JAPAN GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 64 JAPAN GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 65 SOUTH KOREA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 66 SOUTH KOREA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 67 SOUTH KOREA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 68 SOUTH KOREA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 69 AUSTRALIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 AUSTRALIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 71 AUSTRALIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 72 AUSTRALIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 73 SOUTH-EAST ASIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 74 SOUTH-EAST ASIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 75 SOUTH-EAST ASIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 76 SOUTH-EAST ASIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 77 REST OF ASIA PACIFIC GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 78 REST OF ASIA PACIFIC GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 79 REST OF ASIA PACIFIC GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 80 REST OF ASIA PACIFIC GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 81 EUROPE GREETING CARDS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 82 EUROPE GREETING CARDS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 83 EUROPE GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 84 EUROPE GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 85 EUROPE GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 86 EUROPE GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 87 GERMANY GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 88 GERMANY GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 89 GERMANY GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 90 GERMANY GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 91 UK GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 UK GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 93 UK GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 94 UK GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 95 FRANCE GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 96 FRANCE GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 97 FRANCE GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 98 FRANCE GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 99 ITALY GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 100 ITALY GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 101 ITALY GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 102 ITALY GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 103 SPAIN GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 104 SPAIN GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 105 SPAIN GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 106 SPAIN GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 107 RUSSIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 108 RUSSIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 109 RUSSIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 110 RUSSIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 111 REST OF EUROPE GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 112 REST OF EUROPE GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 113 REST OF EUROPE GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 114 REST OF EUROPE GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 115 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 116 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY COUNTRY (THOUSAND UNITS) 2020-2030

TABLE 117 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 118 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 119 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 120 MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 121 UAE GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 122 UAE GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 123 UAE GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 124 UAE GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 125 SAUDI ARABIA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 126 SAUDI ARABIA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 127 SAUDI ARABIA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 128 SAUDI ARABIA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 129 SOUTH AFRICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 130 SOUTH AFRICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 131 SOUTH AFRICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 132 SOUTH AFRICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

TABLE 133 REST OF MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 134 REST OF MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY TYPE (THOUSAND UNITS) 2020-2030

TABLE 135 REST OF MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

TABLE 136 REST OF MIDDLE EAST AND AFRICA GREETING CARDS MARKET BY PRODUCT (THOUSAND UNITS) 2020-2030

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL GREETING CARDS MARKET BY TYPE (USD BILLION) 2020-2030

FIGURE 9 GLOBAL GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2020-2030

FIGURE 11 GLOBAL GREETING CARDS MARKET BY REGION (USD BILLION) 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL GREETING CARDS MARKET BY TYPE (USD BILLION) 2022

FIGURE 14 GLOBAL GREETING CARDS MARKET BY PRODUCT (USD BILLION) 2022

FIGURE 16 GLOBAL GREETING CARDS MARKET BY REGION (USD BILLION) 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 HALLMARK CARDS, INC.: COMPANY SNAPSHOT

FIGURE 19 AMERICAN GREETINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 20 PAPYRUS: COMPANY SNAPSHOT

FIGURE 21 CARLTON CARDS: COMPANY SNAPSHOT

FIGURE 22 ARCHIES LIMITED: COMPANY SNAPSHOT

FIGURE 23 PAPERCHASE: COMPANY SNAPSHOT

FIGURE 24 MOONPIG: COMPANY SNAPSHOT

FIGURE 25 AVANTI PRESS: COMPANY SNAPSHOT

FIGURE 26 CLINTONS: COMPANY SNAPSHOT

FIGURE 27 NOBLEWORKS CARDS: COMPANY SNAPSHOT

FIGURE 28 CARD FACTORY: COMPANY SNAPSHOT

FIGURE 29 CURRENT CATALOG: COMPANY SNAPSHOT

FIGURE 30 UNICEF: COMPANY SNAPSHOT

FIGURE 31 ETSY: COMPANY SNAPSHOT

FIGURE 32 MINTED: COMPANY SNAPSHOT

FIGURE 33 DAYSPRING CARDS: COMPANY SNAPSHOT

FIGURE 34 DESIGNER GREETINGS: COMPANY SNAPSHOT

FIGURE 35 GRAPHIQUE DE FRANCE: COMPANY SNAPSHOT

FIGURE 36 CARDTHARTIC: COMPANY SNAPSHOT

FIGURE 37 RECYCLED PAPER GREETINGS: COMPANY SNAPSHOT

FAQ

The global Smart Door Lock market is anticipated to grow from USD 2.26 Billion in 2023 to USD 8.10 Billion by 2030, at a CAGR of 20 % during the forecast period.

North America accounted for the largest market in the Smart Door Lock market. North America accounted for 38 % market share of the global market value.

Assa Abloy, Allegion, Dormakaba, Samsung SDS, Honeywell, Schlage, August Home, Kwikset, Ultraloq, Gate Labs, Nuki, Igloohome, Lockitron, Danalock, Salto Systems

Through marketing and advertising campaigns, manufacturers and retailers have been instrumental in increasing awareness. Key tactics have included highlighting the features of smart door locks, stressing the security advantages, and presenting actual situations where these gadgets are convenient. Industry associations, manufacturers, and proponents of technology have undertaken educational campaigns to enlighten consumers about the features and benefits of smart door locks. Consumers can make educated decisions with the aid of webinars, tutorials, and product demonstrations.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.