REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

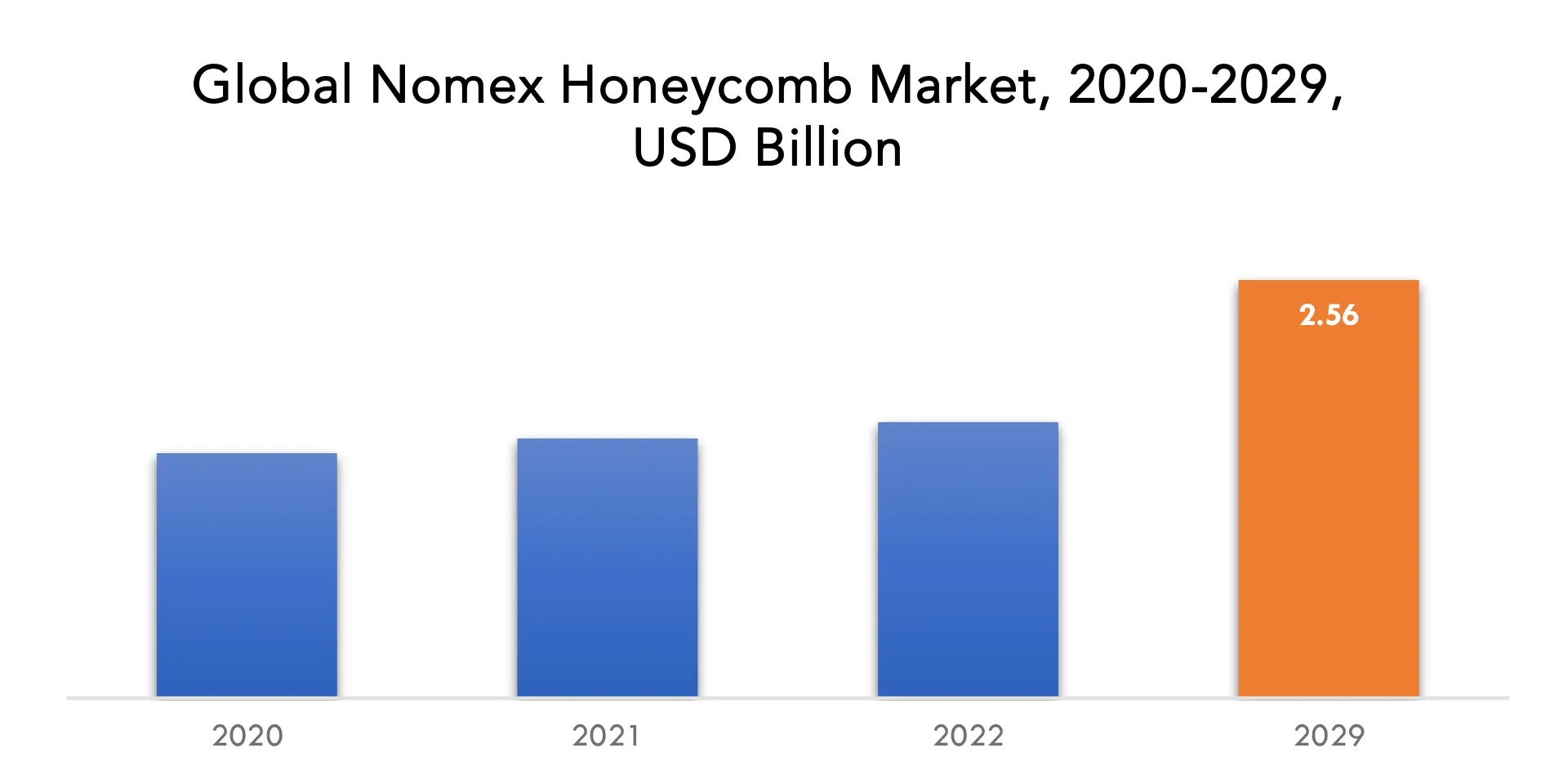

| USD 2.56 billion by 2029 | 6.1% | North America |

| by Type | by Application | by Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Nomex Honeycomb Market Overview

The nomex honeycomb market is expected to grow at 6.1 % CAGR from 2022 to 2029. It is expected to reach above USD 2.56 billion by 2029 from USD 1.5 billion in 2020.

With a high strength to weight ratio and an aramid fiber composition, Nomex honeycomb is a lightweight, flexible material. Its principal characteristics are compatibility with the majority of sandwich composite adhesives, fire and corrosion resistance, thermal insulation, outstanding dielectric capabilities, and improved thermal stability. Due to these characteristics, it can be used for radomes, antennas, flooring, military shelters, and rotor blades for helicopters, fuel tanks, and navy bulkhead joiner panels.

Increased demand for lightweight materials in the aerospace & defense and automotive industries is what is fueling the growth of the worldwide nomex honeycomb market. Additionally, this material’s exceptional compatibility with the majority of adhesives used in sandwich composites drives the industry. But nomex honeycomb’s expensive price restrains market expansion.

The nomex honeycomb industry is expanding as a result of a rise in composite usage in the aerospace and defense sectors. In addition, nomex honeycomb’s great compatibility with any composite material fuels industry expansion. However, the ability of honeycomb’s open cell structures to absorb water and moisture limits the market’s ability to expand. In the years to come, it is anticipated that the use of nomex honeycomb in emerging and novel applications would increase demand for the product.

In the coming years, the worldwide nomex honeycomb market is expected to develop due to the expanding usage of composite materials in the aerospace and defense industries. In addition, the increased demand for nomex honeycomb from the rail transportation industry is anticipated to support the market’s expansion over the coming years. In the near future, it is anticipated that the market will continue to develop due to the expansion of the application base and the increased emphasis on research and development efforts.

The high cost of raw materials and the fact that honeycomb absorbs moisture and humidity due to of its open cell structure, on the other hand, is anticipated to pose a significant challenge for the leading companies functioning in the nomex honeycomb market globally. Nevertheless, the market’s major competitors are concentrating on providing inexpensive goods, which is anticipated to result in potential growth opportunities in the years to come.

Due to its small weight, high strength, and fire resistance, Nomex honeycomb presents a market with substantial prospects. The use of Nomex honeycomb in structural components, sandwich panels, and thermal insulation is advantageous in sectors like aircraft, defense, transportation, and construction. There are favourable conditions for market expansion, offering prospective growth prospects and market penetration for Nomex honeycomb products, thanks to rising demand for fuel-efficient aircraft, strict safety standards, and increasing infrastructure projects.

The Nomex honeycomb market has been greatly impacted by the COVID-19 outbreak. Nomex honeycomb, which is widely utilized in the aerospace and transportation industries, is in demand less frequently as a result of extensive supply chain disruptions and decreased industrial activity. Sales and production have decreased on the market, which has presented problems for suppliers and manufacturers. The resurgence of these sectors of the economy and the general state of the economy are key factors in market recovery.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons). |

| Segmentation | By Type, By Application, By Region. |

| By Type |

|

| By Application |

|

| By Region |

|

Nomex Honeycomb Market Segment Analysis

The nomex honeycomb market is segmented based on type and application.

The manufacture of aircraft uses a particular kind of heat-treated steel called aerospace-grade. It is recyclable and has a high tensile strength, flexibility, and resistance to corrosion. Due to its exceptional qualities, which include lightweight, strong material, and low density, the aircraft industry utilizes a significant volume of this product.

2020’s most popular application segment was aerospace and defense. Widespread use of Nomex honeycomb as a thermal barrier for crew and engine protection can be seen in military aircraft, helicopters, and other aerospace vehicles. Additionally, it gives the product strength, ballistic, and fire-resistance qualities that facilitate its use in military aircraft. Over the projected period, the market is anticipated to develop as a result of increasing demand for composites from producers of commercial aircraft, including Airbus SE.

Nomex Honeycomb Market Key Players

The nomex honeycomb market key players includes Hexcel Corporation, Euro-Composites, The Gill Corporation, Plascore, TenCate Advanced Composites, Rock West Composites, Advanced Honeycomb Technologies, Avic Composite Corporation, Advanced Composite Technology, Taili.

Recent News:

- 15 July 2022: Hexcel Corporation (NYSE: HXL) had joined with Spirit AeroSystems Europe in a strategic collaboration at its Aerospace Innovation Centre (AIC) to develop more sustainable aircraft manufacturing technologies for future aircraft production.

- 10 May 2022: Hexcel had developed a new product range that combines Hexcel resin systems made with bio-derived resin content with natural fiber reinforcements to create material solutions for Automotive, Winter Sports, Marine and Wind Energy applications.

Who Should Buy? Or Key Stakeholders

- Nomex honeycomb manufacturers

- Composite manufacturers

- Raw material suppliers

- Distributors & suppliers

- End-use industries

- Industry associations

- Investment research firms

- Others

Nomex Honeycomb Market Regional Analysis

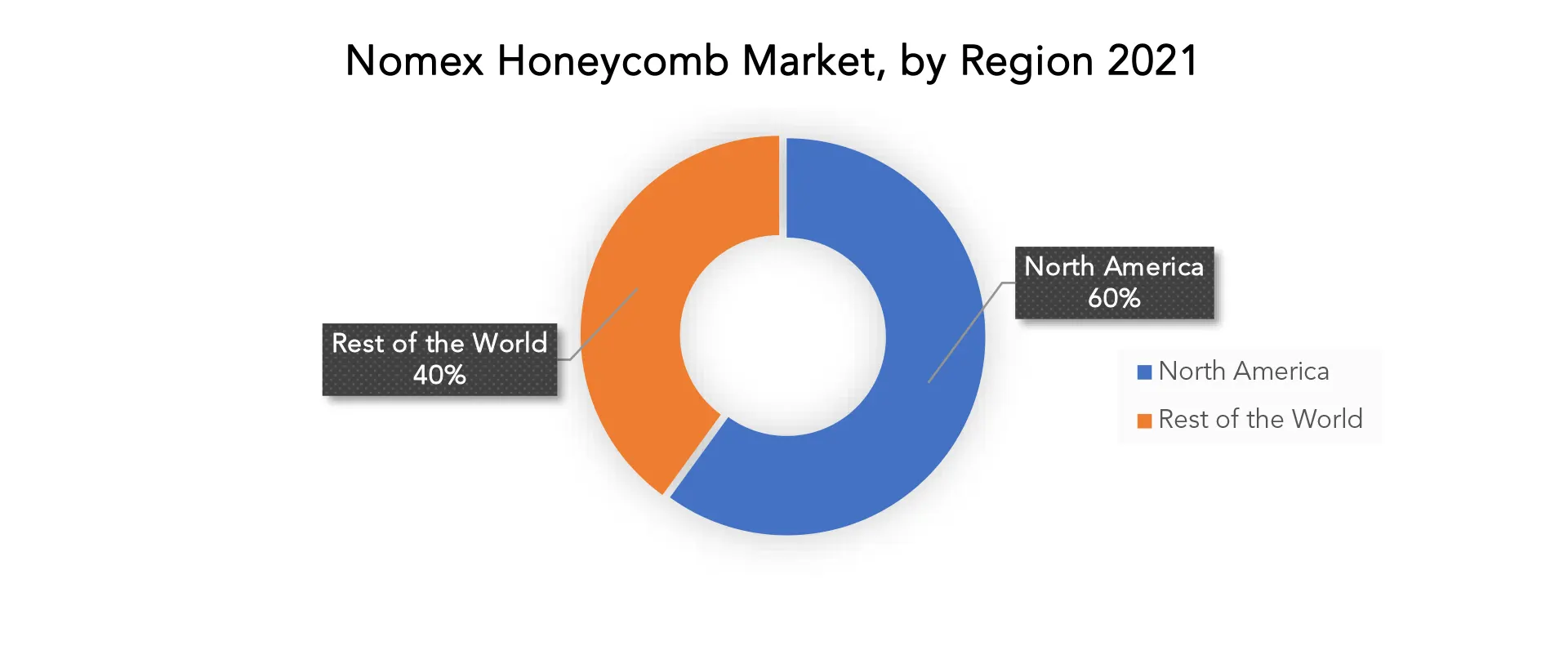

The nomex honeycomb market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North American market is anticipated to rise steadily over the course of the forecast period and is predicted to hold a significant portion of the worldwide nomex honeycomb market. The strict OHSE laws concerning the safety of industrial workers are to blame for the fast expansion of this area. The expanding defence budget is yet another important element anticipated to have a substantial impact on the growth of the North American nomex honeycomb industry in the years to come.

Additionally, it is projected that Europe would maintain its second-place position in the worldwide nomex honeycomb industry. The main drivers of this segment’s growth over the coming years are projected to be the expanding emphasis on R&D activities and the growth of the defence industry. Additionally, it is anticipated that the rapid industrialization of France and Germany would spur further expansion of the European market during the anticipated time frame.

Key Market Segments: Nomex Honeycomb Market

Nomex Honeycomb Market by Type, 2020-2029, (USD Billion), (Kilotons).

- Aerospace Grade

- Commercial Grade

Nomex Honeycomb Market by Application, 2020-2029, (USD Billion), (Kilotons).

- Aerospace & Defense

- Transportation

- Sporting Goods

- Others

Nomex Honeycomb Market by Region, 2020-2029, (USD Billion), (Kilotons).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the nomex honeycomb market over the next 7 years?

- Who are the major players in the nomex honeycomb market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the nomex honeycomb market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the nomex honeycomb market?

- What is the current and forecasted size and growth rate of the global nomex honeycomb market?

- What are the key drivers of growth in the nomex honeycomb market?

- What are the distribution channels and supply chain dynamics in the nomex honeycomb market?

- What are the technological advancements and innovations in the nomex honeycomb market and their impact on material development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the nomex honeycomb market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the nomex honeycomb market?

- What are the products offerings and specifications of leading players in the market?

- What is the pricing trend of nomex honeycomb in the market and what is the impact of raw application prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NOMEX HONEYCOMB MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NOMEX HONEYCOMB MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NOMEX HONEYCOMB MARKET OUTLOOK

- GLOBAL NOMEX HONEYCOMB MARKET BY TYPE, 2020-2029, (USD BILLION), (KILOTONS)

- AEROSPACE GRADE

- COMMERCIAL GRADE

- GLOBAL NOMEX HONEYCOMB MARKET BY APPLICATION, 2020-2029, (USD BILLION), (KILOTONS)

- AEROSPACE & DEFENSE

- TRANSPORTATION

- SPORTING GOODS

- OTHERS

- GLOBAL NOMEX HONEYCOMB MARKET BY REGION, 2020-2029, (USD BILLION), (KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- HEXCEL CORPORATION

- EURO-COMPOSITES

- THE GILL CORPORATION

- PLASCORE

- TENCATE ADVANCED COMPOSITES

- ROCK WEST COMPOSITES

- ADVANCED HONEYCOMB TECHNOLOGIES

- AVIC COMPOSITE CORPORATION

- ADVANCED COMPOSITE TECHNOLOGY

- TAILI *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL NOMEX HONEYCOMB MARKET BY REGION (USD BILLION), 2020-2029

TABLE 6 GLOBAL NOMEX HONEYCOMB MARKET BY REGION (KILOTONS), 2020-2029

TABLE 7 NORTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA NOMEX HONEYCOMB MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA NOMEX HONEYCOMB MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 13 US NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 14 US NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 15 US NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 16 US NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 17 CANADA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 18 CANADA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 19 CANADA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 20 CANADA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 21 MEXICO NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 22 MEXICO NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 MEXICO NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 24 MEXICO NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 27 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 29 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 BRAZIL NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 BRAZIL NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 33 BRAZIL NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 BRAZIL NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 35 ARGENTINA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 36 ARGENTINA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 37 ARGENTINA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 ARGENTINA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 39 COLOMBIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 40 COLOMBIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 COLOMBIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 42 COLOMBIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 44 REST OF SOUTH AMERICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 45 REST OF SOUTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 46 REST OF SOUTH AMERICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 47 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 48 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 49 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 51 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 52 ASIA-PACIFIC NOMEX HONEYCOMB MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 53 INDIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 54 INDIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 55 INDIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 56 INDIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 57 CHINA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 CHINA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 CHINA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 CHINA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 JAPAN NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 62 JAPAN NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 63 JAPAN NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 JAPAN NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 65 SOUTH KOREA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 66 SOUTH KOREA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 67 SOUTH KOREA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 68 SOUTH KOREA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 69 AUSTRALIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 AUSTRALIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 AUSTRALIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 72 AUSTRALIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 SOUTH EAST ASIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 74 SOUTH EAST ASIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 75 SOUTH EAST ASIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SOUTH EAST ASIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 77 REST OF ASIA PACIFIC NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 REST OF ASIA PACIFIC NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 79 REST OF ASIA PACIFIC NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 80 REST OF ASIA PACIFIC NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 81 EUROPE NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 82 EUROPE NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 EUROPE NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 EUROPE NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 EUROPE NOMEX HONEYCOMB MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 86 EUROPE NOMEX HONEYCOMB MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 87 GERMANY NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 GERMANY NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 GERMANY NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 90 GERMANY NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 UK NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 92 UK NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 93 UK NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 UK NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 95 FRANCE NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 FRANCE NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 97 FRANCE NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 FRANCE NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 99 ITALY NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 100 ITALY NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 ITALY NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 102 ITALY NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SPAIN NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 SPAIN NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 105 SPAIN NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 106 SPAIN NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 107 RUSSIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 RUSSIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 109 RUSSIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 RUSSIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 111 REST OF EUROPE NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 REST OF EUROPE NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 114 REST OF EUROPE NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY COUNTRY (KILOTONS), 2020-2029

TABLE 121 UAE NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 122 UAE NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 123 UAE NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 124 UAE NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 125 SAUDI ARABIA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 126 SAUDI ARABIA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 127 SAUDI ARABIA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 128 SAUDI ARABIA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 129 SOUTH AFRICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 130 SOUTH AFRICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 SOUTH AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 132 SOUTH AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 135 REST OF MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA NOMEX HONEYCOMB MARKET BY APPLICATION (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NOMEX HONEYCOMB BY TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NOMEX HONEYCOMB BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL NOMEX HONEYCOMB BY REGION, USD BILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL NOMEX HONEYCOMB BY TYPE, USD BILLION, 2021

FIGURE 13 GLOBAL NOMEX HONEYCOMB BY APPLICATION, USD BILLION, 2021

FIGURE 14 GLOBAL NOMEX HONEYCOMB BY REGION, USD BILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 HEXCEL CORPORATION: COMPANY SNAPSHOT

FIGURE 17 EURO-COMPOSITES: COMPANY SNAPSHOT

FIGURE 18 THE GILL CORPORATION: COMPANY SNAPSHOT

FIGURE 19 PLASCORE: COMPANY SNAPSHOT

FIGURE 20 TENCATE ADVANCED COMPOSITES: COMPANY SNAPSHOT

FIGURE 21 ROCK WEST COMPOSITES: COMPANY SNAPSHOT

FIGURE 22 ADVANCED HONEYCOMB TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 23 AVIC COMPOSITE CORPORATION: COMPANY SNAPSHOT

FIGURE 24 ADVANCED COMPOSITE TECHNOLOGY: COMPANY SNAPSHOT

FIGURE 25 TAILI: COMPANY SNAPSHOT

FAQ

The nomex honeycomb market is expected to grow at 6.1 % CAGR from 2022 to 2029. It is expected to reach above USD 2.56 billion by 2029 from USD 1.5 billion in 2020.

North America held more than 60 % of the nomex honeycomb market revenue share in 2021 and will witness expansion in the forecast period.

In the coming years, the worldwide nomex honeycomb market is expected to develop due to the expanding usage of composite materials in the aerospace and defense industries. In addition, the increased demand for nomex honeycomb from the rail transportation industry is anticipated to support the market’s expansion over the coming years. In the near future, it is anticipated that the market will continue to develop due to the expansion of the application base and the increased emphasis on research and development efforts.

2020’s most popular application segment was aerospace and defense. Widespread use of Nomex honeycomb as a thermal barrier for crew and engine protection can be seen in military aircraft, helicopters, and other aerospace vehicles. Additionally, it gives the product strength, ballistic, and fire-resistance qualities that facilitate its use in military aircraft. Over the projected period, the market is anticipated to develop as a result of increasing demand for composites from producers of commercial aircraft, including Airbus SE.

The North American market is anticipated to rise steadily over the course of the forecast period and is predicted to hold a significant portion of the worldwide nomex honeycomb market. The strict OHSE laws concerning the safety of industrial workers are to blame for the fast expansion of this area. The expanding defence budget is yet another important element anticipated to have a substantial impact on the growth of the North American nomex honeycomb industry in the years to come.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.