| Market Size | CAGR | Dominating Region |

|---|---|---|

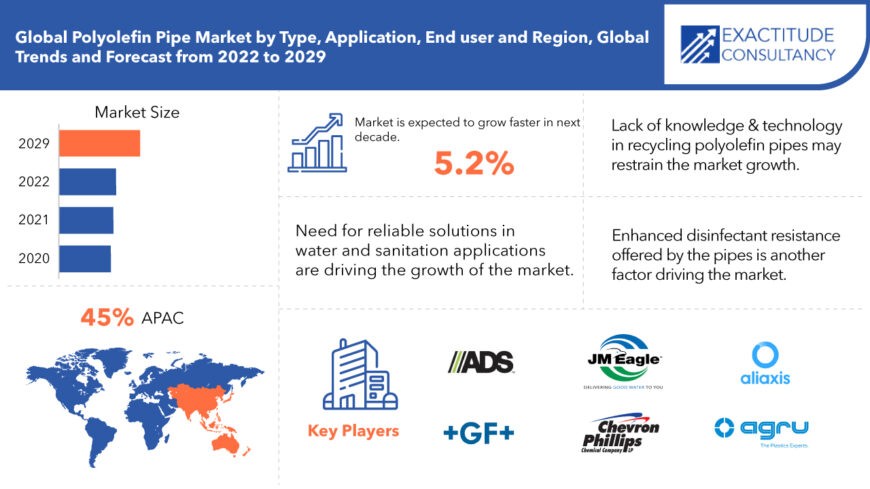

| USD 27.14 billion | 5.2% | APAC |

| By Type | By Application | By End Use Industry | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Polyolefin Pipe Market Overview

The global Polyolefin pipe market is expected to grow at 5.2% CAGR from 2022 to 2029. It is expected to reach above USD 27.14 billion by 2029 from USD 17.2 billion in 2020.

Polyolefin pipes such as polyethylene (PE) and polypropylene (PP) are commodity plastics found in applications varying from household items such as grocery bags, carpets, containers, appliances, and toys to high-tech products like industrial pipes, engineering plastics, and others. Polyolefin’s material is preferred as it is light in weight, offers easy processability, stiffness, and sealing properties. In the food and beverage industry, the utilization of polyethylene is increasing at a high rate due to the rising demand from the manufacturing of packaging materials for food and beverage. Polyolefin are a prime material in a broad variety of industries and for a big arrangement of applications, fluctuate from everyday household use to specialized industrial applications The finest recycled polyolefin made from this waste drives circularity in several markets including packaging, building and construction, agriculture, electronics, automotive, and others such as consumer goods and houseware. Polyolefin pipes are frequently changed metallic systems, chiefly due to their finest resistance to corrosion, chemical attack, and abrasion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Kilotons) |

| Segmentation | By Type, By Application, By End users, By Region |

| By Type

|

|

| By Application

|

|

| By End Users

|

|

| By Region

|

|

The global polyolefin pipe market is expected to boost with the need for reliable solutions in water and sanitation applications. Reliable and long-lasting pipe solutions are critical for reducing losses, conserving energy and providing better service to communities and industry in the future. Water and sanitation systems made of traditional pipe materials frequently experience water losses of up to 50%. Fully welded polyethylene and polypropylene pipe systems are the most efficient and reliable alternatives since they considerably reduce leakage. PE-X, PE-RT, PP-R and PB-1 sanitary plumbing systems offer safe hot and cold-water distribution inside residences and commercial buildings. Plastic pipes also perform more efficiently in sound dampening than copper pipes, resulting in increased comfort. PE and PP pipes also promise enhanced disinfectant resistance, a lower coefficient of linear thermal expansion and better low-temperature impact strength.

Various companies have recently launched new resins, especially to enhance the operations of pipes in sanitation applications. For instance, in 2021, SABIC introduced new PE and PP resins and collaborated with Tecnomatic and Aquatherm to enhance the properties of polyolefin pressure pipe for sanitation applications while cutting resin usage. The new technology offers substantial improvements over existing polyolefin pipes across the entire range of performance criteria. Higher resistance against internal pressure enables wall-thickness reduction and can reduce material use by at least 30%.

Plastic recycling has several possible environmental advantages, including lowering landfill and incineration rates and greenhouse gas emissions. However, the key problem is discovering applications where recycled plastic may successfully replace virgin plastic in terms of functioning. Incorporating recycled high-density polyethylene into polyethylene pipe grade resins is a significant problem that is not currently being addressed in the production of pressure pipes.

Polyolefin Pipe Market Segment Analysis

The global polyolefin pipe market is segmented based on type, application, end use industry and region. Based on type, the market is segmented into polypropylene pipes (PP), polyethylene pipes (PE), and plastomer. Polypropylene piping systems are broadly used for industrial purposes. These are Light in weight with better strength and reliable heat fusion welding, Polypropylene pipes also provide superior abrasion resistance and are a good electrical and thermal insulator. Polyethylene pipes are growingly being used across the gas & oil sector, due to their flexibility, longevity, resistance to abrasion, and economical benefits over lined steel pipes. Plastomer is a polymer that amalgamated a property of both plastics and elastomers. It has rubber- and plastic-like elasticity, clarity, and finish.

Based on application, the market is segmented into power and communication, waste water drainage, irrigation, and others. Polyolefin pipelines are mainly used for gas distribution and water distribution, and for wastewater disposal and sewage. Polyolefin materials have an uncommon abrasion resistance compared to other pipe materials. In comparison to steel, the wear rate of Polyethylene Pipes (PE) is lower, which is why PE has replaced metal pipes for mine tailing lines.

Based on end-user, the market is segmented into building & construction, agriculture, oil & gas, mining, municipal, telecommunication, industrial, others. Polyolefin Pipes have the capability to run the transmission and distribution of fertilizers through the water flow and by which also to raise the productivity of fertilizer utilization. It also put stop to the creation of unwanted moisture in gardens and farms, and as a result, stop breaking out some diseases such as fungal and parasitic at farms. Polyolefin pipes are mainly used in industries where the piping systems are exposed to harsh and highest weather conditions.

Polyolefin Pipe Market Players

The Polyolefin pipe market key players include Agru, Gf Piping Systems, Advanced Drainage Systems, Chevron Phillips Chemical Company, Jm Eagle, Radius Systems, Aliaxis, Prinsco, Thai-Asia P.E. Pipe Co., Ltd., United Poly Systems, Future Pipe Industries, Wl Plastics, Aquatherm, and Blue Diamond Industries.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence in order to meet the rising demand for polyolefin pipe from emerging economies.

- 12/16/2021- GF Piping Systems, a GF division, announces the acquisition of FGS Brasil Indústria e Comércio Ltda. (FGS), Cajamar (Brazil).

- As a leading manufacturer of polyethylene piping systems, FGS serves the local water and gas distribution market and other industrial segments. The acquisition will provide GF Piping Systems with a unique platform for further growth in Brazil and the South American region.

- May 17, 2022 – Future Pipe Industries delivers to the General Petroleum Company (GPC)

- Future Pipe Industries delivers to the General Petroleum Company (GPC) who successfully operate its first phase of a Gas Pipeline in the Abu Senan area, located in the Western Desert in Egypt.

Who Should Buy? Or Key Stakeholders

- Plastics Industries.

- Chemicals & Materials

- Institutional & Retail Players.

- Investment Research Firms

Polyolefin Pipe Market Regional Analysis

The polyolefin pipe market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

APAC is estimated to be the fastest-growing polyolefin pipes market during the forecast period. Among China, Japan, South Korea, India, and Rest of APAC, China was the largest consumer of polyolefin pipe in the region as of 2020 in terms of value as well as volume. Low cost of raw materials as well as their ease of availability, along with the low cost of establishing production facilities are some of the major factors driving the polyolefin pipes market in the region. Water shortages have become a prevalent issue due to a mismatch between rainfalls and population dwell. Only 20% of the world’s water is consumed from groundwater, which can no longer be considered an infinite resource. Water management that is sustainable across the entire water cycle is more vital than ever. Polyolefin piping systems can provide long-term, dependable water management solutions for future generations. Pipes constructed of HDPE convey water to households more efficiently than pipes made of competing materials.

Key Market Segments: Polyolefin Pipe Market

Polyolefin Pipe Market by Type, 2020-2029, (USD Million), (Kilotons)

- Polyethylene

- Polypropylene

- Plastomer

Polyolefin Pipe Market by Application, 2020-2029, (USD Million), (Kilotons)

- Irrigation

- Potable & Plumbing

- Wastewater Drainage

- Power & Communication

- Oil Flow Line

- Dredging Pipeline

- Fire Networks

- Others

Polyolefin Pipe Market by End Use Industry, 2020-2029, (USD Million), (Kilotons)

- Building & Construction

- Agriculture

- Oil & Gas

- Mining

- Municipal

- Telecommunication

- Industrial

- Others

Polyolefin Pipe Market by Region, 2020-2029, (USD Million), (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the polyolefin pipe market?

- What are the key factors influencing the growth of polyolefin pipe?

- What are the major applications for polyolefin pipe?

- Who are the major key players in the polyolefin pipe market?

- Which region will provide more business opportunities for polyolefin pipe in future?

- Which segment holds the maximum share of the polyolefin pipe market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polyolefin Pipes Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Polyolefin Pipes Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Polyolefin Pipes Market Outlook

- Global Polyolefin Pipes Market by Type (USD Million) (Kilotons)

- Polyethylene

- Polypropylene

- Plastomer

- Global Polyolefin Pipes Market by Application (USD Million) (Kilotons)

- Irrigation

- Potable & Plumbing

- Wastewater Drainage

- Power & Communication

- Oil flow line

- Dredging pipeline

- Fire Networks

- Others

- Global Polyolefin Pipes Market by End user (USD Million) (Kilotons)

- Building & Construction

- Agriculture

- Oil & Gas

- Mining

- Municipal

- Telecommunication

- Industrial

- Others

- Global Polyolefin Pipes Market by Region (USD Million) (Kilotons)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Belgium

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Indonesia

- Taiwan

- Malaysia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Agru, Gf Piping Systems

- Advanced Drainage Systems

- Chevron Phillips Chemical Company

- Jm Eagle

- Radius Systems

- Aliaxis

- Prinsco

- Thai-Asia P.E. Pipe Co., Ltd.

- United Poly Systems

- Future Pipe Industries

- Wl Plastics

- Aquatherm

- Blue Diamond Industries *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 3 GLOBAL POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 5 GLOBAL POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 6 GLOBAL POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 7 GLOBAL POLYOXEFIN PIPES MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL POLYOXEFIN PIPES MARKET BY REGION (KILOTONS), 2020-2029

TABLE 9 NORTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 11 NORTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 13 NORTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 15 US POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 16 US POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 17 US POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 18 US POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 19 US POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 20 US POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 21 CANADA POLYOXEFIN PIPES MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 22 CANADA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 23 CANADA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 CANADA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 25 CANADA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 26 CANADA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 27 MEXICO POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 28 MEXICO POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 29 MEXICO POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 30 MEXICO POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 31 MEXICO POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 32 MEXICO POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 33 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 34 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 35 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 36 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 37 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 38 SOUTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 39 BRAZIL POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 40 BRAZIL POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 41 BRAZIL POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 42 BRAZIL POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 43 BRAZIL POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 44 BRAZIL POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 45 ARGENTINA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 46 ARGENTINA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 47 ARGENTINA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 48 ARGENTINA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 49 ARGENTINA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 50 ARGENTINA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 51 COLOMBIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 52 COLOMBIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 53 COLOMBIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 54 COLOMBIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 55 COLOMBIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 56 COLOMBIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 57 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 58 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 59 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 60 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 63 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 64 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 65 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 67 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 68 ASIA-PACIFIC POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 69 INDIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 70 INDIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 71 INDIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 72 INDIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 73 INDIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 74 INDIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 75 CHINA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 76 CHINA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 77 CHINA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 CHINA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 79 CHINA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 80 CHINA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 81 JAPAN POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 82 JAPAN POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 83 JAPAN POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 84 JAPAN POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 85 JAPAN POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 86 JAPAN POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 87 SOUTH KOREA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 88 SOUTH KOREA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 89 SOUTH KOREA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 90 SOUTH KOREA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 91 SOUTH KOREA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 92 SOUTH KOREA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 93 AUSTRALIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 94 AUSTRALIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 95 AUSTRALIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 96 AUSTRALIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 97 AUSTRALIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 98 AUSTRALIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 99 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 100 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 101 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 102 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 103 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 104 SOUTH EAST ASIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 105 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 106 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 107 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 108 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 109 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 110 REST OF ASIA PACIFIC POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 111 EUROPE POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 112 EUROPE POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 113 EUROPE POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 114 EUROPE POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 115 EUROPE POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 116 EUROPE POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 117 GERMANY POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 118 GERMANY POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 119 GERMANY POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 120 GERMANY POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 121 GERMANY POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 122 GERMANY POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 123 UK POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 124 UK POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 125 UK POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 126 UK POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 127 UK POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 128 UK POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 129 FRANCE POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 130 FRANCE POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 131 FRANCE POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 132 FRANCE POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 133 FRANCE POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 134 FRANCE POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 135 ITALY POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 136 ITALY POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 137 ITALY POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 138 ITALY POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 139 ITALY POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 140 ITALY POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 141 SPAIN POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 142 SPAIN POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 143 SPAIN POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 144 SPAIN POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 145 SPAIN POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 146 SPAIN POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 147 RUSSIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 148 RUSSIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 149 RUSSIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 150 RUSSIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 151 RUSSIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 152 RUSSIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 153 REST OF EUROPE POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 154 REST OF EUROPE POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 155 REST OF EUROPE POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 156 REST OF EUROPE POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 157 REST OF EUROPE POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 158 REST OF EUROPE POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 159 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 160 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 161 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 162 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 163 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 164 MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 165 UAE POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 166 UAE POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 167 UAE POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 168 UAE POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 169 UAE POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 170 UAE POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 171 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 172 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 173 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 174 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 175 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 176 SAUDI ARABIA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 177 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 178 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 179 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 180 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 181 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 182 SOUTH AFRICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

TABLE 183 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 184 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY TYPE (KILOTONS), 2020-2029

TABLE 185 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 186 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY APPLICATION (KILOTONS), 2020-2029

TABLE 187 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY END USER (USD MILLION), 2020-2029

TABLE 188 REST OF MIDDLE EAST AND AFRICA POLYOXEFIN PIPES MARKET BY END USER (KILOTONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYOXEFIN PIPES MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL POLYOXEFIN PIPES MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYOXEFIN PIPES MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL POLYOXEFIN PIPES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 POLYOXEFIN PIPES MARKET BY REGION 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 AGRU: COMPANY SNAPSHOT

FIGURE 16 GF PIPING SYSTEMS: COMPANY SNAPSHOT

FIGURE 17 ADVANCED DRAINAGE SYSTEMS: COMPANY SNAPSHOT

FIGURE 18 ADVANCED DRAINAGE SYSTEMS: COMPANY SNAPSHOT

FIGURE 19 JM EAGLE: COMPANY SNAPSHOT

FIGURE 20 RADIUS SYSTEMS: COMPANY SNAPSHOT

FIGURE 21 ALIAXIS: COMPANY SNAPSHOT

FIGURE 22 PRINSCO: COMPANY SNAPSHOT

FIGURE 23 THAI-ASIA P.E. PIPE CO., LTD.: COMPANY SNAPSHOT

FIGURE 24 UNITED POLY SYSTEMS: COMPANY SNAPSHOT

FIGURE 25 FUTURE PIPE INDUSTRIES: COMPANY SNAPSHOT

FIGURE 26 WL PLASTICS: COMPANY SNAPSHOT

FIGURE 27 AQUATHERM: COMPANY SNAPSHOT

FIGURE 28 BLUE DIAMOND INDUSTRIES: COMPANY SNAPSHOT

FAQ

The polyolefin pipe market size had crossed USD 17.2 billion in 2020 and will observe a CAGR of more than 5.2% up to 2029 driven by the need for reliable solutions in water and sanitation applications.

Asia-Pacific held more than 45% of the polyolefin pipe market revenue share in 2020 due to the low cost of raw materials as well as their ease of availability, along with the low cost of establishing production facilities.

The upcoming trends in polyolefin pipe market is that reliable and long-lasting pipe solutions are critical for reducing losses, conserving energy and providing better service to communities and industry in the future.

The global polyolefin pipe market registered a CAGR of 5.2% from 2022 to 2029. The waste water drainage segment was the highest revenue contributor to the market, with 5.9 billion in 2020, and is estimated to reach 8.4 billion by 2029, with a CAGR of 4%.

Leading application of polyolefin pipe market are waste water drainage. Polyolefin pipelines are mainly used for gas distribution and water distribution, and for wastewater disposal and sewage.

Asia-Pacific is expected to hold the largest market share in terms of revenue, during the forecast period. Low cost of raw materials as well as their ease of availability, along with the low cost of establishing production facilities are some of the major factors driving the polyolefin pipes market in the region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.