| Market Size | CAGR | Dominating Region |

|---|---|---|

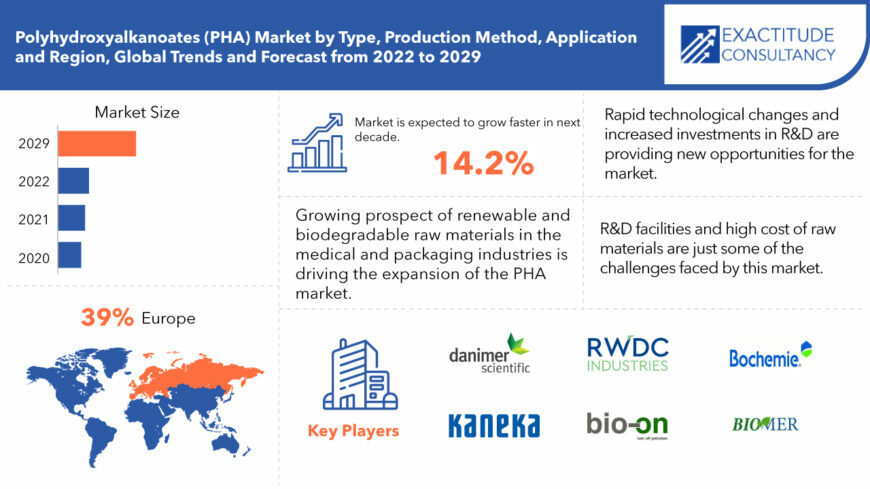

| USD 0.20 billion | 14.2% | Europe |

| By Type | By Production Method | By Application | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

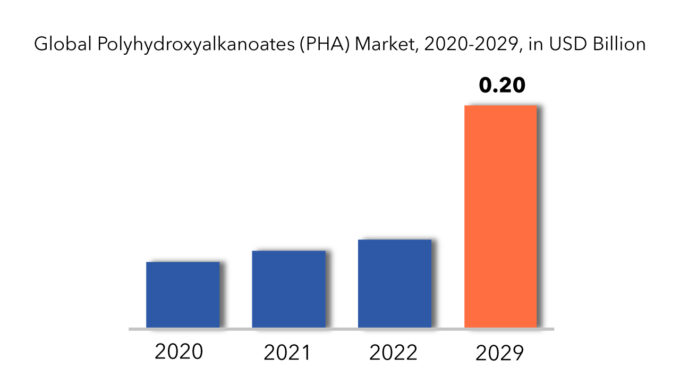

The global Polyhydroxyalkanoates (PHA) Market is expected to grow at 14.2% CAGR from 2022 to 2029. It is expected to reach above USD 0.20 billion by 2029 from USD 0.06 billion in 2020.

Polyhydroxyalkanoates (PHA) Market Overview

Polyhydroxyalkanoates, also known as PHAs are a diverse group of biodegradable polyesters that have been synthesized through both biological and non-biological routes. Polyhydroxyalkanoates, commonly abbreviated as PHA’s, are compounds that belong to the class of polyesters made from renewable resources such as corn starch or sugar cane bagasse. Monomers can form various crystalline structures, such as short chain length monomers and medium chain length monomers. Short chain length PHA monomers consist of not more than four to ten carbon atoms. Some of the short chain length PHA monomers include Polyhydroxybutyrate (PHB), Poly-3-hydroxybutyrate (P3HB), and Polyhydroxyvalerate (PHV). Government regulations and policies against single-use plastics are a major factor in the expansion of the Polyhydroxyalkanoates (PHA) Market. The structure determines the thermal and mechanical properties of the monomers, making them suitable for the use in diversified applications, for instance, environmental-friendly plastics, for packaging and biomedical. PHA monomers can also be used to produce biofuels, degrade polyhydroxyalkanoates with water. The applications best suited for short chain length PHAs, such as packaging materials and carry bags.

Around the world, the growing prospect of renewable and biodegradable raw materials in the medical and packaging industries is driving the expansion of the Polyhydroxyalkanoates (PHA) market. The escalating use of PHA biocomposites as feeders in many applications is boosting prospects for PHA producers and vendors. The biodegradability of PHAs is a key aspect that has driven the preference of the latter over conventional polymers. The emergence of a new line of biocomposites has also boosted revenue generation in the Polyhydroxyalkanoates (PHA) market. PHA has been employed in fixation and orthopedic applications, tissue engineering, bioplastics production, food service, packaging, pharmaceutical industry, and agriculture. PHA’s innovative properties can add additional value to the applications in which they are employed. The advancement of the PHA industrialization process is predicted to increase the cost of PHA and make it an alternative to conventional plastic.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, By Production Method, By Application, By Region |

| By Type

|

|

| By Production Method

|

|

| By Application

|

|

| By Region

|

|

However, the high cost of the raw material compared to conventional polymers, with fewer R&D facilities, will act as a drag on the Polyhydroxyalkanoates (PHA) market for polyhydroxyalkanoates. The manufacturing technology is still in the early stage of development and the factor is acting as a challenge for the polyhydroxyalkanoates market during the foreseen period 2022 – 2027.

The opportunities that would contribute to the expansion of this market are rapid technological changes and increased investments in R&D from developed countries. The worldwide PHA market is driven by the growing call for renewable, environmentally friendly and bio-based materials such as bagasse, zein, casein, vegetable starch, etc. Biomedical applications such as bone marrow scaffolds, cardiovascular patches, nerve repair devices, bones, etc. Strong call for packaging followed by catering is also contributing to market expansion. The wide availability of renewable and profitable raw materials such as

bagasse, zein, casein, vegetable starch and many others encourage the expansion of the market for polyhydroxyalkanoates. Also, with their biomedical applications such as cardiovascular patches, nerve repair devices, bone marrow scaffolds, they strengthen the market expansion. Government regulations and policies against single-use plastics are a major factor in the expansion of the polyhydroxyalkanoate market. The escalating consumption of products such as biological control agents, drug-bearing tissues, engineered biodegradable implants, memory enhancers, and anti-cancer agents will give a significant new boost to the polyhydroxyalkanoate market in the coming years. Strong expansion in R&D investments in the medical industry has led to the escalating development of biocompatible materials, which will further increase the size of the polyhydroxyalkanoate market in the coming years.

Polyhydroxyalkanoates (PHA) Market Segment Analysis

The global polyhydroxyalkanoates (PHA)s market is segmented based on type, production method, application and region. Based on type, the polyhydroxyalkanoates (PHA)s market is segmented into short chain length and medium chain length. Short chain length PHA monomers consist of not more than four to ten carbon atoms. Some of the short chain length PHA monomers include Polyhydroxybutyrate (PHB), Poly-3-hydroxybutyrate (P3HB), and Polyhydroxyvalerate (PHV). The structure determines the thermal and mechanical properties of the monomers, making them suitable for the use in diversified applications, for instance, environmental-friendly plastics, for packaging and biomedical (implants and controlled release drug carriers). PHA monomers can also be used to produce biofuels. The applications best suited for short chain length PHAs, such as packaging materials and carry bags. It has a large market in Europe due to strict governmental regulations regarding the single use plastics.

Based on production method, the polyhydroxyalkanoates (PHA)s market is segmented into sugar fermentation, vegetable oil fermentation and methane fermentation. Depending on the raw material, different strains are selected as different bacterium strains can accumulate PHA from different sources. Sugar fermentation is the most common technique used by most of the companies over 20 years, with sugar as a substrate. The sugar can be obtained from sugarcane, beet, molasses, and bagasse. They are generally found in abundance and is easily consumed and converted by bacteria to produce PHA. Currently, major PHA companies are producing PHA via this method due to the higher availability of raw materials and the easier process, as sugar molecules are easily cracked in the fermentation process.

Based on application, the polyhydroxyalkanoates (PHA)s market is segmented into packaging and food services, bio-medical, agriculture, wastewater treatment, cosmetics, 3D printing and chemical addictive. PHA play a key role in the packaging and food services industry. The demand for PHA in this segment is expected to increase because of its increasing use in several applications, including cups, lids, food containers, and other food service products. The rising environmental concerns, along with waste management issues are the key drivers of this segment. The packaging & food services segment is the biggest source of plastic waste in the world and the penetration of bioplastics and biodegradable plastics is favorable for market growth.

Polyhydroxyalkanoates (PHA) Market Players

The polyhydroxyalkanoates (PHA) market key players include Danimer Scientific, Shenzhen Ecomann Biotechnology Co Ltd., Kaneka Corporation, RWDC Industries, Newlight Technologies LLC, Bio-On, Tianan Biologic Materials Co Ltd., Biomer and Bochemie.

Industry News:

- May 3, 2022-Danimer Scientific and Kemira expand exclusive partnership to commercialize fully biobased barrier coatings

- Danimer Scientific, Inc. (NYSE: DNMR) and Kemira announced today a multi-year license and supply agreement, exclusive in Kemira’s core markets, to commercialize biobased barrier coatings for paper and board products. The companies will introduce the newly developed coatings for food and beverage industry applications within North and South America, Europe, the Middle East and Africa in the coming years. The relevant dispersion barrier market size is currently around EUR 500 million and is expected to grow around 10% per annum.

- May 14, 2021-Cove & RWDC Industries Sign Exclusive Agreement for Over 350 Million Pounds of PHA

- Cove, the California-based material innovation company that plans to introduce the first water bottle made entirely of biodegradable material later this year, today announced it has entered into an exclusive partnership deal with RWDC Industries. RWDC will supply its proprietary PHA – a sustainably sourced, naturally occurring biopolymer – to produce Cove’s water bottles.

Who Should Buy? Or Key Stakeholders

- Resin & polymers industries.

- Chemicals & Materials

- Institutional & retail players.

- Investment research firms

Polyhydroxyalkanoates (PHA) Market Regional Analysis

The polyhydroxyalkanoates (PHA) market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

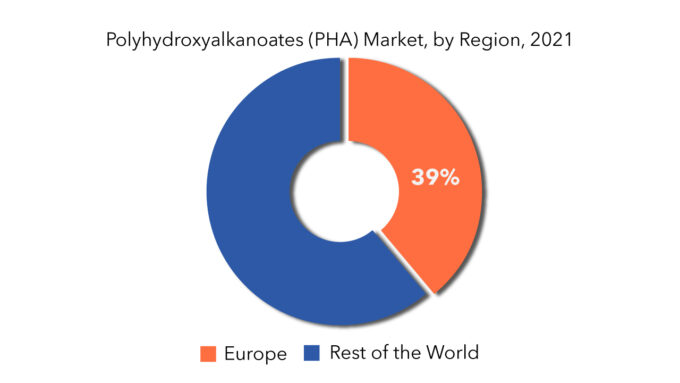

Europe is the most promising market for bioplastics and related industries, including acrylic processing aid. The region is characterized by innovative growth and stringent regulations. The European market is segmented into Germany, France, Italy, UK and Rest of Europe. The Rest of Europe includes, Spain, Poland, the Czech Republic, Romania, the Benelux countries, and the Scandinavian countries.

The government policies supporting the use of biodegradable plastics and increasing awareness among consumers are the key driving factors responsible for the market growth in the European region. The need for environment-friendly products is driving innovation in the bioplastics industry. The packaging and food services industry demands single use plastics and sustainable packaging. This increases the need for bioplastics, which in turn drives the market for polyhydroxyalkanoate (PHA). Moreover, there are a large number of PHA manufacturers in European region which has a huge domestic market in the region, giving this the largest market share.

Key Market Segments: Polyhydroxyalkanoates (PHA) Market

Polyhydroxyalkanoates (PHA) Market by Type, 2020-2029, (USD Million)

- Short Chain Length

- Medium Chain Length

Polyhydroxyalkanoates (PHA) Market by Production Method, 2020-2029, (USD Million)

- Sugar Fermentation

- Vegetable Oil Fermentation

- Methane Fermentation

Polyhydroxyalkanoates (PHA) Market By Application, 2020-2029, (USD Million)

- Packaging and Food Services

- Bio-Medical

- Agriculture

- Wastewater Treatment

- Cosmetics

- 3d Printing

- Chemical Addictive

Polyhydroxyalkanoates (PHA) Market By Region, 2020-2029, (USD Million)

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the polyhydroxyalkanoates (PHA) market?

- What are the key factors influencing the growth of polyhydroxyalkanoates (PHA)?

- What are the major applications for polyhydroxyalkanoates (PHA)?

- Who are the major key players in the polyhydroxyalkanoates (PHA) market?

- Which region will provide more business opportunities for polyhydroxyalkanoates (PHA) in future?

- Which segment holds the maximum share of the polyhydroxyalkanoates (PHA) market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polyhydroxyalkanoates (PHA) Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Polyhydroxyalkanoates (PHA) Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Polyhydroxyalkanoates (PHA) Market Outlook

- Global Polyhydroxyalkanoates (PHA) Market by Type (USD Million) (Thousand Units)

- Short Chain Length

- Medium Chain Length

- Global Polyhydroxyalkanoates (PHA) Market by Production Method (USD Million) (Thousand Units)

- Sugar Fermentation

- Vegetable Oil Fermentation

- Methane Fermentation

- Global Polyhydroxyalkanoates (PHA) Market by Application (USD Million) (Thousand Units)

- Packaging and Food Services

- Bio-Medical

- Agriculture

- Wastewater treatment

- Cosmetics

- 3D Printing

- Chemical Addictive

- Global Polyhydroxyalkanoates (PHA) Market by Region (USD Million) (Thousand Units)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Belgium

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Indonesia

- Taiwan

- Malaysia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Danimer Scientific

- Shenzhen Ecomann Biotechnology Co Ltd.

- Kaneka Corporation

- RWDC Industries

- Newlight Technologies LLC

- Bio-On

- Tianan Biologic Materials Co Ltd.,

- Biomer

- Bochemie *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 6 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 15 US POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 16 US POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 US POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 18 US POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 19 US POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 20 US POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 22 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 26 CANADA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 27 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 28 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 30 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 32 MEXICO POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 33 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 34 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 36 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 38 SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 39 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 40 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 42 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 44 BRAZIL POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 45 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 46 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 48 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 50 ARGENTINA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 51 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 52 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 54 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 56 COLOMBIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 57 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 58 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 60 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 63 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 64 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 66 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 68 ASIA-PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 69 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 70 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 72 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 73 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 74 INDIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 75 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 76 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 78 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 79 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 80 CHINA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 81 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 82 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 83 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 84 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 85 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 86 JAPAN POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 87 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 88 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 90 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 92 SOUTH KOREA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 93 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 94 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 95 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 96 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 97 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 98 AUSTRALIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 99 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 100 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 102 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 103 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 104 SOUTH EAST ASIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 105 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 106 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 108 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 109 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 110 REST OF ASIA PACIFIC POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 111 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 112 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 114 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 115 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 116 EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 117 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 118 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 119 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 120 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 121 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 122 GERMANY POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 123 UK POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 124 UK POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 UK POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 126 UK POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 127 UK POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 128 UK POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 129 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 130 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 131 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 132 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 133 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 134 FRANCE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 135 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 136 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 137 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 138 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 139 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 140 ITALY POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 141 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 142 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 143 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 144 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 145 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 146 SPAIN POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 147 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 148 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 149 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 150 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 151 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 152 RUSSIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 153 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 154 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 155 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 156 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 157 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 158 REST OF EUROPE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 159 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 160 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 161 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 162 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 163 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 164 MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 165 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 166 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 167 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 168 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 169 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 170 UAE POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 171 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 172 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 173 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 174 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 175 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 176 SAUDI ARABIA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 177 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 178 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 179 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 180 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 181 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 182 SOUTH AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

TABLE 183 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 184 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 185 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 186 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 187 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (USD MILLION), 2020-2029

TABLE 188 REST OF MIDDLE EAST AND AFRICA POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY PRODUCTION METHOD, USD MILLION, 2020-2029

FIGURE 11 GLOBAL POLYHYDROXYALKANOATES (PHA) MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 POLYHYDROXYALKANOATES (PHA) MARKET BY REGION 2021

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 DANIMER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 16 SHENZHEN ECOMANN BIOTECHNOLOGY CO LTD.: COMPANY SNAPSHOT

FIGURE 17 KANEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 18 RWDC INDUSTRIES: COMPANY SNAPSHOT

FIGURE 19 NEWLIGHT TECHNOLOGIES LLC: COMPANY SNAPSHOT

FIGURE 20 BIO-ON: COMPANY SNAPSHOT

FIGURE 21 TIANAN BIOLOGIC MATERIALS CO LTD.: COMPANY SNAPSHOT

FIGURE 22 BIOMER: COMPANY SNAPSHOT

FIGURE 23 BOCHEMIE: COMPANY SNAPSHOT

FAQ

The polyhydroxyalkanoates (PHA) market size had crossed USD 0.06 billion in 2020 and will observe a CAGR of more than 14.2% up to 2029 driven by the growing prospect of renewable and biodegradable raw materials in the medical and packaging industries.

Europe held more than 39% of the polyhydroxyalkanoates (PHA) market revenue share in 2020 due to the government policies supporting the use of biodegradable plastics and increasing awareness among consumers which are driving the market in European region.

The upcoming trends in polyhydroxyalkanoates (PHA) market are the rapid technological changes and increased investments in R&D from developed countries.

The global polyhydroxyalkanoates (PHA) market registered a CAGR of 14.2% from 2022 to 2029. The packaging and food services segment was the highest revenue contributor to the market, with 30 million in 2020, and is estimated to reach 70 million by 2029, with a CAGR of 12%.

Leading application of polyhydroxyalkanoates (PHA) market are packaging and food services. The demand for PHA in this segment is expected to increase because of its increasing use in several applications, including cups, lids, food containers, and other food service products.

Europe is expected to hold the largest market share in terms of revenue, during the forecast period. The government policies supporting the use of biodegradable plastics and increasing awareness among consumers are the key driving factors responsible for the market growth in the European region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.