| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 6.36 billion | 5% | APAC |

| By Type | By Applications | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

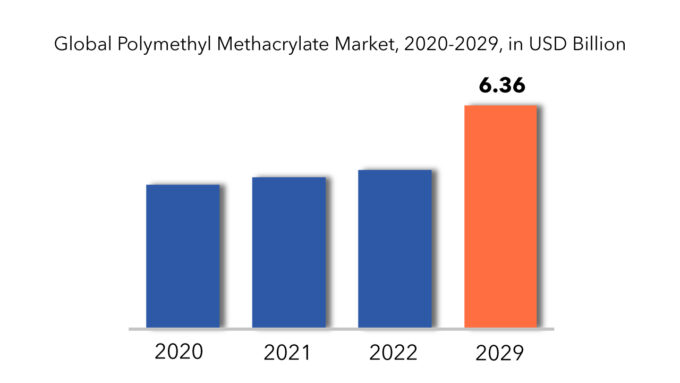

The global Polymethyl Methacrylate Market is expected to grow at 5% CAGR from 2022 to 2029. It is expected to reach above USD 6.36 billion by 2029 from USD 4.1 billion in 2020.

Polymethyl Methacrylate Market Overview

Polymethyl Methacrylate (PMMA) is a synthetic resin produced from the polymerization of methyl methacrylate. It is a transparent and rigid plastic that is commonly used in shatterproof windows, skylights, illuminated signs, and aircraft canopies. The aim of the report is to analyze the present and estimated trends of the global specialty chemical market, as the demand of the product is expected to rise. The report provides a comprehensive analysis of the market potential in various industry applications. The study is focused on the opportunity of the emerging economies of the globe, so that companies can strategically make region specific plans and gain competitive edge. The LCD light guide made from PMMA provides brighter light than the conventional guide panels. Therefore, PMMA is widely used in LCD light guide and the growth of LCD market drives the PMMA market as well. In addition, PMMA’s advance applications in electronic and automotive market also increase its usage.

Rapid digitalization has driven the need for attractive advertising options in the retail industry, leading to increased polymethyl methacrylate demand in signs and displays, lighting, and similar applications. The product is utilized across several industries owing to its inherent advantageous characteristics including high thermal and chemical resistance, durability, low smoke emission, and excellent abrasion resistance.

Manufacturers are utilizing the product as a shatterproof alternative to glass in illuminated signs, aircraft canopies, and shatterproof of windows. It is almost 40% lighter than glass and provides better rigidity, toughness, and transparency. The product also emits negligible amounts of smoke while processing, conforming to stringent manufacturing and emission standards.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) Volume (Thousand Units) |

| Segmentation | By Type, By Application, By Region |

| By Type

|

|

| By Application

|

|

| By Region

|

|

Rapidly increasing demand for sustainable polymers backed by favorable government regulations has led to the emergence of bio-based raw materials. It represents an effective alternative to petroleum derivatives and reduces energy consumption by up to 30% during industrial work. Increasing investments in the development of such renewable products are also paving new market avenues.

Multiple technologies including emulsion polymerization, suspension polymerization, and bulk polymerization are deployed in manufacturing. The industry has witnessed several innovative technologies in recent years and major companies have been engaged in extensive R&D to develop innovative products that meet ever-changing consumer needs.

Recovery in automotive production in the post COVID-19 period is expected to bode well for market growth for MMA and PMMA materials. In the coming years, consumption of acrylic resins is expected to grow led by improvements on the economic front, increased activity in construction and architecture industries, and demand rise from automotive (primarily to improve functionality and to reduce weight) and electronics sectors.

Potential opportunities for PMMA market are immense due to its unique aesthetic features and superior chemical characteristics, which make it a highly valuable material for use in several end-use markets. With demand rising from various industries including signs and displays, electronics, sanitary ware, construction, automotive, and lighting fixtures, many PMMA manufacturers are focusing on increasing their production capacities to meet the growing demand.

Polymethyl Methacrylate Market Segment Analysis

The global polymethyl methacrylate market is segmented based on type, application and region. Based on type, the polymethyl methacrylate market is segmented into extruded sheet, cast acrylic sheet, beads and pellets. Extruded sheets are the dominant product segment. It occupied over 51.39% of the global volume share owing to robust demand for high-performance sheets in various industrial sectors. Excellent thickness tolerance of these sheets makes them ideal for applications where complex shapes are required. Additionally, extruded sheets also provide cost-efficiency since they are produced using economical techniques. Increasing usage of acrylic beads as a texturing agent for thermoplastics or coatings is likely to prove conducive to future growth. The segment is expected to grow at the fastest CAGR of 9.2% from 2019 to 2025. These beads are also an ideal ingredient as binders in curable formulations, such as glues, resins, and composites. Increasing demand for aquariums and other structural panels is generating lucrative opportunities for pellets and cast acrylics.

Based on the application, the polymethyl methacrylate market is segmented into sign & display, automobile, construction, electronics, lighting & fixture. The product is widely used in internally lighted signs for advertising and directions since it fosters excellent transmission of visible light. Telecommunication signs and displays and endoscopy applications are also utilizing fiber optics made from this material, owing to its property to retain a beam of reflected light within surfaces. Rising demand for lightweight parts in vehicles to attain fuel-efficiency is boosting PMMA consumption in the automotive sector. Automotive glazing is another popular application owing to the high weathering and UV resistance of the product, along with optimum acoustic properties. A wide array of PMMA pipe materials and vacuum insulation panels are used for low and passive energy buildings. Cast acrylics and extruded sheets are also gaining popularity in thermal insulation applications. Increasing construction activities, mainly in China, India, and Brazil, owing to growing disposable income levels and governmental support is expected to drive the market.

Polymethyl Methacrylate Market Players

The polymethyl methacrylate market key players include Evonik Industries, Mitsubishi Rayon Group, Sumitomo Chemical Company Ltd., The Dow Chemical Company, Chi Mei Corporation, Kuraray Group, Asahi Kasei Corporation, LG MMA Corp., Makevale Group, Shanghai Jing-Qi Polymer Science Co. and, Polycasa N.V.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new product development, mergers and acquisitions, and collaboration as important growth strategies to improve their product portfolio and geographical presence in order to meet the rising demand for polymethyl methacrylate from emerging economies.

Industry News:

- Feb. 25, 2022-Sumitomo Chemical to Newly Establish MMA Division

- Sumitomo Chemical has decided to establish a new MMA Division as of April 1, 2022, to strengthen its MMA business, which includes MMA (methyl methacrylate) monomer and acrylic resin (PMMA, polymethyl methacrylate). The new division will take charge of strategy formulation and global marketing and sales for the business as a whole.

- June 1, 2022-Asahi Kasei Medical Completes Acquisition of Bionova Scientific, U.S.-based biopharmaceutical CDMO

- Asahi Kasei Medical has completed its acquisition of Bionova Scientific, LLC, a provider of contract process development services and GMP-compliant contract manufacturing services to biopharmaceutical companies as announced on April 19, 2022. The acquisition closed on May 31, 2022 (US Pacific time).

Who Should Buy? Or Key Stakeholders

- Resins & Polymers Industries.

- Chemicals & Materials

- Institutional & Retail Players.

- Investment Research Firms

Polymethyl Methacrylate Market Regional Analysis

The polymethyl methacrylate market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

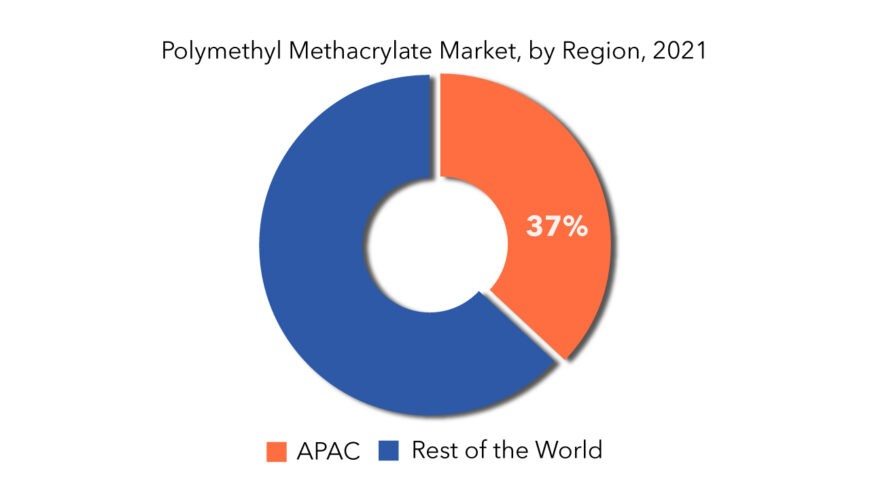

The Asia-Pacific region accounted for the largest market share globally. The demand for PMMA is mainly driven by the increasing demand from industries, such as automotive and transportation, construction, and electrical and electronics. The governments in countries such as China, India, Indonesia, and Singapore have been witnessing huge investments in the construction industry. This is likely to drive the demand for PMMA. The Indian electronics market is expected to reach USD 400 billion by 2025. India is expected to become the fifth-largest consumer electronics and appliances industry in the world by 2025. Additionally, in India, technology transitions, such as the rollout of 4G/LTE networks and IoT (Internet of Things), are driving the adoption of electronics products. Initiatives, such as ‘Digital India’ and ‘Smart City’ projects, raised the demand for IoT in the country.

Key Market Segments: Polymethyl Methacrylate Market

Polymethyl Methacrylate Market by Type, 2020-2029, (USD Million), (Thousand Units)

- Extruded Sheet

- Cast Acrylic Sheet

- Beads and Pellets

Polymethyl Methacrylate Market by Applications, 2020-2029, (USD Million), (Thousand Units)

- Sign & Display

- Automobile

- Construction

- Electronics

- Lighting & Fixture

Polymethyl Methacrylate Market by Region, 2020-2029, (USD Million), (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the polymethyl methacrylate market?

- What are the key factors influencing the growth of polymethyl methacrylate?

- What are the major applications for polymethyl methacrylate?

- Who are the major key players in the polymethyl methacrylate market?

- Which region will provide more business opportunities for polymethyl methacrylate in future?

- Which segment holds the maximum share of the polymethyl methacrylate market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polymethyl Methacrylate Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Polymethyl Methacrylate Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Polymethyl Methacrylate Market Outlook

- Global Polymethyl Methacrylate Market by Type (USD Million) (Thousand Units)

- Extruded Sheet

- Cast Acrylic Sheet

- Beads And Pellets

- Global Polymethyl Methacrylate Market by Application (USD Million) (Thousand Units)

- Sign & Display

- Automobile

- Construction

- Electronics

- Lighting & Fixture

- Global Polymethyl Methacrylate Market by Region (USD Million) (Thousand Units)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Belgium

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Indonesia

- Taiwan

- Malaysia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Evonik Industries

- Mitsubishi Rayon Group

- Sumitomo Chemical Company Ltd.

- The Dow Chemical Company

- Chi Mei Corporation

- Kuraray Group

- Asahi Kasei Corporation

- LG MMA Corp.

- Makevale Group

- Shanghai Jing-Qi Polymer Science Co.

- Polycasa N.V. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 4 GLOBAL POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL POLYMETHYL METHACRYLATE MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 GLOBAL POLYMETHYL METHACRYLATE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 11 US POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 12 US POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 US POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 14 US POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 15 CANADA POLYMETHYL METHACRYLATE MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 16 CANADA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 18 CANADA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 19 MEXICO POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 20 MEXICO POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 MEXICO POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 22 MEXICO POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 23 SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 24 SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 27 BRAZIL POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 28 BRAZIL POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 BRAZIL POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 30 BRAZIL POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 31 ARGENTINA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 32 ARGENTINA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 ARGENTINA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 34 ARGENTINA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 35 COLOMBIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 36 COLOMBIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 COLOMBIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 38 COLOMBIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 39 REST OF SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 40 REST OF SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 41 REST OF SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 42 REST OF SOUTH AMERICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 43 ASIA-PACIFIC POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 44 ASIA-PACIFIC POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 45 ASIA-PACIFIC POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 46 ASIA-PACIFIC POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 47 INDIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 48 INDIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 49 INDIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 50 INDIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 51 CHINA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 52 CHINA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 CHINA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 54 CHINA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 55 JAPAN POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 56 JAPAN POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 57 JAPAN POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 58 JAPAN POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 59 SOUTH KOREA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 60 SOUTH KOREA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 61 SOUTH KOREA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 62 SOUTH KOREA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 63 AUSTRALIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 64 AUSTRALIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 AUSTRALIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 66 AUSTRALIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 67 SOUTH EAST ASIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 68 SOUTH EAST ASIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 69 SOUTH EAST ASIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 70 SOUTH EAST ASIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 71 REST OF ASIA PACIFIC POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 72 REST OF ASIA PACIFIC POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 REST OF ASIA PACIFIC POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 74 REST OF ASIA PACIFIC POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 75 EUROPE POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 76 EUROPE POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 EUROPE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 78 EUROPE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 79 GERMANY POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 80 GERMANY POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 GERMANY POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 82 GERMANY POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 83 UK POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 84 UK POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 UK POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 86 UK POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 87 FRANCE POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 88 FRANCE POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 FRANCE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 90 FRANCE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 91 ITALY POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 92 ITALY POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 ITALY POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 94 ITALY POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 95 SPAIN POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 96 SPAIN POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 SPAIN POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 98 SPAIN POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 99 RUSSIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 100 RUSSIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 101 RUSSIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 102 RUSSIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 103 REST OF EUROPE POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 104 REST OF EUROPE POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 105 REST OF EUROPE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 106 REST OF EUROPE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 107 MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 108 MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 110 MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 111 UAE POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 112 UAE POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 113 UAE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 114 UAE POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 115 SAUDI ARABIA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 116 SAUDI ARABIA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 117 SAUDI ARABIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 118 SAUDI ARABIA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 119 SOUTH AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 120 SOUTH AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 121 SOUTH AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 122 SOUTH AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

TABLE 123 REST OF MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 124 REST OF MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 125 REST OF MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (USD MILLION), 2020-2029

TABLE 126 REST OF MIDDLE EAST AND AFRICA POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYMETHYL METHACRYLATE MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL POLYMETHYL METHACRYLATE MARKET BY APPLICATIONS, USD MILLION, 2020-2029

FIGURE 10 GLOBAL POLYMETHYL METHACRYLATE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 MARKET SHARE ANALYSIS

FIGURE 13 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 14 MITSUBISHI RAYON GROUP: COMPANY SNAPSHOT

FIGURE 15 SUMITOMO CHEMICAL COMPANY LTD.: COMPANY SNAPSHOT

FIGURE 16 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 17 CHI MEI CORPORATION: COMPANY SNAPSHOT

FIGURE 18 KURARAY GROUP: COMPANY SNAPSHOT

FIGURE 19 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

FIGURE 20 LG MMA CORP.: COMPANY SNAPSHOT

FIGURE 21 MAKEVALE GROUP: COMPANY SNAPSHOT

FIGURE 22 SHANGHAI JING-QI POLYMER SCIENCE CO.: COMPANY SNAPSHOT

FIGURE 23 POLYCASA N.V.: COMPANY SNAPSHOT

FAQ

The polymethyl methacrylate market size had crossed USD 4.1 billion in 2020 and will observe a CAGR of more than 5% up to 2029 driven by rapid digitalization which has driven the need for attractive advertising options in the retail industry, leading to increased polymethyl methacrylate demand in signs and displays, lighting, and similar applications.

Asia-Pacific held more than 37% of the polymethyl methacrylate market revenue share in 2020 due to increasing demand from industries, such as automotive and transportation, construction, and electrical and electronics.

The upcoming trends in polymethyl methacrylate market are those multiple technologies including emulsion polymerization, suspension polymerization, and bulk polymerization are deployed in manufacturing.

The global polymethyl methacrylate market registered a CAGR of 5% from 2022 to 2029. The extruded sheets segment was the highest revenue contributor to the market, with 2 billion in 2020, and is estimated to reach 3.1 billion by 2029, with a CAGR of 5%.

Leading application of polymethyl methacrylate market are sign & display. The product is widely used in internally lighted signs for advertising and directions since it fosters excellent transmission of visible light. Telecommunication signs and displays and endoscopy applications are also utilizing fiber optics made from this material, owing to its property to retain a beam of reflected light within surfaces.

Asia-Pacific is expected to hold the largest market share in terms of revenue, during the forecast period. The demand for PMMA is mainly driven by the increasing demand from industries, such as automotive and transportation, construction, and electrical and electronics.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.