REPORT OUTLOOK

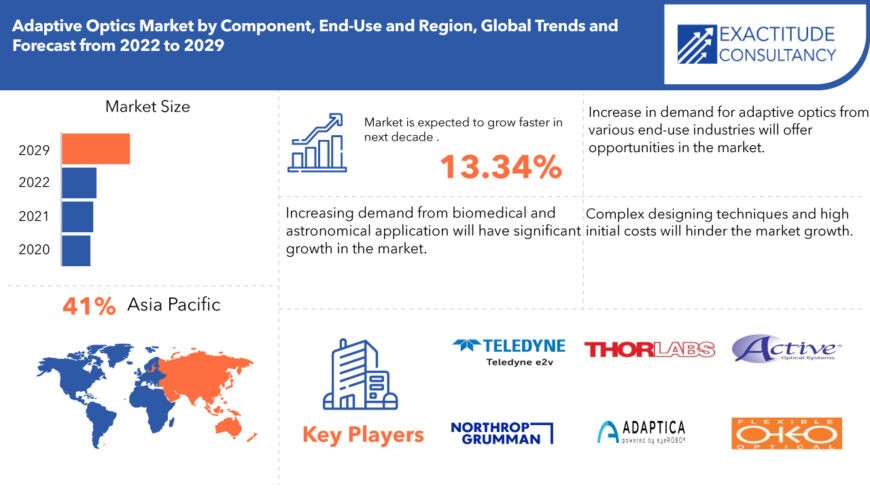

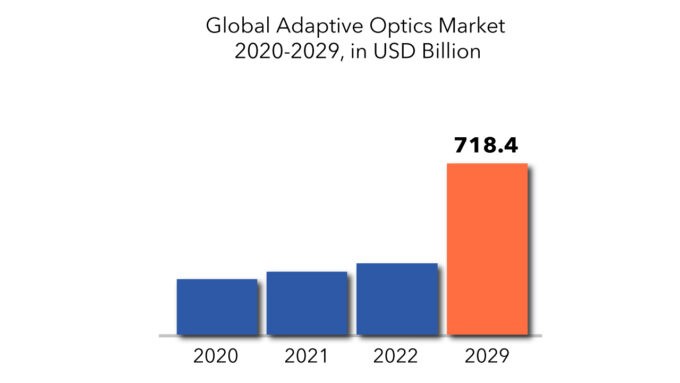

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 718.4 million | 13.34% | Asia Pacific |

| By Component | By End-Use | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Adaptive Optics Market Overview

The global adaptive optics market is expected to grow at a 13.34% CAGR from 2022 to 2029. It is expected to reach above USD 718.4 million by 2029 from USD 232.8 million in 2020.

Adaptive optics is a technique that works with optical systems to enable beam propagation, communications, and imaging. These technologies are used to improve the efficiency of an optical system by eliminating the impacts of wavefront distortion. It’s used in retinal imaging, laser communication, and biological research. The system is made up of three primary parts: a wavefront sensor, a control system, and a wavefront modulator. Adaptive optics aids in the elimination of these imperfections, hence improving the performance of optical devices. High-resolution phenotyping with adaptive optics imaging, along with molecular genetic analysis, is predicted to improve early-stage clinical imaging of AMD and RP. Because of its efficiency in offering better and high-speed imaging, adaptive optics and Optical Coherence Tomography (OCT) are progressively permeating the market. Advanced deformable mirrors are being created in order to accurately regulate the incident wavefront by reshaping a reflecting membrane using precise magnetic actuators.

Adaptive optics aids in the resolution of problems encountered when utilizing high-power microscopes to study a big sample. Adaptive optics uses its fast scanning microscope stage to patch together an image of a big sample as a mosaic. Furthermore, it aids in mitigating errors induced by optical flaws. To solve these issues, adaptive optics is commonly utilised in microscopy. AO improves the resolution, signal intensity, and contrast ratio. These AO benefits assist in in-vivo deep-tissue imaging. The rising prevalence of retinal degeneration illnesses is projected to drive market expansion. The most prevalent retinal degenerative disorders worldwide are age-related macular degeneration (AMD) and retinitis pigmentosa (RP).

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | USD Millions, Thousand Units |

| Segmentation | By Component, End-Use |

| By Component

|

|

| By End-Use

|

|

| By Region

|

|

Furthermore, the development of these flexible mirrors is projected to lower the size, cost, and complexity of AO-OCT systems, paving the way for adaptive optics to be broadly adopted for a variety of clinical applications. As a result, the market is likely to be driven by the development of improved adaptive optics devices, as well as the increasing efforts of vision scientists, ophthalmologists, and entrepreneurs in its creation and research. The rise in R&D expenditure for integrating adaptive optics to offer a wide variety of applications is projected to drive the market. Furthermore, a surge in demand for high-resolution microscopy in different biological research operations propels the worldwide Adaptive Optics Market forward. However, high beginning costs and difficult design methodologies may stifle market expansion over the projection period. Furthermore, the development of lighter materials for adaptive optics is projected to provide important businesses with a plethora of options.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global adaptive optics market is crowded with established players. These players have a commanding say in the market. The technology used in the adaptive optics market is proprietary and needs long-term research and development planning implemented efficiently.

Adaptive Optics Market Segment Analysis

On the basis of Component, the adaptive optics market is divided into wavefront sensor, wavefront modulator, and control system. In 2019, wavefront sensors had the highest revenue share. The sensor aids in the division of light into small beams using an array of microscopic lenses known as lenslets. Because of its simple construction and ease of manufacture, the Shack-Hartmann Wavefront Sensor is the most often used sensor. Curvature and pyramid sensors are other approaches utilised for wavefront sensing; but, due to their complexity, their usage is very rare.

Furthermore, the benefits of wavefront sensors over topography are projected to drive market expansion. The primary benefit of wavefront sensors over corneal topographers is that the topographer only tells about the surface of the eye’s optics. However, wavefront sensors provide information on the overall influence of all optical surfaces. This, in turn, improves the quality of the retinal picture. During the projection period, Deformable Mirrors (DM) are predicted to expand at highest speed. Deformable mirrors are utilised for wavefront correctors, which are the most adaptable element of AO. These mirrors are thin and flexible reflecting layers with a variety of processes controlling their structure or form. DM is chosen based on the application. They have sophisticated features such as actuator count, speed, stoke, inter-actuator connection, and surface polish. These DM requirements change depending on the application for which they are employed. As a result, players are focused on creating customised DM for various applications in order to join or sustain the market, consequently boosting overall market growth.

Based on the End-Use, the adaptive optics market is segmented into consumer, astronomy, biomedical, military & defense, industrial & manufacturing, and communication & others. In 2019, microscopy had the highest revenue share. In-vivo imaging is essential in biological microscopy because live tissues play a vital role in investigating cellular processes. The amount of light used to investigate live tissue is a huge concern since it might harm the sample and may not offer an illuminated structure. To solve these issues, adaptive optics is commonly utilised in microscopy. AO improves the resolution, signal intensity, and contrast ratio. These AO benefits assist in in-vivo deep-tissue imaging. Furthermore, adaptive optics aids in the resolution of problems occurred when utilising high-power microscopes to study a big sample. Adaptive optics uses its fast-scanning microscope stage to patch together an image of a big sample as a mosaic. Also, it aids in mitigating aberrations induced by optical flaws. As a result, the effectiveness of AO in medical microscopy, as well as the inexpensive cost of these devices in comparison to a high-powered, wide field of view scanning microscope, are projected to fuel sector expansion.

During the projected period, the ophthalmology segment is predicted to increase at the highest rate. Adaptive optics aids in the non-invasive detection, diagnosis, and treatment of eye problems. The increasing use of adaptive optics for retinal imaging is likely to drive segment growth. Traditional optical imaging systems are having difficulty identifying retinal disorders because of monochromatic aberrations in the eye caused by flaws in the optics of the eye. To provide a restricted diffracted image, adaptive optics is utilised to measure and rectify these aberrations. As a result of the efficiency of AO, it is available in many forms such as AO fundus camera, AO scanning laser ophthalmoscope, and AO-OCT in the area of ophthalmology, which is predicted to drive sector growth.

Adaptive Optics Market Players

From large companies to small ones, many companies are actively working in the adaptive optics market. These key players include Teledyne e2v LTD, NORTHROP GRUMMAN CORPORATION, Thorlabs, Inc., Iris AO, Inc., Adaptec S.r.l., Active Optical Systems, LLC, Flexible Optical B.V., Imagine Optic SA, Boston Micromachines Corporation, Physics Corp. and others.

Companies are mainly in adaptive optics they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In October 2019: Thorlabs purchased the fibre laser assets of KMLabs. Thorlabs has purchased KMLabs’ Y-Fi portfolio, which comprises a range of NIR/MIR ultrafast fibre lasers, OPAs, and NOPAs with high average power and high repetition rate. Because of patented fibre amplification technology, KMLabs’ ytterbium fibre lasers have short pulse durations at the microjoule level.

- In May 2019: Thorolabs purchased Cirtemo of Columbia, adding two ‘unique’ technologies to its portfolio: multivariate optical elements (MOEs) for spectroscopic chemical analysis and MagAssemble nanopatterning tools used to 3D print photolithography masks utilising nanoparticles.

Who Should Buy? Or Key stakeholders

- Adaptive Optics suppliers

- Investors

- End user companies

- Research institutes

Adaptive Optics Market Regional Analysis

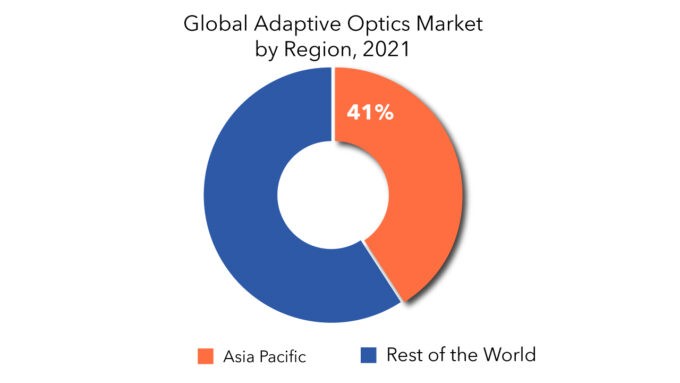

The adaptive optics market by region includes Asia-Pacific (APAC), North America, Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by Asia Pacific, North America, Middle East & Africa (MEA), and Europe. Asia Pacific shares 41% of the total market. The factors contributing to the region’s market growth include the increasing number of adaptive optics production plants and the rapid usage of adaptive optics. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: Adaptive Optics Market

Adaptive Optics Market by Component, 2020-2029, (USD Millions)

- Wavefront Sensor

- Wavefront Modulator

- Control System

Adaptive Optics Market by End-Use, 2020-2029, (USD Millions)

- Consumer

- Astronomy

- Biomedical

- Military & Defense

- Indtrial & Manufacturing

- Communication & Others

Adaptive Optics Market by Region, 2020-2029, (USD Millions)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Adaptive Optics Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Adaptive Optics Market

- Global Adaptive Optics Market Outlook

- Global Adaptive Optics Market by Component, (USD Million, Thousand Units)

- Wavefront Sensor

- Wavefront Modulator

- Control System

- Global Adaptive Optics Market by End-Use, (USD Million, Thousand Units)

- Consumer

- Astronomy

- Biomedical

- Military & Defense

- Industrial & Manufacturing

- Communication & Others

- Global Adaptive Optics Market by Region, (USD Million, Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Teledyne e2v LTD

- NORTHROP GRUMMAN CORPORATION

- Thorlabs Inc.

- Iris AO Inc.

- Adaptec S.r.l.

- Active Optical Systems LLC

- Flexible Optical B.V.

- Imagine Optic SA

- Boston Micromachines Corporation

- Physics Corp. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL ADAPTIVE OPTICS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL ADAPTIVE OPTICS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA ADAPTIVE OPTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA ADAPTIVE OPTICS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 9 US ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 10 US ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 11 US ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 12 US ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 13 CANADA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 14 CANADA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 15 CANADA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 16 CANADA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 17 MEXICO ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 18 MEXICO ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 19 MEXICO ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 20 MEXICO ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 21 SOUTH AMERICA ADAPTIVE OPTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 22 SOUTH AMERICA ADAPTIVE OPTICS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 23 BRAZIL ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 25 BRAZIL ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 26 BRAZIL ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 27 ARGENTINA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 28 ARGENTINA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 29 ARGENTINA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 30 ARGENTINA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 31 COLOMBIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 32 COLOMBIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 33 COLOMBIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 34 COLOMBIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF SOUTH AMERICA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 36 REST OF SOUTH AMERICA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF SOUTH AMERICA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 38 REST OF SOUTH AMERICA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 39 ASIA-PACIFIC ADAPTIVE OPTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 40 ASIA-PACIFIC ADAPTIVE OPTICS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 41 INDIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 42 INDIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 43 INDIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 44 INDIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 45 CHINA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 46 CHINA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 47 CHINA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 48 CHINA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 49 JAPAN ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 50 JAPAN ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 51 JAPAN ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 52 JAPAN ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 53 SOUTH KOREA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 54 SOUTH KOREA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 55 SOUTH KOREA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 56 SOUTH KOREA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 57 AUSTRALIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 58 AUSTRALIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 59 AUSTRALIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 60 AUSTRALIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 61 SOUTH EAST ASIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 62 SOUTH EAST ASIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 63 SOUTH EAST ASIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 64 SOUTH EAST ASIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF ASIA PACIFIC ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 66 REST OF ASIA PACIFIC ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF ASIA PACIFIC ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 68 REST OF ASIA PACIFIC ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 69 EUROPE ADAPTIVE OPTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 70 EUROPE ADAPTIVE OPTICS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 71 GERMANY ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 72 GERMANY ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 73 GERMANY ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 74 GERMANY ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 75 UK ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 76 UK ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 77 UK ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 78 UK ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 79 FRANCE ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 80 FRANCE ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 81 FRANCE ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 82 FRANCE ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 83 ITALY ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 84 ITALY ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 85 ITALY ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 86 ITALY ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 87 SPAIN ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 88 SPAIN ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 89 SPAIN ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 90 SPAIN ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 91 RUSSIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 92 RUSSIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 93 RUSSIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 94 RUSSIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF EUROPE ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 96 REST OF EUROPE ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF EUROPE ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 98 REST OF EUROPE ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 UAE ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 102 UAE ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 103 UAE ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 104 UAE ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 105 SAUDI ARABIA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 106 SAUDI ARABIA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 107 SAUDI ARABIA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 108 SAUDI ARABIA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH AFRICA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 110 SOUTH AFRICA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 111 SOUTH AFRICA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 112 SOUTH AFRICA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY COMPONENT (USD MILLIONS), 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY COMPONENT (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA ADAPTIVE OPTICS MARKET BY END-USE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ADAPTIVE OPTICS MARKET BY COMPONENT, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ADAPTIVE OPTICS MARKET BY END-USE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ADAPTIVE OPTICS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 ADAPTIVE OPTICS MARKET BY REGION 2020

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 TELEDYNE E2V LTD: COMPANY SNAPSHOT

FIGURE 15 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

FIGURE 16 THORLABS INC.: COMPANY SNAPSHOT

FIGURE 17 IRIS AO INC.: COMPANY SNAPSHOT

FIGURE 18 ADAPTEC S.R.L. : COMPANY SNAPSHOT

FIGURE 19 ACTIVE OPTICAL SYSTEMS LLC: COMPANY SNAPSHOT

FIGURE 20 FLEXIBLE OPTICAL B.V.: COMPANY SNAPSHOT

FIGURE 21 IMAGINE OPTIC SA: COMPANY SNAPSHOT

FIGURE 22 BOSTON MICROMACHINES CORPORATION: COMPANY SNAPSHOT

FIGURE 23 PHYSICS CORP.: COMPANY SNAPSHOT

FAQ

Increased demand for adaptive optics from numerous end-use sectors will provide market possibilities.

The global adaptive optics market registered a CAGR of 13.34% from 2022 to 2029.

Asia Pacific holds the largest regional market for the adaptive optics market.

Complex design and high initial cost of raw material production will hinder the growth of the market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.