REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

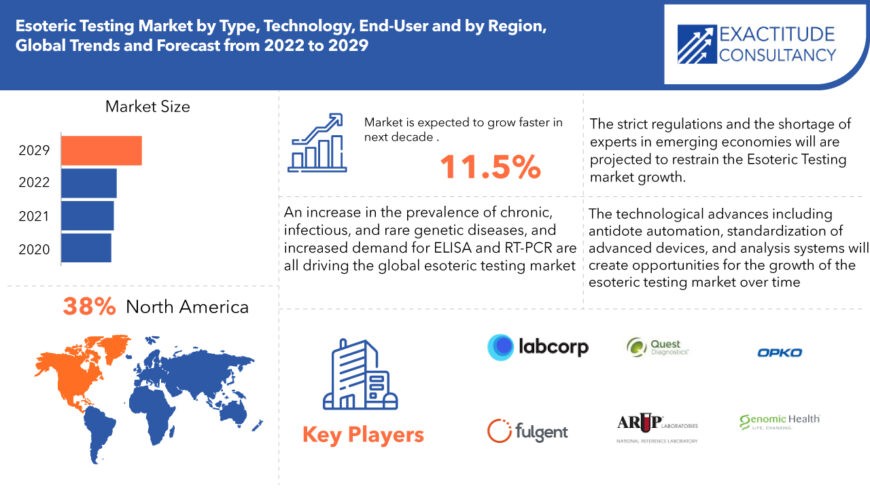

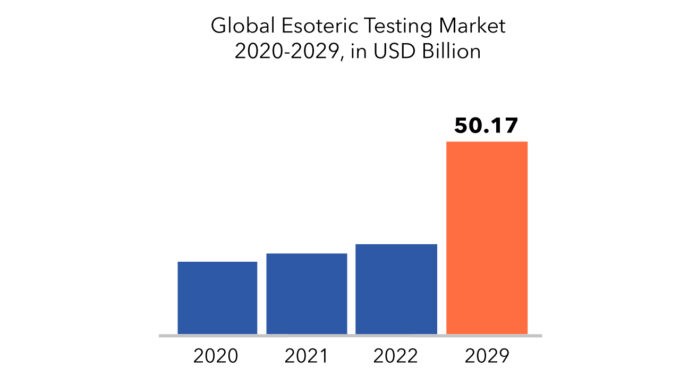

| USD 50.17 billion | 11.5% | North America |

| By Type | By Technology | By End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Esoteric Testing Market Overview

The global Esoteric Testing Market is expected to grow at an 11.5 % CAGR from 2022 to 2029. It is expected to reach above USD 50.17 billion by 2029 from USD 18.83 billion in 2020.

Rare chemicals and compounds are analyzed and detected via esoteric testing. Complex diseases are difficult to diagnose, hence esoteric testing plays an important role in early disease detection. The market will be driven by rising awareness about early disease detection and treatment, as well as the increasing prevalence of complicated and rare diseases.

An increase in the prevalence of chronic, infectious, and rare genetic diseases, increased demand for enzyme-linked immunosorbent assay (ELISA) and real-time polymerase chain reaction (RT-PCR), increased funding from private and government organizations for diagnostic service centers; and advancements in technology for esoteric testing are all driving the global esoteric testing market. According to the World Health Organization (WHO), chronic illness deaths account for 77 percent of mortality in low and middle-income countries in 2021. Cipla Limited, an Indian multinational pharmaceutical business, for example, launched ViraGen, an RT-PCR test kit for COVID-19 detection, in May 2021. When compared to the normal Indian Council of Medical Research (ICMR) test, it is a real-time detection kit that is designed to detect and identify the ORF Lab gene and SARS CoV-2 N gene with a sensitivity of 98.6% and specificity of 98.8%. Furthermore, the rise in the geriatric population, which is more susceptible to chronic diseases, would drive market expansion throughout the projection period. As a result of technological advancements in esoteric testing and an increase in the number of diagnostic tests available, the esoteric testing industry is expected to grow.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Type, By Technology, By End-User, By Region |

| By Type

|

|

| By Technology

|

|

| By End-User

|

|

| By Region

|

|

During the projection period, the high cost of esoteric testing and the absence of reimbursement is projected to restrain the market growth.

Biomarker analysis, digital PCR, next-generation sequencing (NGS), pyrosequencing, or Sanger sequencing, digital microfluidic platforms, and enhanced molecular phenotyping technologies are projected to propel the industry forward. Emerging markets such as India, China, and India are likely to provide significant participants in the esoteric testing market’s new growth opportunities. The rising senior population, high frequency of chronic and infectious diseases, improved healthcare infrastructure, and rising disposable income in these countries are all contributing to this trend.

For decades, a shortage of skilled workers has been a challenge, resulting in an aging workforce and decreased enrollment in training programs. Esoteric tests are more advanced clinical laboratory tests than routine molecular tests.

Esoteric Testing Market Segment Analysis

On the basis of type, the market is segmented into infectious disease, endocrinology, oncology, toxicology, immunology, and genetic testing. Based on technology, the esoteric testing market is bifurcated into ms, clia, Elisa, and Pcr. On the basis of the end-user, the market is segmented into independent & reference laboratories, and hospital laboratories.

Depending on the type, the infectious disease testing segment dominated the market due to the increase in the prevalence of infectious disease, development in healthcare laboratories, and advancements in technology for molecular diagnostics. However, due to an increase in the frequency of genetic illnesses, a surge in demand for stem cell research activities, and an increase in demand for genomic models, the genetic testing segment is likely to develop significantly throughout the forecast period.

The application segment is bifurcated into chemiluminescence immunoassay (CLIA), enzyme-linked immunosorbent assay (ELISA), mass spectrometry (MS), and real-time PCR. The largest proportion of the esoteric testing market was held by CLIA. The advantages of this testing method over others, such as high-performance levels, low detection limits, higher specificity, high signal intensity, and good precision, account for a considerable portion of this market.

Due to an increase in the number of laboratories, high testing volumes, and a spike in diagnostic laboratory digitalization, the independent and reference laboratories segment dominated the market in 2020 and is likely to continue this trend during the forecast period. However, due to the rising prevalence of chronic disease, advancements in hospital laboratories, and the growing need for preventative healthcare, the hospital-based laboratories segment is likely to grow significantly throughout the forecast period.

Esoteric Testing Market Players

The prominent players operating in this market include Labcorp, Quest Diagnostics, OPKO Health Inc., CM Global Laboratories, Laboratory Corporation of America, Fulgent Genetics, Arup Laboratories, Mayo Medical Laboratories, Invitae, Myriad Genetics, Nordic Laboratories, Genomic Health, American Esoteric Laboratories (AEL), Miraca Holdings and BioMONTR among others.

These companies have adopted various organic as well as inorganic growth strategies to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for esoteric testing in the emerging economies.

- In 2021, Labcorp has acquired Myriad Genetics’ autoimmune business unit.

- In 2021, Quest Diagnostics has collaborated with GRAIL to support a first-of-its-kind multi-cancer early detection blood test called Galleri.

- In 2021, OPKO Health Inc. (BioReference Laboratories) has launched Scarlet Health, an in-home diagnostic, fully integrated digital platform, in the US.

Who Should Buy? Or Key Stakeholders

- Esoteric testing kit suppliers

- Investors

- Research institutes

- Environment, Health and Safety Professionals

Esoteric Testing Market Regional Analysis

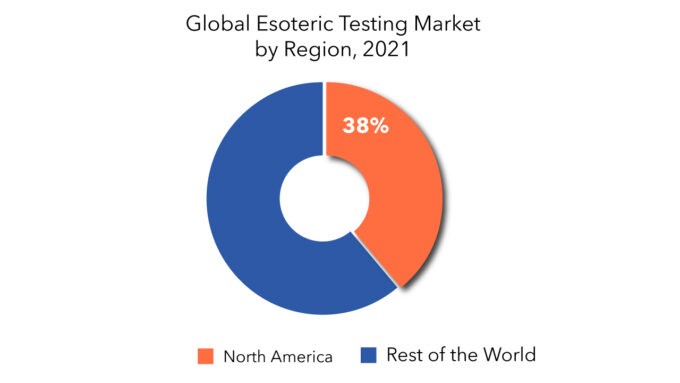

The global esoteric testing market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America dominates the esoteric testing market which attributes to the region’s largest share. The growth is driven by rising per capita healthcare expenditure, the presence of leading market players, increased use of rapid diagnostics, the region’s growing geriatric population, and advances in precision medicine.

Key Market Segments: Global Esoteric testing Market

Global Esoteric Testing Market by Type, 2020-2029, (USD Million)

- Infectious Disease

- Endocrinology

- Oncology

- Toxicology

- Immunology

- Genetic Testing

Global Esoteric Testing Market by Technology, 2020-2029, (USD Million)

- MS

- CLIA

- ELISA

- PCR

Global Esoteric Testing Market by End User, 2020-2029, (USD Million)

- Independent & Reference Laboratories

- Hospital Laboratories

Global Esoteric Testing Market by Region, 2020-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of esoteric testing market across major regions in the future?

- What are the new trends and advancements in the esoteric testing market?

- Which product categories are expected to have the highest growth rate in the esoteric testing market?

- Which are the key factors driving the esoteric testing market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Esoteric Testing Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Esoteric Testing Market

- Global Esoteric Testing Market Outlook

- Global Esoteric Testing Market by Type, (USD Million)

- Infectious Disease

- Endocrinology

- Oncology

- Toxicology

- Immunology

- Genetic Testing

- Global Esoteric Testing Market by Technology, (USD Million)

- MS

- CLIA

- ELISA

- PCR

- Global Esoteric Testing Market by End-User, (USD Million)

- Independent & Reference

- LaboratoriesHospital Laboratories

- Global Esoteric Testing Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle- East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle- East and Africa

- Company Profiles* (Business Overview, Company Snapshot, PRODUCT TYPEs Offered, Recent Developments)

- Labcorp

- QuestDiagnostics

- OPKOHealth Inc.

- CM Global Laboratories

- Laboratory Corporation of America

- Fulgent Genetics

- Arup Laboratories

- Mayo Medical Laboratories

- Invitae

- Myriad Genetics

- Nordic Laboratories

- Genomic Health

- American Esoteric Laboratories (AEL)

- Miraca Holdings

- BioMONTR *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 3 GLOBAL ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL ESOTERIC TESTING MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 5 NORTH AMERICA ESOTERIC TESTING MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 6 NORTH AMERICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 7 NORTH AMERICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 9 US ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 10 US ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 11 US ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 12 CANADA ESOTERIC TESTING MARKET BY TYPE (MILLIONS), 2020-2029

TABLE 13 CANADA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 14 CANADA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 15 MEXICO ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 16 MEXICO ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 17 MEXICO ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 18 SOUTH AMERICA ESOTERIC TESTING MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 19 SOUTH AMERICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 20 SOUTH AMERICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 21 SOUTH AMERICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 22 BRAZIL ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 23 BRAZIL ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 25 ARGENTINA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 26 ARGENTINA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 27 ARGENTINA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 28 COLOMBIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 29 COLOMBIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 30 COLOMBIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 31 REST OF SOUTH AMERICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 32 REST OF SOUTH AMERICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 33 REST OF SOUTH AMERICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 34 ASIA-PACIFIC ESOTERIC TESTING MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 35 ASIA-PACIFIC ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 36 ASIA-PACIFIC ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 37 ASIA-PACIFIC ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 38 INDIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 39 INDIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 40 INDIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 41 CHINA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 42 CHINA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 43 CHINA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 44 JAPAN ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 45 JAPAN ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 46 JAPAN ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 47 SOUTH KOREA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 48 SOUTH KOREA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 49 SOUTH KOREA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 50 AUSTRALIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 51 AUSTRALIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 52 AUSTRALIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 53 SOUTH EAST ASIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH EAST ASIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 55 SOUTH EAST ASIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 56 REST OF ASIA PACIFIC ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 57 REST OF ASIA PACIFIC ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 58 REST OF ASIA PACIFIC ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 59 EUROPE ESOTERIC TESTING MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 60 EUROPE ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 61 EUROPE ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 62 EUROPE ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 63 GERMANY ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 64 GERMANY ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 65 GERMANY ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 66 UK ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 67 UK ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 68 UK ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 69 FRANCE ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 70 FRANCE ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 71 FRANCE ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 72 ITALY ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 73 ITALY ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 74 ITALY ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 75 SPAIN ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 76 SPAIN ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 77 SPAIN ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 78 RUSSIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 79 RUSSIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 80 RUSSIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 81 REST OF EUROPE ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 82 REST OF EUROPE ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 83 REST OF EUROPE ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 84 MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 88 UAE ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 89 UAE ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 90 UAE ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 91 SAUDI ARABIA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 92 SAUDI ARABIA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 93 SAUDI ARABIA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 94 SOUTH AFRICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 95 SOUTH AFRICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 96 SOUTH AFRICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

TABLE 97 REST OF MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA ESOTERIC TESTING MARKET BY END-USER (USD MILLIONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ESOTERIC TESTING MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ESOTERIC TESTING MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ESOTERIC TESTING MARKET BY END-USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ESOTERIC TESTING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL ESOTERIC TESTING MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 14 GLOBAL ESOTERIC TESTING MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 15 GLOBAL ESOTERIC TESTING MARKET BY END-USER, USD MILLION, 2020-2029

FIGURE 16 GLOBAL ESOTERIC TESTING MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 17 ESOTERIC TESTING MARKET BY REGION 2021

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 LABCORP: COMPANY SNAPSHOT

FIGURE 20 QUEST DIAGNOSTICS: COMPANY SNAPSHOT

FIGURE 21 OPKO HEALTH INC: COMPANY SNAPSHOT

FIGURE 22 CM GLOBAL LABORATORIES: COMPANY SNAPSHOT

FIGURE 23 LABORATORY CORPORATION OF AMERICA: COMPANY SNAPSHOT

FIGURE 24 FULGENT GENETICS: COMPANY SNAPSHOT

FIGURE 25 ARUP LABORATORIES: COMPANY SNAPSHOT

FIGURE 26 MAYO MEDICAL LABORATORIES: COMPANY SNAPSHOT

FIGURE 27 INVITAE: COMPANY SNAPSHOT

FIGURE 28 MYRIAD GENETICS: COMPANY SNAPSHOT

FIGURE 29 NORDIC LABORATORIES: COMPANY SNAPSHOT

FIGURE 30 GENOMIC HEALTH: COMPANY SNAPSHOT

FIGURE 31 AMERICAN ESOTERIC LABORATORIES (AEL): COMPANY SNAPSHOT

FIGURE 32 MIRACA HOLDINGS: COMPANY SNAPSHOT

FIGURE 33 BIOMONTR: COMPANY SNAPSHOT

FAQ

The esoteric testing market size had crossed USD 18.83 Billion in 2020 and will observe a CAGR of more than 11.5% up to 2029 driven by an increase in the prevalence of chronic, infectious, and rare genetic diseases, increased demand for enzyme-linked immunosorbent assay (ELISA) and real-time polymerase chain reaction (RT-PCR), increased funding from private and government organizations for diagnostic service centers; and advancements in technology for esoteric testing are all driving the global esoteric testing market.

North America held more than 38% of the esoteric testing market revenue share in 2020 and will witness expansion with rising per capita healthcare expenditure, the presence of leading market players, increased use of rapid diagnostics, and the region’s growing geriatric population, and advances in precision medicine.

The upcoming trends in the esoteric testing market are developing an interest in cutting-edge proteomics and genomics will support the market of the esoteric testing industry.

The global esoteric testing market registered a CAGR of 11.5 % from 2022 to 2029. The Independent & Reference Laboratories segment was the highest revenue contributor to the market.

The major application for the esoteric testing market is it is used in complex diseases.

North America is the largest regional market for the esoteric testing market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.