REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

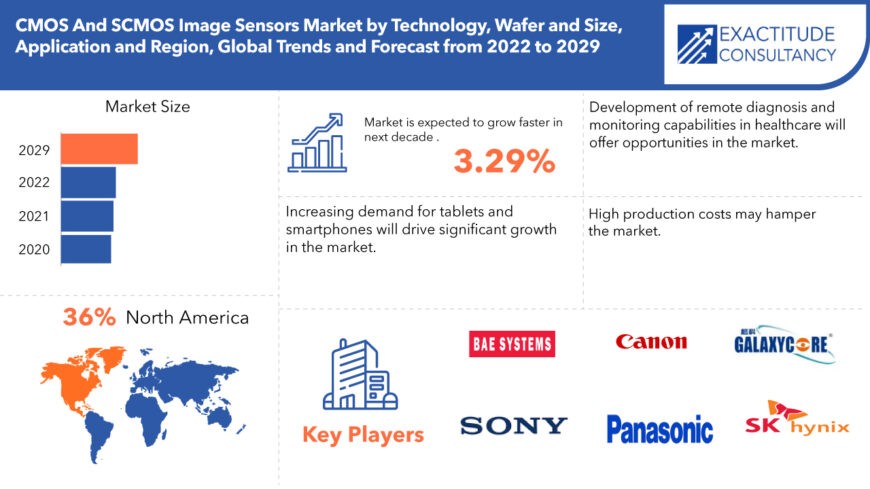

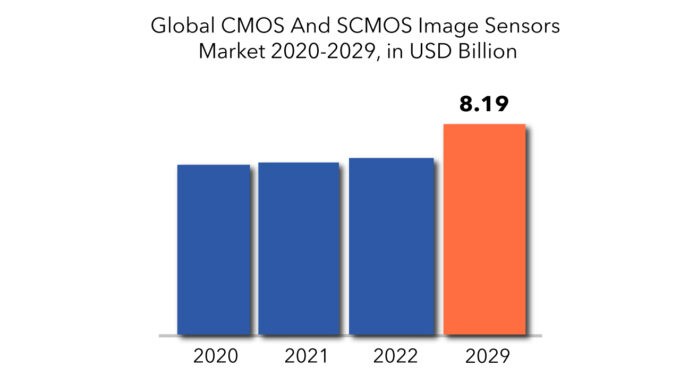

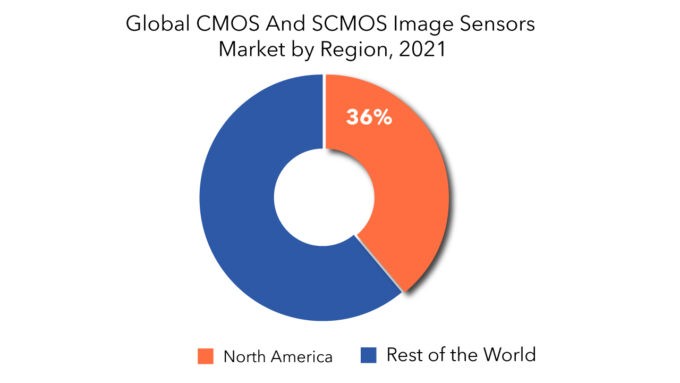

| USD 8.19 Billion by 2029 | 3.29% | North America |

| By Technology | By Wafer and Sensor Size | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

CMOS And SCMOS Image Sensors Market Overview

The global CMOS and SCMOS image sensors market is expected to grow at a 3.29% CAGR from 2022 to 2029. It is expected to reach above USD 8.19 Billion by 2029 from USD 6.12 Billion in 2020.

Smartphones, tablets, and digital single-lens reflex (DSLR) cameras frequently use CMOS image sensors. With smartphone manufacturers increasingly focused on improving camera architecture and quality, the adoption of CMOS technology by all smartphone manufacturers worldwide is expected to increase in the next years. Furthermore, the debut of dual-camera smartphones by key smartphone vendors is anticipated to help sustain demand, as the technology used requires two sensors and combines the colour and monochrome pictures produced by the respective CMOS image sensors to generate an image. The Galaxy S10 from Samsung has four cameras, three on the back and one on the front.

Rising tablet and smartphone demand, as well as the development of remote diagnosis and monitoring capabilities in healthcare, are predicted to significantly boost market demand. One of the primary goals of smartphone producers is to create smaller devices with high resolutions, which may benefit the market. Consumption of consumer electronics may improve market demand in the coming years. High production and maintenance costs may hinder the global CMOS and sCMOS image sensor industries’ growth.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | USD Millions, Thousand Units |

| Segmentation | By Technology, Wafer and Sensor Size, Application |

| By Technology |

|

| By Wafer and Sensor Size |

|

| By Application |

|

| By Region |

|

Because of the wide range of new-generation smartphones and devices, 3D image sensors are expected to gain popularity. The sensors can detect depth and time-of-flight due to the shrinking of electrical and optical components (TOF). Collision avoidance, robotics, and other applications use it in conjunction with 2D sensors. The Ranger3 CMOS sensor series can gather and produce images with a resolution of 2560×200 pixels. Plant inspection and maintenance can permit its usage in critical end-use sectors. Depth perception in conventional solutions will very definitely be implemented in future vision systems.

Manufacturers are spending heavily in the CMOS and sCMOS image sensor sectors in order to shrink equipment size and deliver energy-efficient technologies. The release of new products is expected to drive the majority of the players’ development trajectory. Differentiated techniques of product launch may be regarded as the primary strategy of significant corporations. Samsung Corporation, for example, has produced multi-camera smartphones for budding photographers and hobbyists.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway operation. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global CMOS and SCMOS image sensors market is crowded with established players. These players have a commanding say in the market. The operation used in the CMOS and SCMOS image sensors market is proprietary and needs long-term research and development planning implemented efficiently.

CMOS And SCMOS Image Sensors Market Segment Analysis

On the basis of technology, the CMOS and SCMOS image sensors market is divided into FSI, and BSI. The FSI category is projected to have substantial demand in the global CMOS and sCMOS image sensor market due to cheap production costs and microlenses capable of directing light. The BSI is expected to exceed its counterpart due to the absence of light-sensitive sector limitations. A novel sensor design architecture for improving sensitivity and signal-to-noise ratio has been integrated into vacuums, sports cameras, and drones, and it is predicted to gain popularity throughout the forecast period.

Based on wafer and sensor size, the CMOS and SCMOS image sensors market is segmented into 1 inch,2/3-inch, 1/2.3-inch, 1/3.2-inch, APS-H, APS-C, and MFT 4/3. Over the assessment period, the APS-H sensor size sector is expected to develop a significant amount of revenue. It is highly recommended for use with digital SLR cameras while capturing fast moving objects. In contrast, the APS-C category was the second-largest market and can gain from its use in mirrorless interchangeable-lens cameras (MILCs) and live-preview digital cameras.

On the basis of application, the CMOS and SCMOS image sensors market is divided into automotive, aerospace, machine tool, electronics, and microelectronics, medical, packaging, and military. The consumer electronics application is predicted to provide the greatest revenue for the global CMOS and sCMOS image sensor market due to its use in household appliances, entertainment items, and communication gadgets. Wearables are expected to create a new income stream for the business. This is because there is more interest in performance metrics and the use of videos to track progress.

CMOS And SCMOS Image Sensors Market Players

From large companies to small ones, many companies are actively working in the CMOS And SCMOS Image Sensors market. These key players include BAE Systems PLC,Sony Corporation,Canon Inc.,Panasonic Corporation, Galaxycore Inc.,SK Hynix Inc.,ON Semiconductor Corporation,OmniVision Technologies Inc.,Samsung Electronics Corporation Ltd,Teledyne Technologies Inc.,Sharp Corporation. and others.

Companies are mainly in CMOS And SCMOS image sensors they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In July 2020, The Hydra3D is Teledyne e2v’s new Time-of-Flight (ToF) CMOS image sensor designed for 3D detection and distance measuring. The sensor is compatible with the most recent industrial applications, such as vision-guided robots, logistics, and autonomous guided vehicles.

- In Oct. 2019, Sony has announced the upcoming availability of six new types of stacked CMOS image sensors featuring a global shutter function and a back-illuminated pixel structure for industrial equipment.

Who Should Buy? Or Key Stakeholders

- CMOS And SCMOS Image Sensors suppliers

- Investors

- End user companies

- Research institutes

- Others

CMOS And SCMOS Image Sensors Market Regional Analysis

The CMOS and SCMOS image sensors market includes North America, Asia-Pacific (APAC), Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by Asia Pacific, North America, Middle East & Africa (MEA), and Europe. Asia Pacific shares 33% of the total market. The factors contributing to the region’s market growth include the increasing number of CMOS And SCMOS image sensors production plants and the rapid usage of CMOS And SCMOS image sensors. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: CMOS And SCMOS Image Sensors Market

CMOS And SCMOS Image Sensors Market By Technology, 2020-2029, (USD Millions, Thousand Units)

- FSI

- BSI

CMOS And SCMOS Image Sensors Market By Wafer And Sensor Size, 2020-2029, (USD Millions, Thousand Units)

- 1 Inch

- 2/3 Inch

- 1/2.3 Inch

- 1/3.2 Inch

- Aps-H

- Aps-C

- MFT 4/3

CMOS And SCMOS Image Sensors Market By Application, 2020-2029, (USD Millions, Thousand Units)

- Artificial Intelligence

- Machine Learning

- IOT

- Surveillance

- Sports & Games

- Automotive

- Consumer Electronics

- Commercial Drones

CMOS And SCMOS Image Sensors Market By Region, 2020-2029, (USD Millions, Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the worth of global CMOS and SCMOS image sensors market?

- What are the new trends and advancements in the CMOS and SCMOS image sensors market?

- Which product categories are expected to have the highest growth rate in the CMOS And SCMOS image sensors market?

- Which are the key factors driving the CMOS and SCMOS image sensors market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Technologys

- Data Mining

- Executive Summary

- Market Overview

- Global CMOS And SCMOS Image Sensors Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global CMOS And SCMOS Image Sensors Market

- Global CMOS And SCMOS Image Sensors Market Outlook

- Global CMOS And SCMOS Image Sensors Market by Technology, (USD Million, Thousand Units)

- FSI

- BSI

- Global CMOS And SCMOS Image Sensors Market by Application, (USD Million, Thousand Units)

- Artificial Intelligence

- Machine Learning

- IoT

- Surveillance

- Sports & Games

- Automotive

- Consumer Electronics

- Commercial Drones

- Global CMOS And SCMOS Image Sensors Market by Wafer and Sensor Size, (USD Million, Thousand Units)

- 1 inch

- 2/3 inch

- 1/2.3 inch

- 1/3.2 inch

- APS-H

- APS-C

- MFT 4/3

- Global CMOS And SCMOS Image Sensors Market by Region, (USD Million, Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Wafer and Sensor Size’s Offered, Recent Developments)

-

-

- BAE Systems PLC

- Sony Corporation

- Canon Inc.

- Panasonic Corporation

- Galaxycore Inc.

- SK Hynix Inc.

- ON Semiconductor Corporation

- OmniVision Technologies Inc.

- Samsung Electronics Corporation Ltd

- Teledyne Technologies Inc.

- Sharp Corporation *The Company List Is Indicative

-

LIST OF TABLES

TABLE 1 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 8 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 10 NORTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 11 US CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 12 US CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 13 US CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 14 US CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 15 US CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 16 US CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 17 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 18 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 19 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 20 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 21 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 22 CANADA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 23 MEXICO CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 24 MEXICO CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 25 MEXICOCMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 26 MEXICOCMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 27 MEXICO CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 28 MEXICO CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 29 SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 30 SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 31 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 32 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 33 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 34 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 35 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 36 BRAZIL CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 37 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 38 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 39 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 40 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 41 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 42 ARGENTINA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 43 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 44 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 45 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 46 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 47 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 48 COLOMBIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 49 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 50 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 51 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 52 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 53 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 54 REST OF SOUTH AMERICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 55 ASIA-PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 56 ASIA-PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 57 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 58 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 59 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 60 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 61 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 62 INDIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 63 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 64 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 65 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 66 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 67 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 68 CHINA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 69 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 70 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 71 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 72 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 73 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 74 JAPAN CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 75 SOUTH KOREA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 76 SOUTH KOREA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 77 SOUTH KOREA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 78 SOUTH KOREA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 79 SOUTH KOREA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 80 SOUTH KOREA SANITARYWARE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 81 AUSTRALIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 82 AUSTRALIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 83 AUSTRALIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 84 AUSTRALIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 85 AUSTRALIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 86 AUSTRALIA SANITARYWARE MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 87 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 88 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 89 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 90 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 91 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 92 SOUTH EAST ASIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 93 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 94 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 96 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 98 REST OF ASIA PACIFIC CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 99 EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 102 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 103 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 104 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 105 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 106 GERMANY CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 107 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 108 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 109 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 110 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 111 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 112 UK CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 113 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 114 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 115 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 116 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 117 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 118 FRANCE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 119 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 120 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 121 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 122 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 123 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 124 ITALY CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 125 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 126 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 127 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 128 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 129 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 130 SPAIN CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 131 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 132 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 133 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 134 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 135 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 136 RUSSIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 137 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 138 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 139 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 140 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 141 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 142 REST OF EUROPE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 145 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 146 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 147 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 148 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 149 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 150 UAE CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 151 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 152 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 153 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 154 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 155 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 156 SAUDI ARABIA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 157 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 158 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 159 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 160 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 161 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 162 SOUTH AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (USD MILLIONS), 2020-2029

TABLE 164 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (USD MILLIONS), 2020-2029

TABLE 166 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE (THOUSAND UNITS), 2020-2029

TABLE 167 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (USD MILLIONS), 2020-2029

TABLE 168 REST OF MIDDLE EAST & AFRICA CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY WAFER AND SENSOR SIZE USD MILLION, 2020-2029

FIGURE 11 GLOBAL CMOS AND SCMOS IMAGE SENSORS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 CMOS AND SCMOS IMAGE SENSORS MARKET BY REGION 2020

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 BAE SYSTEMS PLC: COMPANY SNAPSHOT

FIGURE 16 SONY CORPORATION: COMPANY SNAPSHOT

FIGURE 17 CANON INC.: COMPANY SNAPSHOT

FIGURE 18 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 19 GALAXYCORE INC.: COMPANY SNAPSHOT

FIGURE 20 SK HYNIX INC.: COMPANY SNAPSHOT

FIGURE 21 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 22 OMNIVISION TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 23 SAMSUNG ELECTRONICS CORPORATION LTD: COMPANY SNAPSHOT

FIGURE 24 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

FIGURE 25 SHARP CORPORATION: COMPANY SNAPSHOT

FAQ

Increased demand for tablets and smartphones will fuel considerable market expansion.

The global CMOS And SCMOS image sensors market registered a CAGR of 3.29% from 2022 to 2029.

Asia Pacific holds the largest regional market for the CMOS And SCMOS image sensors market.

The market may be hampered by high production costs.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.