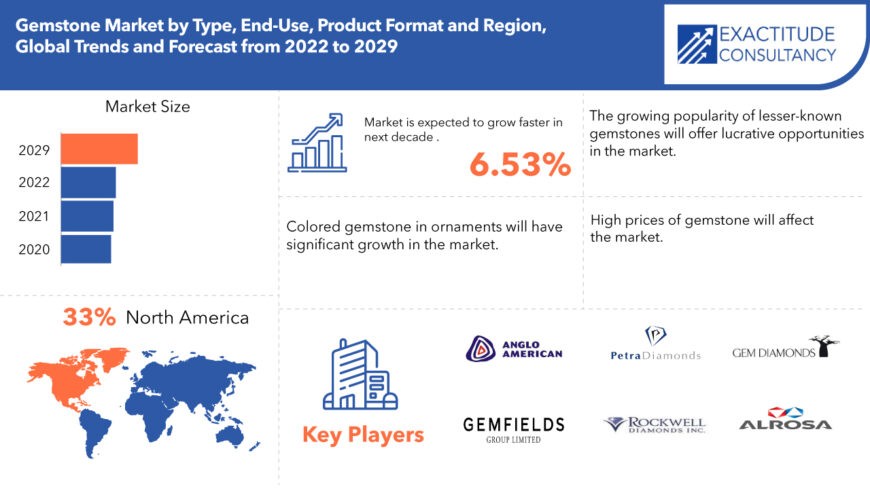

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 53.2 million | 6.53% | North America |

| By Type | By End-Use | By Product Format | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Gemstone Market Overview

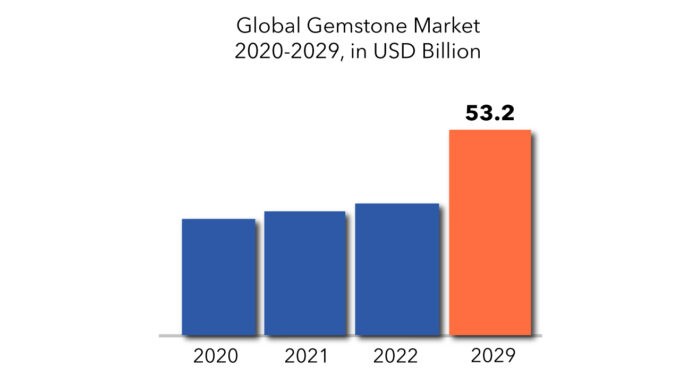

The global gemstone market is expected to grow at a 6.53% CAGR from 2023 to 2029. It is xpected to reach above USD 53.2 million by 2029 from USD 30.1 million in 2022.

Gemstones are mineral components that, once purified and cut, are used to create jewellery, ornaments, and ornamentation. Certain rocks or biological materials that are not minerals are used in the production of jewellery and hence are classified as gemstones. While most gemstones are hard in nature, several soft minerals are used in jewellery because of their brightness and other aesthetic characteristics. In addition to jewellery, hardstone sculptures and ancient jewels have been popular luxury art forms. They are frequently treated to improve the clarity or colour of the stone, and the extent and type of treatment may affect the stone’s value. Certain gemstones are designed to resemble other jewels. Synthetic moissanite and cubic zirconia, a zirconium oxide-based synthetic diamond stimulant, are examples of such jewels.

The gemstones are the same colour and look like real stones, but they lack physical and chemical properties. Moissanite has a higher refractive index than diamond and more “fire” when compared to the same cut and size diamond. Customers prefer to acquire medium-priced gem goods through particular channels such as home shopping via television marketing, which has resulted in significant global demand for gemstones. While the middle class like to buy in sales, the upper class prefers to spend on jewellery and gemstones.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | USD Millions |

| Segmentation | By Type, End-Use, Product Format |

| By Type

|

|

| By End-Use

|

|

| By Product Format

|

|

| By Region

|

|

Furthermore, factors such as fashion designers focusing on producing one-of-a-kind jewellery and manufacturers being vertically integrated into the production of gemstones and jewellery are contributing to the expansion of the gemstones sector. Gemstones have several applications in the jewellery industry. The market for jewellery and diamonds has experienced a significant increase in consumer discretionary expenditure, as well as an increase in the usage of decorations in ceremonies in Asian economies. Consumers in growing economies such as the Asia Pacific are rapidly migrating away from traditional disorganized jewellery and toward organized branded products in order to protect themselves against counterfeit items.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global gemstone market is crowded with established players. These players have a commanding say in the market. The technology used in the gemstone market is proprietary and needs long-term research and development planning implemented efficiently.

Gemstone Market Segment Analysis

On the basis of type, the gemstone market is segmented into diamond, emerald, ruby, sapphire, alexandrite, and topaz. In terms of the revenue share by product category, the diamond segment has a substantial market share. Millennials’ growing interest in jewellery, such as coloured diamond rings, is fuelling the demand for coloured diamonds. Millennials are drawn to high-end coloured diamond jewellery. Millennials’ increased purchasing power has pushed them to switch to coloured diamonds. As a result, demand for diamonds is soaring.

Based on the end-use, the gemstone market is divided into jewellery & ornaments, and luxury art. The usage of colourful gemstones in jewellery and other decorations is projected to stay dominating over the forecast period, according to the research. Retail demand for colourful gemstone jewellery such as bangles, necklaces, and pendants is likely to drive growth. Colored gemstones like ruby and sapphire have been popular options for wedding bands since ancient times. The availability of brilliant gemstone colours is one of the key factors that has inspired the use of coloured gemstones in jewellery. Many retail jewellery stores actively guide customers on the numerous colours available in gemstones.

On the basis of product format, the gemstone market is segmented into natural, and synthetic. Synthetic coloured gemstones accounted for the largest share of the market. Synthetic coloured gemstones have a higher demand than real coloured gemstones. Synthetic coloured gemstones have qualities that are similar to earth-mined colourful gemstones. Furthermore, synthetic gemstones are less expensive than genuine gemstones, which is why they are in higher demand than natural-coloured gemstones. The category is also expected to grow at a higher CAGR throughout the projection period.

Gemstone Market Players

From large companies to small ones, many companies are actively working in the gemstone market. These key players include Anglo American PLC, Gemfields Group Ltd., Petra Diamonds Limited, Rockwell Diamonds Inc., Gem Diamonds Inc., Gem Inc., Gem Group, Rio Tinto Group, Rio Company (Pty) Group, Rio Group, Rio Diamonds Group, Rio Gems Inc., Dominion Diamond Corporation, Mountain Province Diamonds Inc., Pangolin Diamonds Corporation, Stornoway Diamond Corporation, Arctic Star Exploration Corporation, Arctic Hex Group Ltd., and others.

Companies are mainly in gemstone they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

In 2021, Gemfields introduced its high-quality emerald yet- Chipembele, the rhino emerald. The magnificent gem will be auctioned off at the next Gemfields emerald auction, with a portion of the proceeds going to the North Luangwa Conservation Programme in Zambia.

Who Should Buy? Or Key Stakeholders

- Gemstone suppliers

- Investors

- End user companies

- Research institutes

Gemstone Market Regional Analysis

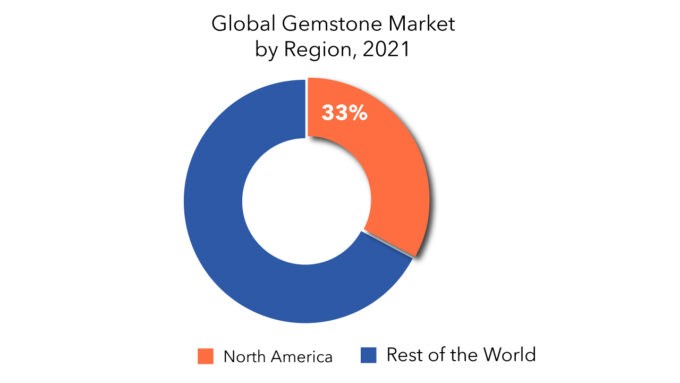

The gemstone market includes North America, Asia-Pacific (APAC), Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by North America, Asia Pacific, Middle East & Africa (MEA), and Europe. North America shares 33% of the total market. The factors contributing to the region’s market growth include the increasing number of Gemstone production plants and the rapid usage of Gemstone. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: Gemstone Market

Gemstone Market by Type, 2023-2029, (USD Millions)

- Diamond

- Emerald

- Ruby

- Sapphire

- Alexandrite

- Topaz

Gemstone Market by End-Use, 2023-2029, (USD Millions)

- Jewellery & Ornaments

- Luxury Art

Gemstone Market by Product Format, 2023-2029, (USD Millions)

- Natural

- Synthetic

Gemstone Market by Region, 2023-2029, (USD Millions)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the worth of global gemstone market?

- What are the new trends and advancements in the gemstone market

- Which product categories are expected to have the highest growth rate in the gemstone market?

- Which are the key factors driving the gemstone market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Types

- Data Mining

- Executive Summary

- Market Overview

- Global Scientific CMOS Camera Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Scientific CMOS Camera Market

- Global Scientific CMOS Camera Market Outlook

- Global Scientific CMOS Camera Market by Type, (USD Million)

- Diamond

- Emerald

- Ruby

- Sapphire

- Alexandrite

- Topaz

- Global Scientific CMOS Camera Market by End-Use, (USD Million)

- Jewellery & Ornaments

- Luxury Art

- Global Scientific CMOS Camera Market by Product Format, (USD Million)

- Natural

- Synthetic

- Global Scientific CMOS Camera Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Product Format’s Offered, Recent Developments)

9.1. Anglo American PLC

9.2. Gemfields Group Ltd.

9.3. Petra Diamonds Limited

9.4. Rockwell Diamonds Inc.

9.5. Gem Diamonds Limited

9.6. PJSC ALROSA

9.7. Swarovski Group

9.8. Rio Tinto Diamonds

9.9. DebswanaDiamond Company (Pty) Limited

9.10. LucaraDiamond Corp.

9.11. Botswana Diamonds P.L.C

9.12. Fura Gems Inc.

9.13. Dominion Diamond Corporation

9.14. Mountain Province Diamonds Inc.

9.15. Pangolin Diamonds Corporation

9.16. Stornoway Diamond Corporation

9.17. Arctic Star Exploration Corp.

9.18. Trans Hex Group Ltd.

9.19. Merlin Diamonds Limited

9.20. KGK Group

9.21. Pala International Inc.

9.22. MIF Gems Co Ltd.

9.23. Greenland Ruby *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL GEMSTONE MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 6 US GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 7 US GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 9 CANADA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 10 CANADA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 12 MEXICO GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 13 MEXICO GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 27 INDIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 28 INDIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 30 CHINA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 31 CHINA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 33 JAPAN GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 34 JAPAN GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 48 GERMANY GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 49 GERMANY GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 51 UK GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 52 UK GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 FRANCE GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 55 FRANCE GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 57 ITALY GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 58 ITALY GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 60 SPAIN GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 61 SPAIN GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 69 UAE GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 70 UAE GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA GEMSTONE MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA GEMSTONE MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA GEMSTONE MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL SCIENTIFIC CMOS CAMERA MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL SCIENTIFIC CMOS CAMERA MARKET BY END-USE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL SCIENTIFIC CMOS CAMERA MARKET BY PRODUCT FORMAT USD MILLION, 2020-2029

FIGURE 11 GLOBAL SCIENTIFIC CMOS CAMERA MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 SCIENTIFIC CMOS CAMERA MARKET BY REGION 2020

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 ANGLO AMERICAN PLC: COMPANY SNAPSHOT

FIGURE 16 GEMFIELDS GROUP LTD.: COMPANY SNAPSHOT

FIGURE 17 PETRA DIAMONDS LIMITED: COMPANY SNAPSHOT

FIGURE 18 ROCKWELL DIAMONDS INC.: COMPANY SNAPSHOT

FIGURE 19 GEM DIAMONDS LIMITED: COMPANY SNAPSHOT

FIGURE 20 PJSC ALROSA: COMPANY SNAPSHOT

FIGURE 21 SWAROVSKI GROUP: COMPANY SNAPSHOT

FIGURE 22 RIO TINTO DIAMONDS: COMPANY SNAPSHOT

FIGURE 23 DEBSWANADIAMOND COMPANY (PTY) LIMITED: COMPANY SNAPSHOT

FIGURE 24 LUCARADIAMOND CORP.: COMPANY SNAPSHOT

FIGURE 25 BOTSWANA DIAMONDS P.L.C: COMPANY SNAPSHOT

FIGURE 26 FURA GEMS INC.: COMPANY SNAPSHOT

FIGURE 27 DOMINION DIAMOND CORPORATION: COMPANY SNAPSHOT

FIGURE 28 MOUNTAIN PROVINCE DIAMONDS INC.: COMPANY SNAPSHOT

FIGURE 29 PANGOLIN DIAMONDS CORPORATION: COMPANY SNAPSHOT

FIGURE 30 STORNOWAY DIAMOND CORPORATION: COMPANY SNAPSHOT

FIGURE 31 ARCTIC STAR EXPLORATION CORP.: COMPANY SNAPSHOT

FIGURE 32 TRANS HEX GROUP LTD.: COMPANY SNAPSHOT

FIGURE 33 MERLIN DIAMONDS LIMITED: COMPANY SNAPSHOT

FIGURE 34 KGK GROUP: COMPANY SNAPSHOT

FIGURE 35 PALA INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 36 MIF GEMS CO LTD.: COMPANY SNAPSHOT

FIGURE 37 GREENLAND RUBY: COMPANY SNAPSHOT

FAQ

Colored gemstones in ornaments will experience significant market expansion.

The global gemstone market registered a CAGR of 6.53% from 2023 to 2029.

North America holds the largest regional market for the gemstone market.

The high cost of manufacture will hinder market expansion.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.