REPORT OUTLOOK

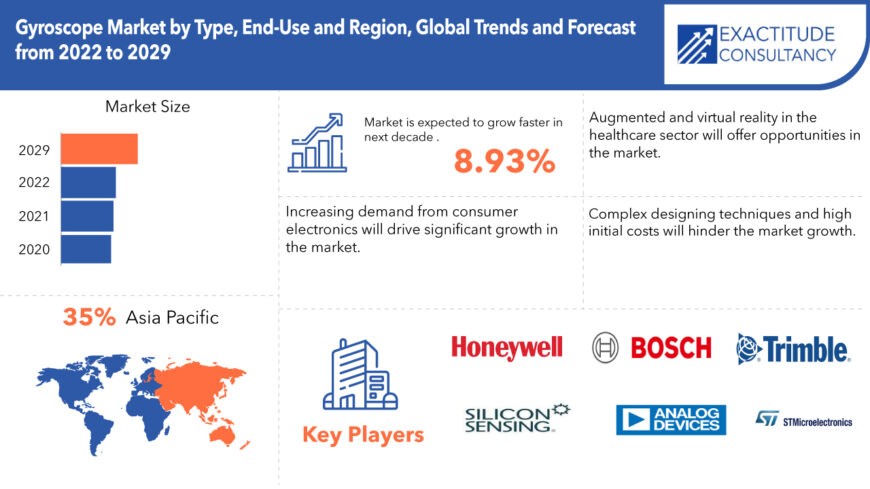

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.7 billion by 2029 | 8.93% | Asia Pacific |

| By Type | By End-Use | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Gyroscope Market Overview

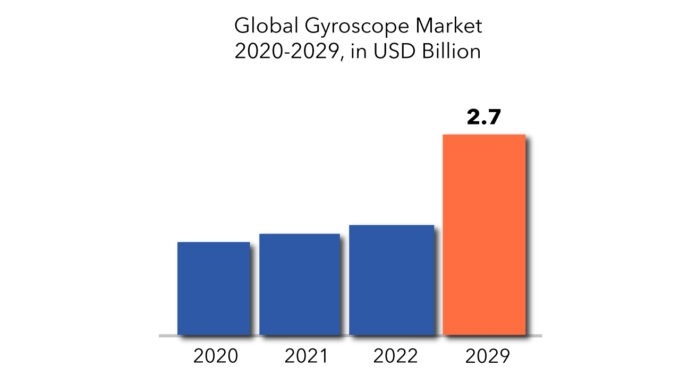

The global gyroscope market is expected to grow at a 8.93% CAGR from 2022 to 2029. It is expected to reach above USD 2.7 billion by 2029 from USD 1.25 billion in 2020.

Gyroscopes are sensors that are used to measure orientation in a variety of devices. Gyroscopes have progressed significantly since the beginning, also helped by gradual technological developments. As a result, they have emerged as one of the most important components of navigation systems. MEMS gyroscopes, fibre optic gyroscopes (FOG), ring laser gyroscopes (RLG), hemispherical resonator gyroscopes (HRG), dynamically tuned gyroscopes (DTG), and other technologies are the many types of gyroscopes.

The growing requirement for INS performance has influenced technical advancements in gyroscopes. The aviation industry, which is the primary consumer of INS systems, has played a significant role in market growth and is likely to continue to be a key driver for the worldwide market. The rapidly increasing use of drones and unmanned aerial vehicles (UAVs) in the defence and commercial sectors has been cited as a significant market driver. Furthermore, technical improvements are resulting in improved performance and cheaper prices as a result of increased market investment. This is boosting the market for gyroscope systems across a variety of sectors, driving market development. However, the growing production complexity and prices in the sector are impeding market expansion.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | USD Millions, Thousand Units |

| Segmentation | By Type, End-Use |

| By Type

|

|

| By End-Use

|

|

| By Region

|

|

According to the International Organization of Motor Vehicle Manufacturers (OICA), 97,302,534 automobiles were manufactured in 2017, with an increase projected in the next years. Furthermore, IndustryARC’s industry experts predict that the autonomous truck market will increase gradually in the future, as will the need for passenger cars, as well as the significant rise of the electric vehicle market due to environmental restrictions. Now, this seismic change and expansion in the automobile industry will produce long-term demand for gyroscope sensors, propelling the gyroscope market forward.

With even more video games appearing that attempt to provide an interactive experience of a real-world setting where the items that dwell in the real-world are augmented with computer-generated perceptual information, there is a perceptible boom in the augmented reality sector. This technology now relies heavily on gyroscope sensors to regulate and measure angular velocity and direction. The anticipated increase in augmented reality will open up new opportunities for producers in the gyroscope industry.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global gyroscope market is crowded with established players. These players have a commanding say in the market. The technology used in the gyroscope market is proprietary and needs long-term research and development planning implemented efficiently.

Gyroscope Market Segment Analysis

The worldwide gyroscope market is divided into several types, including hemispherical resonating gyroscopes, dynamically tuned gyroscopes, ring laser gyroscopes, fibre optic gyroscopes, MEMS gyroscopes, and others. Over the projected period, the MEMS gyroscope segment will lead the market.

The worldwide gyroscope market is divided into applications such as automotive, marine, mining, industrial production, aerospace and military, consumer electronics, and others. Over the projection period, the aerospace and defence segment will dominate the market.

Gyroscope Market Players

From large companies to small ones, many companies are actively working in the gyroscope market. These key players include Honeywell International Inc, Silicon Sensing Systems Limited, Robert Bosch GmbH, Analog Devices Inc., Trimble Inc., STMicroelectronics, TDK Corporation, NXP Semiconductor, Murata Manufacturing Co Ltd, Epson America Inc, InnaLabs.and others.

Companies are mainly in gyroscope they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In April 2019, For more precision, STMicroelectronics N.V. produced a MEMS device that integrated an accelerometer with a high-accuracy temperature sensor. It aids in temperature adaptation by utilising the sensor’s higher precision. With 65 various user modes, the accelerometer offers unparalleled versatility, allowing developers to minimise power consumption and noise to match application-specific needs.

- In January 2019, Honeywell has established an online marketplace for purchasing and selling new and secondhand aeroplane components.

Who Should Buy? Or Key Stakeholders

- Gyroscope suppliers

- Investors

- End user companies

- Research institutes

Gyroscope Market Regional Analysis

The gyroscope market by region includes Asia-Pacific (APAC), North America, Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

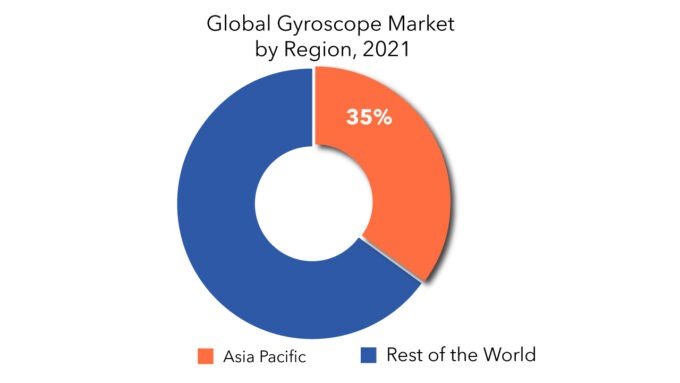

Its major share is occupied by Asia Pacific, North America, Middle East & Africa (MEA), and Europe. Asia Pacific shares 35% of the total market. The factors contributing to the region’s market growth include the increasing number of gyroscope production plants and the rapid usage of gyroscope. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: Gyroscope Market

Gyroscope Market by Type, 2020-2029, (USD Millions, Thousand Units)

- Tuned Gyroscope

- Ring Laser Gyroscope

- Fiber Optic Gyroscope

- Mems Gyroscopes

Gyroscope Market by End-Use, 2020-2029, (USD Millions, Thousand Units)

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Industrial

- Healthcare

Gyroscope Market by Region, 2020-2029, (USD Millions, Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the worth of global gyroscope market?

- What are the new trends and advancements in the gyroscope market

- Which product categories are expected to have the highest growth rate in the gyroscope market?

- Which are the key factors driving the gyroscope market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Gyroscope Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Gyroscope Market

- Global Gyroscope Market Outlook

- Global Gyroscope Market by Type, (USD Million, Thousand Units)

- Tuned Gyroscope

- Ring Laser Gyroscope

- Fiber Optic Gyroscope

- MEMS Gyroscopes

- Global Gyroscope Market by End-Use, (USD Million, Thousand Units)

- Consumer Electronics

- Automotive

- Aerospace And Defense

- Industrial

- Healthcare

- Global Gyroscope Market by Region, (USD Million, Thousand Units)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles*(Business Overview, Company Snapshot, Products Offered, Recent Developments)

8.1. Honeywell International Inc

8.2. Silicon Sensing Systems Limited

8.3. Robert Bosch GmbH

8.4. Analog Devices Inc.

8.5. Trimble Inc.

8.6. STMicroelectronics

8.7. TDK Corporation

8.8. NXP Semiconductor

8.9. Murata Manufacturing Co Ltd

8.10. Epson America Inc

8.11. InnaLabs. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 2 GLOBAL GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 4 GLOBAL GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL GYROSCOPE MARKET BY REGION (USD MILLIONS), 2020-2029

TABLE 6 GLOBAL GYROSCOPE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 7 NORTH AMERICA GYROSCOPE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 8 NORTH AMERICA GYROSCOPE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 9 US GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 10 US GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 11 US GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 12 US GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 13 CANADA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 14 CANADA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 15 CANADA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 16 CANADA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 17 MEXICO GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 18 MEXICO GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 19 MEXICO GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 20 MEXICO GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 21 SOUTH AMERICA GYROSCOPE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 22 SOUTH AMERICA GYROSCOPE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 23 BRAZIL GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 24 BRAZIL GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 25 BRAZIL GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 26 BRAZIL GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 27 ARGENTINA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 28 ARGENTINA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 29 ARGENTINA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 30 ARGENTINA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 31 COLOMBIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 32 COLOMBIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 COLOMBIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 34 COLOMBIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 35 REST OF SOUTH AMERICA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 36 REST OF SOUTH AMERICA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 37 REST OF SOUTH AMERICA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 38 REST OF SOUTH AMERICA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 39 ASIA-PACIFIC GYROSCOPE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 40 ASIA-PACIFIC GYROSCOPE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 41 INDIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 42 INDIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 43 INDIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 44 INDIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 45 CHINA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 46 CHINA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 CHINA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 48 CHINA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 49 JAPAN GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 50 JAPAN GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 51 JAPAN GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 52 JAPAN GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 53 SOUTH KOREA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 54 SOUTH KOREA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 SOUTH KOREA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 56 SOUTH KOREA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 57 AUSTRALIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 58 AUSTRALIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 AUSTRALIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 60 AUSTRALIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 61 SOUTH EAST ASIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 62 SOUTH EAST ASIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 63 SOUTH EAST ASIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 64 SOUTH EAST ASIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF ASIA PACIFIC GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 66 REST OF ASIA PACIFIC GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 67 REST OF ASIA PACIFIC GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 68 REST OF ASIA PACIFIC GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 69 EUROPE GYROSCOPE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 70 EUROPE GYROSCOPE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 71 GERMANY GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 72 GERMANY GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 73 GERMANY GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 74 GERMANY GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 75 UK GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 76 UK GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 77 UK GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 78 UK GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 79 FRANCE GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 80 FRANCE GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 81 FRANCE GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 82 FRANCE GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 83 ITALY GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 84 ITALY GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 ITALY GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 86 ITALY GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 87 SPAIN GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 88 SPAIN GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 89 SPAIN GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 90 SPAIN GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 91 RUSSIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 92 RUSSIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 93 RUSSIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 94 RUSSIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 95 REST OF EUROPE GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 96 REST OF EUROPE GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 REST OF EUROPE GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 98 REST OF EUROPE GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 99 MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY COUNTRY (USD MILLIONS), 2020-2029

TABLE 100 MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 101 UAE GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 102 UAE GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 UAE GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 104 UAE GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 105 SAUDI ARABIA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 106 SAUDI ARABIA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 107 SAUDI ARABIA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 108 SAUDI ARABIA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH AFRICA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 110 SOUTH AFRICA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 111 SOUTH AFRICA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 112 SOUTH AFRICA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY TYPE (USD MILLIONS), 2020-2029

TABLE 114 REST OF MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY END-USE (USD MILLIONS), 2020-2029

TABLE 116 REST OF MIDDLE EAST AND AFRICA GYROSCOPE MARKET BY END-USE (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL GYROSCOPE MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL GYROSCOPE MARKET BY END-USE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL GYROSCOPE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GYROSCOPE MARKET BY REGION 2020

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

FIGURE 15 SILICON SENSING SYSTEMS LIMITED: COMPANY SNAPSHOT

FIGURE 16 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

FIGURE 17 ANALOG DEVICES INC.: COMPANY SNAPSHOT

FIGURE 18 TRIMBLE INC.: COMPANY SNAPSHOT

FIGURE 19 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 20 TDK CORPORATION: COMPANY SNAPSHOT

FIGURE 21 NXP SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 22 MURATA MANUFACTURING CO LTD: COMPANY SNAPSHOT

FIGURE 23 EPSON AMERICA INC: COMPANY SNAPSHOT

FIGURE 24 INNALABS.: COMPANY SNAPSHOT

FAQ

Consumer electronics demand will generate considerable expansion in the industry.

The global Gyroscope market registered a CAGR of 8.93% from 2022 to 2029.

Asia Pacific holds the largest regional market for the gyroscope market.

Complex design and high initial cost of raw material production will hinder the growth of the market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.