REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

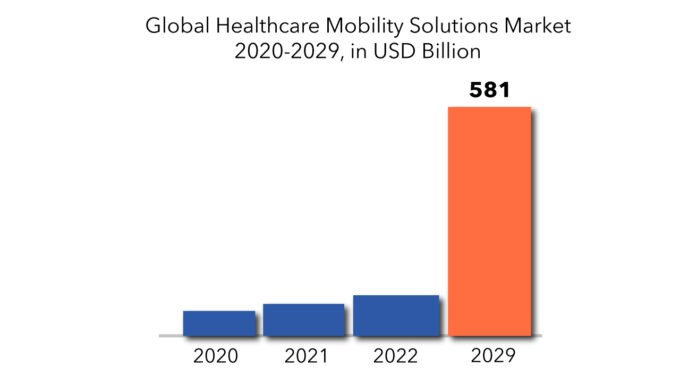

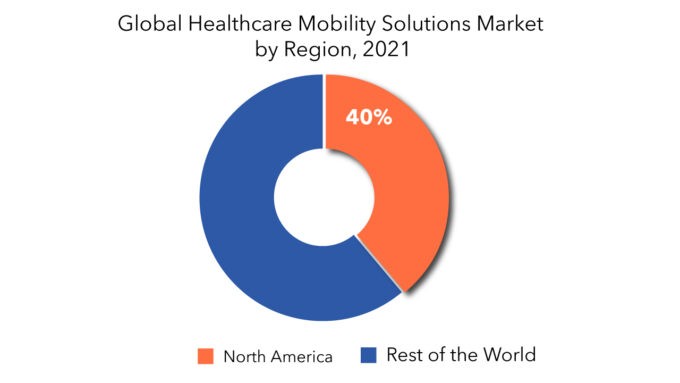

| USD 581 billion | 28% | North America |

| By Type | By Application | By End-User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Healthcare Mobility Solutions Market Overview

The global healthcare mobility solutions market is expected to grow at 28% CAGR from 2022 to 2029. It is expected to reach above USD 581 billion by 2029 from USD 63 billion in 2020.

The healthcare industry is undergoing significant change as it becomes one of the early adopters of advanced mobile technology in its products and services. With the help of quick recognition of the benefits yielded by the mobile-enabled application, healthcare providers have overcome the majority of the challenges they have faced. In the past, the health industry faced numerous challenges such as remote area locations, skyrocketing overhead costs, and complex regulatory requirements, all of which had a significant impact on their overall services. To become one of the economy’s pillars, the healthcare industry needed to overcome these challenges. Mobile technology paved the way for it to take a forward-thinking but cost-effective approach.

Various technologies are being developed to provide mobility solutions for them. Their tried-and-true methodology based on discrete fundamentals has enabled them to stay abreast of the latest service trends and thus provide all benefits to their clients. It is creating applications using cutting-edge technology and adhering to all applicable standards and regulations. It is constantly expanding in order to provide superior experiences to the end-user. It enables them to increase productivity, improve all service levels, and reduce response time. Some of the advantages of using a healthcare mobile solution are that it allows for increased mobility and patient care, which leads to higher levels of productivity.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million) |

| Segmentation | By Component, By End-User, By Region |

| By Type

|

Enterprise Mobility Platforms

Mobile Applications (Apps) Mobile Devices |

| By Application |

|

| By End-User

|

|

| By Region

|

|

COVID-19 has caused both an economic and a healthcare crisis. The COVID-19 pandemic has strained the world’s healthcare system, and the developed world is expected to experience an economic downturn. The COVID-19 pandemic has had a negative impact on the healthcare system, resulting in a 50% to 70% drop in revenue since March. Many small hospitals, clinics, and nursing homes have had to close their doors. As a result of social isolation and localized curfews, elective surgical procedures have been postponed. Furthermore, visa cancellations have caused a halt in medical tourism, which may have a negative impact on the growth of the healthcare services market.

The evolution of healthcare mobility solutions has been fueled by the ever-increasing and changing medical needs. The goal of these solutions is to reduce healthcare costs while providing patients with the best possible solution in the shortest amount of time. The development of healthcare mobility solutions’ products and services such as mobile devices, enterprise mobility platforms, and mobile applications has successfully achieved the simplicity of this objectivity. The increasing demand for medical attention, as well as the increased use of smartphones and other personal digital assistants, have enabled the deployment of this technology. It has helped to bridge the gap between patients and caregivers by facilitating assistance via technology.

Some of the major factors driving the growth of the healthcare mobility solutions market include the rapid adoption of tablet and smartphone technologies in healthcare systems, a greater emphasis on patient-centric mobility, advanced connectivity to ensure the enhanced quality of healthcare solutions, robust penetration of wireless networks such as 2G and 3G, and improved cost-efficiency of mobility solutions resulting in streamlined workflow. Furthermore, the introduction of new innovations is an important factor in the market’s expansion. The shortage of nursing staff and doctors is increasing the adoption of mobile solutions and creating new opportunities for the growth of the healthcare mobility solutions market. However, data security issues, mobile computer battery problems, a lack of reimbursement policies, and a variety of cost issues are restraining the growth of the healthcare mobility solutions market.

Healthcare Mobility Solutions Market Segment Analysis

The global healthcare mobility solutions market is segmented by product and services, application, end user and region.

Based on products and services, the market is segmented into enterprise mobility platforms, mobile applications (apps), and mobile devices. Due to the increasing demand from hospitals and other caregivers to maintain and optimize operational efficiency, enterprise mobility platforms are expected to show an uphill shift during the forecast period. Because of the growing demand for mobile healthcare apps, the mobile application segment is expected to grow at a rapid pace during the forecast period.

Based on application, the market is bifurcated into enterprise solutions and mHealth solutions. the enterprise segment is further divided into patient care management, operation management, and workforce management. Enterprise solutions account for the majority of the market, followed by mHealth applications. The patient care management segment is expected to account for the largest share of the enterprise solutions market and to grow at the fastest CAGR during the forecast period. This growth is primarily due to the growing benefits of mobility solutions in inpatient care, such as efficient patient care, increased response time, improved workflow efficiency, and increased patient throughput while lowering costs and risks.

Based on End-Users, the market is bifurcated into Payers, Providers, and Patients. Healthcare providers are expected to have the largest market share. The high penetration of competent devices such as mobile devices, RFID scanners, and bar code scanners in healthcare systems such as hospitals, clinics, and other ambulatory care settings is primarily responsible for this end-user segment’s large share. The rapid adoption of mobile applications to streamline workflow and performance of clinical processes and patient outcomes is also contributing to the segment’s growth.

Healthcare Mobility Solutions Market Players

The healthcare mobility solutions market key players include Oracle Corporation (U.S.), SAP SE (Germany), McKesson Corporation (U.S.), Cerner Corporation (U.S.), Zebra Technologies (U.S.), Philips Healthcare (Netherlands), AT&T Inc. (U.S.), Cisco Systems, Inc. (U.S.), Omron Corporation (Japan), and Airstrip Technologies, Inc. (U.S.). Other players in this market are Microsoft, Inc. (U.S.), Apple, Inc. (U.S.), Qualcomm, Inc. (U.S.), IBM Corporation (U.S.), Hewlett-Packard (HP) Inc. (U.S.), and Verizon Communications, Inc. (U.S.).

- In August 2022, Indonesia’s Health Ministry launched the Indonesia Health Services platform in Jakarta as a part of the country’s health technology transformation.

- In June 2022, athenahealth, Inc., a provider of network-enabled software and services for medical groups and health systems nationwide, launched its athenaOne Voice Assistant Powered by Nuance, a mobile-embedded, voice-driven digital companion that streamlines information retrieval and enables hands-free completion of meaningful clinical tasks for healthcare providers using athenahealth’s electronic health records (EHR) solution.

Who Should Buy? Or Key Stakeholders

- Healthcare companies.

- Hospitals, Clinics.

- Government organization.

- Investment and research firms.

Healthcare Mobility Solutions Market Regional Analysis

The healthcare mobility solutions market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America has the largest market share due to the large number of smartphone users and higher adaptability to online services, which are expected to drive market growth during the forecast period. With the development of mHealth and its applications that assist people in active personal health management, healthcare in the North American region is experiencing positive trends. Furthermore, the Asia-Pacific region’s market is being driven by an increase in the number of healthcare systems such as hospitals, clinics, and other ambulatory care settings.

Key Market Segments: Healthcare Mobility Solutions Market

Healthcare Mobility Solutions Market by Type, 2020-2029, (USD Million)

- Enterprise Mobility Platforms

- Mobile Applications (Apps)

- Mobile Devices

Healthcare Mobility Solutions Market by Application, 2020-2029, (USD Million)

- Enterprise Solutions

- Patient Care Management

- Operation Management

- Workforces Management

- Health Applications

Healthcare Mobility Solutions Market by End-User, 2020-2029, (USD Million)

- Payers

- Providers

- Patients

Healthcare Mobility Solutions Market by Region, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the healthcare mobility solutions market?

- What are the key factors influencing the growth of healthcare mobility solutions?

- What is the major end-use industry for healthcare mobility solutions?

- Who are the major key players in the healthcare mobility solutions market?

- Which region will provide more business opportunities for healthcare mobility solutions in the future?

- Which segment holds the maximum share of the healthcare mobility solutions market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Healthcare Mobility Solutions Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Healthcare Mobility Solutions Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Healthcare Mobility Solutions Market Outlook

- Global Healthcare Mobility Solutions Market by Product and Services

- Enterprise Mobility Platforms

- Mobile Applications (Apps)

- Mobile Devices

- Global Healthcare Mobility Solutions Market by Application

- Enterprise Solutions

- Patient Care Management

- Operation Management

- Workforces Management

- mHealth Applications

- Enterprise Solutions

- Global Healthcare Mobility Solutions Market by End User

- Payers

- Providers

- Patients

- Global Healthcare Mobility Solutions Market by Region

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Setup Product and Type Offered, Recent Developments)

- Oracle Corporation

- At&T, Inc.

- Cisco Systems, Inc.

- Philips Healthcare

- SAP SE

- Zebra Technologies Corporation

- Cerner Corporation

- Mckesson Corporation

- Omron Corporation

- Airstrip Technologies, Inc. *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 NORTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2028

TABLE 6 US HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 7 US HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 8 US HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 9 CANADA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 10 CANADA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 11 CANADA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 12 MEXICO HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 13 MEXICO HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 MEXICO HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 15 SOUTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2028

TABLE 16 BRAZIL HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 17 BRAZIL HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 BRAZIL HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 20 ARGENTINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 21 ARGENTINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 23 COLOMBIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 COLOMBIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 26 REST OF SOUTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 27 REST OF SOUTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 28 ASIA-PACIFIC HEALTHCARE MOBILITY SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2028

TABLE 29 INDIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 30 INDIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 31 INDIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 CHINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 33 CHINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 CHINA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 JAPAN HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 36 JAPAN HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 37 JAPAN HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 SOUTH KOREA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 39 SOUTH KOREA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 SOUTH KOREA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 AUSTRALIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 42 AUSTRALIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 43 AUSTRALIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 SOUTH-EAST ASIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 45 SOUTH-EAST ASIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 SOUTH-EAST ASIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 REST OF ASIA PACIFIC HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 48 REST OF ASIA PACIFIC HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 49 REST OF ASIA PACIFIC HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 EUROPE HEALTHCARE MOBILITY SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2028

TABLE 51 GERMANY HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 52 GERMANY HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 53 GERMANY HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 54 UK HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 55 UK HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 UK HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 57 FRANCE HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 58 FRANCE HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 59 FRANCE HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 60 ITALY HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 61 ITALY HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 ITALY HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 63 SPAIN HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 64 SPAIN HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 65 SPAIN HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 66 RUSSIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 67 RUSSIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 RUSSIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 69 REST OF EUROPE HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 70 REST OF EUROPE HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 71 REST OF EUROPE HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 72 MIDDLE EAST AND AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY COUNTRY (USD MILLIONS) 2019-2028

TABLE 73 UAE HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 74 UAE HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 75 UAE HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 76 SAUDI ARABIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 77 SAUDI ARABIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 SAUDI ARABIA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 79 SOUTH AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 80 SOUTH AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 81 SOUTH AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 82 REST OF MIDDLE EAST AND AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES (USD MILLIONS) 2020-2029

TABLE 83 REST OF MIDDLE EAST AND AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 REST OF MIDDLE EAST AND AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY PRODUCT AND SERVICES, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL HEALTHCARE MOBILITY SOLUTIONS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET SNAPSHOT

FIGURE 14 EUROPE HEALTHCARE MOBILITY SOLUTIONS MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC HEALTHCARE MOBILITY SOLUTIONS MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA HEALTHCARE MOBILITY SOLUTIONS MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA HEALTHCARE MOBILITY SOLUTIONS MARKET SNAPSHOT

FIGURE 18 ORACLE CORPORATION: COMPANY SNAPSHOT

FIGURE 19 AT&T, INC.: COMPANY SNAPSHOT

FIGURE 20 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

FIGURE 21 PHILIPS HEALTHCARE: COMPANY SNAPSHOT

FIGURE 22 SAP SE: COMPANY SNAPSHOT

FIGURE 23 ZEBRA TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 24 CERNER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 MCKESSON CORPORATION: COMPANY SNAPSHOT

FIGURE 26 OMRON CORPORATION: COMPANY SNAPSHOT

FIGURE 27 AIRSTRIP TECHNOLOGIES, INC.: COMPANY SNAPSHOT

FAQ

The Global Healthcare Mobility Solutions Market is studied from 2022 – 2029.

The Global Healthcare Mobility Solutions Market is growing at a CAGR of 28% over the next 5 years.

North America is growing at the highest 40% over 2022- 2029.

Oracle Corporation (U.S.), SAP SE (Germany), McKesson Corporation (U.S.), Cerner Corporation (U.S.), Zebra Technologies (U.S.), Philips Healthcare (Netherlands), AT&T Inc. (U.S.), Cisco Systems, Inc. (U.S.), Omron Corporation (Japan), and Airstrip Technologies, Inc. (U.S.).

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.