REPORT OUTLOOK

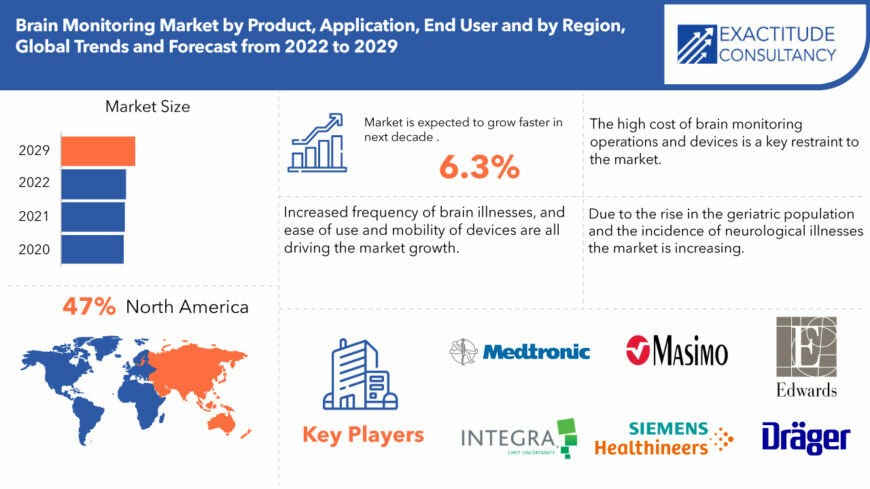

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 9.74 billion | 6.3% | North America |

| By Product | By Application | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Brain Monitoring Market Overview

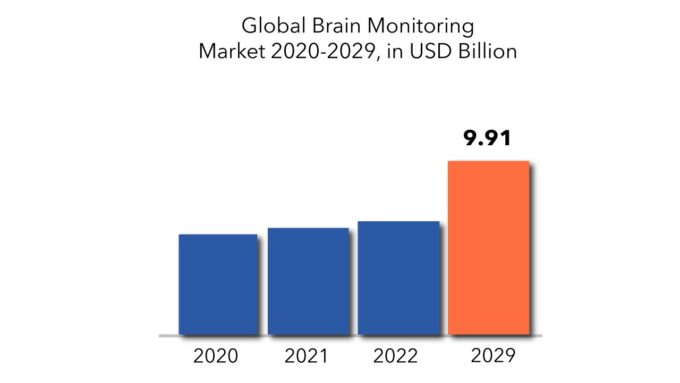

Brain monitoring market size was valued at USD 5.621 billion in 2020 and is projected to reach USD 9.74 billion by 2029, growing at a CAGR of 6.3% from 2022 to 2029.

The ability to accurately monitor changes in the physical and biochemical environment following a brain injury is critical for preventing, treating, and understanding secondary injuries. There are three types of multimodal brain monitoring: invasively monitored direct signals, noninvasively monitored variables, and variables reflecting brain pathophysiology that are not directly observed but estimated at the bedside by dedicated computer software. Intracranial pressure (ICP) monitoring has become an important diagnostic tool in the diagnosis and therapy of a variety of neurological diseases, whether as a single value or as a study of a dynamic trend. Brain injury can occur as a direct result of an insult or as a result of changes in the physical and biochemical environment. The capacity to accurately measure these changes is critical for tailoring treatment to each individual patient and preventing further brain injury. Brain monitoring devices are used to investigate the anatomy and function of the brain in order to monitor and diagnose neurological diseases. Several brain monitoring technologies, such as electroencephalography devices, intracranial pressure monitors, and magnetoencephalography, are used to track brain processes during this process. These gadgets also aid in the monitoring of neuronal and electrical activity in the brain. The demand for electroencephalography equipment is currently increasing among healthcare practitioners. Devices that monitor and diagnose aberrant brain activity are known as brain monitoring devices. Electrical and neuronal activity in the brain can be monitored with the help of brain monitoring devices. Additionally, they aid in the monitoring of blood flow in the brain’s veins and arteries.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, By Application, By End User, By Region |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

Due to the rise in the geriatric population and the incidence of neurological illnesses, the worldwide brain monitoring market is likely to grow significantly in the near future. Furthermore, during the forecast period, technological advances are expected to enhance market growth. During the projection period, however, the market is projected to be hampered by tight government regulations and unfavourable reimbursement policies. The ageing demographic, increased frequency of brain illnesses, and ease of use and mobility of devices are all driving the market’s growth. The first EEG monitors were jam-packed with wires and electrodes, and even today, the vast majority of devices follow this traditional design. The size and awkwardness of EEG monitors and other related devices have been dramatically reduced thanks to wireless technology.

Wireless monitors are gadgets that diagnose without the use of wires or cords. Wireless headphones enable for fully non-invasive readings and, in some situations, assessment of patients from the comfort of their own homes. The recording device can be disconnected from the computer and communicate with it via wireless signals from a distance of up to 10 or 20 metres using wireless technology. These devices are easy to use, inexpensive, and pleasant to wear, and they only require one AAA battery. Portable brain monitoring devices are small, light, and convenient to carry in one’s hand.

In contrast to brain monitoring devices, COVID-19 has resulted in a considerable increase in demand for ventilators, and manufacturers are currently focusing their efforts on meeting the growing demand for ventilators, including other breathing equipment. The pandemic is expected to have a negative influence on the brain monitoring industry, owing to hospitals’ increased attention on establishing COVID-19-specific ICUs, as well as the temporary stoppage of production and manufacture in major afflicted locations around the world.

Because of the increased prevalence of these neurological problems, it’s more crucial than ever to keep an eye on your brain and nervous system. Many neurological illnesses and ailments advance with time, and the risk of developing them grows with age. Other diseases and problems, such as sickle-cell disease and heart abnormalities, are also becoming more prevalent. Another key aspect increasing the demand for brain monitoring is that cardiac procedures can sometimes disrupt the normal functioning of the brain.

The high cost of brain monitoring operations and devices is a key restraint on the global industry, particularly in underdeveloped countries with weak reimbursement policies. The procedures involving the use of brain monitoring equipment are often expensive, and the devices themselves are highly complicated. Due to economic constraints, small hospitals and freestanding ASCs are also less likely to invest in costly and complex equipment; this is especially true in developing nations. Because of the high expense of these procedures, as well as the inadequate reimbursement situation, only a small percentage of patients in underdeveloped nations can afford them. As a result, hospitals are hesitant to invest in new or technologically advanced devices, limiting the market for brain monitoring.

Brain Monitoring Market Segment Analysis

The market is broadly segmented into product, application, end user and region. Based on product, the global brain monitoring market is divided into two categories: devices and accessories. In 2020, the devices category accounted for 74.9 percent of the brain monitoring market. The expanding incidence of neurological, neurodegenerative, psychotic, and sleep disorders, the necessity for early diagnosis, the availability of innovative portable and wearable home-based monitoring equipment, and increased patient awareness are all contributing to this trend.

Based on end users, the global brain monitoring devices market is segmented into hospitals, neurology centres, diagnostic centres, ASCs & clinics, and others. The hospital sector held the greatest share of the worldwide brain monitoring market, accounting for 57.8%. Brain monitoring is a complicated procedure that necessitates the use of pricey and sophisticated technologies and equipment typically available in hospitals. In addition, compared to small clinics and other end users, hospitals experience a significantly higher intake of patients. Furthermore, brain monitoring devices impose a significant financial burden on healthcare facilities in terms of maintenance expenditures; hospitals, more than other end-users, can tolerate such costs. As a result, the majority of brain monitoring devices are utilised in hospitals, which account for the greatest proportion of this market category.

Brain Monitoring Market Players

Companies, like Medtronic PLC, Integra LifeSciences Corporation, Siemens Healthineers, Edwards Lifesciences Corporation, Drägerwerk AG & Co. KGaA, Masimo Corporation, Spiegelberg GmbH & Co. KG, Nihon Kohden Corporation, Masimo Corporation, and Natus Medical Incorporated, hold a substantial market share in the brain monitoring market.

- Medtronic PLC develops additional core technologies, including implantable mechanical devices, drug and biologic delivery devices, and powered and advanced energy surgical instruments.

- Integra LifeSciences, a world leader in medical devices, is dedicated to limiting uncertainty for surgeons, so they can concentrate on providing the best patient care. Integra offers innovative solutions in neurosurgery, and reconstructive and general surgery.

- Masimo is a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, and patient monitors.

Who Should Buy? Or Key Stakeholders

- Healthcare Industry

- Pharmaceutical Companies

- Hospitals & Clinics

- Medical Device Manufacturers

- Scientific Research and Development

- Investors

- Manufacturing companies

- End user companies

- Others

Brain Monitoring Market Regional Analysis

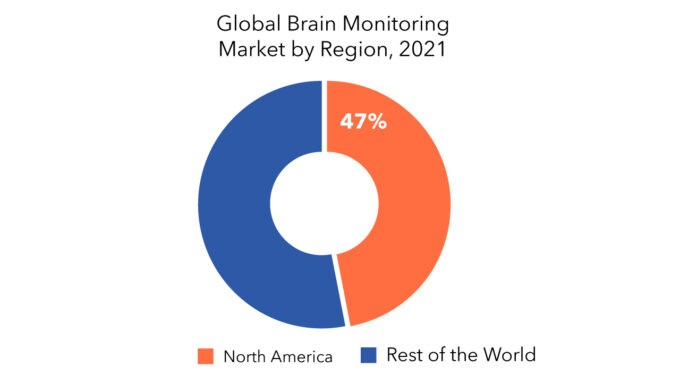

The global brain monitoring market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America held the largest proportion of the global brain monitoring market. This is due to an increase in the incidence of neurological illnesses, a rise in the number of clinical trials of brain monitoring devices, and the availability of medical reimbursement in the United States.

Key Market Segments: Brain Monitoring Market

Brain Monitoring Market by Product, 2020-2029, (USD Million)

- Accessories

- Devices

Brain Monitoring Market by Application, 2020-2029, (USD Million)

- Traumatic Brain Injuries (TBI)

- Stroke

- Dementia

- Epilepsy

- Headache

- Sleep Disorders

Brain Monitoring Market by End User, 2020-2029, (USD Million)

- Hospital

- Clinic

- ASC

Brain Monitoring Market by Region, 2020-2029, (USD Million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What are the growth opportunities related to the adoption of brain monitoring across major regions in the future?

- What are the new trends and advancements in the brain monitoring market?

- Which product categories are expected to have highest growth rate in the brain monitoring market?

- Which are the key factors driving the brain monitoring market?

- What will the market growth rate, growth momentum or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Brain Monitoring Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Brain Monitoring Market

- Global Brain Monitoring Market Outlook

- Global Brain Monitoring Market by Product, (USD Million)

- Accessories

- Devices

- Global Brain Monitoring Market by Application, (USD Million)

- Traumatic Brain Injuries (TBI)

- Stroke

- Dementia

- Epilepsy

- Headache

- Sleep Disorders

- Global Brain Monitoring Market by End User, (USD Million)

- Hospital

- Clinic

- ASC

- Global Brain Monitoring Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Applications Offered, Recent Developments)

-

- Medtronic PLC

- Integra LifeSciences Corporation

- Siemens Healthineers

- Edwards Lifesciences Corporation

- Drägerwerk AG & Co. KGaA

- Masimo Corporation

- Spiegelberg GmbH & Co. KG

- Nihon Kohden Corporation

- Masimo Corporation

- Natus Medical Incorporated

- Others *The Company List Is Indicative

-

LIST OF TABLES

TABLE 1 GLOBAL BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL BRAIN MONITORING MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 6 US BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 7 US BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 9 CANADA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 CANADA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 12 MEXICO BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 13 MEXICO BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 27 INDIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 28 INDIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 30 CHINA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 31 CHINA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 33 JAPAN BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 JAPAN BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 48 GERMANY BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 49 GERMANY BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 51 UK BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 52 UK BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 54 FRANCE BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 55 FRANCE BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 57 ITALY BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 ITALY BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 60 SPAIN BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 61 SPAIN BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 69 UAE BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UAE BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA BRAIN MONITORING MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA BRAIN MONITORING MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA BRAIN MONITORING MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL BRAIN MONITORING MARKETBY PRODUCT, USD MILLION, 2020-2029

FIGURE 10 GLOBAL BRAIN MONITORING MARKETBY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL BRAIN MONITORING MARKETBY END USER, USD MILLION, 2020-2029

FIGURE 12 GLOBAL BRAIN MONITORING MARKETBY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL BRAIN MONITORING MARKETBY PRODUCT, 2020

FIGURE 15 GLOBAL BRAIN MONITORING MARKETBY APPLICATION 2020

FIGURE 16 GLOBAL BRAIN MONITORING MARKETBY END USER 2020

FIGURE 17 BRAIN MONITORING MARKETBY REGION 2020

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 MEDTRONIC PLC: COMPANY SNAPSHOT

FIGURE 20 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT

FIGURE 21 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

FIGURE 22 EDWARDS LIFESCIENCES CORPORATION: COMPANY SNAPSHOT

FIGURE 23 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 24 MASIMO CORPORATION: COMPANY SNAPSHOT

FIGURE 25 SPIEGELBERG GMBH & CO. KG: COMPANY SNAPSHOT

FIGURE 26 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT

FIGURE 27 MASIMO CORPORATION: COMPANY SNAPSHOT

FIGURE 28 NATUS MEDICAL INCORPORATED: COMPANY SNAPSHOT

FAQ

The Brain monitoring market size had crossed USD 5.621 billion in 2020 and will observe a CAGR of more than 6.3% up to 2029 driven by the increased frequency of brain illnesses, and ease of use and mobility of devices are all driving the market’s growth.

The upcoming trends in Brain monitoring market is increase in the frequency of traumatic brain injuries and the number of applications for brain monitoring.

Brain monitoring market size was valued at USD 5.621 billion in 2020 and is projected to reach USD 9.74 billion by 2029, growing at a CAGR of 6.3% from 2022 to 2029.

Sleep Disorders application is the leading application of brain monitoring market.

North America is the largest regional market with 47% of share owning to increase in the incidence of neurological illnesses, a rise in the number of clinical trials of brain monitoring devices.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.