SCOPE OF THE REPORT

ArF Laser Market Overview

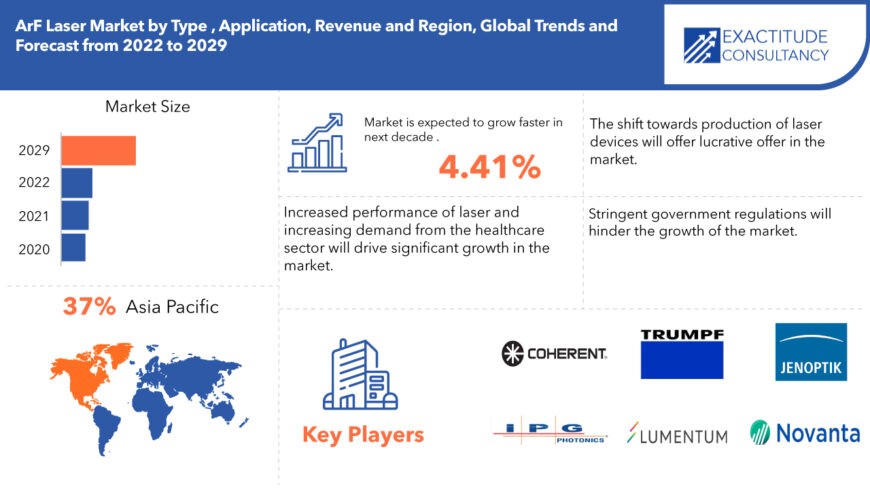

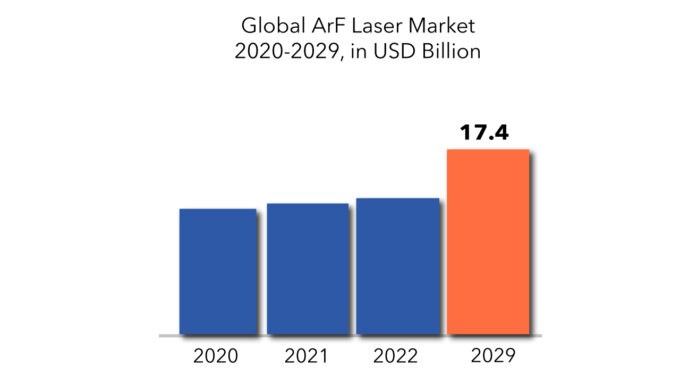

The global ArF laser market is expected to grow at a 4.41% CAGR from 2022 to 2029. It is expected to reach above USD 17.4 billion by 2029 from USD 11.8 billion in 2020.

ArF lasers are commonly utilized in high-resolution photolithography devices, a vital technology in the manufacture of microelectronic chips. The ArF laser is a kind of excimer laser that is also known as an exciplex laser. It is a deep ultraviolet laser with a wavelength of 193 nanometers that is utilized in the fabrication of semiconductor integrated circuits, eye surgery, micromachining, and scientific research. The ArF laser belongs to the excimer laser family. Excimer lasers are made up of a noble gas like xenon, krypton, or argon and a halogen gas like chlorine or fluorine that, when exposed to high pressure and electrical stimulation, emits stimulated ultraviolet (UV) light in the 193 nm range.

The bulk of end-users in the nation relies on laser technology. It is used for quality control in the automotive, commercial, industrial, and other industries. Laser technology aids in the improvement of product quality and in-process quality control at all stages of manufacturing. The technology aids in the verification and measurement of geometric parameters, as well as dimensional inspection and electrical testing. Thickness, distance, radius, and surface contour are all part of the geometric specification.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | USD Millions |

| Segmentation | By Type, Application, Revenue |

| By Type

|

|

| By Application

|

|

| By Revenue

|

|

| By Region

|

|

ArF Laser systems employ wireless technology to communicate between two sites by using a laser beam to transport information through the atmosphere. Laser communication terminals (LCT) are devices that send and receive laser beams. This communication is also possible between planets. The laser diode is commonly used to generate a laser signal as well as for feedback. When fibre cannot be utilised, laser communication is integrated into fiber-optic networks. Laser communication (LC) has a hundred times the bandwidth of RF, has less power loss, consumes less power for transmission, has a smaller antenna, and is more secure.

The main benefit of ArF laser fibre optics in communication is that numerous fibres are wrapped inside a single cable, with each fibre containing billions of bits of information. As a result, many signals may be conveyed with good quality, which is very useful for long-distance communications. The benefits and uses stated above are projected to drive demand for lasers in communication throughout the forecast period.

In 2020, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials. This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global ArF laser market is crowded with established players. These players have a commanding say in the market. The Application used in the ArF laser market is proprietary and needs long-term research and development planning implemented efficiently.

ArF Laser Market Segment Analysis

On the basis of Type, the ArF laser market is divided into Solid, liquid, and gas. In 2019, the market for solid lasers was the most significant. A solid laser is one that is made up of a solid active medium. A glass or crystalline host material is used as the active medium in a solid laser, which is then doped with rare earth elements such as neodymium, chromium, erbium, or ytterbium. The active medium in solid lasers is a solid substance, and the highest energy levels of ions are radiation-free; yet, when the energy transition occurs, the metastable upper laser level is attained. This is the point at which emission takes place, resulting in lasing. Solid lasers use less active medium material and generate both continuous and pulsed output at a higher efficiency than He-Ne and argon lasers by 2% to 3%.

Based on Application, the ArF laser market is segmented into micro processing, macro processing, marking and engraving. Because of its expanding applicability across numerous industries such as medical, automotive, electronics, aerospace, and communications, micro processing is the fastest growing application. The increasing need for micro machining in the fabrication industry is likely to drive the growth of the industrial lasers market. Furthermore, the advancement of microelectronic components in the semiconductor sector is likely to fuel the industrial laser source market. Macro material processing is the dominating market, with growth predicted to be consistent over the projection period. This is due to a slowdown in the development of high-power laser cutting applications.

Aside from that, political uncertainty is causing a lag in macro processing applications. For example, trade flow between China and the United States is likely to have an influence on the manufacturing sector.

ArF Laser Market Players

From large companies to small ones, many companies are actively working in the ArF laser market. These key players include Coherent, IPG Photonics, Trumpf, Lumentum, Jenoptik, Novanta, Lumibird, Laser Star, Epilog Laser, Han’s Laser, MKS Instruments, Gravotech, 600 Group, Eurolasers, Bystronic Lasers, Toptica Photonics, Photonics Industries, Focuslight Technologies, Corning Incorporated, and Access Lasers and others.

Companies are mainly in ArF laser they are competing closely with each other. Innovation is one of the most important key strategies as it has to be for any market. However, companies in the market have also opted for and successfully driven inorganic growth strategies like mergers & acquisitions, and so on.

- In November 2019, Coherent introduced a switchable adjustable ring mode (ARM) fibre laser that can power two independent processes or workstations sequentially.

- In January 2020, Jenoptik has introduced F-theta lenses for ultra-short pulse lasers.

- In January 2020, Trumpf purchased a minority position in GLOphotonics, a laser technology business located in France.

- In December 2018, TRUMPF purchased Photonics GmbH from Philips. TRUMPF’s product range will be strengthened by the addition of highpower diode lasers as a result of this purchase.

Who Should Buy? Or Key stakeholders

- ArF laser suppliers

- Investors

- End user companies

- Research institutes

Arf Laser Market Regional Analysis

The ArF laser market by region includes Asia-Pacific (APAC), North America, Europe, Middle East & Africa (MEA), and South America.

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Its major share is occupied by Asia Pacific, Europe, Middle East & Africa (MEA), and North America. The Asia Pacific shares 37% of the total market. The factors contributing to the region’s market growth include the increasing number of display panel production plants and the rapid usage of ArF laser. The market in the region is expanding as a result of increased foreign investment due to low labor costs and the availability of raw resources.

Key Market Segments: ArF Laser Market

Arf Laser Market by Type, 2020-2029, (USD Millions)

- Solid

- Liquid

- Gas

Arf Laser Market by Application, 2020-2029, (USD Millions)

- Microprocessing

- Macro Processing

- Marking And Engraving

Arf Laser Market by Revenue, 2020-2029, (USD Millions)

- Laser Revenue

- System Revenue

Arf Laser Market by Region, 2020-2029, (USD Millions)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the worth of global ArF laser market?

- What are the new trends and advancements in the ArF laser market?

- Which product categories are expected to have the highest growth rate in the ArF laser market?

- Which are the key factors driving the ArF laser market?

- What will the market growth rate, growth momentum, or acceleration the market carries during the forecast period?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Types

- Data Mining

- Executive Summary

- Market Overview

- Global ArF Laser Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global ArF Laser Market

- Global ArF Laser Market Outlook

- Global ArF Laser Market by Type, (USD Million)

- Solid

- Liquid

- Gas

- Global ArF Laser Market by Application, (USD Million)

- Microprocessing

- Macro processing

- Marking and engraving

- Global ArF Laser Market by Revenue, (USD Million)

- Laser Revenue

- System Revenue

- Global ArF Laser Market by Region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Revenue’s Offered, Recent Developments)

9.1. Coherent

9.2. IPG Photonics

9.3. Trumpf

9.4. Lumentum

9.5. Jenoptik

9.6. Novanta

9.7. Lumibird

9.8. Laser Star

9.9. Epilog Laser

9.10. Han’s Laser

9.11. MKS Instruments

9.12. Gravotech

9.13. 600 Group

9.14. Eurolasers

9.15. Bystronic Lasers

9.16. Toptica Photonics

9.17. Photonics Industries

9.18. Focuslight Technologies

9.19. Corning Incorporated

9.20. Access Lasers *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ArF LASER MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 6 US ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 7 US ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 CANADA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 9 CANADA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 10 CANADA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 11 MEXICO ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 12 MEXICO ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 13 MEXICO ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 INDIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 27 INDIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 28 INDIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 29 CHINA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 30 CHINA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 31 CHINA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 JAPAN ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 33 JAPAN ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 34 JAPAN ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 47 GERMANY ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 48 GERMANY ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 49 GERMANY ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 UK ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 51 UK ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 52 UK ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 53 FRANCE ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 FRANCE ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 55 FRANCE ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 ITALY ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 57 ITALY ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 58 ITALY ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 59 SPAIN ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 60 SPAIN ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 61 SPAIN ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 UAE ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 69 UAE ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 70 UAE ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA ArF LASER MARKET BY FABRIC MATERIAL (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA ArF LASER MARKET BY FILTER MEDIA (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA ArF LASER MARKET BY END USER (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ARF LASER MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ARF LASER MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ARF LASER MARKET BY REVENUE USD MILLION, 2020-2029

FIGURE 11 GLOBAL ARF LASER MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 ARF LASER MARKET BY REGION 2020

FIGURE 14 MARKET SHARE ANALYSIS

FIGURE 15 COHERENT: COMPANY SNAPSHOT

FIGURE 16 IPG PHOTONICS: COMPANY SNAPSHOT

FIGURE 17 TRUMPF: COMPANY SNAPSHOT

FIGURE 18 LUMENTUM: COMPANY SNAPSHOT

FIGURE 19 JENOPTIK: COMPANY SNAPSHOT

FIGURE 20 NOVANTA: COMPANY SNAPSHOT

FIGURE 21 LUMIBIRD: COMPANY SNAPSHOT

FIGURE 22 LASER STAR: COMPANY SNAPSHOT

FIGURE 23 EPILOG LASER: COMPANY SNAPSHOT

FIGURE 24 HAN’S LASER: COMPANY SNAPSHOT

FIGURE 25 MKS INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 26 GRAVOTECH: COMPANY SNAPSHOT

FIGURE 27 600 GROUP: COMPANY SNAPSHOT

FIGURE 28 EUROLASERS: COMPANY SNAPSHOT

FIGURE 29 BYSTRONIC LASERS: COMPANY SNAPSHOT

FIGURE 30 TOPTICA PHOTONICS: COMPANY SNAPSHOT

FIGURE 31 PHOTONICS INDUSTRIES: COMPANY SNAPSHOT

FIGURE 32 FOCUSLIGHT TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 33 CORNING INCORPORATED: COMPANY SNAPSHOT

FIGURE 34 ACCESS LASERS: COMPANY SNAPSHOT

FAQ

The shift toward the development of laser devices will provide a significant market opportunity.

The global ArF laser market registered a CAGR of 4.41% from 2022 to 2029.

Asia Pacific holds the largest regional market for the ArF laser market.

Stringent government rules will hinder sales growth of the ArF laser market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.