| Market Size | CAGR | Dominating Region |

|---|---|---|

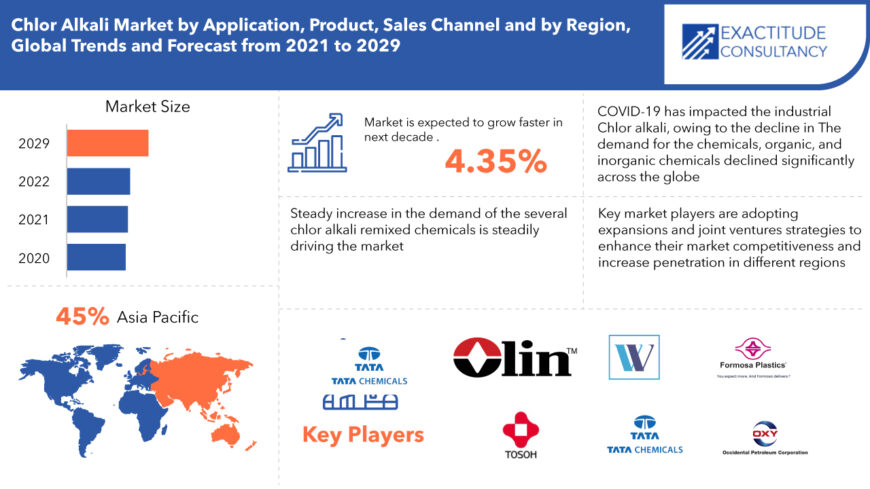

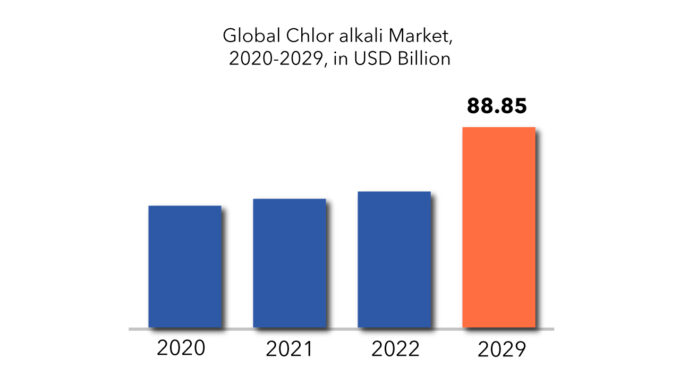

| USD88.85 billion | 4.35% | Asia Pacific |

| By Application | By Product | By Sales Channel | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Chlor Alkali Market Overview

The global Chlor Alkali market is estimated at USD 63.2 billion in 2022 and is expected to grow at a CAGR of 4.35% during the forecasted period. It is estimated to be USD88.85 billion by 2029.

Chlor Alkali is a chemical process that is used to manufacture various chemicals including chlorine, caustic soda, soda ash, and other sodium and chlorine-based derivatives.

There are mainly two types of processes involved in Chlor Alkali namely membrane cell and diaphragm cell process. Chlor Alkali chemicals have a wide range of application areas including alumina, pulp and paper, organic chemical, inorganic chemical, detergent and soap, textile, and others. Growing demand for caustic soda and its derivatives coupled with the rising demand for chlorine from various industries is expected to drive the demand for Chlor Alkali during the forecast period. Additionally, rising demand for alumina from the automotive industry is expected to push the demand for Chlor Alkali during the forecast period. Demand growth from other sectors includes pulp and paper, organic chemicals, inorganic chemicals, detergent, and soap, etc.

the process has a high energy consumption, for example around 2,500 kWh (9,000 MJ) of electricity per ton of sodium hydroxide produced. Because the process yields equivalent amounts of chlorine and sodium hydroxide, it is necessary to find a use for these products in the same proportion. For every mole of chlorine produced, one mole of hydrogen is produced. Much of this hydrogen is used to produce hydrochloric acid, ammonia, hydrogen peroxide, or is burned for power and steam production.

| ATTRIBUTE | DETAILS |

| Study period | 2021-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Unit | Value (USDBillion), (Kilotons) |

| Segmentation | By Application, By product, by sales channel, By Region |

| By application |

|

| By product |

|

| By Sales channel |

|

| By Region |

|

The north American and European market have been impacted the most due to the covid-19 pandemic. Disruption in supply chains and suspension of several manufacturing activities for preventive measures have impacted the global chlor alkali market and other end use industries to result in decline of over 5% in demand in market. Several expansion projects across the globe have been suspended, which has resulted in a decline in demand for chlor-alkali. The demand for the chemicals, organic, and inorganic chemicals declined significantly across the globe. To mitigate the impact, several chemical companies in North America and Europe are channelizing focus on operational efficiency, cost management, and asset optimization. Post pandemic key players are focusing on long-term opportunities such as emerging applications, investing in innovations, studying customer buying behavior patterns, and adopting new business models that help generate sustained growth, among others. Due to the pandemic, various building construction and infrastructural projects were suspended or postponed across the globe. Therefore, the demand for PVC declined across the globe, which, in turn, impacted the chlorine market. Decline in automotive industry further reduced the demand for glass and polymers. Moreover, water treatment projects were either rescheduled or suspended, which, in turn, will have a significant impact on the market.

The chemical industry has witnessed high growth in emerging regions and steady growth in developed/mature markets. Industry participants are keen on addressing the needs/demands of growing economies. Global players have adopted expansion strategies to enhance their production capacities. Key market players are adopting expansions and joint ventures strategies to enhance their market competitiveness and increase penetration in different regions. Chemical industries in the US and Europe are mature and their growth is largely influenced by the GDP growth of these regions.

Chlor Alkali Market Segment Analysis

The global Chlor alkali market is segmented based on application, product, sales channel and region. By application, the market is bifurcated into Alumina, Pulp and paper, organic chemical, inorganic chemical, detergent and soap and textile. By application, Alumina is expected dominate the market in the Chlor alkali market and is expected to help grow the market at fastest rate throughout the forecast period.

The alumina is the largest segment by applications for the Caustic Soda in Chlor-alkali market. Caustic soda is used in the process for the extraction of aluminum from bauxite ore. It dissolves the bauxite ore which is the raw material in the production of aluminum. In this process, pure alumina is separated from the bauxite ore. The alumina collected is further subjected to calcination. APAC dominates the market, followed by North America and Europe. The demand for caustic soda is projected to be

By product type, the market is divided into Chlorine, caustic soda, soda ash, and other sodium and chlorine derivatives, the vinyl segment dominates the global market in terms of chlorine consumption. Chlorine derivatives are prominently used in PVC production. The chlorine demand often fluctuates in tandem with the production of PVC. Besides, chlorine produces several organic, inorganic, and intermediate chemicals that collectively account for over one-third of global consumption: Water treatment and paper & pulp account for a single-digit share in chlorine consumption.

By Sales channel, the distribution of the global chlor alkali market is bifurcated by direct and indirect sales.

Chlor Alkali Market Players

The leading players in the Chlor-Alkali market are Olin Corporation(US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and others.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation

Who Should Buy? Or Key stakeholders

- Chemicals & Materials manufacturers

- Ceramic fiber suppliers

- Chemical companies

- Investors

- Manufacturing companies

- End user companies

- Research institutes

- Other

Chlor Alkali Market Regional Analysis

The Chlor alkali market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

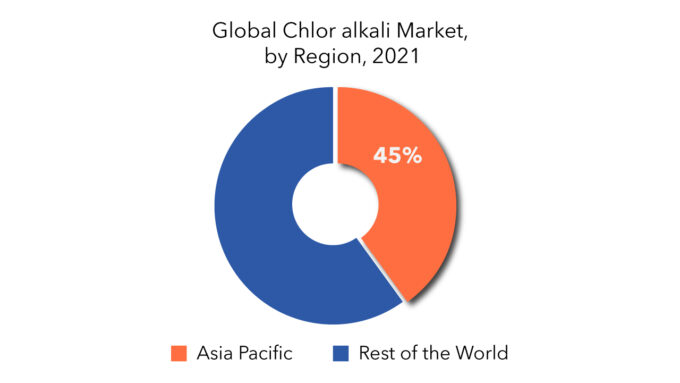

During the projected period, APAC is expected to be the fastest-growing Chlor alkali market, it also is the dominating market. Asia Pacific market is followed by North American market and then by European market in the global market share. Growth is led by rapid industrialization, rising demand from various applications, and increasing government spending. Different industries are focusing on these emerging markets and increasing their footprints by setting up manufacturing facilities, distribution centers, and research & development centers. The APAC chlor-alkali market is expected to see a rising demand from the chemical, water treatment, PVC, glass, metallurgy, and soap & detergents, among other sectors

In the Asia pacific region, China accounts for almost 70% of the chlor alkali regional market consumption.

North America is one of the largest exporters of chlor alkali products in the world. The resurgent construction industry is likely to boost the production of PVC and demand for chlorine over the foreseeable period. The supply in Europe is tight, and the region is a forerunner in achieving green goals in the industry. The demand is expected to increase steadily over the forecast period due to slow developments in the end-use industries. Western European countries such as Germany, France, U.K., Spain, and Italy dominate the regional market.

Key Market Segments: Chlor Alkali Market

Chlor Alkali Market by Application, 2023-2029, (USD Billion), (Kilotons)

- Alumina

- Pulp And Paper

- Organic Chemical

- Inorganic Chemical

- Detergent And Soap

- Textile

Chlor Alkali Market by Product, 2023-2029, (USD Billion), (Kilotons)

- Chlorine

- Caustic Soda

- Soda Ash

- Other Sodium And Chlorine Derivatives

Chlor Alkali Market by Sales Channel, 2023-2029, (USD Billion), (Kilotons)

- Direct Sales And

- Indirect Sales

Chlor Alkali Market by Region, 2023-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the Chlor alkali market?

- What are the key factors influencing the growth of Chlor alkali?

- What are the major applications for Chlor alkali?

- Who are the major key players in the Chlor alkali market?

- Which region will provide more business opportunities for Chlor alkali in the future?

- Which segment holds the maximum share of the Chlor alkali market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Chlor Alkali Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Chlor Alkali Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Chlor Alkali Market Outlook

- Global Chlor Alkali Market by Application, 2021-2029, (USD BILLION), (KILOTONS)

- Alumina

- Pulp and paper

- Organic chemicals

- Inorganic chemicals

- Detergent and soap

- textile

- Global Chlor Alkali Market by Product, 2021-2029, (USD BILLION), (KILOTONS)

- Chlorine

- Caustic soda

- Soda ash

- Other sodium and chlorine derivatives

- Global Chlor Alkali Market by sales channel, 2021-2029, (USD BILLION), (KILOTONS)

- Direct sales

- Indirect sales

- Global Chlor Alkali Market by Region, 2021-2029, (USD BILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Olin Corporation (US)

- Westlake Chemical Corporation (US)

- Tata Chemicals Limited (India)

- Occidental Petroleum Corporation (US)

- Formosa Plastics Corporation (Taiwan)

- Solvay SA (Belgium)

- Tosoh Corporation (Japan)

- Hanwha Solutions Corporation (South Korea)

- Nirma Limited (India)

- AGC, Inc. (Japan)

- Dow Inc. (US)

- Xinjiang Zhongtai Chemical Co. Ltd. (China),

- INOVYN (UK), Ciner Resources Corporation (US)

- Wanhua-Borsodchem (Hungary) *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 2 GLOBAL CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 3 GLOBAL CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 4 GLOBAL CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 5 GLOBAL CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 6 GLOBAL CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 7 GLOBAL CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 8 GLOBAL CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 9 GLOBAL CHLOR ALKALI MARKET BY REGION (USD MILLIONS) 2021-2029

TABLE 10 GLOBAL CHLOR ALKALI MARKET BY REGION (KILOTONS) 2021-2029

TABLE 11 US CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 12 US CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 13 US CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 14 US CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 15 US CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 16 US CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 17 US CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 18 US CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 19 CANADA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 20 CANADA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 21 CANADA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 22 CANADA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 23 CANADA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 24 CANADA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 25 CANADA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 26 CANADA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 27 MEXICO CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 28 MEXICO CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 29 MEXICO CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 30 MEXICO CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 31 MEXICO CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 32 MEXICO CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 33 MEXICO CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 34 MEXICO CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 35 BRAZIL CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 36 BRAZIL CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 37 BRAZIL CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 38 BRAZIL CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 39 BRAZIL CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 40 BRAZIL CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 41 BRAZIL CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 42 BRAZIL CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 43 ARGENTINA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 44 ARGENTINA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 45 ARGENTINA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 46 ARGENTINA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 47 ARGENTINA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 48 ARGENTINA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 49 ARGENTINA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 50 ARGENTINA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 51 COLOMBIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 52 COLOMBIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 53 COLOMBIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 54 COLOMBIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 55 COLOMBIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 56 COLOMBIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 57 COLOMBIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 58 COLOMBIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 59 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 60 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 61 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 62 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 63 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 64 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 65 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 66 REST OF SOUTH AMERICA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 67 INDIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 68 INDIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 69 INDIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 70 INDIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 71 INDIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 72 INDIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 73 INDIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 74 INDIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 75 CHINA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 76 CHINA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 77 CHINA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 78 CHINA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 79 CHINA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 80 CHINA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 81 CHINA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 82 CHINA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 83 JAPAN CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 84 JAPAN CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 85 JAPAN CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 86 JAPAN CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 87 JAPAN CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 88 JAPAN CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 89 JAPAN CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 90 JAPAN CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 91 SOUTH KOREA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 92 SOUTH KOREA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 93 SOUTH KOREA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 94 SOUTH KOREA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 95 SOUTH KOREA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 96 SOUTH KOREA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 97 SOUTH KOREA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 98 SOUTH KOREA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 99 AUSTRALIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 100 AUSTRALIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 101 AUSTRALIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 102 AUSTRALIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 103 AUSTRALIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 104 AUSTRALIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 105 AUSTRALIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 106 AUSTRALIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 107 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 108 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 109 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 110 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 111 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 112 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 113 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 114 SOUTH-EAST ASIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 115 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 116 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 117 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 118 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 119 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 120 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 121 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 122 REST OF ASIA PACIFIC CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 123 GERMANY CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 124 GERMANY CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 125 GERMANY CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 126 GERMANY CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 127 GERMANY CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 128 GERMANY CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 129 GERMANY CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 130 GERMANY CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 131 UK CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 132 UK CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 133 UK CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 134 UK CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 135 UK CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 136 UK CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 137 UK CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 138 UK CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 139 FRANCE CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 140 FRANCE CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 141 FRANCE CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 142 FRANCE CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 143 FRANCE CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 144 FRANCE CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 145 FRANCE CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 146 FRANCE CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 147 ITALY CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 148 ITALY CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 149 ITALY CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 150 ITALY CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 151 ITALY CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 152 ITALY CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 153 ITALY CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 154 ITALY CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 155 SPAIN CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 156 SPAIN CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 157 SPAIN CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 158 SPAIN CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 159 SPAIN CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 160 SPAIN CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 161 SPAIN CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 162 SPAIN CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 163 RUSSIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 164 RUSSIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 165 RUSSIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 166 RUSSIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 167 RUSSIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 168 RUSSIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 169 RUSSIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 170 RUSSIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 171 REST OF EUROPE CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 172 REST OF EUROPE CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 173 REST OF EUROPE CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 174 REST OF EUROPE CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 175 REST OF EUROPE CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 176 REST OF EUROPE CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 177 REST OF EUROPE CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 178 REST OF EUROPE CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 179 UAE CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 180 UAE CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 181 UAE CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 182 UAE CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 183 UAE CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 184 UAE CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 185 UAE CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 186 UAE CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 187 SAUDI ARABIA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 188 SAUDI ARABIA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 189 SAUDI ARABIA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 190 SAUDI ARABIA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 191 SAUDI ARABIA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 192 SAUDI ARABIA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 193 SAUDI ARABIA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 194 SAUDI ARABIA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 195 SOUTH AFRICA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 196 SOUTH AFRICA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 197 SOUTH AFRICA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 198 SOUTH AFRICA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 199 SOUTH AFRICA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 200 SOUTH AFRICA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 201 SOUTH AFRICA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 202 SOUTH AFRICA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

TABLE 203 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY TYPE (USD MILLIONS) 2021-2029

TABLE 204 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY TYPE (KILOTONS) 2021-2029

TABLE 205 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY APPLICATION (USD MILLIONS) 2021-2029

TABLE 206 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY APPLICATION (KILOTONS) 2021-2029

TABLE 207 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY PRODUCT (USD MILLIONS) 2021-2029

TABLE 208 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY PRODUCT (KILOTONS) 2021-2029

TABLE 209 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY SALES CHANNEL (USD MILLIONS) 2021-2029

TABLE 210 REST OF MIDDLE EAST AND AFRICA CHLOR ALKALI MARKET BY SALES CHANNEL (KILOTONS) 2021-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CHLOR ALKALI MARKET BY PODUCT, USD BILLION, 2021-2029

FIGURE 9 GLOBAL CHLOR ALKALI MARKET BY APPLICATION, USD BILLION, 2021-2029

FIGURE 10 GLOBAL CHLOR ALKALI MARKET BY FORM, USD BILLION, 2021-2029

FIGURE 11 GLOBAL CHLOR ALKALI MARKET BY REGION, USD BILLION, 2021-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA CHLOR ALKALI MARKET SNAPSHOT

FIGURE 14 EUROPE CHLOR ALKALI MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA CHLOR ALKALI MARKET SNAPSHOT

FIGURE 16 ASIA PACIFIC CHLOR ALKALI MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST ASIA AND AFRICA CHLOR ALKALI MARKET SNAPSHOT

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 OLIN CORPORATION: COMPANY SNAPSHOT

FIGURE 20 WESTLAKE CHEMICAL CORPORATION: COMPANY SNAPSHOT

FIGURE 21 TATA CHEMICAL LIMITED: COMPANY SNAPSHOT

FIGURE 22 OCCIDENTAL PETROLEUM LIMITED: COMPANY SNAPSHOT

FIGURE 23 FORMOSA PLASTICS: COMPANY SNAPSHOT

FIGURE 24 SOLVAY SA: COMPANY SNAPSHOT

FIGURE 25 TOSOH CORPORATION: COMPANY SNAPSHOT

FIGURE 26 HANWAH SOLUTIONS CORPORATION: COMPANY SNAPSHOT

FIGURE 27 NIRMA LIMITED: COMPANY SNAPSHOT

FIGURE 28 DOW INC.: COMPANY SNAPSHOT

FAQ

The Chlor alkali market size had crossed USD63.2 billion in 2022 and will observe a CAGR of more than 4.35 % up to 2029 driven by the growth of the Chlor alkali market include rising demand for Chlorine, Caustic soda and other vinyl chemicals

Asia Pacific held more than 45% of the Chlor alkali market revenue share in 2022 and will witness expansion with the burgeoning.

Chlor-alkali products such as chlorine, caustic soda, and soda ash play a vital role in the chemical industry. These products are necessary raw materials in major bulk chemical industries and utilized in various industrial and manufacturing value chains. The products are used in different applications such as plastics, alumina, paper & pulp, and others and find applications in diverse end-use industries like construction, automotive, and others.

The region’s largest share is in Asia Pacific. The Asia pacific region is also the fastest growing market with China being the largest consumer with 70%. The North American market is the second largest market followed by European region.

Chlor-alkali is an industrial process widely used to produce chlorine, caustic soda, and other chlorine and sodium derived/based products such as sodium hypochlorite, hydrochloric acid, chlorosulphonic acid, bleaching power, polyaluminium chloride, hydrogen gas, and chlorinated paraffin.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.