| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 11.14 Million | 3.1% | Asia Pacific |

| By Material Type | By Purity | By Application | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Calcium Oxalate Market Overview

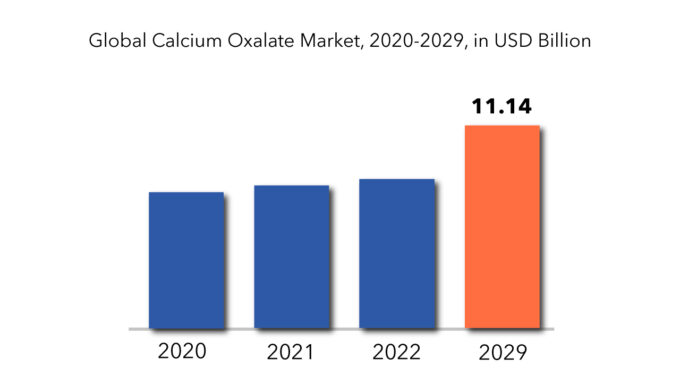

The global Calcium Oxalate market is expected to grow at 3.1% CAGR from 2023 to 2029. It is expected to reach above USD 11.14 Million by 2029 from USD 8.73 Million in 2022.

The lime oxalate, commonly known as Calcium oxalate is a white, odorless powder that is insoluble in water and transforms into an oxide when heated to temperatures above 200 degrees Celsius. Oxalic acid is used as the primary raw material for all oxalates, including calcium oxalate. It is produced via the oxidation of glucose or other carbohydrates using vanadium pentoxide and nitric acid as catalysts. Calcium oxalate is created while heating sodium in close proximity to an alkali catalyst; this calcium oxalate then undergoes a reaction with sulfuric acid to make oxalic acid. But at the time, molasses and sugarcane syrup are used to make calcium oxalate.

All kinds of oxalates, including calcium oxalate, are primarily made from oxalic acid. It is made by oxidizing glucose or other carbohydrates with nitric acid and a vanadium pentoxide catalyst. Sulfuric acid and salt are heated in the presence of an alkali catalyst to produce calcium oxalate. Two of the various applications for calcium oxalate include the production of oxalate and the separation of rare earth elements. Production of ceramics accounts for a sizable share of the market for applications. A growth in the use of ceramic tiles and calcium oxalate in the building industry are the two primary factors driving the calcium oxalate market.

The demand for ceramic tiles has dramatically increased as a result of urbanization. Over the coming years, more people are anticipated to relocate to metropolitan areas, where more than half of the world’s population now dwells. Calcium oxalate is a common ingredient in ceramic glazes, which are used to make ceramic tiles for walls and floors. Ceramic tile manufacturers are forming alliances with distributors and wholesalers of calcium oxalate to guarantee a steady supply of the ingredient for the end-user market.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Million), (Kilotons) |

| Segmentation | By Type, By PURITY, By Application, By Region |

| By Type

|

|

| By Purity

|

|

| By Application

|

|

| By Region |

|

The two main drivers driving the market are an increase in the usage of ceramic tiles and calcium oxalate in the building sector. Oxalates are produced and rare earth metals are separated using calcium oxalate, among other uses. A sizeable share of the entire application segment is devoted to the production of ceramics. Numerous high-tech consumer goods contain rare earth elements. Rare earth metals have special material properties when they are present in oxide compounds, glass, alloys, and ceramic compounds. Steel’s strength and thermal stability are increased in metallurgy via the alloying process and the inclusion of rare earth metals. In numerous end-use sectors, the demand for calcium oxalate is rising as a result of these factors.

Urbanization is causing a sharp increase in demand for ceramic tiles. More than half of the world’s population resides in cities, and more people are expected to move there in the near future. The main component of ceramic glazes, which are used to create ceramic tiles for floors and walls, is calcium oxalate. Ceramic tile producers are developing partnerships with calcium oxalate wholesalers and distributors to ensure a consistent supply for their customers.

Market conditions were adversely affected by the COVID-19 pandemic. The COVID-19 pandemic is likely to cause the worldwide calcium oxalate market to slow down, which will lead to a decline in demand and interruptions in the supply chain. The COVID-19 outbreak has had a number of negative effects, including flight cancellations, travel bans, quarantines, restaurant closures, restrictions on all indoor and outdoor events, the declaration of states of emergency in more than 40 countries, a significant slowdown in the supply chain, and stock market volatility. The calcium oxalate market is going through a terrible financial crisis.

Calcium Oxalate Market Segment Analysis

The global Calcium Oxalate market is segmented based on type, Purity, application and region.

Based on type, the global Calcium Oxalate market has been divided into, powder and chunks/lumps. The calcium oxalate final product is predominantly powder calcium oxalate due to the high solubility requirements of the majority of end-use applications. Most of the leading American manufacturers, have mostly supplied calcium oxalate in powder form to other end users. However, because these manufacturers also offer calcium oxalates in chunks or lumps, the market’s CAGR growth rate is moderate.

Based on Purity, The Calcium Oxalates have been divided into 98.95 % and 99 % percent of purity. The category of pure products with a purity of 99.9% and higher dominated the market in the forecast period. The 98.9% sector is anticipated to grow at a CAGR of 4.1 percent during the forecast period. A significant portion of the market for purity 99 percent and above can be attributed to the fact that high-concentration oxalic acid is chosen in end-use applications due to lower contamination levels. Furthermore, calcium oxalate is advantageous since it is mildly hygroscopic in high dosages. The purity 98 % and 98.9 percent category is anticipated to develop at a considerable CAGR due to the rising demand for ceramic glazes, which are used in the tile industry.

Based on Application, the global Calcium Oxalate market has been divided into ceramic glazes, oxalate processing, and other. Ceramic glazes are anticipated to grow at a CAGR of 4.7 percent. A significant portion of the market for purity 99 percent and above can be attributed to the fact that high-concentration oxalic acid is chosen in end-use applications due to lower contamination levels. Furthermore, calcium oxalate is advantageous since it is mildly hygroscopic in high dosages.

Calcium Oxalate Market Players

The Calcium Oxalate Market Key Players Include American Elements, Central Drug House, Hummel Croton Inc., LGC Standards, Ottokemi, Skamol, Soben International, Taisyou International Business Co. Ltd., Zheijiang Hailong New Building Material Co. Ltd.

Nov. 12, 2020- American Elements Launches Life Science Manufacturing Group

Los-Angeles based American Elements announced today an important milestone in the 25-year history of the company. This month American Elements launches a Life Sciences & Organic Chemistry Product Group.

To diversify their product offerings and establish a solid foothold in the market, major market players are concentrating on R&D efforts and establishing strategic alliances through mergers and acquisitions, joint ventures, collaborations, and other means.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key Stakeholders

- Construction Industry

- Chemical Industry

- Steel Industry

- Petroleum Industry

- Scientific Research and Development

- Investors

- Manufacturing companies

- End user companies

- Others

Calcium Oxalate Market Regional Analysis

The Calcium Oxalate market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

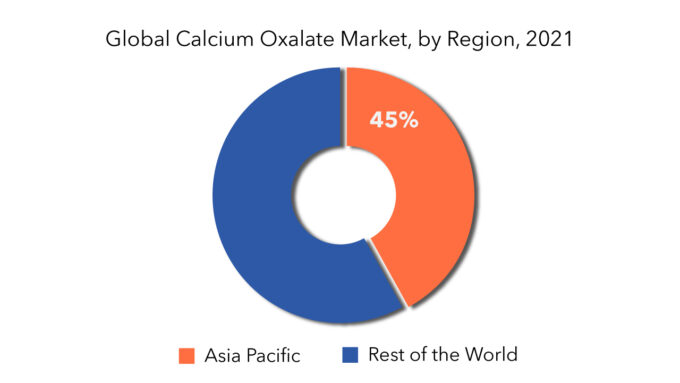

Asia pacific holds the highest market share compared to other region, the European market is estimated to be the fastest growing market during the forecast period.

Due to increased investments in the growth of the chemical sector and the presence of sizable chemical-producing countries in the area, especially China and India. The growth of regional calcium oxalate producers is held responsible for the increase of the Asian market. Over the course of the projection period, the market in the area will grow as a result of the abundance of chances that developing countries like China and India are offering industry participants to grow their presence. Numerous producers of calcium oxalate have evaluated the production of calcium oxalate.

Key Market Segments: Calcium Oxalate Market

Calcium Oxalate Market by Material Type, 2023-2029, (USD Million)

- Powder

- Chunks/Lumps

Calcium Oxalate Market by Purity, 2023-2029, (USD Million)

- 95 %

- 99 %

Calcium Oxalate Market by Application, 2023-2029, (USD Million)

- Ceramic Glaze

- Preparation Of Oxalate

- Others

Calcium Oxalate Market by Region, 2023-2029, (USD Million)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the Calcium Oxalate market?

- What are the key factors influencing the growth of Calcium Oxalate?

- What are the major applications for Calcium Oxalate?

- Who are the major key players in the Calcium Oxalate market?

- Which region will provide more business opportunities for Calcium Oxalate in future?

- Which segment holds the maximum share of the Calcium Oxalate market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Calcium Oxalates Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Calcium Oxalates Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Calcium Oxalates Market Outlook

- Global Calcium Oxalates Market by type, 2020-2029, (USD MILLIONS), (KILOTONS)

- Powder

- Chunks/lumps

- Global Calcium Oxalates Market by Purity, 2020-2029, (USD MILLIONS), (KILOTONS)

- 5 %

- 99 %

- Global Calcium Oxalates Market by Application, 2020-2029, (USD MILLION), (KILOTONS)

- Ceramic glaze

- Preparation of oxalates

- Others

- Global Calcium Oxalates Market by Region, 2020-2029, (USD MILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

8.1. American Elements

8.2. Central Drug House

8.3. Hummel Croton Inc.

8.4. LGC Standards

8.5. Ottokemi

8.6. Arkema

8.7. Skamol

8.8. Soben International

8.9. Chemours

8.10. Taisyou International Business Co. Ltd. *The Company List Is Indicative

LIST OF TABLES:

TABLE 1 GLOBAL CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 7 GLOBAL CALCIUM OXALATES MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL CALCIUM OXALATES MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 10 US CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 11 US CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 US CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 14 US CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 15 CANADA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 16 CANADA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 17 CANADA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 CANADA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 20 CANADA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 21 MEXICO CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 22 MEXICO CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 23 MEXICO CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 MEXICO CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 26 MEXICO CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 27 BRAZIL CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 BRAZIL CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 BRAZIL CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 33 ARGENTINA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 35 ARGENTINA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 39 COLOMBIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 41 COLOMBIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 51 INDIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 52 INDIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 53 INDIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 INDIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 56 INDIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 57 CHINA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 58 CHINA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 59 CHINA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 CHINA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 62 CHINA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 63 JAPAN CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 JAPAN CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 65 JAPAN CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 JAPAN CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 68 JAPAN CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 93 GERMANY CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 94 GERMANY CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 95 GERMANY CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 GERMANY CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 98 GERMANY CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 99 UK CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 100 UK CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 UK CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 UK CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 UK CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 104 UK CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 105 FRANCE CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 106 FRANCE CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 107 FRANCE CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 FRANCE CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 110 FRANCE CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 111 ITALY CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 112 ITALY CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 113 ITALY CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 ITALY CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 116 ITALY CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 117 SPAIN CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 118 SPAIN CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 119 SPAIN CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 SPAIN CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 122 SPAIN CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 123 RUSSIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 125 RUSSIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 127 RUSSIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 135 UAE CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 136 UAE CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 137 UAE CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 139 UAE CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 140 UAE CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY PURITY (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA CALCIUM OXALATES MARKET BY PURITY (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CALCIUM OXALATES MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL CALCIUM OXALATES MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL CALCIUM OXALATES MARKET BY PURITY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL CALCIUM OXALATES MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA CALCIUM OXALATES MARKET SNAPSHOT

FIGURE 14 EUROPE CALCIUM OXALATES MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA CALCIUM OXALATES MARKET SNAPSHOT

FIGURE 16 ASIA PACIFIC CALCIUM OXALATES MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST ASIA AND AFRICA CALCIUM OXALATES MARKET SNAPSHOT

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 AMERICAN ELEMENTS.: COMPANY SNAPSHOT

FIGURE 20 CENTRAL DRUG HOUSE: COMPANY SNAPSHOT

FIGURE 21 HUMMEL CROTON INC.: COMPANY SNAPSHOT

FIGURE 22 LGC STANDARDS.: COMPANY SNAPSHOT

FIGURE 23 OTTOKEMI: COMPANY SNAPSHOT

FIGURE 25 ARKEMA: COMPANY SNAPSHOT

FIGURE 26 SKAMOL: COMPANY SNAPSHOT

FIGURE 27 SOBEN INTERNATIONAL COMPANY SNAPSHOT

FIGURE 28 CHEMOURS: COMPANY SNAPSHOT

FIGURE 29 TAISYOU INTERNATIONAL BUSINESS CO. LTD.: COMPANY SNAPSHOT

FAQ

The Calcium Oxalate market size had crossed USD 8.73 Million in 2022 and will observe a CAGR of more than 3.1 % up to 2029 and will grow up to USD 11.14 million.

Asia Pacific held more than 45 % of the Calcium Oxalate market revenue share in 2021 and will witness expansion over the forecast period.

The demand for ceramic tiles has dramatically increased as a result of urbanization. Over the coming years, more people are anticipated to relocate to metropolitan areas, where more than half of the world’s population now dwells. Calcium oxalate is a common ingredient in ceramic glazes, which are used to make ceramic tiles for walls and floors. Ceramic tile manufacturers are forming alliances with distributors and wholesalers of calcium oxalate to guarantee a steady supply of the ingredient for the end-user market.

The region’s largest share is in Asia Pacific.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.