| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 1953.07 Million | 9% | Asia Pacific |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Fischer Tropsch Hard Wax Market Overview

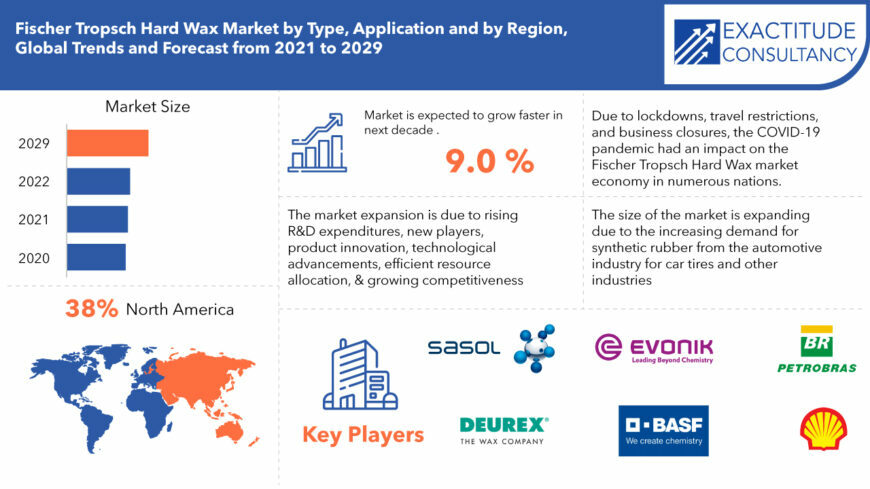

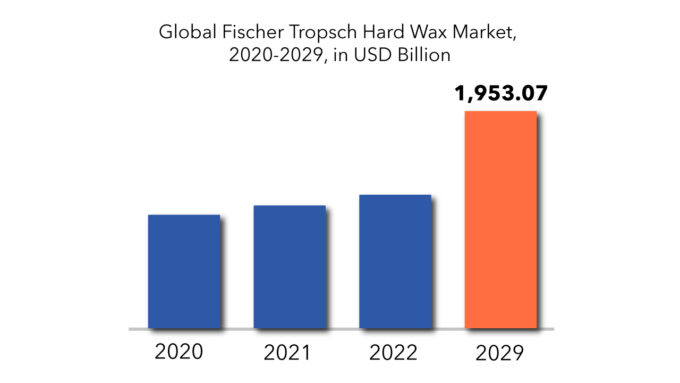

The global Fischer Tropsch Hard Wax market is expected to grow at 9% CAGR from 2023 to 2029. It is expected to reach above USD 1953.07 Million by 2029 from USD 980.18 Million in 2022.

The Fischer-Tropsch process is used to create Fischer-Tropsch wax (FT Wax), a synthetic wax, from natural gas and air. Its linear structure and predominately unbranched chain composition leads to low viscosity. Compared to other waxes, Fischer-Tropsch wax demonstrates greater hardness and high-temperature resistance. It has a higher melting point, lower oil content, narrower carbon number distribution, and higher hardness due to its abundance of saturated straight-chain hydrocarbons. Gas-to-liquids (GTL) technology is used to create Fischer-Tropsch hard wax synthetically. Fischer-Tropsch medium wax is widely used in a variety of items in domestic use consumer products and Industrial goods. The supply and demand imbalance for crude oil, along with rising gas to liquids fuel production, is a major reason in the growth of the sector, because Fischer-synthetic Tropsch’s qualities fluctuate depending on the production procedure, it can be used in a variety of applications.

The carbon efficiency of the Fischer-Tropsch technology process ranges from 25% to 50%, while its thermal efficiency is around 50%. The process’s overall production efficiency is roughly 80%, which is significantly greater than processes produced from petroleum and minerals. The capacity of the product to have continuous supply or cheap production costs in comparison to hydrocarbons derived from petroleum is anticipated to create lucrative prospects for the major players. The rate of product consumption for paints and coatings is being driven by a change in consumer desire for enhanced aesthetic appearance and appealing textures. The Fischer-Tropsch wax market is expanding in terms of revenue due to a number of product benefits, such as UV protection, affordability, usability, and color retention qualities. During the anticipated timeframe, it was anticipated that rising paints & coatings demand will fuel demand for Fischer-Tropsch wax due to rising construction and automobile output.

The Fischer Tropsch hard wax market has recently shown exceptional growth, and this trend is anticipated to continue in the years to come. The expansion of the Fischer Tropsch hard wax industry is due to rising R&D expenditures, the entry of new players, product innovation, technological advancements, efficient resource allocation, and growing competitiveness among competitors to increase their regional and client bases. The future expansion of the Fischer Tropsch hard wax market is expected to be influenced by favorable regulations, supportive government policies, and incentives. The market for Fischer Tropsch hard wax will benefit from a rise in consumer buying power as a result of higher disposable income.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Million), (Kilotons) |

| Segmentation | By Type, By Application, By Region |

| By Type |

|

| By Application | |

| By Region |

|

On the other hand, it is anticipated that changes in the price of raw resources like crude oil will impede market expansion. The Fischer-Tropsch wax market has faced difficulties over the forecast period as a result of COVID-19’s detrimental effects on several industries.

Due to lockdowns, travel restrictions, and business closures, the COVID-19 pandemic had an impact on the economy and industries of numerous nations. Due to value chain disruptions brought on by the closure of domestic and international borders, a number of companies had to scale back their operations, which resulted in a decline in the demand for refrigerants from a number of sectors. Price volatility in the raw materials needed to create refrigerants was brought on by the COVID-19 pandemic. Due to a decrease in demand from many industries, including manufacturing and construction, the world’s consumption of refrigerants has decreased. The COVID-19 pandemic cut demand from a number of businesses, which had a negative effect on the refrigerant market’s expansion. However, as many economies begin to operate again, the need for Fischer Tropsch processed hard wax is anticipated to increase internationally.

Fischer Tropsch Hard Wax Market Segment Analysis

The global Fischer Tropsch Hard Wax market is segmented based on type, application and region.

Based on type, the global Fischer Tropsch Hard Wax market has been divided into C35-C80 type, C-80-C100 type, C100+ type, and other categories.

Based on Application, the global Fischer Tropsch Hard Wax market has been divided into Printing Ink, Corrugated and Solid Fiber Boxes, Tire, Resin, Plastics, and Synthetic Rubber, Polish and Other Sanitation Goods, and Others. The application segment for resin, plastic, and synthetic rubber holds the biggest market share, at around 45%. This is due to the fact that Fischer-Tropsch (FT) chemicals have a high melting point and are frequently utilized to create sticky resins. Paints, plastic processing, printing inks, hot melts, technical emulsions, heavy compounds & candle additives, polishes, and cosmetics are just a few of the uses for adhesive resins. The major companies are anticipated to benefit from favorable features such as increased heat resistance and reduced viscosity of resins developed from FT products.

In order to improve the processing and extrusion qualities of rubber, Fischer-Tropsch wax is also utilized in rubber extrusion. The size of the Fischer-Tropsch wax market is expanding due to the increasing demand for synthetic rubber from the automotive industry for car tires and other industries such as footwear and foam. Fischer-Tropsch wax is also extensively utilized in the synthetic rubber industry’s extrusion process.

Fischer Tropsch Hard Wax Market Players

The Fischer Tropsch Hard Wax Market Key Players Include Sasol, DEUREX AG, Liaoning Fushun Tongyi special paraffin products Co. Ltd., Evonik Industries, BASF SE, Petrobras, Honeywell International Inc., Royal Dutch Shell PLC.com, Nippon Seiro Co., Ltd., Mitsui Chemicals Inc., Exxon Mobil Corporation, Baker Hughes, Total S.A., Sasol Ltd., Petro-Canada Lubricants Inc., PDVSA – Petroleos de Venezuela, S.A., and Nanyang Saier and Others.

To diversify their product offerings and establish a solid foothold in the market, major market players are concentrating on R&D efforts and establishing strategic alliances through mergers and acquisitions, joint ventures, collaborations, and other means.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Recent Developments

ExxonMobil announces $2 billion Baytown chemical expansion project; releases study showing value of investments to U.S. economy

IRVING, Texas – ExxonMobil said today that it will proceed with a $2 billion investment to expand its Baytown, Texas chemical plant, which will create approximately 2,000 jobs during construction and contribute to the approximate 15 percent return the company expects from its chemical investments.

Who Should Buy? Or Key Stakeholders

- Investors

- Manufacturing companies

- Adhesives Industry

- Medical Industry

- Government Institution

- Research Centers

- Consumer Goods

- Environment, Health and Safety Professionals

- Regulatory Authorities

- Others

Fischer Tropsch Hard Wax Market Regional Analysis

The Fischer Tropsch Hard Wax market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

According to regional analysis, the European market is anticipated to experience strong revenue CAGR growth over the forecast period. One of the key drivers propelling the expansion of the Fischer-Tropsch wax industry is the increase in public spending on the building of highways and airports around the world. Due to variables including low viscosity, high softening and melting points, and a gap between supply and demand for crude oil, the need for the product has increased in applications such as printing ink, paint and coatings, polish, tires, and other sanitation items.

Over the course of the forecast period, North America is anticipated to experience significant revenue growth, which can be attributed to the region’s strong key player presence, rising disposable income and changing lifestyle preferences, growing need for commercial and industrial refrigeration, increased R&D to create environmentally friendly end product.

Key Market Segments: Fischer Tropsch Hard Wax Market

Fischer Tropsch Hard Wax Market by Type, 2023-2029, (USD Million), (Kilotons)

- C30-C80 Type

- C-80-C100 Type

- C100+ Type

Fischer Tropsch Hard Wax Market by Application, 2023-2029, (USD Million), (Kilotons)

- Adhesives Industry

- Ink

- Coatings

- Polymer Processing Textiles

- Polishes

- Others

Fischer Tropsch Hard Wax Market by Region, 2023-2029, (USD Million), (Kilotons)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the Fischer Tropsch Hard Wax market?

- What are the key factors influencing the growth of HFC refrigerant?

- What are the major applications for HFC refrigerant?

- Who are the major key players in the Fischer Tropsch Hard Wax market?

- Which region will provide more business opportunities for Fischer Tropsch Hard Wax in future?

- Which segment holds the maximum share of the Fischer Tropsch Hard Wax market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Fischer Tropsch Hard Wax Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Fischer Tropsch Hard Wax Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Fischer Tropsch Hard Wax Market Outlook

- Global Fischer Tropsch Hard Wax Market by type, 2020-2029, (USD MILLIONS), (KILOTONS)

- C30-C80

- C80-C100

- C100+

- Global Fischer Tropsch Hard Wax Market by Application, 2020-2029, (USD MILLION), (KILOTONS)

- Adhesives industry

- Ink

- Coating

- Polymer processing textiles

- Polishes

- Others

- Global Fischer Tropsch Hard Wax Market by Region, 2020-2029, (USD MILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

-

- Sasol

- DEUREX AG

- Evonik Industries

- BASF SE

- Petrobras

- Honeywell International Inc

- Royal Dutch Shell PLC

- Nippon Seiro Co.

- Mitsui Chemicals Inc

- Exxon Mobil Corporation *The Company List Is Indicative

-

LIST OF TABLES:

TABLE 1 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL FISCHER-TROPSCH HARD WAX MARKET BY REGION (KILOTONS) 2020-2029

TABLE 7 US FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 8 US FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 9 US FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 11 CANADA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 13 CANADA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 MEXICO FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 17 MEXICO FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 BRAZIL FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 21 BRAZIL FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 ARGENTINA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 25 ARGENTINA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 COLOMBIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 29 COLOMBIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 INDIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 37 INDIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 CHINA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 41 CHINA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 JAPAN FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 45 JAPAN FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 SOUTH KOREA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH KOREA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 51 AUSTRALIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 53 AUSTRALIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 SOUTH-EAST ASIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 57 SOUTH-EAST ASIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 GERMANY FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 65 GERMANY FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 UK FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 69 UK FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 FRANCE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 73 FRANCE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 75 ITALY FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 77 ITALY FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 SPAIN FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 81 SPAIN FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 83 RUSSIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 85 RUSSIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 REST OF EUROPE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 89 REST OF EUROPE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 UAE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 93 UAE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 SAUDI ARABIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 97 SAUDI ARABIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 99 SOUTH AFRICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 101 SOUTH AFRICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA FISCHER-TROPSCH HARD WAX MARKET BY TYPE (KILOTONS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA FISCHER-TROPSCH HARD WAX MARKET BY APPLICATION (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FISCHER TROPSCH HARD WAX MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL FISCHER TROPSCH HARD WAX MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL FISCHER TROPSCH HARD WAX MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA FISCHER TROPSCH HARD WAX MARKET SNAPSHOT

FIGURE 13 EUROPE FISCHER TROPSCH HARD WAX MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA FISCHER TROPSCH HARD WAX MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC FISCHER TROPSCH HARD WAX MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA FISCHER TROPSCH HARD WAX MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 SASOL.: COMPANY SNAPSHOT

FIGURE 19 DEUREX AG: COMPANY SNAPSHOT

FIGURE 20 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 21 BASF SE.: COMPANY SNAPSHOT

FIGURE 22 PETROBRAS: COMPANY SNAPSHOT

FIGURE 23 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

FIGURE 24 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

FIGURE 25 NIPPON SEIRO CO.: COMPANY SNAPSHOT

FIGURE 26 MITSUI CHEMICALS INC: COMPANY SNAPSHOT

FIGURE 27 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

FAQ

The Fischer Tropsch Hard Wax market size had crossed USD 980.18 Million in 2022 and will observe a CAGR of more than 9 % up to 2029 and will grow up to USD 1953.07 million.

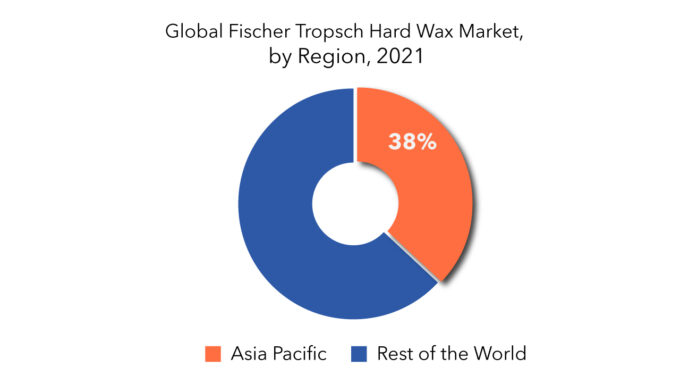

North America held more than 38% of the Fischer Tropsch Hard Wax market revenue share in 2021 and will witness expansion due to the increasing demand for synthetic rubber from the automotive industry for car tires and other industries such as footwear and foam. Fischer-Tropsch wax is also extensively utilized in the synthetic rubber industry’s extrusion process.

The expansion of the Fischer Tropsch hard wax industry is due to rising R&D expenditures, the entry of new players, product innovation, technological advancements, efficient resource allocation, and growing competitiveness among competitors to increase their regional and client bases. The future expansion of the Fischer Tropsch hard wax market is expected to be influenced by favorable regulations, supportive government policies, and incentives. The market for Fischer Tropsch hard wax will benefit from a rise in consumer buying power as a result of higher disposable income.

The region’s largest share is in North America, it is followed by the European market which is expected to grow significantly during the forecast period.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.