| Market Size | CAGR | Dominating Region |

|---|---|---|

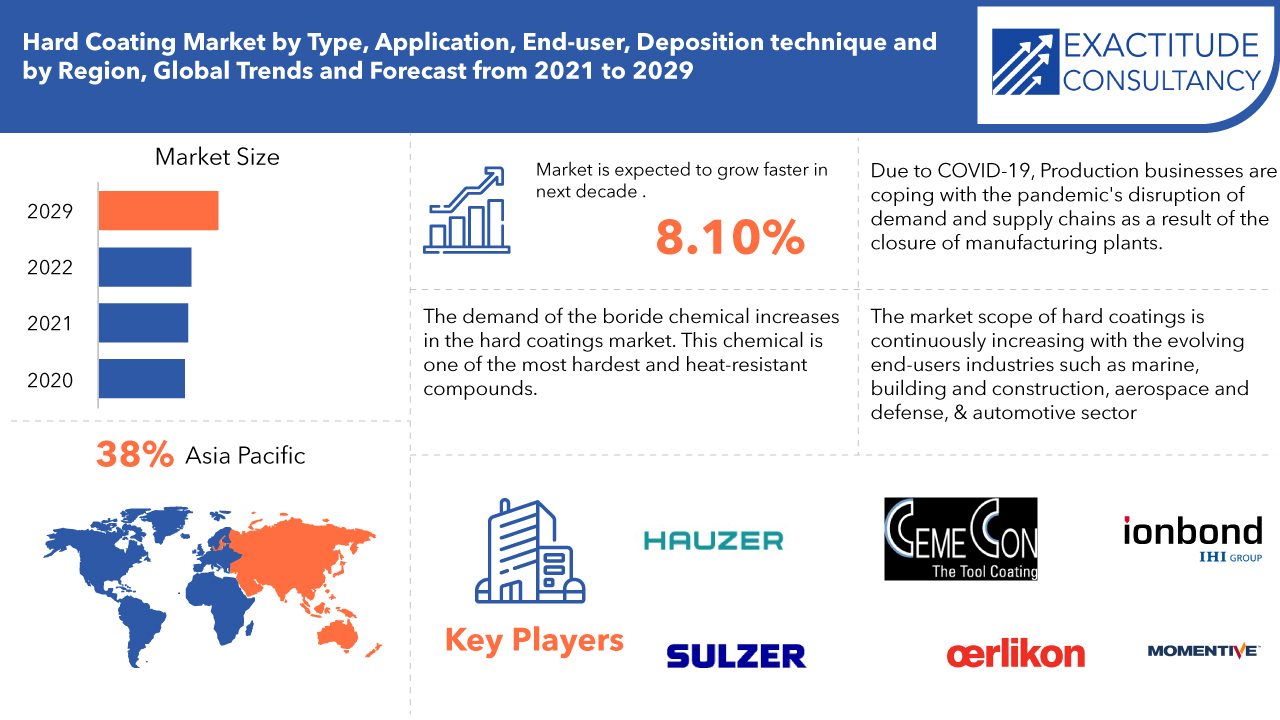

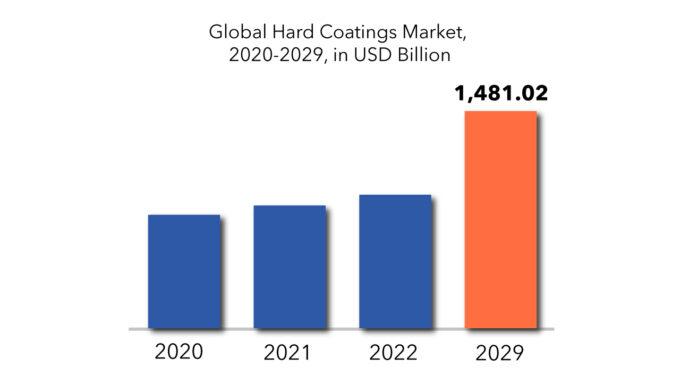

| USD 1481.08 Million | 8.10% | Asia pacific |

| By Material Type | By Application | By End-User, | By Deposition Technique | By Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

The global Hard Coating market is expected to grow at 8.10 % CAGR from 2023 to 2029. It is expected to reach above USD 1481.08 Million by 2029 from USD 794.25 Million in 2022.

Hard Coating Market Overview

Hard coatings are a coating process that produces a hardened surface through the anodization of sulfuric acid with modified electrolyte concentration, temperature, and electric current parameters. Corrosion, hardness, wear, electrical brittleness, and temperature resistance are all characteristics of hard coatings. After lubrication, hard coatings have a low coefficient of friction. The need for hard coatings is anticipated to rise as a result of these qualities. To make lenses scratch-resistant and increase their endurance and lifetime, hard coatings are applied to the lenses. Hard coated films, which are coatings created using a plasma deposition method, have various advantages over soft coatings. Because the plasma deposition process is computer-controlled, it has a high environmental tolerance, even layering, and better performance. To increase the wear resistance of components and tools, hard coatings are frequently employed in surface engineering techniques. The corrosive environments, such as biomedical, marine, or oil and gas applications, can also be employed with the hard coating. As the healthcare industry expands, there is an increase in the demand for hard coatings. This is particularly necessary in the manufacturing of equipment and medical devices. The need for Hard Coatings from the automobile industry has also grown quickly. This is due to increased knowledge of the advantages and effectiveness of applying a hard coating, such as its resistance to anti-corrosion and temperature changes. It also has a low friction coefficient after being lubricated.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Million), (Kilotons) |

| Segmentation | By Type, By Application, By End-User, By Deposition Technique, By Region |

| By Type |

|

| By Application |

|

| By End-user |

|

| By Deposition technique |

|

| By Region |

|

During the forecast period, the increasing emphasis on new product development, innovations, and research and development activities is anticipated to present possibilities for the major players functioning in the worldwide hard coatings market. New developments are also anticipated to exhibit a good trend in the market for hard coatings in a number of emerging nations. Due to lower fuel consumption and carbon dioxide emissions, lightweight materials are preferred in the automotive sector. Hard coats are currently being utilized far more frequently than soft coatings were in the past since they offer many more benefits. While lenses with soft coatings gradually alter over time, those with hard coatings maintain their consistency for years after being used continuously. The scratch-resistant, long-lasting, anti-fog, refractive, and long-lasting hard coatings. In the automotive industry, there is a growth in demand for lightweight cars with appealing shines that boost the durability of the metal parts.

To get a competitive edge, the main corporations are primarily refocusing their efforts on producing novel and ground-breaking goods and expanding their production capabilities into the amino resins industry. The items are made with the intention of assisting in the compliance with strict formaldehyde emission standards.

With the development of end-user industries like marine, building and construction, aerospace and defense, and the automotive industry, the market for hard coatings is constantly expanding. These are some of the key factors that are creating favorable opportunities for the growth of the hard coating market during the forecast period, in addition to the fact that hard coatings have numerous industrial applications that help to protect machinery and equipment that operates in harsh conditions.

Global hard coating market growth has been stunted by the COVID-19 pandemic epidemic. Production businesses are coping with the pandemic’s disruption of the demand and supply chains as a result of the closure of manufacturing plants. Growth in the medical and healthcare sector is anticipated to support the market for hard coating in the post-pandemic era as it helps increase instrument efficiency. Consequently, coronavirus is having a significant impact on the expansion of the engineered foam industry.

Hard Coating Market Segment Analysis

The global Hard Coating market is segmented based on material type, application, end-user and deposition technique.

Based on material type, the market is bifurcated into Nitrides, Oxides and Borides. By material type, Due to the material’s distinctive combination of qualities that makes it beneficial for a number of industries, borides are the most valuable material type in the hard coatings market. Due to its extraordinary toughness, Boride is utilized in cutting tool, it is commonly used as coatings for materials that must endure under the hardest environments.

Based on Application, the market is divided by cutting tools, decorative coatings, optics, gears, bearings, cylinders and hydraulic components. This segment is dominated by cutting tools, the countries like India, China and Japan are the dominant economies in this segment.

Based on End-user, the market is divided into general manufacturing, transportation, aerospace, defense, buildings and construction. In this segment general manufacturing is the dominating and the fastest growing end-user.

Based on Deposition technique, the segment is divided by (PVD) Physical Vapor Deposition and (CVD) Chemical Vapor Deposition. In 2021, Physical Vapor Deposition held a 59% market share, dominating the industry. Due to the automobile industry’s need for lightweight materials to reduce fuel consumption and carbon dioxide emissions, there is a surge in the need for hard coating.

Hard Coating Market Players

The Hard Coating Market Key Players Include HI HAUZER B.V. (Netherlands), Sulzer Ltd (Switzerland). OC Oerlikon Management AG (Switzerland), Cemecon (Germany), IHI Ionbond AG (Switzerland), Momentive (U.S.), ZEISS International (Germany), Covestro AG (Germany), The Lubrizol Corporation (U.S.) Huntsman International LLC (U.S.), Solvay SA (Belgium), Clariant AG (Switzerland), BASF SE (Germany), Avient (U.S.), Construction Materials Co., Ltd., (China), Holcim (Switzerland), CHRYSO GROUP (France), GCP Applied Technologies Inc. (U.S.), Omnova Solutions Inc. (U.S.), Dupont (U.S.)

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key stakeholders

- Manufacturing products.

- Government organization.

- Research firms.

- Chemical companies

- Investors

- End user companies

- Research institutes

- Chemicals & materials manufacturers

- Others

Hard Coating Market Regional Analysis

The Hard Coating market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

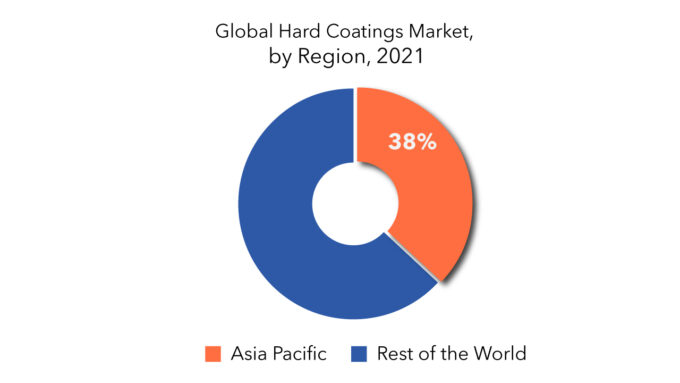

Asia pacific is the largest shareholder of the hard coating market. Asia Pacific accounts for almost 38 % of the market share. Major economies in this region like India, China and Japan are witnessing regular development in industrialization and the government in these economies are investing greatly in development of areas of infrastructure, marine, aerospace & defense. North America is estimated to be the fastest growing market in the forecast period. US is the major contributing economy in this region. The US government is also developing steady growth in the hard coating market focusing mainly on infrastructure, marine and aerospace.

The European market witness steady growth and has several economies collectively contributing towards the development in this the Hard coatings market.

Key Market Segments: Hard Coating Market

Hard Coating Market by Material Type, 2023-2029, (USD Million), (Kilotons)

- Nitrides

- Oxides

- Borides

Hard Coating Market by Application, 2023-2029, (USD Million), (Kilotons)

- Cutting Tools

- Decorative Coatings

- Optics

- Gears

- Bearings

- Cylinders

- Hydraulic Components

Hard Coating Market by End-User, 2023-2029, (USD Million), (Kilotons)

- General Manufacturing

- Transportation

- Aerospace

- Defense

- Building and Construction

Hard Coating Market by Deposition Technique, 2023-2029, (USD Million), (Kilotons)

- PVD (Physical Vapor Deposition)

- CVD (Chemical Vapor Deposition)

Hard Coating Market by Region, 2023-2029, (USD Million), (Kilotons)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the Hard Coating market?

- What are the key factors influencing the growth of Hard Coating?

- What are the major applications for Hard Coating?

- Who are the major key players in the Hard Coating market?

- Which region will provide more business opportunities for Hard Coating in future?

- Which segment holds the maximum share of the Hard Coating market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Heat Coatings Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Heat Coatings Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Heat Coatings Market Outlook

- Global Heat Coatings Market by Material type, 2020-2029, (USD MILLIONS), (KILOTONS)

- Nitrites

- Oxides

- Borides

- Global Heat Coatings Market by Application, 2020-2029, (USD MILLION), (KILOTONS)

- Cutting tools

- Decorative coatings

- Optics

- Gears

- Bearings

- Cylinders

- Hydraulic components

- Global Heat Coatings Market by end-user, 2020-2029, (USD MILLIONS), (KILOTONS)

- General manufacturing

- Transportation

- Aerospace

- Defense

- Building and construction

- Global Heat Coatings Market by deposition technique, 2020-2029, (USD MILLIONS), (KILOTONS)

- PVD

- CVD

- Global Heat Coatings Market by Region, 2020-2029, (USD MILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

-

- HI HAUZER B.V.

- Sulzer Ltd

- OC Oerlikon Management AG

- Cemecon

- IHI Ionbond AG

- Momentive

- ZEISS International

- Covestro AG

- Huntsman International LLC

- The Lubrizol Corporation Mfg. Co. Ltd *The Company List Is Indicative

-

LIST OF TABLES

TABLE 1 GLOBAL HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 7 GLOBAL HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 9 GLOBAL HEAT COATINGS MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 10 GLOBAL HEAT COATINGS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 US HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 12 US HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 13 US HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 US HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 US HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 16 US HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 17 US HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 18 US HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 19 CANADA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 20 CANADA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 21 CANADA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 CANADA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 23 CANADA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 24 CANADA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 25 CANADA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 CANADA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 27 MEXICO HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 28 MEXICO HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 29 MEXICO HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 MEXICO HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 MEXICO HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 32 MEXICO HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 33 MEXICO HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 34 MEXICO HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 BRAZIL HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 36 BRAZIL HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 37 BRAZIL HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 BRAZIL HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 39 BRAZIL HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 40 BRAZIL HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 41 BRAZIL HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 42 BRAZIL HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 ARGENTINA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 44 ARGENTINA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 45 ARGENTINA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 ARGENTINA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 ARGENTINA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 48 ARGENTINA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 49 ARGENTINA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 ARGENTINA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 COLOMBIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 52 COLOMBIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 53 COLOMBIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 COLOMBIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 COLOMBIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 56 COLOMBIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 58 COLOMBIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 59 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 64 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 66 REST OF SOUTH AMERICA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 INDIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 68 INDIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 69 INDIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 INDIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 71 INDIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 72 INDIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 73 INDIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 INDIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 CHINA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 76 CHINA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 77 CHINA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 CHINA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 CHINA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 80 CHINA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 81 CHINA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 82 CHINA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 83 JAPAN HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 84 JAPAN HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 85 JAPAN HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 JAPAN HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 87 JAPAN HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 88 JAPAN HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 89 JAPAN HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 90 JAPAN HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 91 SOUTH KOREA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 92 SOUTH KOREA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 SOUTH KOREA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 96 SOUTH KOREA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 SOUTH KOREA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 100 AUSTRALIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 AUSTRALIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 104 AUSTRALIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 105 AUSTRALIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 106 AUSTRALIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 108 SOUTH-EAST ASIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 110 SOUTH-EAST ASIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 111 SOUTH-EAST ASIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 112 SOUTH-EAST ASIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 113 SOUTH-EAST ASIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 114 SOUTH-EAST ASIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 116 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 117 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 118 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 119 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 120 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 121 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 REST OF ASIA PACIFIC HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 123 GERMANY HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 124 GERMANY HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 125 GERMANY HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 GERMANY HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 127 GERMANY HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 128 GERMANY HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 129 GERMANY HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 130 GERMANY HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 UK HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 132 UK HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 133 UK HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 134 UK HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 136 UK HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 137 UK HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 138 UK HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 139 FRANCE HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 140 FRANCE HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 141 FRANCE HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 142 FRANCE HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 143 FRANCE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 144 FRANCE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 145 FRANCE HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 FRANCE HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 147 ITALY HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 148 ITALY HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 149 ITALY HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 ITALY HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 ITALY HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 152 ITALY HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 153 ITALY HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 154 ITALY HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 155 SPAIN HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 156 SPAIN HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 157 SPAIN HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 158 SPAIN HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 SPAIN HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 160 SPAIN HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 161 SPAIN HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 162 SPAIN HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 163 RUSSIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 164 RUSSIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 165 RUSSIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 166 RUSSIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 RUSSIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 168 RUSSIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 169 RUSSIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 170 RUSSIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 171 REST OF EUROPE HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 172 REST OF EUROPE HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 173 REST OF EUROPE HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 174 REST OF EUROPE HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 175 REST OF EUROPE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 176 REST OF EUROPE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 177 REST OF EUROPE HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 178 REST OF EUROPE HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 179 UAE HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 180 UAE HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 181 UAE HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 182 UAE HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 183 UAE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 184 UAE HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 185 UAE HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 186 UAE HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 SAUDI ARABIA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 188 SAUDI ARABIA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 189 SAUDI ARABIA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 190 SAUDI ARABIA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SAUDI ARABIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 192 SAUDI ARABIA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 193 SAUDI ARABIA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 194 SAUDI ARABIA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 195 SOUTH AFRICA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 196 SOUTH AFRICA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 197 SOUTH AFRICA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 198 SOUTH AFRICA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 199 SOUTH AFRICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 200 SOUTH AFRICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 201 SOUTH AFRICA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 202 SOUTH AFRICA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

TABLE 203 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 204 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY MATERIAL TYPE (KILOTONS) 2020-2029

TABLE 205 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 206 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 207 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (USD MILLIONS) 2020-2029

TABLE 208 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE (KILOTONS) 2020-2029

TABLE 209 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 210 REST OF MIDDLE EAST AND AFRICA HEAT COATINGS MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HEAT COATINGS MARKET BY MATERIAL TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEAT COATINGS MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEAT COATINGS MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 9 GLOBAL HEAT COATINGS MARKET BY DEPOSITION TECHNIQUE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL HEAT COATINGS MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 NORTH AMERICA HEAT COATINGS MARKET SNAPSHOT

FIGURE 13 EUROPE HEAT COATINGS MARKET SNAPSHOT

FIGURE 14 SOUTH AMERICA HEAT COATINGS MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC HEAT COATINGS MARKET SNAPSHOT

FIGURE 16 MIDDLE EAST ASIA AND AFRICA HEAT COATINGS MARKET SNAPSHOT

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 HI HAUZER B.V.: COMPANY SNAPSHOT

FIGURE 19 SULZER LTD INDUSTRIES: COMPANY SNAPSHOT

FIGURE 20 OC OERLIKON MANAGEMENT AG GROUP: COMPANY SNAPSHOT

FIGURE 21 CEMECON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 22 IHI IONBOND AG: COMPANY SNAPSHOT

FIGURE 23 GEA GROUP AG: COMPANY SNAPSHOT

FIGURE 24 JOHNSON CONTROLS: COMPANY SNAPSHOT

FIGURE 25 INGERSOLL RAND: COMPANY SNAPSHOT

FIGURE 26 LU-VE GROUP: COMPANY SNAPSHOT

FIGURE 27 THE LUBRIZOL CORPORATION MFG. CO. LTD: COMPANY SNAPSHOT

FAQ

The Hard Coating market size had crossed USD 794.25 Million in 2022 and will observe a CAGR of more than 8.10 % up to 2029. The demand of the boride chemical increases in the hard coatings market. This chemical is one of the hardest and heat-resistant compounds. Furthermore, it is widely used as coatings for materials that have to withstand in the harshest situations due to their incredible toughness properties used to cutting tool. The rising demand of boride chemical in hard coating are expected to drive the growth rate of the hard coating market.

Asia Pacific held more than 38% of the Hard Coating market revenue share in 2021 and will witness expansion.

Increase the use of boride chemicals, which is generally the toughest material in the segment and contributes highest towards the growth of the market, Rise in demand due to unique properties like temperature resistant, resistant to corrosion, hardness and wear and have low friction coefficient after lubrication, rising awareness about the benefits of hard coatings has also been a major driver of the market.

The region’s largest share is in Asia Pacific.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.