| Market Size | CAGR | Dominating Region |

|---|---|---|

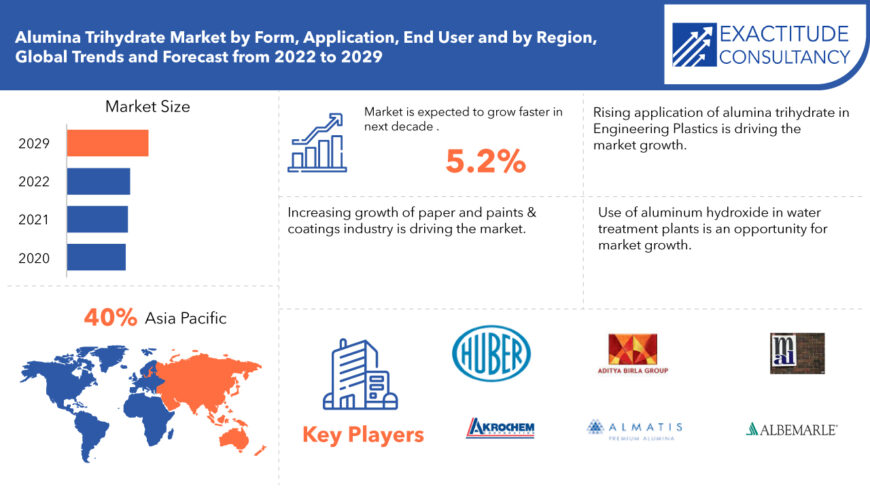

| USD 1.84 billion | 5.2% | Asia Pacific |

| By Form | By Application | By End User | By Regions |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Alumina Trihydrate Market Overview

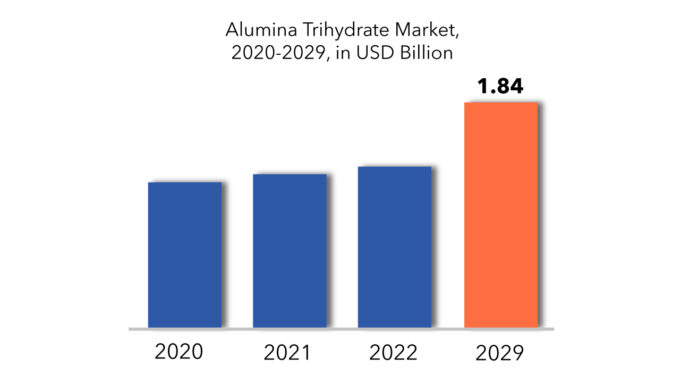

The global alumina trihydrate market is projected to reach USD 1.84 billion by 2029 from USD 1.16 billion in 2020, at a CAGR of 5.2% from 2022 to 2029

Alumina trihydrate is a powder-form solid substance that is white in colour, odourless, non-toxic, chemically inert, and less abrasive. Aluminum trihydroxide is another name for it. Although alumina trihydrate has poor water solubility, it is amphoteric, which means it dissolves in both strong alkalis and acids. It is usually made from various sizes of bauxite ore that has been processed using the Bayer process. After being washed away, the chemical can be used as a feedstock for a variety of alumina compounds. Alumina trihydrate decomposes into aluminium oxide and water when heated to 180°C, and aluminium oxide is frequently utilised as a flame retardant.

Aluminum, adhesives, coatings, wires and cables, caulks and sealants, rubbers, paper, and carpet backing are all made with alumina trihydrate. Aluminum manufacturing is the most typical application of alumina trihydrate. It’s utilised as smoke suppression filler in polymers and as a flame retardant in rubber products and carpet backing. In the pharmaceutical sector, alumina trihydrate is used as an antacid to help balance the pH in the stomach.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Form, By Application, By End User, By Region. |

| By Form

|

|

| By Application

|

|

| By End User

|

|

| By Region

|

|

Explosions and fire-related catastrophes are becoming more common as the number of residential and commercial buildings grows. As a result, strict fire safety laws and processes have been enacted in various nations across North America and Europe. As a result of these government laws, the use of flame retardants in buildings has increased. Electric wire insulation in architecture and construction, as well as transportation, is two of the most common uses for flame retardants. Circuit boards, electronic housing, and cables and wire systems all need flame retardants. The need for halogen-free flame retardants is being driven by strict fire safety rules to minimise the spread of flames in residential and commercial structures. The move toward more environmentally friendly alternatives will boost demand for non-halogenated flame retardants, resulting in market expansion.

The most common coagulant used in water and wastewater treatment is aluminium hydroxide (alum). The primary goal of alum in these applications is to increase suspended solids settling and colour removal. Phosphate is also removed from wastewater treatment effluent using alum. As a result, rising urbanisation in emerging economies like China and India is likely to increase demand for residential water treatment plants. Despite this, many people still lack access to safe drinking water and are infected with preventable water-borne microbial infections, causing an increase in the demand for wastewater treatment plants. As a result, the usage of aluminium hydroxide in water treatment facilities in residential areas is likely to boost the global alumina trihydrate market.

Alumina Trihydrate Market Segment Analysis

The alumina trihydrate market is divided into three categories based on form powder and liquid. Powder accounted for the highest proportion of the alumina trihydrate market. Aluminum trihydrate comes in a variety of uncoated and coated grades, with particle sizes ranging from 2 to 80 microns per sample. Aluminum trihydrate is a frequent principal constituent in most solid surface materials, accounting for up to 70% of the total product weight. Bauxite ore, a natural substance that is the primary source of aluminium, is used to make ATH. A number of alumina compounds are made from the powder. Due to its many favourable qualities, alumina trihydrate is the filler of choice for many solid surface manufacturing businesses.

The market is divided into coatings, inks and pigments, fertilizers, adhesive and sealants, paper, polymers, glass and glazes, synthetic rubber, wires and cables, cleansing agent based on application. Coating segment dominate the alumina trihydrate market growth. Due to its versatility and low cost, aluminium trihydrate (ATH) is the most often used flame retardant in industrial coatings. At working temperatures below 220°C, it can be utilised in a wide range of paint binders. ATH is nontoxic, halogen-free, chemically inert, and abrasion-resistant. Additional benefits include acid exposure and smoke suppression. The alumina trihydrate produced is used in the plastics industry in addition to the coatings business. Plastics are employed in a variety of end-user sectors due to benefits such as low cost, light weight, durability, and water resistance, among others.

The market is divided into automotive, building and construction, electrical and electronics, paints and coatings, rubber industry, textile industry, industrial, agriculture, pharmaceuticals based on end user. Building and construction segment dominate the alumina trihydrate market. In terms of the number of deals entered, North America, Europe, and Asia are the most dominant regions. Both Europe and Asia have seen a drop in construction deals, but North America has seen a significant increase in total deals. The global economy is currently experiencing a severe downturn as a result of a deepening financial crunch, economies’ development targets being thrown off, and the global pandemic of COVID-19.

Alumina Trihydrate Market Players

The major players operating in the global alumina trihydrate industry include Huber Engineered Materials (J.M. Huber Corporation), Akrochem Corporation, Aditya Birla Management Corporation Pvt. Ltd., Almatis, MAL-Hungarian Aluminium Producer and Trading Co., Nabaltec AG and Albemarle Corporation Alumina – Chemicals & Castable. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the market.

For instance, in 2020 Nabaltec AG announced the opening of their newest U.S. production facility Naprotec LLC located in Chattanooga, TN. Naprotec LLC is a state-of-art plant dedicated to the production of wide range of ground Alumina Trihydrate (ATH) particle distributions, surface modified ground, fine precipitated ATH grades and performance enhanced ATH products.

Similarly, in September 2020, The Fire-Retardant Additives division of Huber Engineered Materials (HEM) announced its plans for a major sustainability project and substantial investment in a new power plant at its Martinswerk facility in Bergheim, Germany.

Who Should Buy? Or Key stakeholders

- Research and development

- Manufacturing

- Automotive

- Building and Construction

- Electrical and Electronics

- Paints and Coatings

- Rubber Industry

- Textile Industry

- Agriculture

- Pharmaceuticals

- Others

Alumina Trihydrate Market Regional Analysis

Geographically, the advanced wound care market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

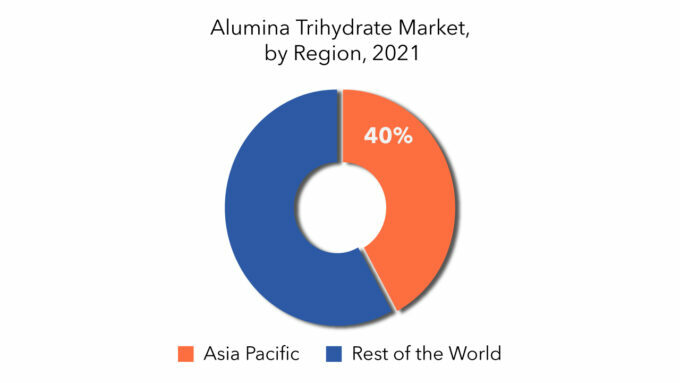

Asia Pacific is expected to hold the largest share of the global alumina trihydrate market. The use of alumina trihydrate is increasing in the region owning to rising demand for plastics and expanding construction industries in nations like China, India, and Japan. During the projected period, demand in the area is expected to grow at the fastest rate. During the forecast period, these expanding industries are expected to boost demand for Alumina Trihydrate. Furthermore, the rising construction industry in countries such as India and China is increasing demand for Alumina Trihydrate, which is propelling the alumina trihydrate market forward. The building sector in industrialised countries is mature in comparison to the construction sector in emerging economies, which is rapidly growing due to increased population and urbanisation.

Key Market Segments: Alumina Trihydrate Market

Alumina Trihydrate Market By Form, 2020-2029, (USD Million) (Kilotons)

- Powder

- Liquid

Alumina Trihydrate Market By Application, 2020-2029, (USD Million) (Kilotons)

- Coatings

- Inks And Pigments

- Fertilizers

- Adhesive And Sealants

- Paper

- Polymers

- Glass And Glazes

- Synthetic Rubber

- Wires And Cables

- Cleansing Agent

Alumina Trihydrate Market By End User, 2020-2029, (USD Million) (Kilotons)

- Automotive

- Building And Construction

- Electrical And Electronics

- Paints And Coatings

- Rubber Industry

- Textile Industry

- Industrial

- Agriculture

- Pharmaceuticals

Alumina Trihydrate Market By Regions, 2020-2029, (USD Million) (Kilotons)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current scenario of the global alumina trihydrate market?

- What are the emerging technologies for the development of alumina trihydrate devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Alumina Trihydrate Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Alumina Trihydrate Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Alumina Trihydrate Market Outlook

- Global Alumina Trihydrate Market by Form (USD Million) (Kilotons)

- Powder

- Liquid

- Global Alumina Trihydrate Market by Application (USD Million) (Kilotons)

- Coatings

- Inks and Pigments

- Fertilizers

- Adhesive and Sealants

- Paper

- Polymers

- Glass and Glazes

- Synthetic Rubber

- Wires and Cables

- Cleansing Agent

- Global Alumina Trihydrate Market by End User (USD Million) (Kilotons)

- Automotive

- Building and Construction

- Electrical and Electronics

- Paints and Coatings

- Rubber Industry

- Textile Industry

- Industrial

- Agriculture

- Pharmaceuticals

- Global Alumina Trihydrate Market by Region

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Huber Engineered Materials (J.M. Huber Corporation)

- Akrochem Corporation

- Aditya Birla Management Corporation Pvt. Ltd.

- Almatis

- MAL-Hungarian Aluminium Producer and Trading Co.

- Albemarle Corporation Alumina – Chemicals & Castable

- Others *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 3 GLOBAL ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL ALUMINA TRIHYDRATE MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL ALUMINA TRIHYDRATE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 10 US ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 11 US ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 12 US ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 13 US ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 US ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 15 CANADA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 16 CANADA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 17 CANADA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 CANADA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 19 CANADA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 MEXICO ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 22 MEXICO ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 23 MEXICO ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 MEXICO ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 MEXICO ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 27 BRAZIL ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 29 BRAZIL ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 31 BRAZIL ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 33 ARGENTINA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 35 ARGENTINA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 37 ARGENTINA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 39 COLOMBIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 41 COLOMBIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 43 COLOMBIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 INDIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 52 INDIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 53 INDIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 INDIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 55 INDIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 INDIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 57 CHINA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 58 CHINA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 59 CHINA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 60 CHINA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 CHINA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 CHINA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 JAPAN ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 64 JAPAN ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 65 JAPAN ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 JAPAN ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 JAPAN ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 JAPAN ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 77 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 GERMANY ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 94 GERMANY ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 95 GERMANY ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 GERMANY ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 GERMANY ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 GERMANY ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 UK ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 100 UK ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 101 UK ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 UK ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 UK ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 UK ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 FRANCE ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 106 FRANCE ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 107 FRANCE ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 108 FRANCE ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 FRANCE ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 FRANCE ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 ITALY ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 112 ITALY ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 113 ITALY ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 114 ITALY ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 ITALY ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 ITALY ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 SPAIN ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 118 SPAIN ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 119 SPAIN ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 SPAIN ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 SPAIN ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 SPAIN ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 123 RUSSIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 125 RUSSIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 127 RUSSIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 135 UAE ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 136 UAE ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 137 UAE ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 138 UAE ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 139 UAE ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 UAE ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY FORM (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY FORM (KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA ALUMINA TRIHYDRATE MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ALUMINA TRIHYDRATE MARKET BY FORM, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ALUMINA TRIHYDRATE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ALUMINA TRIHYDRATE MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ALUMINA TRIHYDRATE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA ALUMINA TRIHYDRATE MARKET SNAPSHOT

FIGURE 14 EUROPE ALUMINA TRIHYDRATE MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC ALUMINA TRIHYDRATE MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA ALUMINA TRIHYDRATE MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA ALUMINA TRIHYDRATE MARKET SNAPSHOT

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 ALBEMARLE CORPORATION ALUMINA – CHEMICALS & CASTABLE: COMPANY SNAPSHOT

FIGURE 20 MAL-HUNGARIAN ALUMINIUM PRODUCER AND TRADING CO.: COMPANY SNAPSHOT

FIGURE 21 ALMATIS: COMPANY SNAPSHOT

FIGURE 22 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.: COMPANY SNAPSHOT

FIGURE 23 AKROCHEM CORPORATION.: COMPANY SNAPSHOT

FIGURE 24 HUBER ENGINEERED MATERIALS (J.M. HUBER CORPORATION): COMPANY SNAPSHOT

FAQ

The alumina trihydrate market size had crossed USD 1.16 Billion in 2020 and will observe a CAGR of more than 5.2% up to 2029 driven by the rising application of alumina trihydrate in Engineering Plastics.

The upcoming trend in alumina trihydrate market is use of aluminum hydroxide in water treatment plants is an opportunity for market growth.

The global alumina trihydrate market registered a CAGR of 5.2% from 2022 to 2029. The form segment was the highest revenue contributor to the market.

Asia Pacific is the largest regional market with 40% of share owning to the use of alumina trihydrate is increasing in the region owning to rising demand for plastics and expanding construction industries in nations like China, India, and Japan.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.