REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 16.4 Billion by 2029 | 6.0% | Asia Pacific |

| By Chemistry | By Technology | By Application | By End Use Industry |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Pressure Sensitive Adhesives Market Overview

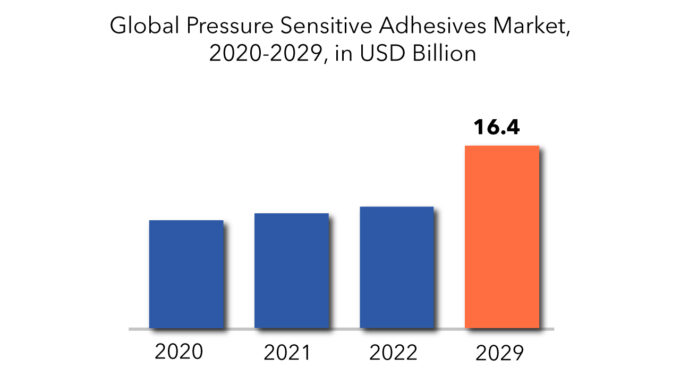

The Pressure Sensitive Adhesives Market handling equipment market is projected to reach USD 16.4 Billion by 2029 from USD 9.7 billion in 2022, at a CAGR of 6.0 % from 2023 to 2029.

Pressure-sensitive adhesive (PSA, self-adhesive, self-stick adhesive) is a type of nonreactive adhesive which forms a bond when pressure is applied to bond the adhesive with a surface. No solvent, water, or heat is needed to activate the adhesive. It is used in pressure-sensitive tapes, labels, glue dots, stickers, sticky note pads, automobile trim, and a wide variety of other products.

When pressure is given to an adhesive to adhere it to a surface, the adhesive forms a link and is known as pressure-sensitive adhesive (PSA, self-adhesive, or self-stick adhesive). The adhesive may be activated without the need of a solvent, water, or heat. It is utilized in a broad range of items, including pressure-sensitive tapes, labels, adhesive dots, stickers, sticky note pads, and automotive trim. Normally, PSAs are designed to adhere and hold securely at ambient temperature. PSAs frequently lose or have reduced tack at low temperatures and their ability to retain shear at high temperatures; special adhesives are intended to work at high or low temperatures. A link between the surface and the adhesive is made when pressure is applied to a non-reactive adhesive, such as PSA. The distinctive characteristic of PSAs is that they maintain their fluidity and do not solidify. They are always sticky as a result, and if they touch a surface, they may dampen it. Because of their adaptability, growing use in tapes and labels, and high demand in APAC, PSAs are widely accepted and are driving growth in the sector.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION ) (KILOTON) |

| Segmentation | By Chemistry, By Technology, By Application, By End Use Industry, By Region. |

| By Chemistry

|

|

| By Technology

|

|

| By Application

|

|

| By Industry

|

|

| By Region

|

|

Due to the growth of products and increased competitiveness, packaging standards are getting more and more complicated, especially in the food and beverage sector. Since PSAs provide the flexibility needed to satisfy these intricate criteria, this will expand market opportunities. PSAs are utilized in a variety of fields, including the automobile industry, where they are employed on component identification labels in the supply chain as well as on safety and warning labels.

Thermoplastic in nature, acrylic-based pressure sensitive adhesives (PSA) may be created using acrylic monomers and polymers with low glass transition temperatures. These pressure-sensitive adhesives are ideal for label applications since they are adaptable, affordable, and have improved performance qualities. Because of its polar nature, acrylic PSA tend to adhere well to polar surfaces such metals, glass, polyesters, polycarbonates, and neoprene. These are the main drivers of market growth for pressure-sensitive adhesives. For packing, distributing, and preserving food, medicines, drinks, and other items that require longer shelf life, flexible packaging is the most cost-effective option. Due to a rise in end-user demand during the past ten years, the flexible packaging sector has experienced tremendous expansion. Thus, packaging engineers frequently use pressure sensitive adhesives as a tool since they help maintain the packing in place until it gets to where it must go. All these elements work together to increase demand for pressure-sensitive adhesives, which fuels the worldwide market’s expansion.

The pressure sensitive adhesives market’s expansion is expected to be constrained by changing raw material costs, though. Due to the rising cost of the raw materials used in their production, the market for pressure-sensitive adhesives is seeing a limited rate of expansion. Another significant obstacle facing the adhesives business is the shortage of a crucial raw material used in the industrial of water-based and other adhesives. The market shortage of VAM is linked to the closure of a few production facilities in Europe, the United States, and Asia-Pacific owing to plant failure, accidents, or regularly scheduled maintenance work.

On the other hand, a rise in demand for pressure-sensitive adhesives made from biomaterials is anticipated to create new opportunities throughout the projected period. The necessity for bio-based pressure sensitive adhesives has arisen as the need for environmentally friendly solutions grows on a worldwide scale. A commercially available acrylate and a bio-based monomer chain are combined to create a bio-based pressure sensitive glue. These adhesives operate just as well as conventional formulations even though around 60% of the components used in their manufacture are bio-based. It is simple to create bio-based pressure sensitive adhesives since they are compatible with existing manufacturing methods like mini-emulsion polymerization and standard emulsion.

Pressure Sensitive Adhesives Market Segment Analysis

The Pressure Sensitive Adhesives Market is divided into Chemistry, Technology, Application and End-use Industry. By chemistry, market is bifurcated into Acrylic, Rubber, Silicone. By Technology market is bifurcated into Water-based, Solvent-based, Hot Melt. By Application market is bifurcated into Labels, Tapes, Graphics. By end use industry market is bifurcated into Packaging, Automotive, Healthcare.

The pressure sensitive adhesives market is anticipated to be dominated by the acrylic segment based on chemistry. Rubber PSAs are softer and less sturdy than acrylic PSAs. Acrylics have outstanding anti-aging qualities, great oxidation, temperature, and UV radiation resistance, strong environmental resistance, a quick cure time, a good balance of adhesion and cohesiveness with excellent water resistance, and high peel, tack, and shear strengths. They are suited for usage in a variety of applications because to their high temperature tolerance and strong bonding with polar surfaces including metal, glass, polyester, and polycarbonates, which accounts for their significant market share in pressure sensitive adhesives.

The pressure sensitive adhesives market’s largest technology category is anticipated to be the water base segment. Pressure-sensitive tapes, labels, adhesive dots, note pads, vehicle trims, films, and peelable are just a few products that use water-based technology. Other industries that use it include packaging, electrical, electronics & communications, medical & healthcare, and automotive. The demand from the medical and packaging industries has led to rise in the market for water-based PSAs despite the new coronavirus epidemic. Due to the pandemic, there is an ongoing need for PSAs in the packaging industry, which is one of the main businesses supported by FMCG and food items. People across the world are buying only what they need to live during quarantines and lockdowns, which has led to this increase in demand.

Based on application, the pressure sensitive adhesives market is anticipated to be dominated by the tape application segment. Due to their simplicity of use and low cost as compared to conventional methods, PSAs on tapes are being employed more and more in the packaging and healthcare industries. APAC is home to several emerging nations, including Taiwan, China, South Korea, India, and China. Packaging, healthcare, the automotive and transportation industry, and building and construction are just a few of the rising sectors in these developing nations. The need for PSAs is being driven by the rising industries in the APAC nations.

Based on end use industry, the pressure sensitive adhesives market is anticipated to be dominated by the packaging end-use sector. There are two forms of packaging: flexible and rigid. Depending on the applicability of the application, PSAs are utilized. These adhesives are employed, among other things, in the packaging of consumer and industrial goods, hygiene and medical packaging, packaging for medicine delivery, packaging in the construction industry during transport, and packaging in automotive-related logistics. Transport, warehousing, logistics, and the packaging of commodities and containers all employ packing tapes. PSAs are applied to packaging via images to increase consumer appeal.

Pressure Sensitive Adhesives Market Players

The key players of pressure sensitive adhesive market include Henkel AG & Company KGAA (Germany), The Dow Chemical Company (US), Avery Dennison Corporation (US), H.B. Fuller (US), 3M Company (US), Arkema Group (France), Sika AG (Switzerland), Scapa Group PLC (UK), and Ashland Inc., (US). Henkel AG & Company KGAA (Germany).

Is one of the largest pressure sensitive adhesive companies. This company manufactures customized solutions catering to industries and applications. The company has leveraged its strong financial background and distribution network to expand its business across countries of AAPC, North America, and Europe.

Recent Developments:

In September 2020, Wacker launched DEHESIVE PSA 84X, which consists of three solvent-based silicone pressure sensitive adhesives. It features low, medium, and high adhesion forces. The new PSA series has realized the desired adhesion range by cold blending.

In February 2020, Henkel Adhesives Technologies opened its new production facility in Kurkumbh, Pune, India. The unit aims to serve the growing demand for high-performance solutions in adhesives, sealants, and surface treatment products in Indian industries. Designed as a smart factory, the new plant will also help a wide range of industry 4.0 operations and meet the highest standards for sustainability.

Who Should Buy? Or Key stakeholders

- Research and development

- Automotive and Transportation Industries

- Building and Construction Industries

- Pharmaceutical Industries

- Others

Pressure Sensitive Adhesives Market Regional Analysis

Geographically, the Pressure Sensitive Adhesives market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

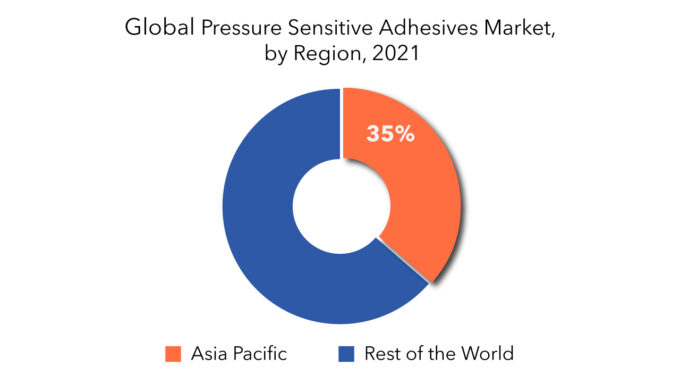

APAC is the largest and the fastest-growing market in the global PSAs market. During the projected period, APAC is anticipated to have the greatest market share for pressure sensitive adhesive. In the world market for PSAs, APAC is both the largest and the fastest-growing region. China, India, Japan, and South Korea are major players in the market for PSAs in this area. China, which in 2019 accounted for the largest market for PSAs in APAC, is anticipated to boost global expansion. With various levels of economic growth and a wide range of sectors, this area is home to a diversified spectrum of economies. Manufacturing, mining, semiconductors, electronics, oil & natural gas, textiles, autos, financial services, pharmaceuticals, and telephony are some of the major businesses in this area.

Due to the increasing population, the packaging and FMCG industries are expanding extremely quickly. The PSA market in this region is constantly being boosted by the automotive, electronics, and packaging sectors. The Asia pacific pressure sensitive adhesive market size is projected to grow at the highest CAGR 6.9% during the forecast period and acquired 35% of pressure sensitive adhesive market share in 2020.

This is due to the increase in infrastructure projects in nations like China and India. Additionally, the need for pressure-sensitive adhesives is growing along with the demand for construction chemicals. The need for water-based pressure sensitive adhesive is also rising because of the increased demand from nations like China, Japan, and India for adhesives with low volatile organic compound (VOC) content.

Key Market Segments: Pressure Sensitive Adhesives Market

Pressure Sensitive Adhesives Market by Chemistry, 2023-2029, (USD Billion) (Kiloton)

- Acrylic PSA

- Rubber PSA

- Silicone PSA

- Others

Pressure Sensitive Adhesives Market By Technology, 2023-2029, (USD Billion) (Kiloton)

- Water-Based PSA

- Solvent-Based PSA

- Hot-Melt PSA

- Radiation PSA

Pressure Sensitive Adhesives Market By Application, 2023-2029, (USD Billion) (Kiloton)

- Tapes

- Labels

- Graphics

Pressure Sensitive Adhesives Market By End Use Industry, 2023-2029, (USD Billion) (Kiloton)

- Packaging

- Electrical, Electronics & Telecommunication

- Automotive & Transportation

- Building & Construction

- Medical & Healthcare

Pressure Sensitive Adhesives Market By Regions, 2023-2029, (USD Billion ) (Kiloton)

- North America

- Europe

- Asia Pacific

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered

Key Question Answered

- What is the current scenario of the global pressure sensitive adhesives market?

- What are the major developments impacting the market?

- What are the upcoming technologies in the pressure sensitive adhesives market?

- What will be the major factors impacting market growth during the forecast period?

- What are the driving factors, opportunities, restraints, and challenges that affect the growth of the market?

- What will be the future of the pressure sensitive adhesives market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET OUTLOOK

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET BY CHEMISTRY, (USD MILLION) (KILOTONS)

- ACRYLIC PSA

- RUBBER PSA

- SILICONE PSA

- OTHERS

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET BY TECHNOLOGY, (USD MILLION) (KILOTONS)

- WATER-BASED PSA

- SOLVENT-BASED PSA

- HOT-MELT PSA

- RADIATION PSA

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET BY APPLICATION, (USD MILLION) (KILOTONS)

- TAPES

- LABELS

- GRAPHICS

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET BY END-USE INDUSTRY, (USD MILLION) (KILOTONS)

- PACKAGING

- ELECTRICAL, ELECTRONICS & TELECOMMUNICATION

- AUTOMOTIVE & TRANSPORTATION

- BUILDING & CONSTRUCTION

- MEDICAL & HEALTHCARE

- OTHERS

- GLOBAL PRESSURE SENSITIVE ADHESIVES MARKET BY REGION, (USD MILLION) (KILOTONS)

- INTRODUCTION

- ASIA-PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA-PACIFIC

- NORTH AMERICA

- UNITED STATES

- CANADA

- MEXICO

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, TECHNOLOGY LOADS OFFERED, RECENT DEVELOPMENTS)

- HENKEL AG & CO. KGAA

- THE DOW CHEMICAL COMPANY

- AVERY DENNISON CORPORATION

- B. FULLER COMPANY

- 3M COMPANY

- ARKEMA SA

- SIKA AG

- SCAPA GROUP PLC

- ASHLAND INC.

- OTHERS*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 3 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 5 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 7 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 9 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 10 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 12 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 13 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 14 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 15 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 16 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 17 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 18 US PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 19 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 20 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 21 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 22 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 23 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 24 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 25 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 26 CANADA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 27 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 28 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 29 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 30 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 31 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 32 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 34 MEXICO PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 35 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 36 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 37 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 38 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 39 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 40 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 42 BRAZIL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 43 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 44 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 45 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 46 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 47 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 48 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 49 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 50 ARGENTINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 51 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 52 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 53 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 54 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 55 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 57 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 58 COLOMBIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 59 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 60 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 62 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 64 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 66 REST OF SOUTH AMERICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 67 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 68 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 69 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 70 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 71 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 72 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 74 INDIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 75 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 76 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 77 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 78 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 79 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 80 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 81 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 82 CHINA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 83 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 84 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 85 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 86 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 87 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 88 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 89 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 90 JAPAN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 91 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 92 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 94 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 96 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 98 SOUTH KOREA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 100 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 102 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 104 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 106 AUSTRALIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 108 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 110 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 111 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 112 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 113 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 114 SOUTH-EAST ASIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 116 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 117 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 118 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 119 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 120 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 121 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 122 REST OF ASIA PACIFIC PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 123 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 124 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 125 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 126 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 127 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 128 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 130 GERMANY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 131 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 132 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 133 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 134 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 135 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 136 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 137 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 138 UK PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 139 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 140 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 141 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 142 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 143 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 144 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 145 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 146 FRANCE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 147 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 148 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 149 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 150 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 151 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 152 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 154 ITALY PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 155 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 156 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 157 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 158 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 159 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 160 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 161 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 162 SPAIN PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 163 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 164 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 165 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 166 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 167 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 168 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 169 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 170 RUSSIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 171 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 172 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 173 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 174 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 175 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 176 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 177 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 178 REST OF EUROPE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 179 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 180 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 181 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 182 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 183 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 184 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 186 UAE PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 187 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 188 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 189 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 190 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 191 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 192 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 193 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 194 SAUDI ARABIA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 195 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 196 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 197 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 198 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 199 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 200 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 201 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 202 SOUTH AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

TABLE 203 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (USD MILLIONS) 2020-2029

TABLE 204 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY (KILOTONS) 2020-2029

TABLE 205 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (USD MILLIONS) 2020-2029

TABLE 206 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD (KILOTONS) 2020-2029

TABLE 207 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 208 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 209 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (USD MILLIONS) 2020-2029

TABLE 210 REST OF MIDDLE EAST AND AFRICA PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY, USD MILLION, 2020-2029

FIGURE 9 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD, USD MILLION, 2020-2029

FIGURE 11 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 12 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY CHEMISTRY, 2020

FIGURE 15 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY END USE INDUSTRY 2020

FIGURE 16 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY TECHNOLOGY LOAD 2020

FIGURE 17 GLOBAL PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY APPLICATION 2020

FIGURE 18 PRESSURE SENSITIVE ADHESIVES EQUIPMENT MARKET BY REGION 2020

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 21 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 22 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

FIGURE 23 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 24 3M COMPANY: COMPANY SNAPSHOT

FIGURE 25 ARKEMA SA: COMPANY SNAPSHOT

FIGURE 26 SIKA AG: COMPANY SNAPSHOT

FIGURE 27 SCAPA GROUP PLC: COMPANY SNAPSHOT

FIGURE 28 ASHLAND INC.: COMPANY SNAPSHOT

FAQ

The global pressure sensitive adhesives market forecast was valued at USD 9.7 Billion in 2022, and is projected to reach USD 16.4 billion by 2029, growing at a CAGR of 6.0 % from 2023 to 2029.

Increasing use of pressure sensitive adhesives in tapes and labels due to their ease-of-use and low cost coupled with increasing demand from APAC has helped boost market growth.

The global Pressure Sensitive Adhesives market registered a CAGR of 6.0% from 2022 to 2029. The industry segment was the highest revenue contributor to the market.

The major restraining factor for the pressure sensitive adhesives market growth is the volatility in raw material prices. The raw materials used for manufacturing PSAs are petrochemicals and are derived from crude oil. Most of the world’s crude oil is located in regions that have been prone historically to political upheaval, or have had their oil production disrupted due to political events. These events lead to actual disruptions or create uncertainty about future supply or demand, which can lead to higher volatility in prices.

Geographically, The Asia-Pacific region is leading the pressure sensitive adhesives market, followed by North America and Europe. Rapid industrialization and rise in infrastructural developments are factors contributing to the growth of the pressure sensitive adhesives market in the Asia-Pacific region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.