| Market Size | CAGR | Dominating Region |

|---|---|---|

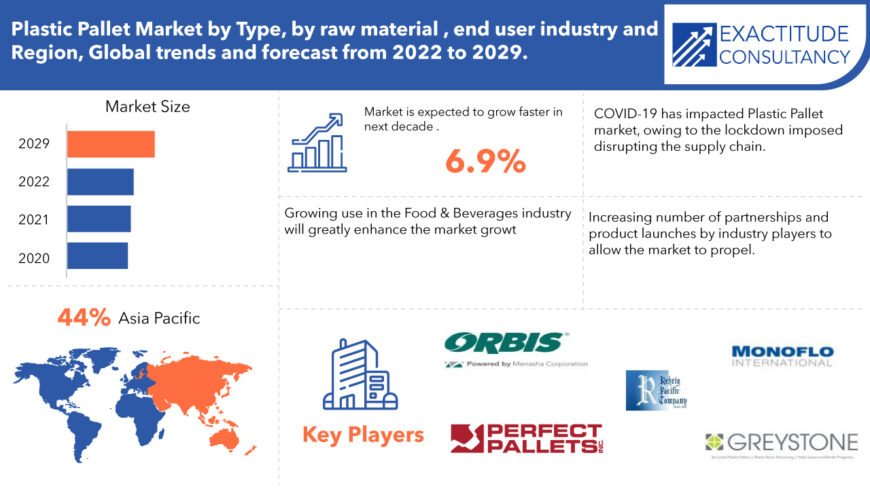

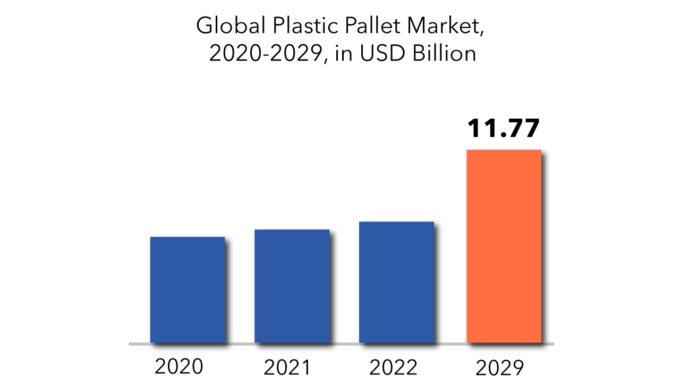

| USD 11.76 billion | 6.9% | Asia Pacific |

| By Type | By Raw Materials | By End User Industry | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Plastic Pallet Market Overview

The plastic pallet market is expected to grow at 6.9 % CAGR from 2023 to 2029. It is expected to reach above USD 11.76 billion by 2029 from USD 6.45 billion in 2022. Plastic pallets are stable and flat plastic platforms, which are used to support and transport goods & materials. Plastic pallets are used in processing and manufacturing units, conveying systems, distribution centers, static storage, and for transportation of heavy items to the production unit. For instance, plastic pallets are used at cold storages & food processing units, supermarkets, butcheries & bakeries, spinning & dying units, packaging sections, cement & fertilizers production units, publishing and printing houses, by garment exporters, book publishers, and storing & transporting books and stationary items among others.

Plastic pallets are used in warehouses to conveniently store both raw materials and completed goods, as well as for the effective handling and storage of goods in a variety of end-use sectors, including the food and beverage, pharmaceutical, chemical, and textile industries. Over the course of the forecast period, the market is anticipated to increase as a result of expanding end-use industries around the world.

The food and beverage, pharmaceutical, and chemical sectors are predicted to have a growing demand for sanitary, durable, and free of contamination pallets. High-density polyethylene (HDPE) and polypropylene (PP) are strong materials that are used to make plastic pallets, which are intended to make mechanical handling of items by front loaders, forklifts, jacks, and other material handling equipment easier. Compared to single-use wood pallets, the initial expenditure for plastic pallets is significantly more; however, as the number of journeys increases, a reduced cost per trip may be realized, guaranteeing a quick return on investment. The worldwide Plastic Pallets market revealed a sizable market size in 2019, and it is anticipated to rise greatly in 2029, with a swift increase in revenue. Due to shifting market trends and consumption patterns, industry study shows that demand for Plastic Pallets has been rising significantly, and their acceptance has been expanding concurrently. These variables are anticipated to boost industry growth as well as market growth throughout the projection period.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2019-2021 |

| Unit | Value (USD BILLION) KILOTONS |

| Segmentation | By Type, By End User Industry, By Region |

| By Type |

|

| By materials |

|

| By End User Industry |

|

| By Region |

|

The worldwide pallet market is anticipated to increase significantly as the developed countries economy grows. Pallets are weight-bearing constructions that provide a strong foundation for the transportation and storage of a unit load, which consists of varied materials and goods. Forklifts or pallet jacks are typically used to handle these pallets. The global demand for plastic goods is correlated with the growth of plastic pellet production. The basic ingredients needed to make plastic items are called plastic pellets. The global market for plastic pellets will increase as a result of the high demand for plastic from various end-use industries. The expansion of the world market for plastic pellets is being constrained by environmental concerns brought on by plastics’ negative impacts. Alternatives to plastic are also anticipated to restrict the market in other ways.

The market is anticipated to be driven by rising demand from the food and beverage, pharmaceutical, and chemical sectors for hygienic, contaminant-free, and long-lasting pallets. In order to enable mechanical handling of items by the front loader, forklift, jack, and other material handling equipment, plastic pallets are built of sturdy materials like high-density polyethylene (HDPE) and polypropylene (PP). Compared to single-use wood pallets, the cost of purchasing plastic pallets is initially higher. However, as the number of journeys increases, the cost per trip decreases, ensuring a quick return on investment.

Due to their durability and light weight, plastic pallets are increasingly being used in a number of sectors, including culinary, automotive, and chemical, for the logistics of various commodities and equipment. Due to the incorporation of technology like radio-frequency identification (RFID) in plastic pallets, which enables users to detect and find products across the supply chain, plastic pallets are currently becoming more and more common. Furthermore, it is anticipated that throughout the course of the projected period, increased R&D activity in the logistics industry would provide new possibilities. Additionally, the expansion of the e-commerce market and the medical sector is anticipated to fuel market development throughout the forecast period. The area market has been negatively damaged by the COVID-19 epidemic. However, it is anticipated that over the projection period, demand for plastic pallets in the region would increase as a result of rising COVID-19 vaccine manufacturing and the start of vaccination programs.

Plastic Pallet Market Segment Analysis

The global Plastic Pallet market is segmented based on type, raw materials, end user industry, region.

The worldwide plastic pallet market is divided into Nestable, Rackable, Stackable, and Others. categories based on type. By 2030, the market for nestable pallets is anticipated to develop at a CAGR of 6%. Nestable pallets are a great plastic pallet alternative for export or open-loop supply chain applications since they are less expensive than rackable and stackable pallets. The development of nestable pallets is anticipated to be aided in the coming years by the rising demand to minimise the weight of bulk transportation. Rackable pallets are made to be stored on racks; because they may be arranged evenly apart in vertical order on the racks, these pallets enable end-use businesses to utilize their floor space. In order to handle big loads, racking pallets typically contain a picture frame or runner frame at the bottom.

The worldwide plastic pallet market is divided into High-Density Polyethylene, Low-Density Polyethylene, Polypropylene, and Others based on the materials used. The highest market is held by high-density polypropylene (HDPE), which is projected to increase at a CAGR of 5.9% by 2030. HDPE pallets suffer minimal to no damage from harsh handling by forklifts and other material handling equipment because HDPE is extremely resilient and impact-resistant.

Plastic Pallet Market Players

The Plastic Pallet market key players include Agrico Plastiques Ltee, Allied Plastics Inc., Brambles Ltd., CABKA Group GmbH, CTC Plastics, DIC Corp, Enlightening Pallet Industry Co. Ltd., Greif Inc., Greystone Logistics Inc., Kamps Pallets Inc., Litco International Inc., Loscam International Holdings Co. Ltd., Monoflo International Inc., Myers Industries Inc., Nefab AB, Perfect Pallets Inc., PGS Group, Polymer Solutions International Inc., PURUS PLASTICS GmbH, Rehrig Pacific Co., Schoeller Allibert BV, SDI Packaging Inc., T.M. Fitzgerald and Associates, TranPak Inc., and Vierhouten Groep BV among others.

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending in product development, which is fueling revenue generation.

Who Should Buy? Or Key Stakeholders

- Food and Beverages

- Construction

- Pharmaceuticals

- Petroleum and Lubricants

- Others

Plastic Pallet Market Regional Analysis

The Plastic Pallet market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

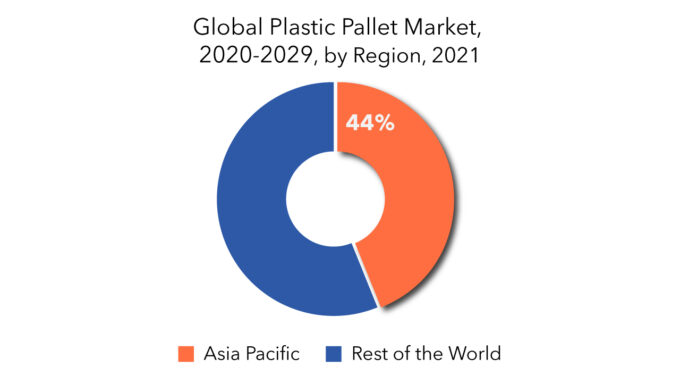

The plastic pallet market is dominated by Asia-Pacific. The Trans-Pacific Partnership (TPP) nations’ participation has led to Asia-Pacific becoming a manufacturing powerhouse. The TPP is a free trade agreement that has bolstered the industrial and commerce sectors in the area, increasing demand for plastic pallets over time. Demand for Plastic Pallets in Asia Pacific has been rising at a significantly high pace, owing to growth of the manufacturing sector in India and China. Furthermore, outsourcing of manufacturing operations by several global players to India has also boosted growth of the Asia Pacific Plastic Pallets market. The North America market accounted for the second-largest revenue share in the global Plastic Pallets market in 2019 and the trend is projected to continue over the forecast period.

North America holds the second-largest share in the global plastic pallet market. This is a result of rising end-user industry demand for plastic pallets, especially within domestic supply chains. The region’s considerable proportion was mostly due to the region’s strong manufacturing sector, notably in the United States.

The third-largest market position is now held by Europe. The European Union has backed sustainable development through EU treaties by acknowledging its environmental, economic, and social elements. End-use sectors were greatly impacted by the European Commission’s new roadmap for sustainability in the EU’s economy, which was released in December 2019. The objectives drove these businesses to embrace green packaging, including reusable plastic pallets. Additionally, increased plastic recycling efforts by pallet manufacturers to support a closed-loop pallet system are anticipated to be advantageous for the industry.

Key Market Segments: Plastic Pallet Market

Plastic Pallet Market by Type, 2022-2029, (USD Billion) Kilotons

- Nestable

- Rackable

- Stackable

- Others

Plastic Pallet Market by Raw Materials, 2022-2029, (USD Billion) Kilotons

- High-Density Polyethylene

- Low-Density Polyethylene

- Polypropylene

- Others

Plastic Pallet Market by End User Industry, 2022-2029, (USD Billion) Kilotons

- Food and Beverages

- Chemicals

- Pharmaceutical

- Petroleum and Lubricants

- Others

Plastic Pallet Market by Region, 2022-2029, (USD Billion) Kilotons

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the Plastic Pallet market?

- What are the key factors influencing the growth of Plastic Pallet?

- What are the major applications for Plastic Pallet?

- Who are the major key players in the Plastic Pallet market?

- Which region will provide more business opportunities for Plastic Pallet in future?

- Which segment holds the maximum share of the Plastic Pallet market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Plastic Pallet Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Plastic Pallet Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Plastic Pallet Market Outlook

- GLOBAL PLASTIC PALLET MARKET BY TYPE, 2020-2029, (USD BILLION), (THOUSAND UNIT)

- Nestable

- Rackable

- Stackable

- Others

- GLOBAL PLASTIC PALLET MARKET BY RAW MATERIALS, 2020-2029, (USD BILLION), (THOUSAND UNIT)

- High-Density Polyethylene

- Low-Density Polyethylene

- Polypropylene

- Others

- GLOBAL PLASTIC PALLET MARKET BY END USER INDUSTRY, 2020-2029, (USD BILLION), (THOUSAND UNIT)

- Food and Beverages

- Chemicals

- Pharmaceutical

- Petroleum and Lubricants

- Others

- Global Plastic Pallet Market by Region, 2020-2029, (USD MILLION), (THOUSAND UNIT)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

-

-

- Orbis Corporation

- Rehrig Pacific Company

- Monoflo International

- CABKA Group

- Perfect Pallets Inc.

- Greystone Logistics

- Polymer Solutions International Inc.

- TMF Corporation

- Allied Plastics Inc.

- TranPak Inc.

-

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 3 GLOBAL PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 5 GLOBAL PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL PLASTIC PALLET MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL PLASTIC PALLET MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 US PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 10 US PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 11 US PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 12 US PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 13 US PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 14 US PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 15 CANADA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 16 CANADA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 17 CANADA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 18 CANADA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 19 CANADA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 20 CANADA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 21 MEXICO PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 22 MEXICO PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 23 MEXICO PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 24 MEXICO PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 25 MEXICO PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 MEXICO PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 27 BRAZIL PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 28 BRAZIL PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 29 BRAZIL PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 30 BRAZIL PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 31 BRAZIL PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 32 BRAZIL PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 33 ARGENTINA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 34 ARGENTINA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 35 ARGENTINA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 36 ARGENTINA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 37 ARGENTINA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 38 ARGENTINA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 39 COLOMBIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 40 COLOMBIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 41 COLOMBIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 42 COLOMBIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 43 COLOMBIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 44 COLOMBIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 45 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 46 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 47 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 48 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 REST OF SOUTH AMERICA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 51 INDIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 52 INDIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 53 INDIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 54 INDIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 55 INDIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 56 INDIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 57 CHINA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 58 CHINA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 59 CHINA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 60 CHINA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 61 CHINA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 62 CHINA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 JAPAN PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 64 JAPAN PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 65 JAPAN PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 66 JAPAN PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 67 JAPAN PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 68 JAPAN PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 SOUTH KOREA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 70 SOUTH KOREA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 71 SOUTH KOREA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 72 SOUTH KOREA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 73 SOUTH KOREA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 SOUTH KOREA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 AUSTRALIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 76 AUSTRALIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 77 AUSTRALIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 78 AUSTRALIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 79 AUSTRALIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 80 AUSTRALIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 82 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 83 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 84 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 85 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 86 SOUTH-EAST ASIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 89 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 90 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 91 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 92 REST OF ASIA PACIFIC PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 GERMANY PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 94 GERMANY PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 95 GERMANY PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 96 GERMANY PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 97 GERMANY PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 GERMANY PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 UK PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 100 UK PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 101 UK PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 102 UK PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 103 UK PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 104 UK PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 FRANCE PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 106 FRANCE PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 107 FRANCE PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 108 FRANCE PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 109 FRANCE PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 110 FRANCE PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 ITALY PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 112 ITALY PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 113 ITALY PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 114 ITALY PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 115 ITALY PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 116 ITALY PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 SPAIN PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 118 SPAIN PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 119 SPAIN PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 120 SPAIN PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 121 SPAIN PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 SPAIN PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 123 RUSSIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 124 RUSSIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 125 RUSSIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 126 RUSSIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 127 RUSSIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 128 RUSSIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 129 REST OF EUROPE PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 130 REST OF EUROPE PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 131 REST OF EUROPE PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 132 REST OF EUROPE PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 133 REST OF EUROPE PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 134 REST OF EUROPE PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 135 UAE PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 136 UAE PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 137 UAE PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 138 UAE PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 139 UAE PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 140 UAE PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 141 SAUDI ARABIA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 142 SAUDI ARABIA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 143 SAUDI ARABIA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 144 SAUDI ARABIA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 145 SAUDI ARABIA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 SAUDI ARABIA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 147 SOUTH AFRICA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 148 SOUTH AFRICA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 149 SOUTH AFRICA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 150 SOUTH AFRICA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 151 SOUTH AFRICA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 152 SOUTH AFRICA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

TABLE 153 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY MATERIAL TYPE (USD MILLIONS) 2020-2029

TABLE 154 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY MATERIAL TYPE(KILOTONS) 2020-2029

TABLE 155 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY RAW MATERIAL (USD MILLIONS) 2020-2029

TABLE 156 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY RAW MATERIAL(KILOTONS) 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA PLASTIC PALLET MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL PLASTIC PALLET MARKET BY MATERIAL TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL PLASTIC PALLET MARKET BY RAW MATERIAL, USD MILLION, 2020-2029

FIGURE 10 GLOBAL PLASTIC PALLET MARKET BY END USER INDUSTRY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL PLASTIC PALLET MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA PLASTIC PALLET MARKET SNAPSHOT

FIGURE 14 EUROPE PLASTIC PALLET MARKET SNAPSHOT

FIGURE 15 SOUTH AMERICA PLASTIC PALLET MARKET SNAPSHOT

FIGURE 16 ASIA PACIFIC PLASTIC PALLET MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST ASIA AND AFRICA PLASTIC PALLET MARKET SNAPSHOT

FIGURE 18 MARKET SHARE ANALYSIS

FIGURE 19 ORBIS CORPORATION: COMPANY SNAPSHOT

FIGURE 20 REHRIG PACIFIC COMPANY: COMPANY SNAPSHOT

FIGURE 21 MONOFLO INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 CABKA GROUP: COMPANY SNAPSHOT

FIGURE 23 PERFECT PALLETS INC.: COMPANY SNAPSHOT

FIGURE 24 GREYSTONE LOGISTICS: COMPANY SNAPSHOT

FIGURE 25 POLYMER SOLUTIONS INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 26 TMF CORPORATION: COMPANY SNAPSHOT

FIGURE 27 ALLIED PLASTICS INC.: COMPANY SNAPSHOT

FAQ

The Plastic Pallet market size had crossed USD 6.45 billion in 2022 and will observe a CAGR of more than 6.9 % up to 2029 driven by the increased adoption of Plastic Pallet among various end-user industries, with major demand coming from industries such as, Food and Beverages, Chemicals, Pharmaceutical, Petroleum and Lubricants among others.

Asia Pacific held more than 44 % of the Plastic Pallet market revenue share in 2020 and will witness demand as a major manufacturing hub and key supply chain stakeholder for a wide range of products.

The key driver of Plastic pallet the market growth is the increasing adoption Plastic Pallet of across various end-user industries.

The food & beverages industry is rising as a result of better adoption of Plastic Pallet. Food and Beverages dominate the global plastic pallet market. Because of changing lifestyles, convenience, and expanded retail store penetration, the food and beverage business has experienced significant expansion in recent years.

Asia Pacific is expected to lead the market over the projection period. due to demand for Plastic Pallets in Asia Pacific has been rising at a significantly high pace, owing to growth of the manufacturing sector in India and China. Furthermore, outsourcing of manufacturing operations by several global players to India has also boosted growth of the Asia Pacific Plastic Pallets market. period China, India, and Japan are three of the main Asian markets expected to have a beneficial impact on the worldwide FDS industry. The expansion is expected to be fueled by rising per capita disposable income and strong industrial sector growth.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.