REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 14.61 billion | 6.1% | North America |

| By Product | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

All-Terrain Vehicle Market Overview

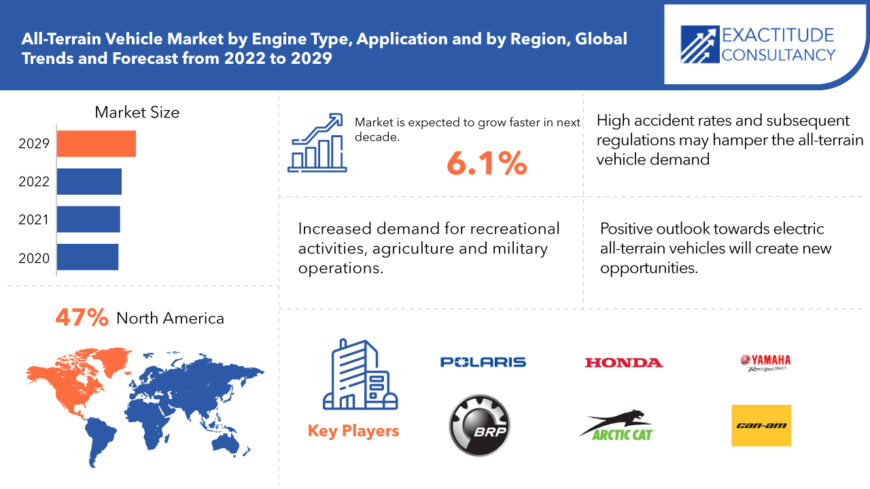

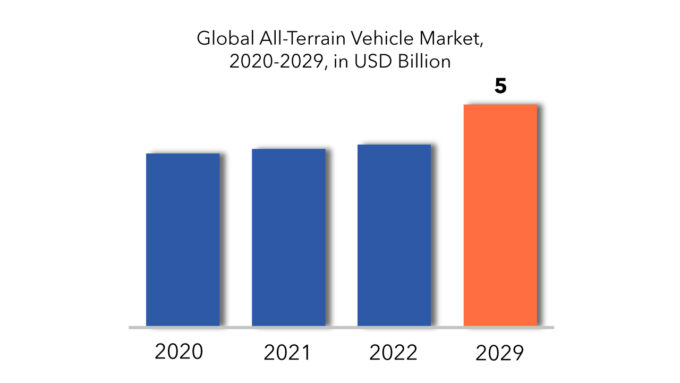

The global all-terrain vehicle market is projected to reach USD 14.61 billion by 2029 from USD 8.34 billion in 2022, at a CAGR of 6.1% from 2023 to 2029.

ATVs are vehicles with three or four wheels, a four-track variant that runs on low-pressure tires, steering handlebars, and a seat that the rider straddles. It was designed to have off-road capability and maneuverability. It is widely employed in a variety of industries, including sports and adventure, military, surveying, forestry, and others. It is vital to obtain adequate training to safely operate such a vehicle. An all-terrain vehicle (ATV), also known as a light utility vehicle, a quad bike, or simply a quad, is a vehicle that travels on low-pressure tires and has a seat that is straddled by the operator, as well as handlebars for steering control, according to the American National Standards Institute (ANSI). As the name implies, it is designed to handle a wider range of terrain than most other vehicles.

While it is lawful in some countries, it is prohibited in the majority of Australian states, territories, and provinces, as well as the United States and Canada. There is no such thing as an ATV that is “one-size-fits-all.” According to the ATV industry, all riders should ride an ATV that is appropriate for their age. Kids’ ATVs are designed with smaller hands and feet in mind, and they travel at a slower speed than adult ATVs. Every ATV made by one of our members comes with a warning label that states the manufacturer’s minimum age requirement. Rather than having a mechanical suspension, most early ATVs had enormous balloon tires. In the early 1980s, manufacturers began to develop All-Terrain Vehicles with better components, including as suspension, racks, and lower-profile tires. In the late 1980s, manufacturers changed three-wheel ATVs to four-wheel models due to safety concerns.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion) (Thousand Units) |

| Segmentation | By Product, By Application, By Region. |

| By Product

|

|

| By Application

|

|

| By Region

|

|

The all-terrain vehicle market is rising as a result of the increased demand for adventure and sports, as well as recreational activities. Furthermore, an individual’s increased disposable income fuels market expansion. Furthermore, rising demand for ATVs in the military defence, and agriculture sectors is pushing market growth upward. Concerns about safety as a result of increased accident rates, on the other hand, are expected to hinder market growth. The great power and torque of all-terrain vehicles are fueling market demand. As the number of desert events, ATV championships, adventure trails, and parks increases, so will the ATV business.

Furthermore, the industry is predicted to rise due to substantial government support for the construction of off-road vehicle adventure routes, automotive diesel engines. For example, the US Forest Service created the Travel Management and Off-Highway Vehicle initiative to raise trail availability knowledge. Increased investments in improving vehicle performance, like as output, torque, and manoeuvrability, will help the industry advance. Thanks to technology advancements, electric drive trains can now handle a wider range of terrains and provide increased stability. Furthermore, manufacturers are gradually adding versions with high-end stereos, GPS screens, and plush upholstery to smooth out the ride across rough terrains.

The ATV market suffered a setback during the first six months of the COVID-19 outbreak. The global lockdown and travel restrictions imposed by government authorities during the first half of last year resulted in a substantial decline in motorsports and leisure activities. However, due to a shift in customer demand for sports activities, the ATV industry has seen a significant increase in unit shipments from the previous quarter. AWD is predicted to be the fastest-growing category of the all-terrain vehicle market. The engine power is distributed evenly across all four wheels in AWD ATVs. AWD ATVs are designed to give riders twice the grip for added safety.

All-Terrain Vehicle Market Segment Analysis

The all-terrain vehicle market is divided into below 400cc, 400cc-800cc, above 800cc based on engine type. 400cc-800cc engine segment dominate the all-terrain vehicle market. The rising popularity of these cars for utility purposes is to blame for the increase. ATVs, for example, are designed with a lot of storage space and are frequently used to transport supplies and equipment. These vehicles are being used by government agencies for search and rescue missions as well as monitoring wild and forest regions. To serve to a broader spectrum of consumers and uncover new application areas, leading manufacturers in the market are launching 400cc-800cc ATVs. Suzuki Motor of America, Inc., for example, offered the Quad 750 XP and 500 XP in the 400-800cc category with greater towing capacity to suit customer demand.

The market is divided into agriculture, sports, recreational, military and defence based on application. Recreational segment dominates the market. The growing popularity of hiking and camping activities can be related to the strong demand for ATVs for recreational purposes. Furthermore, government initiatives to promote ATVs, such as providing incentives to those who participate in off-road and rough terrain sports, are likely to drive market expansion throughout the forecast period. The Oregon Parks & Recreation Department, for example, launched an ATV grant programme in 2017 to help with emergency medical services, law enforcement, operation and maintenance, and property acquisition.

All-Terrain Vehicle Market Players

The major players operating in the global all-terrain vehicle industry include Polaris Inc., Bombardier Recreational Products (BRP), American Honda Motor Co., Inc., Arctic Cat Inc., Yamaha Motor Corporation, Can-Am, Textron, Suzuki. The presence of established industry players and is characterized by mergers and acquisitions, joint ventures, capacity expansions, substantial distribution, and branding decisions to improve market share and regional presence. Also, they are involved in continuous R&D activities to develop new products as well as are focused on expanding the product portfolio. This is expected to intensify competition and pose a potential threat to the new players entering the market.

Who Should Buy? Or Key Stakeholders

- Research and development

- Manufacturing

- End Use industries

- Automotive Industries

- Military and Defense

All-Terrain Vehicle Market Regional Analysis

Geographically, the all-terrain vehicle market is segmented into North America, South America, Europe, APAC and MEA.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

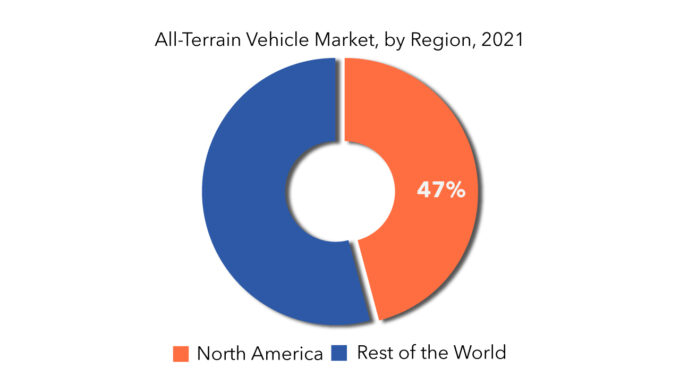

North America is expected to hold the largest share of the global all-terrain vehicle market. ATV adoption has increased significantly in the United States and Canada as a result of a variety of causes, including inhabitants’ better discretionary income, the developed economy, government laws governing ATVs, and impending electric vehicle projects. Many off-road terrain trails and parks, such as Northwest Off-Highway Vehicle Park, Rocky Ridge Ranch, and River Valley Motocross, are located in the region, and these off-road terrain trails and parks attract many tourists, resulting in market expansion. The MEA region is expected to grow. The increased demand for off-road vehicles in the military & defense and agriculture sectors might be credited to the market’s rise. The market is expected to rise due to the development of standardized test methodologies and safety criteria, as well as changed laws due to emissions from non-road mobile machinery.

Key Market Segments: All-Terrain Vehicle Market

All-Terrain Vehicle Market by Product, 2023-2029, (USD Million) (Thousand Units)

- Below 400cc

- 400cc-800cc

- Above 800cc

All-Terrain Vehicle Market by Application, 2023-2029, (USD Million) (Thousand Units)

- Agriculture

- Sports

- Recreational

- Military And Defense

All-Terrain Vehicle Market by Regions, 2023-2029, (USD Million) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered

Key Question Answered

- What is the current scenario of the global all-terrain vehicle market?

- What are the emerging technologies for the development of all-terrain vehicle devices?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for the players in the market?

- Which are the key regions from the investment perspective?

- What are the key strategies being adopted by the major players to up their market shares?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global All-Terrain Vehicle Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On All-Terrain Vehicle Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global All-Terrain Vehicle Market Outlook

- Global All-Terrain Vehicle Market by Engine Type (USD Millions) (Thousand Units)

- Below 400 cc

- 400CC-800 cc

- Above 800 cc

- Global All-Terrain Vehicle Market by Application (USD Millions) (Thousand Units)

- Agriculture

- Sports

- Recreational

- Military and Defense

- Automotive

- Global All-Terrain Vehicle Market by Region (USD Millions) (Thousand Units)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Polaris Inc.,

- Bombardier Recreational Products (BRP)

- American Honda Motor Co., Inc.,

- Arctic Cat Inc.

- Yamaha Motor Corporation

- Honda

- Can-Am

- Textron

- Suzuki

- Others

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 3 GLOBAL ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 5 GLOBAL ALL-TERRAIN VEHICLE MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL ALL-TERRAIN VEHICLE MARKET BY REGION (THOUSAND UNITS) 2020-2029

TABLE 7 US ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 8 US ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 9 US ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 10 US ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 11 CANADA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 12 CANADA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 13 CANADA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 CANADA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 15 MEXICO ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 16 MEXICO ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 17 MEXICO ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 18 MEXICO ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 19 BRAZIL ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 20 BRAZIL ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 21 BRAZIL ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 22 BRAZIL ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 23 ARGENTINA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 24 ARGENTINA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 25 ARGENTINA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 ARGENTINA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 27 COLOMBIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 28 COLOMBIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 29 COLOMBIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 30 COLOMBIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 31 REST OF SOUTH AMERICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 32 REST OF SOUTH AMERICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 33 REST OF SOUTH AMERICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 34 REST OF SOUTH AMERICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 35 INDIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 36 INDIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 37 INDIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 INDIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 39 CHINA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 40 CHINA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 41 CHINA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 42 CHINA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 43 JAPAN ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 44 JAPAN ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 45 JAPAN ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 46 JAPAN ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 47 SOUTH KOREA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 48 SOUTH KOREA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 49 SOUTH KOREA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 SOUTH KOREA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 51 AUSTRALIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 52 AUSTRALIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 53 AUSTRALIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 54 AUSTRALIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 55 SOUTH-EAST ASIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 56 SOUTH-EAST ASIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 57 SOUTH-EAST ASIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 58 SOUTH-EAST ASIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 59 REST OF ASIA PACIFIC ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF ASIA PACIFIC ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 61 REST OF ASIA PACIFIC ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 REST OF ASIA PACIFIC ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 63 GERMANY ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 64 GERMANY ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 65 GERMANY ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 66 GERMANY ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 67 UK ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 68 UK ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 69 UK ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 70 UK ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 71 FRANCE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 72 FRANCE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 73 FRANCE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 FRANCE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 75 ITALY ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 76 ITALY ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 77 ITALY ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 78 ITALY ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 79 SPAIN ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 80 SPAIN ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 81 SPAIN ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 82 SPAIN ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 83 RUSSIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 84 RUSSIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 85 RUSSIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 86 RUSSIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 87 REST OF EUROPE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 88 REST OF EUROPE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 89 REST OF EUROPE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 90 REST OF EUROPE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 91 UAE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 92 UAE ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 93 UAE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 94 UAE ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 95 SAUDI ARABIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 96 SAUDI ARABIA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 97 SAUDI ARABIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 98 SAUDI ARABIA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 99 SOUTH AFRICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 100 SOUTH AFRICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 101 SOUTH AFRICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 102 SOUTH AFRICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

TABLE 103 REST OF MIDDLE EAST AND AFRICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (USD MILLIONS) 2020-2029

TABLE 104 REST OF MIDDLE EAST AND AFRICA ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE (THOUSAND UNITS) 2020-2029

TABLE 105 REST OF MIDDLE EAST AND AFRICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 106 REST OF MIDDLE EAST AND AFRICA ALL-TERRAIN VEHICLE MARKET BY APPLICATION (THOUSAND UNITS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ALL-TERRAIN VEHICLE MARKET BY ENGINE TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ALL-TERRAIN VEHICLE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ALL-TERRAIN VEHICLE MARKET BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ALL-TERRAIN VEHICLE MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 NORTH AMERICA ALL-TERRAIN VEHICLE MARKET SNAPSHOT

FIGURE 14 EUROPE ALL-TERRAIN VEHICLE MARKET SNAPSHOT

FIGURE 15 ASIA PACIFIC ALL-TERRAIN VEHICLE MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA ALL-TERRAIN VEHICLE MARKET SNAPSHOT

FIGURE 17 MIDDLE EAST & AFRICA ALL-TERRAIN VEHICLE MARKET SNAPSHOT

FIGURE 18 POLARIS INC.: COMPANY SNAPSHOT

FIGURE 19 BOMBARDIER RECREATIONAL PRODUCTS (BRP): COMPANY SNAPSHOT

FIGURE 20 AMERICAN HONDA MOTOR CO., INC.: COMPANY SNAPSHOT

FIGURE 21 ARCTIC CAT INC.: COMPANY SNAPSHOT

FIGURE 22 YAMAHA MOTOR CORPORATION: COMPANY SNAPSHOT

FIGURE 23 HONDA: COMPANY SNAPSHOT

FIGURE 24 CAN-AM: COMPANY SNAPSHOT

FIGURE 25 TEXTRON: COMPANY SNAPSHOT

FIGURE 26 SUZUKI: COMPANY SNAPSHOT

FAQ

The all-terrain vehicle market size had crossed USD 8.34 Billion in 2020 and will observe a CAGR of more than 6.1% up to 2029 driven by the rising demand for recreational activities, agriculture and military operations.

The upcoming trend in all-terrain vehicle market is positive outlook towards electric all-terrain vehicles will create new opportunities.

The global all-terrain vehicle market registered a CAGR of 6.1% from 2023 to 2029. The application segment was the highest revenue contributor to the market.

North America is the largest regional market with 47% of share owning to ATV adoption has increased significantly in the United States and Canada as a result of a variety of causes, including inhabitants’ better discretionary income, the developed economy, government laws governing ATVs, and impending electric vehicle projects.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.