REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

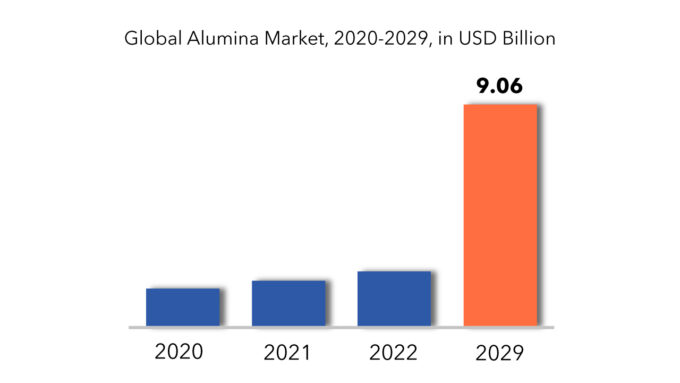

| USD 9.06 Billion | 21.93% | Asia Pacific |

| By Type | By Technology | By Application |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Alumina Market Overview

The global Alumina Market size is USD 1.56 Billion in 2020 and is expected to grow till USD 9.06 Billion by 2029, at a Compounded annual growth rate (CAGR) of 21.93%.

Aluminum Oxide, or Alumina, is a white crystalline chemical substance made mostly from the mineral bauxite. It’s employed in a variety of technical applications, such as anti-corrosion materials, wear and abrasion-resistant components, and the electronics sector. Alumina is a cost-effective product with quality characteristics such as high durability, brightness, low heat radiation, and high temperature stability.

The worldwide alumina market is growing due to the increased usage of LED bulbs over conventional bulbs, as well as technical advancements. In rising economies like China and India, demand for LED lights is quite strong. To lower the country’s energy usage, the governments of these nations have urged citizens to adopt energy-efficient lighting. Furthermore, by the end of 2018, the Indian government had distributed 210 million LED bulbs around the country and had launched contracts for LED streetlight conversion projects. Furthermore, to fulfil bid criteria for income, production capacity, and manufacturing capabilities, multinational bidders are forming joint ventures with local lighting firms.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Million) |

| Segmentation | By Type, By Technology, By Application, By region |

| By Type |

|

| By Technology |

|

| By Application |

|

| By Region |

|

Increased demand for HPA throughout the world, along with government backing, has resulted in a rise in LED adoption, propelling the global HPA market forward. Alumina with a purity of 4N is also utilized in the production of Li-ion batteries. Automobile manufacturers are focusing on the production of electric vehicles (EVs) as a result of environmental regulations imposed by the governments of several developed and developing countries, including the United States, Germany, China, and India, to reduce pollution and reliance on conventional fuel sources. The need for Li-ion batteries for electric cars is likely to rise as a result. Li-ion battery makers are likely to increase their need for high purity alumina as a result of this issue.

However, rising HPA prices and strict government limitations on the extraction of “Red Mud” may limit the worldwide high purity alumina market’s growth. Growing demand for high pure alumina from rising economies like as China and India, owing to an increase in demand for LED bulbs and a fast-expanding medical sector, is projected to provide lucrative prospects for high purity alumina market growth in the near future.

Alumina Market Segment Analysis

The Alumina market is segmented by type, Technology and Application

On the basis of Type, global Alumina market is segmented into, 4N high purity alumina (HPA), 5N high purity alumina (HPA), 6N high purity alumina (HPA). The 4N high purity alumina sector had a huge portion of the alumina market. LED bulbs and electrical displays are the most common uses for 4N HPA. Leading businesses in this market are investing more in R&D to customize products to meet the needs of certain application sectors. During the forecast period, the market for 4N HPA is likely to be driven by government backing, which will lead to more LED use and lower costs than other forms of HPA.

On the basis of Technology, global Alumina market is segmented into, Hydrolysis, Hydrochloric Acid Leaching. The hydrolysis sector accounted for a significant portion of the high purity alumina market. Alumina refineries all over the world have boosted their output to fulfil the rising demand for primary aluminum. Since a result, demand for hydrolysis technology to extract alumina has increased dramatically, as this technology also aids in the recovery of acid, which can be reused, lowering operating costs. Additionally, it aids in the personalization of HPA products for end customers. These factors are expected to boost demand for hydrolysis technology to extract alumina, resulting in the worldwide high purity alumina market expanding.

On the basis of Application, global Alumina market is segmented into, LED Bulbs, Semiconductor Substrate, Li-ion Batteries, Optical Lenses, Bio Medical Devices, Others. The LED bulb industry accounts for a significant portion of the high purity alumina market. In compared to traditional incandescent bulbs, demand for LED bulbs has increased dramatically over the world. The deployment of energy-efficient lighting around the globe is fueled by the implementation of severe standards. Furthermore, a government campaign to encourage people to adopt LED lights to save energy is expected to raise demand for LED bulbs. Furthermore, multinational firms are developing joint ventures with local lighting companies in order to expand production capacity and manufacturing capabilities in order to fulfil the country’s rising demand for LED bulbs. Increased demand for HPA throughout the world, along with government backing, has resulted in a rise in LED adoption, propelling the global HPA market forward.

Alumina Market Players

The Key Players in Alumina Market are Sasol Ltd., Sumitomo Chemical Co. Ltd, Nippon Light Mryal Holdings Company Ltd., Alcoa Corporation, and Altech Chemicals.

To increase their market position, these businesses have implemented a variety of growth tactics. These companies are using expansion, new Technology development, mergers and acquisitions, and cooperation as important growth strategies to improve their Technology range and geographical presence in order to fulfil the rising demand for Alumina from emerging nations.

Industry Development:

- In January 2019, Vedanta Limited, a mining company based in India and a major alumina market player, planned to increase its capital expenditure to $250–$300 million in order to raise the production capacity of its Lanjigarh alumina refinery in Odisha. The refinery expansion is aimed at reducing Vedanta’s dependence on imported alumina and also lead to decreased aluminum production costs.

Who Should Buy? Or Key Stakeholders

- Industry and consulting firms

- State and national regulatory authorities

- Investors

- Suppliers and Distributors

- Research Institutes

- Others

Alumina Market Regional Analysis

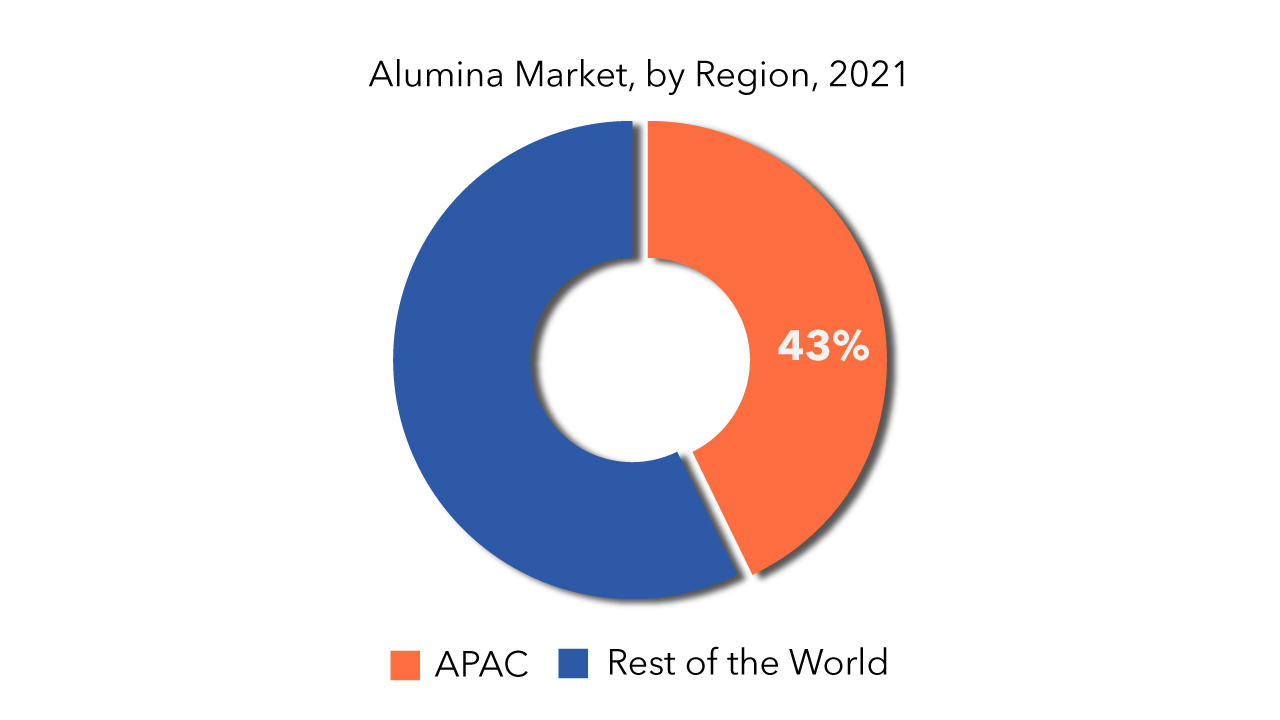

Geographically, Alumina market is segmented into North America, Europe, Asia Pacific, and Rest of the world.

- North America: includes the US, Canada, Mexico

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

Due to the rise of economies such as China and India, Asia-Pacific accounted for a significant portion of the market. The presence of established HPA companies in the region, as well as increased demand for HPA from the automotive and electronics sectors, are projected to boost HPA demand in the region. Furthermore, the government’s strict controls on the manufacturing, import, and sale of incandescent lights have fueled the expansion of the smart lighting business, which makes LED bulbs, increasing demand for HPA across the area.

Key Market Segments: Alumina Market

Alumina Market by Type, 2022-2029, (USD Millions)

- 4n High Purity Alumina (Hpa)

- 5n High Purity Alumina (Hpa)

- 6n High Purity Alumina (Hpa)

Alumina Market by Technology, 2022-2029, (USD Millions)

- Hydrolysis

- Hydrochloric Acid Leaching

Alumina Market by Application, 2022-2029, (USD Millions)

- Led Bulbs

- Semiconductor Substrate

- Li-Ion Batteries

- Optical Lenses

- Bio Medical Devices

- Others

Alumina Market by Region, 2022-2029, (USD Millions)

- North America

- Europe

- Apac

- Mea

- Latin America

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current market size of this high growth market?

- What is the overall growth rate?

- What are the key growth areas, Applications, end uses and types?

- Key reasons for growth

- Challenges for growth

- What technological developments are happening in this area?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Alumina Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Global Alumina Market

- Global Alumina Market Outlook

- Global Alumina Market by Type, (USD Million)

- 4N high purity alumina (HPA)

- 5N high purity alumina (HPA)

- 6N high purity alumina (HPA)

- Global Alumina Market by Technology, (USD Million)

- Hydrolysis

- Hydrochloric Acid Leaching

- Global Alumina Market by Application, (USD Million)

- Led bulbs

- Semiconductor substrate

- Li-ion batteries

- Optical lenses

- Bio medical devices

- Others

- Global Alumina Market by region, (USD Million)

- Introduction

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- South-East Asia

- Rest of Asia-Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

- Company Profiles* (Business Overview, Company Snapshot, Types Offered, Recent Developments)

-

- Alcoa corporation

- Altech chemicals ltd

- Baikowski sas

- Hebei pengda advanced materials technology co., ltd

- Nippon light metal holdings company, ltd

- Norsk hydro asa

- Sasol ltd

- Sumitomo chemical co., ltd

- Xuancheng jingrui new material co., ltd

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 2 GLOBAL ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 3 GLOBAL ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ALUMINA MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 5 US ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 6 US ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 7 US ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 8 CANADA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 9 CANADA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 10 CANADA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 11 MEXICO ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 12 MEXICO ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 13 MEXICO ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 14 BRAZIL ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 15 BRAZIL ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 16 BRAZIL ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 17 ARGENTINA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 18 ARGENTINA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 19 ARGENTINA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 20 COLOMBIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 21 COLOMBIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 22 COLOMBIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 23 REST OF SOUTH AMERICA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 24 REST OF SOUTH AMERICA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 25 REST OF SOUTH AMERICA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 26 INDIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 27 INDIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 28 INDIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 29 CHINA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 30 CHINA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 31 CHINA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 32 JAPAN ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 33 JAPAN ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 34 JAPAN ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 35 SOUTH KOREA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 36 SOUTH KOREA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 37 SOUTH KOREA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 38 AUSTRALIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 39 AUSTRALIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 40 AUSTRALIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 41 SOUTH-EAST ASIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 42 SOUTH-EAST ASIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 43 SOUTH-EAST ASIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 44 REST OF ASIA PACIFIC ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 45 REST OF ASIA PACIFIC ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 46 REST OF ASIA PACIFIC ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 47 GERMANY ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 48 GERMANY ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 49 GERMANY ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 50 UK ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 51 UK ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 52 UK ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 53 FRANCE ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 54 FRANCE ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 55 FRANCE ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 56 ITALY ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 57 ITALY ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 58 ITALY ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 59 SPAIN ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 60 SPAIN ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 61 SPAIN ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 62 RUSSIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 63 RUSSIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 64 RUSSIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 65 REST OF EUROPE ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 66 REST OF EUROPE ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 67 REST OF EUROPE ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 68 UAE ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 69 UAE ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 70 UAE ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 71 SAUDI ARABIA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 72 SAUDI ARABIA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 73 SAUDI ARABIA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 74 SOUTH AFRICA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 75 SOUTH AFRICA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 76 SOUTH AFRICA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

TABLE 77 REST OF MIDDLE EAST AND AFRICA ALUMINA MARKET BY TYPE (USD MILLIONS) 2020-2029

TABLE 78 REST OF MIDDLE EAST AND AFRICA ALUMINA MARKET BY TECHNOLOGY (USD MILLIONS) 2020-2029

TABLE 79 REST OF MIDDLE EAST AND AFRICA ALUMINA MARKET BY APPLICATION (USD MILLIONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ALUMINA MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ALUMINA MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ALUMINA MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES TECHNOLOGYL

FIGURE 12 GLOBAL ALUMINA MARKET BY TYPE, USD MILLION, 2020-2029

FIGURE 13 GLOBAL ALUMINA MARKET BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 14 GLOBAL ALUMINA MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 15 ALUMINA MARKET BY REGION 2020

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 ALCOA CORPORATION COMPANY SNAPSHOT

FIGURE 18 ALTECH CHEMICALS LTD COMPANY SNAPSHOT

FIGURE 19 BAIKOWSKI SAS COMPANY SNAPSHOT

FIGURE 20 HEBEI PENGDA ADVANCED MATERIALS TECHNOLOGY CO., LTD COMPANY SNAPSHOT

FIGURE 21 NIPPON LIGHT METAL HOLDINGS COMPANY, LTD COMPANY SNAPSHOT

FIGURE 22 NORSK HYDRO ASA COMPANY SNAPSHOT

FIGURE 23 SASOL LTD COMPANY SNAPSHOT

FIGURE 24 SUMITOMO CHEMICAL CO., LTD COMPANY SNAPSHOT

FIGURE 25 XUANCHENG JINGRUI NEW MATERIAL CO., LTD COMPANY SNAPSHOT

FAQ

The Alumina market size had crossed USD 1.56 Billion in 2022.

The Largest Regional market for Alumina market is APAC having a market share of 43%.

The global Alumina market registered a CAGR of 21.93% from 2023 to 2029.

The study period for Alumina market is from 2022-2029

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.