REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 64.95 billion | 7% | North America |

| By animal type | By Product | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Animal Health Market Overview

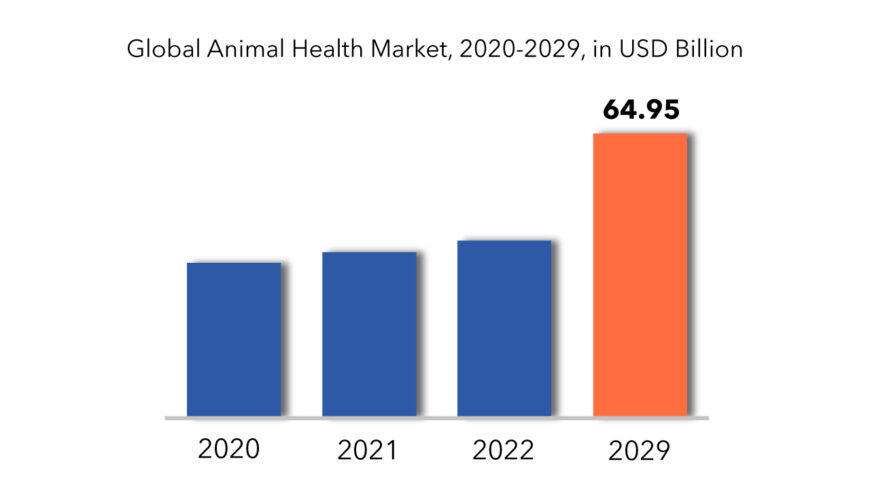

The global animal health market size was valued at USD 37.8 billion in 2022 and is expected USD 64.95 billion in 2029 with a CAGR of 7%.

Animal healthcare involves taking care of animals with appropriate use of drugs, vaccines, medicated animal feeds, and diagnostic products to treat the medical conditions related to the them. Animals hold great importance in human life. They provide food, protection as well as companionship to humans. Moreover, animals serve as models in biological research, such as genetics and drug testing. The growing awareness about animal diseases, increasingly stringent regulations and growing focus on prevention from diseases originated from animal epidemics are expected to increase demand for animal healthcare products. All around the world, the veterinary healthcare market is expanding rapidly as a result of these factors. The market is primarily driven by an enormous growth in pet adoption, an uptick in zoonotic and food-borne illnesses, and rising consumer demand. Additionally, market-wide technology advancements and the Animal health market growth is being boosted by the development of information systems.

The veterinary healthcare market is going to be driven by a rise in the prevalence of zoonotic illnesses. Increased pet adoption for companionship is leading to more people coming into contact with the disease-spreading animal-borne diseases that are sweeping the globe. During the projection period, increased awareness of preventive measures and expanding access to treatment choices are projected to fuel demand for animal care products. The Center for Disease Control estimates that thousands of Americans fall ill each year as a result of animal-transmitted diseases. By acting as test subjects for the evaluation of medications and medical equipment, animals play a crucial role in the development of healthcare products. Because many hereditary and chronic human diseases cannot be licensed for testing on humans, the use of animals as test subjects in medication development is crucial. Animals are particularly useful in studies regarding chronic degenerative diseases since they can easily be made to manifest in them, helping the market as a whole to grow.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion), (KILOTONS) |

| Segmentation | By ANIMAL TYPE, Product, End user, Distribution channel, By Region |

| By animal type

|

|

| By Product

|

|

| By End User

|

|

| By Distribution Channel

|

|

| By Region

|

|

Government restrictions on animal medication approval are anticipated to impede industry expansion. For sale in the United States, all medications for animals must have approval from the Food and Drug Administration. It takes three to five years and approximately USD 80 million to produce a new vaccination. The Animal Drug User Fees Act (ADUF) and the Animal Generic Drug Act authorize user fees, which animal health product makers utilize to support the FDA approval process. Rapid urbanization and growing disposable incomes are some of the key factors driving pet ownership in these countries. Many pet owners in these countries are now willing to spend more on pet care, specifically healthcare services. The prolonged use of specific parasiticides and antibiotics generates parasite resistance, which is a burning issue in the animal health market.

The commercial milk and meat cattle farming industry, as well as the rising trend of companion animal adoption and regulatory agencies making companion animal immunisation mandatory, have all contributed to the prevalence of animal diseases and their spread to humans, as well as the growing demand for diets high in protein. As the number of animals has expanded and illnesses have gotten more common, it has become more crucial to produce pharmaceuticals for animal care. Animal/Veterinary Ultrasound imaging is used for animals and is known as diagnostic sonography.

The COVID-19 epidemic has impacted the whole healthcare industry, including animal health. Initially, there was a considerable risk of animals becoming infected as a result of their close proximity to humans. Various market players for animal health care responded to the necessity and demand for COVID-19 testing kits for animals by launching their own solutions to assist veterinarians. Noticing the need and demand for COVID-19 testing kits for animals, various market players launched their products to help veterinarians. Furthermore, the spread of virus has severely impacted the consultation and treatment of animals owing to travel restrictions and in many cases closure of veterinary hospitals.

Animal Health Market Segment Analysis

By Product ANIMAL TYPE, the pharmaceutical segment dominated the market for animal health and held the largest revenue share of over 33.7% in 2022. It is estimated to retain its dominant position throughout the forecast period on account of consistent advancements in veterinary drugs. It is also believed that a considerable increase in companion animal ownership has also expedited the adoption of pharmaceuticals to help increase longevity. The veterinary diagnostics segment is expected to witness significant growth over the forecast period. Various factors such as growing animal health expenditure, rising incidence of zoonotic diseases, and increasing number of veterinary practitioners and their incomes in developed economies are also responsible for market growth.

The production animal segment dominated the market for animal health and accounted for the largest revenue share. Animal-based food products account for one-third of human protein consumption, leading to an increase in livestock productivity, which is critical to meet the dietary needs of the growing human population. The companion animal segment is expected to grow lucratively during the forecast period owing to an increase in demand for efficient animal care and the pet-human bond due to the associated health benefits. Companion animals are known to lower blood pressure, provide psychological stability, and reduce the frequency of cardiac arrhythmias and anxiety attacks, which enhance the overall well-being of humans.

Animal Health Market Players

The key players in this market includes Televet, Merck Animal Health, Zoetis, IDEXX, Heska Corporation, Virbac, Covetrus, DRE Veterinary, Midmark Corporation, Thermo Fisher Scientific, Inc., IDVe.

Major players operating in the market witnessed growth during the pandemic in spite of the restriction and supply chain disruption. The registered growth in the market for animal health is a result of product launches, extensive regional expansion strategies, mergers and acquisitions, and collaborative research initiatives undertaken by major market players.

Who Should Buy? Or Key Stakeholders

- Pharmaceutical Industries

- Medical Sectors

- Healthcare Sectors

- Research Organizations

- Institutional Players

- Investors

- Regulatory Authorities

- Others

Animal Health Market Regional Analysis

The Animal Health market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

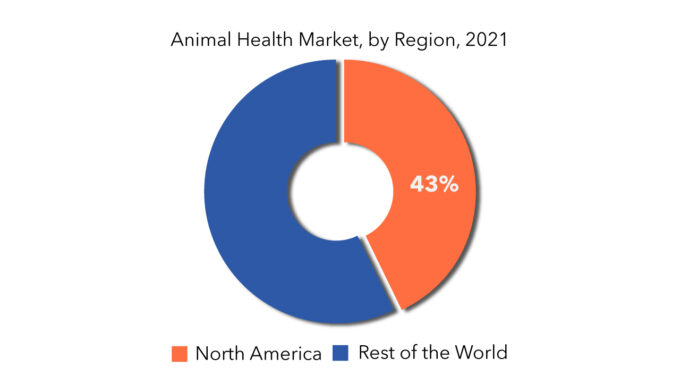

North America dominated the market for animal health and accounted for the largest revenue share of 29.5% in 2021, owing to the wide range of definitive measures adopted by government animal welfare organizations that are consistently working for overall improvement in animal health. Additionally, the market is anticipated to rise in this nation because to technology developments, an increase in zoonotic diseases, and an increase in pet owners. It is projected that a number of cooperative initiatives by significant corporations to improve their R&D capabilities and guarantee high-quality standards will further fuel demand in this region. Furthermore, the high disease load in this area might also be blamed for the overwhelming share.

Asia Pacific, the market for animal health is expected to register a lucrative CAGR of 10.5% over the coming years. The high growth registered by this region is believed to be a consequence of consistent R&D investments by prominent players in the field of animal health and their efforts to commercialize branded and generic therapeutics at a relatively inexpensive price. The exponential growth is owing to growing awareness pertaining to pet nutrition supplies and increasing disposable income.

Key Market Segments: Animal Health Market

Animal Health Market by Type, 2023-2029, (USD Billion), (Thousand Unit)

- Companion Animal

- Livestock Animal

Animal Health Market by Product 2023-2029, (USD Billion), (Thousand Unit)

- Pharmaceuticals

- Feed Additives

- Vaccines

Animal Health Market by End User, 2023-2029, (USD Billion), (Thousand Unit)

- Clinics

- Animal Care and Rehabilitation Centers

- Diagnostic Centers

- Others

Animal Health Market by Distribution Channel, 2023-2029, (USD Billion), (Thousand Unit)

- Retail Pharmacy

- E- Commerce

- Hospital Pharmacy

Animal Health Market by Region, 2023-2029, (USD Billion), (Thousand Unit)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the animal health market?

- What are the key factors influencing the growth of animal health market?

- What are the major applications for animal health market?

- Who are the major key players in the animal health market?

- Which region will provide more business opportunities for animal health market in future?

- Which segment holds the maximum share of the animal health market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Animal Health Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Animal Health Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Animal Health Market Outlook

- Global Animal Health Market by ANIMAL TYPE, 2020-2029, (USD MILLION), (KILOTONS)

- Companion Animal

- Livestock Animal

- Global Animal Health Market by Product, 2020-2029, (USD MILLION), (KILOTONS)

- Pharmaceuticals

- Feed Additives

- Vaccines

- Global Animal Health Market by End User, 2020-2029, (USD MILLION), (KILOTONS)

- Clinics

- Animal care and rehabilitation centres

- Diagnostic centres

- Others

- Global Animal Health Market by Distribution Channel, 2020-2029, (USD MILLION), (KILOTONS)

- Retail pharmacy

- E- commerce

- Hospital pharmacy

- Global Animal Health Market by Region, 2020-2029, (USD MILLION), (KILOTONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, VENT TYPEs Offered, Recent Developments)

8.1. Televet

8.2. Merck Animal Health

8.3. Zoetis

8.4. IDEXX

8.5 Heska Corporation

8.6. Virbac

8.7. Covetrus

8.8, DRE Veterinary

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS)

TABLE 2 GLOBAL ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 3 GLOBAL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 4 GLOBAL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 5 GLOBAL ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 6 GLOBAL ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 7 GLOBAL ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 8 GLOBAL ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 9 GLOBAL ANIMAL HEALTH MARKET BY REGION (USD MILLIONS) 2020-2029

TABLE 10 GLOBAL ANIMAL HEALTH MARKET BY REGION (KILOTONS)2020-2029

TABLE 11 US ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 12 US ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 13 US ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 14 US ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 15 US ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 16 US ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 17 US ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 18 US ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 19 CANADA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 20 CANADA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 21 CANADA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 22 CANADA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 23 CANADA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 24 CANADA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 25 CANADA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 26 CANADA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 27 MEXICO ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 28 MEXICO ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 29 MEXICO ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 30 MEXICO ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 31 MEXICO ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 32 MEXICO ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 33 MEXICO ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 34 MEXICO ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 35 BRAZIL ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 36 BRAZIL ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 37 BRAZIL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 38 BRAZIL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 39 BRAZIL ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 40 BRAZIL ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 41 BRAZIL ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 42 BRAZIL ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 43 ARGENTINA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 44 ARGENTINA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 45 ARGENTINA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 46 ARGENTINA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 47 ARGENTINA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 48 ARGENTINA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 49 ARGENTINA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 50 ARGENTINA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 51 COLOMBIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 52 COLOMBIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 53 COLOMBIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 54 COLOMBIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 55 COLOMBIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 56 COLOMBIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 57 COLOMBIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 58 COLOMBIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 59 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 60 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 61 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 62 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 63 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 64 REST OF SOUTH AMERICA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 65 REST OF SOUTH AMERICA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 66 REST OF SOUTH AMERICA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 67 INDIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 68 INDIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 69 INDIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 70 INDIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 71 INDIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 72 INDIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 73 INDIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 74 INDIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 75 CHINA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 76 CHINA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 77 CHINA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 78 CHINA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 79 CHINA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 80 CHINA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 81 CHINA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 82 CHINA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 83 JAPAN ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 84 JAPAN ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 85 JAPAN ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 86 JAPAN ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 87 JAPAN ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 88 JAPAN ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 89 JAPAN ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 90 JAPAN ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 91 SOUTH KOREA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 92 SOUTH KOREA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 93 SOUTH KOREA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 94 SOUTH KOREA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 95 SOUTH KOREA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 96 SOUTH KOREA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 97 SOUTH KOREA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 98 SOUTH KOREA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 99 AUSTRALIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 100 AUSTRALIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 101 AUSTRALIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 102 AUSTRALIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 103 AUSTRALIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 104 AUSTRALIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 105 AUSTRALIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 106 AUSTRALIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 107 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 108 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 109 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 110 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 111 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 112 SOUTH-EAST ASIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 113 SOUTH-EAST ASIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 114 SOUTH-EAST ASIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 115 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 116 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 117 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 118 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 119 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 120 REST OF ASIA PACIFIC ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 121 REST OF ASIA PACIFIC ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 122 REST OF ASIA PACIFIC ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 123 GERMANY ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 124 GERMANY ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 125 GERMANY ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 126 GERMANY ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 127 GERMANY ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 128 GERMANY ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 129 GERMANY ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 130 GERMANY ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 131 UK ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 132 UK ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 133 UK ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 134 UK ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 135 UK ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 136 UK ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 137 UK ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 138 UK ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 139 FRANCE ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 140 FRANCE ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 141 FRANCE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 142 FRANCE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 143 FRANCE ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 144 FRANCE ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 145 FRANCE ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 146 FRANCE ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 147 ITALY ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 148 ITALY ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 149 ITALY ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 150 ITALY ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 151 ITALY ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 152 ITALY ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 153 ITALY ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 154 ITALY ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 155 SPAIN ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 156 SPAIN ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 157 SPAIN ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 158 SPAIN ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 159 SPAIN ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 160 SPAIN ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 161 SPAIN ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 162 SPAIN ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 163 RUSSIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 164 RUSSIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 165 RUSSIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 166 RUSSIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 167 RUSSIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 168 RUSSIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 169 RUSSIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 170 RUSSIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 171 REST OF EUROPE ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 172 REST OF EUROPE ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 173 REST OF EUROPE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 174 REST OF EUROPE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 175 REST OF EUROPE ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 176 REST OF EUROPE ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 177 REST OF EUROPE ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 178 REST OF EUROPE ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 179 UAE ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 180 UAE ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 181 UAE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 182 UAE ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 183 UAE ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 184 UAE ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 185 UAE ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 186 UAE ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 187 SAUDI ARABIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 188 SAUDI ARABIA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 189 SAUDI ARABIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 190 SAUDI ARABIA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 191 SAUDI ARABIA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 192 SAUDI ARABIA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 193 SAUDI ARABIA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 194 SAUDI ARABIA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 195 SOUTH AFRICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 196 SOUTH AFRICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 197 SOUTH AFRICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 198 SOUTH AFRICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 199 SOUTH AFRICA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 200 SOUTH AFRICA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 201 SOUTH AFRICA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 202 SOUTH AFRICA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

TABLE 203 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (USD MILLIONS) 2020-2029

TABLE 204 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY ANIMAL TYPE (KILOTONS)2020-2029

TABLE 205 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (USD MILLIONS) 2020-2029

TABLE 206 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL (KILOTONS)2020-2029

TABLE 207 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY PRODUCT (USD MILLIONS) 2020-2029

TABLE 208 REST OF MIDDLE EAST AND AFRICA ANIMAL HEALTH MARKET BY PRODUCT (KILOTONS)2020-2029

TABLE 209 REST OF MIDDLE EAST AND AFRICA ENGINE MOUNT MARKET BY END USER (USD MILLIONS) 2020-2029

TABLE 210 REST OF MIDDLE EAST AND AFRICA ENGINE MOUNT MARKET BY END USER (KILOTONS)2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL ANIMAL HEALTH MARKET BY ANIMAL TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL ANIMAL HEALTH MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 10 GLOBAL ANIMAL HEALTH MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 11 GLOBAL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL, USD MILLION, 2019-2029

FIGURE 13 GLOBAL ANIMAL HEALTH MARKET BY REGION, USD MILLION, 2020-2029

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 GLOBAL ANIMAL HEALTH MARKET BY ANIMAL TYPE, USD MILLION, 2020-2029

FIGURE 16 GLOBAL ANIMAL HEALTH MARKET BY PRODUCT, USD MILLION, 2020-2029

FIGURE 17 GLOBAL ANIMAL HEALTH MARKET BY END USER, USD MILLION, 2020-2029

FIGURE 18 GLOBAL ANIMAL HEALTH MARKET BY DISTRIBUTION CHANNEL, USD MILLION, 2020-2029

FIGURE 20 ANIMAL HEALTH MARKET BY REGION 2021

FIGURE 21 MARKET SHARE ANALYSIS

FIGURE 18 MERCK ANIMAL HEALTH: COMPANY SNAPSHOT

FIGURE 19 CEVA SANTÉ ANIMALE: COMPANY SNAPSHOT

FIGURE 20 ZOETIS: COMPANY SNAPSHOT

FIGURE 21 ELANCO: COMPANY SNAPSHOT

FIGURE 22 HESKA CORPORATION: COMPANY SNAPSHOT

FIGURE 23 VIRBAC: COMPANY SNAPSHOT

FIGURE 24 COVETRUS: COMPANY SNAPSHOT

FIGURE 25 DRE VETERINARY: COMPANY SNAPSHOT

FIGURE 26 TELEVET: COMPANY SNAPSHOT

FAQ

The Animal health market size had crossed USD 37.80 billion in 2022 and will observe a CAGR of more than 7% up to 2029 driven by the rise in the prevalence of zoonotic illnesses, creased pet adoption for companionship is leading to more people coming into contact with the disease-spreading animal-borne diseases that are sweeping the globe.

North America dominated the market for animal health and accounted for the largest revenue share of 29.5% in 2022, owing to the wide range of definitive measures adopted by government animal welfare organizations that are consistently working for overall improvement in animal health.

The key drivers are increased awareness of preventive measures and expanding access to treatment choices are projected to fuel demand for animal care products. Also, rapid urbanization and growing disposable incomes are some of the key factors driving pet ownership.

The pharmaceutical segment dominated the market for animal health and held the largest revenue share of over 33.7% in 2022. It is estimated to retain its dominant position throughout the forecast period on account of consistent advancements in veterinary drugs.

North America is the largest market for animal health and accounted for the largest revenue share in a year due to measures adopted by government animal welfare organizations that are consistently working for overall improvement in animal health.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.