REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 3.96 billion | 12.9% | North America |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

LNG Truck Market Overview

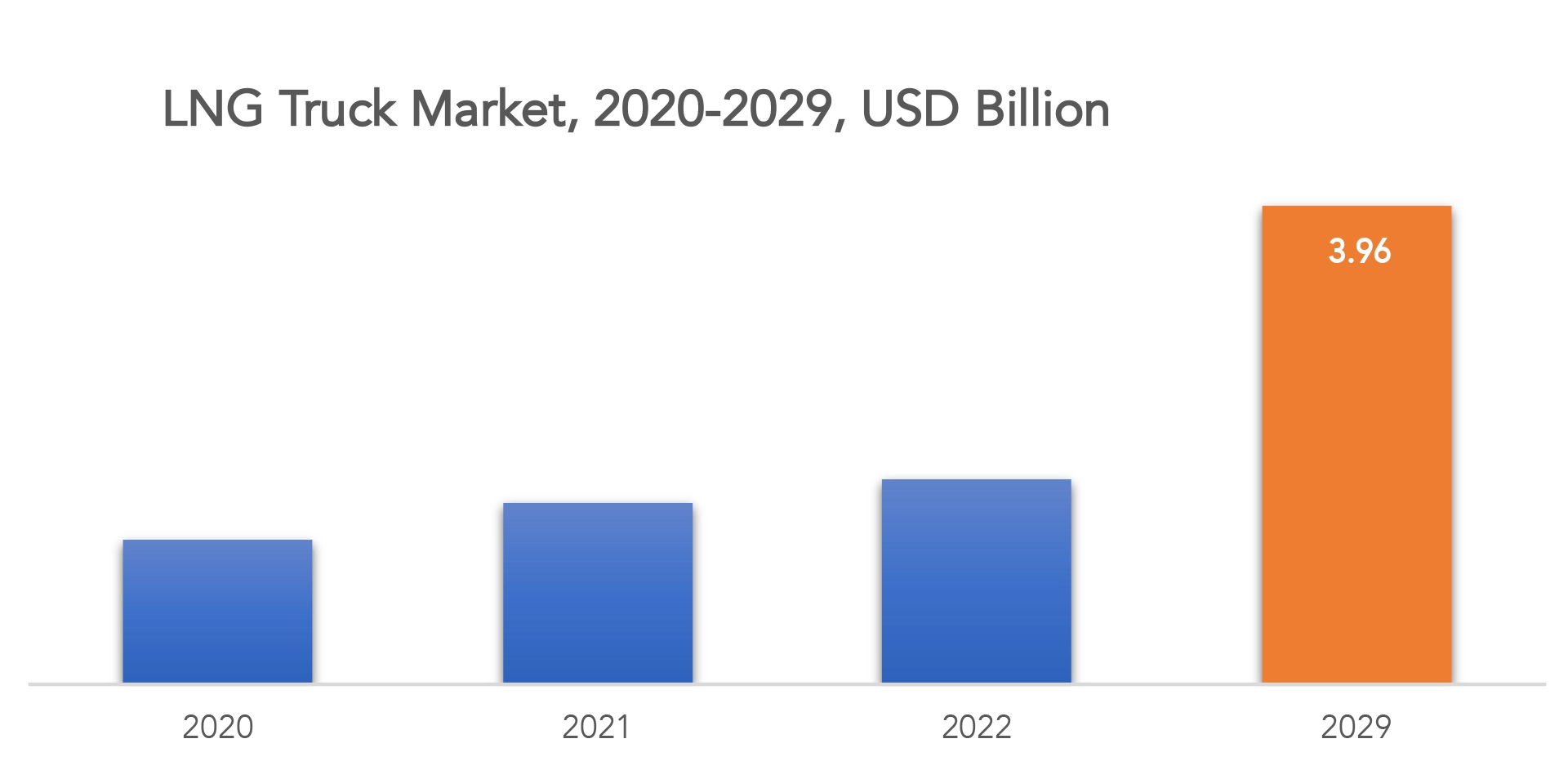

The global LNG truck Market is estimated to grow from USD 1.2 billion in 2022 to USD 3.96 billion by 2029, at a CAGR of 12.9% during the forecast period.

An LNG truck is a vehicle that uses liquefied natural gas (LNG) as fuel. Natural gas vehicles have been around for decades, but the Market has grown significantly in recent years due to increased availability of LNG and increased environmental awareness. As awareness of the harmful effects of carbon emissions grows, demand for vehicles powered by liquefied natural gas (LNG) is increasing. Commercial vehicle manufacturers are constantly experimenting with different technologies to ensure that their commercial vehicles are not only safe, but also environmentally friendly and efficient.

The global market for natural gas trucks will continue to grow, supported by stricter emissions and noise regulations and lower natural gas prices. The MD truck segment, which consists of scrap and distribution, will grow in the medium term, while long-haul vehicles will continue to grow in critical demand for natural gas vehicles through the expansion of OEM and Tier I engine supplier fueling infrastructure and internal NG engine platforms provide a boost. The study captures important emerging trends in major natural gas Markets in North America, Europe and China. It also focuses on technology penetration in various duty cycle applications.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION), (THOUSAND UNITS). |

| Segmentation | By Type, By Application, By Region |

| By Type

|

|

| By Application

|

|

| By Region

|

|

Governments in various regions are accepting his LNG commercial vehicles as an alternative to diesel and petrol until automakers design and develop affordable and practical electric vehicles. In addition, governments are taking initiatives and increasing investments to build adequate infrastructure, which is boosting the growth of the LNG commercial vehicle Market which creates large amounts of evaporation loss. On the other hand, for large long heavy trucks, LNG is a best option as it moves continuously.

Market growth is attributed to increasing demand for LNG trucks due to strict emission standards and increasing use of natural gas as a transportation fuel. A major factor driving the global LNG commercial vehicle Market is the growing awareness of the dangerous impact of carbon emissions on the global environment. LNG commercial vehicles are being considered by the government as an alternative and his OEMs in various regions as an alternative to gasoline and diesel vehicles to reduce CO2 emissions and improve efficiency and productivity of commercial vehicles.

As natural gas production has become easier and safer, hence LNG adoption rate among automakers has increased. Another factor driving this LNG commercial vehicles in the world is government support and technological advancements in the LNG commercial vehicle Market.

Especially in developing regions, the infrastructure required for the growth of the LNG commercial vehicle Market is not in place. Bunkering infrastructure, distribution networks, etc. are restraining the growth of the LNG commercial vehicle Market. The main limiting factors are depletion of natural resources and higher operating costs per kg compared to medium and large LNG. It is this issue that is hindering growth for manufacturers of innovative LNG products. Decreasing the LNG truck Market.

For gasoline and diesel commercial vehicles with a focus on long-term contracts. Major manufacturers are focusing on developing emerging regions such as China. Brazil and other countries where the automotive industry is developing rapidly and the demand for skid steer loaders is increasing. Favorable government initiatives related to environmental regulations to increase demand for greener solutions create more revenue opportunities for Market participants. The European Commission and other federal agencies are creating new laws and regulations such as the Eco Product Certification Scheme (ECS). These regulations ensure a green and sustainable environment with low or no harmful emissions. To produce greener fuels, these regulations will encourage fuel companies to invest in bio-based fuel sources, increasing demand for greener fuel solutions. United States and Western European government regulations, particularly on air pollution, will continue to favor the use of clean fuels. These initiatives create specific growth opportunities in the Market of LNG and as a result in LNG truck over the forecast period.

In 2022, the rise of the COVID-19 pandemic hurt the transportation sector due to nationwide manufacturing plant closures, labor shortages, and contraction of global supply and demand chains. These factors have temporarily impacted the growth of his small LNG industry, which is primarily used as fuel for his LNG trucks and vehicles. However, since 2021, many countries around the world have seen a steady recovery in automotive sector production activity, increasing demand for small-scale LNG and as a LNG’s increasing demand Market of LNG truck is also boosted.

LNG Truck Market Segment Analysis

The LNG truck Market is segmented based on type, application and region, global trends and forecast.

By Type, the Market is bifurcated into (Tractor Truck, Dump Truck, Other). By Application (Transportation, Construction) and Region, Global trends and forecast.

A tractor-trailer is a large vehicle used to tow trailers and other vehicles. They are usually equipped with a fifth wheel that allows the tractor to tow the semitrailer. Tractor units are often used in the transportation industry for long-distance cargo transportation. The segment is expected to maintain its leadership during the forecast period due to the growing demand, LNG as a fuel source for heavy duty vehicles. The high efficiency and low emissions of LNG make it an attractive option for shipping companies looking to reduce their carbon footprint.

A dump truck is a vehicle for transporting loose materials such as sand, gravel, and mud. It consists of an open box bed that can be lifted at the front end to place the contents on the floor behind. These trucks are commonly used to transport materials from one location to another in construction and mining activities. This segment is expected to grow at a significant CAGR during the forecast period owing to increasing demand from construction companies looking for less polluting alternatives to diesel fuel.

The transportation industry is the largest consumer of his LNG trucks. The growth of this segment is due to the growing demand for natural gas as a fuel for commercial vehicles due to its low emissions and high efficiency. Natural gas-powered vehicles produce less greenhouse gas emissions than traditional diesel-powered vehicles, making them an attractive alternative for transportation companies looking to reduce their carbon footprint. The use of liquefied natural gas (LNG) in heavy commercial vehicles results in particulate matter and nitrogen oxide emissions when used as an engine fuel or cooling medium in compression processes in truck terminals and distribution centers such as warehouses and ports.

The construction industry is his second largest consumer of LNG trucks. The growth of this segment is due to the growing demand for natural gas as a fuel for construction machinery due to its low emissions and high efficiency. Construction companies are looking for ways to reduce their environmental impact, and switching to natural gas-powered vehicles is one way. In addition, the use of LNG in construction equipment results in near-zero emissions of particulate matter and nitrogen oxides when used as engine fuel and as a cooling medium for compression processes at construction sites.

LNG Truck Market Players

The LNG Truck Market key players include Volvo Trucks, Fiat Industrial, China International Marine Containers (Group), Sinotruk Group, Paccar, Scania, Shaanxi Automobile Group, Faw jiefang, Daimler, ISUZU.

Recent Developments

1-2-2023 Volvo launches powerful biogas truck for lowering CO2 on longer transports

Volvo Trucks is now launching a new, stronger gas-powered truck that can run on liquified biogas. The new truck can carry out demanding, long distance transport tasks, while reducing overall CO2 emissions.

CIMC Enric Boosting LNG Logistics Mode Upgrade

Who Should Buy? Or Key stakeholders

- LNG truck Suppliers

- Raw Materials Manufacturers

- Manufacturing Companies

- LNG Suppliers

- Mining Industries

- Filtration Industries

- Research Organizations

- Investors

- Regulatory Authorities

- Others

LNG Truck Market Regional Analysis

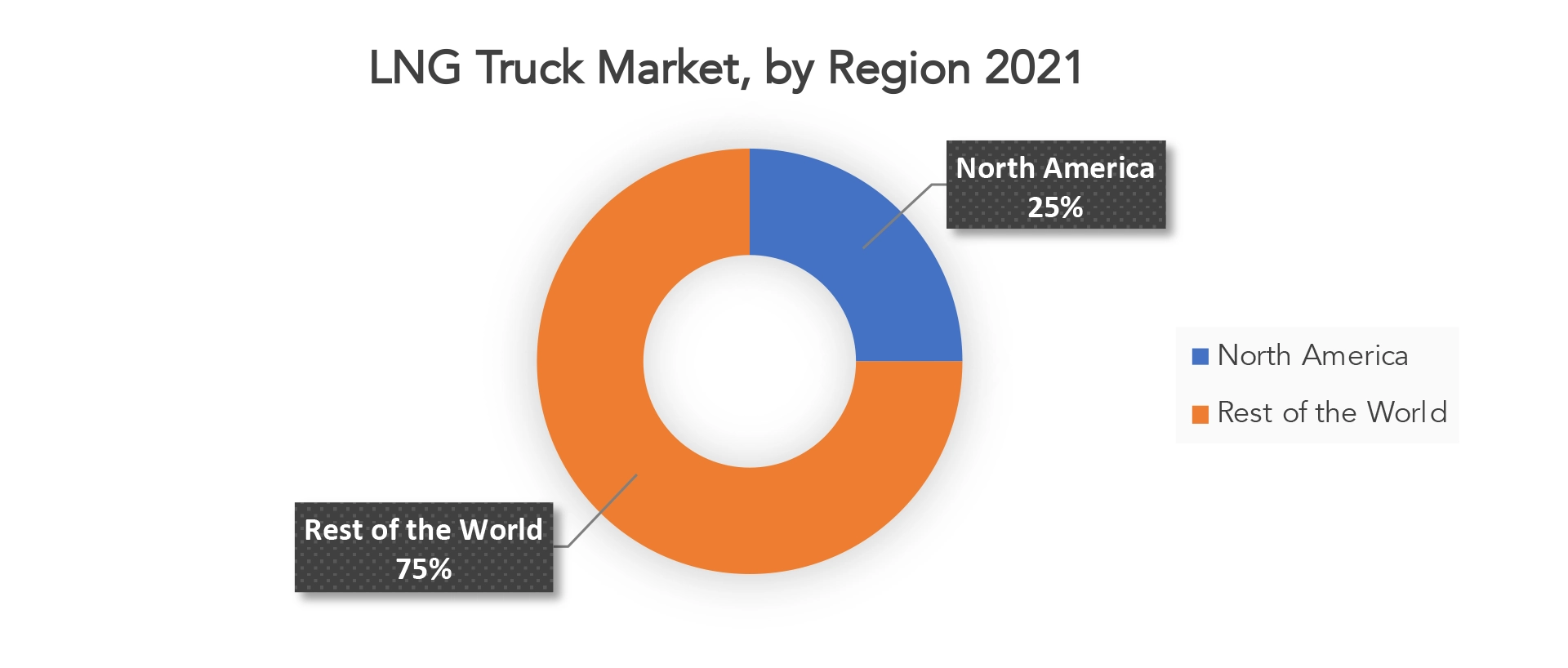

The LNG Truck Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The North American region is the largest Market for LNG trucks. The growth in this region can be attributed to the increasing demand for natural gas as a fuel source for commercial vehicles, owing to its low emissions and high efficiency. In addition, the abundance of natural gas resources in North America makes it an attractive option for transportation companies looking to switch to a less-polluting alternative fuel.

The South America region is the second largest Market for LNG trucks. Growth in the region is driven by the growing demand for natural gas as a fuel for commercial vehicles due to its low emissions and high efficiency. Moreover, economic growth in countries such as Brazil and Mexico is boosting the growth of this Market in South America.

The Europe region is his third largest Market for LNG trucks. Spain dominates the Market in terms of Market share and Market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. The Market growth over this region is attributed to the easy availability of LNG fuel at a reasonable costs within the region. U.K. on the other hand, is estimated to show exponetial growth over the forecast period of 2022-2029, due to the strict government regulations within the region.

The Asia-Pacific region is expected to grow at a significant CAGR over the forecast period due to rising demand from developing countries such as India and China, which are increasingly interested in infrastructure development projects requiring the deployment of LNG.

The Middle East and Africa region is expected to grow at a moderate CAGR during the forecast period owing to rising demand for natural gas as a fuel source for commercial vehicles in countries such as Saudi Arabia and UAE.

Key Market Segments: LNG Truck Market

LNG Truck Market by Type, 2022-2029, (USD Billion), (Thousand Units).

- Tractor Truck

- Dump Truck

- Other

LNG Truck Market by Product, 2022-2029, (USD Billion), (Thousand Units).

- Transportation

- Construction

LNG Truck Market by Region, 2022-2029, (USD Billion), (Thousand Units).

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the LNG Truck Market?

- What are the key factors influencing the growth of LNG trucks?

- What are the major applications for LNG trucks?

- Who are the major key players in the LNG Truck Market?

- Which region will provide more business opportunities for LNG truck in future?

- Which segment holds the maximum share of the LNG Truck Market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL SMART GLASS OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON SMART GLASS

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL SMART GLASS OUTLOOK

- GLOBAL LNG TRUCK MARKET BY TYPE, 2022-2029, (USD BILLION, THOUSAND UNITS)

- TRACTOR TRUCK

- DUMP TRUCK

- OTHER

- GLOBAL LNG TRUCK MARKET BY APPLICATION, 2022-2029, (USD BILLION, THOUSAND UNITS)

- TRANSPORTATION

- CONSTRUCTION

- GLOBAL LNG TRUCK MARKET BY REGION, 2022-2029, (USD BILLION, THOUSAND UNITS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- VOLVO TRUCKS

- FIAT INDUSTRIAL

- CHINA INTERNATIONAL MARINE CONTAINERS (GROUP)

- SINOTRUK GROUP

- PACCAR

- SCANIA

- SHAANXI AUTOMOBILE GROUP

- FAW JIEFANG

- DAIMLER

- ISUZU *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 2 GLOBAL LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 3 GLOBAL LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 4 GLOBAL LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 5 GLOBAL LNG TRUCK MARKET BY REGION (USD BILLION), 2022-2029

TABLE 6 GLOBAL LNG TRUCK MARKET BY REGION (THOUSAND UNITS), 2022-2029

TABLE 7 NORTH AMERICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 8 NORTH AMERICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 9 NORTH AMERICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 10 NORTH AMERICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 11 NORTH AMERICA LNG TRUCK MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 12 NORTH AMERICA LNG TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2022-2029

TABLE 13 US LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 14 US LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 15 US LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 16 US LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 17 CANADA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 18 CANADA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 19 CANADA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 20 CANADA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 21 MEXICO LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 22 MEXICO LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 23 MEXICO LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 24 MEXICO LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 25 SOUTH AMERICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 26 SOUTH AMERICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 27 SOUTH AMERICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 28 SOUTH AMERICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 29 BRAZIL LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 30 BRAZIL LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 31 BRAZIL LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 32 BRAZIL LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 33 ARGENTINA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 34 ARGENTINA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 35 ARGENTINA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 36 ARGENTINA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 37 COLOMBIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 38 COLOMBIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 39 COLOMBIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 40 COLOMBIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 41 REST OF SOUTH AMERICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 42 REST OF SOUTH AMERICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 43 REST OF SOUTH AMERICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 44 REST OF SOUTH AMERICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 45 ASIA-PACIFIC LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 46 ASIA-PACIFIC LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 47 ASIA-PACIFIC LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 48 ASIA-PACIFIC LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 49 ASIA-PACIFIC LNG TRUCK MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 50 ASIA-PACIFIC LNG TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2022-2029

TABLE 51 INDIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 52 INDIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 53 INDIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 54 INDIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 55 CHINA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 56 CHINA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 57 CHINA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 58 CHINA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 59 JAPAN LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 60 JAPAN LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 61 JAPAN LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 62 JAPAN LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 63 SOUTH KOREA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 64 SOUTH KOREA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 65 SOUTH KOREA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 66 SOUTH KOREA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 67 AUSTRALIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 68 AUSTRALIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 69 AUSTRALIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 70 AUSTRALIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 71 SOUTH EAST ASIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 72 SOUTH EAST ASIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 73 SOUTH EAST ASIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 74 SOUTH EAST ASIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 75 REST OF ASIA PACIFIC LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 76 REST OF ASIA PACIFIC LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 77 REST OF ASIA PACIFIC LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 78 REST OF ASIA PACIFIC LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 79 EUROPE LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 80 EUROPE LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 81 EUROPE LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 82 EUROPE LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 83 EUROPE LNG TRUCK MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 84 EUROPE LNG TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2022-2029

TABLE 85 GERMANY LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 86 GERMANY LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 87 GERMANY LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 88 GERMANY LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 89 UK LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 90 UK LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 91 UK LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 92 UK LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 93 FRANCE LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 94 FRANCE LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 95 FRANCE LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 96 FRANCE LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 97 ITALY LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 98 ITALY LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 99 ITALY LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 100 ITALY LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 101 SPAIN LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 102 SPAIN LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 103 SPAIN LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 104 SPAIN LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 105 RUSSIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 106 RUSSIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 107 RUSSIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 108 RUSSIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 109 REST OF EUROPE LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 110 REST OF EUROPE LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 111 REST OF EUROPE LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 112 REST OF EUROPE LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 113 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 114 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 115 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 116 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 117 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY COUNTRY (USD BILLION), 2022-2029

TABLE 118 MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY COUNTRY (THOUSAND UNITS), 2022-2029

TABLE 119 UAE LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 120 UAE LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 121 UAE LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 122 UAE LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 123 SAUDI ARABIA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 124 SAUDI ARABIA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 125 SAUDI ARABIA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 126 SAUDI ARABIA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 127 SOUTH AFRICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 128 SOUTH AFRICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 129 SOUTH AFRICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 130 SOUTH AFRICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

TABLE 131 REST OF MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY TYPE (USD BILLION), 2022-2029

TABLE 132 REST OF MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY TYPE (THOUSAND UNITS), 2022-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY APPLICATION (USD BILLION), 2022-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA LNG TRUCK MARKET BY APPLICATION (THOUSAND UNITS), 2022-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL LNG TRUCK BY TYPE, USD MILLION, 2022-2029

FIGURE 9 GLOBAL LNG TRUCK BY APPLICATION, USD MILLION, 2022-2029

FIGURE 10 GLOBAL LNG TRUCK BY REGION, USD MILLION, 2022-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL LNG TRUCK BY TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL LNG TRUCK BY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL LNG TRUCK BY REGION, USD MILLION, 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 VOLVO TRUCKS: COMPANY SNAPSHOT

FIGURE 17 FIAT INDUSTRIAL: COMPANY SNAPSHOT

FIGURE 18 CHINA INTERNATIONAL MARINE CONTAINERS (GROUP): COMPANY SNAPSHOT

FIGURE 19 SINOTRUK GROUP: COMPANY SNAPSHOT

FIGURE 20 PACCAR: COMPANY SNAPSHOT

FIGURE 21 SCANIA: COMPANY SNAPSHOT

FIGURE 22 SHAANXI AUTOMOBILE GROUP: COMPANY SNAPSHOT

FIGURE 23 FAW JIEFANG: COMPANY SNAPSHOT

FIGURE 24 DAIMLER: COMPANY SNAPSHOT

FIGURE 25 ISUZU: COMPANY SNAPSHOT

FAQ

The Global LNG Truck Market is estimated to grow from USD 1.2 billion in 2022 to USD 3.96 billion by 2029, at a CAGR of 12.9% during the forecast period.

North America held more than 25% of the LNG Truck Market revenue share in 2021 and will witness expansion in the forecast period.

Market growth is attributed to increasing demand for LNG trucks due to strictly emission standards and increasing use of natural gas as a transportation fuel. A major factor driving the global LNG commercial vehicle Market is the growing awareness of the dangerous impact of carbon emissions on the global environment. LNG commercial vehicles are being considered by the government as an alternative and his OEMs in various regions as an alternative to gasoline and diesel vehicles to reduce CO2 emissions and improve efficiency and productivity of commercial vehicles. As natural gas production has become easier and safer, hence LNG adoption rate among automakers has increased. Another factor driving this LNG commercial vehicles in the world is government support and technological advancements in the LNG commercial vehicle Market.

An LNG truck is a vehicle that uses liquefied natural gas (LNG) as fuel. Natural gas vehicles have been around for decades, but the Market has grown significantly in recent years due to increased availability of LNG and increased environmental awareness. As awareness of the harmful effects of carbon emissions grows, demand for vehicles powered by liquefied natural gas (LNG) is increasing. Commercial vehicle manufacturers are constantly experimenting with different technologies to ensure that their commercial vehicles are not only safe, but also environmentally friendly and efficient.

The North American region is the largest Market for LNG trucks. The growth in this region can be attributed to the increasing demand for natural gas as a fuel source for commercial vehicles, owing to its low emissions and high efficiency. In addition, the abundance of natural gas resources in North America makes it an attractive option for transportation companies looking to switch to a less-polluting alternative fuel.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.