REPORT OUTLOOK

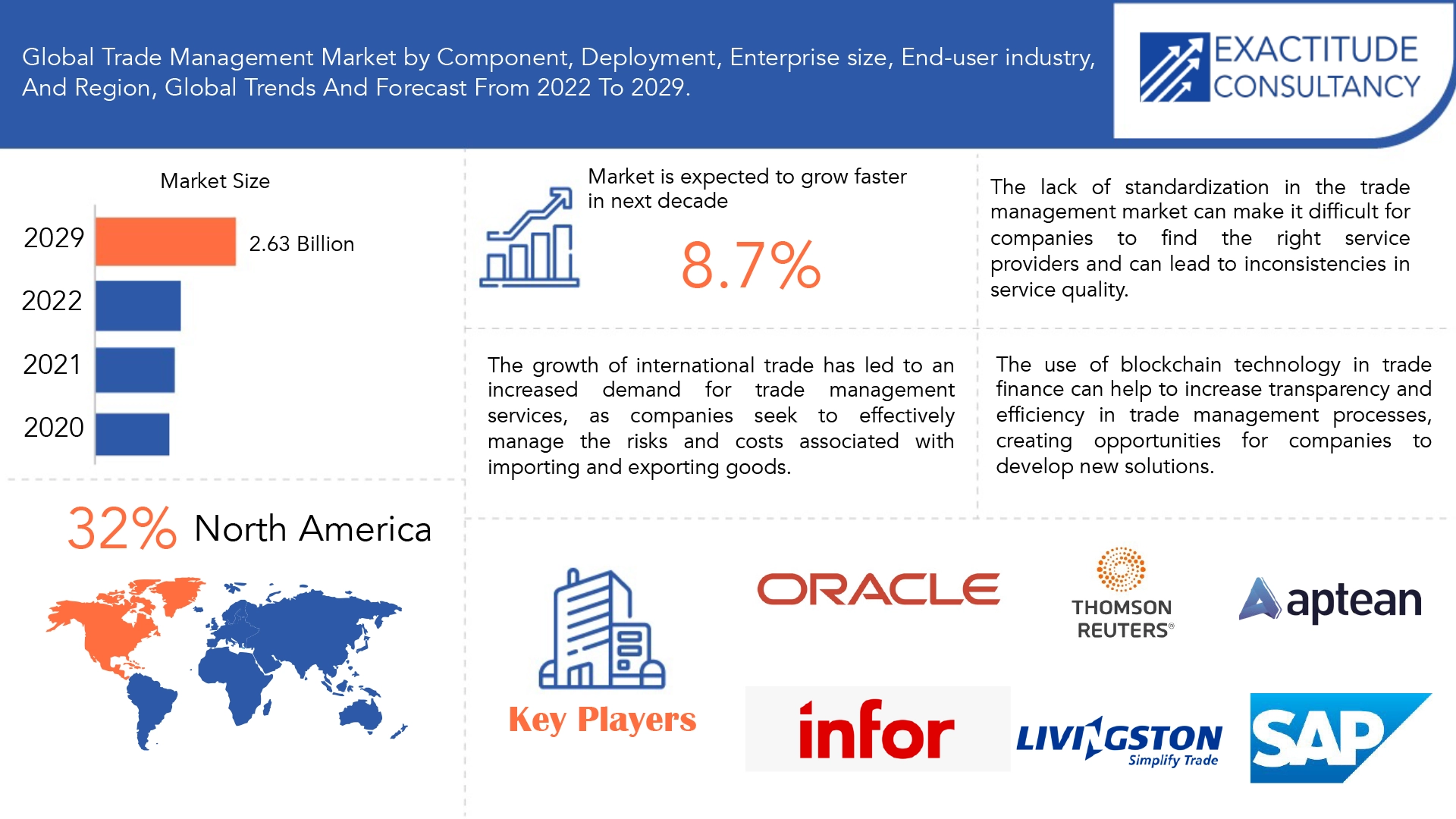

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 2.63 billion by 2029 | 8.7% | North America |

| By Component | By Deployment | By End-User Industry |

|---|---|---|

Solution

Service

|

|

|

SCOPE OF THE REPORT

Trade Management Market Overview

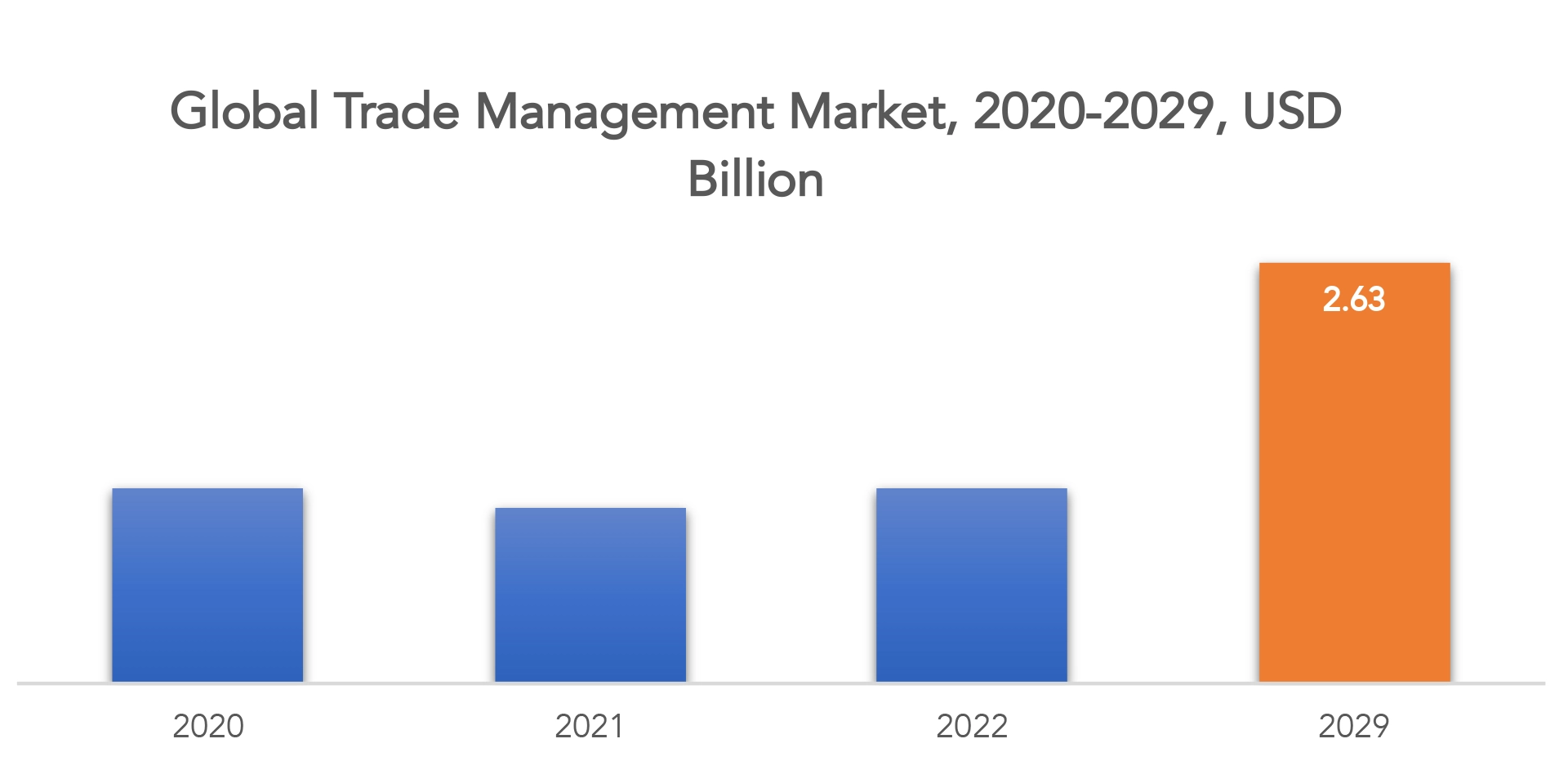

The global Trade Management Market is expected to grow at 10.5% CAGR from 2023 to 2029. It is expected to reach above USD 2.63 billion by 2029 from USD 1.1 billion in 2022.

The many procedures and actions involved in the buying and selling of products and services across international borders are referred to as trade management. It includes a broad range of tasks like market analysis, sourcing, logistics, shipping, customs clearance, payments, and observing different rules. The purpose of trade management is to assist businesses in efficiently managing the risks and expenses related to global trade while also optimizing their chances for worldwide sourcing and sales.

The market for trade management can be divided into a variety of sectors, each with its own set of actors and service offerings, including freight forwarding, customs brokerage, trade finance, trade compliance, and trade logistics. The globalization of trade, the expansion of e-commerce, and the requirement for businesses to maintain compliance with shifting rules have all contributed to the market growth for global trade management in recent years.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By component, deployment, enterprise size, end-user industry, and region. |

| By Component

|

Solution

Service

|

| By Deployment |

|

| By Enterprise Size

|

|

| By End-User Industry

|

|

| By Region

|

|

With the use of software and technological solutions to automate and optimize trade management procedures, technology has played a significant influence in the growth of the market for trade management. In order to streamline their trade management operations and maintain regulatory compliance, several businesses have implemented digital solutions in recent years. In addition to the expanding use of Artificial Intelligence (AI) and Machine Learning (ML) in logistics and supply chain management, examples include the use of Electronic Data Interchange (EDI) for customs clearance and digital trade platforms for logistics management.

When conducting the trade process manually, importers and exporters confront difficulties, particularly with regard to back-office solutions. As a result, more people are using trade management software since it easily improves and streamlines corporate operations connected to cross-border trade. Additionally, the commerce sector has grown rapidly over the past ten years as a result of increased industry 4.0 and digitalization-related activities. The market for trade management software may have growth restraints due to the high cost and integration challenges associated with advanced trade management solutions. Additionally, it is anticipated that an increase in expenditures in the construction of logistical infrastructure in emerging economies will create chances for the market for trade management software to expand.

Trade Management Market Segment Analysis

Global Trade management by Component is divided into (Solution [Trade Function, Trade Compliance, Supply Chain, Visibility Trade Finance], Service [Professional Services and Managed Services])

Trade management services are essential to ensuring that trade management solutions are properly integrated with the intricate network infrastructure used in businesses. Trade management services keep an eye on, maintain, and update the key components of trade management solutions to ensure that they continue to work as intended over time. By automating and optimizing trade operations, handling control expenses, lowering the likelihood of fines and penalties, and expediting customs clearance, trade management aids in accelerating the cross-border supply chain.

Global Trade management by Deployment is divided into Cloud and On-premise.

Cloud deployment is a flexible technique to deployment that is used in the trade management industry to meet the needs of a company. One of the main advantages of cloud-based deployment is the capacity to scale up current solutions with cutting-edge technologies without incurring additional hardware and software costs. Deployment costs are reduced because there is no requirement for on-site storage, which also decreases the systems’ original cost and ongoing maintenance costs. Businesses are thinking about the cloud deployment option as a result of vendors’ competitive pricing for SaaS models and major enterprises’ cooperation to reach SMEs.

As an instance, Integration Point and GT Nexus collaborated to offer businesses a single cloud-based worldwide trade administration system. More than 190 nations offer their trade legislation to customers.

Global Trade management by Enterprise Size is divided into SMEs and Large Enterprises.

Due to the surge in demand for effective trade management, compliance management, import/export management, and finance management solutions to manage and track the complicated supply chain, the large enterprise sector is anticipated to hold the majority of the market share. Trade management software is expected to be in demand as a result of the requirement for large businesses engaged in international trade to adhere to international trade regulations.

The segment of small and medium-sized businesses is anticipated to develop at the greatest CAGR because of rising investment and funding for international business expansion. Due to the low cost and pay-per-use pricing model of cloud-based software, which is likely to propel market expansion, SMEs are concentrating on implementing it.

Global Trade management by End-User Industry is divided into Automotive, Healthcare & Life Sciences, Manufacturing, Transportation & Logistics, IT & Telecom, Retail & Consumer Goods and Products, and Others.

Due to increased international trade among pharmaceutical businesses, the healthcare & life sciences industry is predicted to develop at the highest CAGR. It is anticipated that the dissemination of this software across industries will increase as a result of the rising import and export of capital goods, petroleum products, vehicles, raw materials, and consumer goods.

Trade Management Market Key Players

The trade management market key players include Oracle (US), Infor (US), Thomson Reuters (US), Livingston International (Canada), Aptean (US), SAP (Germany), Noatum Logistics (Spain), E2open (US), Descartes (Canada), CargoWise (Australia), Expeditors (US), BDP International (US), Accuity (US), QAD Precision (US), 3rdwave (Canada), AEB (Germany), Shipsy (India), Bamboo Rose (US), Bolero International (UK), MIC Customs Solutions (UK), OCR Services (US), Webb Fontaine (UAE), Neurored (Spain), 4PL Consultancy (UK), Global Custom Compliance (China), Vigilant Global Trade Services (US), and Centrade (US).

For corporate expansion, these key leaders are implementing strategic formulations such as new product development and commercialization, commercial expansion, and distribution agreements. Moreover, these participants are substantially spending on product development, which is fueling revenue generation.

Recent Developments:

In October 2022, Oracle partnered with healthcare organizations to create patient centered supply chains. Unpredictable supply and demand across the healthcare industry creates complex challenges, which makes it difficult for healthcare organizations to predict supply shortages, manage complex pricing, replenish orders quickly, and maintain accurate billing.

In October 2022, Aptean signed an agreement with Insight Partners and existing investor TA Associates (TA) to accelerate innovation and global expansion of its solutions.

In July 2022, Livingston International launched a wholly digital, user-directed platform that provides U.S. importers greater visibility into and hands-on control over online customs clearance.

In June 2022, Infor has entered into a technology partnership with Everstream Analytics to help organizations better anticipate and navigate supply chain risks and disruptions.

Who Should Buy? Or Key stakeholders

- Manufacturing companies

- Defense and Aerospace industry

- IT and Telecomm industry

- Consumer electronics

- Government organization.

- Research firms

- Telecom industry

- Investors

- End-user companies

- Research institutes

- Others

Trade Management Market Regional Analysis

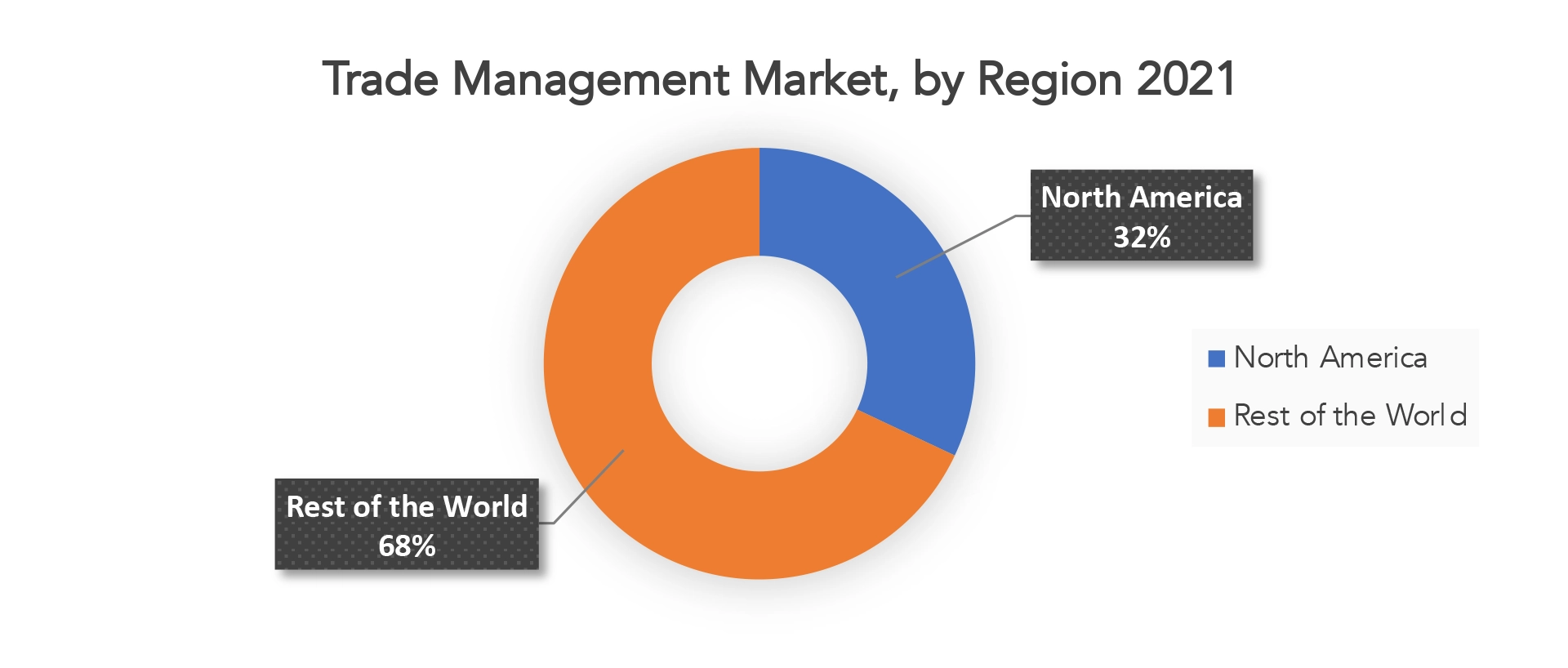

The Trade management market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and the Rest of MEA

Increasing trade activity and the sizeable export and import volumes in the United States have given North America a dominant market position for trade management software. The U.S. is home to a number of significant market participants, which is credited with the industry expansion. The United States is the greatest trading nation in the world, with USD 5.6 trillion worth of goods and services imported and exported in 2019. More than USD 2.5 trillion worth of goods were imported into the United States in total in 2019. Additionally, US exports in 2019 totaled USD 1.6 trillion. Over 200 nations, regional groups, and territories have trading links with the United States.

The World Bank estimates that it costs USD 275 per shipment and takes 9 hours to complete the documentation needed for importation into the United States. These elements are probably going to help the local market grow.

During the projection period, the Asia Pacific region is anticipated to grow at the highest CAGR. The regional need for trade management software is predicted to be driven by the growth of logistics-related industries and businesses. India has negotiated trade agreements with a number of Asian nations, such as Japan, Korea, and ASEAN nations. The usage of free trade agreements by importers has greatly increased over time. The Indian government had to implement anti-abuse procedures to prevent the abuse of duty-free access to India’s market due to the spike in duty-free imports and the ensuing trade deficit.

Key Market Segments: Next-Generation Packaging Market

Trade Management Market By Component, 2022-2029, (Usd Billion), (Kilotons)

Solution

- Trade Function

- Trade Compliance

- Supply Chain

- Visibility Trade Finance

Service

- Professional Services

- Managed Services

Trade Management Market By Deployment, 2022-2029, (Usd Billion), (Kilotons)

- Cloud

- On-Premise

Trade Management Market By Enterprise Size, 2022-2029, (Usd Billion), (Kilotons)

- Smes

- Large Enterprises

Trade Management Market By End-User Industry, 2022-2029, (Usd Billion), (Kilotons)

- Automotive

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- It & Telecom

- Retail & Consumer Goods

- Products

- Others

Trade Management Market By Region, 2022-2029, (Usd Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the Trade management market?

- What are the key factors influencing the growth of the Trade management market?

- What are the major applications of the Trade management market?

- Who are the major key players in the Trade management market?

- Which region will provide more business opportunities for Micro-Electro-Mechanical Systems (MEMS) in the future?

- Which segment holds the maximum share of the Trade management market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Trade Management Market Outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 On Trade Management Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Trade Management Market Outlook

- Global Trade Management Market by Component, 2020-2029, (USD BILLION)

- Solutions

- Services

- Global Trade Management Market by Deployment, 2020-2029, (USD BILLION)

- Cloud

- On-premises

- Global Trade Management Market by Enterprise size, 2020-2029, (USD BILLION)

- SMEs

- Large enterprises

- Global Trade Management Market by End-user industry, 2020-2029, (USD BILLION)

- Automotive

- Healthcare & Life Sciences

- Manufacturing

- Transportation & Logistics

- IT & Telecom

- Retail & Consumer Goods

- Products

- Others

- Global Trade Management Market by Region, 2020-2029, (USD BILLION)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles* (Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Oracle

- Infor

- Thomson Reuters

- Livingston International

- Aptean

- SAP

- Noatum Logistics

- E2open

- Descartes

- CargoWise

- Expeditors

- BDP International

- Accuity

- QAD Precision

- 3rdwave *The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 2 GLOBAL TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 3 GLOBAL TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 4 GLOBAL TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 5 GLOBAL TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 6 GLOBAL TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 7 GLOBAL TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 8 GLOBAL TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 9 GLOBAL TRADE MANAGEMENT MARKET BY REGION (USD BILLION) 2019-2028

TABLE 10 GLOBAL TRADE MANAGEMENT MARKET BY REGION (KILOTONS) 2019-2028

TABLE 11 NORTH AMERICA TRADE MANAGEMENT MARKET BY COUNTRY (USD BILLION) 2019-2028

TABLE 12 NORTH AMERICA TRADE MANAGEMENT MARKET BY COUNTRY (KILOTONS) 2019-2028

TABLE 13 US TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 14 US TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 15 US TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 16 US TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 17 US TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 18 US TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 19 US TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 20 US TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 21 CANADA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 22 CANADA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 23 CANADA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 24 CANADA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 25 CANADA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 26 CANADA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 27 CANADA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 28 CANADA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 29 MEXICO TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 30 MEXICO TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 31 MEXICO TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 32 MEXICO TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 33 MEXICO TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 34 MEXICO TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 35 MEXICO TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 36 MEXICO TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 37 SOUTH AMERICA TRADE MANAGEMENT MARKET BY COUNTRY (USD BILLION) 2019-2028

TABLE 38 SOUTH AMERICA TRADE MANAGEMENT MARKET BY COUNTRY (KILOTONS) 2019-2028

TABLE 39 BRAZIL TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 40 BRAZIL TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 41 BRAZIL TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 42 BRAZIL TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 43 BRAZIL TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 44 BRAZIL TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 45 BRAZIL TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 46 BRAZIL TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 47 ARGENTINA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 48 ARGENTINA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 49 ARGENTINA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 50 ARGENTINA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 51 ARGENTINA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 52 ARGENTINA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 53 ARGENTINA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 54 ARGENTINA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 55 COLOMBIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 56 COLOMBIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 57 COLOMBIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 58 COLOMBIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 59 COLOMBIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 60 COLOMBIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 61 COLOMBIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 62 COLOMBIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 63 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 64 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 65 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 66 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 67 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 68 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 69 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 70 REST OF SOUTH AMERICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 71 ASIA-PACIFIC TRADE MANAGEMENT MARKET BY COUNTRY (USD BILLION) 2019-2028

TABLE 72 ASIA-PACIFIC TRADE MANAGEMENT MARKET BY COUNTRY (KILOTONS) 2019-2028

TABLE 73 INDIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 74 INDIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 75 INDIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 76 INDIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 77 INDIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 78 INDIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 79 INDIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 80 INDIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 81 CHINA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 82 CHINA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 83 CHINA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 84 CHINA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 85 CHINA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 86 CHINA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 87 CHINA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 88 CHINA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 89 JAPAN TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 90 JAPAN TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 91 JAPAN TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 92 JAPAN TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 93 JAPAN TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 94 JAPAN TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 95 JAPAN TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 96 JAPAN TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 97 SOUTH KOREA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 98 SOUTH KOREA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 99 SOUTH KOREA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 100 SOUTH KOREA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 101 SOUTH KOREA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 102 SOUTH KOREA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 103 SOUTH KOREA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 104 SOUTH KOREA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 105 AUSTRALIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 106 AUSTRALIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 107 AUSTRALIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 108 AUSTRALIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 109 AUSTRALIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 110 AUSTRALIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 111 AUSTRALIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 112 AUSTRALIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 113 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 114 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 115 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 116 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 117 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 118 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 119 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 120 SOUTH-EAST ASIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 121 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 122 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 123 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 124 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 125 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 126 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 127 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 128 REST OF ASIA PACIFIC TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 129 EUROPE TRADE MANAGEMENT MARKET BY COUNTRY (USD BILLION) 2019-2028

TABLE 130 EUROPE TRADE MANAGEMENT MARKET BY COUNTRY (KILOTONS) 2019-2028

TABLE 131 GERMANY TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 132 GERMANY TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 133 GERMANY TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 134 GERMANY TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 135 GERMANY TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 136 GERMANY TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 137 GERMANY TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 138 GERMANY TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 139 UK TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 140 UK TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 141 UK TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 142 UK TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 143 UK TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 144 UK TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 145 UK TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 146 UK TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 147 FRANCE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 148 FRANCE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 149 FRANCE TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 150 FRANCE TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 151 FRANCE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 152 FRANCE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 153 FRANCE TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 154 FRANCE TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 155 ITALY TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 156 ITALY TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 157 ITALY TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 158 ITALY TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 159 ITALY TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 160 ITALY TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 161 ITALY TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 162 ITALY TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 163 SPAIN TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 164 SPAIN TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 165 SPAIN TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 166 SPAIN TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 167 SPAIN TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 168 SPAIN TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 169 SPAIN TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 170 SPAIN TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 171 RUSSIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 172 RUSSIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 173 RUSSIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 174 RUSSIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 175 RUSSIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 176 RUSSIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 177 RUSSIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 178 RUSSIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 179 REST OF EUROPE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 180 REST OF EUROPE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 181 REST OF EUROPE TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 182 REST OF EUROPE TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 183 REST OF EUROPE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 184 REST OF EUROPE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 185 REST OF EUROPE TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 186 REST OF EUROPE TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 187 MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY COUNTRY (USD BILLION) 2019-2028

TABLE 188 MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY COUNTRY (KILOTONS) 2019-2028

TABLE 189 UAE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 190 UAE TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 191 UAE TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 192 UAE TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 193 UAE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 194 UAE TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 195 UAE TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 196 UAE TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 197 SAUDI ARABIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 198 SAUDI ARABIA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 199 SAUDI ARABIA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 200 SAUDI ARABIA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 201 SAUDI ARABIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 202 SAUDI ARABIA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 203 SAUDI ARABIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 204 SAUDI ARABIA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 205 SOUTH AFRICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 206 SOUTH AFRICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 207 SOUTH AFRICA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 208 SOUTH AFRICA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 209 SOUTH AFRICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 210 SOUTH AFRICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 211 SOUTH AFRICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 212 SOUTH AFRICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

TABLE 213 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (USD BILLION) 2019-2028

TABLE 214 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE (KILOTONS) 2019-2028

TABLE 215 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY COMPONENT (USD BILLION) 2019-2028

TABLE 216 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY COMPONENT (KILOTONS) 2019-2028

TABLE 217 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (USD BILLION) 2019-2028

TABLE 218 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY END-USER INDUSTRY (KILOTONS) 2019-2028

TABLE 219 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (USD BILLION) 2019-2028

TABLE 220 REST OF MIDDLE EAST AND AFRICA TRADE MANAGEMENT MARKET BY DEPLOYMENT (KILOTONS) 2019-2028

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL TRADE MANAGEMENT MARKET BY COMPONENT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL TRADE MANAGEMENT MARKET BY DEPLOYMENT, USD BILLION, 2020-2029

FIGURE 10 GLOBAL TRADE MANAGEMENT MARKET BY ENTERPRISE SIZE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL TRADE MANAGEMENT MARKET BY END USER INDUSTRY, USD BILLION, 2020-2029

FIGURE 12 GLOBAL TRADE MANAGEMENT MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 NORTH AMERICA TRADE MANAGEMENT MARKET SNAPSHOT

FIGURE 15 EUROPE TRADE MANAGEMENT MARKET SNAPSHOT

FIGURE 16 SOUTH AMERICA TRADE MANAGEMENT MARKET SNAPSHOT

FIGURE 17 ASIA PACIFIC TRADE MANAGEMENT MARKET SNAPSHOT

FIGURE 18 MIDDLE EAST ASIA AND AFRICA TRADE MANAGEMENT MARKET SNAPSHOT

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 ORACLE: COMPANY SNAPSHOT

FIGURE 21 INFOR: COMPANY SNAPSHOT

FIGURE 22 THOMSON REUTERS: COMPANY SNAPSHOT

FIGURE 23 LIVINGSTON INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 24 APTEAN: COMPANY SNAPSHOT

FIGURE 25 SAP: COMPANY SNAPSHOT

FIGURE 26 NOATUM LOGISTICS: COMPANY SNAPSHOT

FIGURE 27 E2OPEN: COMPANY SNAPSHOT

FIGURE 28 DESCARTES: COMPANY SNAPSHOT

FIGURE 29 CARGOWISE: COMPANY SNAPSHOT

FIGURE 30 EXPEDITORS: COMPANY SNAPSHOT

FIGURE 31 BDP INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 32 ACCUITY: COMPANY SNAPSHOT

FIGURE 33 QAD PRECISION: COMPANY SNAPSHOT

FIGURE 34 3RDWAVE: COMPANY SNAPSHOT

FAQ

The global trade management market is expected to grow at 10.5% CAGR from 2022 to 2029. It is expected to reach above USD 2.63 billion by 2029 from USD 1.1 billion in 2022.

North America generates around 32% of the revenue. Increasing trade activity and the sizeable export and import volumes in the United States have given North America a dominant market position for trade management software. The U.S. is home to a number of significant market participants, which is credited with the industry expansion. The United States is the greatest trading nation in the world, with USD 5.6 trillion worth of goods and services imported and exported in 2019. More than USD 2.5 trillion worth of goods were imported into the United States in total in 2019. Additionally, US exports in 2019 totaled USD 1.6 trillion. Over 200 nations, regional groups, and territories have trading links with the United States.

The growth of international trade has led to an increased demand for trade management services, as companies seek to effectively manage the risks and costs associated with importing and exporting goods. The growth of e-commerce has led to an increased demand for logistics and transportation services, which in turn has driven growth in the trade management market.

Due to increased international trade among pharmaceutical businesses, the healthcare & life sciences industry is predicted to develop at the highest CAGR. It is anticipated that the dissemination of this software across industries will increase as a result of the rising import and export of capital goods, petroleum products, vehicles, raw materials, and consumer goods.

In terms of revenue generation and largest market share North America dominates the Trade management market.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.