REPORT OUTLOOK

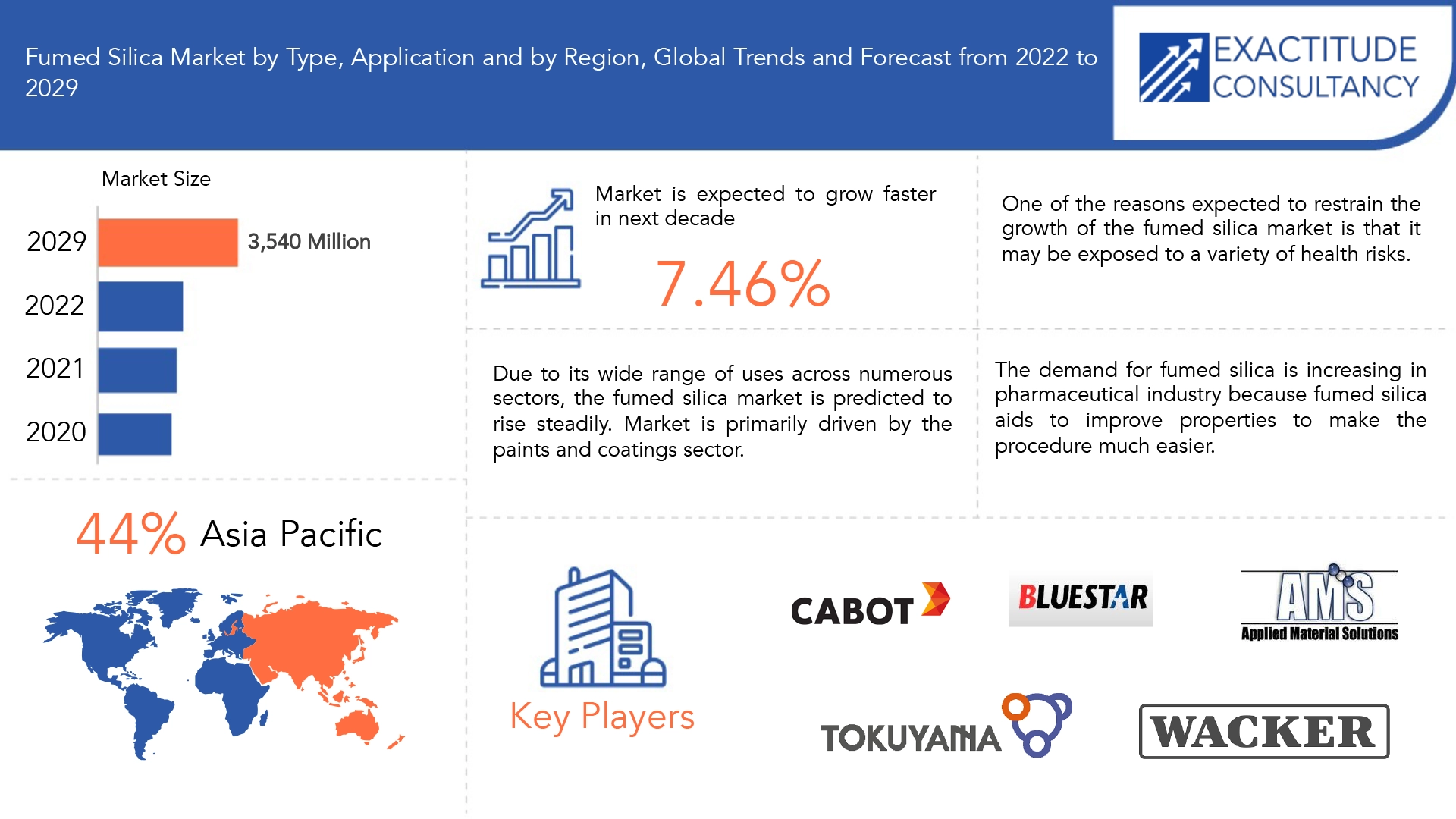

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 3540 million | 7.46% | Asia Pacific |

| By Type | By Application | By Region |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Fumed Silica Market Overview

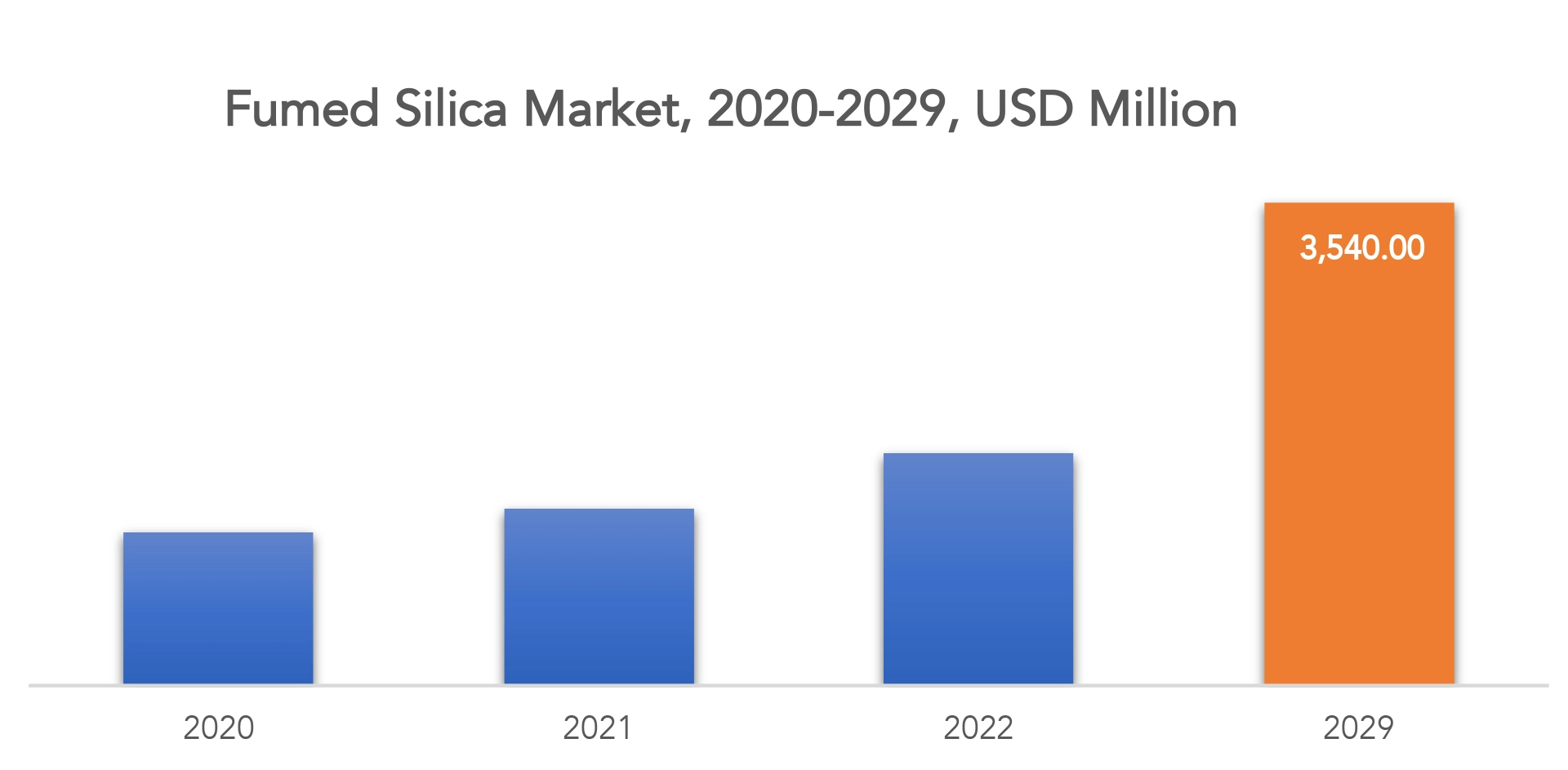

The Fumed Silica Market is expected to grow at 7.46% CAGR from 2022 to 2029. It is expected to reach above USD 3540 million by 2029.

The market for fused silica is primarily driven by the paints and coatings sector and its affordability. The market’s prediction would be hampered by a lack of awareness combined with the availability of biogenic fumed silica as a replacement. The market is expanding as a result of increased demand for water-based coatings and booming need for lubricants for industrial applications.

Due to its wide range of uses across numerous sectors, the Fumed Silica Market is predicted to rise steadily. Micron-sized amorphous silica droplets make up the synthetic substance known as “fused silica.” The main factors influencing the development of the global market are fumed silica’s rheological and reinforcing qualities. The market offers two varieties of fumed silica: hydrophilic and hydropoor fumed silica. The product is a major functional material utilized in applications such as adhesives, personal care goods, pharmaceuticals, food, and many others, supported by its adaptable qualities.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), (TONS) |

| Segmentation | By Type, By Application, By Region |

| By Type

|

|

| By Application

|

|

| By Region

|

|

The strong demand for automobile and personal care items is significantly influenced by rising consumer expenditure and the population’s continued growth, particularly in developing economies. The number of working women is increasing, which is fueling a boom in the market for skincare and cosmetics. Due to its distinctive particle features, including high surface area and purity, the fumed silica particle offers excellent performance advantages in the production of adhesives, paints, and sealants. In the expanding food and beverage business, it is also frequently utilized as an anticaking agent and thickening agent.

The beauty and personal care industries are expected to drive much of the growth in demand for fumed silica. According to consumer insights from a recent Cosmetics Europe poll, nearly 74% of consumers say that using cosmetics increases their sense of self-worth.

In addition, more than 94% of customers answered that dental care items are important in their daily lives. Fumed silica is a perfect ingredient used in many cosmetic products for skin, hair, body and dental care. Fumed silica is in demand by many major cosmetic manufacturers for its anti-aging properties.

The biggest source of the world’s rising environmental pollution and CO2 emissions is the car industry. Increased consumer awareness and government initiatives are encouraging more electric vehicle usage globally. To make cars lighter overall, automakers are constantly looking for new coatings, paints, and additives. The demand for autos, especially battery-operated vehicles, is significantly increasing globally, which is further boosting the demand for automotive coatings.

With the rise in cases of COVID-19, implementation of emergency protocols and shutdown of various operations and facilities have been observed during 2020. The outbreak of COVID-19 in Wuhan, China, has spread across the major APAC, European, and North American countries, affecting the market for fumed silica since most of the global companies have their headquarters in these countries. This impact of COVID-19 had caused disruption in the supply chain, which had slowed down the market growth due to lack of raw materials and unavailability of workforce.

Fumed Silica Market Segment Analysis

The fumed silica market is segmented based on type, application and region, global trends and forecast.

By type, the market is bifurcated into Hydrophobic, Hydrophilic. By Application (Paints and Coatings, Adhesive and Sealants, Pharmaceuticals, Personal Care, Food and Beverages, Gel Batteries, Lighting) and Region, Global trends and forecast.

Hydrophilic and hydrophobic are type segment of fumed silica market. hydrophilic fumed silica segment is leading the market by type segment. Hydrophobic segment is expected to grow at a high cagr during the forecast period. water-repellent properties of hydrophobic fumed silica have resulted into its increased use as anti-corrosive applications.

Application segment like paints and coatings, adhesive and sealants, pharmaceuticals, personal care, food and beverages, gel batteries, lighting and others dominated the market for fumed silica. This is largely driven by the increasing demand for water-based paints & coatings from the architectural and industrial applications. because of their physiological inertness, they are appropriate for application in the healthcare business, particularly in blood transfusions, artificial heart valves, and different prosthetic devices.

Fumed Silica Market Players

The fumed silica market key players include Cabot Corporation, Wacker Chemie AG, Tokuyama Corporation, China National Bluestar, Applied Material Solutions, Orisil, Cargill Inc., Agsco Corporation, Norchem, Inc., Dongyue Group Ltd., Elkem ASA, Elkon Products Inc., Dow, BASF SE, Cementec Industries Inc., Kryton International Inc., Brock White Company, LLC, Bisley & Company Pty Ltd., Rockfit Corporation, SHANGHAI TOPKEN SILICA FUME CO. LTD., Kemitura A/S.

Recent Developments

Jun. 7, 2017– Cabot Corporation and joint venture partner Inner Mongolia Hengyecheng Silicone Co., Ltd (HYC) broke ground today on their new fumed silica manufacturing facility in Wuhai, China.

WACKER Builds New Pyrogenic Silica Plant in the USA

With An Annual Capacity Of 13,000 Metric Tons, The New Production Facility For Pyrogenic Silica Supplements The Charleston Site’s Value Chain.Construction Work Is Expected To Begin In Spring Of 2017, With Completion Planned For The First Half Of 2019.

Who Should Buy? Or Key stakeholders

- Fumed Silica Suppliers

- Pharmaceutical Industry

- Organizations, forums and alliances related to Fumed Silica distribution

- Government bodies such as regulating authorities and policy makers

- Market research organizations and consulting companies

- Others

Fumed Silica Market Regional Analysis

The fumed silica market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

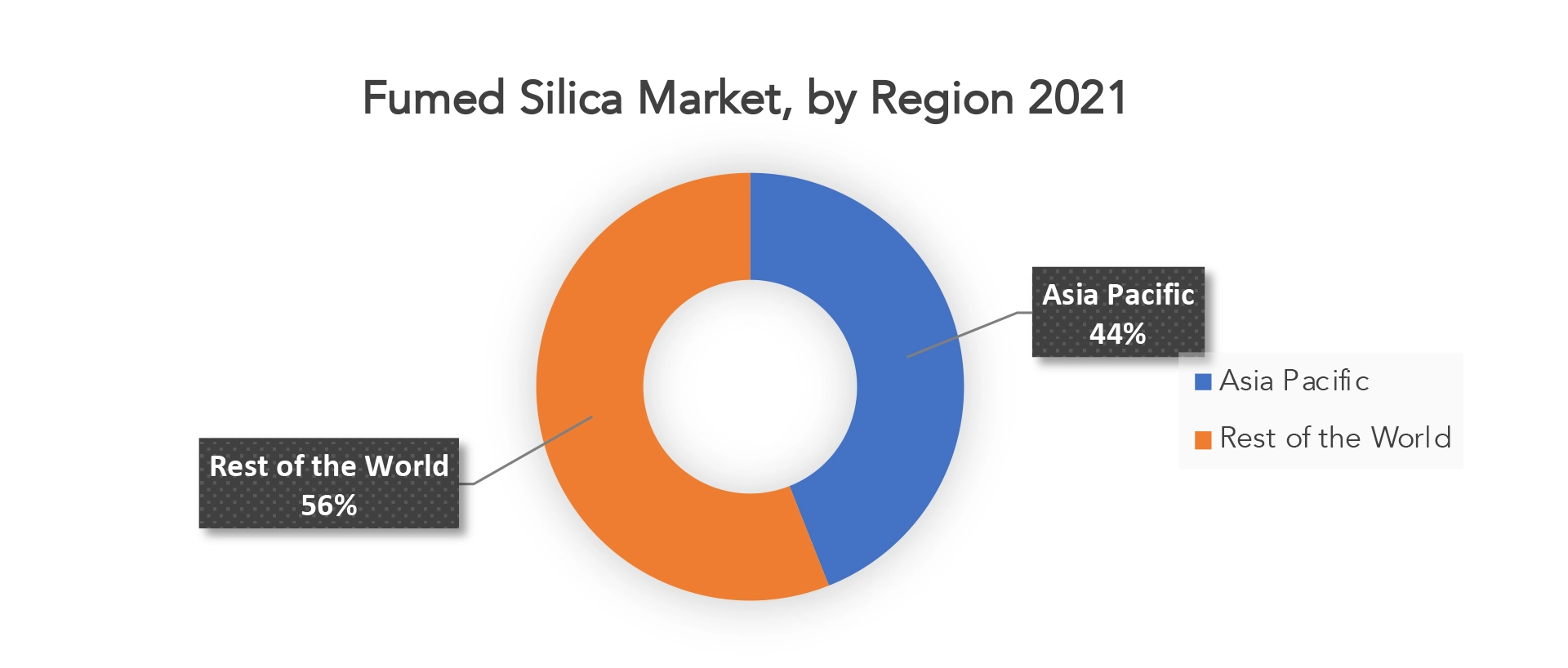

During the projected period Asia Pacific, the largest market in 2021 accounted for majority of the market. Surging use of fumed silica in paints & coatings, adhesives & sealants and gel batteries applications has led Asia Pacific as leading region in a fumed silica market. Europe is predicted to register a moderate growth.

According to global demand data, North America is the region that consumes the most fumed silica mast. The expansion of the automotive and construction sectors, which account for the majority of the demand for fumed silica in North America, are predicted to have a significant impact on the growth of the worldwide fumed silica market. In 2021, this region used around 30% of the world’s fugitive silica. The next two biggest consumers of fumed silica are Europe and Asia Pacific. Asia Pacific is the market’s top producer of fumed silica, according to production. In 2021, this area produced over 44% of the total amount of Fumed Silica produced worldwide.

Key Market Segments: Fumed Silica Market

Fumed Silica Market By Type, 2020-2029, (USD Million), (Tons)

- Hydrophobic

- Hydrophilic

Fumed Silica Market By Application, 2020-2029, (USD Million), (Tons)

- Paints And Coatings

- Adhesive And Sealants

- Pharmaceuticals

- Personal Care

- Food And Beverages

- Gel Batteries

- Lighting

Fumed Silica Market By Region, 2020-2029, (USD Million), (Tons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the Fumed Silica market?

- What are the key factors influencing the growth of Fumed Silica?

- What are the major applications for Fumed Silica?

- Who are the major key players in the Fumed Silica market?

- Which region will provide more business opportunities Fumed Silica in future?

- Which segment holds the maximum share of the Fumed Silica market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL FUMED SILICA MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON FUMED SILICA MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL FUMED SILICA MARKET OUTLOOK

- GLOBAL FUMED SILICA MARKET BY TYPE (USD MILLION, TONS)

- HYDROPHOBIC

- HYDROPHILIC

- GLOBAL FUMED SILICA MARKET BY APPLICATION (USD MILLION, TONS)

- PAINTINGS AND COATINGS

- ADHESIVE AND SEALANTS

- PHARMACEUTICALS

- PERSONAL CARE

- FOOD AND BEVERAGES

- GEL BATTERIES

- LIGHTING

- GLOBAL FUMED SILICA MARKET BY REGION (USD MILLION, TONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

8.1 CABOT CORPORATION

8.2 WACKER CHEMIE AG

8.3 TOKUYAMA CORPORATION

8.4 CHINA NATIONAL BLUESTAR

8.5 APPLIED MATERIAL SOLUTION

8.6 ORISIL

8.7 CARGILL INC.

8.8 AGSCO CORPORATION

8.9 NORCHEM, INC.

8.10 DONGYUE GROUP LTD. *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 2 GLOBAL FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 3 GLOBAL FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 4 GLOBAL FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 5 GLOBAL FUMED SILICA MARKET BY REGION (USD MILLION), 2020-2029

TABLE 6 GLOBAL FUMED SILICA MARKET BY REGION (TONS), 2020-2029

TABLE 7 NORTH AMERICA FUMED SILICA BY COUNTRY (USD MILLION), 2020-2029

TABLE 8 NORTH AMERICA FUMED SILICA BY COUNTRY (TONS), 2020-2029

TABLE 9 NORTH AMERICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 11 NORTH AMERICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 13 US FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 14 US FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 15 US FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 16 US FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 17 CANADA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 18 CANADA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 19 CANADA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 20 CANADA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 21 MEXICO FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 22 MEXICO FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 23 MEXICO FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 24 MEXICO FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 25 SOUTH AMERICA FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 26 SOUTH AMERICA FUMED SILICA MARKET BY COUNTRY (TONS), 2020-2029

TABLE 27 SOUTH AMERICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 28 SOUTH AMERICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 29 SOUTH AMERICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 30 SOUTH AMERICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 31 BRAZIL FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 32 BRAZIL FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 33 BRAZIL FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 34 BRAZIL FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 35 ARGENTINA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 36 ARGENTINA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 37 ARGENTINA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 38 ARGENTINA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 39 COLOMBIA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 40 COLOMBIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 41 COLOMBIA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 42 COLOMBIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 43 COLOMBIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 44 REST OF SOUTH AMERICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 45 REST OF SOUTH AMERICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 46 REST OF SOUTH AMERICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 47 REST OF SOUTH AMERICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 48 ASIA-PACIFIC FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 49 ASIA-PACIFIC FUMED SILICA MARKET BY COUNTRY (TONS), 2020-2029

TABLE 50 ASIA-PACIFIC FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 51 ASIA-PACIFIC FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 52 ASIA-PACIFIC FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 53 ASIA-PACIFIC FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 54 INDIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 55 INDIA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 56 INDIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 57 INDIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 58 CHINA FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 59 CHINA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 60 CHINA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 61 CHINA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 62 JAPAN FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 63 JAPAN FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 64 JAPAN FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 65 JAPAN FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 66 SOUTH KOREA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 67 SOUTH KOREA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 68 SOUTH KOREA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 69 SOUTH KOREA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 70 AUSTRALIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 71 AUSTRALIA FUMED SILICABY TYPE (TONS), 2020-2029

TABLE 72 AUSTRALIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 73 AUSTRALIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 74 SOUTH EAST ASIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 75 SOUTH EAST ASIA FUMED SILICABY TYPE (TONS), 2020-2029

TABLE 76 SOUTH EAST ASIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 77 SOUTH EAST ASIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 78 REST OF ASIA PACIFIC FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 79 REST OF ASIA PACIFIC FUMED SILICABY TYPE (TONS), 2020-2029

TABLE 80 REST OF ASIA PACIFIC FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 81 REST OF ASIA PACIFIC FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 82 EUROPE FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 83 EUROPE FUMED SILICA MARKET BY COUNTRY (TONS), 2020-2029

TABLE 84 EUROPE FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 85 EUROPE FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 86 EUROPE FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 87 EUROPE FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 88 GERMANY FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 89 GERMANY FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 90 GERMANY FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 91 GERMANY FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 92 UK FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 93 UK FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 94 UK FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 95 UK FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 96 FRANCE FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 97 FRANCE FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 98 FRANCE FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 99 FRANCE FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 100 ITALY FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 101 ITALY FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 102 ITALY FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 103 ITALY FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 104 SPAIN FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 105 SPAIN FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 106 SPAIN FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 107 SPAIN FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 108 RUSSIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 109 RUSSIA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 110 RUSSIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 111 RUSSIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 112 REST OF EUROPE FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 113 REST OF EUROPE FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 114 REST OF EUROPE FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 115 REST OF EUROPE FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY COUNTRY (TONS), 2020-2029

TABLE 118 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 119 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 120 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TECHNOLOGY (USD MILLION), 2020-2029

TABLE 121 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TECHNOLOGY (TONS), 2020-2029

TABLE 122 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 123 MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 124 UAE FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 125 UAE FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 126 UAE FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 127 UAE FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 128 SAUDI ARABIA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 129 SAUDI ARABIA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 130 SAUDI ARABIA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 131 SAUDI ARABIA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 132 SOUTH AFRICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 133 SOUTH AFRICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 134 SOUTH AFRICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 135 SOUTH AFRICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

TABLE 136 REST OF MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TYPE (USD MILLION), 2020-2029

TABLE 137 REST OF MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY TYPE (TONS), 2020-2029

TABLE 138 REST OF MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY APPLICATION (USD MILLION), 2020-2029

TABLE 139 REST OF MIDDLE EAST AND AFRICA FUMED SILICA MARKET BY APPLICATION (TONS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL FUMED SILICA BY TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL FUMED SILICA BY APPLICATION, USD MILLION, 2020-2029

FIGURE 10 GLOBAL FUMED SILICABY REGION, USD MILLION, 2020-2029

FIGURE 11 PORTER’S FIVE FORCES MODEL

FIGURE 12 GLOBAL FUMED SILICA MARKET BY TYPE, USD MILLION, 2021

FIGURE 13 GLOBAL FUMED SILICA MARKET BY APPLICATION, USD MILLION, 2021

FIGURE 14 GLOBAL FUMED SILICA MARKET BY REGION 2021

FIGURE 15 MARKET SHARE ANALYSIS

FIGURE 16 CABOT CORPORATION: COMPANY SNAPSHOT

FIGURE 17 WACKER CHEMIE AG: COMPANY SNAPSHOT

FIGURE 18 TOKUYAMA CORPORATION: COMPANY SNAPSHOT

FIGURE 19 CHINA NATIONAL BLUESTAR: COMPANY SNAPSHOT

FIGURE 20 APPLIED MATERIAL SOLUTION: COMPANY SNAPSHOT

FIGURE 21 ORISIL: COMPANY SNAPSHOT

FIGURE 22 CARGILL INC: COMPANY SNAPSHOT

FIGURE 23 AGSCO CORPORATION: COMPANY SNAPSHOT

FIGURE 24 NORCHEM, INC: COMPANY SNAPSHOT

FIGURE 25 DONGYUE GROUP LTD: COMPANY SNAPSHOT

FAQ

The global fumed silica market is growing at a CAGR of 7.46% during forecasting period 2022-2029. It is expected to reach above USD 3540 million by 2029.

Asia Pacific held more than 44% of the fumed silica market revenue share in 2021 and will witness expansion in the forecast period.

Rising demand for beauty and personal care products, and rising awareness among consumers regarding the benefits of using cosmetics and personal care products are the key factors expected to drive the market during the forecast period.

Beauty & personal care and pharmaceuticals are expected to be the leading application of Fumed Silica Market in the upcoming years.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.