REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

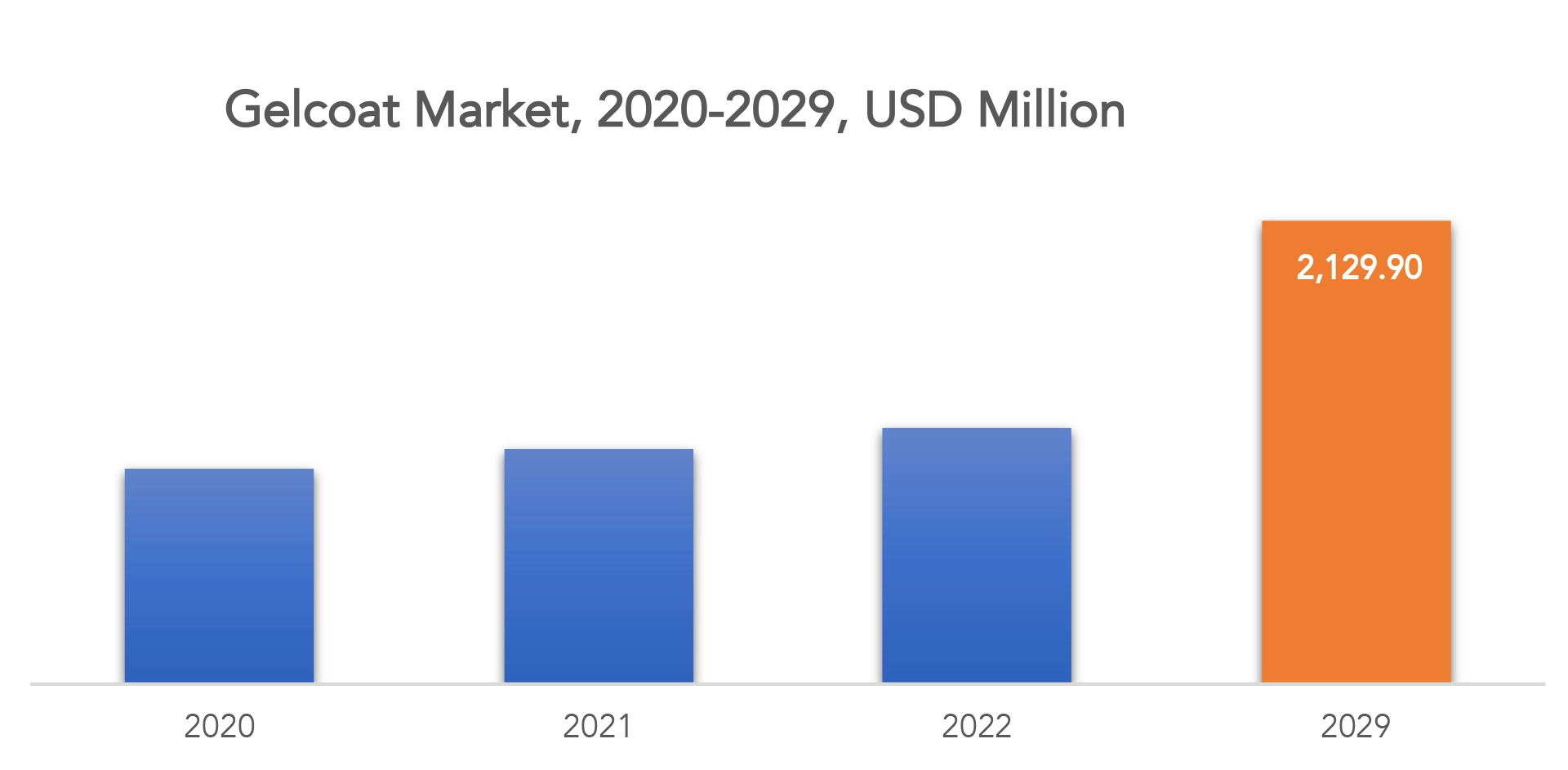

| 2129.9 million | 8.80% | North America |

| by Resin Type | by Application Pattern | by End-User Industry |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Gelcoat Market Overview

The gelcoat market is anticipated to grow at 8.80% CAGR from 2022 to 2029. It is expected to reach above USD 2129.9 million by 2029 from USD 994.9 million in 2020.

Gelcoat being a high-quality final finish on the visible surface of a fiber-reinforced composite. They are specially modified so that they can be applied to molds in the liquid state. The Gel-Coated surface happens to look glossy after curing and also it offers superior properties such as flexibility, stiffness, strength, chemical resistance, corrosion resistance, weather resistance, and UV resistance which enhances the durability of the reinforced plastics substrate. The highly viscous Gelcoat displays thixotropic behavior as well it stays on the surface. The viscosity should be at a level which is low enough to permit the coating material to be applied to the surface and suitable enough to remain there until the curing treatment can start.

Gelcoats are polishable, have high thermal resistance, abrasion resistance, are transparent, resistant to chemicals, and impact resistant. The growing need of gelcoats in transportation industry, which are mainly epoxy-based and have broad usage in marine and transportation sectors, can be proved as a driving factor for gelcoat market.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), (Kiloton) |

| Segmentation | By Resin Type, By Application Pattern, By End-User Industry, By Region |

| By Resin Type

|

|

| By Application Pattern

|

|

| By End-User Industry

|

|

| By Region

|

|

The composites used in several industries is boosting gelcoat market growth. They are used from Marine, wind- energy to sanitary waves applications. In Wind energy sector, the wind blades are made up from a mixture of fiberglass and carbon composites to enhance the stiffness of blades, hence paving way for new avenues in the gelcoat market growth. The Plasticolors and PPG with help of urethane primer, topcoat, and professional services takes a complete technical solution to the wind energy sector. The pigmented gel coat, AGC10000 Series, displays similar adhesion properties, laminated with excellent outdoor durability and dimensional stability.

Many countries operating in aerospace and wind energy industries have raised a demand for gelcoats which would have improved resistance to UV rays and fire.

These are some factors that affect the life of the product. Thus, the gelcoat manufacturers have invested heavily in the development of gelcoats with the addition of additives which would provide them with properties like fire resistance.

The inclination towards the process of closed molding can be considered as coldness for the Gelcoat Market. This is affecting the use of gel coat and the indecision in PTC is affecting the usage growth of the wind energy industry that will hamper the market growth.

Open molding is widely employed for the manufacturing of bathtubs, spas, shower stalls, and decks. The usage of open molding is decreased since few years. The guidelines issued by the government for the safety of the environment are significant challenge being faced right now. The emission of organic HAP should be under control.

The Gelcoat Market was adversely affected by the outbreak of COVID-19 pandemic. Looking through the pandemic scenario, while almost every nation had to witness lockdown to control and decrease the COVID-19 cases. This resulted the demand and supply chain of the product disrupted affecting the market globally. Due to Pandemic, the manufacturing units, infrastructural projects, industries, and various operations were put on hold. The volatile prices of raw material restricted the growth pf the market.

In the after scene of COVID-19 situation when the conditions were returning to the normal state, it meant that the market will see better growth in next few years. Also, the emergence of vaccines for COVID-19 and reopening of various recycling units would result in the re-initiation of the gelcoat market at its full-scale capacity worldwide.

Gelcoat Market Segment Analysis

The Gelcoat market is segmented based on resin type, application pattern, end-user industry and region, global trends and forecast.

Among the resin type segment, the polyester resin segment accounted for the largest revenue share in 2021 The main characteristics of polyester materials for almost all composite manufactures are cost, with performance, And more importantly, value for money. Polyester resins are cheaper as compared to Vinyl esters and Epoxy resins. As the resin constitutes 40% to 50% of the weight of a composite Component, this difference in the cost is seen as a significant impact on the value of the laminate.

The Epoxy resin’s segment is predicted to have the highest revenue growth rate during the forecast period. Epoxy resins have better adhesive properties compares to other resins. The excellent adhesion of epoxy is due to two main factors, the first is its molecular level and presence pf ether groups and polar hydroxyl which improves adhesion. And the second being physical level of epoxies. They cure with low shrinkage and many surface contacts set up between the liquid resin and the fiber not being disturbed during cure. Resulting in a better homogenous bond between resin and fibers and a better transfer of load between various components of matrix.

Among the end-user industry segment, the marine industry segment accounted for the largest revenue share in the global gelcoat market in 2020. Specially formulated coating are designed for marine applications to ensure smooth sailing and as such are used for anti-corrosion, anti-fouling and self-cleaning purposes.

The Automotive Industry segment is expected to register the highest revenue growth rate during the projected period.

Gelcoat Market Players

The Gelcoat market top competitors players include Akzo Nobel N.V., Ashland Inc., LyondellBasell Industries Holdings B.V, 3M, Sika AG , Bang & Bonsomer, Sino Polymer Co. Ltd. (, Eastman Chemical Company, Hexion, Huntsman International LLC, BASF SE, Aditya Birla Group Chemicals, Reichhold LLC, Scott Bader Company Limited, Atul Ltd, New Japan Chemical Co. Ltd., Kukdo Chemicals Co. Ltd., Anhui Xinyuan Chemical Co. Ltd., SIR Industriale, LANXESS.

Recent news->

Ashland has launched a new white gelcoat to help boat manufacturers improve the efficacy and usability of their products in demanding marine applications.

Ashland announces resin and gelcoat price increase for EMEA.

In June 2020, Scott Bader Australia Pty Ltd acquired the assets of Summit Composites Pty Ltd, distributing gelcoats, high-performance resins, and adhesives to the Australian market. This helps the company to maintain its long-term presence in the Australian composites market.

In February 2020, The Polynt Group announced that it would launch its fully-owned subsidiary, Polynt Composites Turkey. This expansion will aid the company in increasing its gelcoat business in Turkey.

Who Should Buy? Or Key stakeholders

- Suppliers and traders of Gelcoat and related products

- Government, associations, and industrial associations

- Investors and trade experts

- Consulting in chemical experts

- Can Coating Manufactures

- Marine Industry

- Flame retardant

- Transportation Industry

- Wind-Energy Industry

Gelcoat Market Regional Analysis

The Gelcoat market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

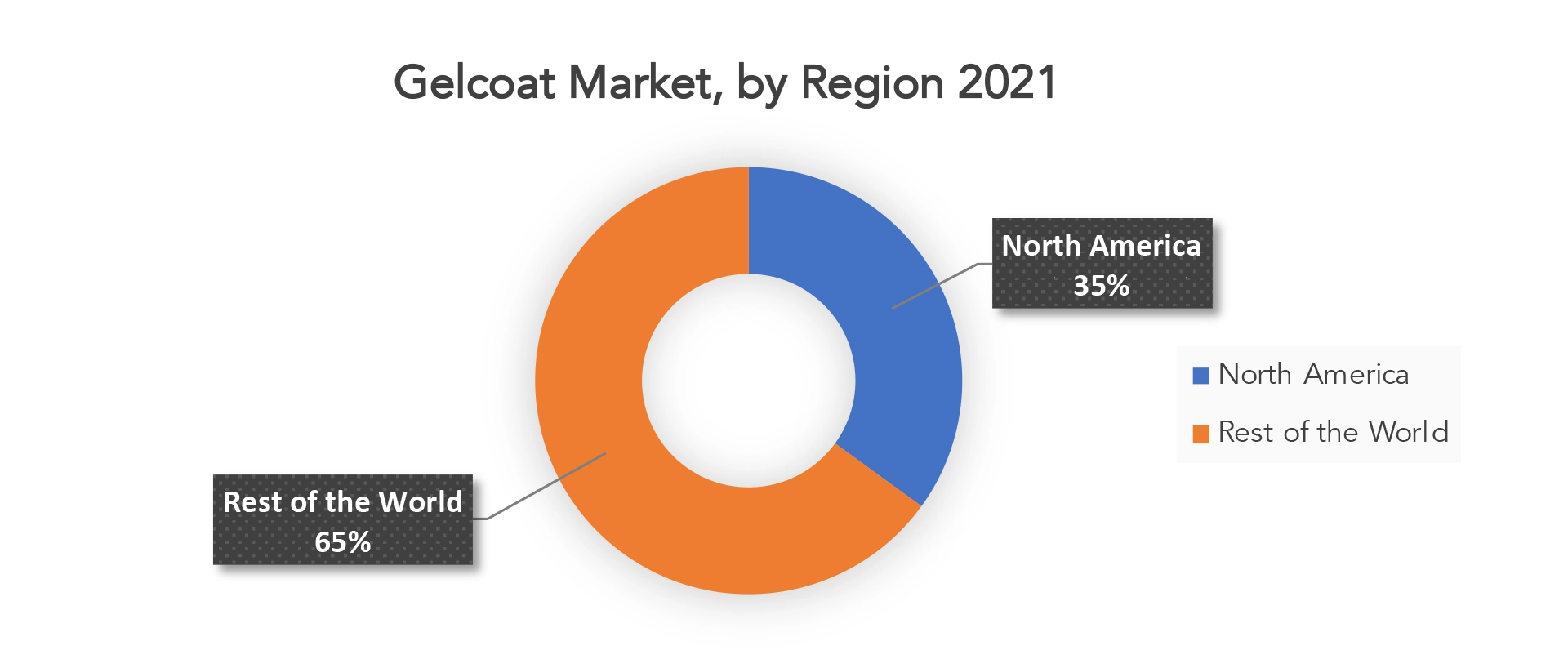

North America dominated the gelcoat market in market share revenue due to its growing marine applications, especially in US and Canada. It accounted for a significant share of the total gelcoat market in 2021. Also, the rising need for anticorrosion, water protection and anti-weather coats in the wind energy sector are some major driving forces of Gelcoat Market.

The region of Asia-Pacific registered its name as the fastest growing region during the projected period of 2022-2029. This growth is owned by the high economic growth in developing countries and the expansion of several end-user verticals in Asia-Pacific.

Europe accounted for a significant share of the market, which is seeing a resurgence in the marine industry as a result of the significant transformation of the shipbuilding industry. The demand for gelcoat in the region is driven by growing investment in the construction sector. The construction sector of Germany was anticipated to growth at a rate of 3% in 2022. The same industry in Spain is predicted to rebound strongly over the next decade, having yearly building volume to rise by 4%. As a result of the economic recovery, foreign investments, and a return of corporate confidence, the industry will improve.

South America gelcoat market is driven mainly by the demand coming from end-user industries such as construction, marine, transportation. Thus, the region also witnessed increased demand from construction sector.

Key Market Segments: Gelcoat Market

Gelcoat Market by Resin Type, 2020-2029, (USD Million), (Kiloton)

- Polyester

- Vinyl Ester

- Epoxy

Gelcoat Market by Application Pattern, 2020-2029, (USD Million), (Kiloton)

- Spray Gelcoats

- Brush Gelcoats

Gelcoat Market by End-User Industry, 2020-2029, (USD Million), (Kiloton)

- Marine

- Aviation & Transportation

- Wind Energy

- Sanitary Waves

- Construction

Gelcoat Market by Region, 2020-2029, (USD Million), (Kiloton)

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the future market size of the Gelcoat market?

- How is the gelcoat market aligned?

- What are the key factors influencing the growth of Gelcoat?

- What are the challenges in the gelcoat market?

- What are the major applications for Gelcoat?

- Who are the major key players operating in the Gelcoat market?

- Which region is the fastest-growing market for Gelcoats?

- Which segment holds the largest market share of the Gelcoat market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL GELCOAT OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON GELCOAT MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL GELCOAT OUTLOOK

- GLOBAL GELCOAT MARKET BY RESIN TYPE, (USD MILLION, KILOTONS)

- POLYESTER

- VINYL ESTER

- EPOXY

- GLOBAL GELCOAT MARKET BY APPLICATION PATTERN, (USD MILLION, KILOTONS)

- SPRAY GELCOATS

- BRUSH GELCOATS

- GLOBAL GELCOAT MARKET BY END-USER INDUSTRY, (USD MILLION, KILOTONS)

- MARINE

- AVIATION &TRANSPORTATION

- WIND ENERGY

- SANITARY WAVES

- CONSTRUCTION

- GLOBAL GELCOAT MARKET BY REGION, (USD MILLION, KILOTONS)

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AKZO NOBEL N.V.

- ASHLAND INC

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V

- 3M

- SIKA AG

- BANG & BONSOMER

- SINO POLYMER CO. LTD.

- EASTMAN CHEMICAL COMPANY

- HEXION

- HUNTSMAN INTERNATIONAL LLC

- BASF SE

- ADITYA BIRLA GROUP CHEMICALS

- REICHHOLD LLC

- SCOTT BADER COMPANY LIMITED

- ATUL LTD

- NEW JAPAN CHEMICAL CO. LTD.

- KUKDO CHEMICALS CO. LTD.

- ANHUI XINYUAN CHEMICAL CO. LTD.

- SIR INDUSTRIALE

- LANXESS *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL GELCOAT MARKET BY RESIN TYPE (USD MILLION ), 2020-2029

TABLE 2 GLOBAL GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 3 GLOBAL GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 4 GLOBAL GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 5 GLOBAL GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 6 GLOBAL GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 7 GLOBAL GELCOAT MARKET BY REGION (USD MILLION), 2020-2029

TABLE 8 GLOBAL GELCOAT MARKET BY REGION (KILOTON), 2020-2029

TABLE 9 NORTH AMERICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 10 NORTH AMERICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 11 NORTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 12 NORTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 13 NORTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 14 NORTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 15 NORTH AMERICA GELCOAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 16 NORTH AMERICA GELCOAT MARKET BY COUNTRY (KILOTON), 2020-2029

TABLE 17 US GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 18 US GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 19 US GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 20 US GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 21 US GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 22 US GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 23 CANADA GELCOAT MARKET BY RESIN TYPE (MILLION), 2020-2029

TABLE 24 CANADA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 25 CANADA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 26 CANADA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 27 CANADA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 28 CANADA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 29 MEXICO GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 30 MEXICO GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 31 MEXICO GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 32 MEXICO GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 33 MEXICO GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 34 MEXICO GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 35 SOUTH AMERICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 36 SOUTH AMERICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 37 SOUTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 38 SOUTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 39 SOUTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 40 SOUTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 41 SOUTH AMERICA GELCOAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 42 SOUTH AMERICA GELCOAT MARKET BY COUNTRY (KILOTON), 2020-2029

TABLE 43 BRAZIL GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 44 BRAZIL GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 45 BRAZIL GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 46 BRAZIL GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 47 BRAZIL GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 48 BRAZIL GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 49 ARGENTINA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 50 ARGENTINA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 51 ARGENTINA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 52 ARGENTINA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 53 ARGENTINA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 54 ARGENTINA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 55 COLOMBIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 56 COLOMBIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 57 COLOMBIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 58 COLOMBIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 59 COLOMBIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 60 COLOMBIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 61 REST OF SOUTH AMERICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 63 REST OF SOUTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 65 REST OF SOUTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 67 ASIA-PACIFIC GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 68 ASIA-PACIFIC GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 69 ASIA-PACIFIC GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 70 ASIA-PACIFIC GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 71 ASIA-PACIFIC GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 72 ASIA-PACIFIC GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 73 ASIA-PACIFIC GELCOAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 74 ASIA-PACIFIC GELCOAT MARKET BY COUNTRY (KILOTON), 2020-2029

TABLE 75 INDIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 76 INDIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 77 INDIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 78 INDIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 79 INDIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 80 INDIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 81 CHINA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 82 CHINA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 83 CHINA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 84 CHINA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 85 CHINA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 86 CHINA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 87 JAPAN GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 88 JAPAN GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 89 JAPAN GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 90 JAPAN GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 91 JAPAN GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 92 JAPAN GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 93 SOUTH KOREA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 94 SOUTH KOREA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 95 SOUTH KOREA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 96 SOUTH KOREA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 97 SOUTH KOREA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 98 SOUTH KOREA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 99 AUSTRALIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 100 AUSTRALIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 101 AUSTRALIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 102 AUSTRALIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 103 AUSTRALIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 104 AUSTRALIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 105 SOUTH EAST ASIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 107 SOUTH EAST ASIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 109 SOUTH EAST ASIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 111 REST OF ASIA PACIFIC GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 113 REST OF ASIA PACIFIC GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 115 REST OF ASIA PACIFIC GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 117 EUROPE GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 118 EUROPE GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 119 EUROPE GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 120 EUROPE GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 121 EUROPE GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 122 EUROPE GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 123 EUROPE GELCOAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 124 EUROPE GELCOAT MARKET BY COUNTRY (KILOTON), 2020-2029

TABLE 125 GERMANY GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 126 GERMANY GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 127 GERMANY GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 128 GERMANY GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 129 GERMANY GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 130 GERMANY GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 131 UK GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 132 UK GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 133 UK GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 134 UK GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 135 UK GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 136 UK GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 137 FRANCE GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 138 FRANCE GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 139 FRANCE GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 140 FRANCE GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 141 FRANCE GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 142 FRANCE GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 143 ITALY GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 144 ITALY GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 145 ITALY GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 146 ITALY GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 147 ITALY GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 148 ITALY GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 149 SPAIN GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 150 SPAIN GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 151 SPAIN GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 152 SPAIN GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 153 SPAIN GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 154 SPAIN GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 155 RUSSIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 156 RUSSIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 157 RUSSIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 158 RUSSIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 159 RUSSIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 160 RUSSIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 161 REST OF EUROPE GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 162 REST OF EUROPE GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 163 REST OF EUROPE GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 164 REST OF EUROPE GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 165 REST OF EUROPE GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 166 REST OF EUROPE GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA GELCOAT MARKET BY COUNTRY (USD MILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA GELCOAT MARKET BY COUNTRY (KILOTON), 2020-2029

TABLE 175 UAE GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 176 UAE GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 177 UAE GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 178 UAE GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 179 UAE GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 180 UAE GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 181 SAUDI ARABIA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 182 SAUDI ARABIA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 183 SAUDI ARABIA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 184 SAUDI ARABIA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 185 SAUDI ARABIA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 186 SAUDI ARABIA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 187 SOUTH AFRICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 188 SOUTH AFRICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 189 SOUTH AFRICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 190 SOUTH AFRICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 191 SOUTH AFRICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 192 SOUTH AFRICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY RESIN TYPE (USD MILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY RESIN TYPE (KILOTON), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY APPLICATION PATTERN (USD MILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY APPLICATION PATTERN (KILOTON), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY END-USER INDUSTRY (USD MILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA GELCOAT MARKET BY END-USER INDUSTRY (KILOTON), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL GELCOATBY RESIN TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL GELCOATBY APPLICATION PATTERN, USD MILLION, 2020-2029

FIGURE 10 GLOBAL GELCOATBY END-USER INDUSTRY, USD MILLION, 2020-2029

FIGURE 11 GLOBAL GELCOATBY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL GELCOATBY RESIN TYPE, USD MILLION, 2021

FIGURE 14 GLOBAL GELCOATBY APPLICATION PATTERN, USD MILLION, 2021

FIGURE 15 GLOBAL GELCOATBY END-USER INDUSTRY, USD MILLION, 2021

FIGURE 16 GELCOAT MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 AKZO NOBEL N.V.: COMPANY SNAPSHOT

FIGURE 19 ASHLAND INC.: COMPANY SNAPSHOT

FIGURE 20 LYONDELLBASELL INDUSTRIES HOLDINGS B.V: COMPANY SNAPSHOT

FIGURE 21 3M: COMPANY SNAPSHOT

FIGURE 22 SIKA AG: COMPANY SNAPSHOT

FIGURE 23 BANG & BONSOMER: COMPANY SNAPSHOT

FIGURE 24 SINO POLYMER CO. LTD.: COMPANY SNAPSHOT

FIGURE 25 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 27 HEXION: COMPANY SNAPSHOT

FIGURE 28 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 29 BASF SE: COMPANY SNAPSHOT

FIGURE 30 ADITYA BIRLA GROUP CHEMICALS: COMPANY SNAPSHOT

FIGURE 31 REICHHOLD LLC: COMPANY SNAPSHOT

FIGURE 32 SCOTT BADER COMPANY LIMITED: COMPANY SNAPSHOT

FIGURE 33 ATUL LTD: COMPANY SNAPSHOT

FIGURE 34 NEW JAPAN CHEMICAL CO. LTD.: COMPANY SNAPSHOT

FIGURE 35 KUKDO CHEMICALS CO. LTD: COMPANY SNAPSHOT

FIGURE 36 ANHUI XINYUAN CHEMICAL CO. LTD.: COMPANY SNAPSHOT

FIGURE 37 SIR INDUSTRIALE: COMPANY SNAPSHOT

FIGURE 38 LANXESS: COMPANY SNAPSHOT

FAQ

The Gelcoat market size crossed USD 994.9 million in 2020 and will observe a CAGR of more than 8.80 % up to 2029.

North America held more than 35% of the Gelcoat market revenue share in 2021.

The growing need in the construction industry is a major driver of the gelcoat market and thus it is expected to grow in the projected period. In the shelter works, the use of gelcoat is done to manufacture buildings and deliver protective barriers that would add visual appeal and increase the building’s life also providing less maintenance and long-lasting durability.

Gelcoat is one of the most common surface coatings used in the fabrication and repair of fiberglass reinforced products. It is a specially formulated two-part polyester resin which is probably the first layer of resin applied while making of a polyester or vinyl ester composite part.

The region’s largest share is in North America Region. Owing to the growing marine applications also the growing need for anticorrosion, water protection and anti-weather coats in the wind energy industry majorly drove the Gelcoat Market growth. Now Asia-Pacific Region is anticipated to be the fastest growing region in the next few years due to the high economic growth of the developing countries in the region.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.