REPORT OUTLOOK

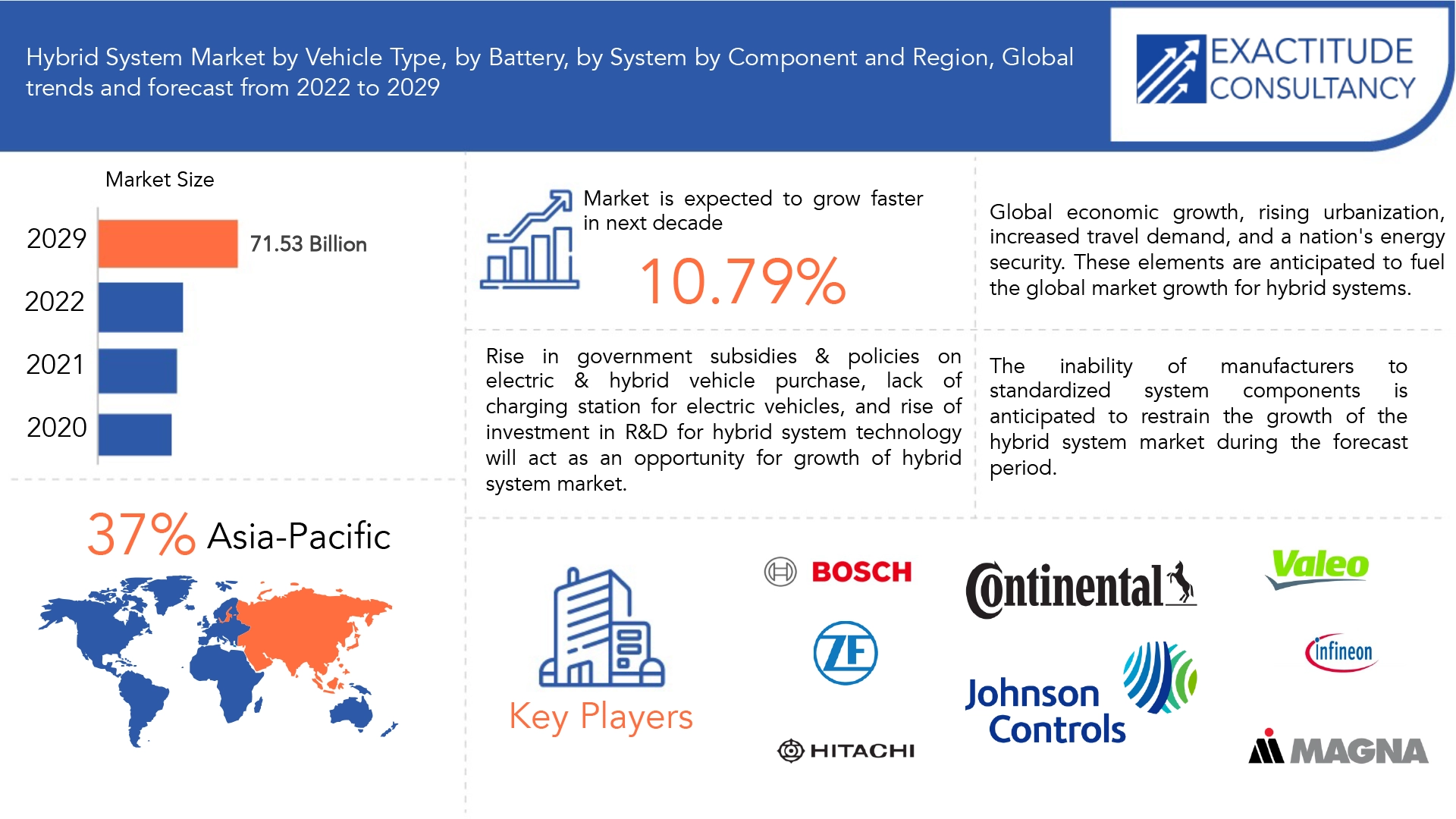

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 71.53 billion by 2029 | 10.79% | Asia-Pacific |

| By Vehicle Type | By Battery Type | By System | By Component | By Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Hybrid System Market Overview

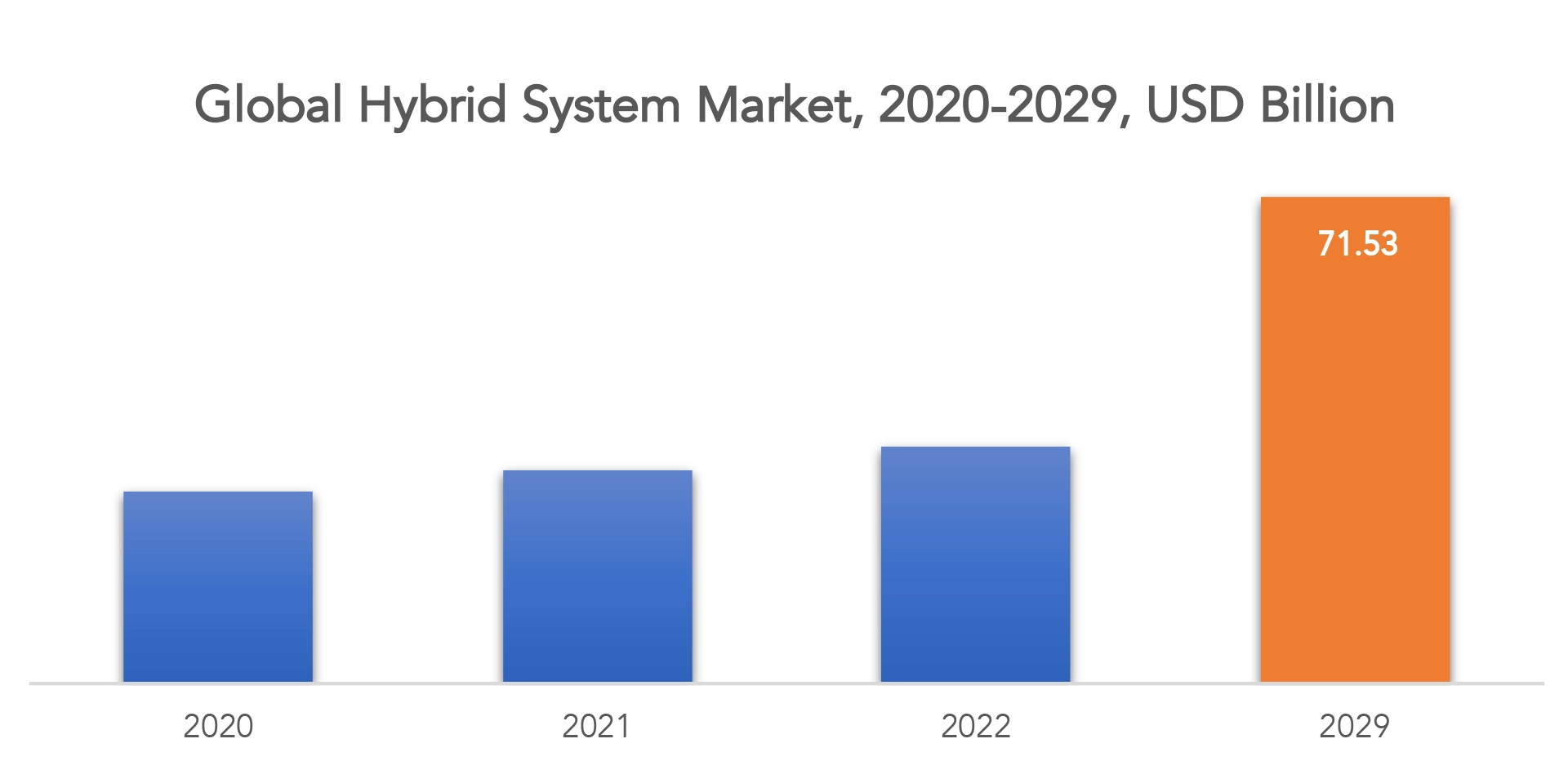

The Hybrid System Market is expected to grow at 10.79% CAGR from 2023 to 2029. It is expected to reach above USD 71.53 billion by 2029 from USD 28.44 billion in 2022.

The Hybrid System Market is a dynamical system that shows both continuous and discrete dynamic activity. It is combination of both techniques and methods of the dynamic systems. The systems that integrate neural nets and fuzzy logic, or electrical and mechanical drivelines are frequently referred as hybrid dynamical systems. These systems have various advantages like increased fuel efficiency, exclusion of mechanical linkages, low tail-pipe emission, allows greater modeling flexibility while dealing with dynamic phenomena and incorporating a broader range of systems within structure.

Parallel hybrid bus and Series hybrid bus are two different types of hybrid systems. In parallel hybrid bus the internal combustion engine (ICE) and electric motors are independently connected to the transmission, ICE gives better fuel efficiency at higher speed. In Series hybrid bus, the ICE is connected to electric generator. Hybridization has enhanced the system’s ability by boosting the durability of the system and reduced the operating expenses. The adoption of hybrid system is expected to rise in the land and sea-based industry, and commercial sector, which will boost the growth of the hybrid system market.

The growth of the market is primarily driven by increasing the demand for high fuel efficiency, high voltage applications, and government’s regulations for stringent emission and to decrease the carbon emission have forced manufacturers to adopt the hybrid and electric vehicle technology.

| ATTRIBUTE | DETAILS |

| Study period | 2023-2029 |

| Base year | 2022 |

| Estimated year | 2023 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2022 |

| Unit | Value (USD BILLION) |

| Segmentation | By Vehicle Type, By Battery Type, By System, By Component, By Region |

| By Type

|

|

| By Battery Type

|

|

| By System

|

|

| By Component

|

|

| By Region

|

|

The hybrid systems have various advantages like increased fuel efficiency, exclusion of mechanical linkages, low tail-pipe emission these factors are driving the market growth and are expected to drive the growth in forecast years. The government’s stringent rules for decreasing the carbon emission and vehicles emission are raising the demand for electric vehicles. For instance, it is crucial to introduce alternative means in the transportation sector given the commitments made by governments around the world during the COP21 Summit held in Paris to reduce emission intensity by 33–35% by 2030 from 2005 levels. This is because these commitments are expected to coincide with global economic growth, rising urbanization, increased travel demand, and a nation’s energy security. These elements are anticipated to fuel the global market growth for hybrid systems.

The market expansion for hybrid systems is being constrained by the lack of standardized hybrid technology, such as high voltage batteries. There are no existing norms or requirements for the industry. To save the cost of R&D for developing hybrid systems, components including electric motors, starter generators, and energy storage devices can be standardized. The inability of manufacturers to standardized system components is anticipated to restrain the growth of the hybrid system market during the forecast period.

Rise in government subsidies & policies on electric & hybrid vehicle purchase, lack of charging station for electric vehicles, and rise of investment in R&D for hybrid system technology will act as an opportunity for growth of hybrid system market.

The hybrid system market is reaching its pre-COVID state in short period of time, and it is expected to grow in forecast years. The COVID-19 affected various markets; hybrid system market is no exception. The lockdown has caused transportation bans and many business shutdowns which affected the global supply chain of the market. Hybrid system was an evolving sector before the pandemic since; the demand for hybrid vehicle was increasing. But COVID-19 had a positive impact on the electric vehicles market since the sales of electric vehicles has increased than the previous year which affects the sale of hybrid vehicles which in turn affects the hybrid system market.

Hybrid System Market Segment Analysis

The Hybrid System Market is segmented based on Vehicle Type, Battery Type, System, Component and Region, Global trends and forecast.

By Vehicle type, the market is bifurcated into Mild Hybrid, EV, HEV and PHEV, by Battery Type market is bifurcated into Lead Acid Battery, Lithium Ion Battery, Nickel based Battery, by System market is bifurcated into Start-Stop, Regenerative Braking, EV Drive, and e-Boost. By Component market is bifurcated into High voltage Battery, DC/AC Convertor, DC/AC Invertor and Region, Global trends.

In terms of vehicle type, the hybrid system market is segmented into Mild Hybrid, EV, HEV, and PHEV. The EV segment dominates the hybrid system market and accounts for largest share of 41% of the total market. To reduce the carbon emission the adoption of EV vehicles is growing across the world, which will eventually increase the demand contributing to the growth of hybrid system market.

In terms of battery type the market is divided into Lead Acid battery, Lithium battery, and Nickel based battery. Based on battery type the lithium ion battery holds the largest share. The lithium ion battery is popular in high voltage battery market because of its high power-to-weight ratio, good high temperature performance, high energy efficiency, and low-self-discharge. Most of the hybrid and fully electric vehicles use lithium ion batteries. The nickel based batteries holds the second place in the market.

In terms of system type the hybrid system market is segmented into Start-stop, Regenerative braking, EV drive and e-boost. The regenerative braking held the largest share of 38% in 2021. The demand for regenerative braking cars is increasing as these cars reduce the fuel usage by 10-25 %. The EV drive segment is expected to grow at 10.79% CAGR in forecast years.

In terms of components the market is divided into High voltage Battery, DC/AC Convertor and DC/AC Invertor. Based on components the high voltage battery is expected hold the largest share. High voltage battery is important and costly component in hybrid and electric vehicles. The market of high voltage battery is projected to remain largest during forecast years.

Hybrid System Market Players

The Hybrid System Market key players include Bosch, Continental, Magna International, Denso, Delphi, Johnson Controls, ZF, Valeo, Hitachi Automotive, Schaeffler, Infineon, GKN, Adgero Hybrid Systems, , Odyne Systems Llc.

Who Should Buy? Or Key Stakeholders

- Automotive & Transportation Manufacturers

- Automotive Companies

- Industrial Supplier

- Motor Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Hybrid System Market Regional Analysis

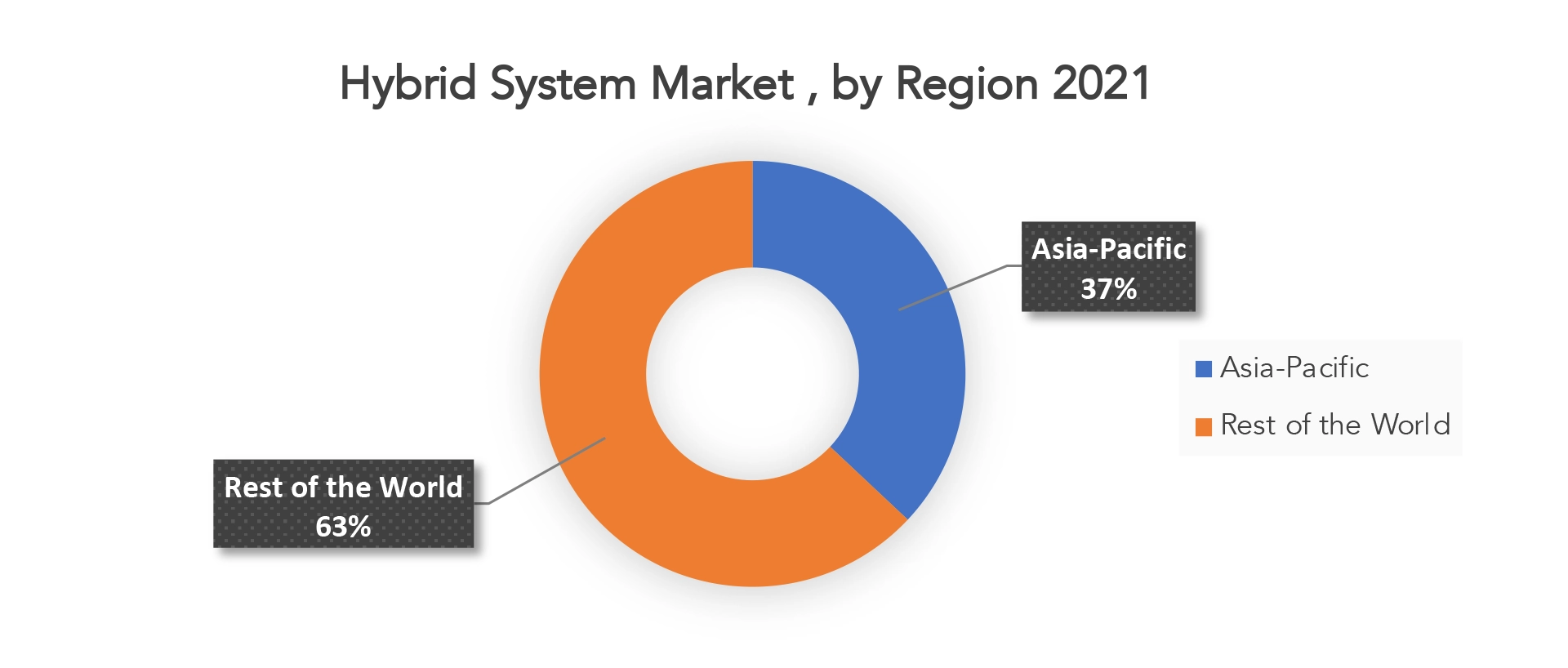

The Hybrid System Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Poland, Austria, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, Colombia, and Rest of South America

- Middle East & Africa: includes UAE, Saudi Arabia, South Africa, and Rest of MEA

Based on regions the Asia-Pacific region holds the largest market share of 37% of the global market and it is projected to grow at 10.79% CAGR during forecast period. The sales of the electric vehicles is incresing in the countries like China, India and Japan which has accelerated the maket growth. The electric vehicles in China and Japan are expected to increase in coming years. The chinese government is working on to end the production and sales of the gasoline and diesel cars and Japnese Government is initiated “Next-Generation Vehicle Strategy 2010” , which targets the eclectric vehicles market incresing elecric vehicles sales by 50% of thotal vehicles by the year 2020. Thus as electric vehicles sales is incrasing the hybrid systems market is also growing.

During the projection period, the North American region is anticipated to experience considerable growth at a CAGR of 10.79%. The U.S.’s strict corporate average fuel-economical standards, which have encouraged the use of electric and hybrid vehicles in the area, are boosting the demand for hybrid systems.

The European hybrid and electric cars market is highly copetiotive as compared to other regions due to presecnce of large number automakers within the region but demand is still at early adoption stage. In forecast years the market will show considerable growth in this region.

Key Market Segments: Hybrid System Market

Hybrid System Market By Vehicle Type, 2023-2029, (USD Billion)

- Mild Hybrid

- EV

- HEV

- PHEV

Hybrid System Market By Battery Type, 2023-2029, (USD Billion)

- Lead Acid Battery

- Lithium Ion Battery

- Nickel Based Battery

Hybrid System Market By System, 2023-2029, (USD Billion)

- Start-Stop

- Regenerative Braking

- EV Drive

- Eboost

Hybrid System Market By Component, 2023-2029, (USD Billion)

- High Voltage Battery

- Dc/Ac Convertor

- Dc/Ac Invertor

Hybrid System Market By Region, 2023-2029, (USD Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Key Question Answered

- What is the current size of the Hybrid System Market?

- What are the key factors influencing the growth of Hybrid System Market?

- What are the major applications for Hybrid System vehicles?

- Who are the major key players in the Hybrid System Market?

- Which region will provide more business opportunities for hybrid vehicles in future?

- Which segment holds the maximum share of the Hybrid System Market?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Hybrid System outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on Hybrid System market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Hybrid System outlook

- GLOBAL HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLION)

- Mild Hybrid

- EV

- HEV

- PHEV

- GLOBAL HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION)

- Lead Acid Battery

- Lithium Ion Battery

- Nickel Based Battery

- GLOBAL HYBRID SYSTEM MARKET BY SYSTEM (USD BILLION)

- Start-Stop

- Regenerative Braking

- EV Drive

- E-Boost

- GLOBAL HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION)

- High Voltage Battery

- DC/AC Convertor

- DC/AC Invertor

- GLOBAL HYBRID SYSTEM MARKET BY REGION (USD BILLIONS)

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Poland

- Austria

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Bosch

- Continental

- Magna International

- Denso

- Delphi

- Johnson Controls

- ZF

- Valeo

- Hitachi Automotive

- Schaeffler

- Infineon

- GKN

- Adgero Hybrid System

- Odyne Systems Llc.

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 3 GLOBAL HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 4 GLOBAL HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 5 GLOBAL HYBRID SYSTEM MARKET BY REGION (USD BILLIONS), 2020-2029

TABLE 6 NORTH AMERICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 7 NORTH AMERICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 9 NORTH AMERICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA HYBRID SYSTEM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 11 US HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 12 US HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 13 US HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 14 US HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 15 CANADA HYBRID SYSTEM MARKET BY VEHICLE TYPE (BILLIONS), 2020-2029

TABLE 16 CANADA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 17 CANADA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 18 CANADA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 19 MEXICO HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 20 MEXICO HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 21 MEXICO HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 22 MEXICO HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 23 SOUTH AMERICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 24 SOUTH AMERICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 25 SOUTH AMERICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 26 SOUTH AMERICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 27 SOUTH AMERICA HYBRID SYSTEM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 28 BRAZIL HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 29 BRAZIL HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 30 BRAZIL HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 31 BRAZIL HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 32 ARGENTINA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 33 ARGENTINA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 34 ARGENTINA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 35 ARGENTINA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 36 COLOMBIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 37 COLOMBIA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 38 COLOMBIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 39 COLOMBIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 40 REST OF SOUTH AMERICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 41 REST OF SOUTH AMERICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 42 REST OF SOUTH AMERICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 43 REST OF SOUTH AMERICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 44 ASIA -PACIFIC HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 45 ASIA -PACIFIC HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 46 ASIA -PACIFIC HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 47 ASIA -PACIFIC HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 48 ASIA -PACIFIC HYBRID SYSTEM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 49 INDIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 50 INDIA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 51 INDIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 52 INDIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 53 CHINA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 54 CHINA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 55 CHINA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 56 CHINA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 57 JAPAN HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 58 JAPAN HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 59 JAPAN HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 60 JAPAN HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 61 SOUTH KOREA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 62 SOUTH KOREA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 63 SOUTH KOREA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 64 SOUTH KOREA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 65 AUSTRALIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 66 AUSTRALIA HYBRID SYSTEMBY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 67 AUSTRALIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 68 AUSTRALIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 69 SOUTH EAST ASIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 70 SOUTH EAST ASIA HYBRID SYSTEMBY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 71 SOUTH EAST ASIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 72 SOUTH EAST ASIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 73 REST OF ASIA PACIFIC HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 74 REST OF ASIA PACIFIC HYBRID SYSTEMBY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 75 REST OF ASIA PACIFIC HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 76 REST OF ASIA PACIFIC HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 77 EUROPE HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 78 EUROPE HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 79 EUROPE HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 80 EUROPE HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 81 EUROPE HYBRID SYSTEM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 82 GERMANY HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 83 GERMANY HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 84 GERMANY HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 85 GERMANY HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 86 UK HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 87 UK HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 88 UK HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 89 UK HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 90 FRANCE HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 91 FRANCE HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 92 FRANCE HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 93 FRANCE HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 94 ITALY HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 95 ITALY HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 96 ITALY HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 97 ITALY HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 98 POLAND HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 99 POLAND HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 100 POLAND HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 101 POLAND HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 102 RUSSIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 103 RUSSIA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 104 RUSSIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 105 RUSSIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 106 AUSTRIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 107 AUSTRIA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 108 AUSTRIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 109 AUSTRIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 110 REST OF EUROPE HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 111 REST OF EUROPE HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 112 REST OF EUROPE HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 113 REST OF EUROPE HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 114 MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 115 MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 116 MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 117 MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 118 MIDDLE EAST ABD AFRICA HYBRID SYSTEM MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 119 UAE HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 120 UAE HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 121 UAE HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 122 UAE HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 123 SAUDI ARABIA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 124 SAUDI ARABIA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 125 SAUDI ARABIA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 126 SAUDI ARABIA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 127 SOUTH AFRICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 128 SOUTH AFRICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 129 SOUTH AFRICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 130 SOUTH AFRICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

TABLE 131 REST OF MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY VEHICLE TYPE (USD BILLIONS), 2020-2029

TABLE 132 REST OF MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY BATTERY TYPE (USD BILLION), 2020-2029

TABLE 133 REST OF MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY SYSTEM (USD BILLIONS), 2020-2029

TABLE 134 REST OF MIDDLE EAST AND AFRICA HYBRID SYSTEM MARKET BY COMPONENT (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HYBRID SYSTEMS BY VEHICLE TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL HYBRID SYSTEMS BY BATTERY TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL HYBRID SYSTEMS BY SYSTEM, USD BILLION, 2020-2029

FIGURE 11 GLOBAL HYBRID SYSTEMS BY COMPONENT, USD BILLION, 2020-2029

FIGURE 12 GLOBAL HYBRID SYSTEMS BY REGION, USD BILLION, 2020-2029

FIGURE 13 PORTER’S FIVE FORCES MODEL

FIGURE 14 HYBRID SYSTEM MARKET BY VEHICLE TYPE 2021

FIGURE 15 HYBRID SYSTEM MARKET BY BATTERY TYPE 2021

FIGURE 16 HYBRID SYSTEM MARKET BY SYSTEM 2021

FIGURE 17 HYBRID SYSTEM MARKET BY COMPONENT 2021

FIGURE 18 HYBRID SYSTEM MARKET BY REGION 2021

FIGURE 19 MARKET SHARE ANALYSIS

FIGURE 20 BOSCH: COMPANY SNAPSHOT

FIGURE 21 CONTINENTAL: COMPANY SNAPSHOT

FIGURE 22 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 23 DENSO: COMPANY SNAPSHOT

FIGURE 24 DELPHI: COMPANY SNAPSHOT

FIGURE 25 JOHNSON CONTROLS: COMPANY SNAPSHOT

FIGURE 26 ZF: COMPANY SNAPSHOT

FIGURE 27 VALEO: COMPANY SNAPSHOT

FIGURE 28 HITACHI AUTOMOTIVE: COMPANY SNAPSHOT

FIGURE 29 SCHAEFFLER: COMPANY SNAPSHOT

FIGURE 30 INFINEON: COMPANY SNAPSHOT

FIGURE 31 GKN: COMPANY SNAPSHOT

FAQ

The Hybrid System Market size was USD 31.51 billion in 2022 and will observe a CAGR of more than 10.79 % up to 2029.

Asia-Pacific held more than 35% of the Hybrid System Market revenue share in 2022 and will witness expansion in the forecast period.

Stringent emission norms, favorable government policies, and increasing sales of electric vehicles are expected to drive the demand of global hybrid system market.

Based on the battery type, the market is divided into lead acid battery, lithium-ion battery, and nickel-based battery. Lithium-ion battery is expected to capture the largest market share in the forecast period.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.