REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

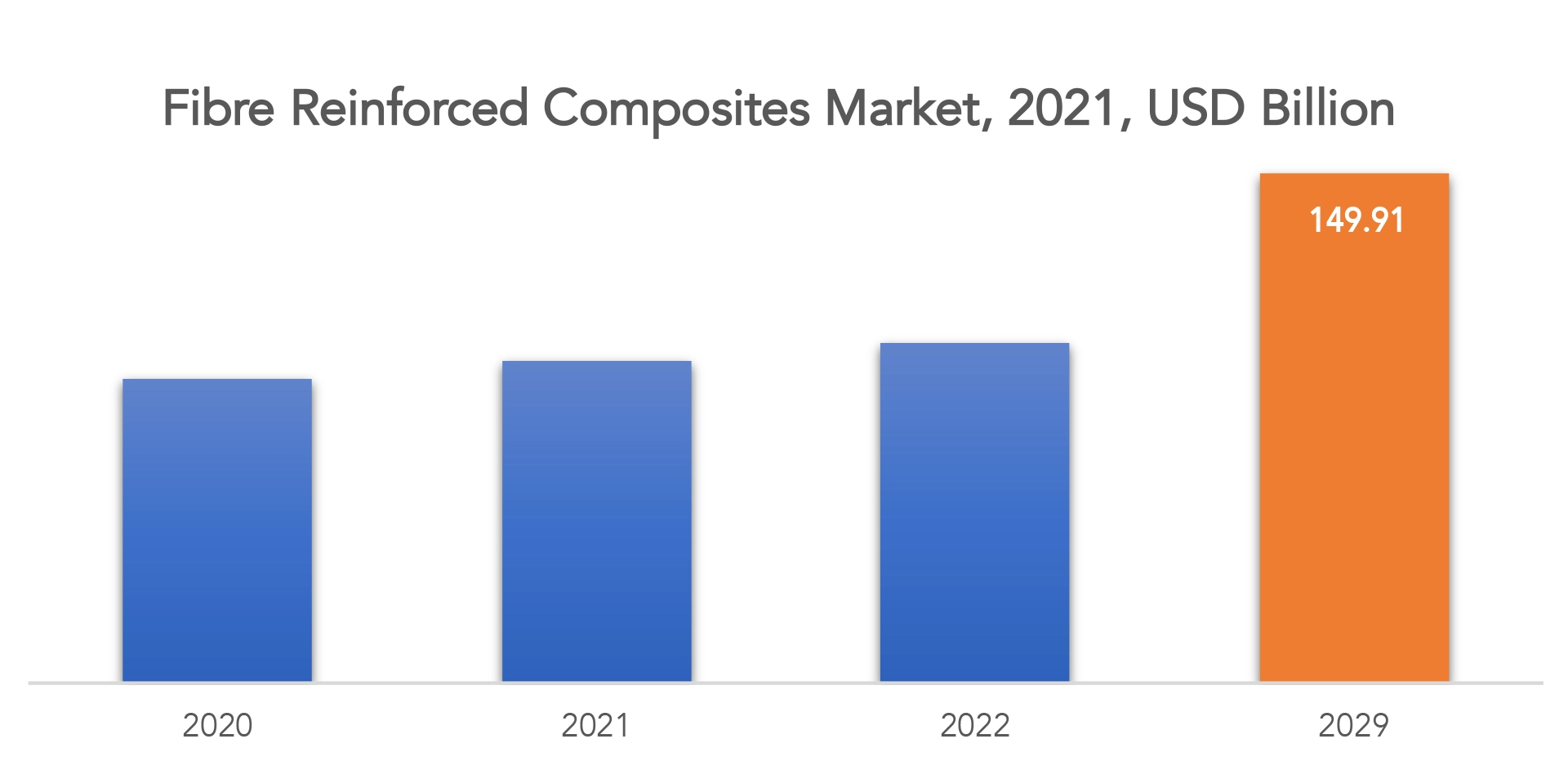

| USD 149.9 billion by 2029 | 5.9% | North America |

| By Product Type | By Resin Type | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Fiber Reinforced Composites Market Overview

The Fiber Reinforced Composites Market is expected to grow at 5.9% CAGR from 2022 to 2029. It is expected to reach above USD 149.9 billion by 2029 from USD 89.49 billion in 2020.

The global market for fiber-reinforced composites is currently dominated by the construction, automotive and aerospace industries. In the construction industry, FRC is used as a substitute for steel building structures. Polymer composites are stronger than steel and 25% lighter than steel. FRC also provides resistance to corrosion and wear.

Compared to aluminum automotive parts, FRC has better formability, higher tensile strength and lighter weight, which contributes to the safety, weight reduction and fuel efficiency of automobiles. Carbon fiber FRC is lighter than traditional steel or aluminum. They are used in the manufacture of automotive structural parts. Moreover, the growth of the global electric vehicle market is expected to boost the demand for FRC during the forecast period. The use of composite materials helps increase the range of electric vehicles by reducing powertrain weight. It also helps improve the electrical and mechanical properties of the drive system.

In addition, composites are processed into aerospace structural components that reduce aircraft weight. Airframes made from FRC are more robust and powerful. In addition, the lighter weight allows it to carry more passengers and consume less fuel. The aerospace industry is seeing innovations such as air taxis and large drones using fiber-reinforced composites.

Demand for FRC is also increasing in the wind energy market where carbon fiber composites are used to manufacture wind turbine blades.

Increasing the length of the wind turbine blades increases the efficiency of the wind turbine as it produces more wind energy.

| ATTRIBUTE | DETAILS |

| Study period | 2022-2029 |

| Base year | 2022 |

| Estimated year | 2022 |

| Forecasted year | 2023-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (KILLOTONS) |

| Segmentation | By Product Type, By Application, By End User By Region |

| By Product Type |

|

| By Resin Type |

|

| By End User |

|

| By Region |

|

The automotive and aviation industries are increasingly demanding lightweight materials that can reduce fuel consumption, extend range and minimize CO2 emissions as a result, the demand for fiber-reinforced composites in the aerospace and automotive industries is increasing.

FRC offers improved mechanical and chemical properties that are likely to improve further during the forecast period. In the field of fiber reinforced composites, research and research are being carried out to improve their properties and manufacturing processes. Therefore, new product developments and product launches are expected to bring new opportunities to the global fiber reinforced composites market during the forecast period. For example, fiber-reinforced composites market leader SABIC has launched UDMAX, a fiber-reinforced thermoplastic composite designed to replace traditional metal and thermoset sheet materials for automotive interior and exterior applications.

The pandemic has mainly hit the aerospace, construction and automotive industries. These three are the major end users of fiber reinforced composites. To contain the spread of the virus, countries such as India, Germany, the United States and China have had to shut down production facilities and restrict domestic and international travel. There has been a shift in consumer spending behavior as consumers delay new car purchases to minimize spending. This decline in car sales led to lower sales for all automakers. Declining consumer demand was reflected in quarterly sales. The industry is primarily driven by increasing financial incentives and regulatory support from governments around the world. The current natural fiber reinforced composites market is largely affected by his COVID-19 pandemic. Most projects in China, the US, Germany and South Korea have been postponed. These companies face short-term operational challenges due to supply chain constraints and inaccessibility to factories due to the COVID-19 outbreak. The spread of COVID-19 is expected to hit the Asia Pacific region hard due to the impact of the pandemic on China, Japan and India.

Fiber Reinforced Composites Market Segment Analysis

The Fiber reinforced composites market is segmented based on Fiber Type, Resin Type, End User and Region, Global trends and forecast. By fiber type, the fiber reinforced composites market is divided into carbon fibers, glass fibers, aramid fibers, and others. Based on resin type, the market is bifurcated into thermoset composites and thermoplastic composites. Based on end-user industry, the market is fragmented into building & construction, automotive, electrical & electronics, aerospace & defense, sporting goods, wind energy, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The fiberglass segment captured the largest revenue share in the global fiber-reinforced composites market in 2019. His fiberglass-based FRCs are widely used in aerospace, defense, automotive, sporting goods and wind turbine blades.

Based on resin type, the thermoset composites segment held the largest market share of fiber-reinforced composites in 2019. Thermoset fiber composites are increasingly used in the aerospace, sporting goods, wind energy and automotive industries. Thermoset composites are not deformed by heat as compared to thermoplastic composites. Therefore, they are used to create durable components.

The automotive segment held the largest revenue share in the global fiber-reinforced composites market. Fiber composites are used to manufacture structural and non-structural parts such as seat structures, bumpers, bonnets and fuel tanks. Composites for the automotive industry enable designers to improve durability, meet load-bearing requirements and reduce vehicle weight.

Fiber Reinforced Composites Market Players

The major key players of market include BASF SE, E. I. du Pont de Nemours and Company, Hexcel Corporation, Huntsman International LLC., Reliance Industries Limited, Avient Coorporation, SGL Carbon, Solvay SA, RTP Company, Enduro Composites, Inc., COTESA GmbH.

Recent Developments:

- 2022– Avient Corporation announced the release of nine new reSoundä BIO thermoplastic elastomers formulated with bio-renewable content from plants.

- 2022– Avient Corporation launched new bio-based polymer solutions for medical and pharmaceutical applications.

- 2022– Hexcel Corporation launched HexPLy,â, made from bio-derived resin content with natural fiber reinforcements.

- 2022– Hexcel Corporation and Archer Aviation entered a letter of intent covering a proposed relationship for high-performance carbon fiber material supply.

Who Should Buy? Or Key stakeholders

- Buyers and Suppliers

- Government Agencies

- Local Communities

- Providers of automotive related fields

- Research Organizations

- Investors

- Others

Fiber Reinforced Composites Market Regional Analysis

The Fiber Reinforced Composites Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America accounted for a large share of the global market in 2017. The Asia-Pacific market is projected to grow with the highest annual growth rate during the forecast period, followed by North America and Europe. In terms of market capitalization, Asia-Pacific and North America lead the global market. This trend is expected to continue during the forecast period. However, the Asia-Pacific market is expected to grow significantly from 2018 to 2026, owing to increased construction investment due to rapid industrialization and urbanization. This is expected to drive the fiber reinforced composites market in Asia Pacific during the forecast period.

Key Market Segments: Fiber reinforced composites market

Fiber Reinforced Composites Market By Fiber Type, 2020-2029, (Usd Billion), (Killotons)

- Carbon

- Glass

- Armid Fibers

- Others

Fiber Reinforced Composites Market Byresin Type, 2020-2029, (Usd Billion), (Killotons)

- Thermoset Composites

- Thermoplastic Composites

Fiber Reinforced Composites Market By End User, 2020-2029, (Usd Billion), (Killotons)

- Building And Construction

- Automotive

- Electrical And Electronics

- Aerospace And Defense

- Sporting Goods

- Wind Energy

- Others

Fiber Reinforced Composites Market By Region, 2020-2029, (Usd Billion), (Killotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Key Question Answered

- What is the current size of the Fiber reinforced composites market?

- What are the key factors influencing the growth of Fiber reinforced composites market?

- Who are the major key players in the Fiber reinforced composites market?

- Which region will provide more business opportunities Fiber reinforced composites market in future?

- Which segment holds the maximum share of the Fiber reinforced composites market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL TELEMATIC SOLUTIONS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON TELEMATIC SOLUTIONS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL TELEMATIC SOLUTIONS MARKET OUTLOOK

- GLOBAL TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION)

- PASSENGER VEHICLES

- LIGHT COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- GLOBAL TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION)

- TETHERED

- EMBEDDED

- INTEGRATED

- GLOBAL TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION)

- GOVERNMENT

- FLEET/ASSET MANAGEMENT

- INFOTAINMENT SYSTEM

- NAVIGATION & LOCATION-BASED SYSTEM

- SAFETY & SECURITY

- INSURANCE TELEMATICS

- V2X

- OTHER

- GLOBAL TELEMATIC SOLUTIONS MARKET BY REGION

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- MIX TELEMATICS

- VERIZON

- TRIMBLE

- TOMTOM INTERNATIONAL

- VISTEON

- LG ELECTRONICS

- HARMAN

- QUALCOMM TECHNOLOGIES

- INTEL

- ROBERT BOSCH

- CONTINENTAL

- ATANDT

- OMNITRACS

- AGERO

- FLEETMATICS

- DESCARTES

- INSEEGO CORPORATION*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 2 GLOBAL TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 3 GLOBAL TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 4 GLOBAL TELEMATIC SOLUTIONS MARKET BY REGION (USD BILLION), 2020-2029

TABLE 5 NORTH AMERICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 6 NORTH AMERICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA TELEMATIC SOLUTIONS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 9 US TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 10 US TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 11 US TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 CANADA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (BILLION), 2020-2029

TABLE 13 CANADA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 14 CANADA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 15 MEXICO TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 16 MEXICO TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 17 MEXICO TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 18 SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 19 SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 20 SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 21 SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 22 BRAZIL TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 23 BRAZIL TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 24 BRAZIL TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 25 ARGENTINA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 26 ARGENTINA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 27 ARGENTINA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 28 COLOMBIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 29 COLOMBIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 30 COLOMBIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 31 REST OF SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 32 REST OF SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 33 REST OF SOUTH AMERICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 34 ASIA-PACIFIC TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 35 ASIA-PACIFIC TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 36 ASIA-PACIFIC TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 37 ASIA-PACIFIC TELEMATIC SOLUTIONS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 38 INDIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 39 INDIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 40 INDIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 41 CHINA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 42 CHINA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 43 CHINA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 44 JAPAN TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 45 JAPAN TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 46 JAPAN TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 47 SOUTH KOREA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 48 SOUTH KOREA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 49 SOUTH KOREA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 50 AUSTRALIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 51 AUSTRALIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 52 AUSTRALIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 53 SOUTH EAST ASIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 54 SOUTH EAST ASIA TELEMATIC SOLUTIONSBY TYPE (THOUSAND UNITS), 2020-2029

TABLE 55 SOUTH EAST ASIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 56 SOUTH EAST ASIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 57 REST OF ASIA PACIFIC TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 58 REST OF ASIA PACIFIC TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 59 REST OF ASIA PACIFIC TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 60 EUROPE TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 61 EUROPE TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 62 EUROPE TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 63 EUROPE TELEMATIC SOLUTIONS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 64 GERMANY TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 65 GERMANY TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 66 GERMANY TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 67 UK TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 68 UK TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 69 UK TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 70 FRANCE TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 71 FRANCE TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 72 FRANCE TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 73 ITALY TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 74 ITALY TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 75 ITALY TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 76 SPAIN TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 77 SPAIN TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 78 SPAIN TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 79 RUSSIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 80 RUSSIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 81 RUSSIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 82 REST OF EUROPE TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 83 REST OF EUROPE TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 84 REST OF EUROPE TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 85 MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 86 MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 87 MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 88 MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 89 UAE TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 90 UAE TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 91 UAE TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 92 SAUDI ARABIA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 93 SAUDI ARABIA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 94 SAUDI ARABIA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 95 SOUTH AFRICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 96 SOUTH AFRICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 97 SOUTH AFRICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 98 REST OF MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY VEHICLE TYPE (USD BILLION), 2020-2029

TABLE 99 REST OF MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY FORM TYPE (USD BILLION), 2020-2029

TABLE 100 REST OF MIDDLE EAST AND AFRICA TELEMATIC SOLUTIONS MARKET BY APPLICATION (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL TELEMATIC SOLUTIONS BY VEHICLE TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL TELEMATIC SOLUTIONS BY FORM TYPE, USD MILLION, 2020-2029

FIGURE 10 GLOBAL TELEMATIC SOLUTIONS BY APPLICATION, USD MILLION, 2020-2029

FIGURE 11 GLOBAL TELEMATIC SOLUTIONS BY REGION, USD MILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 TELEMATIC SOLUTIONS MARKET BY REGION 2021

FIGURE 14 GLOBAL TELEMATIC SOLUTIONS BY VEHICLE TYPE 2021

FIGURE 15 GLOBAL TELEMATIC SOLUTIONS BY FORM TYPE 2021

FIGURE 16 GLOBAL TELEMATIC SOLUTIONS BY APPLICATION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 MIX TELEMATICS: COMPANY SNAPSHOT

FIGURE 19 VERIZON: COMPANY SNAPSHOT

FIGURE 20 TRIMBLE: COMPANY SNAPSHOT

FIGURE 21 TOMTOM INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 22 VISTEON: COMPANY SNAPSHOT

FIGURE 23 LG ELECTRONICS: COMPANY SNAPSHOT

FIGURE 24 HARMAN: COMPANY SNAPSHOT

FIGURE 25 QUALCOMM TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 26 INTEL: COMPANY SNAPSHOT

FIGURE 27 ROBERT BOSCH: COMPANY SNAPSHOT

FIGURE 28 CONTINENTAL: COMPANY SNAPSHOT

FIGURE 29 ATANDT: COMPANY SNAPSHOT

FIGURE 30 OMNITRACS: COMPANY SNAPSHOT

FIGURE 31 AGERO: COMPANY SNAPSHOT

FIGURE 32 FLEETMATICS: COMPANY SNAPSHOT

FIGURE 33 DESCARTES: COMPANY SNAPSHOT

FIGURE 34 INSEEGO CORPORATION: COMPANY SNAPSHOT

FAQ

The Fiber reinforced composites market is expected to grow at 5.9% CAGR from 2022 to 2029. It is expected to reach above USD 149.9 billion by 2029 from USD 89.49 billion in 2020.

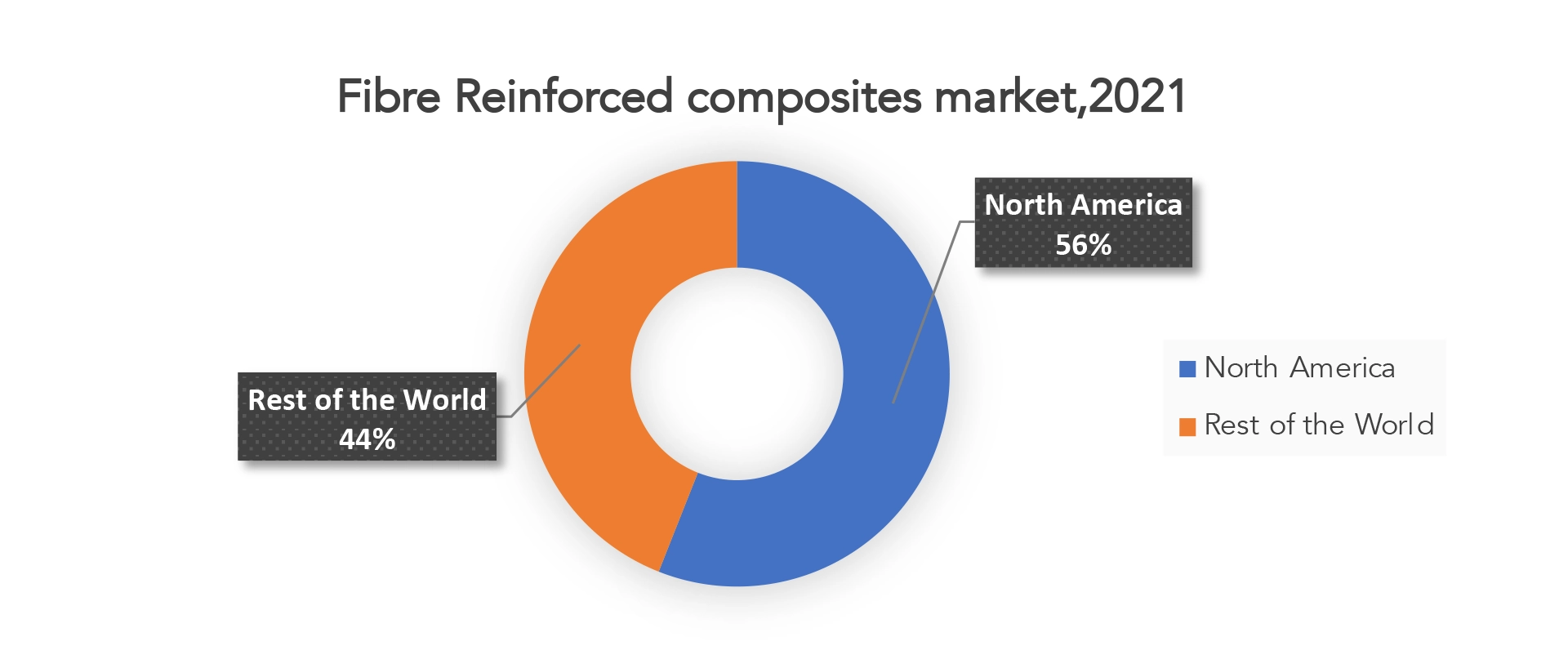

North America held more than 56% of the Fiber reinforced composites market revenue share in 2021 and will witness expansion in the forecast period.

The automotive and aviation industries are increasingly demanding lightweight materials that can reduce fuel consumption, extend range and minimize CO2 emissions. Emissions control has emerged as a major driver for the development of advanced composite materials used in automotive body sections and aircraft structural parts

North America, the largest market in 2021 accounted for more revenue generation of worldwide sales and is likely to dominate the market over the estimated period. The growth of the region is attributed to the increasing demand.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.