REPORT OUTLOOK

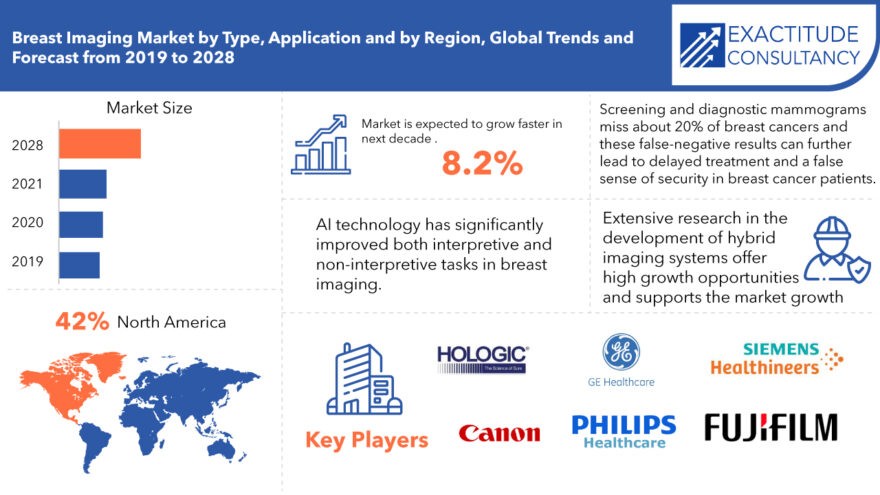

| Market Size | CAGR | Dominating Region |

|---|---|---|

| 6.76 billion | 8.2% | North America |

| Technology Segment | End-User Segment | Regions |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Breast Imaging Market Overview

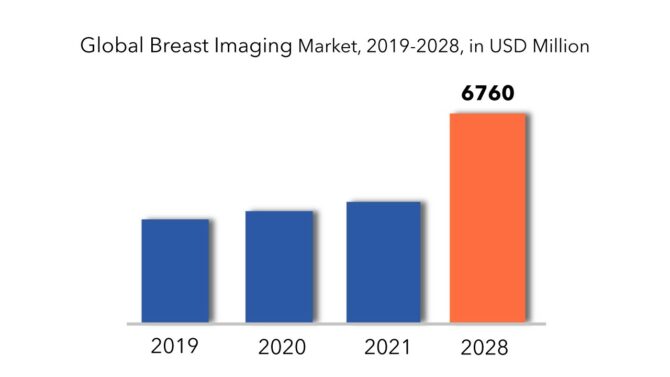

The global market of Breast imaging is expected to grow at more than 8.2% CAGR from 2020 to 2028. It is expected to reach above USD 6.76 billion by 2028 from USD 3.6 billion in 2020.

Breast imaging encompasses a variety of medical imaging techniques specifically tailored for the assessment of breast tissue. These methodologies serve the purposes of screening, diagnosis, and monitoring of breast health, particularly concerning the identification of breast cancer and related abnormalities. Common modalities include mammography, ultrasound, magnetic resonance imaging (MRI), and, to a lesser extent, molecular breast imaging (MBI) and breast-specific gamma imaging (BSGI). Each modality offers distinct advantages and may be employed independently or in conjunction, depending on factors such as patient age, risk profile, and clinical presentation.

The incidence of breast cancer is consistently rising globally, prompting a heightened demand for technologically advanced instruments focused on early detection. Governments worldwide are increasingly emphasizing awareness campaigns stressing the significance of early breast cancer detection. According to the American Cancer Society, breast cancer ranks as the second leading cause of cancer-related mortality among women worldwide. In 2020 alone, approximately 2,261,419 new cases of breast cancer were diagnosed in women, with 684,996 deaths attributed to the disease globally. Given the sustained increase in breast cancer cases annually, the demand for advanced breast imaging equipment is anticipated to escalate in the foreseeable future.

Factors such as the growing prevalence of breast cancer, technological advancements in breast imaging, and investments from various organizations in breast cancer screening programs are driving market growth. According to the World Cancer Research Fund (WCRF), global breast cancer cases are projected to reach approximately 2.1 million by 2030.

Breast Screen Australia, the government’s nationwide screening initiative, mandates free mammograms for women aged 50 to 74 every two years. Early diagnosis through breast imaging for breast cancer in its initial stages was addressed in Cancer Australia’s “Guidance for the management of early breast cancer – Recommendations and practice points,” published in September 2020.

Breast Imaging Market Segment Analysis

On the basis of Technology, Breast Imaging techniques are sub-segmented into ionizing breast imaging and non-ionizing breast imaging technologies. The non-ionizing breast imaging segment is expected to grow at a higher CAGR as compared with ionizing imaging segment during the forecast period. Growth in this segment can be attributed to the advantages offered by non-ionizing breast imaging technologies such as ability of better diagnosis of breast lesions, anatomical details for diagnosis, and higher sensitivity to small breast lesions in women with dense breast tissues.

By type, the mammography segment was the largest contributor to the ionizing breast imaging technologies market. Mammography (analogue mammography, full-field digital mammography, and 3D breast tomosynthesis), positron emission tomography-computed tomography (PET-CT), molecular breast imaging/breast-specific gamma imaging (MBI/BSGI), positron emission mammography (PEM), and cone-beam computed tomography comprise the market for ionising breast imaging technologies by type (CBCT). In 2019, mammography held the largest share of the ionising breast imaging technologies market. Its large market share can be attributed to technological advancements in this sector as well as increased awareness.

The breast ultrasound segment was the largest contributor to the non-ionizing breast imaging technologies market. Breast ultrasound, breast MRI, automated whole-breast ultrasound (AWBU), breast thermography, electric impedance tomography, and optical imaging are all non-ionizing breast imaging technologies. In 2019, the breast ultrasound segment held the largest share of the non-ionizing breast imaging technologies market, while the AWBU segment is expected to grow at the second-fastest rate during the forecast period. The large share of the breast ultrasound segment can be attributed to the lower risk of radiation exposure and the benefits provided by breast ultrasound, such as the ability to detect lesions and the nature of lesions in women with dense breast tissues, the ability to distinguish between a cyst and a solid mass, and the detection of blood flow through vessels.

Key End-Users are Hospitals & Clinics, Specialty Centers, and Diagnostic Imaging Centers. The hospitals and clinics segment is expected to hold the largest market share. Well-equipped operating & diagnostic rooms, presence of highly skilled healthcare professionals, ease in accessibility, and better health coverage from various private and group insurance companies are factors to drive this end user segment.

Breast Imaging Market Key Market Players

Companies in this space are actively working on strategies like new technology development and increasing presence in emerging economies. Product approval and launches, acquisition, partnerships and agreements are the most widely adopted growth strategies by market players. There is moderate competition in the market as every market player is trying to get the maximum share of revenue in this growth area. Few of the important market players include Koninklijke Philips N.V., GE Healthcare, Siemens Healthcare, Fujifilm Holdings Corporation, Hologic, Inc., Dilon Technologies, Inc.

Who Should Buy? Or Key stakeholders

- Medical Technology Companies

- Healthcare and Medical Device Consulting firms

- Research Organizations

- Medical Devices manufacturers

- Regulatory Authorities

- Others

Breast Imaging Market Regional Analysis

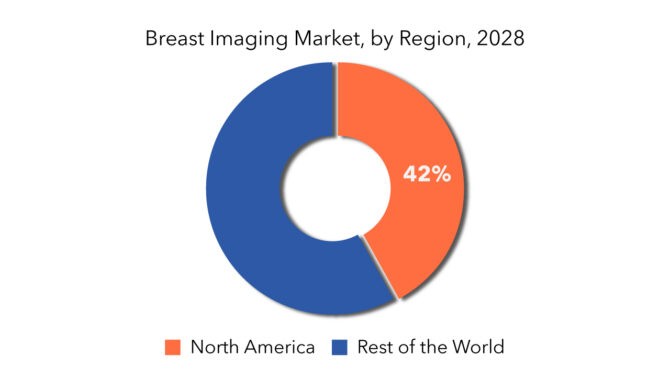

By Region, North America captured the largest market share of the global breast imaging market in 2019, followed by Europe and Asia-Pacific. The large share of this market is largely attributed to the well-established healthcare system, greater adoption of advanced technologies, and growing prevalence of breast cancer. However, emerging economies specifically in the Asia Pacific, South America are expected to witness a very high growth rate in the Breast Imaging market during the forecast period due to growing government focus on the healthcare sector, rising prevalence of breast tumor, increasing health insurance penetration, and female aging population in the region.

Key Market Segments: Breast Imaging Market

Technology Segment, 2019-2025, (in USD million)

- Mammography (FFDM, Digital & 3D Mammography)

- Molecular Breast Imaging (MBI)/Molecular Breast-Specific Gamma Imaging (BSGI)

- PET-CT

- Contrast-Enhanced Spectral Mammography (CESM)

- Cone Beam Computed Tomography (CBCT)

- Automated Breast Ultrasound (ABUS)

- Breast MRI

- Breast Thermography

- Optical Imaging

- Electrical Impedance Imaging (EIT)

End-User Segment, 2019-2025, (in USD million)

- Hospitals & Clinics

- Specialty Centers

- Diagnostic Imaging Centers

Regions, 2019-2025, (in USD million)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Important countries in all regions are covered

Key Question Answered

- What is the current market size of this high-growth market?

- What is the overall growth rate?

- What are the key growth areas, applications, end uses and types?

- Key reasons for the growth

- Challenges for growth

- Who are the important market players in this market?

- What are the key strategies of these players?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET DYNAMICS

- MARKET SEGMENTATION

- REPORT TIMELINES

- KEY STAKEHOLDERS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT MATTER EXPERT ADVICE

- QUALITY CHECK

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA MINING

- EXECUTIVE SUMMARY

- INTRODUCTION

- GLOBAL BREAST IMAGING MARKET BY TECHNOLOGY

- GLOBAL BREAST IMAGING MARKET BY END USER

- GLOBAL BREAST IMAGING MARKET BY REGION

- MARKET DYNAMICS

- DRIVERS

- FACTORS HELPING IN GROWTH OF THE MARKET

- RESTRAINTS

- FACTORS AFFECTING THE MARKET GROWTH NEGATIVELY

- INDUSTRY VALUE CHAIN

- MANUFACTURER

- DISTRIBUTOR

- END USER

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- DRIVERS

- BREAST IMAGING MARKET BY TECHNOLOGY

- INTRODUCTION

- MAMMOGRAPHY (FFDM, DIGITAL & 3D MAMMOGRAPHY)

- MOLECULAR BREAST IMAGING (MBI)/MOLECULAR BREAST-SPECIFIC GAMMA IMAGING (BSGI)

- PET-CT

- CONTRAST-ENHANCED SPECTRAL MAMMOGRAPHY (CESM)

- CONE BEAM COMPUTED TOMOGRAPHY (CBCT)

- AUTOMATED BREAST ULTRASOUND (ABUS)

- BREAST MRI

- BREAST THERMOGRAPHY

- OPTICAL IMAGING

- ELECTRICAL IMPEDANCE IMAGING (EIT)

- INTRODUCTION

- GLOBAL BREAST IMAGING MARKET BY TYPE

- GLOBAL BREAST IMAGING MARKET BY END USER

- INTRODUCTION

- HOSPITALS & CLINICS

- SPECIALTY CENTERS

- DIAGNOSTIC IMAGING CENTERS

- INTRODUCTION

- BREAST IMAGING MARKET BY REGION

- INTRODUCTION

- GLOBAL BREAST IMAGING MARKET BY REGION

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- ASIA-PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- COMPETITIVE LANDSCAPES

- MERGERS, ACQUISITIONS, JOINT VENTURES, COLLABORATIONS, AND AGREEMENTS

- KEY DEVELOPMENT

- MARKET SHARE

- STRATEGIES ADOPTED BY LEADING PLAYERS

- MERGERS, ACQUISITIONS, JOINT VENTURES, COLLABORATIONS, AND AGREEMENTS

- COMPANY PROFILES

- KONINKLIJKE PHILIPS N.V

- BUSINESS OVERVIEW

- COMPANY SNAPSHOT

- PRODUCTS OFFERED

- KEY DEVELOPMENT

- GE HEALTHCARE

- SIEMENS HEALTHCARE

- FUJIFILM HOLDINGS CORPORATION

- HOLOGIC, INC.

- SONOCINE, INC.

- DILON TECHNOLOGIES, INC.

- AURORA HEALTHCARE US CORP.

- ALLENGERS

- PLANMED OY

- DELPHINUS MEDICAL TECHNOLOGIES, INC.

- OTHERS

- KONINKLIJKE PHILIPS N.V

- FUTURE OPPORTUNITIES AND TRENDS

- FUTURE MARKET OPPORTUNITIES AND TRENDS

List of Tables

TABLE 1 GLOBAL Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 2 GLOBAL Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 3 GLOBAL Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 4 GLOBAL Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 5 GLOBAL Catheters MARKET BY REGION (USD MILLIONS) 2019-2028

TABLE 6 GLOBAL Catheters MARKET BY REGION (THOUSAND UNITS) 2019-2028

TABLE 7 US Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 8 US Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 9 US Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 10 US Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 11 CANADA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 12 CANADA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 13 CANADA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 14 CANADA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 15 MEXICO Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 16 MEXICO Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 17 MEXICO Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 18 MEXICO Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 19 BRAZIL Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 20 BRAZIL Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 21 BRAZIL Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 22 BRAZIL Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 23 ARGENTINA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 24 ARGENTINA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 25 ARGENTINA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 26 ARGENTINA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 27 COLOMBIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 28 COLOMBIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 29 COLOMBIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 30 COLOMBIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 31 REST OF SOUTH AMERICA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 32 REST OF SOUTH AMERICA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 33 REST OF SOUTH AMERICA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 34 REST OF SOUTH AMERICA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 35 INDIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 36 INDIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 37 INDIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 38 INDIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 39 CHINA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 40 CHINA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 41 CHINA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 42 CHINA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 43 JAPAN Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 44 JAPAN Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 45 JAPAN Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 46 JAPAN Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 47 SOUTH KOREA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 48 SOUTH KOREA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 49 SOUTH KOREA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 50 SOUTH KOREA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 51 AUSTRALIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 52 AUSTRALIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 53 AUSTRALIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 54 AUSTRALIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 55 SOUTH-EAST ASIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 56 SOUTH-EAST ASIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 57 SOUTH-EAST ASIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 58 SOUTH-EAST ASIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 59 REST OF ASIA PACIFIC Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 60 REST OF ASIA PACIFIC Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 61 REST OF ASIA PACIFIC Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 62 REST OF ASIA PACIFIC Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 63 GERMANY Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 64 GERMANY Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 65 GERMANY Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 66 GERMANY Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 67 UK Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 68 UK Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 69 UK Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 70 UK Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 71 FRANCE Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 72 FRANCE Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 73 FRANCE Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 74 FRANCE Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 75 ITALY Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 76 ITALY Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 77 ITALY Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 78 ITALY Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 79 SPAIN Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 80 SPAIN Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 81 SPAIN Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 82 SPAIN Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 83 RUSSIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 84 RUSSIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 85 RUSSIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 86 RUSSIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 87 REST OF EUROPE Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 88 REST OF EUROPE Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 89 REST OF EUROPE Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 90 REST OF EUROPE Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 91 UAE Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 92 UAE Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 93 UAE Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 94 UAE Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 95 SAUDI ARABIA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 96 SAUDI ARABIA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 97 SAUDI ARABIA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 98 SAUDI ARABIA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 99 SOUTH AFRICA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 100 SOUTH AFRICA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 101 SOUTH AFRICA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 102 SOUTH AFRICA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

TABLE 103 REST OF MIDDLE EAST AND AFRICA Catheters MARKET BY TECHNOLOGY (USD MILLIONS) 2019-2028

TABLE 104 REST OF MIDDLE EAST AND AFRICA Catheters MARKET BY TECHNOLOGY (THOUSAND UNITS) 2019-2028

TABLE 105 REST OF MIDDLE EAST AND AFRICA Catheters MARKET BY END USER (USD MILLIONS) 2019-2028

TABLE 106 REST OF MIDDLE EAST AND AFRICA Catheters MARKET BY END USER (THOUSAND UNITS) 2019-2028

List of Figures

- Market Scope and Definition

- Market Size Estimation: Top-Down Approach

- Market Size Estimation: Bottom-Up Approach

- Data triangulation methodology

- Key factors considered for forecasts

- Primary respondent types

- Value Chain Analysis

- Porter’s Five Forces Analysis

- Breast Imaging Market, By Technology, 2019 & 2028 (USD Million)

- Breast Imaging Market, By End User, 2019 & 2028 (USD Million)

- Breast Imaging Market, By Region, 2019 & 2028

- Global Breast Imaging Market Snapshot

- North America Breast Imaging Market Snapshot

- Europe Breast Imaging Market Snapshot

- Asia Pacific Breast Imaging Market Snapshot

- South America Breast Imaging Market Snapshot

- Middle East & Africa Breast Imaging Market Snapshot

- Product Benchmarking

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.