REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 51.59 billion by 2029 | 11.7% | Asia Pacific |

| By Product | By Application | By End Use | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Cell Culture Market Overview

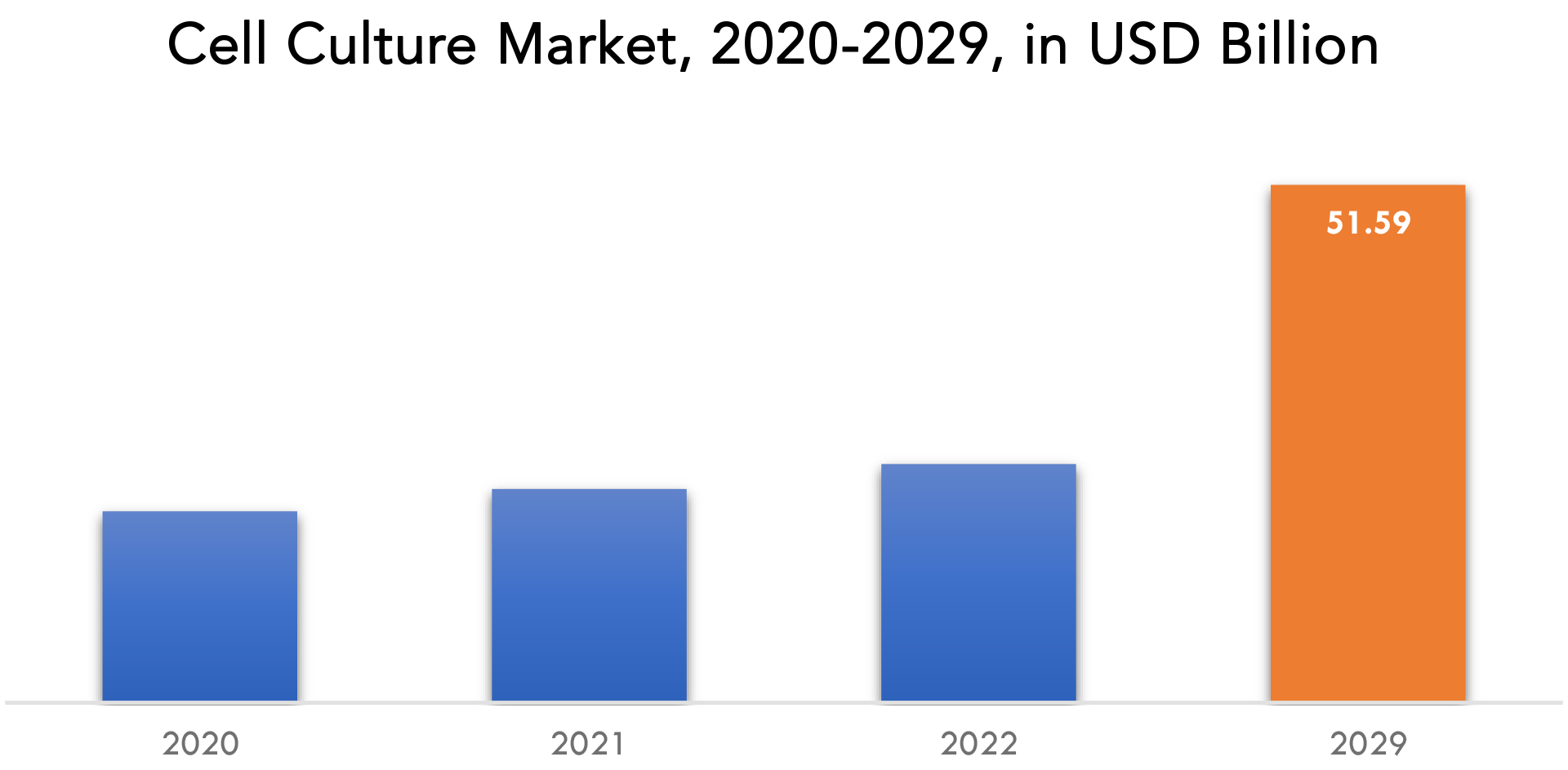

The cell culture market is expected to grow at 11.7% CAGR from 2023 to 2029. It is expected to reach above USD 51.59 billion by 2029 from USD 19.07 billion in 2022.

The technique of taking cells from an animal or plant source and growing them later under controlled circumstances is known as cell culture (in vitro). In addition, this artificial environment contains nutrients that are necessary for cell growth and multiplication, such as the right temperature, gases, pH, and humidity. Before culture, cells from the tissues can be removed mechanically or enzymatically. The cells that need to be cultivated can also come from an established cell line or cell strain.

Cell cultures are used to create biological products like recombinant proteins or antibodies or for in vitro tests. The culture media is typically supplemented with blood or a variety of specified chemicals to promote optimal cell growth.

Cell culture is the controlled cultivation of nucleated (eukaryotic) cells in a laboratory setting. Only in cell culture may infectious pathogens be isolated that need to replicate in living host cells. Cell culture is no longer commonly used for routine clinical diagnostic purposes due to the development of molecular diagnostic assays based on nucleic acid detection, as a result of the lengthy turnaround times (days to weeks), high cost, and requirement for significant technical expertise to perform cell culture and interpret results.

Global demand for 3D cell culture technology is growing as a result of recent advances in proteomic gene expression, innovative biopharmaceuticals, and vaccine development. The global cell culture market is expanding due to the increased incidence of cancer, the expansion of cancer research initiatives, and enhanced gene therapy applications. The market for cell culture is expanding thanks to the existence of numerous contract manufacturing and research companies. The prevalence of chronic diseases among the world’s population is increasing, which has drawn funding for cytology and biology research studies.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), (Kilotons) |

| Segmentation | By Product, By Application, By End use, By Region |

| By PRODUCT

|

|

| By Application

|

|

| By Region

|

|

Global demand for vaccines is anticipated to be fueled by the rising prevalence of infectious illnesses and the rising risk of pandemics. Cell culture has emerged as a significant component of vaccine development in the pharmaceutical business. To create vaccinations against rotavirus, polio, smallpox, hepatitis, rubella, and chickenpox, cell culture technology was employed. Additionally, many European nations and the US have approved the use of cell-based influenza vaccinations. The main elements anticipated to boost the growth of the cell culture market during the forecast period are rising awareness of the advantages of cell culture-based vaccinations and the regulatory approval of numerous cell culture-based vaccines globally.

The use of 3D cell cultures is more expensive to establish, and results are not always predictable. Lack of consistency will continue to be a significant market problem until they start. Additionally, it is anticipated that a scarcity of qualified labor and high technology costs will limit industry growth. Due to the fact that animal cells grow more slowly than many common pollutants, cell culture techniques require highly competent staff and careful asepsis procedures (e.g., bacteria, viruses and fungi).

The fundamental benefit of employing a batch of clonal cells is the uniformity and repeatability of the results. Cell cultures can precisely manage their physicochemical environment, including pH, temperature, osmotic pressure, oxygen tension, and carbon dioxide tension, as well as their physiological state, which can be monitored regularly.

Due to the crucial role cell culture technology played in the identification of innovative diagnostic and treatment options for the disease, the COVID-19 pandemic has increased the need for cell culture goods. For instance, studies targeted at understanding the mechanism of viral entry into host cells and high-throughput COVID-19 drug screening to identify new treatment candidates are anticipated to have a favorable impact on the market’s growth. Additionally, culturing methods provide crucial resources for the creation of viral particles for vaccine research, expanding the field’s growth prospects.

The enormous amount of money needed for cell culture research, followed by proving its efficacy, manufacture, and distribution, will impede the expansion of the market for cell culture products worldwide.

Cell Culture Market Segment Analysis

The cell culture market is segmented based on product, applications and end user and Region, Global trends and forecast.

By type, the market is bifurcated into by product (equipment, consumables, ice), by application (cancer research, gene therapy, tissue culture, bioproduction, vaccines), by end use (research, pharma, hospitals, laboratories) and region, global trends and forecast.

In terms of Product, the consumables category dominated the worldwide cell culture market in terms of product. The financing for cell-based research has increased, which has greatly encouraged the use of consumables. One of the main causes of the increased demand for consumables worldwide is the quickly expanding number of biopharmaceutical firms, contract manufacturers, contract research organizations, and academic research institutes. Significant market expansion is being driven by the escalating demand for equipment among cell culture application development companies and research facilities. The adoption of automation and robots is anticipated to improve output and accelerate market expansion in the near future.

Based on applications, the cell culture market’s largest portion belongs to the bioproduction sector. The use of cell culture goods for research and commercial bioproduction, the rising demand for pharmaceutical and biopharmaceutical products, and the accessibility of funding for research activities are the main drivers of this segment’s substantial market share. Applications of the technology in vaccine production are projected to have a favorable impact on industry growth given the COVID-19 pandemic’s acceleration of vaccine approval procedures and significant investments in vaccine production.

Cell Culture Market Players

Key companies in the global market include Bio-Radd laboratories, thermo fisher scientific inc, merck KGaA, VWR international LLC, Eppendorf SE, BioSpherixltd, becton, bio-techne corporation, cytiva, lonza group, avantor inc, agilent technologies.

06-02-2023: – Thermo Fisher Scientific, the world leader in serving science, and Celltrio, a leading manufacturer of robotics-based solutions for the life sciences industry, have announced their collaboration to bring a fully automated cell culture system to biotherapeutics customers.

24-01-2023: – Thermo Fisher Scientific partners with AstraZeneca to develop solid tissue and blood-based companion diagnostic test for tagrisso.

Who Should Buy? Or Key Stakeholders

- Cell Culture Suppliers

- Hospitals

- Laboratories

- Vaccines lab

- Investors

- Research

- Others

Cell Culture Market Regional Analysis

The cell culture market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

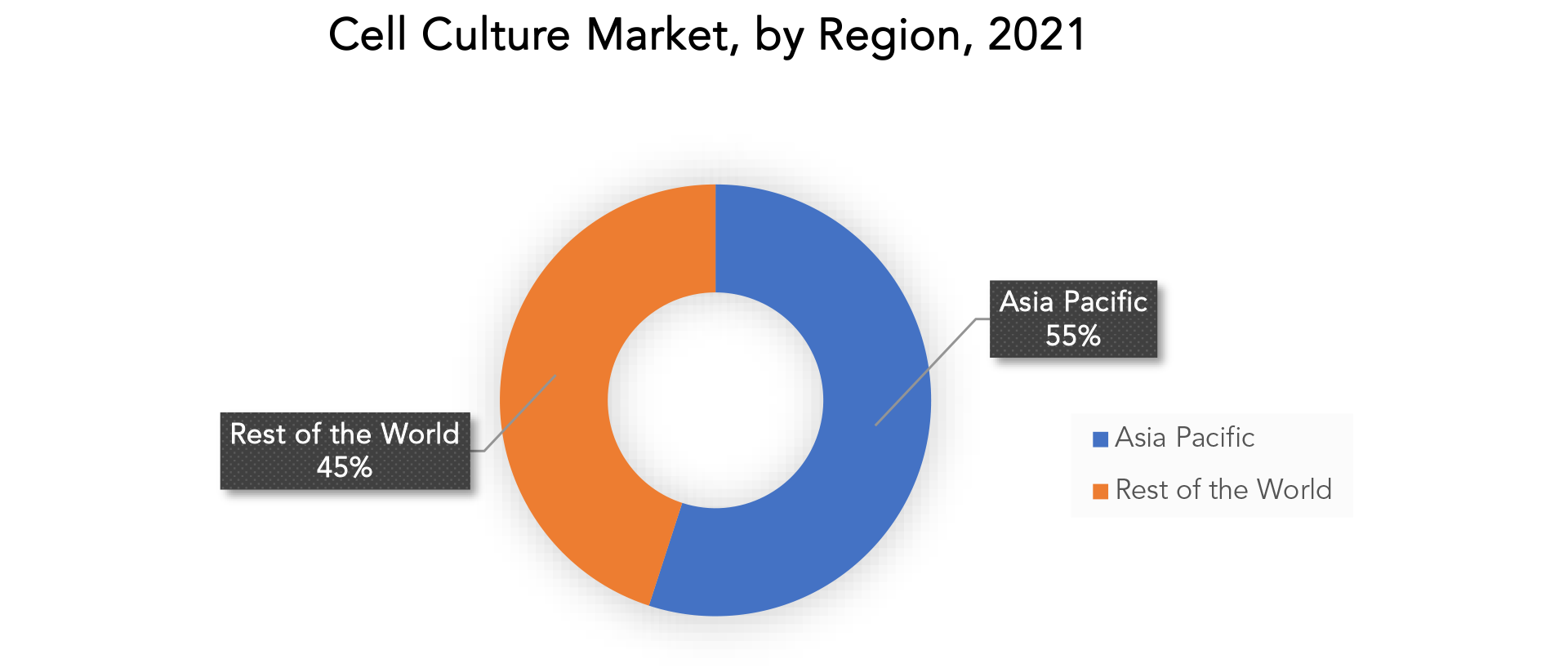

During the projected period, Asia Pacific is the largest market in 2021 accounted for 55% revenue generation of worldwide sales. It is due to advancement in technology and advancement in manufacturing is the reason behind this.

Due to the increase in knowledge surrounding the usage of cell culture techniques, Asia-Pacific offers attractive potential for the key players functioning in the cell culture market. A further driver of market expansion is the increase in regional research funding. In addition, it is anticipated that the major manufacturers’ focus on increasing their geographic presence in the developing Asia-Pacific nations will propel the market for cell culture in the area. Asia-Pacific presents enticing potential for the major companies operating in the cell culture market because of the increased awareness surrounding the use of cell culture procedures. The growth in regional research funding is another factor influencing market expansion. Additionally, it’s expected that the leading manufacturers’ focus on expanding their geographic reach in the rising Asia-Pacific nations will fuel the region’s cell culture market.

Due to large investments in research and development, the presence of an established scientific infrastructure, the high demand for media devoid of animal components, and other factors, North America is also anticipating the great rise in the cell culture market. Additionally, it is anticipated that continued research and the growth of the biopharmaceutical industry in the United States will accelerate industry growth in the region.

Key Market Segments: Cell Culture Market

Cell Culture Market By Product, 2020-2029, (USD Billion), (Kilotons)

- Equipment

- Consumables

Cell Culture Market By Application, 2020-2029, (USD Billion), (Kilotons)

- Cancer Research

- Gene Therapy

- Tissue Culture

- Bioproduction

- Vaccines

Cell Culture Market By End Use, 2020-2029, (USD Billion), (Kilotons)

- Research

- Pharma

- Hospitals

- Laboratories

Cell Culture Market By Region, 2020-2029, (USD Billion), (Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the cell culture market over the next 7 years?

- Who are the major players in the cell culture market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the cell culture market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the cell culture market?

- What is the current and forecasted size and growth rate of the global cell culture market?

- What are the key drivers of growth in the cell culture market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the cell culture market?

- What are the technological advancements and innovations in the cell culture market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the cell culture market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the cell culture market?

- What are the service offerings and specifications of leading players in the market?

- What is the pricing trend of cell cultures in the market and what is the impact of raw material prices on the price trend?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Cell culture Market outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on cell culture market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry Value Chain Analysis

- Global Cell culture Market outlook

- Global Cell Culture Market by Product (USD Billion) (Kilotons) 2020-2029

- Equipment

- Consumables

- Global Cell culture Market by Application (USD Billion) (Kilotons) 2020-2029

- Cancer Research

- Gene Therapy

- Tissue Culture

- Bioproduction

- Vaccines

- Global Cell culture Market by End Use (USD Billion) (Kilotons) 2020-2029

- Research

- Pharma

- Hospitals

- Laboratories

- Global Cell culture Market by Region (USD Billion) (Kilotons) 2020-2029

- NORTH AMERICA

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- NORTH AMERICA

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Bio-Rad Laboratories

- Thermo Fisher Scientific Inc

- Merck Kgaa

- Vwr International LLC

- Eppendor Se

- Bio-Spherix Ltd

- Bio-Techne Corporation

- Cytiva

- Lonza Group

- Avantor Inc

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 2 GLOBAL CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 3 GLOBAL CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL CELL CULTURE MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL CELL CULTURE MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA CELL CULTURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA CELL CULTURE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 US CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 12 US CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 13 US CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 US CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 US CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 US CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 CANADA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 18 CANADA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 19 CANADA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 CANADA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 CANADA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 CANADA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 23 MEXICO CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 24 MEXICO CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 25 MEXICO CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 MEXICO CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 MEXICO CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 MEXICO CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 SOUTH AMERICA CELL CULTURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 30 SOUTH AMERICA CELL CULTURE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 31 BRAZIL CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 32 BRAZIL CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 33 BRAZIL CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 34 BRAZIL CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 35 BRAZIL CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 36 BRAZIL CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 37 ARGENTINA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 38 ARGENTINA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 39 ARGENTINA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 ARGENTINA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 ARGENTINA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 ARGENTINA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 COLOMBIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 44 COLOMBIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 45 COLOMBIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 COLOMBIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 COLOMBIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 COLOMBIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 49 REST OF SOUTH AMERICA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 50 REST OF SOUTH AMERICA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 51 REST OF SOUTH AMERICA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 REST OF SOUTH AMERICA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 REST OF SOUTH AMERICA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 REST OF SOUTH AMERICA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 ASIA-PACIFIC CELL CULTURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 56 ASIA-PACIFIC CELL CULTURE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 57 INDIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 58 INDIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 59 INDIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 60 INDIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 61 INDIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 62 INDIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 63 CHINA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 64 CHINA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 65 CHINA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 66 CHINA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 67 CHINA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 68 CHINA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 69 JAPAN CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 70 JAPAN CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 71 JAPAN CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 JAPAN CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 JAPAN CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 JAPAN CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 SOUTH KOREA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 76 SOUTH KOREA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 77 SOUTH KOREA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 SOUTH KOREA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 SOUTH KOREA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 SOUTH KOREA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 AUSTRALIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 82 AUSTRALIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 83 AUSTRALIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 AUSTRALIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 AUSTRALIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 AUSTRALIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 SOUTH-EAST ASIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 88 SOUTH-EAST ASIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 89 SOUTH-EAST ASIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 SOUTH-EAST ASIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 SOUTH-EAST ASIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 SOUTH-EAST ASIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 REST OF ASIA PACIFIC CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 94 REST OF ASIA PACIFIC CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 95 REST OF ASIA PACIFIC CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 REST OF ASIA PACIFIC CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 REST OF ASIA PACIFIC CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 REST OF ASIA PACIFIC CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 EUROPE CELL CULTURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 100 EUROPE CELL CULTURE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 101 GERMANY CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 102 GERMANY CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 103 GERMANY CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 104 GERMANY CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 105 GERMANY CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 106 GERMANY CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 107 UK CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 108 UK CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 109 UK CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 110 UK CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 111 UK CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 112 UK CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 113 FRANCE CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 114 FRANCE CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 115 FRANCE CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 116 FRANCE CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 117 FRANCE CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 118 FRANCE CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 119 ITALY CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 120 ITALY CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 121 ITALY CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 ITALY CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 ITALY CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 ITALY CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 SPAIN CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 126 SPAIN CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 127 SPAIN CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 SPAIN CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 SPAIN CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 SPAIN CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 RUSSIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 132 RUSSIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 133 RUSSIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 RUSSIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 RUSSIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 RUSSIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 REST OF EUROPE CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 138 REST OF EUROPE CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 139 REST OF EUROPE CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 REST OF EUROPE CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 REST OF EUROPE CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 REST OF EUROPE CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 143 MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 144 MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 145 UAE CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 146 UAE CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 147 UAE CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 148 UAE CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 149 UAE CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 150 UAE CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 151 SAUDI ARABIA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 152 SAUDI ARABIA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 153 SAUDI ARABIA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 154 SAUDI ARABIA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 155 SAUDI ARABIA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 156 SAUDI ARABIA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 157 SOUTH AFRICA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 158 SOUTH AFRICA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020-2029

TABLE 159 SOUTH AFRICA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 160 SOUTH AFRICA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 161 SOUTH AFRICA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 162 SOUTH AFRICA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 163 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY PRODUCT (USD BILLION) 2020-2029

TABLE 164 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY PRODUCT (KILOTONS) 2020- 2029

TABLE 165 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 166 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 167 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY END USER (USD BILLION) 2020-2029

TABLE 168 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

TABLE 169 REST OF MIDDLE EAST AND AFRICA CELL CULTURE MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL CELL CULTURE BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL CELL CULTURE BY END USER, USD BILLION, 2020-2029

FIGURE 10 GLOBAL CELL CULTURE BY APPLICATION, USD BILLION, 2020-2029

FIGURE 11 GLOBAL CELL CULTURE BY REGION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL CELL CULTURE BY PRODUCT, USD BILLION, 2021

FIGURE 13 GLOBAL CELL CULTUREBY END USER, USD BILLION, 2021

FIGURE 14 GLOBAL CELL CULTUREBY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL CELL CULTUREBY REGION, USD BILLION, 2021

FIGURE 16 PORTER’S FIVE FORCES MODEL

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 BIO-RAD LABORATORIES: COMPANY SNAPSHOT

FIGURE 19 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 20 MERCK KGAA: COMPANY SNAPSHOT

FIGURE 21 VWR INTERNATIONAL LLC: COMPANY SNAPSHOT

FIGURE 22 EPPENDOR SE: COMPANY SNAPSHOT

FIGURE 23 BIOSPHERIX LTD: COMPANY SNAPSHOT

FIGURE 24 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT

FIGURE 25 CYTIVA: COMPANY SNAPSHOT

FIGURE 26 LONZA: COMPANY SNAPSHOT

FAQ

The cell culture market is expected to grow at 11.7% CAGR from 2022 to 2029. It is expected to reach above USD 51.59 billion by 2029 from USD 19.07 billion in 2020.

Asia Pacific held more than 55% of the Cell Culture market revenue share in 2021 and will witness expansion in the forecast period.

Global demand for 3D cell culture technology is growing as a result of recent advances in proteomic gene expression, innovative biopharmaceuticals, and vaccine development. The global cell culture market is expanding due to the increased incidence of cancer, the expansion of cancer research initiatives, and enhanced gene therapy applications. The market for cell culture is expanding thanks to the existence of numerous contract manufacturing and research companies.

Applications of the technology in vaccine production are projected to have a favorable impact on industry growth given the COVID-19 pandemic’s acceleration of vaccine approval procedures and significant investments in vaccine production

Asia Pacific is the largest market in 2021 accounted for 55% revenue generation of worldwide sales. It is due to advancement in technology and advancement in manufacturing is the reason behind this.

Due to the increase in knowledge surrounding the usage of cell culture techniques, Asia-Pacific offers attractive potential for the key players functioning in the cell culture market

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.