REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

| USD 47.77 billion by 2029 | 7.2% | Asia Pacific |

| By Product Type | By Application | By End User | By Region |

|---|---|---|---|

|

|

|

|

SCOPE OF THE REPORT

Polymer Emulsion Market Overview

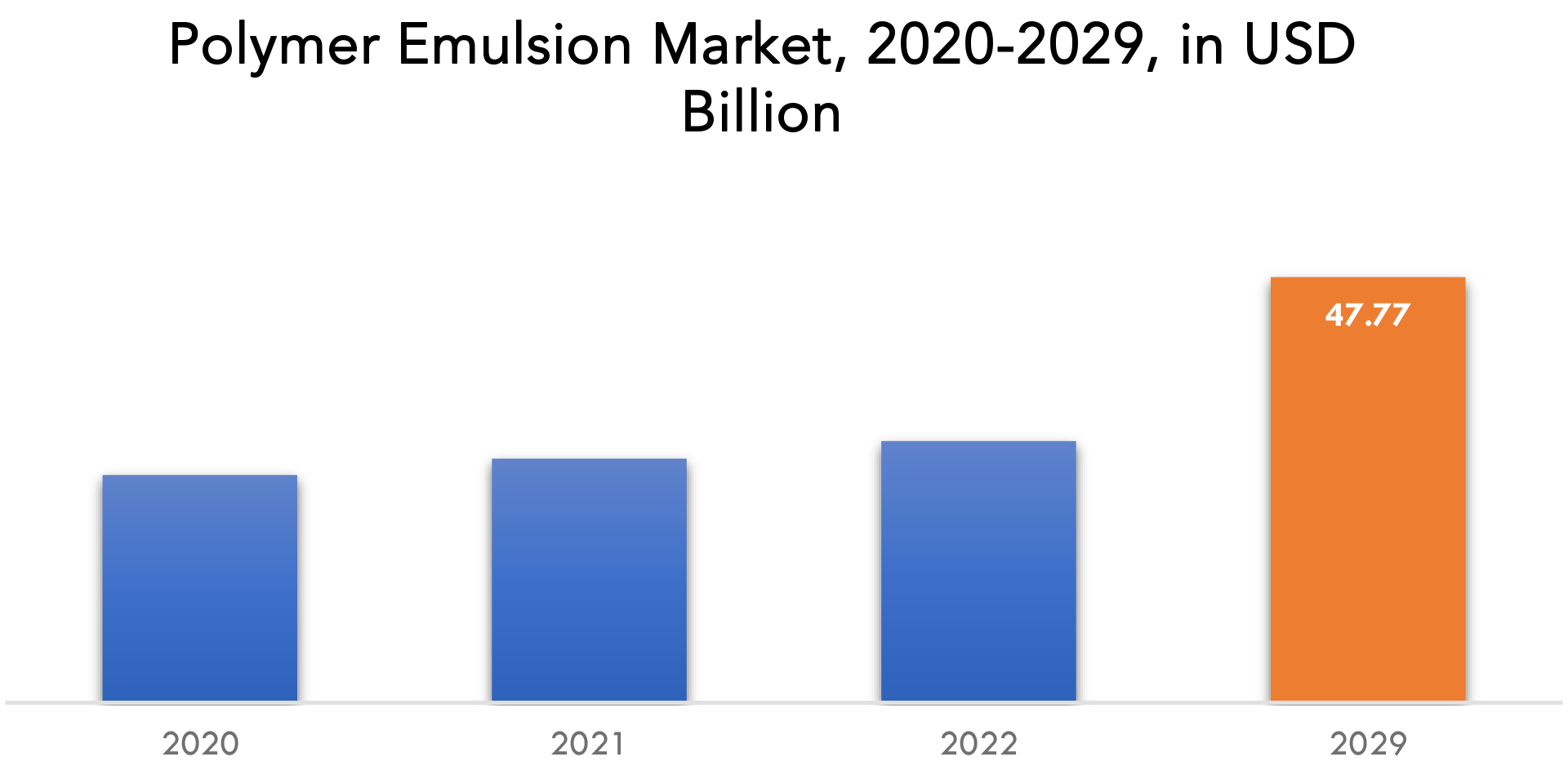

The polymer emulsion market is expected to grow at 7.2% CAGR from 2023 to 2029. It is expected to reach above USD 47.77 billion by 2029 from USD 25.56 billion in 2022.

Water-soluble polymers, such as certain polyvinyl alcohols or hydroxylate celluloses, can also be used as emulsifiers/stabilizers in polymer emulsion. Emulsion polymerization differs from many other polymerization techniques in that it employs a specific mechanism and kinetics. Radical polymerization of the emulsion type typically starts with an emulsion containing water, monomer, and surfactant. Polymer emulsions can be bio-based or synthetic, depending on their structure and the polymerization process used. Polymer emulsions are distinguished by their high molecular weight, rapid polymerization, and environmental friendliness.

The most common type of emulsion polymerization is an oil-in-water emulsion, in which droplets of the monomer (the oil) are emulsified (with surfactants) in a continuous phase of water. Emulsion polymerization yields a variety of economically significant polymers. Many of these polymers must be separated from the aqueous dispersion after polymerization because they are used as solid materials. In the paper industry, polymer emulsions are used to make sheets, paper bags, boxes, cartons, and other products. In the adhesive industry, they act as a binding agent for items such as bands, stickers, glue, windings, and hygiene goods. These end-user segments significantly contribute to the growth of the polymer emulsion industry.

Emulsion polymerization has several advantages. High molecular-weight polymers can be produced using fast polymerization rates. In contrast, in bulk and solution-free radical polymerization, there is a trade-off between molecular weight and polymerization rate. The continuous water phase is an excellent heat conductor, allowing for rapid polymerization rates while maintaining temperature control.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion), Volume (Kilotons) |

| Segmentation | By Product Type, By Application, By End User, By Region |

| By Product Type

|

|

| By Application

|

|

| By End User

|

|

| By Region

|

|

The growing use of polymer emulsion in the paints, coatings, and adhesives industries is expected to drive the polymer emulsion market forward. Demand for polymer emulsion will be boosted by an increase in construction projects, particularly in the developing economies of Asia Pacific and the Middle East. Furthermore, premium paints and coatings are in high demand in these economies. Increased adhesive use in the automotive coating sector is expected to significantly boost demand for polymer emulsions soon.

Several polymer emulsions manufacturing companies have reduced or ceased operations due to the risk of employee infection, while also supporting the government’s goal of maintaining critical business activities such as healthcare, power generation, and food production. Due to potential upstream supply chain issues, companies in the automotive, textile, construction, chemical, and coating industries have been forced to close locations. Because consumers are less likely to be looking for new homes as a result of low consumer confidence and declining earnings, demand for residential building construction is expected to be low. As a result of the uncertain future, demand for automobiles has sharply decreased. On average, the global impact on textile orders for apparel and apparel accessories has decreased by 30%.

Chemical manufacturers have ceased production or are using fewer resources than usual. However, as the lockdown is lifted, governments around the world are encouraging businesses in the automotive, textile, construction, chemical, and coatings industries to resume operations, and these businesses are attempting to recover the market in anticipation of a gradual increase in sales in 2022.

Polymer Emulsion Market Segment Analysis

The polymer emulsion market is segmented based on product type, application, end user and region, global trends and forecast.

The market is segmented into acrylic, styrene butadiene latex, vinyl acetate polymers, polyurethane dispersions based on product type. Acrylics are expected to be the fastest-growing product segment in the coming years, thanks to increased demand from the superabsorbent polymers and adhesives and sealants segments. An increase in construction and building activities in developing countries is expected to boost demand even more. Furthermore, the growing use of acrylic polymers in water treatment is expected to fuel growth. From 2022 to 2028, vinyl acetate is expected to grow rapidly, owing primarily to an expanding application base in adhesives, paper, fabric, and wood manufacturing.

Based on application, the market is segmented into adhesive & sealants, paints & coatings, paper & paperboard. Paints and coatings dominated the market and are expected to continue to do so throughout the forecast period. Consumers’ concerns about quality and appearance are growing, and as a result, increased demand for high-quality paints and technology-driven coatings is expected to drive product demand over the forecast period. Additionally, the growing preference for odor-free, low-VOC products is driving growth in the paints and coatings segment. The presence of stringent environmental regulations and policies that favour environmentally friendly products is the primary reason for this preference.

The market is segmented into building & construction, chemicals, automotive, textile & coatings. Building and construction is expected to grow rapidly in the coming years as consumers focus on results based on essence and presentation, resulting in a high demand for polymer emulsion on deck paints, trim paints, architectural paints, elastomeric wall coatings, and other products. Superior sturdiness, excellent water resistance, and frequent environmental policies and regulations are the representatives driving market demand.

Polymer Emulsion Market Players

The Polymer Emulsion Market key players include Arkema Group, Asahi Kasei Corporation, BASF SE, Celanese Corporation, clariant, dic corporation, Dow Inc., Gellner Industrial LLC, Halltech Inc., Interpolymer Co. Ltd, momentive, Resil Chemicals Pvt. Ltd, Synthomer PLC, the lubrizol corporation, Wacker Chemie AG.

8 February, 2023: Celanese Corporation announced that more sustainable versions of multiple Acetyl Chain materials are available.

25 January, 2023: Dow and LVMH Beauty announced the collaboration to accelerate the use of sustainable packaging across LVMH’s products.

Who Should Buy? Or Key Stakeholders

- Distributors

- Construction Industry

- Automotive Industry

- Chemicals & Textile Industry

- Manufacturers

- Consumer Goods Packagers

- Retailers

- Regulatory Authorities

- Government Bodies

- Investors

Polymer Emulsion Market Regional Analysis

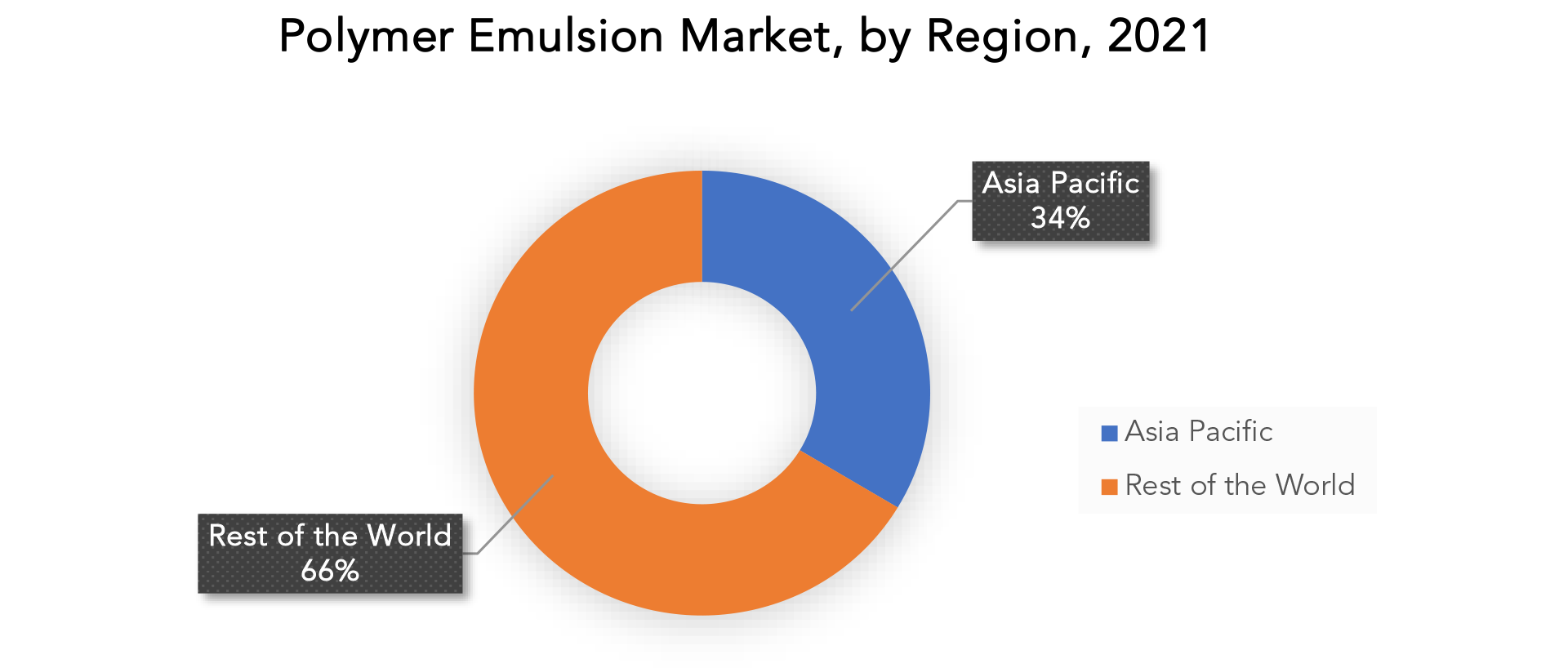

The Polymer Emulsion Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN, and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina, and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

The Asia-Pacific region controlled the majority of the global market. End-user industries such as automotive, construction, electronics, and packaging have increased their demand for products such as paints, coatings, and adhesives. Many construction projects and investments are planned in India, China, the Philippines, Vietnam, and Indonesia, which is expected to increase demand for architectural paints, coatings, and adhesives. India, Thailand, Vietnam, Pakistan, and Malaysia have seen significant increases in automotive production.

China, the world’s largest automaker, intends to increase EV production to 2 million units per year by 2020, and 7 million units per year by 2025. Furthermore, with cultural change, the influence of Western culture, increased cosmetic demand from the youth population, and rising women employment, demand in the cosmetic & personal care industry is increasing at a noticeable rate in the region. As a result, market participants in this market are increasing investments and production, driving up demand for raw materials such as polymer emulsion. As a result, all of these favourable market trends are expected to drive the growth of the Asia-Pacific polymer emulsion market during the forecast period.

Key Market Segments: Polymer Emulsion Market

Polymer Emulsion Market By Product Type, 2020-2029, (USD Billion, Kilotons)

- Acrylic

- Styrene Butadiene Latex

- Vinyl Acetate Polymers

- Polyurethane Dispersions

Polymer Emulsion Market By Application, 2020-2029, (USD Billion, Kilotons)

- Adhesive & Sealants

- Paints & Coatings

- Paper & Paperboard

Polymer Emulsion Market By End User, 2020-2029, (USD Billion, Kilotons)

- Building & Construction

- Chemicals

- Automotive

- Textile & Coatings

Polymer Emulsion Market By Region, 2020-2029, (USD Billion, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries in All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the polymer emulsion market over the next 7 years?

- Who are the major players in the polymer emulsion market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the polymer emulsion market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the polymer emulsion market?

- What is the current and forecasted size and growth rate of the global polymer emulsion market?

- What are the key drivers of growth in the polymer emulsion market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the polymer emulsion market?

- What are the technological advancements and innovations in the polymer emulsion market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the polymer emulsion market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the polymer emulsion market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of polymer emulsion in the market and what is the impact of raw material prices on the price trend?

Table of Content

- Introduction

- Market Definition

- Market Segmentation

- Research Timelines

- Assumptions and Limitations

- Research Methodology

- Data Mining

- Secondary Research

- Primary Research

- Subject-Matter Experts’ Advice

- Quality Checks

- Final Review

- Data Triangulation

- Bottom-Up Approach

- Top-Down Approach

- Research Flow

- Data Sources

- Data Mining

- Executive Summary

- Market Overview

- Global Polymer Emulsion Market outlook

- Market Drivers

- Market Restraints

- Market Opportunities

- Impact of Covid-19 on Polymer Emulsion Market

- Porter’s five forces model

- Threat from new entrants

- Threat from substitutes

- Bargaining power of suppliers

- Bargaining power of customers

- Degree of competition

- Industry value chain Analysis

- Global Polymer Emulsion Market outlook

- Global Polymer Emulsion Market by Product Type, (USD Billion, Kilotons), 2020-2029

- Acrylic

- Styrene Butadiene Latex

- Vinyl Acetate Polymers

- Polyurethane Dispersions

- Global Polymer Emulsion Market by Application, (USD Billion, Kilotons), 2020-2029

- Adhesive & Sealants

- Paints & Coatings

- Paper & Paperboard

- Global Polymer Emulsion Market by End User, (USD Billion, Kilotons), 2020-2029

- Building & Construction

- Chemicals

- Automotive

- Textile & Coatings

- Global Polymer Emulsion Market by Region, (USD Billion, Kilotons), 2020-2029

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Rest Of South America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- India

- China

- Japan

- South Korea

- Australia

- South-East Asia

- Rest Of Asia Pacific

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

- Rest Of Middle East and Africa

- North America

- Company Profiles*

(Business Overview, Company Snapshot, Products Offered, Recent Developments)

- Arkema Group

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- clariant

- dic corporation

- Dow Inc.

- Gellner Industrial LLC

- Halltech Inc.

- Interpolymer Co. Ltd

- Momentive

- Resil Chemicals Pvt. Ltd

- Synthomer PLC

- The lubrizol corporation

- Wacker Chemie AG

*The Company List Is Indicative

LIST OF TABLES

TABLE 1 GLOBAL POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 2 GLOBAL POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 4 GLOBAL POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 5 GLOBAL POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 6 GLOBAL POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 7 GLOBAL POLYMER EMULSION MARKET BY REGION (USD BILLION) 2020-2029

TABLE 8 GLOBAL POLYMER EMULSION MARKET BY REGION (KILOTONS) 2020-2029

TABLE 9 NORTH AMERICA POLYMER EMULSION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 10 NORTH AMERICA POLYMER EMULSION MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 12 NORTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 14 NORTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 16 NORTH AMERICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 17 US POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 18 US POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 19 US POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 20 US POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 21 US POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 22 US POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 23 CANADA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 24 CANADA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 25 CANADA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 26 CANADA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 27 CANADA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 28 CANADA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 29 MEXICO POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 30 MEXICO POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 31 MEXICO POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 32 MEXICO POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 33 MEXICO POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 34 MEXICO POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 35 SOUTH AMERICA POLYMER EMULSION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 36 SOUTH AMERICA POLYMER EMULSION MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 37 SOUTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 38 SOUTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 39 SOUTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 40 SOUTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 41 SOUTH AMERICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 42 SOUTH AMERICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 43 BRAZIL POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 44 BRAZIL POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 45 BRAZIL POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 46 BRAZIL POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 47 BRAZIL POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 48 BRAZIL POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 49 ARGENTINA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 50 ARGENTINA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 51 ARGENTINA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 52 ARGENTINA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 53 ARGENTINA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 54 ARGENTINA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 55 COLOMBIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 56 COLOMBIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 57 COLOMBIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 58 COLOMBIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 59 COLOMBIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 60 COLOMBIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 61 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 62 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 63 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 64 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 65 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 66 REST OF SOUTH AMERICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 67 ASIA-PACIFIC POLYMER EMULSION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 68 ASIA-PACIFIC POLYMER EMULSION MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 69 ASIA-PACIFIC POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 70 ASIA-PACIFIC POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 71 ASIA-PACIFIC POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 72 ASIA-PACIFIC POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 73 ASIA-PACIFIC POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 74 ASIA-PACIFIC POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 75 INDIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 76 INDIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 77 INDIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 78 INDIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 79 INDIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 80 INDIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 81 CHINA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 82 CHINA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 83 CHINA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 84 CHINA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 85 CHINA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 86 CHINA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 87 JAPAN POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 88 JAPAN POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 89 JAPAN POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 90 JAPAN POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 91 JAPAN POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 92 JAPAN POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 93 SOUTH KOREA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 94 SOUTH KOREA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 95 SOUTH KOREA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 96 SOUTH KOREA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 97 SOUTH KOREA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 98 SOUTH KOREA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 99 AUSTRALIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 100 AUSTRALIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 101 AUSTRALIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 102 AUSTRALIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 103 AUSTRALIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 104 AUSTRALIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 105 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 106 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 107 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 108 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 109 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 110 SOUTH-EAST ASIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 111 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 112 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 113 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 114 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 115 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 116 REST OF ASIA PACIFIC POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 117 EUROPE POLYMER EMULSION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 118 EUROPE POLYMER EMULSION MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 119 EUROPE POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 120 EUROPE POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 121 EUROPE POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 122 EUROPE POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 123 EUROPE POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 124 EUROPE POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 125 GERMANY POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 126 GERMANY POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 127 GERMANY POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 128 GERMANY POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 129 GERMANY POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 130 GERMANY POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 131 UK POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 132 UK POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 133 UK POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 134 UK POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 135 UK POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 136 UK POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 137 FRANCE POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 138 FRANCE POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 139 FRANCE POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 140 FRANCE POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 141 FRANCE POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 142 FRANCE POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 143 ITALY POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 144 ITALY POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 145 ITALY POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 146 ITALY POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 147 ITALY POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 148 ITALY POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 149 SPAIN POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 150 SPAIN POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 151 SPAIN POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 152 SPAIN POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 153 SPAIN POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 154 SPAIN POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 155 RUSSIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 156 RUSSIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 157 RUSSIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 158 RUSSIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 159 RUSSIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 160 RUSSIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 161 REST OF EUROPE POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 162 REST OF EUROPE POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 163 REST OF EUROPE POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 164 REST OF EUROPE POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 165 REST OF EUROPE POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 166 REST OF EUROPE POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY COUNTRY (USD BILLION) 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 175 UAE POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 176 UAE POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 177 UAE POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 178 UAE POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 179 UAE POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 180 UAE POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 181 SAUDI ARABIA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 182 SAUDI ARABIA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 183 SAUDI ARABIA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 184 SAUDI ARABIA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 185 SAUDI ARABIA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 186 SAUDI ARABIA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 187 SOUTH AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 188 SOUTH AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 189 SOUTH AFRICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 190 SOUTH AFRICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 191 SOUTH AFRICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 192 SOUTH AFRICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (USD BILLION) 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY PRODUCT TYPE (KILOTONS) 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY APPLICATION (USD BILLION) 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY APPLICATION (KILOTONS) 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY END USER (USD BILLION) 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA POLYMER EMULSION MARKET BY END USER (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL POLYMER EMULSION MARKET BY PRODUCT TYPE, USD BILLION, 2020-2029

FIGURE 9 GLOBAL POLYMER EMULSION MARKET BY APPLICATION, USD BILLION, 2020-2029

FIGURE 10 GLOBAL POLYMER EMULSION MARKET BY END USER INDUSTRY, USD BILLION, 2020-2029

FIGURE 11 GLOBAL POLYMER EMULSION MARKET BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL POLYMER EMULSION MARKET BY PRODUCT TYPE, USD BILLION, 2021

FIGURE 14 GLOBAL POLYMER EMULSION MARKET BY APPLICATION, USD BILLION, 2021

FIGURE 15 GLOBAL POLYMER EMULSION MARKET BY END USER INDUSTRY, USD BILLION, 2021

FIGURE 16 GLOBAL POLYMER EMULSION MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 ARKEMA GROUP: COMPANY SNAPSHOT

FIGURE 19 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

FIGURE 20 BASF SE: COMPANY SNAPSHOT

FIGURE 21 CELANESE CORPORATION: COMPANY SNAPSHOT

FIGURE 22 CLARIANT: COMPANY SNAPSHOT

FIGURE 23 DIC CORPORATION: COMPANY SNAPSHOT

FIGURE 24 DOW INC.: COMPANY SNAPSHOT

FIGURE 25 GELLNER INDUSTRIAL LLC: COMPANY SNAPSHOT

FIGURE 27 HALLTECH INC.: COMPANY SNAPSHOT

FIGURE 28 INTERPOLYMER CO. LTD: COMPANY SNAPSHOT

FIGURE 29 MOMENTIVE: COMPANY SNAPSHOT

FIGURE 30 RESIL CHEMICALS PVT. LTD: COMPANY SNAPSHOT

FIGURE 31 SYNTHOMER PLC: COMPANY SNAPSHOT

FIGURE 32 THE LUBRIZOL CORPORATION: COMPANY SNAPSHOT

FIGURE 33 WACKER CHEMIE AG: COMPANY SNAPSHOT

FAQ

The Polymer Emulsion Market size had crossed USD 25.56 billion in 2020 and will observe a CAGR of more than 7.2% up to 2029.

Increasing demand from end user industries and emerging economies is the major growth factor in the polymer emulsion market. Moreover, stringent regulations and increasing awareness about green buildings are driving the polymer emulsion market.

The region’s largest share is in Asia Pacific. Products manufactured in nations like India and China that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

The polymer emulsion market is highly fragmented with the presence of many market players. Most of the large players in the polymer emulsion market have a global presence and a strong customer base. Companies mostly compete with one another by expanding their product portfolio for different applications. Thus, the intensity of competitive rivalry in the polymer emulsion market is high.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.