REPORT OUTLOOK

| Market Size | CAGR | Dominating Region |

|---|---|---|

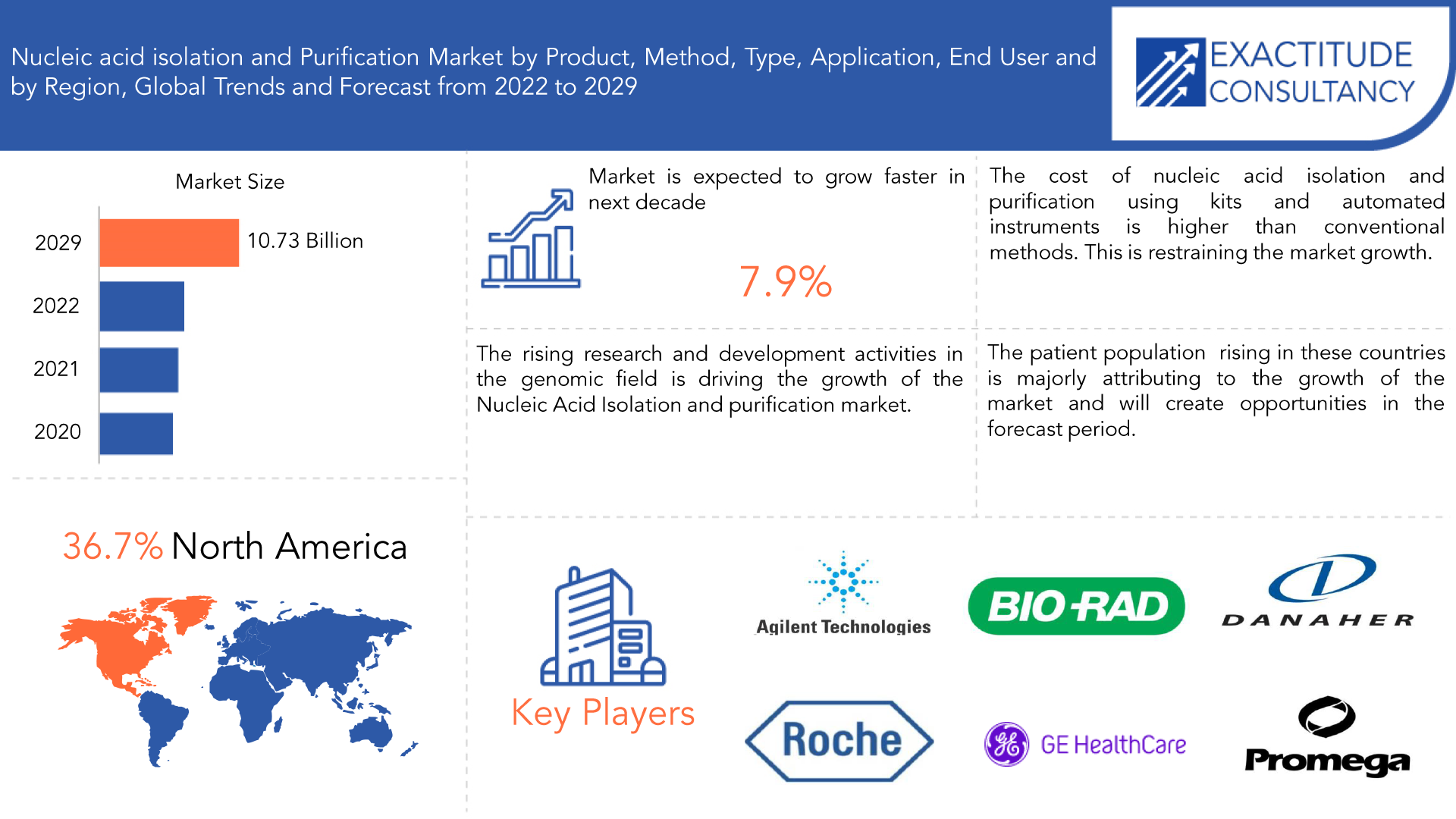

| USD 10.73 billion by 2029 | 7.9 % CAGR | North America |

| By Product | By Method | By Type |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

Nucleic Acid Isolation and Purification Market Overview

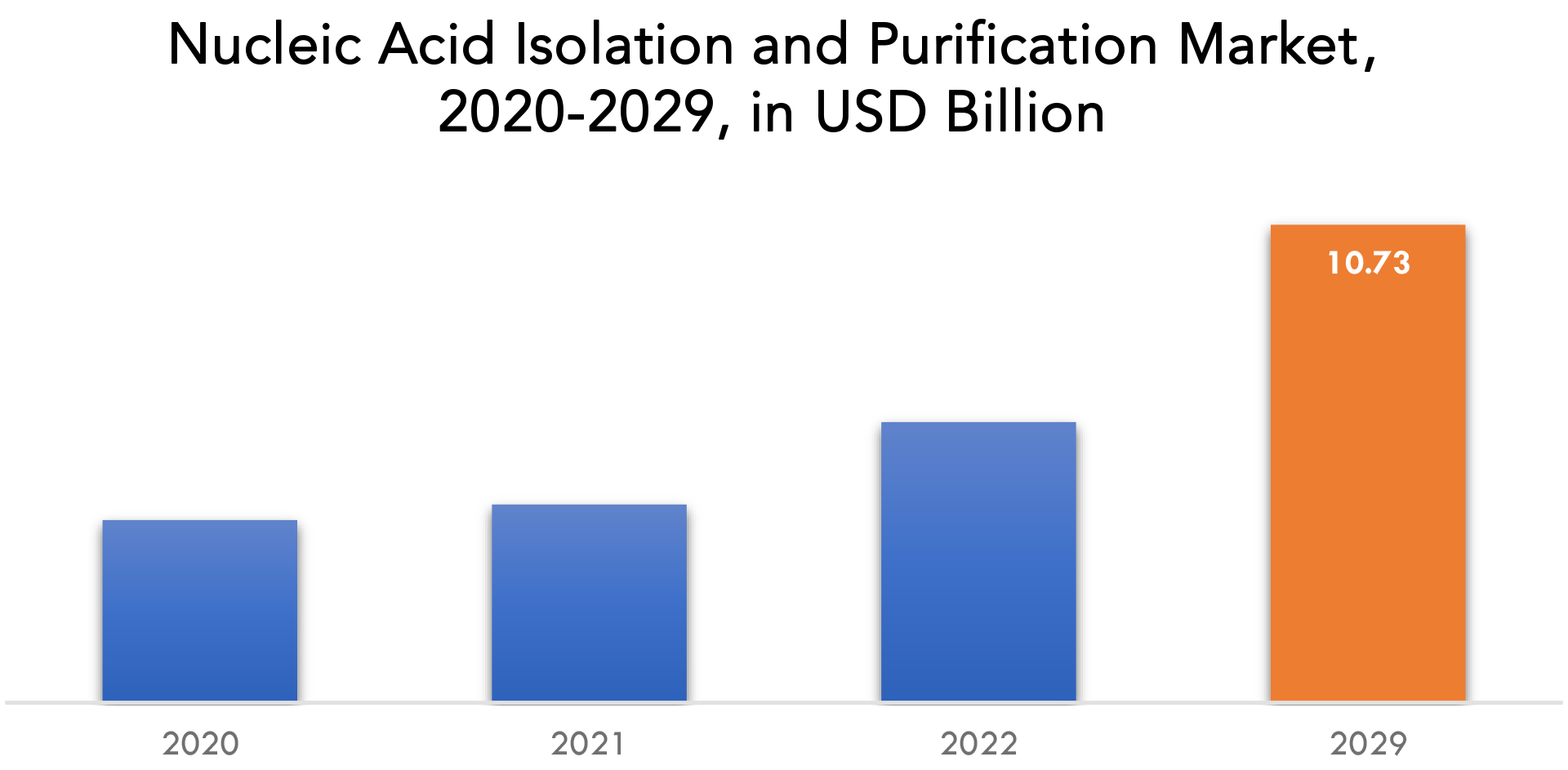

The Nucleic Acid Isolation and Purification market is expected to grow at 7.9 % CAGR from 2022 to 2029. It is expected to reach above USD 10.73 billion by 2029 from USD 4.45 billion in 2021.

The naturally occurring building blocks, which serve as a primary information carrying molecules within a cell are nucleic acids. The storage and expression of genetic information is done by two primary type of nucleic acid, DNA and RNA.

The procedure by which DNA or RNA are separated from proteins, membranes, and other biological components is known as nucleic acid isolation. The quality of the isolation phase in the process is crucial because nucleic acids are essential to many of the molecular testing techniques used today. It is essential to ensure that the yield and purity of the nucleic acid isolation, which is the initial stage in the entire molecular process, fulfil the expectations. The downstream applications and the research domains can have different expectations. Lyse, bind, wash, and elute are the four fundamental processes of a nucleic acid isolation procedure. The cellular structure is first disrupted to produce a lysate. To liberate the nucleic acid, the cell and nucleus are split open. The nucleic acids are attached to a carrier. Because the nucleic acid has been released from the nucleus after the first lysate phase but is still mixed with cell debris and other insoluble material, it is possible to separate the nucleic acid after the binding step. Third, the target nucleic acid is purified to get rid of any remaining impurities by washing the mixture with certain buffers. In order to use the pure nucleic acid, it is often redissolved at this step in an elution buffer.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Billion) |

| Segmentation | By Product, by method, by type, by application, by end user |

| By Product |

|

| By Method |

|

| By Type | |

| By Application |

|

| By end user |

|

| By Region |

|

The rising research and development activities in the genomic field is driving the growth of the Nucleic Acid Isolation and purification market. The growing needs of the healthcare sector are fulfilled by the pharmaceutical and biotechnology companies which heavily invest in such activities. One of the factors influencing the market is the increase in company partnerships in the biotech sector.

Another significant driver of revenue generation in the market for nucleic acid isolation and purification is the advancement of personalized medicine. Cancer tumor biopsies are increasingly using Next Generation Sequencing (NGS). Because the procedure uses a straightforward and common test that can identify cancer at an early stage, liquid biopsies are a desirable choice for cancer diagnostics. The biggest challenge in treating cancer is its early diagnosis, and NGS can successfully address this issue, driving up demand for NGS technology. Therefore, it is projected that increased NGS technology use will have a direct impact on the uptake of nucleic acid isolation and purification methods.

The high cost of analytical instruments hinders the growth of nucleic acid isolation and purification market. The cost of nucleic acid isolation and purification using kits and automated instruments is higher than conventional methods. Though these techniques offer significant benefits like simplifications in isolation processes, reductions in working times, increased safety and higher output, the cost limits their adoption. Along with the cost of instruments additional expenses for reagents, disposables and maintenance and training are added. Thus, institutes or companies with smaller budgets cannot afford these techniques.

The markets in the developing countries such as India, China, Mexico, Africa and Brazil are expected to offer growth opportunities for the nucleic acid isolation and purification market. The patient population rising in these countries is majorly attributing to the growth of the market. The healthcare industry is growing in these countries which is resulting in introduction of sophisticated analysis equipment. The adoption of genomic analysis is expected to increase as a result of these factors.

The covid-19 pandemic was a positive catalyst in the growth of the nucleic acid isolation and purification market. Specific assays and kits were being developed for rapid detection of SARS-CoV-2. Viral RNA Xpress Kit was launched for efficient and rapid viral RNA isolation.

Nucleic Acid Isolation and Purification Market Segment Analysis

The Nucleic Acid Isolation and Purification market is segmented based on Product, method, type, application, end user and region.

Based on the product, market is segmented into Kit, Reagent and Instrument. The kits and reagents segment dominated the market for nucleic acid isolation and purification. The expansion of the market is primarily responsible for the widespread use of kits and reagents for DNA and RNA isolation in the preparation of samples and libraries. The segment is also being driven by the increasing use of kits and reagents in research investigations aimed at understanding both common and uncommon genome-based disorders. The instrument segment is expected to witness fastest growth in the forecast period.

Between methods used for nucleic acid isolation and purification such as column-based, magnetic beads, reagent-based, magnetic beads segment dominated the market. It accounted for a share of 37.9 %. This method provides researchers and scientists with improves assay performance. This technique reduces the need for centrifugation, which typically causes nucleic acids to break.

Based on type market is sub segmented into genomic DNA, plasmid DNA, miRNA. Due to its expanding use in COVID-19 diagnostics and rising use of purified miRNA for the creation of the cDNA library, the RNA isolation and purification segment dominated the market for nucleic acid isolation and purification in 2020, accounting for the biggest revenue share of 53.6%. Several uses for these libraries exist, including clinical diagnostics, sequencing, and gene expression monitoring.

The applications of the nucleic acid isolation and purification market include precision medicine, diagnostics, drug discovery & development, agriculture and animal research. Among these, the diagnostics segment accounted for the largest revenue share in the year 2020. The significant market share can be attributed to the growing use of DNA and RNA isolation for disease detection in regular sample processing.

Among the end users of the market, hospitals and diagnostic centers accounted for the highest share of the market. The growth of the segment was due to the increasing demand for early and accurate diagnosis of diseases. Techniques for isolating and purifying DNA/RNA are proved to be effective diagnostic tools for even hereditary illnesses such sickle cell anemia, hemophilia A, and Tay-Sachs disease.

Nucleic Acid Isolation and Purification Market Players

The Nucleic Acid Isolation and Purification market key players include Agilent Technologies, Bio-Rad Laboratories Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd, GE Healthcare, Promega Corporation, Qiagen NV, Thermo Fisher Scientific Inc, Takara Bio, Inc., Biogenuix.

Recent News

May 12, 2022: Danaher joined bespoke gene therapy consortium (BGTC) for rare diseases. The BGTC will generate gene therapy resources that the research community can use to streamline gene therapy development for rare disorders, making the process more efficient and less costly.

April 6, 2021: Promega Opened new Research & Development Facility Supporting Science at the Edge of Innovation. Kornberg Center incorporated energizing architectural design that bridges office and meeting spaces with advanced laboratories to foster flexibility in exploration and collaboration.

Who Should Buy? Or Key stakeholders

- Nucleic Acid Isolation and Purification Suppliers

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

Nucleic Acid Isolation and Purification Market Regional Analysis

The Nucleic Acid Isolation and Purification market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

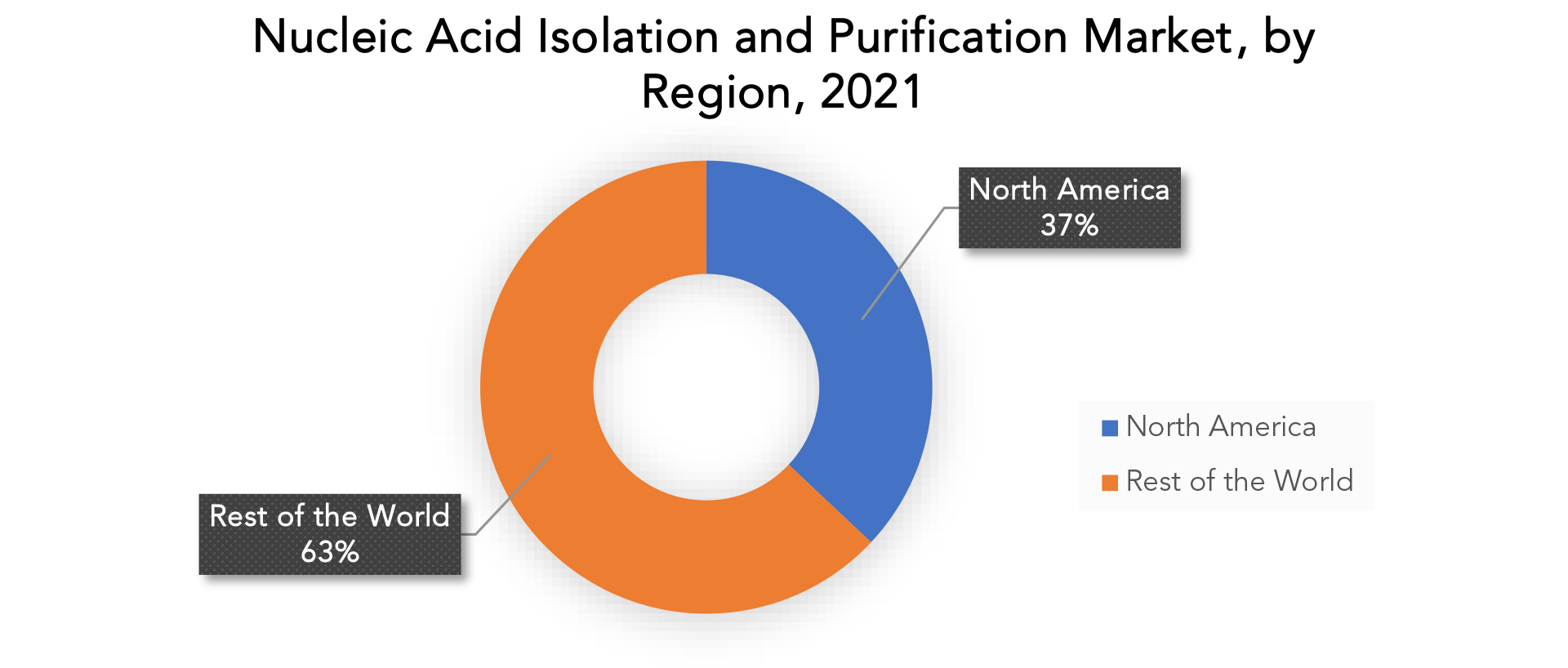

The nucleic acid isolation and purification market was dominated by the North American region. The region held the largest revenue share of 36.7 % in the year 2021. The main factor driving market expansion in the area is the presence of established companies and their work on creating technologically advanced rapid purification and isolation systems. Additionally, the increasing financing initiatives for biotechnology research are accelerating the market’s growth in the area. US is projected to lead the nucleic acid isolation and purification market. The novel detection techniques and molecular diagnostic represented by nucleic acid hybridization and nucleic acid sequence analysis are becoming significant in the medical industry.

Asia Pacific is the region with the greatest rate of growth. Rising economic growth, substantial life sciences research, an increasing patient population, government measures that are supportive, and the existence of numerous creative biotech companies in the area are all factors that are causing the market in the region to flourish. The rise in prevalence of chronic diseases such as cancer is propelling the demand for associated diagnostics and treatments. Hence, China is expected to emerge as highly remunerative nucleic acid isolation and purification market in the forecast period.

In the European region, the increased usage in covid-19 detection encouraged the growth of the market. The European Medicine Agency in the U.K. is using nucleic acid tests for emergency use for detection of virus in patients. The increased investments by governments and private agencies are fueling the market growth in the region.

Key Market Segments: Nucleic Acid Isolation and Purification Market

Nucleic Acid Isolation And Purification Market By Product, 2020-2029, (Usd Billion)

- Kit

- Reagent

- Instrument

Nucleic Acid Isolation And Purification Market By Method, 2020-2029, (Usd Billion)

- Column-Based

- Magnetic Beads

- Reagent-Based

Nucleic Acid Isolation And Purification Market By Type, 2020-2029, (Usd Billion)

- Genomic Dna

- Plasmid Dna

- Mi Rna

- Others

Nucleic Acid Isolation And Purification Market By Application 2020-2029, (Usd Billion)

- Precision Medicine

- Diagnostics

- Drug Discovery & Development

- Agriculture And Animal Research

Nucleic Acid Isolation And Purification Market By End User, 2020-2029, (Usd Billion)

- Academic Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Hospitals And Diagnostic Centers

Nucleic Acid Isolation And Purification Market By Region, 2020-2029, (Usd Billion)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Questions Answered

- What is the expected growth rate of the Nucleic Acid Isolation and Purification Market over the next 5 years?

- Who are the major players in the Nucleic Acid Isolation and Purification Market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the Nucleic Acid Isolation and Purification Market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the Nucleic Acid Isolation and Purification Market?

- What is the current and forecasted size and growth rate of the global Nucleic Acid Isolation and Purification Market?

- What are the key drivers of growth in the Nucleic Acid Isolation and Purification Market?

- Who are the major players in the market and what is their market share?

- What are the distribution channels and supply chain dynamics in the Nucleic Acid Isolation and Purification Market?

- What are the technological advancements and innovations in the Nucleic Acid Isolation and Purification Market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the Nucleic Acid Isolation and Purification Market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the Nucleic Acid Isolation and Purification Market?

- What are the product offerings/ service offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON NUCLEIC ACID ISOLATION AND PURIFICATION MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION OUTLOOK

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT ( USD BILLION )

- KIT

- REAGENT

- INSTRUMENT

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD( USD BILLION )

- COLUMN-BASED

- MAGNETIC BEADS

- REAGENT-BASED

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE ( USD BILLION )

- GENOMIC DNA

- PLASMID DNA

- MIRNA

- OTHERS

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION ( USD BILLION )

- PRECISION MEDICINE

- DIAGNOSTICS

- DRUG DISCOVERY & DEVELOPMENT

- AGRICULTURE AND ANIMAL RESEARCH

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER ( USD BILLION )

- ACADEMIC RESEARCH INSTITUTES

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- CONTRACT RESEARCH ORGANIZATIONS

- HOSPITALS AND DIAGNOSTIC CENTERS

- GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY REGION (USD BILLION )

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES* (BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- AGILENT TECHNOLOGIES

- BIO-RAD LABORATORIES INC.

- DANAHER CORPORATION

- HOFFMANN-LA ROCHE LTD

- GE HEALTHCARE

- PROMEGA CORPORATION

- QIAGEN NV,

- THERMO FISHER SCIENTIFIC INC

- TAKARA BIO, INC.

- *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 3 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 5 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY REGION (USD BILLION), 2020-2029

TABLE 7 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 8 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 9 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 11 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 13 US NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 14 US NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 15 US NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 16 US NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 17 US NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 18 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (BILLIONS), 2020-2029

TABLE 19 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 20 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 21 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 22 CANADA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 23 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 24 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 25 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 27 MEXICO NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 29 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 30 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 31 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 32 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 33 SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 34 BRAZIL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 35 BRAZIL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 36 BRAZIL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 37 BRAZIL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 38 BRAZIL NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 39 ARGENTINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 40 ARGENTINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 41 ARGENTINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 42 AREGENTINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 43 AREGENTINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 44 COLOMBIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 45 COLOMBIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 46 COLOMBIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 47 COLOMBIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 48 COLOMBIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 49 REST OF SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 50 REST OF SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 51 REST OF SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 REST OF SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 53 REST OF SOUTH AMERICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 55 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 56 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 57 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 58 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 59 ASIA-PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 60 INDIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 61 INDIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 62 INDIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 63 INDIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 64 INDIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 65 CHINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 66 CHINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 67 CHINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 68 CHINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 69 CHINA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 70 JAPAN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 71 JAPAN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 72 JAPAN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 73 JAPAN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 74 JAPAN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 75 SOUTH KOREA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 76 SOUTH KOREA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 77 SOUTH KOREA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 SOUTH KOREA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 79 SOUTH KOREA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 AUSTRALIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 81 AUSTRALIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 82 AUSTRALIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 83 AUSTRALIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 84 AUSTRALIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 85 SOUTH EAST ASIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 86 SOUTH EAST ASIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 87 SOUTH EAST ASIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 88 SOUTH EAST ASIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 89 SOUTH EAST ASIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 90 REST OF ASIA PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 91 REST OF ASIA PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 92 REST OF ASIA PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 93 REST OF ASIA PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 94 REST OF ASIA PACIFIC NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 95 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 96 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 97 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 98 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 99 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 100 EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 101 GERMANY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 102 GERMANY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 103 GERMANY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 104 GERMANY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 105 GERMANY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 106 UK NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 107 UK NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 108 UK NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 109 UK NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 110 UK NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 111 FRANCE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 112 FRANCE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 113 FRANCE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 114 FRANCE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 115 FRANCE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 ITALY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 117 ITALY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 118 ITALY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 119 ITALY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 120 ITALY NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 121 SPAIN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 122 SPAIN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 123 SPAIN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 124 SPAIN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 125 SPAIN NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 126 RUSSIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 127 RUSSIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 128 RUSSIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 129 RUSSIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 130 RUSSIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 131 REST OF EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 132 REST OF EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 133 REST OF EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 REST OF EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 135 REST OF EUROPE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 137 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 138 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 139 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 140 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 141 MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 142 UAE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 143 UAE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 144 UAE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 145 UAE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 146 UAE NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 147 SAUDI ARABIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 148 SAUDI ARABIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 149 SAUDI ARABIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 150 SAUDI ARABIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 151 SAUDI ARABIA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 152 SOUTH AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 153 SOUTH AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 154 SOUTH AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 155 SOUTH AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 156 SOUTH AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

TABLE 157 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 158 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD (USD BILLION), 2020-2029

TABLE 159 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 160 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION (USD BILLION), 2020-2029

TABLE 161 REST OF MIDDLE EAST AND AFRICA NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER (USD BILLION), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY METHOD, USD BILLION, 2020-2029

FIGURE 10 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY TYPE, USD BILLION, 2020-2029

FIGURE 11 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY APPLICATION, USD BILLION, 2020-2029

FIGURE 12 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY END USER, USD BILLION, 2020-2029

FIGURE 13 GLOBAL NUCLEIC ACID ISOLATION AND PURIFICATION BY REGION, USD BILLION, 2020-2029

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY PRODUCT 2021

FIGURE 16 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY METHOD 2021

FIGURE 17 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY TYPE 2021

FIGURE 18 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY APPLICATION 2021

FIGURE 19 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY END USER 2021

FIGURE 20 NUCLEIC ACID ISOLATION AND PURIFICATION MARKET BY REGION 2021

FIGURE 21 MARKET SHARE ANALYSIS

FIGURE 22 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 23 BIO-RAD LABORATORIES INC.: COMPANY SNAPSHOT

FIGURE 24 DANAHER CORPORATION: COMPANY SNAPSHOT

FIGURE 25 F. HOFFMANN-LA ROCHE LTD : COMPANY SNAPSHOT

FIGURE 26 GE HEALTHCARE.: COMPANY SNAPSHOT

FIGURE 27 PROMEGA CORPORATION: COMPANY SNAPSHOT

FIGURE 28 QIAGEN NV: COMPANY SNAPSHOT

FIGURE 29 THERMO FISHER SCIENTIFIC INC: COMPANY SNAPSHOT

FIGURE 30 TAKARA BIO, INC: COMPANY SNAPSHOT

FIGURE 31 BIOGENUIX.: COMPANY SNAPSHOT

FAQ

The Nucleic Acid Isolation and Purification market size was 4.45 billion in the year 2021 and is expected to grow at a CAGR of 36.7 %.

North America held more than 36.7 % of the Nucleic Acid Isolation and Purification market revenue share in 2021 and will witness expansion in the forecast period.

The rising research and development activities in the genomic field is driving the growth of the Nucleic Acid Isolation and purification market

The kits and reagents segment dominated the market for nucleic acid isolation and purification. The expansion of the market is primarily responsible for the widespread use of kits and reagents for DNA and RNA isolation in the preparation of samples and libraries. The segment is also being driven by the increasing use of kits and reagents in research investigations aimed at understanding both common and uncommon genome-based disorders. The instrument segment is expected to witness fastest growth in the forecast period.

The nucleic acid isolation and purification market was dominated by the North American region. The region held the largest revenue share of 36.7 % in the year 2021. The main factor driving market expansion in the area is the presence of established companies and their work on creating technologically advanced rapid purification and isolation systems. Additionally, the increasing financing initiatives for biotechnology research are accelerating the market’s growth in the area.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.