Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

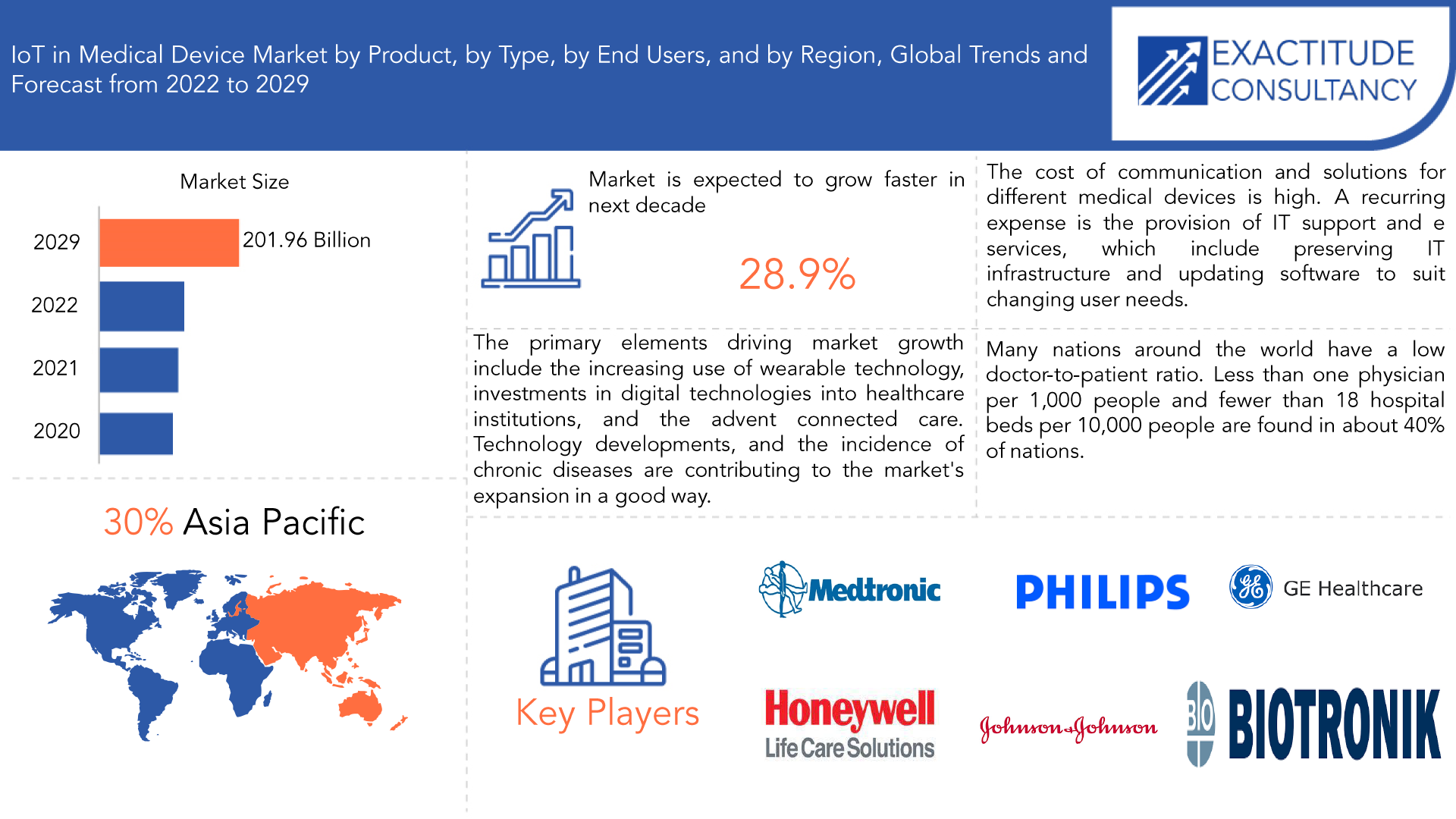

| USD 201.96 Billion by 2029 | 28.9% | Asia Pacific |

| By Product | By Type | By End User |

|---|---|---|

|

|

|

SCOPE OF THE REPORT

IoT in medical device Market Overview

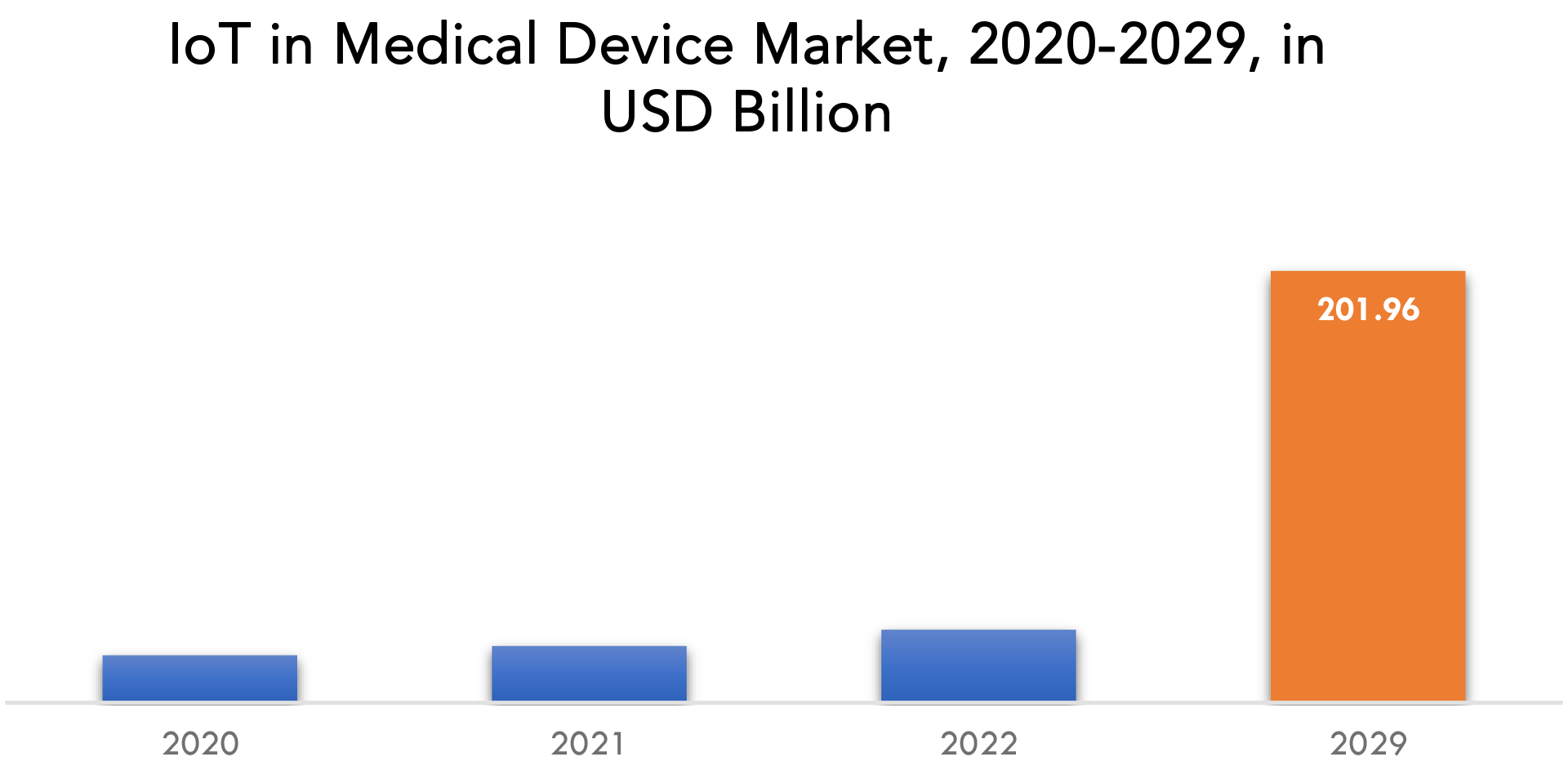

The IoT in medical device Market is expected to grow at 28.9% CAGR from 2022 to 2029. It is expected to reach above USD 201.96 Billion by 2029 from USD 22.20 Billion in 2020.

According to estimates, the global market for loT medical devices will grow due to the need to control healthcare delivery costs as well as a growing emphasis on patient engagement and centered care. The rise of demand in the global market during the forecast period is also likely to be boosted by government initiatives to encourage digital health. The overall cost of healthcare delivery has increased by double digits in the last few decades. The primary factors contributing to the sharp rise in healthcare costs are rising health insurance premiums, soaring demand for high-quality medical treatment, an ageing population, and an increase in the prevalence of chronic diseases globally. The heavy reliance on antiquated clinical technology, which raises the risk of medical errors, patient readmission, and administrative costs, is another important factor in this trend.

The internet of things (IoT) is a network of actual objects that employs connectivity to allow data exchange. In the healthcare industry, IoT is also utilised for data collecting, analysis for research, and monitoring of electronic health records that contain personally identifiable information, protected health information, and other machine-generated healthcare data. IoT type in medical devices also ease the strain on medical professionals and facilitate crucial tasks like improving patient outcomes. Medical devices with Internet of Things (IoT) capabilities have enabled remote monitoring in the healthcare industry, unlocking the potential to keep patients safe and healthy and enabling doctors to provide excellent treatment. The Internet of Things is a crucial part of the digital transformation of the healthcare business, and numerous stakeholders are ramping up their efforts in this area. As a result, growth in IoT in medical device is undoubtedly predicted to accelerate from 2017 to 2022.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD BILLION), (THOUSAND UNITS). |

| Segmentation | By Product, By Type, By End user, By Region |

| By Product |

|

| By Type |

|

| By End user |

|

| By Region |

|

IoT in medical devices have the ability to instantly evaluate and share vital medical data to enable seamless departmental communication, lower healthcare costs by streamlining general procedures, and optimise medicine dosage and delivery through monitoring drug effectiveness. These and other elements may increase the uptake of IoT in medical devices and fuel future market revenue growth. IoT in medical devices are currently on the market and offer services like remote temperature monitoring for vaccines, tools for transmitting medical data, monitoring of vital signs, remote care biometric scanners, and sleep monitors, among others. By utilising connected devices with IoT sensors to provide a continuous stream of real-time patient health data, IoT-enabled devices enhance patient outcomes and lower expenses. Other factors anticipated to help to the market’s revenue growth in the future include an increase in joint research and development activities, the trend toward patient care at home, and an increase in the number of product releases.

The primary elements driving market growth include the increasing use of wearable technology, investments in integrating digital technologies into healthcare institutions, and the advent of connected care. Technology developments, a growing elderly population, and the incidence of chronic diseases are all contributing to the market’s expansion in a good way. The adoption of supportive government regulatory policies, technological advancements, rising incidence rates of chronic diseases like COPD, genetic diseases, respiratory diseases, and others, and better access to high-speed internet are some of the main factors driving the growth of the internet of things in the healthcare market.

In addition, there is a growing need for affordable illness management and treatment, as well as a rise in the use of wearables and smart devices, a growing interest in measuring one’s own health, and a decrease in healthcare costs due to the use of IoT in medical device products. Additionally, growing interest from startup businesses, like MedAngelONE, Amiko, SWORD health, and Aira, in the IoT healthcare sector is anticipated to fuel market expansion. The market’s expansion is anticipated to be hampered by difficulties like high development costs for IoT infrastructure, data privacy and security concerns, a lack of public awareness in developing regions, and a lack of technical expertise. Several elements, including government actions to support IoT platforms, improvements in developing nations’ healthcare infrastructure, and high R&D spending, are anticipated to boost market expansion.

Solutions for communication and interoperability across various medical equipment come at a hefty price. Additionally, IT support and maintenance services—which include updating software to meet changing user needs and keeping a productive IT infrastructure—represent a recurrent cost. This makes up a sizable portion of the overall ownership cost. Additionally, additional verification and validation are necessary for post-sale custom interface creation for device integration to guarantee solution accuracy and comprehensiveness. The total cost of ownership for healthcare providers is subsequently increased by this. Small healthcare facilities are hesitant to replace their outdated systems with cutting-edge loT-enabled devices because of the hefty expenses involved, especially in emerging nations.

The cost of communication and interoperability solutions for different medical devices is high. A recurring expense is the provision of IT support and maintenance services, which include preserving an effective IT infrastructure and updating software to suit changing user needs. This accounts for a considerable amount of the total cost of ownership. In order to ensure the accuracy and thoroughness of the solution, further validation and verification are required for the design of specific post-sale interfaces for device integration. This consequently results in an increase in the total cost of ownership for healthcare providers. Due to the high costs involved, especially in developing countries, small healthcare facilities are reluctant to replace their antiquated systems with cutting-edge loT-enabled devices.

The governments of numerous nations have started programmes to advance digital health. Measures like enacting required requirements for electronic health record (HER) systems are only two examples of the considerable changes being made to the healthcare sector. The demand for healthcare in disadvantaged areas, rising investment, and an increase in internet users are some of the drivers boosting the IoT healthcare market’s expansion. Government attempts to promote digital health and a low doctor-to-patient ratio are expected to make for promising opportunities for industry participants.

Many nations around the world have a low doctor-to-patient ratio. Less than one physician per 1,000 people and fewer than 18 hospital beds per 10,000 people are found in about 40% of nations, according to the 2017 World Health Statistics report. In terms of residents’ access to healthcare, there is also a considerable discrepancy between developed and developing markets. For instance, compared to rich countries, developing nations in APAC and Africa have much fewer hospital beds, doctors, nurses, and midwives per 10,000 people.

The pandemic has altered providers’ readiness to embrace IoT solutions, assisting in the usage of the internet of things to diagnose the infection. In addition, a rising number of IoT technologies are aiding authorities in both treating those who have already contracted COVID-19 and preventing its further spread. IoT, notably and especially when integrated with additional revolutionary technologies like cloud computing and artificial intelligence (AI). This resulted in a variety of IoT type in medical devices during this crisis. According to the WHO, for instance, in 2020, personnel and patients at a field hospital in Wuhan, China, wore bracelets and rings that were synced with an AI. This platform from CloudMinds, a Beijing-based provider of cloud-based systems for intelligent robots, will offer continuous monitoring of vital indicators throughout the COVID-19 pandemic, including temperature, heart rate, and blood oxygen levels. Also in India, the Union Health Ministry on April 2, 2020, released the mobile type aarogya setu app, which aids users in determining whether they are at risk of COVID-19 infection. Thus, Covid-19 has increased the need for the internet of things in the healthcare industry and offers chances for the makers in a variety of type in the healthcare domain over the forecast period.

IoT in medical device Market Segment Analysis

The IoT in medical device market is segmented based on product, type, end user, and region, global trends and forecast.

By product type, the market is bifurcated into (Blood pressure monitor, Glucometer, Cardiac Monitor, Pulse Oximeter, and Infusion Pump). By type into (Wearable, Implantable, Stationary). By end user into (Hospitals and Clinics, Nursery homes, others) and region, global trends and forecast.

Among product segments, the blood pressure monitor segment is anticipated to expand at the fastest rate over the forecasted period. In terms of product segments, the blood pressure monitor sector is anticipated to increase at the greatest CAGR during the forecast period. This is primarily because of the rising prevalence of hypertension, the rising obesity rate, and the growing inclination for self-health management.

The market for loT medical devices is anticipated to be dominated by the stationary medical devices type segment. In 2020, the stationary medical devices market had the largest share of the overall lol medical devices market. The introduction of government policies requiring the use of EHR and the benefits provided by these devices are propelling the growth of this market.

According to end user, the hospitals and clinics segment is anticipated to hold the largest market share for loT medical devices. The market is further divided into nursing homes, assisted living facilities, long-term care facilities, and home care settings. The primary driver of this market’s growth is the growing necessity to handle an expanding amount of patient data and the rising need for data accessibility and interoperability in hospitals and clinics.

IoT in medical device Market Players

The IoT in medical device Market key players includes Medtronic, GE Healthcare, Koninklijke Philips NV, Honeywell Life Care Solutions, BIOTRONIK , Boston Scientific Corporation , Johnson & Johnson Services, Inc., Siemens AG, Omron Healthcare, Inc, Bio Telemetry, Inc., AliveCor, Inc., iHealth Lab, Inc., AgaMatrix, Abbott Laboratories, Stanley Healthcare, and Hillrom-Welch Allyn.

Industry Development:

- 28 November 2022: GE Healthcare has announced an agreement with ulrich medical for a GE Healthcare branded contrast media injector in the U.S. The CT motion multi-dose syringeless injector, which delivers iodinated contrast media for Computed Tomography (CT) imaging procedures, reduces procedure setup time and increases patient throughput by eliminating time consuming preparation steps, while helping to optimize patient dosing and reduce wasted contrast media.

- 7 July 2022: GE Healthcare, a leading global medical technology, diagnostics, and digital solutions innovator, inaugurated its 5G Innovation Lab in Bengaluru, India, the first for GE Healthcare across the globe. With the advantage of massive bandwidth, high data speeds, low latency, and highly reliable connectivity.

Who Should Buy? Or Key stakeholders

- IoT in medical device Service provider

- Consultancy Firms/ Advisory Firms

- Healthcare Industries

- Hospitals

- Pharmaceutical Industries

- IT Industries

- Raw Materials Manufacturers

- Research Organizations

- Investors

- Regulatory Authorities

- Others

IoT in medical device Market Regional Analysis

The IoT in medical device Market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

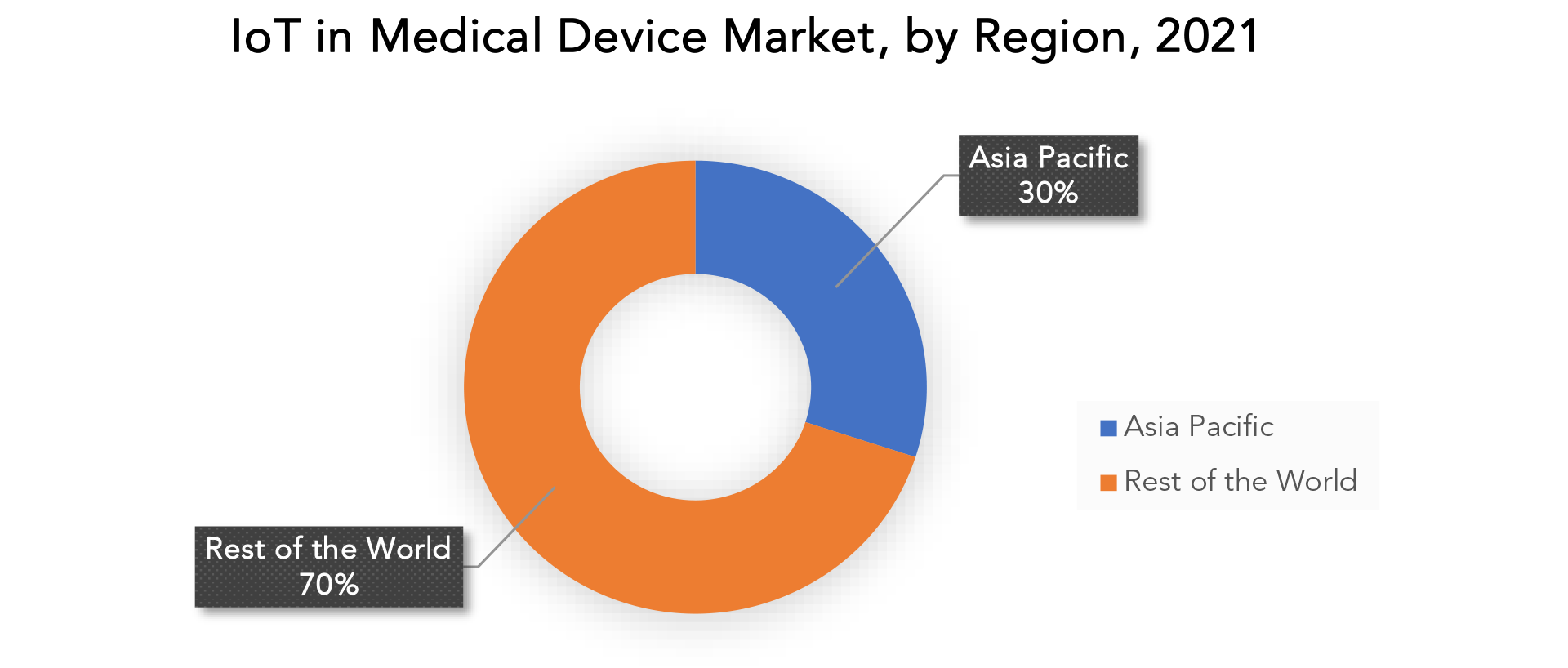

Throughout the projected period, Asia Pacific is anticipated to gain the largest revenue share. The governments place a strong emphasis on eHealth solutions to cater to the diverse demographics of nations like China, India, South Korea, and others. The Chinese government is using telemedicine and digital healthcare to provide assistance in rural and isolated areas, according to the 2020 report. During the projection period, India is anticipated to demonstrate a high growth rate. Large prospects in healthcare are being presented by India’s fast expanding population and the government’s significant digital investments.

After the Asia Pacific, North America is expected to hold a sizable portion of the market. In North America, there has been a tremendous uptake of cutting-edge technologies across all industries, including the IoT, which has fueled market expansion. Due to the healthcare sector’s explosive growth, the United States is projected to dominate the market revenue. Demand for wearable and remote patient monitoring services in the nation is projected to increase as a result of changing lifestyles and increased attention to health management.

Throughout the predicted period, Europe is expected to have tremendous growth. IoT is being quickly adopted in the healthcare sector by European nations including France and the UK. The region’s market is expanding as a result of rising hospital demand for mHealth, electronic health records, and telemedicine.

South America will have consistent growth over the predicted period as a result of increased government attention to improving the healthcare systems of the nations. For instance, various Brazilian Ministries of Healthcare, Innovation, and Technology announced a collaboration in February 2020 to implement internet-of-things programmes in the healthcare sector.

Significant market growth is projected for the Middle East and Africa. To propel loT in the healthcare market growth, the countries primarily concentrate on investments in healthcare sectors. For instance, HBKICare and Sure Universal introduced a general remote healthcare loT platform in September 2020 to support healthcare facilities in Israel and the United Arab Emirates (UAE). This is anticipated to accelerate the growth of healthcare in the area.

Key Market Segments: IoT in medical device Market

IoT In Medical Device Market By Product, 2020-2029, (USD Billion), (Thousand Units).

- Blood Pressure Monitor

- Glucometer

- Cardiac Monitor

- Pulse Oximeter

- Infusion Pump

IoT In Medical Device Market By Type, 2020-2029, (USD Billion), (Thousand Units).

- Wearable

- Implantable

- Stationarity

IoT In Medical Device Market By End User, 2020-2029, (USD Billion), (Thousand Units).

- Hospitals And Clinics

- Nursing Home

- Others

IoT In Medical Device Market By Region, 2020-2029, (USD Billion), (Thousand Units).

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the IoT in medical device market over the next 7 years?

- Who are the major players in the IoT in medical device market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the IoT in medical device market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the IoT in medical device market?

- What is the current and forecasted size and growth rate of the global IoT in medical device market?

- What are the key drivers of growth in the IoT in medical device market?

- What are the distribution channels and supply chain dynamics in the IoT in medical device market?

- What are the technological advancements and innovations in the IoT in medical device market and their impact on form development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the IoT in medical device market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the IoT in medical device market?

- What are the services offerings and specifications of leading players in the market?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL IOT IN MEDICAL DEVICE MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON IOT IN MEDICAL DEVICE MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL IOT IN MEDICAL DEVICE MARKET OUTLOOK

- GLOBAL IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION, THOUSAND UNITS), 2020-2029

- BLOOD PRESSURE MONITOR

- GLUCOMETER

- CARDIAC MONITOR

- PULSE OXIMETER

- INFUSION PUMP

- GLOBAL IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION, THOUSAND UNITS),2020-2029

- WEARABLE

- IMPLANTABLE

- STATIONARY

- GLOBAL IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION, THOUSAND UNITS),2020-2029

- HOSPITALS AND CLINICS

- NURSERY HOMES

- OTHERS

- GLOBAL IOT IN MEDICAL DEVICE MARKET BY REGION (USD BILLION, THOUSAND UNITS),2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- MEDTRONIC

- GE HEALTHCARE

- KONINKLIJKE PHILIPS NV

- HONEYWELL LIFE CARE SOLUTIONS

- BIOTRONIK

- BOSTON SCIENTIFIC CORPORATION

- JOHNSON & JOHNSON SERVICES, INC.

- SIEMENS AG

- OMRON HEALTHCARE INC.

- BIO TELEMETRY, INC.

- ALIVECOR INC.

- IHEALTH LAB, INC.

- AGAMATRIX

- ABBOTT LABORATORIES

- STANLEY HEALTHCARE

- HILLROM-WELCH ALLYN

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 2 GLOBAL IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 3 GLOBAL IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 4 GLOBAL IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 5 GLOBAL IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 6 GLOBAL IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 7 GLOBAL IOT IN MEDICAL DEVICE MARKET BY REGION (USD BILLION), 2020-2029

TABLE 8 GLOBAL IOT IN MEDICAL DEVICE MARKET BY REGION (THOUSAND UNITS), 2020-2029

TABLE 9 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 10 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 11 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 12 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 13 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 14 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 15 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 16 NORTH AMERICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 17 US IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 18 US IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 19 US IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 20 US IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 21 US IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 22 US IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 23 CANADA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (BILLION), 2020-2029

TABLE 24 CANADA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 25 CANADA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 26 CANADA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 27 CANADA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 28 CANADA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 29 MEXICO IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 30 MEXICO IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 31 MEXICO IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 32 MEXICO IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 33 MEXICO IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 34 MEXICO IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 35 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 36 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 37 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 38 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 39 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 40 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 41 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 42 SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 43 BRAZIL IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 44 BRAZIL IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 45 BRAZIL IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 46 BRAZIL IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 47 BRAZIL IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 48 BRAZIL IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 49 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 50 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 51 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 52 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 53 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 54 ARGENTINA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 55 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 56 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 57 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 58 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 59 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 60 COLOMBIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 61 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 62 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 63 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 64 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 65 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 66 REST OF SOUTH AMERICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 67 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 68 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 69 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 70 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 71 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 72 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 73 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 74 ASIA-PACIFIC IOT IN MEDICAL DEVICE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 75 INDIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 76 INDIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 77 INDIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 78 INDIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 79 INDIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 80 INDIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 81 CHINA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 82 CHINA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 83 CHINA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 84 CHINA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 85 CHINA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 86 CHINA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 87 JAPAN IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 88 JAPAN IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 89 JAPAN IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 90 JAPAN IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 91 JAPAN IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 92 JAPAN IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 93 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 94 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 95 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 96 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 97 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 98 SOUTH KOREA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 99 AUSTRALIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 100 AUSTRALIA IOT IN MEDICAL DEVICEBY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 101 AUSTRALIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 102 AUSTRALIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 103 AUSTRALIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 104 AUSTRALIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 105 SOUTH EAST ASIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 106 SOUTH EAST ASIA IOT IN MEDICAL DEVICEBY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 107 SOUTH EAST ASIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 108 SOUTH EAST ASIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 109 SOUTH EAST ASIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 110 SOUTH EAST ASIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 111 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 112 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICEBY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 113 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 114 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 115 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 116 REST OF ASIA PACIFIC IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 117 EUROPE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 118 EUROPE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 119 EUROPE IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 120 EUROPE IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 121 EUROPE IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 122 EUROPE IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 123 EUROPE IOT IN MEDICAL DEVICE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 124 EUROPE IOT IN MEDICAL DEVICE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 125 GERMANY IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 126 GERMANY IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 127 GERMANY IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 128 GERMANY IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 129 GERMANY IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 130 GERMANY IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 131 UK IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 132 UK IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 133 UK IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 134 UK IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 135 UK IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 136 UK IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 137 FRANCE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 138 FRANCE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 139 FRANCE IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 140 FRANCE IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 141 FRANCE IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 142 FRANCE IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 143 ITALY IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 144 ITALY IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 145 ITALY IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 146 ITALY IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 147 ITALY IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 148 ITALY IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 149 SPAIN IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 150 SPAIN IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 151 SPAIN IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 152 SPAIN IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 153 SPAIN IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 154 SPAIN IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 155 RUSSIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 156 RUSSIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 157 RUSSIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 158 RUSSIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 159 RUSSIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 160 RUSSIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 161 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 162 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 163 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 164 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 165 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 166 REST OF EUROPE IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 167 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 168 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 169 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 170 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 171 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 172 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 173 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (USD BILLION), 2020-2029

TABLE 174 MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY COUNTRY (THOUSAND UNITS), 2020-2029

TABLE 175 UAE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 176 UAE IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 177 UAE IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 178 UAE IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 179 UAE IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 180 UAE IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 181 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 182 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 183 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 184 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 185 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 186 SAUDI ARABIA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 187 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 188 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 189 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 190 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 191 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 192 SOUTH AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

TABLE 193 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (USD BILLION), 2020-2029

TABLE 194 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY PRODUCT (THOUSAND UNITS), 2020-2029

TABLE 195 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (USD BILLION), 2020-2029

TABLE 196 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY TYPE (THOUSAND UNITS), 2020-2029

TABLE 197 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (USD BILLION), 2020-2029

TABLE 198 REST OF MIDDLE EAST AND AFRICA IOT IN MEDICAL DEVICE MARKET BY END USER (THOUSAND UNITS), 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL IOT IN MEDICAL DEVICE BY PRODUCT, USD BILLION, 2020-2029

FIGURE 9 GLOBAL IOT IN MEDICAL DEVICE BY TYPE, USD BILLION, 2020-2029

FIGURE 10 GLOBAL IOT IN MEDICAL DEVICE BY END USER, USD BILLION, 2020-2029

FIGURE 11 GLOBAL IOT IN MEDICAL DEVICE BY REGION, USD BILLION, 2020-2029

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL IOT IN MEDICAL DEVICE MARKET BY PRODUCT, USD BILLION, 2021

FIGURE 14 GLOBAL IOT IN MEDICAL DEVICE MARKET BY TYPE, USD BILLION, 2021

FIGURE 15 GLOBAL IOT IN MEDICAL DEVICE MARKET BY END USER, USD BILLION, 2021

FIGURE 16 GLOBAL IOT IN MEDICAL DEVICE MARKET BY REGION 2021

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 MEDTRONIC: COMPANY SNAPSHOT

FIGURE 19 GE HEALTHCARE: COMPANY SNAPSHOT

FIGURE 20 KONINKLIJKE PHILIPS NV: COMPANY SNAPSHOT

FIGURE 21 HONEYWELL LIFE CARE SOLUTIONS: COMPANY SNAPSHOT

FIGURE 22 BIOTRONIK: COMPANY SNAPSHOT

FIGURE 23 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

FIGURE 24 JOHNSON & JOHNSON SERVICES INC.: COMPANY SNAPSHOT

FIGURE 25 SIEMENS AG: COMPANY SNAPSHOT

FIGURE 26 OMRON HEALTHCARE INC.: COMPANY SNAPSHOT

FIGURE 27 BIO TELEMETRY INC.: COMPANY SNAPSHOT

FIGURE 28 IHEALTH LAB INC.: COMPANY SNAPSHOT

FIGURE 29 AGAMATRIX: COMPANY SNAPSHOT

FIGURE 30 ABBOTT LABORATORIES: COMPANY SNAPSHOT

FIGURE 31 STANLEY HEALTHCARE: COMPANY SNAPSHOT

FIGURE 32 HILLROM-WELCH ALLYN: COMPANY SNAPSHOT

FAQ

The IoT in medical device Market is expected to grow at 28.9% CAGR from 2022 to 2029. It is expected to reach above USD 201.96 Billion by 2029 from USD 22.20 Billion in 2020.

North America held more than 30% of the IoT in medical device Market revenue share in 2021 and will witness expansion in the forecast period.

The primary elements driving market growth include the increasing use of wearable technology, investments in integrating digital technologies into healthcare institutions, and the advent of connected care. Technology developments, a growing elderly population, and the incidence of chronic diseases are all contributing to the market’s expansion in a good way. The adoption of supportive government regulatory policies, technological advancements, rising incidence rates of chronic diseases like COPD, genetic diseases, respiratory diseases, and others, and better access to high-speed internet are some of the main factors driving the growth of the internet of things in the healthcare market.

The internet of things (IoT) is a network of actual objects that employs connectivity to allow data exchange. In the healthcare industry, IoT is also utilised for data collecting, analysis for research, and monitoring of electronic health records that contain personally identifiable information, protected health information, and other machine-generated healthcare data. IoT type in medical devices also ease the strain on medical professionals and facilitate crucial tasks like improving patient outcomes. Medical devices with Internet of Things (IoT) capabilities have enabled remote monitoring in the healthcare industry, unlocking the potential to keep patients safe and healthy and enabling doctors to provide excellent treatment. The Internet of Things is a crucial part of the digital transformation of the healthcare business, and numerous stakeholders are ramping up their efforts in this area. As a result, growth in IoT in medical device is undoubtedly predicted to accelerate from 2017 to 2022.

Throughout the projected period, Asia Pacific is anticipated to gain the largest revenue share. The governments place a strong emphasis on eHealth solutions to cater to the diverse demographics of nations like China, India, South Korea, and others. The Chinese government is using telemedicine and digital healthcare to provide assistance in rural and isolated areas, according to the 2020 report. During the projection period, India is anticipated to demonstrate a high growth rate. Large prospects in healthcare are being presented by India’s fast expanding population and the government’s significant digital investments.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.