Report Outlook

| Market Size | CAGR | Dominating Region |

|---|---|---|

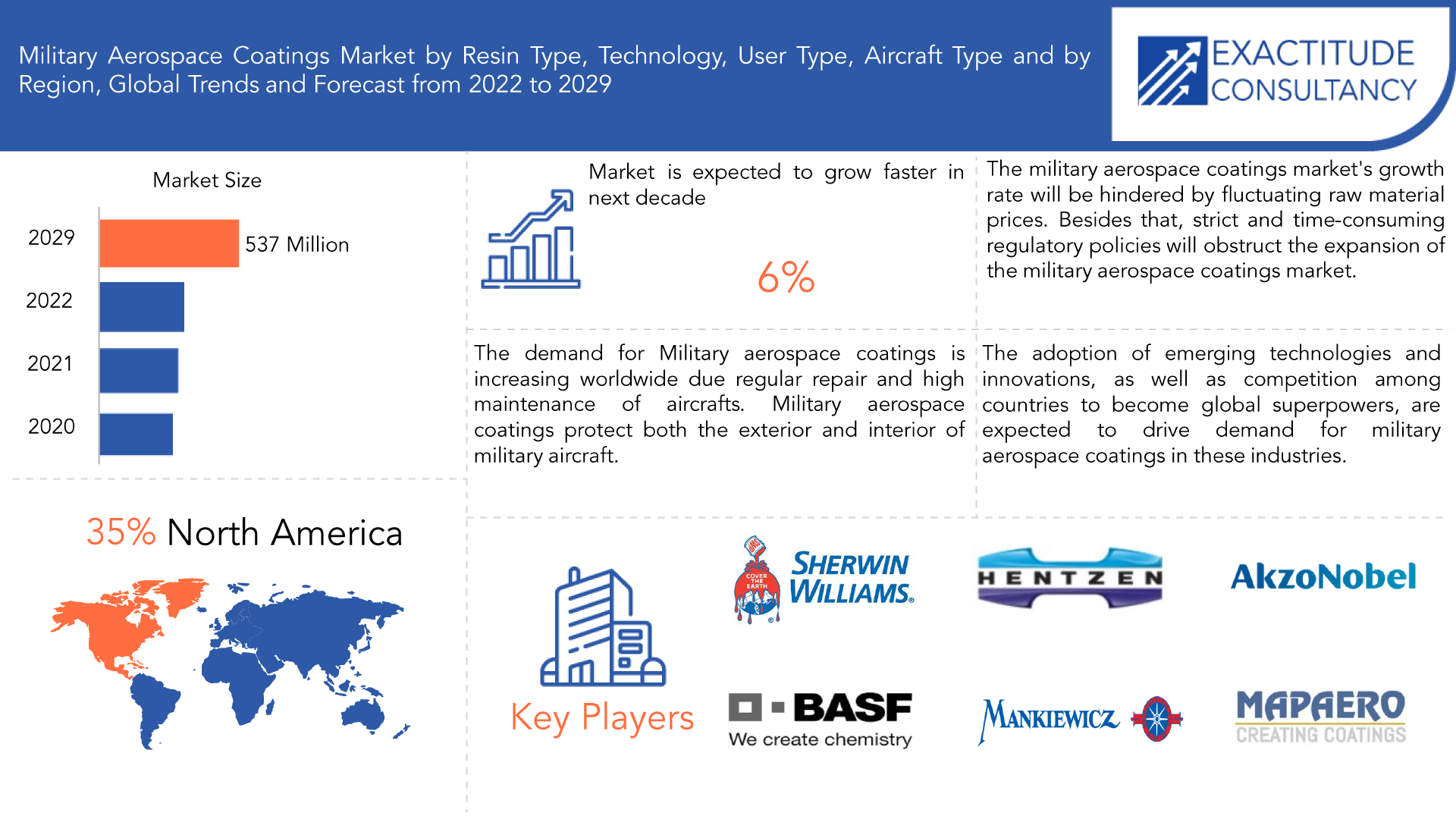

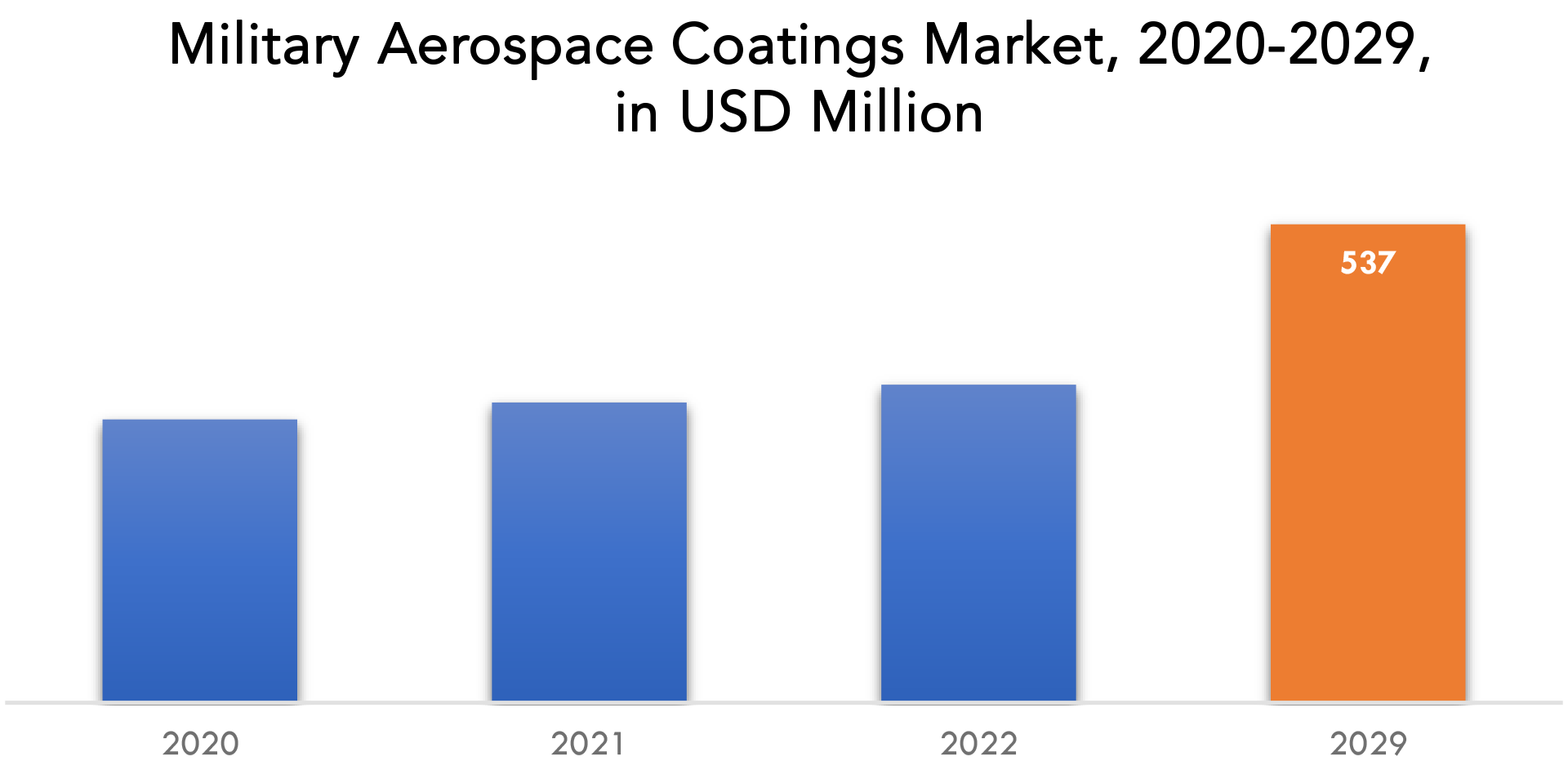

| USD 537 Million by 2029 | 6% | North America |

| By Resin Type | By Technology | By User Type | By Aircraft Type | By Region |

|---|---|---|---|---|

|

|

|

|

|

SCOPE OF THE REPORT

Military Aerospace Coatings Market Overview

The military aerospace coatings market is expected to grow at 6% CAGR from 2021 to 2029. It is expected to reach above USD 537 Million by 2029 from USD 318 Million in 2020.

Military aerospace coatings are coating materials that are widely used to cover the outer and inner surfaces of aircraft to improve their functional properties. These coating materials protect the surface from corrosion and exposure to the elements. Affordable commercial air traffic is emerging as a viable option in both developing and developed economies, potentially opening up new market opportunities. Reduced global defense budgets may limit market growth. The aerospace coatings industry will grow as demand for new generation aircrafts to replace the existing military aircraft fleet grows. Furthermore, the growing popularity of lightweight aerospace coatings among major aircraft manufacturers will boost market demand. Raw material price volatility, on the other hand is limiting market expansion.

Aircraft must withstand high climatic stress, which typically damages the metal surface and necessitates frequent repairs and maintenance. Aerospace coatings are more resistant to corrosion, UV rays and solar heat, fog, and other adverse weather conditions. The coating also guards against corrosion and chemical attacks. Furthermore, frequent environmental changes have increased the demand for aircraft coatings. Aerospace coatings are intended to prevent temperature fluctuations, changes in air pressure, and air instabilities.

| ATTRIBUTE | DETAILS |

| Study period | 2020-2029 |

| Base year | 2021 |

| Estimated year | 2022 |

| Forecasted year | 2022-2029 |

| Historical period | 2018-2020 |

| Unit | Value (USD Million), Volume (Kilotons) |

| Segmentation | By Resin Technology, By Technology, By User Type, By Aircraft Type, By Region |

| By Resin Technology | |

| By Technology |

|

| By User Type |

|

| By Aircraft Type |

|

| By Region |

|

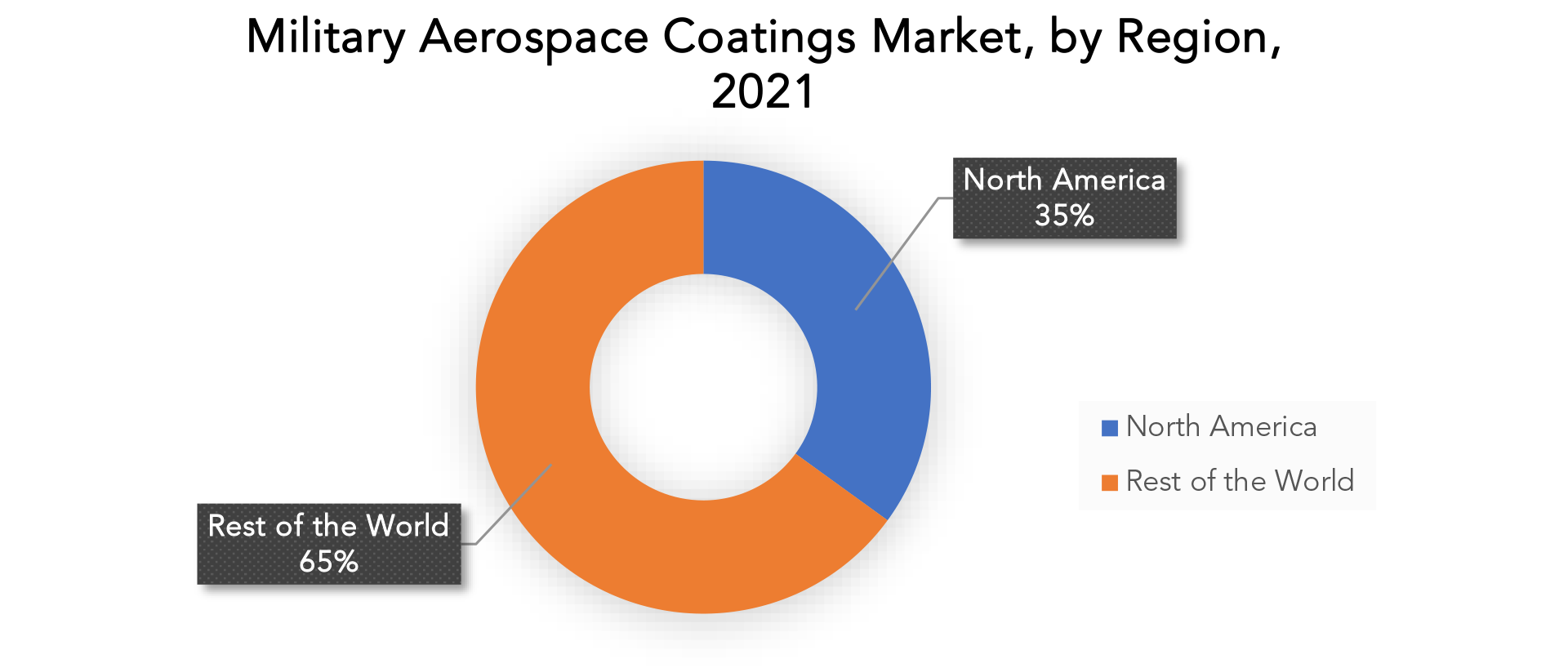

North America had the largest share of the global aerospace coating market in 2019. The aerospace industry in the United States has grown over the years, and the country has seen the emergence of various aerospace companies in recent years. Government regulations governing coating products have increased demand for polyurethane aerospace coatings in this region. Increased military and defense spending has also fueled the growth of the aerospace coatings market in North America. Furthermore, the surge in demand for commercial aircraft due to increased air travel, as well as ongoing research and development projects aimed at lowering emission levels, has driven the North American aerospace coating market.

Raw material prices are currently volatile. This has the potential to significantly increase the cost of the raw materials required to manufacture aerospace coatings. As a result, aeroplane manufacturers must use more expensive products, which means producing fewer planes. Even with wild fluctuations in raw material prices, the aerospace coatings industry must find ways to keep its products affordable.

COVID-19 is expected to usher in the digital era. COVID-19 promoted new forms of social interaction, such as social distancing and contactless delivery. It also prompted governments all over the world to implement quarantines and lockdowns. Because they had a limited effect, they were only temporary.

Many businesses in many markets suffered as a result of being forced to drastically reduce production or temporarily shut down. Companies in the aerospace coatings market were not immune. People flew much less because of COVID-19 and the mask-wearing mandates imposed by airlines on passengers. Demand for new planes fell, forcing many aerospace coatings manufacturers to either drastically reduce production or shut down, either temporarily or permanently.

Military Aerospace Coatings Market Segment Analysis

The military aerospace coatings market is segmented based on resin technology, technology, user type, aircraft type, and region, global trends and forecast.

On the basis of resin type, the market is segmented into polyurethane, epoxy, acrylic, silicone.

The epoxy sub-segment has the highest CAGR in the resin segment. In 2021, epoxy resin had a market share of more than 21% in the aerospace coating market. Epoxy resin is a reactive prepolymer and polymer that contains epoxide groups. Polymers become more elastic and tough as a result. This makes them suitable for a wide range of applications. Voltage resistance, water absorption, strength, heat and temperature resistance, chemical resistance, elongation, shrinkage coefficient, thermal conductivity, induced rate, and others are the main properties of epoxy resin. It has superior mechanical properties as well as greater thermal and chemical resistance than other types of resins. As a result, it is only used in the manufacture of aircraft components. According to the India brand equity foundation (IBEF), the Indian government has set a target of us$25.00 billion in defence production by 2025. In 2019-20, India’s defence exports are expected to total us$1.29 billion. The value of India’s defence imports was $463 million in fy20 and is expected to be $469.9 million in fy21. Defence exports in the country have increased significantly in the last two years. As a result, the thriving aerospace industry is driving up demand for epoxy resin in the aerospace coatings market.

On the basis of user type, the market is segmented into OEM, MRO.

The MRO segment will have the largest aerospace coatings market share. There are two reasons behind this, firstly, the aeroplane often needs repairs and secondly, aeroplanes are high-maintenance. From $800 million in 2018, the MRO industry is expected to grow to more than $2.4 billion in 2019. Land allotment for entities establishing MRO facilities in India has been extended to September 2021 for a period of 30 years. The government aims to make India a ‘global MRO hub. As a result, the use of aerospace coatings in MRO will boost market growth for the aerospace coatings industry during the forecast period.

Military Aerospace Coatings Market Players

The Military Aerospace Coatings Market Key players include PPG Industries, Sherwin-Williams, Hentzen Coatings, Akzo Nobel, BASF, Henkel, 3Chem, Mankiewicz, Zircotec, mapaero, Creative Coatings, Valspar, Klinge Enameling Inc., Chase Corporation, Evonik Industries AG.

Industry Development

- 2 February, 2023: PPG announced its SEM products business is expanding its sundries that offer Versatile Cup system for automotive refinish Market. VCS hybrid system includes multi-functional cups, liners and lids.

- 2 February 2023: PPG announced the launch of a digital lesson created by partner Centrum JongerenCommunicatie Chemie (C3), a Dutch education nonprofit that introduces children and young people to chemistry and life sciences.

Who Should Buy? Or Key stakeholders

- Military Aerospace Coating Manufacturers

- Raw Material Suppliers

- Military Aerospace Traders, Distributors & Suppliers

- Regional Manufacturer Associations

- General Military Aerospace Coatings Associations

- Government & Regional Agencies

- Research Organizations

- Investors

- Regulatory Authorities

Military Aerospace Coatings Market Regional Analysis

The military aerospace coatings market by region includes North America, Asia-Pacific (APAC), Europe, South America, and Middle East & Africa (MEA).

- North America: includes the US, Canada, Mexico

- Asia Pacific: includes China, Japan, South Korea, India, Australia, ASEAN and Rest of APAC

- Europe: includes UK, Germany, France, Italy, Spain, Russia, and Rest of Europe

- South America: includes Brazil, Argentina and Rest of South America

- Middle East & Africa: includes Turkey, UAE, Saudi Arabia, South Africa, and Rest of MEA

North America is expected to dominate in terms of both regional CAGR and market share. North America held a share of around 39% in the year 2021, followed by Asia Pacific. The reason for this is that the United States manufactures and exports the most aircraft in the world. According to the FAA, air traffic in the United States will increase by 1.9% per year until 2029.

As a result, the number of international and domestic flights has increased, necessitating the use of more planes. As a result, the demand for aerospace coatings has skyrocketed. The European Union holds the second-largest market share for aerospace coatings. This is due to an increase in innovative uses for aerospace coatings. The European Union is expected to have a high CAGR as well. Many European governments are also encouraging the development of newer and better aerospace coatings with more novel applications. The Asia-Pacific region is expected to grow at a 4.8% CAGR.

The Middle East and North Africa, as well as South America, are experiencing respectable growth, owing to their governments’ heavy investments in the aerospace industry and increased tourism to these regions.

Key Market Segments: Military Aerospace Coatings Market

Military Aerospace Coatings Market By Resin Type, 2020-2029, (USD Million, Kilotons)

- Polyurethane

- Epoxy

- Acrylic

- Silicone

Military Aerospace Coatings Market By Technology, 2020-2029, (USD Million, Kilotons)

- Liquid-Based

- Solvent-Based

- Water-Based

- Powder-Based

Military Aerospace Coatings Market By User Type, 2020-2029, (USD Million, Kilotons)

- Oem

- Mro

Military Aerospace Coatings Market By Aircraft Type, 2020-2029, (USD Million, Kilotons)

- Fixed Wing

- Rotary Wing

Military Aerospace Coatings Market By Region, 2020-2029, (USD Million, Kilotons)

- North America

- Asia Pacific

- Europe

- South America

- Middle East And Africa

Important Countries In All Regions Are Covered.

Exactitude Consultancy Services Key Objectives:

- Increasing sales and market share

- Developing new technology

- Improving profitability

- Entering new markets

- Enhancing brand reputation

Key Question Answered

- What is the expected growth rate of the military aerospace coatings market over the next 7 years?

- Who are the major players in the military aerospace coatings market and what is their market share?

- What are the end-user industries driving demand for market and what is their outlook?

- What are the opportunities for growth in emerging markets such as Asia-Pacific, Middle East, and Africa?

- How is the economic environment affecting the military aerospace coatings market, including factors such as interest rates, inflation, and exchange rates?

- What is the expected impact of government policies and regulations on the military aerospace coatings market?

- What is the current and forecasted size and growth rate of the global military aerospace coatings market?

- What are the key drivers of growth in the military aerospace coatings market?

- What are the distribution channels and supply chain dynamics in the military aerospace coatings market?

- What are the technological advancements and innovations in the military aerospace coatings market and their impact on product development and growth?

- What are the regulatory considerations and their impact on the market?

- What are the challenges faced by players in the military aerospace coatings market and how are they addressing these challenges?

- What are the opportunities for growth and expansion in the military aerospace coatings market?

- What are the product offerings and specifications of leading players in the market?

- What is the pricing trend of military aerospace coatings in the market and what is the impact of raw material prices on the price trend?

Table of Content

- INTRODUCTION

- MARKET DEFINITION

- MARKET SEGMENTATION

- RESEARCH TIMELINES

- ASSUMPTIONS AND LIMITATIONS

- RESEARCH METHODOLOGY

- DATA MINING

- SECONDARY RESEARCH

- PRIMARY RESEARCH

- SUBJECT-MATTER EXPERTS’ ADVICE

- QUALITY CHECKS

- FINAL REVIEW

- DATA TRIANGULATION

- BOTTOM-UP APPROACH

- TOP-DOWN APPROACH

- RESEARCH FLOW

- DATA SOURCES

- DATA MINING

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GLOBAL MILITARY AEROSPACE COATINGS MARKET OUTLOOK

- MARKET DRIVERS

- MARKET RESTRAINTS

- MARKET OPPORTUNITIES

- IMPACT OF COVID-19 ON MILITARY AEROSPACE COATINGS MARKET

- PORTER’S FIVE FORCES MODEL

- THREAT FROM NEW ENTRANTS

- THREAT FROM SUBSTITUTES

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMERS

- DEGREE OF COMPETITION

- INDUSTRY VALUE CHAIN ANALYSIS

- GLOBAL MILITARY AEROSPACE COATINGS MARKET OUTLOOK

- GLOBAL MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION, KILOTONS), 2020-2029

- POLYURETHANE

- EPOXY

- ACRYLIC

- SILICONE

- GLOBAL MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION, KILOTONS), 2020-2029

- LIQUID-BASED

- SOLVENT-BASED

- WATER-BASED

- POWDER-BASED

- GLOBAL MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION, KILOTONS), 2020-2029

- OEM

- MRO

- GLOBAL MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION, KILOTONS), 2020-2029

- FIXED WING

- ROTARY WING

- GLOBAL MILITARY AEROSPACE COATINGS MARKET BY REGION (USD MILLION, KILOTONS), 2020-2029

- NORTH AMERICA

- US

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- REST OF SOUTH AMERICA

- EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- INDIA

- CHINA

- JAPAN

- SOUTH KOREA

- AUSTRALIA

- SOUTH-EAST ASIA

- REST OF ASIA PACIFIC

- MIDDLE EAST AND AFRICA

- UAE

- SAUDI ARABIA

- SOUTH AFRICA

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

- PPG INDUSTRIES

- THE SHERWIN-WILLIAMS COMPANY

- HENTZEN COATINGS INC.

- AKZO NOBEL N.V.

- BASF SE

- HENKEL AG & COMPANY

- 3CHEM

- MANKIEWICZ GEBR. & CO.

- ZIRCOTEC LTD

- MAPAERO

- CREATIVE COATINGS

- VALSPAR

- KLINGE ENAMELING INC.

- CHASE CORPORATION

- EVONIK INDUSTRIES AG

*THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 2 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 3 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 4 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 5 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 6 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 7 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 8 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 9 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY REGION (USD MILLION) 2020-2029

TABLE 10 GLOBAL MILITARY AEROSPACE COATINGS MARKET BY REGION (KILOTONS) 2020-2029

TABLE 11 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 12 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 13 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 14 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 15 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 16 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 17 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 18 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 19 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 20 NORTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 21 US MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 22 US MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 23 US MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 24 US MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 25 US MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 26 US MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 27 US MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 28 US MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 29 CANADA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 30 CANADA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 31 CANADA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 32 CANADA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 33 CANADA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 34 CANADA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 35 CANADA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 36 CANADA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 37 MEXICO MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 38 MEXICO MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 39 MEXICO MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 40 MEXICO MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 41 MEXICO MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 42 MEXICO MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 43 MEXICO MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 44 MEXICO MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 45 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 46 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 47 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 48 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 49 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 50 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 51 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 52 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 53 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 54 SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 55 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 56 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 57 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 58 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 59 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 60 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 61 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 62 BRAZIL MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 63 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 64 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 65 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 66 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 67 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 68 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 69 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 70 ARGENTINA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 71 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 72 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 73 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 74 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 75 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 76 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 77 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 78 COLOMBIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 79 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 80 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 81 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 82 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 83 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 84 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 85 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 86 REST OF SOUTH AMERICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 87 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 88 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 89 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 90 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 91 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 92 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 93 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 94 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 95 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 96 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 97 INDIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 98 INDIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 99 INDIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 100 INDIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 101 INDIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 102 INDIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 103 INDIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 104 INDIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 105 CHINA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 106 CHINA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 107 CHINA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 108 CHINA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 109 CHINA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 110 CHINA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 111 CHINA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 112 CHINA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 113 JAPAN MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 114 JAPAN MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 115 JAPAN MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 116 JAPAN MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 117 JAPAN MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 118 JAPAN MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 119 JAPAN MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 120 JAPAN MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 121 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 122 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 123 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 124 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 125 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 126 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 127 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 128 SOUTH KOREA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 129 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 130 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 131 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 132 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 133 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 134 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 135 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 136 AUSTRALIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 137 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 138 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 139 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 140 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 141 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 142 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 143 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 144 SOUTH-EAST ASIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 145 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 146 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 147 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 148 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 149 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 150 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 151 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 152 REST OF ASIA PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 153 EUROPE MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 154 EUROPE MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 155 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 156 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 157 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 158 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 159 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 160 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 161 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 162 ASIA-PACIFIC MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 163 GERMANY MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 164 GERMANY MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 165 GERMANY MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 166 GERMANY MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 167 GERMANY MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 168 GERMANY MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 169 GERMANY MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 170 GERMANY MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 171 UK MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 172 UK MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 173 UK MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 174 UK MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 175 UK MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 176 UK MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 177 UK MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 178 UK MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 179 FRANCE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 180 FRANCE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 181 FRANCE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 182 FRANCE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 183 FRANCE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 184 FRANCE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 185 FRANCE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 186 FRANCE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 187 ITALY MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 188 ITALY MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 189 ITALY MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 190 ITALY MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 191 ITALY MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 192 ITALY MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 193 ITALY MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 194 ITALY MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 195 SPAIN MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 196 SPAIN MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 197 SPAIN MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 198 SPAIN MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 199 SPAIN MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 200 SPAIN MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 201 SPAIN MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 202 SPAIN MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 203 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 204 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 205 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 206 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 207 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 208 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 209 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 210 RUSSIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 211 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 212 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 213 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 214 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 215 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 216 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 217 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 218 REST OF EUROPE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 219 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (USD MILLION) 2020-2029

TABLE 220 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY COUNTRY (KILOTONS) 2020-2029

TABLE 221 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 222 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 223 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 224 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 225 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 226 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 227 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 228 MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 229 UAE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 230 UAE MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 231 UAE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 232 UAE MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 233 UAE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 234 UAE MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 235 UAE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 236 UAE MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 237 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 238 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 239 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 240 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 241 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 242 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 243 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 244 SAUDI ARABIA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 245 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 246 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 247 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 248 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 249 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 250 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 251 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 252 SOUTH AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

TABLE 253 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (USD MILLION) 2020-2029

TABLE 254 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY RESIN TYPE (KILOTONS) 2020-2029

TABLE 255 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (USD MILLION) 2020-2029

TABLE 256 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY TECHNOLOGY (KILOTONS) 2020-2029

TABLE 257 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (USD MILLION) 2020-2029

TABLE 258 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY USER TYPE (KILOTONS) 2020-2029

TABLE 259 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (USD MILLION) 2020-2029

TABLE 260 REST OF MIDDLE EAST AND AFRICA MILITARY AEROSPACE COATINGS MARKET BY AIRCRAFT TYPE (KILOTONS) 2020-2029

LIST OF FIGURES

FIGURE 1 MARKET DYNAMICS

FIGURE 2 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 3 BOTTOM-UP APPROACH

FIGURE 4 RESEARCH FLOW

FIGURE 5 GLOBAL MILITARY AEROSPACE COATINGS BY RESIN TYPE, USD MILLION, 2020-2029

FIGURE 6 GLOBAL MILITARY AEROSPACE COATINGS BY TECHNOLOGY, USD MILLION, 2020-2029

FIGURE 7 GLOBAL MILITARY AEROSPACE COATINGS BY USER TYPE, USD MILLION, 2020-2029

FIGURE 8 GLOBAL MILITARY AEROSPACE COATINGS BY AIRCRAFT TYPE, USD MILLION, 2020-2029

FIGURE 9 GLOBAL MILITARY AEROSPACE COATINGS BY REGION, USD MILLION, 2020-2029

FIGURE 10 PORTER’S FIVE FORCES MODEL

FIGURE 11 GLOBAL MILITARY AEROSPACE COATINGS BY RESIN TYPE, USD MILLION, 2021

FIGURE 12 GLOBAL MILITARY AEROSPACE COATINGS BY TECHNOLOGY, USD MILLION, 2021

FIGURE 13 GLOBAL MILITARY AEROSPACE COATINGS BY USER TYPE, USD MILLION, 2021

FIGURE 14 GLOBAL MILITARY AEROSPACE COATINGS BY AIRCRAFT TYPE, USD MILLION, 2021

FIGURE 15 GLOBAL MILITARY AEROSPACE COATINGS BY REGION, USD MILLION, 2021

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 PPG INDUSTRIES: COMPANY SNAPSHOT

FIGURE 18 SHERWIN-WILLIAMS: COMPANY SNAPSHOT

FIGURE 19 HENTZEN COATINGS: COMPANY SNAPSHOT

FIGURE 20 AKZO NOBEL: COMPANY SNAPSHOT

FIGURE 21 BASF: COMPANY SNAPSHOT

FIGURE 22 HENKEL: COMPANY SNAPSHOT

FIGURE 23 3CHEM: COMPANY SNAPSHOT

FIGURE 24 MANKIEWICZ: COMPANY SNAPSHOT

FIGURE 25 ZIRCOTEC: COMPANY SNAPSHOT

FIGURE 26 MAPAERO: COMPANY SNAPSHOT

FIGURE 27 CREATIVE COATINGS: COMPANY SNAPSHOT

FIGURE 28 VALSPAR: COMPANY SNAPSHOT

FIGURE 29 KLINGE ENAMELING INC.: COMPANY SNAPSHOT

FIGURE 30 CHASE CORPORATION: COMPANY SNAPSHOT

FIGURE 31 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FAQ

The Military Aerospace Coatings Market size had crossed USD 318 Million in 2020 and will observe a CAGR of more than 6% up to 2029.

Increase focus on military activities in various countries is a key driver for the market.

The region’s largest share is in North America. Products manufactured in nations like US and Canada that perform similarly and are inexpensively accessible to the general public have led to the increasing appeal.

In-Depth Database

Our Report’s database covers almost all topics of all regions over the Globe.

Recognised Publishing Sources

Tie ups with top publishers around the globe.

Customer Support

Complete pre and post sales

support.

Safe & Secure

Complete secure payment

process.